Mga Batayang Estadistika

| Nilai Portofolio | $ 1,097,390,548 |

| Posisi Saat Ini | 252 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

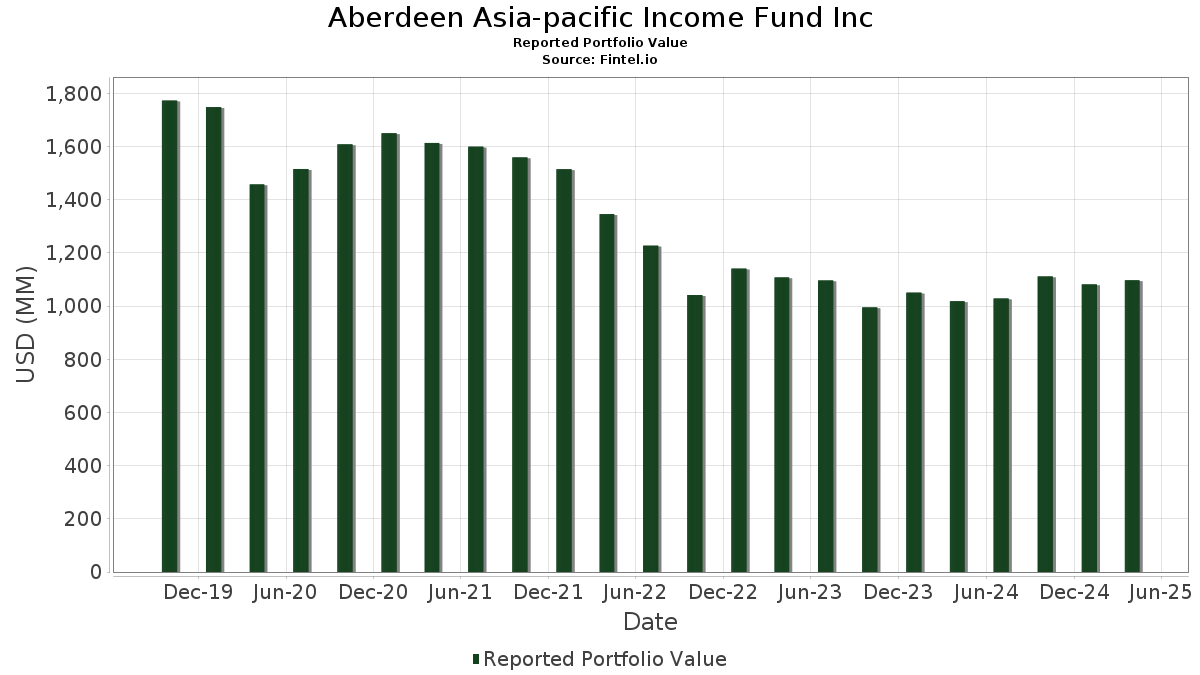

Aberdeen Asia-pacific Income Fund Inc telah mengungkapkan total kepemilikan 252 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,097,390,548 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Aberdeen Asia-pacific Income Fund Inc adalah Mexican Bonos (MX:MX0MGO0000H9) , Indonesia Treasury Bond (ID:IDG000020801) , Philippine Government Bond (PH:PHY6972HMW34) , Indonesia Treasury Bond (ID:IDG000011701) , and India Government Bond (IN:IN0020220094) . Posisi baru Aberdeen Asia-pacific Income Fund Inc meliputi: Mexican Bonos (MX:MX0MGO0000H9) , Indonesia Treasury Bond (ID:IDG000020801) , Philippine Government Bond (PH:PHY6972HMW34) , Indonesia Treasury Bond (ID:IDG000011701) , and India Government Bond (IN:IN0020220094) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 12.25 | 12.25 | 1.7800 | 1.7463 | |

| 10.08 | 1.4647 | 1.4647 | ||

| 7.21 | 1.0484 | 1.0484 | ||

| 6.42 | 0.9334 | 0.9334 | ||

| 5.74 | 0.8337 | 0.8337 | ||

| 5.74 | 0.8337 | 0.8337 | ||

| 4.96 | 0.7203 | 0.7203 | ||

| 4.85 | 0.7046 | 0.7046 | ||

| 4.30 | 0.6257 | 0.6257 | ||

| 16.06 | 2.3340 | 0.5638 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 7.48 | 1.0875 | -0.9143 | ||

| 6.84 | 0.9946 | -0.6100 | ||

| 2.57 | 0.3734 | -0.3707 | ||

| 8.33 | 1.2104 | -0.3294 | ||

| 2.95 | 0.4285 | -0.2817 | ||

| 3.47 | 0.5039 | -0.2416 | ||

| -1.45 | -0.2111 | -0.2111 | ||

| -1.44 | -0.2095 | -0.2095 | ||

| -1.44 | -0.2095 | -0.2095 | ||

| -1.29 | -0.1871 | -0.1871 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-13 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MX0MGO0000H9 / Mexican Bonos | 23.75 | 9.54 | 3.4515 | 0.3105 | |||||

| IDG000020801 / Indonesia Treasury Bond | 22.20 | -1.05 | 3.2261 | -0.0240 | |||||

| PHY6972HMW34 / Philippine Government Bond | 20.87 | 4.80 | 3.0332 | 0.1477 | |||||

| IDG000011701 / Indonesia Treasury Bond | 19.77 | -1.51 | 2.8736 | -0.0352 | |||||

| IN0020220094 / India Government Bond | 19.04 | 5.79 | 2.7669 | 0.1594 | |||||

| Pakistan Treasury Bills / DBT (PK12T2905254) | 18.64 | 1.95 | 2.7090 | 0.0601 | |||||

| Pakistan Treasury Bills / DBT (PK12T2905254) | 18.64 | 1.95 | 2.7090 | 0.0601 | |||||

| USG46715AC56 / Hutchison Whampoa Finance CI Ltd | 16.48 | -0.15 | 2.3960 | 0.0039 | |||||

| IN0020180454 / India Government Bond | 16.48 | 4.29 | 2.3946 | 0.1056 | |||||

| IDG000010307 / Indonesia Treasury Bond | 16.21 | -0.96 | 2.3557 | -0.0154 | |||||

| USY20721AE96 / Indonesia Government International Bond | 16.06 | 31.44 | 2.3340 | 0.5638 | |||||

| IDG000012907 / Indonesia Treasury Bond | 15.30 | -1.09 | 2.2236 | -0.0176 | |||||

| PHY6972FPV67 / Philippine Government Bond | 14.88 | 4.12 | 2.1622 | 0.0920 | |||||

| PTPP / PT PP (Persero) Tbk | 14.02 | -0.85 | 2.0374 | -0.0111 | |||||

| IDG000021809 / INDONESIA GOV'T | 13.95 | -0.85 | 2.0279 | -0.0111 | |||||

| IDG000011107 / Indonesia Treasury Bond | 13.02 | -1.33 | 1.8927 | -0.0198 | |||||

| KR103502GC32 / KOREA TRSY BD | 12.82 | 5.85 | 1.8632 | 0.1082 | |||||

| R2032 / South Africa - Corporate Bond/Note | 12.82 | 0.79 | 1.8630 | 0.0203 | |||||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 12.25 | 5,163.39 | 12.25 | 5,178.45 | 1.7800 | 1.7463 | |||

| Inter-American Development Bank / DBT (XS2608242108) | 10.32 | 4.41 | 1.4998 | 0.0678 | |||||

| Inter-American Development Bank / DBT (XS2608242108) | 10.32 | 4.41 | 1.4998 | 0.0678 | |||||

| European Bank for Reconstruction & Development / DBT (XS2783648012) | 10.12 | 4.00 | 1.4707 | 0.0608 | |||||

| Malaysia Government Bond / DBT (MYBMX2400021) | 10.08 | 1.4647 | 1.4647 | ||||||

| International Bank for Reconstruction & Development / DBT (XS2749532680) | 9.82 | 3.85 | 1.4275 | 0.0571 | |||||

| International Bank for Reconstruction & Development / DBT (XS2749532680) | 9.82 | 3.85 | 1.4275 | 0.0571 | |||||

| PHY6972FKF62 / PHILIPPINE GOVERNMENT BOND | 9.45 | 4.20 | 1.3741 | 0.0594 | |||||

| IN0020220102 / India Government Bond | 9.31 | 5.34 | 1.3533 | 0.0726 | |||||

| Pakistan Investment Bond / DBT (PK03P2009278) | 8.89 | -1.53 | 1.2921 | -0.0159 | |||||

| Pakistan Investment Bond / DBT (PK03P2009278) | 8.89 | -1.53 | 1.2921 | -0.0159 | |||||

| AU3CB0281053 / Wesfarmers Ltd | 8.33 | -21.64 | 1.2104 | -0.3294 | |||||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 7.98 | 3.93 | 1.1596 | 0.0474 | |||||

| Philippine Government Bond / DBT (PH0000058133) | 7.88 | 3.90 | 1.1458 | 0.0464 | |||||

| US853254CS76 / Standard Chartered plc | 7.56 | 0.71 | 1.0984 | 0.0110 | |||||

| XS1910827887 / Nigeria Government International Bond | 7.48 | -45.84 | 1.0875 | -0.9143 | |||||

| XS1596795358 / Huarong Finance 2017 Co Ltd | 7.41 | 0.98 | 1.0776 | 0.0139 | |||||

| US73928RAA41 / Power Finance Corp Ltd | 7.40 | 0.96 | 1.0751 | 0.0134 | |||||

| R2037 / South Africa - Sovereign or Government Agency Debt | 7.35 | -1.59 | 1.0685 | -0.0140 | |||||

| US05464XAA37 / AXIS BANK LTD/GIFT CITY 144A | 7.28 | -0.11 | 1.0578 | 0.0022 | |||||

| USY20721AL30 / Indonesia Government International Bond | 7.22 | 0.04 | 1.0490 | 0.0036 | |||||

| Greenko Wind Projects Mauritius Ltd / DBT (US39531JAB08) | 7.21 | 1.0484 | 1.0484 | ||||||

| US718286BG11 / Philippine Government International Bond | 7.11 | 2.10 | 1.0331 | 0.0245 | |||||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 7.03 | -6.74 | 1.0215 | -0.0703 | |||||

| CND10004JSG1 / China Construction Bank Corp | 7.02 | -0.24 | 1.0198 | 0.0005 | |||||

| US404280DT33 / HSBC Holdings PLC | 6.96 | -1.32 | 1.0114 | -0.0103 | |||||

| XS1318576086 / Angolan Government International Bond | 6.84 | -38.21 | 0.9946 | -0.6100 | |||||

| XS2277590209 / CAS CAPITAL NO 1 LIMITED 4%/VAR PERP REGS | 6.70 | -0.65 | 0.9731 | -0.0034 | |||||

| Asian Infrastructure Investment Bank/The / DBT (XS2643319192) | 6.48 | 4.86 | 0.9412 | 0.0463 | |||||

| US059895AL66 / BANGKOK BANK PCL/HK SR UNSECURED 144A 10/20 4.8 | 6.42 | 0.9334 | 0.9334 | ||||||

| INE752E07NU8 / Power Grid Corp of India Ltd | 6.11 | 3.81 | 0.8878 | 0.0352 | |||||

| US36321PAB67 / Galaxy Pipeline Assets Bidco Ltd | 6.10 | 2.08 | 0.8862 | 0.0206 | |||||

| US25159XAC74 / Development Bank of Kazakhstan JSC | 6.02 | 0.03 | 0.8754 | 0.0029 | |||||

| XS1795263281 / Shinhan Bank Co Ltd | 5.87 | 1.72 | 0.8531 | 0.0170 | |||||

| US45410LAA08 / India Green Power Holdings | 5.83 | -7.35 | 0.8479 | -0.0645 | |||||

| IN0020200096 / India Government Bond | 5.82 | 5.57 | 0.8460 | 0.0470 | |||||

| US78392BAF40 / SK Hynix Inc | 5.75 | 0.56 | 0.8354 | 0.0073 | |||||

| Tongyang Life Insurance Co Ltd / DBT (XS3045733840) | 5.74 | 0.8337 | 0.8337 | ||||||

| Tongyang Life Insurance Co Ltd / DBT (XS3045733840) | 5.74 | 0.8337 | 0.8337 | ||||||

| USG98149AH33 / Wynn Macau Ltd | 5.73 | -1.07 | 0.8324 | -0.0065 | |||||

| MALRY / Mineral Resources Limited - Depositary Receipt (Common Stock) | 5.70 | -7.32 | 0.8282 | -0.0627 | |||||

| US69583PAA21 / Pakistan Global Sukuk Programme Co Ltd/The | 5.48 | -6.18 | 0.7970 | -0.0499 | |||||

| US05565A5R02 / BNP PARIBAS REGD V/R /PERP/ 144A P/P 8.50000000 | 5.46 | -0.85 | 0.7938 | -0.0044 | |||||

| US44891CBL63 / Hyundai Capital America | 5.33 | -0.15 | 0.7750 | 0.0012 | |||||

| PHY6972FML13 / Philippine Government Bond | 5.25 | 4.25 | 0.7635 | 0.0335 | |||||

| Perenti Finance Pty Ltd / DBT (US71367VAB53) | 5.19 | -0.44 | 0.7540 | -0.0011 | |||||

| US00131LAN55 / AIA Group Ltd | 5.17 | 0.74 | 0.7517 | 0.0078 | |||||

| Korea Housing Finance Corp / DBT (US50065RAU14) | 5.15 | 2.14 | 0.7485 | 0.0179 | |||||

| XS2530049837 / EGYPT TASKEEK COMPANY REGD REG S 10.87500000 | 5.14 | -0.45 | 0.7468 | -0.0011 | |||||

| US500631AZ96 / Korea Electric Power Corp | 5.06 | 0.28 | 0.7360 | 0.0043 | |||||

| US718286CX35 / Philippine Government International Bond | 5.05 | 1.59 | 0.7339 | 0.0137 | |||||

| PUSAN / Busan Bank Co Ltd | 5.02 | 0.80 | 0.7292 | 0.0080 | |||||

| STAB / Standard Chartered PLC - Preferred Security | 5.01 | -2.91 | 0.7281 | -0.0195 | |||||

| XS2648476302 / Hongkong Land Finance Cayman Islands Co Ltd/The | 5.01 | 2.20 | 0.7277 | 0.0178 | |||||

| US302154DW60 / Export-Import Bank of Korea | 5.00 | 1.73 | 0.7268 | 0.0146 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 4.99 | -2.00 | 0.7248 | -0.0125 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 4.99 | -2.00 | 0.7248 | -0.0125 | |||||

| XS2403426427 / PRUDENTIAL PLC 2.95%/VAR 11/03/2033 REGS | 4.98 | 0.95 | 0.7241 | 0.0090 | |||||

| BABA34 / Alibaba Group Holding Ltd | 4.98 | 1.97 | 0.7239 | 0.0162 | |||||

| 511218 / Shriram Finance Limited | 4.97 | -1.11 | 0.7230 | -0.0058 | |||||

| 3690 / Meituan | 4.97 | 2.03 | 0.7228 | 0.0166 | |||||

| 3690 / Meituan | 4.97 | 2.03 | 0.7228 | 0.0166 | |||||

| Khazanah Capital Ltd / DBT (XS2894851042) | 4.97 | 1.93 | 0.7228 | 0.0159 | |||||

| Greensaif Pipelines Bidco Sarl / DBT (US39541EAE32) | 4.97 | 0.83 | 0.7224 | 0.0083 | |||||

| Greensaif Pipelines Bidco Sarl / DBT (US39541EAE32) | 4.97 | 0.83 | 0.7224 | 0.0083 | |||||

| Science City Guangzhou Investment Group Co Ltd / DBT (XS2756274614) | 4.96 | -0.50 | 0.7216 | -0.0014 | |||||

| Science City Guangzhou Investment Group Co Ltd / DBT (XS2756274614) | 4.96 | -0.50 | 0.7216 | -0.0014 | |||||

| USY6886MAE04 / Petronas Capital Ltd | 4.96 | 0.7203 | 0.7203 | ||||||

| RECLTD / REC Limited | 4.95 | 1.06 | 0.7197 | 0.0098 | |||||

| US80007RAE53 / Sands China Ltd | 4.92 | -16.26 | 0.7150 | -0.1361 | |||||

| XS2226973522 / Emirate of Dubai Government International Bonds | 4.85 | 0.7046 | 0.7046 | ||||||

| 4755 / Rakuten Group, Inc. | 4.81 | 25.73 | 0.6990 | 0.1447 | |||||

| XS1681539539 / Santos Finance Ltd | 4.80 | 0.90 | 0.6982 | 0.0084 | |||||

| XS2328392951 / China Oil & Gas Group Ltd | 4.79 | 3.36 | 0.6966 | 0.0248 | |||||

| 881 / Zhongsheng Group Holdings Limited | 4.71 | -1.24 | 0.6840 | -0.0065 | |||||

| Melco Resorts Finance Ltd / DBT (US58547DAH26) | 4.60 | -3.36 | 0.6687 | -0.0211 | |||||

| Ivory Coast Government International Bond / DBT (US221625AU01) | 4.59 | -5.57 | 0.6673 | -0.0373 | |||||

| US50201PAA49 / LLPL Capital Pte Ltd | 4.39 | -6.44 | 0.6375 | -0.0418 | |||||

| BRSTNCNTF212 / Brazil Notas do Tesouro Nacional Serie F | 4.37 | 7.27 | 0.6352 | 0.0447 | |||||

| USP3579ECQ81 / Dominican Republic International Bond | 4.34 | 2.10 | 0.6305 | 0.0148 | |||||

| LG Energy Solution Ltd / DBT (US50205MAG42) | 4.30 | 0.6257 | 0.6257 | ||||||

| CND10004R2K8 / Industrial & Commercial Bank of China Ltd | 4.22 | -0.52 | 0.6141 | -0.0013 | |||||

| Georgia Global Utilities JSC / DBT (US373196AB02) | 4.16 | 0.58 | 0.6051 | 0.0053 | |||||

| US948596AE12 / Weibo Corp | 4.13 | -16.43 | 0.6002 | -0.1158 | |||||

| MYBMS1900047 / Malaysia Government Bond | 3.99 | 176.88 | 0.5796 | 0.3786 | |||||

| Corp Andina de Fomento / DBT (XS2810190152) | 3.98 | 4.69 | 0.5780 | 0.0276 | |||||

| Corp Andina de Fomento / DBT (XS2810190152) | 3.98 | 4.69 | 0.5780 | 0.0276 | |||||

| IDG000013806 / Indonesia Treasury Bond | 3.97 | -0.85 | 0.5770 | -0.0031 | |||||

| US556079AC52 / Macquarie Bank Ltd | 3.94 | 1.36 | 0.5725 | 0.0095 | |||||

| IN0020170026 / India Government Bond 6.79% 05/15/2027 | 3.90 | 3.64 | 0.5668 | 0.0216 | |||||

| US88032XBC74 / Tencent Holdings Ltd | 3.84 | 0.60 | 0.5575 | 0.0050 | |||||

| Krakatau Posco PT / DBT (XS2833229391) | 3.74 | -0.64 | 0.5440 | -0.0017 | |||||

| US404280DR76 / HSBC Holdings PLC | 3.72 | 0.38 | 0.5408 | 0.0037 | |||||

| XS2385923722 / Bank Negara Indonesia Persero Tbk PT | 3.69 | 172.02 | 0.5370 | 0.3402 | |||||

| XS2314779427 / GLP China Holdings Ltd | 3.66 | 5.97 | 0.5316 | 0.0315 | |||||

| UPLLIN / UPL Corp Ltd | 3.63 | -0.08 | 0.5275 | 0.0011 | |||||

| 2282 / MGM China Holdings Limited | 3.62 | -1.50 | 0.5255 | -0.0063 | |||||

| IN2220170061 / State of Maharashtra India | 3.61 | 3.65 | 0.5241 | 0.0201 | |||||

| Medco Maple Tree Pte Ltd / DBT (USY5951MAA00) | 3.60 | -3.13 | 0.5226 | -0.0152 | |||||

| XS2393797530 / Far East Horizon Ltd | 3.58 | 0.42 | 0.5210 | 0.0038 | |||||

| US74947LAD64 / REC Ltd | 3.51 | 0.75 | 0.5104 | 0.0054 | |||||

| 316140 / Woori Financial Group Inc. | 3.49 | -1.50 | 0.5070 | -0.0061 | |||||

| 316140 / Woori Financial Group Inc. | 3.49 | -1.50 | 0.5070 | -0.0061 | |||||

| AU3CB0300358 / Westpac Banking Corp | 3.47 | -32.62 | 0.5039 | -0.2416 | |||||

| XS2132986741 / NWD Finance BVI Ltd | 3.45 | 93.82 | 0.5018 | 0.2437 | |||||

| MYBMZ2000016 / Malaysia Government Bond | 3.44 | 5.01 | 0.5000 | 0.0253 | |||||

| IN0020220151 / INDIA (REPUBLIC OF) | 3.37 | 4.92 | 0.4901 | 0.0244 | |||||

| AU3CB0300366 / WESTPAC BANKING | 3.34 | 3.12 | 0.4854 | 0.0161 | |||||

| US46654XAA72 / JSW Infrastructure Ltd | 3.27 | -1.06 | 0.4747 | -0.0037 | |||||

| US654579AE17 / Nippon Life Insurance Co | 3.22 | 0.4674 | 0.4674 | ||||||

| US654579AE17 / Nippon Life Insurance Co | 3.22 | 0.4674 | 0.4674 | ||||||

| USG84228FL77 / Standard Chartered PLC | 3.21 | 0.41 | 0.4670 | 0.0033 | |||||

| HTBB / Mong Duong Finance Holdings BV | 3.16 | 0.00 | 0.4586 | 0.0014 | |||||

| India Government Bond / DBT (IN0020230077) | 3.14 | 5.83 | 0.4564 | 0.0265 | |||||

| USG85381AG95 / Studio City Finance Ltd | 3.07 | -3.64 | 0.4467 | -0.0154 | |||||

| US71568PAF62 / Perusahaan Listrik Negara PT | 3.01 | -0.23 | 0.4369 | 0.0002 | |||||

| XS0308427581 / DP World PLC | 2.96 | 1.86 | 0.4297 | 0.0091 | |||||

| 055550 / Shinhan Financial Group Co., Ltd. | 2.95 | -39.85 | 0.4285 | -0.2817 | |||||

| US902613BF40 / UBS Group AG | 2.92 | -0.92 | 0.4240 | -0.0026 | |||||

| US69379VAA70 / Pertamina Geothermal Energy PT | 2.90 | 0.59 | 0.4220 | 0.0038 | |||||

| Melco Resorts Finance Ltd / DBT (USG5975LAK29) | 2.89 | 0.4207 | 0.4207 | ||||||

| 4020 / Saudi Real Estate Company | 2.84 | -0.25 | 0.4121 | 0.0002 | |||||

| Hyundai Capital America / DBT (US44891ACV70) | 2.81 | -0.07 | 0.4091 | 0.0009 | |||||

| Hyundai Capital America / DBT (US44891ACV70) | 2.81 | -0.07 | 0.4091 | 0.0009 | |||||

| XS2258819874 / AC Energy Finance International Ltd | 2.79 | -0.82 | 0.4058 | -0.0021 | |||||

| IDG000014101 / Indonesia Treasury Bond | 2.74 | -1.33 | 0.3982 | -0.0041 | |||||

| USV6703DAC84 / Network i2i Ltd | 2.74 | 0.3979 | 0.3979 | ||||||

| USY85859AC38 / Tenaga Nasional Bhd | 2.73 | 5.04 | 0.3972 | 0.0202 | |||||

| AU3CB0293769 / COM BK AUSTRALIA | 2.68 | 2.96 | 0.3899 | 0.0124 | |||||

| XS1299811486 / Pakistan Government International Bond | 2.66 | -1.48 | 0.3871 | -0.0045 | |||||

| XS2340147813 / GLP Pte Ltd | 2.65 | 6.85 | 0.3854 | 0.0257 | |||||

| XS1729875598 / Pakistan Government International Bond | 2.63 | -29.10 | 0.3830 | -0.1554 | |||||

| US67091TAA34 / OCP SA | 2.63 | -2.99 | 0.3816 | -0.0106 | |||||

| Muangthai Capital PCL / DBT (XS2892939575) | 2.58 | -1.79 | 0.3745 | -0.0057 | |||||

| XS2399467807 / MAF Global Securities Ltd | 2.57 | -49.99 | 0.3734 | -0.3707 | |||||

| US67778NAA63 / Oil and Gas Holding Co BSCC/The | 2.56 | -0.27 | 0.3720 | 0.0002 | |||||

| US30216KAG76 / Export-Import Bank of India | 2.54 | 1.31 | 0.3697 | 0.0060 | |||||

| XS2592797398 / BANK OF EAST ASIA LTD/THE MTN 6.750000% 03/15/2027 | 2.53 | 0.16 | 0.3674 | 0.0017 | |||||

| 531213 / Manappuram Finance Limited | 2.48 | -0.80 | 0.3609 | -0.0019 | |||||

| 531213 / Manappuram Finance Limited | 2.48 | -0.80 | 0.3609 | -0.0019 | |||||

| USY6142NAG35 / State of Mongolia | 2.48 | -2.02 | 0.3605 | -0.0063 | |||||

| Fortune Star BVI Ltd / DBT (XS2922957746) | 2.48 | -1.43 | 0.3604 | -0.0040 | |||||

| Fortune Star BVI Ltd / DBT (XS2922957746) | 2.48 | -1.43 | 0.3604 | -0.0040 | |||||

| Bank of Georgia JSC / DBT (US062269AA38) | 2.46 | 0.45 | 0.3569 | 0.0028 | |||||

| TAJIKI / Republic of Tajikistan International Bond | 2.45 | -16.92 | 0.3555 | -0.0711 | |||||

| XS1668531335 / Phoenix Lead Ltd | 2.40 | -3.15 | 0.3488 | -0.0102 | |||||

| MUTHOOTFIN / Muthoot Finance Limited | 2.37 | -2.47 | 0.3450 | -0.0075 | |||||

| Navoi Mining & Metallurgical Combinat / DBT (US63890CAB00) | 2.37 | 1.50 | 0.3438 | 0.0062 | |||||

| Navoi Mining & Metallurgical Combinat / DBT (US63890CAB00) | 2.37 | 1.50 | 0.3438 | 0.0062 | |||||

| 1378 / China Hongqiao Group Limited | 2.32 | 186.51 | 0.3365 | 0.2193 | |||||

| XS2224065289 / Periama Holdings LLC | 2.27 | -30.68 | 0.3299 | -0.1445 | |||||

| IIFL / IIFL Finance Limited | 2.23 | -5.83 | 0.3242 | -0.0190 | |||||

| IIFL / IIFL Finance Limited | 2.23 | -5.83 | 0.3242 | -0.0190 | |||||

| XS2577785921 / Bank Mandiri Persero Tbk PT | 2.23 | 0.22 | 0.3241 | 0.0017 | |||||

| USY68856AW66 / Petronas Capital Ltd | 2.22 | -1.20 | 0.3221 | -0.0029 | |||||

| US88323AAB89 / Thaioil Treasury Center Co. Ltd. | 2.20 | -3.21 | 0.3197 | -0.0096 | |||||

| Airport Authority / DBT (US00946AAN46) | 2.20 | 2.47 | 0.3196 | 0.0087 | |||||

| USQ6535DBH63 / National Australia Bank Ltd | 2.10 | 0.48 | 0.3055 | 0.0024 | |||||

| USY68851AK32 / Petroliam Nasional Bhd | 2.09 | -0.10 | 0.3033 | 0.0005 | |||||

| XS2399476972 / Globe Telecom Inc | 2.05 | 0.59 | 0.2979 | 0.0026 | |||||

| IDG000023607 / INDONESIA GOVERNMENT IDR 6.625% 02-15-34 | 2.02 | -1.03 | 0.2930 | -0.0021 | |||||

| XS2577258713 / Wanda Properties Global Co. Ltd. | 1.94 | 2.65 | 0.2816 | 0.0081 | |||||

| NWD MTN Ltd / DBT (XS2873948702) | 1.84 | 50.45 | 0.2670 | 0.0901 | |||||

| NWD MTN Ltd / DBT (XS2873948702) | 1.84 | 50.45 | 0.2670 | 0.0901 | |||||

| INE906B07HH5 / National Highways Authority of India | 1.83 | 3.86 | 0.2659 | 0.0107 | |||||

| INE752E07NT0 / Power Grid Corp of India Ltd | 1.81 | 3.48 | 0.2637 | 0.0096 | |||||

| US902613BE74 / UBS Group AG | 1.79 | -3.25 | 0.2599 | -0.0078 | |||||

| US50050GAN88 / Kookmin Bank | 1.77 | 3.03 | 0.2573 | 0.0084 | |||||

| US917288BM35 / Uruguay Government International Bond | 1.77 | 3.82 | 0.2567 | 0.0101 | |||||

| Vedanta Resources Finance II PLC / DBT (US92243XAH44) | 1.65 | -6.63 | 0.2398 | -0.0162 | |||||

| Vedanta Resources Finance II PLC / DBT (US92243XAL55) | 1.63 | -10.13 | 0.2373 | -0.0259 | |||||

| XS2342248593 / AAC Technologies Holdings Inc | 1.61 | 0.44 | 0.2347 | 0.0017 | |||||

| XS2207510582 / Globe Telecom Inc | 1.59 | 1.34 | 0.2307 | 0.0037 | |||||

| USY4470XAA10 / JSW Infrastructure Ltd | 1.53 | -1.10 | 0.2221 | -0.0017 | |||||

| XS1787454922 / MAF Global Securities Ltd | 1.50 | 0.34 | 0.2176 | 0.0015 | |||||

| XS2322319638 / Pakistan Government International Bond | 1.46 | -9.05 | 0.2118 | -0.0204 | |||||

| US00946AAJ34 / Airport Authority | 1.37 | 1.41 | 0.1988 | 0.0034 | |||||

| USY0606WBQ25 / BANGKOK BANK PCL REG S SUB 9.025% 03-15-29 | 1.36 | 0.44 | 0.1983 | 0.0015 | |||||

| US88167AAS06 / Teva Pharmaceutical Finance Netherlands III BV | 1.29 | -0.85 | 0.1870 | -0.0011 | |||||

| IDG000015207 / Indonesia Treasury Bond | 1.25 | -0.79 | 0.1820 | -0.0008 | |||||

| MYBVN1902854 / DRB-Hicom Bhd | 1.21 | 3.41 | 0.1764 | 0.0065 | |||||

| 1112 / Health and Happiness (H&H) International Holdings Limited | 1.20 | -0.99 | 0.1742 | -0.0012 | |||||

| 1112 / Health and Happiness (H&H) International Holdings Limited | 1.20 | -0.99 | 0.1742 | -0.0012 | |||||

| INE040A08484 / HDFC Bank Ltd | 1.19 | 3.30 | 0.1731 | 0.0060 | |||||

| US36256WAC82 / GMR Hyderabad International Airport Ltd | 1.19 | 0.17 | 0.1722 | 0.0007 | |||||

| MYBMO1700040 / Malaysia Government Bond | 1.18 | 3.97 | 0.1713 | 0.0070 | |||||

| MYBMS1300057 / Malaysia Government Bond | 1.17 | 4.17 | 0.1707 | 0.0073 | |||||

| INE148I07EM6 / Indiabulls Housing Finance Ltd | 1.16 | 3.76 | 0.1687 | 0.0067 | |||||

| MYBVI2001730 / Press Metal Aluminium Holdings Bhd | 1.16 | 3.29 | 0.1686 | 0.0059 | |||||

| MYBVL2002377 / Pengerang LNG Two Sdn Bhd | 1.13 | 4.26 | 0.1639 | 0.0072 | |||||

| USG4672CAC94 / Hutchison Whampoa International 03/33 Ltd | 1.12 | 0.27 | 0.1635 | 0.0010 | |||||

| MYBVM2002383 / Pengerang LNG Two Sdn Bhd | 1.12 | 4.47 | 0.1629 | 0.0073 | |||||

| IDG000009200 / Indonesia Treasury Bond | 1.09 | -1.71 | 0.1586 | -0.0023 | |||||

| AU3CB0297554 / NATL AUSTRALIABK | 0.99 | 3.23 | 0.1441 | 0.0050 | |||||

| Vedanta Resources Finance II PLC / DBT (US92243XAJ00) | 0.99 | -3.90 | 0.1433 | -0.0052 | |||||

| US 5YR NOTE (CBT) JUN25 / DIR (000000000) | 0.94 | 0.1364 | 0.1364 | ||||||

| KOREA 10YR BND FU JUN25 / DIR (000000000) | 0.85 | 0.1234 | 0.1234 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0.85 | 0.1234 | 0.1234 | ||||||

| AU3CB0281293 / Emeco Pty Ltd | 0.62 | 0.98 | 0.0902 | 0.0012 | |||||

| INE053F07AY7 / Indian Railway Finance Corp Ltd | 0.62 | 4.20 | 0.0901 | 0.0038 | |||||

| AU3CB0291466 / Australia & New Zealand Banking Group Ltd | 0.59 | 3.15 | 0.0857 | 0.0029 | |||||

| XS2085045503 / Yuzhou Group Holdings Co Ltd | 0.51 | -3.43 | 0.0738 | -0.0023 | |||||

| PURCHASED THB / SOLD USD / DFE (000000000) | 0.45 | 0.0655 | 0.0655 | ||||||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 0.25 | 0.00 | 0.0367 | 0.0001 | |||||

| Long: B17315554 IRS USD R V 00MSOFR SL_2717315554_RECEIVE OIS / Short: B17315554 IRS USD P F 3.38270 SLI_2717315554_PAY OIS / DIR (000000000) | 0.23 | 0.0339 | 0.0339 | ||||||

| Long: B17315554 IRS USD R V 00MSOFR SL_2717315554_RECEIVE OIS / Short: B17315554 IRS USD P F 3.38270 SLI_2717315554_PAY OIS / DIR (000000000) | 0.23 | 0.0339 | 0.0339 | ||||||

| XS1953029284 / Shimao Property Holdings Ltd | 0.22 | -18.91 | 0.0324 | -0.0074 | |||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.17 | 0.0247 | 0.0247 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.17 | 0.0247 | 0.0247 | ||||||

| XS2025575114 / Shimao Group Holdings Ltd | 0.14 | -17.82 | 0.0209 | -0.0044 | |||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.11 | 0.0164 | 0.0164 | ||||||

| PURCHASED USD / SOLD CNH / DFE (000000000) | 0.11 | 0.0164 | 0.0164 | ||||||

| Long: B71731555 IRS USD R V 00MSOFR SL_2717315556_RECEIVE CCPOIS / Short: B71731555 IRS USD P F 3.40020 SL_2717315556_PAY CCPOIS / DIR (000000000) | 0.08 | 0.0109 | 0.0109 | ||||||

| Long: B71731555 IRS USD R V 00MSOFR SL_2717315556_RECEIVE CCPOIS / Short: B71731555 IRS USD P F 3.40020 SL_2717315556_PAY CCPOIS / DIR (000000000) | 0.08 | 0.0109 | 0.0109 | ||||||

| KAISAG / Kaisa Group Holdings Ltd | 0.05 | -27.27 | 0.0070 | -0.0026 | |||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0.03 | 0.0044 | 0.0044 | ||||||

| XS2201954067 / Kaisa Group Holdings Ltd | 0.03 | -23.68 | 0.0043 | -0.0013 | |||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0.01 | -0.0008 | -0.0008 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0.01 | -0.0016 | -0.0016 | ||||||

| Long: B20948775 IRS USD R V 00MSOFR SL_2720948775_RECEIVE CCPOIS / Short: B20948775 IRS USD P F 3.39600 SL_2720948775_PAY CCPOIS / DIR (000000000) | -0.10 | -0.0143 | -0.0143 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | -0.11 | -0.0157 | -0.0157 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | -0.11 | -0.0157 | -0.0157 | ||||||

| US ULTRA BOND CBT JUN25 / DIR (000000000) | -0.11 | -0.0159 | -0.0159 | ||||||

| US ULTRA BOND CBT JUN25 / DIR (000000000) | -0.11 | -0.0159 | -0.0159 | ||||||

| US 10YR NOTE (CBT)JUN25 / DIR (000000000) | -0.19 | -0.0272 | -0.0272 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0.61 | -0.0889 | -0.0889 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0.71 | -0.1032 | -0.1032 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0.71 | -0.1032 | -0.1032 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | -0.81 | -0.1178 | -0.1178 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | -1.16 | -0.1679 | -0.1679 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | -1.29 | -0.1871 | -0.1871 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | -1.44 | -0.2095 | -0.2095 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | -1.44 | -0.2095 | -0.2095 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -1.45 | -0.2111 | -0.2111 |