Mga Batayang Estadistika

| Nilai Portofolio | $ 122,692,622 |

| Posisi Saat Ini | 41 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

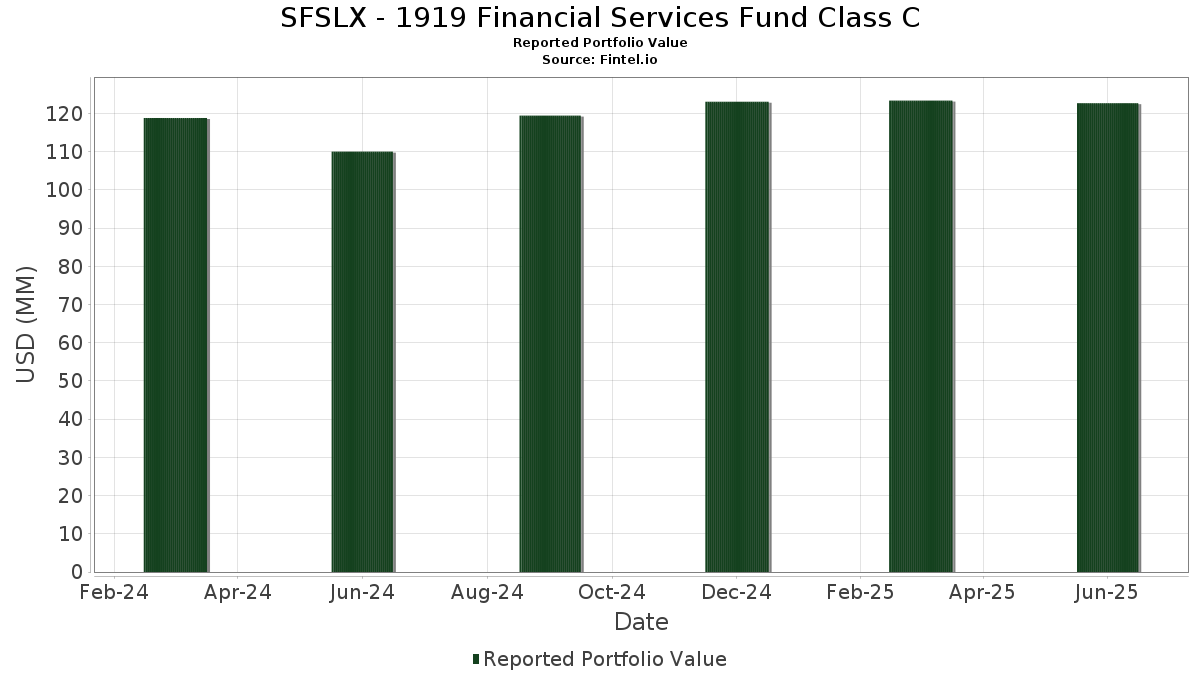

SFSLX - 1919 Financial Services Fund Class C telah mengungkapkan total kepemilikan 41 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 122,692,622 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama SFSLX - 1919 Financial Services Fund Class C adalah JPMorgan Chase & Co. (US:JPM) , Chubb Limited (US:CB) , Visa Inc. (US:V) , Coastal Financial Corporation (US:CCB) , and Intercontinental Exchange, Inc. (US:ICE) . Posisi baru SFSLX - 1919 Financial Services Fund Class C meliputi: The Progressive Corporation (US:PGR) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 11.29 | 9.2291 | 1.4794 | |

| 0.02 | 1.41 | 1.1530 | 0.6225 | |

| 0.01 | 1.23 | 1.0064 | 0.5506 | |

| 0.11 | 5.38 | 4.3986 | 0.5491 | |

| 0.00 | 0.67 | 0.5454 | 0.5454 | |

| 0.01 | 4.93 | 4.0297 | 0.4024 | |

| 0.05 | 3.59 | 2.9362 | 0.3883 | |

| 0.03 | 2.97 | 2.4314 | 0.3612 | |

| 0.06 | 5.83 | 4.7676 | 0.3517 | |

| 0.01 | 0.92 | 0.7510 | 0.3417 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 3.90 | 3.1898 | -0.8648 | |

| 1.55 | 1.55 | 1.2673 | -0.6886 | |

| 0.04 | 4.49 | 3.6710 | -0.4167 | |

| 0.01 | 5.10 | 4.1699 | -0.3671 | |

| 0.02 | 1.92 | 1.5705 | -0.3362 | |

| 0.01 | 2.56 | 2.0928 | -0.2253 | |

| 0.02 | 7.23 | 5.9091 | -0.2035 | |

| 0.06 | 3.80 | 3.1090 | -0.1318 | |

| 0.02 | 1.24 | 1.0169 | -0.1210 | |

| 0.01 | 1.51 | 1.2368 | -0.0640 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-29 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JPM / JPMorgan Chase & Co. | 0.04 | 0.00 | 11.29 | 18.19 | 9.2291 | 1.4794 | |||

| CB / Chubb Limited | 0.02 | 0.00 | 7.23 | -4.07 | 5.9091 | -0.2035 | |||

| V / Visa Inc. | 0.02 | 0.00 | 6.75 | 1.31 | 5.5151 | 0.1126 | |||

| CCB / Coastal Financial Corporation | 0.06 | 0.00 | 5.83 | 7.15 | 4.7676 | 0.3517 | |||

| ICE / Intercontinental Exchange, Inc. | 0.03 | 0.00 | 5.75 | 6.36 | 4.7046 | 0.3149 | |||

| BAC / Bank of America Corporation | 0.11 | 0.00 | 5.38 | 13.41 | 4.3986 | 0.5491 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 0.00 | 5.10 | -8.80 | 4.1699 | -0.3671 | |||

| AMP / Ameriprise Financial, Inc. | 0.01 | 0.00 | 4.93 | 10.25 | 4.0297 | 0.4024 | |||

| BRO / Brown & Brown, Inc. | 0.04 | 0.00 | 4.49 | -10.88 | 3.6710 | -0.4167 | |||

| FI / Fiserv, Inc. | 0.02 | 0.00 | 3.90 | -21.93 | 3.1898 | -0.8648 | |||

| QCRH / QCR Holdings, Inc. | 0.06 | 0.00 | 3.80 | -4.81 | 3.1090 | -0.1318 | |||

| FITB / Fifth Third Bancorp | 0.09 | 0.00 | 3.63 | 4.91 | 2.9691 | 0.1608 | |||

| SYBT / Stock Yards Bancorp, Inc. | 0.05 | 0.00 | 3.59 | 14.36 | 2.9362 | 0.3883 | |||

| BANR / Banner Corporation | 0.05 | 0.00 | 3.19 | 0.60 | 2.6050 | 0.0351 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.02 | 0.00 | 3.12 | 6.09 | 2.5508 | 0.1640 | |||

| VRSK / Verisk Analytics, Inc. | 0.01 | 0.00 | 3.12 | 4.67 | 2.5466 | 0.1320 | |||

| SCHW / The Charles Schwab Corporation | 0.03 | 0.00 | 2.97 | 16.58 | 2.4314 | 0.3612 | |||

| FIS / Fidelity National Information Services, Inc. | 0.03 | 0.00 | 2.83 | 9.02 | 2.3130 | 0.2073 | |||

| MTB / M&T Bank Corporation | 0.01 | 0.00 | 2.79 | 8.51 | 2.2838 | 0.1954 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.01 | 0.00 | 2.56 | -10.43 | 2.0928 | -0.2253 | |||

| SPGI / S&P Global Inc. | 0.00 | 0.00 | 2.32 | 3.80 | 1.8968 | 0.0829 | |||

| SSB / SouthState Corporation | 0.02 | 0.00 | 2.22 | -0.85 | 1.8114 | -0.0017 | |||

| WBS / Webster Financial Corporation | 0.04 | 0.00 | 2.21 | 5.94 | 1.8094 | 0.1140 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.01 | 0.00 | 2.14 | 0.75 | 1.7480 | 0.0260 | |||

| IIIV / i3 Verticals, Inc. | 0.08 | 0.00 | 2.09 | 11.37 | 1.7070 | 0.1862 | |||

| THG / The Hanover Insurance Group, Inc. | 0.01 | 0.00 | 2.09 | -2.34 | 1.7058 | -0.0277 | |||

| GPN / Global Payments Inc. | 0.02 | 0.00 | 1.92 | -18.30 | 1.5705 | -0.3362 | |||

| SMBK / SmartFinancial, Inc. | 0.06 | 0.00 | 1.87 | 8.66 | 1.5284 | 0.1328 | |||

| CME / CME Group Inc. | 0.01 | 0.00 | 1.74 | 3.89 | 1.4196 | 0.0636 | |||

| FIGXX / Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I | 1.55 | -35.70 | 1.55 | -35.68 | 1.2673 | -0.6886 | |||

| GL / Globe Life Inc. | 0.01 | 0.00 | 1.51 | -5.68 | 1.2368 | -0.0640 | |||

| CBU / Community Financial System, Inc. | 0.02 | 115.65 | 1.41 | 115.93 | 1.1530 | 0.6225 | |||

| TRNO / Terreno Realty Corporation | 0.02 | 0.00 | 1.24 | -11.34 | 1.0169 | -0.1210 | |||

| ACGL / Arch Capital Group Ltd. | 0.01 | 131.47 | 1.23 | 119.25 | 1.0064 | 0.5506 | |||

| RLI / RLI Corp. | 0.01 | 102.55 | 0.92 | 82.14 | 0.7510 | 0.3417 | |||

| SPG / Simon Property Group, Inc. | 0.01 | 0.00 | 0.92 | -3.17 | 0.7491 | -0.0189 | |||

| TBBK / The Bancorp, Inc. | 0.01 | 0.00 | 0.76 | 7.79 | 0.6227 | 0.0495 | |||

| FAF / First American Financial Corporation | 0.01 | 0.00 | 0.68 | -6.38 | 0.5521 | -0.0336 | |||

| PGR / The Progressive Corporation | 0.00 | 0.67 | 0.5454 | 0.5454 | |||||

| AMAL / Amalgamated Financial Corp. | 0.02 | 0.00 | 0.58 | 8.66 | 0.4719 | 0.0404 | |||

| COLB / Columbia Banking System, Inc. | 0.02 | 0.00 | 0.39 | -6.10 | 0.3149 | -0.0185 |