Mga Batayang Estadistika

| Nilai Portofolio | $ 895,863 |

| Posisi Saat Ini | 55 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

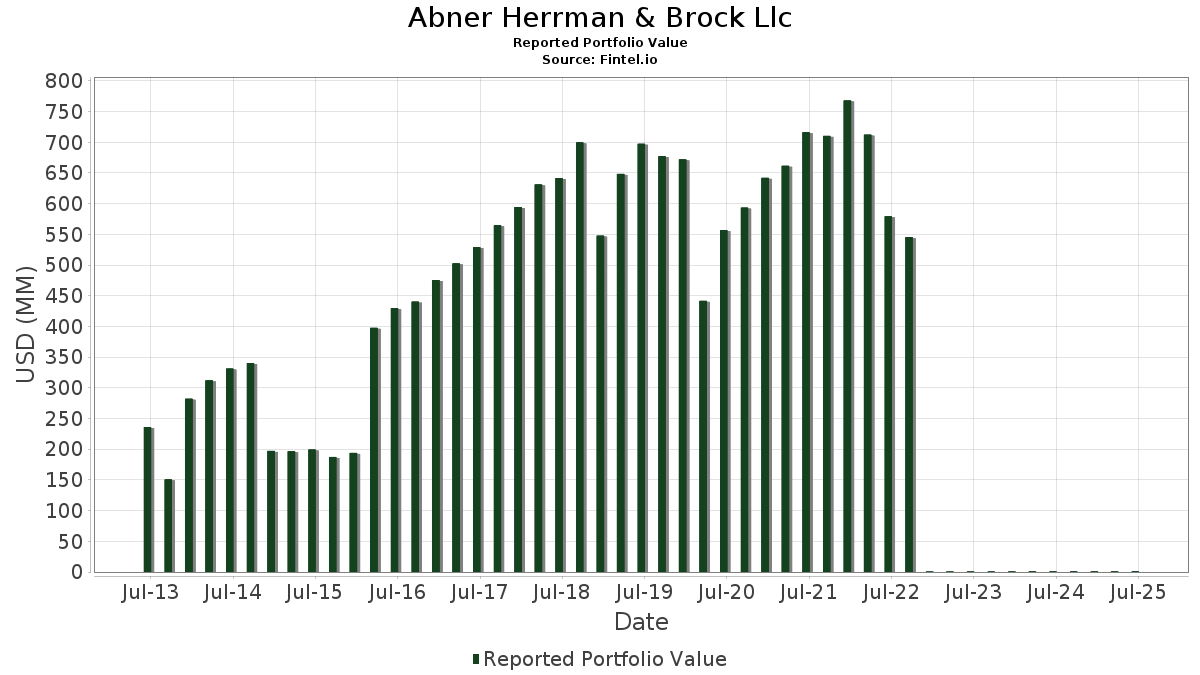

Abner Herrman & Brock Llc telah mengungkapkan total kepemilikan 55 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 895,863 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Abner Herrman & Brock Llc adalah NVIDIA Corporation (US:NVDA) , Netflix, Inc. (US:NFLX) , International Business Machines Corporation (US:IBM) , Microsoft Corporation (US:MSFT) , and JPMorgan Chase & Co. (US:JPM) . Posisi baru Abner Herrman & Brock Llc meliputi: Tesla, Inc. (US:TSLA) , Hilton Worldwide Holdings Inc. (US:HLT) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 0.02 | 1.9817 | 1.9817 | |

| 0.03 | 0.02 | 1.9101 | 1.1203 | |

| 0.03 | 0.05 | 5.1041 | 1.0440 | |

| 0.03 | 0.01 | 0.9229 | 0.9229 | |

| 0.06 | 0.02 | 2.4408 | 0.7447 | |

| 0.42 | 0.07 | 7.4424 | 0.6731 | |

| 0.08 | 0.04 | 4.2602 | 0.5526 | |

| 0.02 | 0.00 | 0.4928 | 0.4928 | |

| 0.16 | 0.02 | 2.1567 | 0.4433 | |

| 0.04 | 0.03 | 3.3193 | 0.4229 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 0.01 | 0.7010 | -0.7263 | |

| 0.16 | 0.02 | 2.5696 | -0.7088 | |

| 0.06 | 0.02 | 2.2217 | -0.6540 | |

| 0.10 | 0.02 | 2.3777 | -0.5678 | |

| 0.09 | 0.01 | 1.4903 | -0.4873 | |

| 0.03 | 0.02 | 2.4058 | -0.4766 | |

| 0.07 | 0.02 | 2.2934 | -0.4704 | |

| 0.06 | 0.02 | 1.8329 | -0.4291 | |

| 0.13 | 0.01 | 1.5175 | -0.4108 | |

| 0.26 | 0.02 | 2.3133 | -0.3311 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-07 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.42 | -13.73 | 0.07 | 24.53 | 7.4424 | 0.6731 | |||

| NFLX / Netflix, Inc. | 0.03 | 0.13 | 0.05 | 45.16 | 5.1041 | 1.0440 | |||

| IBM / International Business Machines Corporation | 0.15 | -0.50 | 0.04 | 16.67 | 4.7723 | 0.1446 | |||

| MSFT / Microsoft Corporation | 0.08 | -0.81 | 0.04 | 31.03 | 4.2602 | 0.5526 | |||

| JPM / JPMorgan Chase & Co. | 0.12 | -3.82 | 0.04 | 12.90 | 3.9879 | -0.0250 | |||

| AMZN / Amazon.com, Inc. | 0.15 | 0.51 | 0.03 | 14.29 | 3.6605 | 0.0481 | |||

| META / Meta Platforms, Inc. | 0.04 | 2.36 | 0.03 | 31.82 | 3.3193 | 0.4229 | |||

| ORCL / Oracle Corporation | 0.12 | -25.67 | 0.03 | 18.18 | 2.9070 | 0.0463 | |||

| AXP / American Express Company | 0.08 | 5.35 | 0.02 | 26.32 | 2.7136 | 0.2286 | |||

| INTU / Intuit Inc. | 0.03 | 0.78 | 0.02 | 33.33 | 2.6977 | 0.3109 | |||

| MS / Morgan Stanley | 0.16 | -25.74 | 0.02 | -8.00 | 2.5696 | -0.7088 | |||

| MA / Mastercard Incorporated | 0.04 | -1.13 | 0.02 | 0.00 | 2.5124 | -0.3228 | |||

| GOOG / Alphabet Inc. | 0.13 | 0.94 | 0.02 | 15.79 | 2.4955 | 0.0050 | |||

| HD / The Home Depot, Inc. | 0.06 | 64.54 | 0.02 | 61.54 | 2.4408 | 0.7447 | |||

| LLY / Eli Lilly and Company | 0.03 | 1.15 | 0.02 | -4.55 | 2.4058 | -0.4766 | |||

| AAPL / Apple Inc. | 0.10 | -0.03 | 0.02 | -8.70 | 2.3777 | -0.5678 | |||

| CRM / Salesforce, Inc. | 0.08 | -0.47 | 0.02 | 5.00 | 2.3677 | -0.3101 | |||

| WFC / Wells Fargo & Company | 0.26 | -10.35 | 0.02 | 0.00 | 2.3133 | -0.3311 | |||

| CB / Chubb Limited | 0.07 | -1.07 | 0.02 | -4.76 | 2.2934 | -0.4704 | |||

| WMT / Walmart Inc. | 0.21 | 0.10 | 0.02 | 11.11 | 2.2661 | -0.0588 | |||

| AON / Aon plc | 0.06 | -1.15 | 0.02 | -13.64 | 2.2217 | -0.6540 | |||

| MAR / Marriott International, Inc. | 0.07 | 1.49 | 0.02 | 18.75 | 2.1750 | 0.0378 | |||

| DELL / Dell Technologies Inc. | 0.16 | 7.04 | 0.02 | 46.15 | 2.1567 | 0.4433 | |||

| AMD / Advanced Micro Devices, Inc. | 0.13 | -9.24 | 0.02 | 28.57 | 2.0986 | 0.1837 | |||

| ABT / Abbott Laboratories | 0.14 | -1.67 | 0.02 | 0.00 | 2.0510 | -0.2759 | |||

| TSLA / Tesla, Inc. | 0.06 | 0.02 | 1.9817 | 1.9817 | |||||

| ADP / Automatic Data Processing, Inc. | 0.06 | -0.34 | 0.02 | 0.00 | 1.9759 | -0.2707 | |||

| ISRG / Intuitive Surgical, Inc. | 0.03 | 152.12 | 0.02 | 183.33 | 1.9101 | 1.1203 | |||

| MCD / McDonald's Corporation | 0.06 | -0.91 | 0.02 | -5.88 | 1.8329 | -0.4291 | |||

| AIG / American International Group, Inc. | 0.16 | 3.50 | 0.01 | 7.69 | 1.5748 | -0.1929 | |||

| XOM / Exxon Mobil Corporation | 0.13 | -0.70 | 0.01 | -13.33 | 1.5175 | -0.4108 | |||

| CVX / Chevron Corporation | 0.09 | 0.70 | 0.01 | -13.33 | 1.4903 | -0.4873 | |||

| SYK / Stryker Corporation | 0.03 | 1.46 | 0.01 | 8.33 | 1.4569 | -0.0884 | |||

| RTX / RTX Corporation | 0.09 | 5.51 | 0.01 | 20.00 | 1.4171 | 0.0233 | |||

| EMR / Emerson Electric Co. | 0.08 | 0.00 | 0.01 | 25.00 | 1.2100 | 0.0719 | |||

| APD / Air Products and Chemicals, Inc. | 0.04 | -0.94 | 0.01 | 0.00 | 1.1348 | -0.2352 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | -7.66 | 0.01 | 0.00 | 0.9445 | -0.1148 | |||

| C / Citigroup Inc. | 0.10 | 1.57 | 0.01 | 33.33 | 0.9374 | 0.0570 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.03 | 0.01 | 0.9229 | 0.9229 | |||||

| ADBE / Adobe Inc. | 0.02 | -44.31 | 0.01 | -45.45 | 0.7010 | -0.7263 | |||

| BK / The Bank of New York Mellon Corporation | 0.05 | 98.25 | 0.00 | 100.00 | 0.5480 | 0.2570 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.02 | 0.00 | 0.4928 | 0.4928 | |||||

| PG / The Procter & Gamble Company | 0.02 | -22.82 | 0.00 | -40.00 | 0.4330 | -0.2535 | |||

| UBER / Uber Technologies, Inc. | 0.04 | 0.00 | 0.4007 | 0.4007 | |||||

| AMGN / Amgen Inc. | 0.01 | 4.00 | 0.00 | 0.00 | 0.3765 | -0.0856 | |||

| BA / The Boeing Company | 0.02 | 0.00 | 0.00 | 50.00 | 0.3540 | 0.0244 | |||

| PEP / PepsiCo, Inc. | 0.01 | -2.69 | 0.00 | 0.00 | 0.1590 | -0.0531 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.02 | -3.21 | 0.00 | 0.00 | 0.1526 | -0.0237 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 0.00 | 0.00 | 0.00 | 0.1189 | -0.0292 | |||

| EQT / EQT Corporation | 0.01 | 0.00 | 0.00 | 0.0900 | -0.0044 | ||||

| NEE / NextEra Energy, Inc. | 0.01 | -3.40 | 0.00 | 0.0875 | -0.0183 | ||||

| DD / DuPont de Nemours, Inc. | 0.01 | 0.00 | 0.00 | 0.0804 | -0.0197 | ||||

| PFE / Pfizer Inc. | 0.01 | 0.00 | 0.00 | 0.0400 | -0.0078 | ||||

| LPG / Dorian LPG Ltd. | 0.01 | 0.00 | 0.00 | 0.0286 | -0.0014 | ||||

| ET / Energy Transfer LP - Limited Partnership | 0.01 | 0.00 | 0.00 | 0.0202 | -0.0035 | ||||

| AMAT / Applied Materials, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BAC / Bank of America Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |