Mga Batayang Estadistika

| Nilai Portofolio | $ 32,931,218 |

| Posisi Saat Ini | 101 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

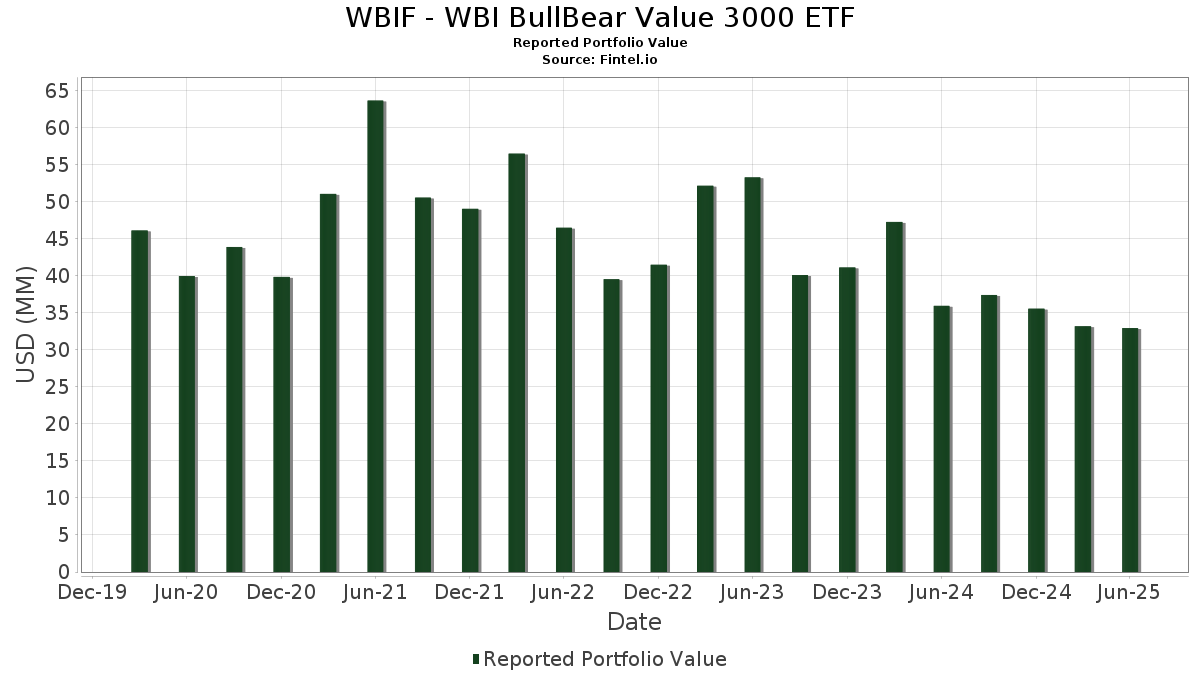

WBIF - WBI BullBear Value 3000 ETF telah mengungkapkan total kepemilikan 101 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 32,931,218 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama WBIF - WBI BullBear Value 3000 ETF adalah NVIDIA Corporation (US:NVDA) , Meta Platforms, Inc. (US:META) , Microsoft Corporation (US:MSFT) , Comfort Systems USA, Inc. (US:FIX) , and Amazon.com, Inc. (US:AMZN) . Posisi baru WBIF - WBI BullBear Value 3000 ETF meliputi: FedEx Corporation (US:FDX) , Williams-Sonoma, Inc. (US:WSM) , The Charles Schwab Corporation (US:SCHW) , Vertiv Holdings Co (US:VRT) , and ServiceNow, Inc. (US:NOW) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 4.41 | 4.41 | 15.4762 | 15.4762 | |

| 0.74 | 0.74 | 2.5800 | 2.5800 | |

| 0.00 | 0.52 | 1.8175 | 1.8175 | |

| 0.00 | 0.51 | 1.7958 | 1.7958 | |

| 0.00 | 0.48 | 1.6746 | 1.6746 | |

| 0.00 | 0.43 | 1.5077 | 1.5077 | |

| 0.01 | 0.41 | 1.4417 | 1.4417 | |

| 0.00 | 0.65 | 2.2752 | 1.2886 | |

| 0.00 | 0.36 | 1.2568 | 1.2568 | |

| 0.00 | 0.60 | 2.1124 | 1.2499 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.10 | 0.3605 | -3.8511 | |

| 0.00 | 0.14 | 0.4948 | -3.5834 | |

| 0.00 | 0.24 | 0.8300 | -3.5524 | |

| 0.00 | 0.17 | 0.5940 | -3.5264 | |

| 0.04 | 0.35 | 1.2193 | -3.2825 | |

| 0.00 | 0.28 | 0.9766 | -3.2423 | |

| 0.00 | 0.31 | 1.0747 | -2.9666 | |

| 0.00 | 0.11 | 0.3737 | -2.8726 | |

| 0.00 | 0.27 | 0.9422 | -2.8074 | |

| 0.00 | 0.33 | 1.1671 | -2.7108 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Mount Vernon Liquid Assets Portfolio, LLC / STIV (N/A) | 4.41 | 4.41 | 15.4762 | 15.4762 | |||||

| US BANK MMDA - USBFS 2 / STIV (N/A) | 0.74 | 0.74 | 2.5800 | 2.5800 | |||||

| NVDA / NVIDIA Corporation | 0.00 | -27.84 | 0.66 | 5.11 | 2.3104 | 0.2124 | |||

| META / Meta Platforms, Inc. | 0.00 | 72.02 | 0.65 | 120.41 | 2.2752 | 1.2886 | |||

| MSFT / Microsoft Corporation | 0.00 | -30.96 | 0.61 | -8.57 | 2.1351 | -0.0944 | |||

| FIX / Comfort Systems USA, Inc. | 0.00 | -57.33 | 0.61 | -41.41 | 2.1305 | -0.9843 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 27.59 | 0.60 | 47.19 | 2.1135 | 0.7413 | |||

| GOOGL / Alphabet Inc. | 0.00 | 105.29 | 0.60 | 134.24 | 2.1124 | 1.2499 | |||

| IBKR / Interactive Brokers Group, Inc. | 0.01 | 25.52 | 0.56 | -57.97 | 1.9781 | -2.5204 | |||

| AAPL / Apple Inc. | 0.00 | -21.82 | 0.56 | -27.83 | 1.9492 | -0.6291 | |||

| PAG / Penske Automotive Group, Inc. | 0.00 | 15.19 | 0.55 | 21.81 | 1.9419 | 0.5761 | |||

| WRB / W. R. Berkley Corporation | 0.01 | -53.26 | 0.53 | -41.32 | 1.8744 | -1.0675 | |||

| FANG / Diamondback Energy, Inc. | 0.00 | -42.45 | 0.53 | -42.35 | 1.8638 | -0.0857 | |||

| AMAT / Applied Materials, Inc. | 0.00 | 17.94 | 0.53 | 6.71 | 1.8445 | 0.3652 | |||

| FDX / FedEx Corporation | 0.00 | 0.52 | 1.8175 | 1.8175 | |||||

| MLI / Mueller Industries, Inc. | 0.01 | 85.66 | 0.51 | 93.96 | 1.8043 | 0.9149 | |||

| YUMC / Yum China Holdings, Inc. | 0.01 | 90.43 | 0.51 | 63.58 | 1.7969 | 0.7474 | |||

| DTE / DTE Energy Company | 0.00 | 0.51 | 1.7958 | 1.7958 | |||||

| PRI / Primerica, Inc. | 0.00 | 3.19 | 0.50 | -0.80 | 1.7371 | 0.0654 | |||

| TTEK / Tetra Tech, Inc. | 0.01 | 52.58 | 0.48 | 87.94 | 1.6943 | 0.8315 | |||

| WSM / Williams-Sonoma, Inc. | 0.00 | 0.48 | 1.6746 | 1.6746 | |||||

| OXY / Occidental Petroleum Corporation | 0.01 | -39.50 | 0.48 | -50.72 | 1.6745 | -1.2358 | |||

| SCHW / The Charles Schwab Corporation | 0.00 | 0.43 | 1.5077 | 1.5077 | |||||

| HPQ / HP Inc. | 0.02 | -65.75 | 0.43 | -77.78 | 1.4925 | -2.4163 | |||

| MNST / Monster Beverage Corporation | 0.01 | 0.41 | 1.4417 | 1.4417 | |||||

| VRT / Vertiv Holdings Co | 0.00 | 0.36 | 1.2568 | 1.2568 | |||||

| ADT / ADT Inc. | 0.04 | -75.14 | 0.35 | -74.16 | 1.2193 | -3.2825 | |||

| EMR / Emerson Electric Co. | 0.00 | 0.34 | 1.1769 | 1.1769 | |||||

| EA / Electronic Arts Inc. | 0.00 | -81.94 | 0.33 | -78.30 | 1.1671 | -2.7108 | |||

| AMP / Ameriprise Financial, Inc. | 0.00 | 0.33 | 1.1418 | 1.1418 | |||||

| EBAY / eBay Inc. | 0.00 | -77.27 | 0.32 | -72.73 | 1.1388 | -2.6995 | |||

| NOW / ServiceNow, Inc. | 0.00 | 0.32 | 1.1177 | 1.1177 | |||||

| TKO / TKO Group Holdings, Inc. | 0.00 | 0.31 | 1.0981 | 1.0981 | |||||

| ARES / Ares Management Corporation | 0.00 | 0.31 | 1.0860 | 1.0860 | |||||

| CSCO / Cisco Systems, Inc. | 0.00 | -85.25 | 0.31 | -80.98 | 1.0747 | -2.9666 | |||

| LW / Lamb Weston Holdings, Inc. | 0.01 | 0.29 | 1.0299 | 1.0299 | |||||

| WTY / Willis Towers Watson Public Limited Company | 0.00 | 0.29 | 1.0125 | 1.0125 | |||||

| V / Visa Inc. | 0.00 | 127.53 | 0.29 | 131.45 | 1.0085 | 0.5906 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | 0.28 | 0.9985 | 0.9985 | |||||

| ANSS / ANSYS, Inc. | 0.00 | 0.28 | 0.9977 | 0.9977 | |||||

| VRSK / Verisk Analytics, Inc. | 0.00 | -87.34 | 0.28 | -83.30 | 0.9766 | -3.2423 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.00 | -37.55 | 0.27 | -46.03 | 0.9552 | -0.6746 | |||

| LRCX / Lam Research Corporation | 0.00 | -82.07 | 0.27 | -76.05 | 0.9422 | -2.8074 | |||

| CRM / Salesforce, Inc. | 0.00 | 0.27 | 0.9295 | 0.9295 | |||||

| KLAC / KLA Corporation | 0.00 | -56.49 | 0.26 | -38.17 | 0.9267 | -0.4532 | |||

| SF / Stifel Financial Corp. | 0.00 | 0.25 | 0.8917 | 0.8917 | |||||

| AXP / American Express Company | 0.00 | -51.36 | 0.25 | -47.81 | 0.8781 | -0.6691 | |||

| R / Ryder System, Inc. | 0.00 | -35.66 | 0.24 | -34.93 | 0.8581 | -0.3538 | |||

| EG0 / Essent Group Ltd. | 0.00 | 0.24 | 0.8576 | 0.8576 | |||||

| J / Jacobs Solutions Inc. | 0.00 | 0.24 | 0.8570 | 0.8570 | |||||

| LNG / Cheniere Energy, Inc. | 0.00 | 0.24 | 0.8523 | 0.8523 | |||||

| RMD / ResMed Inc. | 0.00 | -54.29 | 0.24 | -47.38 | 0.8478 | -0.6894 | |||

| CBOE / Cboe Global Markets, Inc. | 0.00 | -74.89 | 0.24 | -74.22 | 0.8416 | -2.2648 | |||

| HRB / H&R Block, Inc. | 0.00 | -31.37 | 0.24 | -40.80 | 0.8368 | -0.3730 | |||

| NEU / NewMarket Corporation | 0.00 | -56.88 | 0.24 | -47.46 | 0.8359 | -0.6821 | |||

| MCK / McKesson Corporation | 0.00 | -83.38 | 0.24 | -81.96 | 0.8300 | -3.5524 | |||

| LEN / Lennar Corporation | 0.00 | -18.80 | 0.24 | -52.04 | 0.8243 | -0.6503 | |||

| CF / CF Industries Holdings, Inc. | 0.00 | -24.92 | 0.23 | -11.70 | 0.8224 | -0.0664 | |||

| MTG / MGIC Investment Corporation | 0.01 | 0.23 | 0.8224 | 0.8224 | |||||

| CSL / Carlisle Companies Incorporated | 0.00 | -43.13 | 0.23 | -52.83 | 0.8184 | -0.6671 | |||

| OC / Owens Corning | 0.00 | 0.23 | 0.8136 | 0.8136 | |||||

| EXP / Eagle Materials Inc. | 0.00 | -23.34 | 0.23 | -46.03 | 0.8101 | -0.4789 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 301.67 | 0.23 | 139.36 | 0.7910 | 0.4752 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.00 | -74.74 | 0.22 | -74.16 | 0.7884 | -2.1191 | |||

| G / Genpact Limited | 0.01 | 143.39 | 0.22 | 112.50 | 0.7783 | 0.4287 | |||

| TXRH / Texas Roadhouse, Inc. | 0.00 | -19.41 | 0.22 | -9.50 | 0.7696 | -0.0414 | |||

| ACN / Accenture plc | 0.00 | 0.22 | 0.7610 | 0.7610 | |||||

| ADP / Automatic Data Processing, Inc. | 0.00 | -50.92 | 0.21 | -48.18 | 0.7506 | -0.5864 | |||

| NEE / NextEra Energy, Inc. | 0.00 | 0.21 | 0.7333 | 0.7333 | |||||

| STZ / Constellation Brands, Inc. | 0.00 | 0.20 | 0.7000 | 0.7000 | |||||

| FCFS / FirstCash Holdings, Inc. | 0.00 | 44.69 | 0.19 | 63.25 | 0.6720 | 0.2770 | |||

| VST / Vistra Corp. | 0.00 | -98.97 | 0.17 | -89.44 | 0.5940 | -3.5264 | |||

| ROK / Rockwell Automation, Inc. | 0.00 | 0.15 | 0.5195 | 0.5195 | |||||

| BX / Blackstone Inc. | 0.00 | 0.14 | 0.4994 | 0.4994 | |||||

| PH / Parker-Hannifin Corporation | 0.00 | -95.65 | 0.14 | -92.22 | 0.4948 | -3.5834 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.00 | 0.14 | 0.4926 | 0.4926 | |||||

| ABBV / AbbVie Inc. | 0.00 | 0.14 | 0.4837 | 0.4837 | |||||

| BR / Broadridge Financial Solutions, Inc. | 0.00 | -72.02 | 0.14 | -68.51 | 0.4824 | -0.8250 | |||

| AME / AMETEK, Inc. | 0.00 | 0.14 | 0.4817 | 0.4817 | |||||

| TMUS / T-Mobile US, Inc. | 0.00 | 0.14 | 0.4754 | 0.4754 | |||||

| ROL / Rollins, Inc. | 0.00 | 0.14 | 0.4739 | 0.4739 | |||||

| CHTR / Charter Communications, Inc. | 0.00 | 0.13 | 0.4645 | 0.4645 | |||||

| COST / Costco Wholesale Corporation | 0.00 | 0.13 | 0.4617 | 0.4617 | |||||

| LAD / Lithia Motors, Inc. | 0.00 | 0.11 | 0.3755 | 0.3755 | |||||

| BYD / Boyd Gaming Corporation | 0.00 | -90.17 | 0.11 | -89.45 | 0.3737 | -2.8726 | |||

| SCI / Service Corporation International | 0.00 | -9.85 | 0.11 | -8.70 | 0.3711 | -0.0163 | |||

| EQH / Equitable Holdings, Inc. | 0.00 | -8.12 | 0.11 | -0.94 | 0.3695 | 0.0128 | |||

| NFG / National Fuel Gas Company | 0.00 | -19.94 | 0.11 | -13.93 | 0.3687 | -0.0425 | |||

| LECO / Lincoln Electric Holdings, Inc. | 0.00 | 0.10 | 0.3643 | 0.3643 | |||||

| GL / Globe Life Inc. | 0.00 | -92.93 | 0.10 | -92.17 | 0.3605 | -3.8511 | |||

| AIT / Applied Industrial Technologies, Inc. | 0.00 | 0.10 | 0.3579 | 0.3579 | |||||

| THG / The Hanover Insurance Group, Inc. | 0.00 | -16.62 | 0.10 | -18.55 | 0.3556 | -0.0616 | |||

| GPI / Group 1 Automotive, Inc. | 0.00 | -45.61 | 0.10 | -43.50 | 0.3507 | -0.2224 | |||

| AIZ / Assurant, Inc. | 0.00 | -81.97 | 0.10 | -83.08 | 0.3484 | -1.6119 | |||

| RL / Ralph Lauren Corporation | 0.00 | 0.10 | 0.3463 | 0.3463 | |||||

| SLGN / Silgan Holdings Inc. | 0.00 | 0.10 | 0.3412 | 0.3412 | |||||

| AVY / Avery Dennison Corporation | 0.00 | -11.90 | 0.10 | -12.73 | 0.3372 | -0.0336 | |||

| LPX / Louisiana-Pacific Corporation | 0.00 | 0.09 | 0.3302 | 0.3302 | |||||

| VNOM / Viper Energy, Inc. | 0.00 | 0.09 | 0.3260 | 0.3260 | |||||

| KBR / KBR, Inc. | 0.00 | -17.32 | 0.09 | -20.18 | 0.3065 | -0.0614 | |||

| DCI / Donaldson Company, Inc. | 0.00 | 0.07 | 0.2610 | 0.2610 | |||||

| LLY / Eli Lilly and Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.4952 | ||||

| CVSCL / CVS Health Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.6424 |