Mga Batayang Estadistika

| Nilai Portofolio | $ 374,985,719 |

| Posisi Saat Ini | 164 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

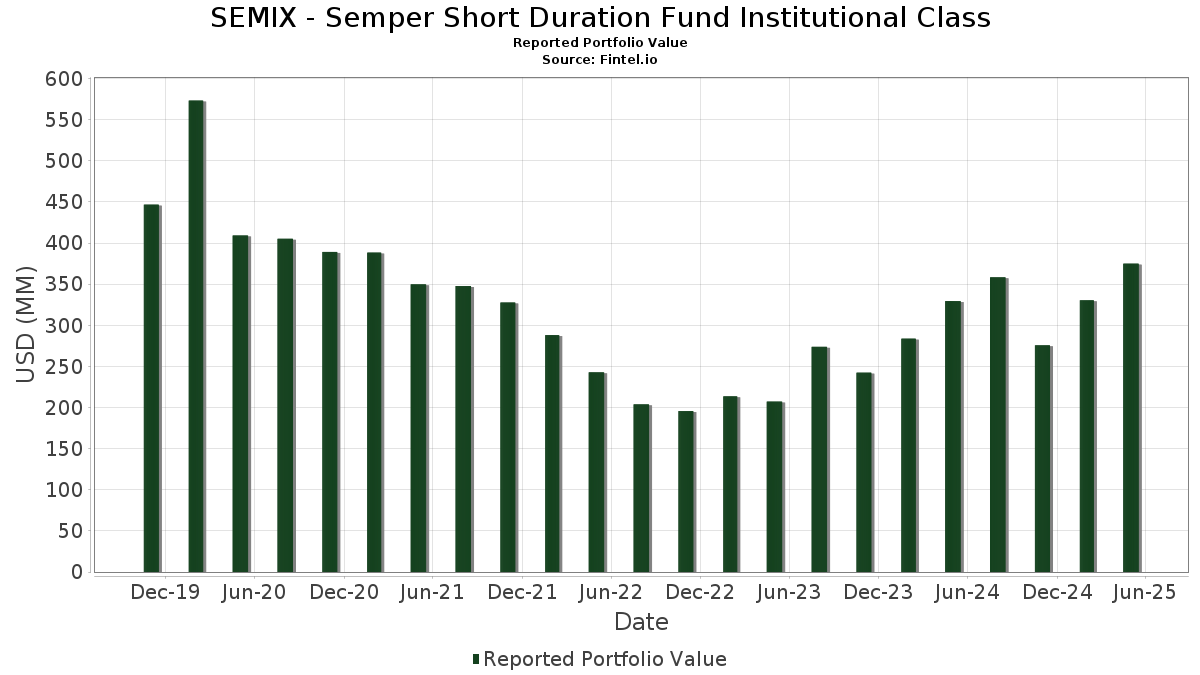

SEMIX - Semper Short Duration Fund Institutional Class telah mengungkapkan total kepemilikan 164 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 374,985,719 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama SEMIX - Semper Short Duration Fund Institutional Class adalah First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , Freddie Mac STACR REMIC Trust 2022-DNA3 (US:US35564KUX52) , Theorem Funding Trust 2022-2 (US:US88339FAB94) , BBCMS 2020-BID MORTGAGE TRUST (US:USU0733RAD36) , and TPG Real Estate Finance Issuer LTD (KY:US87276WAG87) . Posisi baru SEMIX - Semper Short Duration Fund Institutional Class meliputi: Freddie Mac STACR REMIC Trust 2022-DNA3 (US:US35564KUX52) , Theorem Funding Trust 2022-2 (US:US88339FAB94) , BBCMS 2020-BID MORTGAGE TRUST (US:USU0733RAD36) , TPG Real Estate Finance Issuer LTD (KY:US87276WAG87) , and BXMT 2020-FL2 LTD (KY:US12434LAG95) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 7.01 | 1.8877 | 1.8877 | ||

| 5.92 | 1.5925 | 1.5925 | ||

| 5.00 | 1.3460 | 1.3460 | ||

| 4.98 | 1.3406 | 1.3406 | ||

| 4.73 | 1.2743 | 1.2743 | ||

| 4.37 | 1.1749 | 1.1749 | ||

| 7.75 | 2.0853 | 1.1432 | ||

| 4.11 | 1.1058 | 1.1058 | ||

| 3.99 | 1.0751 | 1.0751 | ||

| 3.94 | 1.0612 | 1.0612 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.95 | 0.7940 | -0.7102 | ||

| 0.88 | 0.2362 | -0.5020 | ||

| 0.42 | 0.1135 | -0.4286 | ||

| 0.18 | 0.0495 | -0.2558 | ||

| 2.89 | 0.7771 | -0.2518 | ||

| 1.89 | 0.5099 | -0.2358 | ||

| 2.66 | 0.7154 | -0.2358 | ||

| 2.57 | 0.6918 | -0.2351 | ||

| 6.09 | 1.6397 | -0.2269 | ||

| 0.84 | 0.2256 | -0.2149 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-24 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 21.41 | 8.75 | 21.41 | 8.75 | 5.7631 | -0.1816 | |||

| US35564KUX52 / Freddie Mac STACR REMIC Trust 2022-DNA3 | 7.75 | 148.33 | 2.0853 | 1.1432 | |||||

| ACHV ABS Trust 2024-3AL / ABS-O (US00092KAD63) | 7.01 | 1.8877 | 1.8877 | ||||||

| US88339FAB94 / Theorem Funding Trust 2022-2 | 6.09 | -1.46 | 1.6397 | -0.2269 | |||||

| Pagaya AI Debt Grantor Trust 2024-6 And Pagaya AI Debt Trust 2024-6 / ABS-O (US69548KAC36) | 5.92 | 1.5925 | 1.5925 | ||||||

| Pagaya AI Debt Trust 2023-7 / ABS-O (US69548RAC88) | 5.06 | -0.88 | 1.3622 | -0.1796 | |||||

| USU0733RAD36 / BBCMS 2020-BID MORTGAGE TRUST | 5.00 | 1.3460 | 1.3460 | ||||||

| SKY Trust 2025-LINE / ABS-MBS (US830941AC40) | 4.98 | 1.3406 | 1.3406 | ||||||

| BAMLL Trust 2025-ASHF / ABS-MBS (US05494CAA36) | 4.98 | -0.62 | 1.3403 | -0.1728 | |||||

| US87276WAG87 / TPG Real Estate Finance Issuer LTD | 4.98 | 0.00 | 1.3392 | -0.1630 | |||||

| US12434LAG95 / BXMT 2020-FL2 LTD | 4.87 | 63.63 | 1.3117 | 0.4126 | |||||

| US55375KAS50 / MSSG Trust, Series 2017-237P, Class A | 4.73 | 1.2743 | 1.2743 | ||||||

| Lake Shore MM CLO IV Ltd / ABS-CBDO (US510758AC99) | 4.51 | -0.13 | 1.2131 | -0.1495 | |||||

| US91835GAA22 / VOLT CV LLC, Series 2021-CF2, Class A1 | 4.51 | -2.99 | 1.2129 | -0.1896 | |||||

| HTAP Issuer Trust 2025-1 / ABS-MBS (US40446AAA34) | 4.37 | 1.1749 | 1.1749 | ||||||

| US35564KWT23 / STACR_22-DNA4 | 4.33 | 312.68 | 1.1652 | 0.8484 | |||||

| US12663UAD81 / CPS Auto Receivables Trust 2022-D | 4.18 | 97.96 | 1.1238 | 0.4868 | |||||

| Greystone CRE Notes 2024-HC3 / ABS-CBDO (US39808MAG87) | 4.11 | 1.1058 | 1.1058 | ||||||

| BCC Middle Market CLO 2024-1 LLC / ABS-CBDO (US05555GAA04) | 4.02 | 0.00 | 1.0827 | -0.1318 | |||||

| Owl Rock CLO XII LLC / ABS-CBDO (US69120FAA49) | 4.01 | 0.15 | 1.0800 | -0.1295 | |||||

| BXMT 2025-FL5 Ltd / ABS-CBDO (US05613YAC75) | 3.99 | 1.0751 | 1.0751 | ||||||

| US03880XAL01 / Arbor Realty Collateralized Loan Obligation Ltd., Series 2022-FL1, Class E | 3.99 | 0.15 | 1.0731 | -0.1291 | |||||

| Atrium Hotel Portfolio Trust 2024-ATRM / ABS-MBS (US04963XAL82) | 3.94 | 1.0612 | 1.0612 | ||||||

| US05609GAE89 / BXMT 2021-FL4 Ltd | 3.86 | 1.0388 | 1.0388 | ||||||

| Toorak Mortgage Trust 2024-RRTL1 / ABS-MBS (US89054YAB92) | 3.79 | 125.15 | 1.0195 | 0.5116 | |||||

| BlackRock Maroon Bells CLO XI LLC / ABS-CBDO (US09290EAC30) | 3.76 | 1.0108 | 1.0108 | ||||||

| US44928XAY04 / ICG US CLO 2014-1 Ltd | 3.66 | -0.05 | 0.9842 | -0.1203 | |||||

| LHOME Mortgage Trust 2024-RTL1 / ABS-MBS (US50205DAA72) | 3.53 | -0.37 | 0.9510 | -0.1197 | |||||

| US46651BBA70 / JP MORGAN MORTGAGE TRUST SER 2019-6 CL B3 V/R REGD 144A P/P 4.27129000 | 3.52 | -2.71 | 0.9466 | -0.1449 | |||||

| Kohlberg Credit Clo 2025-1 LLC / ABS-CBDO (US499925AA38) | 3.50 | 0.9420 | 0.9420 | ||||||

| Multifamily Connecticut Avenue Securities Trust 2025-01 / ABS-MBS (US62549CAC55) | 3.50 | 0.9420 | 0.9420 | ||||||

| US85521DAJ19 / STAR 2021-SFR1 Trust | 3.44 | 0.79 | 0.9272 | -0.1046 | |||||

| US05609GAJ76 / BXMT 2021-FL4 Ltd | 3.13 | 0.19 | 0.8434 | -0.1008 | |||||

| MF1 2025-FL19 LLC / ABS-CBDO (US55287KAL70) | 3.10 | 0.8355 | 0.8355 | ||||||

| Unlock HEA Trust 2024-1 / ABS-MBS (US91530QAA85) | 3.07 | 0.8256 | 0.8256 | ||||||

| Golub Capital Partners CLO 2016-30M Ltd / ABS-CBDO (US38179JAA16) | 3.06 | 0.10 | 0.8223 | -0.0992 | |||||

| US91683VAB09 / Upstart Securitization Trust 2023-2 | 3.03 | -0.82 | 0.8167 | -0.1069 | |||||

| Cerberus Loan Funding XLVIII LLC / ABS-CBDO (US15675JAA88) | 3.02 | 0.57 | 0.8132 | -0.0938 | |||||

| Upgrade Master Pass-Thru Trust Series 2025-ST3 / ABS-O (US91534LAA52) | 3.02 | 0.8121 | 0.8121 | ||||||

| US00086AAQ76 / ABPCI Direct Lending Fund CLO I LLC | 3.00 | -0.03 | 0.8084 | -0.0988 | |||||

| US02530TAJ07 / American Credit Acceptance Receivables Trust 2021-4 | 3.00 | 0.40 | 0.8069 | -0.0946 | |||||

| FIGRE Trust 2025-PF1 / ABS-MBS (US316922AA11) | 2.97 | 0.7990 | 0.7990 | ||||||

| US74331UAJ79 / Progress Residential Trust | 2.97 | -0.47 | 0.7980 | -0.1014 | |||||

| US055978AA83 / BCRED CLO 2023-1 LLC | 2.96 | 0.7973 | 0.7973 | ||||||

| MF1 2025-FL17 LLC / ABS-CBDO (US55287HAE09) | 2.95 | -40.79 | 0.7940 | -0.7102 | |||||

| Greystone CRE Notes 2024-HC3 / ABS-CBDO (US39808MAE30) | 2.92 | -0.95 | 0.7849 | -0.1040 | |||||

| US20754QAB41 / Connecticut Avenue Securities Trust 2023-R04 | 2.91 | -1.05 | 0.7835 | -0.1048 | |||||

| Pagaya AI Debt Trust 2024-1 / ABS-O (US69548AAC53) | 2.89 | -15.29 | 0.7771 | -0.2518 | |||||

| US05609GAG38 / BXMT 2021-FL4 Ltd | 2.85 | 0.32 | 0.7682 | -0.0909 | |||||

| US693984AC08 / PRKCM 2023-AFC3 TR 7.088% | 2.74 | 0.7371 | 0.7371 | ||||||

| Harvest Commercial Capital Loan Trust 2024-1 / ABS-MBS (US417927AC44) | 2.73 | -0.87 | 0.7349 | -0.0966 | |||||

| US76119NAE76 / Residential Mortgage Loan Trust, Series 2019-3, Class B1 | 2.66 | 0.64 | 0.7172 | -0.0822 | |||||

| Pagaya AI Debt Trust 2023-8 / ABS-O (US694960AB13) | 2.66 | -15.62 | 0.7154 | -0.2358 | |||||

| Freddie Mac Multifamily Structured Credit Risk / ABS-MBS (US355917AC97) | 2.65 | -1.15 | 0.7141 | -0.0964 | |||||

| US72353PAA49 / Pioneer Aircraft Finance Ltd | 2.64 | -3.97 | 0.7099 | -0.1194 | |||||

| Connecticut Avenue Securities Trust 2024-R05 / ABS-MBS (US20754XAG88) | 2.61 | -0.57 | 0.7030 | -0.0903 | |||||

| LAFL / Labrador Aviation Finance Ltd 2016-1A | 2.57 | -16.29 | 0.6918 | -0.2351 | |||||

| US35564KQC61 / Freddie Mac STACR REMIC Trust 2022-DNA1 | 2.55 | -0.51 | 0.6862 | -0.0874 | |||||

| Connecticut Avenue Securities Series 2025-R01 / ABS-MBS (US20755JAC71) | 2.52 | 0.08 | 0.6777 | -0.0821 | |||||

| US05554QAA94 / BCC Middle Market CLO 2023-2 LLC | 2.51 | -0.32 | 0.6768 | -0.0846 | |||||

| US03666BAA26 / Antares CLO 2021-1 Ltd | 2.50 | -0.04 | 0.6733 | -0.0822 | |||||

| Ares Direct Lending CLO 5 LLC / ABS-CBDO (US04020UAA97) | 2.49 | 0.6705 | 0.6705 | ||||||

| Affirm Asset Securitization Trust 2023-B / ABS-O (US00792FAH10) | 2.46 | 0.6630 | 0.6630 | ||||||

| US85022WAP95 / SpringCastle America Funding LLC | 2.46 | 0.16 | 0.6623 | -0.0793 | |||||

| Connecticut Avenue Securities Trust 2024-R02 / ABS-MBS (US20754GAF72) | 2.40 | -1.03 | 0.6455 | -0.0860 | |||||

| US62548QAF81 / MCAS 2020-01 CE | 2.35 | -0.21 | 0.6337 | -0.0786 | |||||

| Owl Rock CLO III Ltd / ABS-CBDO (US69120DAA90) | 2.35 | -0.21 | 0.6313 | -0.0784 | |||||

| US35564KDX46 / Freddie Mac Structured Agency Credit Risk Debt Notes | 2.29 | -2.05 | 0.6161 | -0.0894 | |||||

| US88607AAA79 / THUNDERBOLT III AIRCRAFT LEASE LTD 2019-1 A 3.671% 11/15/2039 144A | 2.28 | -6.37 | 0.6130 | -0.1216 | |||||

| US52521GAE52 / LBSBC 2007-1A M1 | 2.21 | -8.12 | 0.5936 | -0.1311 | |||||

| US35564KJA88 / FHLMC STACR REMIC Trust, Series 2021-DNA5, Class B1 | 2.16 | -0.37 | 0.5807 | -0.0732 | |||||

| FIGRE Trust 2025-HE2 / ABS-MBS (US31684KAA16) | 2.10 | 0.5662 | 0.5662 | ||||||

| US20753VBE74 / Connecticut Avenue Securities Trust 2020-SBT1 | 2.07 | -0.86 | 0.5567 | -0.0732 | |||||

| US46650AAM53 / JP Morgan Mortgage Trust 2018-7FRB | 2.06 | -6.72 | 0.5531 | -0.1122 | |||||

| US69700GAJ13 / Palmer Square CLO 2019-1 Ltd | 2.03 | -5.27 | 0.5470 | -0.1007 | |||||

| US40390JAJ16 / HGI CRE CLO 2021-FL2 Ltd. | 2.02 | -0.35 | 0.5424 | -0.0682 | |||||

| US20754KAB70 / Fannie Mae Connecticut Avenue Securities | 2.01 | -0.64 | 0.5416 | -0.0699 | |||||

| LCM 39 Ltd / ABS-CBDO (US50204NAQ16) | 2.00 | -0.10 | 0.5390 | -0.0663 | |||||

| COLT 2022-7 Mortgage Loan Trust / ABS-MBS (US12663GAD97) | 1.99 | 0.5367 | 0.5367 | ||||||

| US69145CAA27 / Oxford Finance Funding Trust 2023-1 | 1.99 | -9.71 | 0.5355 | -0.1297 | |||||

| Saluda Grade Alternative Mortgage Trust 2025-NPL2 / ABS-MBS (US79589BAA61) | 1.96 | 0.5266 | 0.5266 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.92 | 0.5170 | 0.5170 | ||||||

| US10637WAA71 / Brean Asset Backed Securities Trust 2022-RM5 | 1.91 | -2.10 | 0.5150 | -0.0749 | |||||

| US05609RAS31 / BX 2021-BXMF 1ML+359.02 10/15/2026 144A | 1.91 | 97.52 | 0.5141 | 0.1785 | |||||

| US30165JAF30 / Exeter Automobile Receivables Trust, Series 2021-4A, Class D | 1.89 | -23.32 | 0.5099 | -0.2358 | |||||

| US50067HDD61 / Korth Direct Mortgage Inc | 1.89 | 0.00 | 0.5090 | -0.0620 | |||||

| US30166AAF12 / EART_21-3A | 1.89 | -19.20 | 0.5086 | -0.1976 | |||||

| US36169BAA44 / GCAT 2023-NQM1 Trust | 1.89 | -2.99 | 0.5075 | -0.0794 | |||||

| Sequoia Mortgage Trust 2025-3 / ABS-MBS (US817370AB55) | 1.88 | 0.5050 | 0.5050 | ||||||

| Towd Point Mortgage Trust 2019-HY2 / ABS-MBS (US89177HAF91) | 1.87 | -4.25 | 0.5038 | -0.0864 | |||||

| US70806JAA51 / PennantPark CLO Ltd | 1.77 | -10.84 | 0.4760 | -0.1230 | |||||

| US61764BAA17 / MORGAN STANLEY CAPITAL I TRUST 3.912% 09/09/2032 144A 2014-150E A | 1.77 | -2.75 | 0.4755 | -0.0728 | |||||

| FIGRE Trust 2024-HE5 / ABS-MBS (US31684FAA21) | 1.75 | -5.75 | 0.4722 | -0.0897 | |||||

| Bayview Opportunity Master Fund VII 2024-EDU1 LLC / ABS-O (US07336PAA21) | 1.75 | -9.27 | 0.4713 | -0.1115 | |||||

| Trinitas CLO XI Ltd / ABS-CBDO (US89641HBC34) | 1.75 | -0.17 | 0.4706 | -0.0581 | |||||

| Venture 28A Clo Ltd / ABS-CBDO (US92331DBJ63) | 1.75 | 0.4702 | 0.4702 | ||||||

| US55286MAB63 / MFA 2023-NQM3 Trust | 1.74 | -6.20 | 0.4683 | -0.0919 | |||||

| Harvest Commercial Capital Loan Trust 2024-1 / ABS-MBS (US417927AD27) | 1.74 | -0.74 | 0.4682 | -0.0609 | |||||

| US078777AD10 / Bellemeade RE 2021-3 Ltd | 1.73 | 0.17 | 0.4659 | -0.0560 | |||||

| US55284AAL26 / MF1 2021-FL7 Ltd | 1.63 | -0.67 | 0.4390 | -0.0569 | |||||

| US92873BAB27 / Vericrest Opportunity Loan Transferee | 1.62 | 4.45 | 0.4360 | -0.0324 | |||||

| US92540DAC92 / Verus Securitization Trust 2023-8 | 1.56 | -10.45 | 0.4201 | -0.1061 | |||||

| MFA 2024-RTL2 Trust / ABS-MBS (US592916AA80) | 1.52 | -0.26 | 0.4093 | -0.0509 | |||||

| Point Securitization Trust 2025-1 / ABS-MBS (US73072DAA90) | 1.50 | 0.4031 | 0.4031 | ||||||

| US35565TBD00 / STACR_20-HQA5 | 1.49 | -2.62 | 0.4001 | -0.0607 | |||||

| Towd Point Mortgage Trust 2024-CES1 / ABS-MBS (US89183CAB19) | 1.44 | -8.19 | 0.3864 | -0.0857 | |||||

| PRET 2024-NPL5 LLC / ABS-MBS (US74143QAA31) | 1.43 | -4.99 | 0.3848 | -0.0693 | |||||

| US20754RAB24 / Connecticut Avenue Securities Trust 2021-R01 | 1.37 | -7.98 | 0.3696 | -0.0810 | |||||

| US35564KKY46 / Freddie Mac STACR REMIC Trust 2021-DNA6 | 1.36 | 5.28 | 0.3650 | -0.0241 | |||||

| US46654EAG61 / JP MORGAN CHASE COMMERCIAL MORTGAGE SECURITIES TRU JPMCC 2021-NYAH D | 1.32 | -0.08 | 0.3548 | -0.0435 | |||||

| US20754LAB53 / Fannie Mae Connecticut Avenue Securities | 1.31 | -0.53 | 0.3532 | -0.0450 | |||||

| EFMT 2024-RM2 / ABS-MBS (US268431AA18) | 1.27 | -3.72 | 0.3417 | -0.0564 | |||||

| Connecticut Avenue Securities Trust 2024-R01 / ABS-MBS (US20753UAF75) | 1.23 | -0.48 | 0.3323 | -0.0422 | |||||

| US33846AAJ51 / Flagship Credit Auto Trust 2019-3 | 1.21 | -30.54 | 0.3264 | -0.2006 | |||||

| Pagaya AI Debt Trust 2023-8 / ABS-O (US694960AA30) | 1.20 | -18.35 | 0.3222 | -0.1205 | |||||

| US20754RAF38 / Connecticut Avenue Securities Trust 2021-R01 | 1.18 | -0.34 | 0.3174 | -0.0400 | |||||

| Greystone CRE Notes 2024-HC3 / ABS-CBDO (US39808MAJ27) | 1.16 | -0.94 | 0.3122 | -0.0412 | |||||

| US35564KBD00 / Freddie Mac STACR REMIC Trust 2021-DNA1 | 1.11 | -2.11 | 0.2994 | -0.0437 | |||||

| US92873HAA14 / Vericrest Opportunity Loan Transferee | 1.10 | -22.99 | 0.2968 | -0.1353 | |||||

| Trinitas CLO XIV Ltd / ABS-CBDO (US89641QAN07) | 1.10 | 0.2963 | 0.2963 | ||||||

| US35564K2K40 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1.06 | -0.65 | 0.2866 | -0.0368 | |||||

| US207932AB01 / Connecticut Avenue Securities Trust 2023-R01 | 1.06 | -1.03 | 0.2846 | -0.0379 | |||||

| US12659PAA12 / Credit Suisse Mortgage Capital Certificates | 1.04 | -5.71 | 0.2800 | -0.0532 | |||||

| US69548HAB24 / Pagaya AI Debt Trust 2022-5 | 1.04 | -0.58 | 0.2789 | -0.0358 | |||||

| Connecticut Avenue Securities Trust 2024-R03 / ABS-MBS (US207941AF22) | 1.03 | -1.16 | 0.2763 | -0.0372 | |||||

| US46591HBY53 / Chase Mortgage Finance Corp | 1.02 | 0.49 | 0.2757 | -0.0321 | |||||

| Connecticut Avenue Securities Trust 2024-R03 / ABS-MBS (US207941AB18) | 1.01 | -0.20 | 0.2727 | -0.0340 | |||||

| US46591HBM16 / J.P. Morgan Wealth Management | 1.00 | -2.16 | 0.2684 | -0.0395 | |||||

| US30165XAF24 / Exeter Automobile Receivables Trust, Series 2021-2A, Class D | 0.99 | -20.22 | 0.2675 | -0.1089 | |||||

| US55282XAJ90 / MF1 Multifamily Housing Mortgage Loan Trust | 0.99 | -1.20 | 0.2656 | -0.0358 | |||||

| US92538NAB38 / Verus Securitization Trust 2022-4 | 0.97 | -2.91 | 0.2601 | -0.0403 | |||||

| PRET 2024-NPL4 LLC / ABS-MBS (US74143RAA14) | 0.93 | -3.92 | 0.2506 | -0.0421 | |||||

| US12569CAB72 / CHNGE_22-NQM1 | 0.90 | -6.22 | 0.2436 | -0.0477 | |||||

| US000876AC64 / ACHV ABS TRUST 2023-3PL | 0.88 | -64.13 | 0.2362 | -0.5020 | |||||

| US35564K2F54 / FHLMC Structured Agency Credit Risk Debt Notes, Series 2023-HQA2, Class M1A | 0.87 | -16.48 | 0.2347 | -0.0805 | |||||

| US05492NAA19 / BBCMS 2019-BWAY Mortgage Trust | 0.84 | -2.89 | 0.2263 | -0.0348 | |||||

| US91835EAA73 / VOLT_21-NPL6 | 0.84 | -42.56 | 0.2256 | -0.2149 | |||||

| Vista Point Securitization Trust 2024-CES1 / ABS-MBS (US92839HAA41) | 0.82 | 0.87 | 0.2198 | -0.0246 | |||||

| US465985AA77 / JP Morgan Mortgage Trust 2023-HE3 | 0.81 | -13.15 | 0.2169 | -0.0634 | |||||

| Pagaya AI Debt Grantor Trust 2024-8 / ABS-O (US69544QAA85) | 0.79 | -15.09 | 0.2123 | -0.0681 | |||||

| US78434KAC18 / SG Residential Mortgage Trust 2022-2 | 0.78 | -2.63 | 0.2094 | -0.0319 | |||||

| Ally Bank Auto Credit-Linked Notes Series 2024-B / ABS-O (US02007G4D28) | 0.77 | -11.25 | 0.2083 | -0.0548 | |||||

| Multifamily Connecticut Avenue Securities Trust 2023-01 / ABS-MBS (US62548NAC20) | 0.76 | -3.19 | 0.2043 | -0.0324 | |||||

| US64831HAB96 / NEW RESIDENTIAL MORTGAGE LOAN TRUST 2023-NQM1 | 0.69 | -7.26 | 0.1859 | -0.0388 | |||||

| US75050KAA43 / Radnor RE Ltd., Series 2023-1, Class M1A | 0.60 | -17.99 | 0.1609 | -0.0592 | |||||

| US68377GAB23 / OPTN_21-B | 0.59 | -22.82 | 0.1575 | -0.0715 | |||||

| US437307AD33 / Home RE 2021-1 Ltd | 0.57 | -26.08 | 0.1528 | -0.0789 | |||||

| US22845XAC48 / Crown Point CLO IV Ltd | 0.50 | -39.98 | 0.1347 | -0.1169 | |||||

| US69547PAA75 / Pagaya AI Debt Selection Trust, Series 2021-HG1, Class A | 0.46 | -45.12 | 0.1243 | -0.1294 | |||||

| US26982EAA47 / Eagle RE 2023-1 Ltd | 0.44 | -20.72 | 0.1186 | -0.0489 | |||||

| US03465EAD31 / Angel Oak Mortgage Trust 2021-3 | 0.43 | -7.91 | 0.1162 | -0.0252 | |||||

| US69547MAB28 / PAID_22-3 | 0.42 | -76.55 | 0.1135 | -0.4286 | |||||

| US100842AC71 / Boston Lending Trust 2021-1 | 0.39 | 2.87 | 0.1062 | -0.0096 | |||||

| US69546VAB36 / PAID_22-2 | 0.18 | -81.88 | 0.0495 | -0.2558 | |||||

| US75279YAC57 / Radnor RE 2021-1 Ltd | 0.16 | -60.96 | 0.0419 | -0.0782 | |||||

| US803169AN15 / Saranac CLO III Ltd | 0.09 | -61.40 | 0.0240 | -0.0451 | |||||

| US48250LAW90 / KKR FINANCIAL CLO LTD 07/30 1 | 0.08 | -38.69 | 0.0226 | -0.0188 | |||||

| South Carolina Student Loan Corp / DBT (US83715AAM18) | 0.05 | 0.00 | 0.0139 | -0.0017 | |||||

| US3137G1CT29 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0.03 | 0.00 | 0.0077 | -0.0010 | |||||

| US09774XBD30 / BOMBARDIER CAPITAL MORTGAGE SE BCM 1999 B A3 | 0.01 | -16.67 | 0.0016 | -0.0004 | |||||

| Government National Mortgage Association / ABS-MBS (US38375QR275) | 0.00 | 0.00 | 0.0012 | -0.0002 | |||||

| US449670EQ79 / Imc Home Equity Loan Trust 1998-3 | 0.00 | 0.00 | 0.0003 | -0.0001 | |||||

| US38373M5R72 / Government National Mortgage Association | 0.00 | 0.0001 | -0.0000 | ||||||

| US79549ARU50 / Credit-Based Asset Servicing & Securitization LLC | 0.00 | 0.0000 | -0.0000 |