Mga Batayang Estadistika

| Nilai Portofolio | $ 21,059,822 |

| Posisi Saat Ini | 56 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

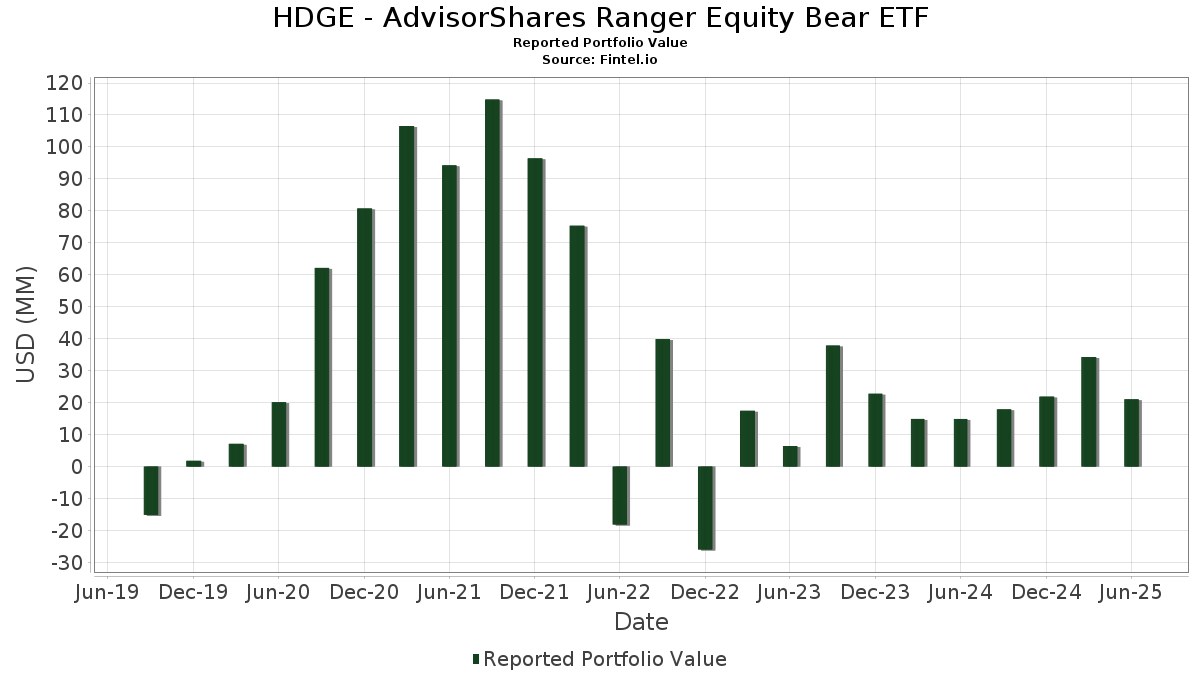

HDGE - AdvisorShares Ranger Equity Bear ETF telah mengungkapkan total kepemilikan 56 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 21,059,822 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama HDGE - AdvisorShares Ranger Equity Bear ETF adalah Blackrock Liquidity Funds - BlackRock Liquidity Funds FedFund Portfolio Institutional Class (US:TFDXX) , Equinix, Inc. (US:EQIX) , Amkor Technology, Inc. (US:AMKR) , Microchip Technology Incorporated (US:MCHP) , and MKS Inc. (US:MKSI) . Posisi baru HDGE - AdvisorShares Ranger Equity Bear ETF meliputi: The Sherwin-Williams Company (US:SHW) , Lennox International Inc. (US:LII) , WPP plc - Depositary Receipt (Common Stock) (US:WPP) , Six Flags Entertainment Corporation (US:FUN) , and Glaukos Corporation (US:GKOS) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 61.64 | 61.64 | 135.1937 | 15.1046 | |

| 5.11 | 5.11 | 11.2000 | 11.2000 | |

| 0.00 | 0.00 | 3.1395 | ||

| -0.01 | -0.99 | -2.1619 | 2.6079 | |

| 0.00 | 0.00 | 2.0839 | ||

| 0.00 | 0.00 | 1.9695 | ||

| -0.01 | -0.97 | -2.1325 | 1.8993 | |

| 0.00 | 0.00 | 1.6293 | ||

| 0.00 | 0.00 | 1.6054 | ||

| 0.00 | 0.00 | 1.5540 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -0.01 | -1.85 | -4.0499 | -4.0499 | |

| -0.02 | -1.34 | -2.9481 | -2.9481 | |

| -0.01 | -1.08 | -2.3667 | -2.3667 | |

| -0.02 | -1.03 | -2.2700 | -2.2700 | |

| -0.01 | -1.02 | -2.2443 | -2.2443 | |

| -0.01 | -1.01 | -2.2197 | -2.2197 | |

| -0.01 | -0.96 | -2.1018 | -2.1018 | |

| -0.01 | -0.91 | -2.0019 | -2.0019 | |

| -0.00 | -0.90 | -1.9646 | -1.9646 | |

| -0.01 | -0.89 | -1.9624 | -1.9624 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-25 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TFDXX / Blackrock Liquidity Funds - BlackRock Liquidity Funds FedFund Portfolio Institutional Class | 61.64 | 1.07 | 61.64 | 1.07 | 135.1937 | 15.1046 | |||

| FIDELITY INSTITUTIONAL MONEY MARKET GOVERNMENT PORTFOLIO ? CLASS III / STIV (000000000) | 5.11 | 5.11 | 11.2000 | 11.2000 | |||||

| MCHP / Microchip Technology Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | 0.9532 | ||||

| MKSI / MKS Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.1836 | ||||

| F / Ford Motor Company | 0.00 | -100.00 | 0.00 | -100.00 | 1.1849 | ||||

| CNC / Centene Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 1.5540 | ||||

| HUM / Humana Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 2.0839 | ||||

| YETI / YETI Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.6293 | ||||

| HELE / Helen of Troy Limited | 0.00 | -100.00 | 0.00 | -100.00 | 1.3165 | ||||

| WPC / W. P. Carey Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.4911 | ||||

| GIS / General Mills, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.1772 | ||||

| HUN / Huntsman Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 1.2436 | ||||

| CRUS / Cirrus Logic, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 3.1395 | ||||

| HTLD / Heartland Express, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.0892 | ||||

| HTLD / Heartland Express, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.0892 | ||||

| MRTN / Marten Transport, Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | 1.0806 | ||||

| REXR / Rexford Industrial Realty, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.2334 | ||||

| EQIX / Equinix, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.6054 | ||||

| WLK / Westlake Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 1.9695 | ||||

| AMKR / Amkor Technology, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.0668 | ||||

| IPGP / IPG Photonics Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 1.0567 | ||||

| FR / First Industrial Realty Trust, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.2749 | ||||

| VC / Visteon Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 1.1462 | ||||

| KFRC / Kforce Inc. | Short | -0.01 | -0.00 | -0.41 | -15.78 | -0.9021 | 0.0606 | ||

| IPG / The Interpublic Group of Companies, Inc. | Short | -0.02 | -0.00 | -0.54 | -9.88 | -1.1812 | -0.0047 | ||

| WU / The Western Union Company | Short | -0.07 | -0.55 | -1.2004 | -1.2004 | ||||

| PCG / PG&E Corporation | Short | -0.04 | -0.56 | -1.2229 | -1.2229 | ||||

| NCNO / nCino, Inc. | Short | -0.02 | 29.41 | -0.62 | 31.97 | -1.3496 | -0.4301 | ||

| ALB / Albemarle Corporation | Short | -0.01 | -0.63 | -1.3745 | -1.3745 | ||||

| KIM / Kimco Realty Corporation | Short | -0.03 | -0.00 | -0.63 | -1.10 | -1.3830 | -0.1284 | ||

| CUBE / CubeSmart | Short | -0.01 | -79.17 | -0.64 | -66.96 | -1.3982 | 0.0164 | ||

| DHI / D.R. Horton, Inc. | Short | -0.01 | -0.64 | -1.4138 | -1.4138 | ||||

| AXTA / Axalta Coating Systems Ltd. | Short | -0.02 | -0.00 | -0.65 | -10.43 | -1.4326 | 0.0043 | ||

| BC / Brunswick Corporation | Short | -0.01 | -0.66 | -1.4538 | -1.4538 | ||||

| SHW / The Sherwin-Williams Company | Short | -0.00 | -0.69 | -1.5061 | -1.5061 | ||||

| LII / Lennox International Inc. | Short | -0.00 | -0.69 | -1.5087 | -1.5087 | ||||

| WPP / WPP plc - Depositary Receipt (Common Stock) | Short | -0.02 | -0.70 | -1.5357 | -1.5357 | ||||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | Short | -0.01 | -0.71 | -1.5482 | -1.5482 | ||||

| AKAM / Akamai Technologies, Inc. | Short | -0.01 | -64.00 | -0.72 | -64.29 | -1.5744 | -0.3059 | ||

| S / SentinelOne, Inc. | Short | -0.04 | -0.73 | -1.6037 | -1.6037 | ||||

| FUN / Six Flags Entertainment Corporation | Short | -0.03 | -0.76 | -1.6685 | -1.6685 | ||||

| Viking Holdings Ltd / EC (BMG93A5A1010) | Short | -0.01 | -0.00 | -0.80 | 34.06 | -1.7532 | -0.5792 | ||

| Viking Holdings Ltd / EC (BMG93A5A1010) | Short | -0.01 | -0.00 | -0.80 | 34.06 | -1.7532 | -0.5792 | ||

| CDW / CDW Corporation | Short | -0.00 | -77.50 | -0.80 | -78.12 | -1.7626 | 1.2299 | ||

| BBY / Best Buy Co., Inc. | Short | -0.01 | 20.00 | -0.81 | -29.94 | -1.7668 | 0.5029 | ||

| GKOS / Glaukos Corporation | Short | -0.01 | -0.83 | -1.8123 | -1.8123 | ||||

| NSIT / Insight Enterprises, Inc. | Short | -0.01 | 50.00 | -0.83 | 38.23 | -1.8171 | -0.6358 | ||

| PI / Impinj, Inc. | Short | -0.01 | -0.83 | -1.8270 | -1.8270 | ||||

| CZR / Caesars Entertainment, Inc. | Short | -0.03 | 50.00 | -0.85 | -2.63 | -1.8680 | -0.6437 | ||

| NDSN / Nordson Corporation | Short | -0.00 | 33.33 | -0.86 | 41.65 | -1.8806 | -0.6891 | ||

| TRUP / Trupanion, Inc. | Short | -0.02 | 3.69 | -0.86 | 53.85 | -1.8882 | -0.7874 | ||

| 4FAP / Star Bulk Carriers Corp. | Short | -0.05 | -0.86 | -1.8917 | -1.8917 | ||||

| O / Realty Income Corporation | Short | -0.01 | 25.00 | -0.86 | 24.14 | -1.8953 | -0.5246 | ||

| DLR / Digital Realty Trust, Inc. | Short | -0.01 | -0.87 | -1.9117 | -1.9117 | ||||

| AVY / Avery Dennison Corporation | Short | -0.01 | -0.00 | -0.88 | -1.35 | -1.9242 | -0.1721 | ||

| AN / AutoNation, Inc. | Short | -0.00 | -55.00 | -0.89 | -40.51 | -1.9606 | 0.2115 | ||

| CMA / Comerica Incorporated | Short | -0.01 | -0.89 | -1.9624 | -1.9624 | ||||

| CACC / Credit Acceptance Corporation | Short | -0.00 | 3.41 | -0.90 | 2.05 | -1.9642 | -0.2359 | ||

| KLAC / KLA Corporation | Short | -0.00 | -0.90 | -1.9646 | -1.9646 | ||||

| EXTR / Extreme Networks, Inc. | Short | -0.05 | -16.67 | -0.90 | 13.11 | -1.9684 | -0.4055 | ||

| WHR / Whirlpool Corporation | Short | -0.01 | -0.91 | -2.0019 | -2.0019 | ||||

| WMS / Advanced Drainage Systems, Inc. | Short | -0.01 | -0.00 | -0.92 | 5.64 | -2.0153 | -0.3039 | ||

| WAL / Western Alliance Bancorporation | Short | -0.01 | 20.00 | -0.94 | 21.74 | -2.0523 | -0.5396 | ||

| OZK / Bank OZK | Short | -0.02 | -0.00 | -0.94 | 8.29 | -2.0643 | -0.3532 | ||

| WK / Workiva Inc. | Short | -0.01 | -0.96 | -2.1018 | -2.1018 | ||||

| GPC / Genuine Parts Company | Short | -0.01 | -0.00 | -0.97 | 1.78 | -2.1285 | -0.2518 | ||

| SYNA / Synaptics Incorporated | Short | -0.01 | -40.00 | -0.97 | -49.06 | -2.1325 | 1.8993 | ||

| LRCX / Lam Research Corporation | Short | -0.01 | -0.00 | -0.97 | 33.84 | -2.1349 | -0.7035 | ||

| XHB / SPDR Series Trust - SPDR S&P Homebuilders ETF | Short | -0.01 | -60.00 | -0.99 | -59.33 | -2.1619 | 2.6079 | ||

| EXPE / Expedia Group, Inc. | Short | -0.01 | -1.01 | -2.2197 | -2.2197 | ||||

| LAD / Lithia Motors, Inc. | Short | -0.00 | -70.00 | -1.01 | -66.69 | -2.2227 | 0.2569 | ||

| Aptiv PLC / EC (JE00BTDN8H13) | Short | -0.01 | -1.02 | -2.2443 | -2.2443 | ||||

| PAG / Penske Automotive Group, Inc. | Short | -0.01 | -0.00 | -1.03 | 15.21 | -2.2609 | -0.9412 | ||

| SNV / Synovus Financial Corp. | Short | -0.02 | -1.03 | -2.2700 | -2.2700 | ||||

| OMC / Omnicom Group Inc. | Short | -0.01 | -1.08 | -2.3667 | -2.3667 | ||||

| KMX / CarMax, Inc. | Short | -0.02 | -1.34 | -2.9481 | -2.9481 | ||||

| AAPL / Apple Inc. | Short | -0.01 | -1.85 | -4.0499 | -4.0499 |