Mga Batayang Estadistika

| Nilai Portofolio | $ 303,901,056 |

| Posisi Saat Ini | 154 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

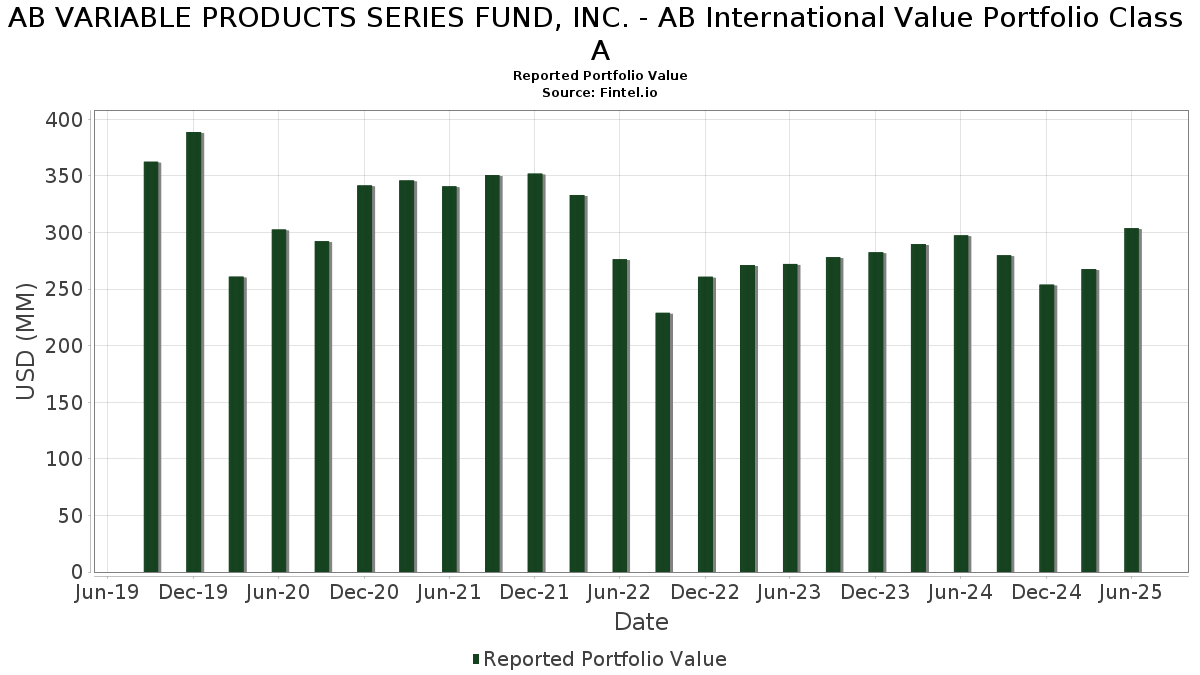

AB VARIABLE PRODUCTS SERIES FUND, INC. - AB International Value Portfolio Class A telah mengungkapkan total kepemilikan 154 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 303,901,056 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama AB VARIABLE PRODUCTS SERIES FUND, INC. - AB International Value Portfolio Class A adalah Shell plc (GB:SHEL) , Roche Holding AG (CH:ROG) , Tokyo Electron Limited (DE:TKY) , Resona Holdings, Inc. (JP:8308) , and Airbus SE (FR:AIR) . Posisi baru AB VARIABLE PRODUCTS SERIES FUND, INC. - AB International Value Portfolio Class A meliputi: Mitsubishi Electric Corporation (MX:MITS N) , Persol Holdings Co.,Ltd. (JP:2181) , Toyo Suisan Kaisha, Ltd. (JP:2875) , Toho Co., Ltd. (JP:9602) , and Toyo Tire Corporation (US:TOTTF) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.22 | 4.79 | 1.5582 | 1.5582 | |

| 2.36 | 4.61 | 1.5025 | 1.5025 | |

| 0.06 | 4.24 | 1.3807 | 1.3807 | |

| 0.07 | 4.15 | 1.3523 | 1.3523 | |

| 0.16 | 3.48 | 1.1331 | 1.1331 | |

| 0.04 | 8.04 | 2.6189 | 0.8240 | |

| 3.19 | 3.89 | 1.2664 | 0.5581 | |

| 0.18 | 6.51 | 2.1195 | 0.4904 | |

| 0.42 | 5.47 | 1.7809 | 0.4151 | |

| 0.26 | 4.23 | 1.3778 | 0.4059 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.13 | 4.60 | 1.4981 | -1.2704 | |

| 0.22 | 5.72 | 1.8633 | -1.1681 | |

| 0.04 | 3.05 | 0.9942 | -0.9782 | |

| 4.12 | 4.12 | 1.3402 | -0.7795 | |

| 0.08 | 3.80 | 1.2387 | -0.7137 | |

| 0.03 | 9.82 | 3.1975 | -0.5459 | |

| 0.06 | 5.77 | 1.8797 | -0.4512 | |

| 1.15 | 5.89 | 1.9191 | -0.3267 | |

| 0.26 | 2.81 | 0.9161 | -0.2748 | |

| 0.21 | 3.91 | 1.2746 | -0.2573 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SHEL / Shell plc | 0.31 | 16.20 | 10.78 | 11.52 | 3.5107 | -0.0743 | |||

| ROG / Roche Holding AG | 0.03 | -1.92 | 9.82 | -2.72 | 3.1975 | -0.5459 | |||

| TKY / Tokyo Electron Limited | 0.04 | 18.98 | 8.04 | 66.18 | 2.6189 | 0.8240 | |||

| 8308 / Resona Holdings, Inc. | 0.82 | -2.03 | 7.57 | 3.63 | 2.4656 | -0.2441 | |||

| AIR / Airbus SE | 0.03 | -9.83 | 7.22 | 7.13 | 2.3494 | -0.1483 | |||

| CS / AXA SA | 0.14 | -3.42 | 6.91 | 11.00 | 2.2505 | -0.0584 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 0.18 | 14.10 | 6.51 | 48.17 | 2.1195 | 0.4904 | |||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 0.23 | -2.67 | 6.38 | 26.14 | 2.0777 | 0.2018 | |||

| 27M / Melrose Industries PLC | 0.86 | 5.31 | 6.26 | 24.27 | 2.0378 | 0.1702 | |||

| ITX / Industria de Diseño Textil, S.A. | 0.12 | 24.48 | 6.21 | 30.42 | 2.0228 | 0.2565 | |||

| HLN / Haleon plc | 1.15 | -4.38 | 5.89 | -2.68 | 1.9191 | -0.3267 | |||

| RYSD / NatWest Group plc | 0.82 | -2.64 | 5.77 | 15.80 | 1.8802 | 0.0313 | |||

| NESN / Nestlé S.A. | 0.06 | -6.66 | 5.77 | -8.16 | 1.8797 | -0.4512 | |||

| 6758 / Sony Group Corporation | 0.22 | -31.88 | 5.72 | -30.01 | 1.8633 | -1.1681 | |||

| PRU / Prudential plc | 0.44 | 17.88 | 5.53 | 36.74 | 1.7997 | 0.3007 | |||

| 37C / CNH Industrial N.V. | 0.42 | 40.71 | 5.47 | 48.49 | 1.7809 | 0.4151 | |||

| ENEL / Enel SpA | 0.57 | -0.10 | 5.42 | 16.95 | 1.7663 | 0.0465 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0.12 | -1.81 | 5.29 | 9.54 | 1.7238 | -0.0686 | |||

| DG / Vinci SA | 0.04 | 0.46 | 5.29 | 17.55 | 1.7231 | 0.0534 | |||

| BA. / BAE Systems plc | 0.20 | -13.35 | 5.29 | 11.38 | 1.7216 | -0.0389 | |||

| EDP / EDP - Energias de Portugal, S.A. | 1.21 | -2.70 | 5.28 | 25.60 | 1.7177 | 0.1604 | |||

| CRH / CRH plc | 0.06 | 0.39 | 5.23 | 4.75 | 1.7018 | -0.1481 | |||

| CCEP / COCA COLA EUROPACIFIC COMPANY GUAR REGS 11/27 1.5 | 0.06 | -2.66 | 5.19 | 3.70 | 1.6894 | -0.1658 | |||

| DSN / Danske Bank A/S | 0.13 | -3.15 | 5.11 | 20.87 | 1.6636 | 0.0960 | |||

| BBVA / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0.32 | -3.04 | 4.99 | 9.41 | 1.6245 | -0.0666 | |||

| RYAAY / Ryanair Holdings plc - Depositary Receipt (Common Stock) | 0.08 | -0.11 | 4.87 | 35.98 | 1.5851 | 0.2575 | |||

| LUNMF / Lundin Mining Corporation | 0.46 | 0.27 | 4.81 | 30.14 | 1.5652 | 0.1955 | |||

| MITS N / Mitsubishi Electric Corporation | 0.22 | 4.79 | 1.5582 | 1.5582 | |||||

| ASRNL / ASR Nederland N.V. | 0.07 | -3.15 | 4.76 | 11.93 | 1.5487 | -0.0269 | |||

| SHL / Siemens Healthineers AG | 0.09 | 24.47 | 4.75 | 28.08 | 1.5478 | 0.1716 | |||

| TYIDY / Toyota Industries Corporation - Depositary Receipt (Common Stock) | 0.04 | -10.04 | 4.75 | 18.72 | 1.5471 | 0.0629 | |||

| 2181 / Persol Holdings Co.,Ltd. | 2.36 | 4.61 | 1.5025 | 1.5025 | |||||

| DTE / Deutsche Telekom AG | 0.13 | -37.84 | 4.60 | -38.39 | 1.4981 | -1.2704 | |||

| TLS / Telstra Group Limited | 1.43 | -3.33 | 4.57 | 16.68 | 1.4873 | 0.0356 | |||

| KPN / Koninklijke KPN N.V. | 0.93 | -3.26 | 4.56 | 11.42 | 1.4831 | -0.0328 | |||

| HMC / Honda Motor Co., Ltd. - Depositary Receipt (Common Stock) | 0.47 | 25.81 | 4.50 | 34.07 | 1.4647 | 0.2204 | |||

| 8801 / Mitsui Fudosan Co., Ltd. | 0.46 | -2.82 | 4.48 | 5.07 | 1.4573 | -0.1223 | |||

| 9009 / Keisei Electric Railway Co., Ltd. | 0.46 | 39.54 | 4.35 | 44.40 | 1.4150 | 0.2991 | |||

| REP / Repsol, S.A. | 0.29 | 0.35 | 4.30 | 10.53 | 1.4010 | -0.0424 | |||

| 2875 / Toyo Suisan Kaisha, Ltd. | 0.06 | 4.24 | 1.3807 | 1.3807 | |||||

| BB2 / Burberry Group plc | 0.26 | 0.12 | 4.23 | 61.49 | 1.3778 | 0.4059 | |||

| 9602 / Toho Co., Ltd. | 0.07 | 4.15 | 1.3523 | 1.3523 | |||||

| US0186167484 / AB Fixed Income Shares, Inc. - Government Money Market Portfolio | 4.12 | -28.00 | 4.12 | -28.01 | 1.3402 | -0.7795 | |||

| US0186167484 / AB Fixed Income Shares, Inc. - Government Money Market Portfolio | 4.09 | -0.62 | 4.09 | -0.61 | 1.3319 | -0.0083 | |||

| MRL / Marlowe plc | 0.30 | 26.73 | 3.95 | 56.65 | 1.2849 | 0.3507 | |||

| VK / Vallourec S.A. | 0.21 | -3.29 | 3.91 | -5.25 | 1.2746 | -0.2573 | |||

| EBS / Erste Group Bank AG | 0.05 | -4.07 | 3.90 | 18.06 | 1.2685 | 0.0449 | |||

| SHMUF / Shimizu Corporation | 0.35 | -3.62 | 3.89 | 20.93 | 1.2682 | 0.0741 | |||

| JD. / JD Sports Fashion Plc | 3.19 | 47.64 | 3.89 | 103.61 | 1.2664 | 0.5581 | |||

| FRE / Frendy Energy S.p.A. | 0.08 | -38.70 | 3.80 | -27.75 | 1.2387 | -0.7137 | |||

| 3405 / Kuraray Co., Ltd. | 0.30 | 39.36 | 3.79 | 43.83 | 1.2343 | 0.2569 | |||

| IJF / ICON Public Limited Company | 0.03 | 13.97 | 3.73 | -5.29 | 1.2132 | -0.2453 | |||

| TOS / Tosoh Corporation | 0.25 | -3.60 | 3.64 | 2.53 | 1.1859 | -0.1315 | |||

| TOTTF / Toyo Tire Corporation | 0.16 | 3.48 | 1.1331 | 1.1331 | |||||

| MRK / Marks Electrical Group PLC | 0.03 | 0.00 | 3.28 | -5.80 | 1.0683 | -0.2229 | |||

| GSK / GSK plc | 0.17 | -3.73 | 3.27 | -3.97 | 1.0637 | -0.1975 | |||

| 7012 / Kawasaki Heavy Industries, Ltd. | 0.04 | 0.00 | 3.21 | 25.24 | 1.0437 | 0.0947 | |||

| VNX / NXP Semiconductors N.V. | 0.01 | -0.55 | 3.14 | 14.34 | 1.0229 | 0.0039 | |||

| CCJ / Cameco Corporation | 0.04 | -68.18 | 3.05 | -42.60 | 0.9942 | -0.9782 | |||

| AKE / Arkema S.A. | 0.04 | -4.13 | 2.98 | -7.56 | 0.9715 | -0.2251 | |||

| 669 / Techtronic Industries Company Limited | 0.26 | -4.85 | 2.81 | -12.39 | 0.9161 | -0.2748 | |||

| AA2 / Amada Co., Ltd. | 0.21 | -6.32 | 2.31 | 4.95 | 0.7533 | -0.0640 | |||

| US63906EB929 / NatWest Markets PLC | 0.14 | 0.0441 | 0.0441 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0.13 | 0.0428 | 0.0428 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0.13 | 0.0428 | 0.0428 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.11 | 0.0357 | 0.0357 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.09 | 0.0281 | 0.0281 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.09 | 0.0281 | 0.0281 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0.06 | 0.0183 | 0.0183 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0.06 | 0.0183 | 0.0183 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.05 | 0.0152 | 0.0152 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.05 | 0.0152 | 0.0152 | ||||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0.04 | 0.0146 | 0.0146 | ||||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0.04 | 0.0146 | 0.0146 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.04 | 0.0138 | 0.0138 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.04 | 0.0138 | 0.0138 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.04 | 0.0128 | 0.0128 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.04 | 0.0118 | 0.0118 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.04 | 0.0118 | 0.0118 | ||||||

| PURCHASED SEK / SOLD USD / DFE (000000000) | 0.04 | 0.0116 | 0.0116 | ||||||

| PURCHASED SEK / SOLD USD / DFE (000000000) | 0.04 | 0.0116 | 0.0116 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.03 | 0.0112 | 0.0112 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.03 | 0.0105 | 0.0105 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.03 | 0.0091 | 0.0091 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.03 | 0.0083 | 0.0083 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.02 | 0.0072 | 0.0072 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.02 | 0.0072 | 0.0072 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.02 | 0.0066 | 0.0066 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.02 | 0.0061 | 0.0061 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.02 | 0.0060 | 0.0060 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.02 | 0.0059 | 0.0059 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.02 | 0.0059 | 0.0059 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.02 | 0.0058 | 0.0058 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.02 | 0.0054 | 0.0054 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.01 | 0.0046 | 0.0046 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.01 | 0.0043 | 0.0043 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.01 | 0.0043 | 0.0043 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.01 | 0.0037 | 0.0037 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0.01 | 0.0037 | 0.0037 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0.01 | 0.0029 | 0.0029 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.01 | 0.0027 | 0.0027 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.01 | 0.0024 | 0.0024 | ||||||

| PURCHASED NZD / SOLD USD / DFE (000000000) | 0.01 | 0.0020 | 0.0020 | ||||||

| PURCHASED NZD / SOLD USD / DFE (000000000) | 0.01 | 0.0020 | 0.0020 | ||||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0.01 | 0.0017 | 0.0017 | ||||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0.01 | 0.0017 | 0.0017 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.00 | 0.0015 | 0.0015 | ||||||

| PURCHASED NOK / SOLD USD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| PURCHASED NOK / SOLD USD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0004 | -0.0004 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0004 | -0.0004 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.00 | -0.0013 | -0.0013 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.00 | -0.0013 | -0.0013 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.00 | -0.0014 | -0.0014 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.01 | -0.0020 | -0.0020 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.01 | -0.0020 | -0.0020 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0.01 | -0.0028 | -0.0028 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0.01 | -0.0028 | -0.0028 | ||||||

| PURCHASED USD / SOLD CHF / DFE (000000000) | -0.01 | -0.0028 | -0.0028 | ||||||

| PURCHASED USD / SOLD CHF / DFE (000000000) | -0.01 | -0.0028 | -0.0028 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.01 | -0.0033 | -0.0033 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.01 | -0.0033 | -0.0033 | ||||||

| US63906EB929 / NatWest Markets PLC | -0.01 | -0.0042 | -0.0042 | ||||||

| US63906EB929 / NatWest Markets PLC | -0.01 | -0.0042 | -0.0042 | ||||||

| US63906EB929 / NatWest Markets PLC | -0.01 | -0.0042 | -0.0042 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.01 | -0.0046 | -0.0046 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.01 | -0.0046 | -0.0046 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.02 | -0.0055 | -0.0055 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.02 | -0.0060 | -0.0060 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.02 | -0.0060 | -0.0060 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.02 | -0.0061 | -0.0061 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.02 | -0.0061 | -0.0061 | ||||||

| US63906EB929 / NatWest Markets PLC | -0.02 | -0.0072 | -0.0072 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.03 | -0.0089 | -0.0089 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.03 | -0.0089 | -0.0089 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.03 | -0.0095 | -0.0095 | ||||||

| DGZ / DB Gold Short ETN | -0.03 | -0.0100 | -0.0100 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.04 | -0.0121 | -0.0121 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.04 | -0.0121 | -0.0121 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.04 | -0.0126 | -0.0126 | ||||||

| PURCHASED USD / SOLD TWD / DFE (000000000) | -0.05 | -0.0167 | -0.0167 | ||||||

| PURCHASED USD / SOLD TWD / DFE (000000000) | -0.05 | -0.0167 | -0.0167 | ||||||

| PURCHASED USD / SOLD TWD / DFE (000000000) | -0.13 | -0.0411 | -0.0411 | ||||||

| PURCHASED USD / SOLD TWD / DFE (000000000) | -0.13 | -0.0411 | -0.0411 | ||||||

| PURCHASED USD / SOLD KRW / DFE (000000000) | -0.23 | -0.0755 | -0.0755 | ||||||

| PURCHASED USD / SOLD KRW / DFE (000000000) | -0.23 | -0.0755 | -0.0755 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0.29 | -0.0939 | -0.0939 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0.29 | -0.0939 | -0.0939 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.38 | -0.1234 | -0.1234 |