Mga Batayang Estadistika

| Nilai Portofolio | $ 208,410,709 |

| Posisi Saat Ini | 59 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

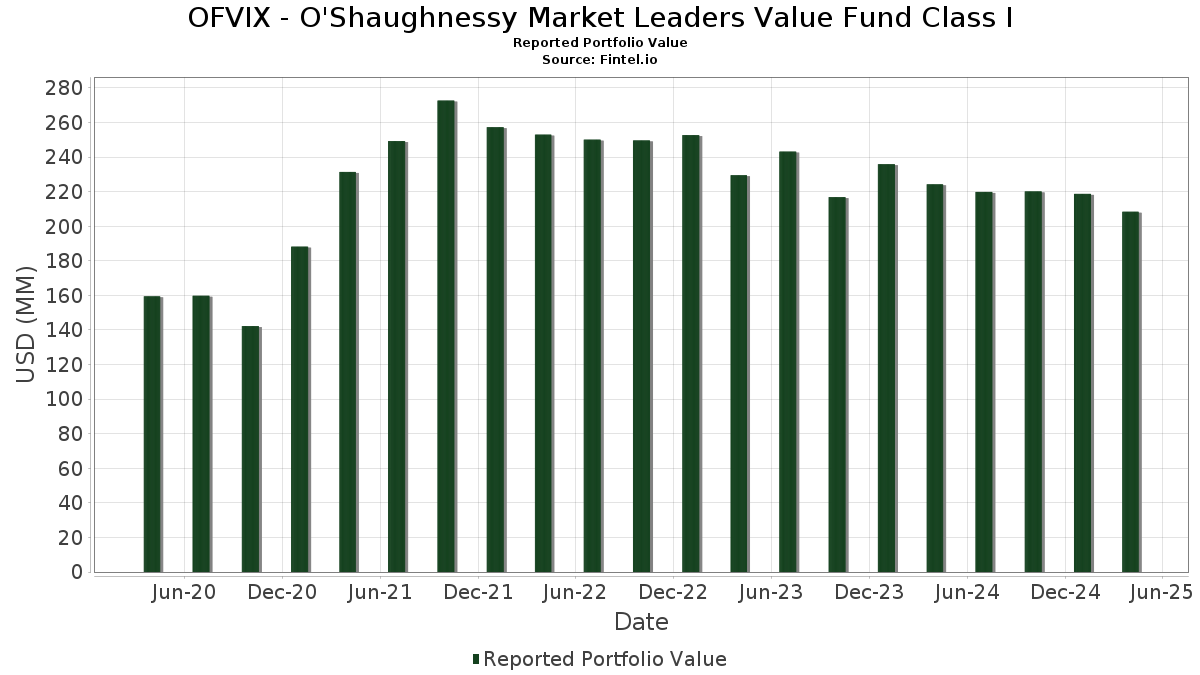

OFVIX - O'Shaughnessy Market Leaders Value Fund Class I telah mengungkapkan total kepemilikan 59 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 208,410,709 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama OFVIX - O'Shaughnessy Market Leaders Value Fund Class I adalah Wells Fargo & Company (US:WFC) , Altria Group, Inc. (US:MO) , Fidelity National Information Services, Inc. (US:FIS) , RTX Corporation (US:RTX) , and MetLife, Inc. (US:MET) . Posisi baru OFVIX - O'Shaughnessy Market Leaders Value Fund Class I meliputi: Truist Financial Corporation (US:TFC) , Centene Corporation (US:CNC) , The Kraft Heinz Company (US:KHC) , EOG Resources, Inc. (US:EOG) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.07 | 4.87 | 2.3214 | 1.8024 | |

| 0.08 | 7.09 | 3.3801 | 1.6759 | |

| 0.04 | 5.03 | 2.3995 | 1.3877 | |

| 0.06 | 3.25 | 1.5499 | 1.3818 | |

| 0.09 | 7.15 | 3.4086 | 1.2133 | |

| 0.11 | 4.88 | 2.3279 | 1.1715 | |

| 0.01 | 5.33 | 2.5391 | 1.0009 | |

| 0.10 | 8.22 | 3.9182 | 0.9912 | |

| 0.02 | 3.90 | 1.8606 | 0.8864 | |

| 0.05 | 1.86 | 0.8863 | 0.8863 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 5.77 | 2.7533 | -4.8466 | |

| 0.02 | 3.27 | 1.5588 | -1.9243 | |

| 0.01 | 0.84 | 0.3999 | -1.5194 | |

| 0.11 | 5.89 | 2.8102 | -1.3593 | |

| 0.01 | 3.62 | 1.7254 | -1.3063 | |

| 0.03 | 4.68 | 2.2310 | -1.0400 | |

| 0.03 | 3.67 | 1.7519 | -1.0083 | |

| 0.08 | 4.57 | 2.1802 | -0.7985 | |

| 0.02 | 2.28 | 1.0854 | -0.7681 | |

| 0.04 | 2.62 | 1.2514 | -0.5881 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-18 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| WFC / Wells Fargo & Company | 0.15 | 0.00 | 10.38 | -9.88 | 4.9479 | -0.2390 | |||

| MO / Altria Group, Inc. | 0.16 | -3.35 | 9.21 | 9.46 | 4.3903 | 0.6013 | |||

| FIS / Fidelity National Information Services, Inc. | 0.10 | 30.61 | 8.22 | 26.47 | 3.9182 | 0.9912 | |||

| RTX / RTX Corporation | 0.06 | 18.27 | 7.33 | 15.69 | 3.4940 | 0.6408 | |||

| MET / MetLife, Inc. | 0.09 | 68.36 | 7.15 | 46.68 | 3.4086 | 1.2133 | |||

| MDT / Medtronic plc | 0.08 | 100.76 | 7.09 | 87.39 | 3.3801 | 1.6759 | |||

| CAT / Caterpillar Inc. | 0.02 | 11.52 | 6.82 | -7.15 | 3.2526 | -0.0566 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -8.08 | 6.38 | -1.05 | 3.0438 | 0.1377 | |||

| SYF / Synchrony Financial | 0.11 | -15.46 | 5.89 | -36.33 | 2.8102 | -1.3593 | |||

| APP / AppLovin Corporation | 0.02 | -53.03 | 5.77 | -65.78 | 2.7533 | -4.8466 | |||

| BK / The Bank of New York Mellon Corporation | 0.07 | 0.00 | 5.62 | -6.41 | 2.6790 | -0.0255 | |||

| CSL / Carlisle Companies Incorporated | 0.01 | 60.04 | 5.33 | 55.93 | 2.5391 | 1.0009 | |||

| CVX / Chevron Corporation | 0.04 | 145.65 | 5.03 | 124.04 | 2.3995 | 1.3877 | |||

| VZ / Verizon Communications Inc. | 0.11 | 70.00 | 4.88 | 90.18 | 2.3279 | 1.1715 | |||

| PYPL / PayPal Holdings, Inc. | 0.07 | 468.43 | 4.87 | 322.66 | 2.3214 | 1.8024 | |||

| JNJ / Johnson & Johnson | 0.03 | -37.28 | 4.68 | -35.57 | 2.2310 | -1.0400 | |||

| VLO / Valero Energy Corporation | 0.04 | -6.09 | 4.65 | -18.02 | 2.2185 | -0.3383 | |||

| GIS / General Mills, Inc. | 0.08 | -26.71 | 4.57 | -30.86 | 2.1802 | -0.7985 | |||

| AIG / American International Group, Inc. | 0.05 | 0.00 | 4.41 | 10.68 | 2.1008 | 0.3076 | |||

| EBAY / eBay Inc. | 0.06 | 37.75 | 4.17 | 39.16 | 1.9860 | 0.6376 | |||

| CMCSA / Comcast Corporation | 0.12 | -8.30 | 4.16 | -6.84 | 1.9821 | -0.0276 | |||

| MPC / Marathon Petroleum Corporation | 0.03 | -23.23 | 3.92 | -27.61 | 1.8707 | -0.5704 | |||

| EXPE / Expedia Group, Inc. | 0.02 | 96.54 | 3.90 | 80.40 | 1.8606 | 0.8864 | |||

| STLD / Steel Dynamics, Inc. | 0.03 | -40.74 | 3.67 | -40.05 | 1.7519 | -1.0083 | |||

| LMT / Lockheed Martin Corporation | 0.01 | -47.90 | 3.62 | -46.25 | 1.7254 | -1.3063 | |||

| AFL / Aflac Incorporated | 0.03 | -10.89 | 3.40 | -9.82 | 1.6204 | -0.0769 | |||

| GDDY / GoDaddy Inc. | 0.02 | -52.26 | 3.27 | -57.73 | 1.5588 | -1.9243 | |||

| NTRS / Northern Trust Corporation | 0.03 | 140.77 | 3.25 | 101.55 | 1.5513 | 0.8241 | |||

| LYB / LyondellBasell Industries N.V. | 0.06 | 1,032.36 | 3.25 | 771.31 | 1.5499 | 1.3818 | |||

| CRH / CRH plc | 0.03 | 25.50 | 3.08 | 20.89 | 1.4707 | 0.3218 | |||

| COP / ConocoPhillips | 0.03 | 105.71 | 2.87 | 85.50 | 1.3666 | 0.6706 | |||

| LH / Labcorp Holdings Inc. | 0.01 | 84.85 | 2.64 | 78.34 | 1.2602 | 0.5927 | |||

| RF / Regions Financial Corporation | 0.13 | 7.65 | 2.64 | -10.84 | 1.2590 | -0.0748 | |||

| DD / DuPont de Nemours, Inc. | 0.04 | -25.21 | 2.62 | -35.75 | 1.2514 | -0.5881 | |||

| GM / General Motors Company | 0.06 | -1.43 | 2.51 | -9.84 | 1.1971 | -0.0572 | |||

| RS / Reliance, Inc. | 0.01 | 158.35 | 2.40 | 157.17 | 1.1457 | 0.7249 | |||

| BLDR / Builders FirstSource, Inc. | 0.02 | -22.64 | 2.28 | -44.69 | 1.0854 | -0.7681 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.02 | -33.85 | 2.21 | -35.99 | 1.0516 | -0.5004 | |||

| FOXA / Fox Corporation | 0.04 | 441.16 | 2.14 | 426.85 | 1.0200 | 0.8370 | |||

| JBL / Jabil Inc. | 0.01 | 457.17 | 2.11 | 402.63 | 1.0045 | 0.8157 | |||

| TWLO / Twilio Inc. | 0.02 | 148.76 | 1.98 | 64.16 | 0.9455 | 0.4013 | |||

| TFC / Truist Financial Corporation | 0.05 | 1.86 | 0.8863 | 0.8863 | |||||

| CF / CF Industries Holdings, Inc. | 0.02 | 7.83 | 1.79 | -8.36 | 0.8521 | -0.0262 | |||

| CNC / Centene Corporation | 0.03 | 1.71 | 0.8134 | 0.8134 | |||||

| HCA / HCA Healthcare, Inc. | 0.00 | -23.18 | 1.67 | 17.22 | 0.7953 | 0.1403 | |||

| HPQ / HP Inc. | 0.06 | 64.89 | 1.66 | 16.82 | 0.7917 | 0.1469 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | -32.75 | 1.65 | -42.49 | 0.7886 | -0.5070 | |||

| PFE / Pfizer Inc. | 0.06 | 1.54 | 0.7353 | 0.7353 | |||||

| TPR / Tapestry, Inc. | 0.02 | -18.44 | 1.51 | 109.14 | 0.7203 | 0.3877 | |||

| PFG / Principal Financial Group, Inc. | 0.02 | 39.95 | 1.50 | 31.09 | 0.7142 | 0.2109 | |||

| NUE / Nucor Corporation | 0.01 | 1.42 | 0.6755 | 0.6755 | |||||

| DVN / Devon Energy Corporation | 0.05 | -35.71 | 1.42 | -42.65 | 0.6751 | -0.4373 | |||

| CI / The Cigna Group | 0.00 | 190.52 | 1.34 | 214.02 | 0.6410 | 0.4471 | |||

| STT / State Street Corporation | 0.01 | -39.25 | 0.97 | -42.33 | 0.4625 | -0.2987 | |||

| KHC / The Kraft Heinz Company | 0.03 | 0.96 | 0.4560 | 0.4560 | |||||

| HIG / The Hartford Insurance Group, Inc. | 0.01 | -82.10 | 0.84 | -80.33 | 0.3999 | -1.5194 | |||

| MAR / Marriott International, Inc. | 0.00 | 0.00 | 0.83 | -17.83 | 0.3977 | -0.0599 | |||

| EQH / Equitable Holdings, Inc. | 0.02 | -69.10 | 0.76 | -53.26 | 0.3624 | -0.3172 | |||

| EOG / EOG Resources, Inc. | 0.01 | 0.60 | 0.2854 | 0.2854 |