Mga Batayang Estadistika

| Nilai Portofolio | $ 169,002,997 |

| Posisi Saat Ini | 114 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

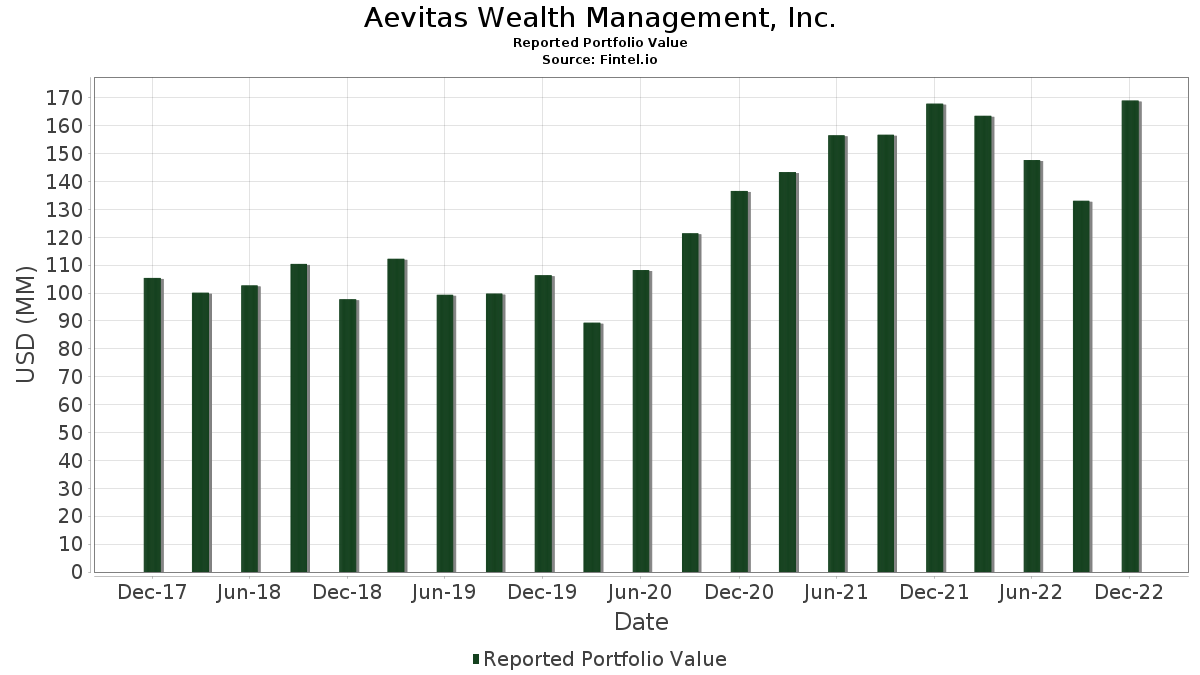

Aevitas Wealth Management, Inc. telah mengungkapkan total kepemilikan 114 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 169,002,997 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Aevitas Wealth Management, Inc. adalah iShares Trust - iShares 1-3 Year Treasury Bond ETF (US:SHY) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , PIMCO ETF Trust - PIMCO Enhanced Low Duration Active Exchange-Traded Fund (US:LDUR) , and Exxon Mobil Corporation (US:XOM) . Posisi baru Aevitas Wealth Management, Inc. meliputi: iShares Trust - iShares 1-3 Year Treasury Bond ETF (US:SHY) , PIMCO ETF Trust - PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (US:MINT) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.24 | 19.23 | 11.3807 | 11.3807 | |

| 0.07 | 6.30 | 3.7277 | 1.2515 | |

| 0.01 | 0.80 | 0.4723 | 0.4723 | |

| 0.00 | 0.27 | 0.1585 | 0.1585 | |

| 0.00 | 0.22 | 0.1273 | 0.1273 | |

| 0.00 | 0.21 | 0.1222 | 0.1222 | |

| 0.05 | 6.03 | 3.5675 | 0.0919 | |

| 0.01 | 1.03 | 0.6094 | 0.0202 | |

| 0.01 | 0.63 | 0.3721 | 0.0197 | |

| 0.00 | 0.52 | 0.3067 | 0.0038 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 4.05 | 0.0024 | -3.6168 | |

| 0.04 | 4.58 | 0.0027 | -2.7485 | |

| 0.02 | 4.11 | 0.0024 | -2.6871 | |

| 0.06 | 7.69 | 4.5473 | -1.9621 | |

| 0.03 | 2.92 | 1.7307 | -1.8562 | |

| 0.05 | 3.61 | 0.0021 | -1.6864 | |

| 0.02 | 2.52 | 0.0015 | -1.5541 | |

| 0.02 | 2.35 | 0.0014 | -1.5437 | |

| 0.01 | 1.91 | 0.0011 | -1.3808 | |

| 0.01 | 2.12 | 0.0013 | -1.2853 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2023-01-24 untuk periode pelaporan 2022-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.24 | 19.23 | 11.3807 | 11.3807 | |||||

| MSFT / Microsoft Corporation | 0.04 | 0.06 | 8.66 | 3.04 | 5.1214 | -1.1911 | |||

| AAPL / Apple Inc. | 0.06 | -5.63 | 7.69 | -11.28 | 4.5473 | -1.9621 | |||

| LDUR / PIMCO ETF Trust - PIMCO Enhanced Low Duration Active Exchange-Traded Fund | 0.07 | 92.09 | 6.30 | 91.17 | 3.7277 | 1.2515 | |||

| XOM / Exxon Mobil Corporation | 0.05 | 3.18 | 6.03 | 30.36 | 3.5675 | 0.0919 | |||

| PEP / PepsiCo, Inc. | 0.03 | 1.49 | 5.82 | 12.30 | 3.4456 | -0.4508 | |||

| JNJ / Johnson & Johnson | 0.03 | 0.20 | 5.62 | 8.36 | 3.3225 | -0.5717 | |||

| VDE / Vanguard World Fund - Vanguard Energy ETF | 0.04 | 4.86 | 4.58 | 25.18 | 0.0027 | -2.7485 | |||

| VTEB / Vanguard Municipal Bond Funds - Vanguard Tax-Exempt Bond ETF | 0.09 | 263.31 | 4.42 | 273.63 | 0.0026 | -0.8864 | |||

| BDX / Becton, Dickinson and Company | 0.02 | 0.54 | 4.11 | 14.72 | 0.0024 | -2.6871 | |||

| PANW / Palo Alto Networks, Inc. | 0.03 | -1.26 | 4.05 | -15.88 | 0.0024 | -3.6168 | |||

| VHT / Vanguard World Fund - Vanguard Health Care ETF | 0.01 | 0.22 | 3.64 | 11.12 | 2.1522 | -0.3074 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.05 | 41.28 | 3.61 | 60.61 | 0.0021 | -1.6864 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -4.30 | 3.09 | 10.71 | 1.8291 | -0.2691 | |||

| AMZN / Amazon.com, Inc. | 0.03 | -17.57 | 2.92 | -38.74 | 1.7307 | -1.8562 | |||

| IEI / iShares Trust - iShares 3-7 Year Treasury Bond ETF | 0.03 | 94.37 | 2.89 | 95.33 | 0.0017 | -1.1090 | |||

| GOOG / Alphabet Inc. | 0.03 | 5.45 | 2.76 | -2.72 | 1.6323 | -0.4982 | |||

| ABBV / AbbVie Inc. | 0.02 | 1.21 | 2.52 | 21.84 | 0.0015 | -1.5541 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.02 | 1.58 | 2.35 | 14.06 | 0.0014 | -1.5437 | |||

| PG / The Procter & Gamble Company | 0.01 | 0.18 | 2.25 | 20.21 | 1.3305 | -0.0748 | |||

| SYK / Stryker Corporation | 0.01 | 2.56 | 2.12 | 23.71 | 0.0013 | -1.2853 | |||

| MCD / McDonald's Corporation | 0.01 | 3.02 | 2.09 | 17.60 | 1.2341 | -0.0982 | |||

| KO / The Coca-Cola Company | 0.03 | 1.28 | 2.05 | 14.97 | 1.2132 | -0.1267 | |||

| ACN / Accenture plc | 0.01 | 0.15 | 1.91 | 3.81 | 0.0011 | -1.3808 | |||

| VFH / Vanguard World Fund - Vanguard Financials ETF | 0.02 | 0.41 | 1.89 | 11.57 | 0.0011 | -1.2719 | |||

| MA / Mastercard Incorporated | 0.00 | -0.09 | 1.61 | 22.18 | 0.0010 | -0.9918 | |||

| AMGN / Amgen Inc. | 0.01 | 0.21 | 1.51 | 16.69 | 0.8939 | -0.0785 | |||

| STZ / Constellation Brands, Inc. | 0.01 | 0.12 | 1.50 | 1.01 | 0.0009 | -1.1158 | |||

| O / Realty Income Corporation | 0.02 | -1.90 | 1.47 | 6.84 | 0.0009 | -1.0324 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.01 | 8.31 | 1.46 | 23.48 | 0.0009 | -0.8889 | |||

| CVS / CVS Health Corporation | 0.02 | 12.42 | 1.43 | 9.87 | 0.8433 | -0.1313 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 5.75 | 1.34 | 13.81 | 0.0008 | -0.8807 | |||

| GAFFX / Growth Fund Of America - Growth Fund of America - Class F-3 | 0.03 | -2.81 | 1.34 | -3.96 | 0.0008 | -1.0438 | |||

| ENB / Enbridge Inc. | 0.03 | 0.02 | 1.30 | 5.35 | 0.7691 | -0.1575 | |||

| AMT / American Tower Corporation | 0.01 | 2.14 | 1.27 | 0.80 | 0.7492 | -0.1947 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.13 | 1.23 | 5.03 | 0.7289 | -0.1519 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.01 | 0.79 | 1.21 | 20.28 | 0.7161 | -0.0399 | |||

| WELL / Welltower Inc. | 0.02 | -6.39 | 1.19 | -4.66 | 0.0007 | -0.9341 | |||

| ALNY / Alnylam Pharmaceuticals, Inc. | 0.00 | 3.58 | 1.16 | 22.94 | 0.6885 | -0.0224 | |||

| CMCSA / Comcast Corporation | 0.03 | -27.69 | 1.06 | -13.81 | 0.0006 | -0.9244 | |||

| EMR / Emerson Electric Co. | 0.01 | 0.17 | 1.03 | 31.25 | 0.6094 | 0.0202 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.02 | -10.77 | 0.95 | -11.16 | 0.0006 | -0.8005 | |||

| AEP / American Electric Power Company, Inc. | 0.01 | 0.32 | 0.92 | 10.07 | 0.5435 | -0.0832 | |||

| T.PRC / AT&T Inc. - Preferred Stock | 0.05 | 0.91 | 0.0005 | 0.0005 | |||||

| PEG / Public Service Enterprise Group Incorporated | 0.01 | 0.36 | 0.90 | 9.22 | 0.0005 | -0.6187 | |||

| RTX / RTX Corporation | 0.01 | -0.12 | 0.89 | 23.03 | 0.5282 | -0.0166 | |||

| GOOGL / Alphabet Inc. | 0.01 | 11.32 | 0.85 | 2.66 | 0.5033 | -0.1190 | |||

| PAYX / Paychex, Inc. | 0.01 | 17.06 | 0.81 | 20.42 | 0.4786 | -0.0256 | |||

| CL / Colgate-Palmolive Company | 0.01 | 0.10 | 0.81 | 12.10 | 0.4773 | -0.0630 | |||

| MINT / PIMCO ETF Trust - PIMCO Enhanced Short Maturity Active Exchange-Traded Fund | 0.01 | 0.80 | 0.4723 | 0.4723 | |||||

| CLX / The Clorox Company | 0.01 | 0.11 | 0.80 | 9.35 | 0.4704 | -0.0759 | |||

| EFX / Equifax Inc. | 0.00 | 3.26 | 0.78 | 16.92 | 0.0005 | -0.5015 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.01 | 18.27 | 0.77 | 21.64 | 0.0005 | -0.4752 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.01 | -29.20 | 0.77 | -54.79 | 0.0005 | -1.2793 | |||

| VGT / Vanguard World Fund - Vanguard Information Technology ETF | 0.00 | 0.81 | 0.75 | 4.74 | 0.0004 | -0.5391 | |||

| VBR / Vanguard Index Funds - Vanguard Small-Cap Value ETF | 0.00 | -3.93 | 0.75 | 6.42 | 0.0004 | -0.5263 | |||

| GD / General Dynamics Corporation | 0.00 | 0.07 | 0.70 | 16.86 | 0.4146 | -0.0355 | |||

| NKE / NIKE, Inc. | 0.01 | -14.80 | 0.70 | 19.90 | 0.4140 | -0.0241 | |||

| TJX / The TJX Companies, Inc. | 0.01 | -5.37 | 0.69 | 21.27 | 0.4084 | -0.0192 | |||

| ORCL / Oracle Corporation | 0.01 | 0.20 | 0.63 | 33.90 | 0.3721 | 0.0197 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.32 | 0.60 | 5.80 | 0.3565 | -0.0711 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.00 | 0.00 | 0.59 | 12.50 | 0.0004 | -0.3964 | |||

| MDT / Medtronic plc | 0.01 | -32.04 | 0.59 | -34.67 | 0.3484 | -0.3280 | |||

| EVRG / Evergy, Inc. | 0.01 | -1.03 | 0.56 | 4.83 | 0.0003 | -0.4040 | |||

| ABT / Abbott Laboratories | 0.01 | 0.14 | 0.55 | 13.37 | 0.3266 | -0.0386 | |||

| ES / Eversource Energy | 0.01 | 2.43 | 0.54 | 9.90 | 0.3225 | -0.0495 | |||

| MKC.V / McCormick & Company, Incorporated | 0.01 | 0.05 | 0.54 | 16.34 | 0.0003 | -0.3491 | |||

| V / Visa Inc. | 0.00 | 4.01 | 0.54 | 21.44 | 0.0003 | -0.3326 | |||

| LIN / Linde plc | 0.00 | 0.18 | 0.53 | 21.14 | 0.3155 | -0.0151 | |||

| DE / Deere & Company | 0.00 | 0.17 | 0.52 | 28.54 | 0.3067 | 0.0038 | |||

| BSCN / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2023 Corporate Bond ETF | 0.02 | 0.30 | 0.52 | 0.58 | 0.0003 | -0.3860 | |||

| GS.PRJ / Goldman Sachs Group, 5.50% Dep Shares Fixd/Float Non-Cumul Preferred Stock Ser J | 0.00 | 16.98 | 0.51 | 36.73 | 0.0003 | -0.2800 | |||

| CME / CME Group Inc. | 0.00 | 4.41 | 0.51 | -0.98 | 0.2989 | -0.0844 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 0.27 | 0.50 | 22.06 | 0.0003 | -0.3063 | |||

| VPU / Vanguard World Fund - Vanguard Utilities ETF | 0.00 | 1.34 | 0.47 | 9.15 | 0.0003 | -0.3199 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.29 | 0.46 | 28.69 | 0.2736 | 0.0038 | |||

| INTC / Intel Corporation | 0.02 | -7.37 | 0.46 | -5.19 | 0.0003 | -0.3619 | |||

| VTIAX / Vanguard Star Funds - Vanguard Total International Stock Index Fund Admiral | 0.01 | 0.97 | 0.46 | 14.04 | 0.0003 | -0.2996 | |||

| VIS / Vanguard World Fund - Vanguard Industrials ETF | 0.00 | 0.45 | 0.0003 | 0.0003 | |||||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.01 | 0.23 | 0.44 | 14.96 | 0.0003 | -0.2861 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 0.22 | 0.40 | 19.34 | 0.2338 | -0.0150 | |||

| SO / The Southern Company | 0.01 | 0.32 | 0.39 | 5.19 | 0.2281 | -0.0469 | |||

| ISEE / IVERIC bio Inc | 0.02 | 0.57 | 0.38 | 19.87 | 0.2252 | -0.0131 | |||

| NVDA / NVIDIA Corporation | 0.00 | -44.04 | 0.37 | -32.79 | 0.2200 | -0.1949 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | 0.16 | 0.37 | 21.67 | 0.0002 | -0.2252 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.00 | 0.47 | 0.35 | 5.17 | 0.2050 | -0.0423 | |||

| GIS / General Mills, Inc. | 0.00 | 0.12 | 0.34 | 9.58 | 0.2031 | -0.0321 | |||

| USB / U.S. Bancorp | 0.01 | 4.98 | 0.33 | 13.27 | 0.0002 | -0.2207 | |||

| EQR / Equity Residential | 0.01 | -1.06 | 0.33 | -13.33 | 0.0002 | -0.2816 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.01 | 0.74 | 0.33 | 16.07 | 0.0002 | -0.2102 | |||

| MMP / Magellan Midstream Partners L.P. | 0.01 | 0.00 | 0.32 | 5.56 | 0.1913 | -0.0387 | |||

| VPL / Vanguard International Equity Index Funds - Vanguard FTSE Pacific ETF | 0.00 | -40.81 | 0.32 | -33.81 | 0.1903 | -0.1742 | |||

| PFE / Pfizer Inc. | 0.01 | 0.18 | 0.31 | 17.23 | 0.1853 | -0.0153 | |||

| HON / Honeywell International Inc. | 0.00 | 0.34 | 0.31 | 28.40 | 0.1849 | 0.0023 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.00 | 0.27 | 0.31 | 13.55 | 0.0002 | -0.2050 | |||

| SYY / Sysco Corporation | 0.00 | 0.07 | 0.31 | 8.13 | 0.0002 | -0.2125 | |||

| EIX / Edison International | 0.00 | 0.29 | 0.0002 | 0.0002 | |||||

| VAW / Vanguard World Fund - Vanguard Materials ETF | 0.00 | -15.06 | 0.29 | 97,154.03 | 0.1715 | -0.0525 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.44 | 0.28 | 6.82 | 0.1670 | -0.0314 | |||

| VALE / Vale S.A. - Depositary Receipt (Common Stock) | 0.02 | -17.73 | 0.28 | 4.49 | 0.0002 | -0.2005 | |||

| USMV / iShares Trust - iShares MSCI USA Min Vol Factor ETF | 0.00 | 13.01 | 0.28 | 23.11 | 0.0002 | -0.1689 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.27 | 0.1585 | 0.1585 | |||||

| MMM / 3M Company | 0.00 | 0.50 | 0.26 | 8.71 | 0.1556 | -0.0255 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.37 | 0.26 | 14.67 | 0.1530 | -0.0161 | |||

| CRM / Salesforce, Inc. | 0.00 | 15.02 | 0.25 | 5.86 | 0.1502 | -0.0294 | |||

| D / Dominion Energy, Inc. | 0.00 | -41.90 | 0.24 | -48.49 | 0.1416 | -0.2071 | |||

| SRE / Sempra | 0.00 | 0.27 | 0.23 | 3.13 | 0.1372 | -0.0311 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.21 | 0.22 | -3.49 | 0.1313 | -0.0408 | |||

| CARR / Carrier Global Corporation | 0.01 | 0.22 | 0.0001 | 0.0001 | |||||

| MRK / Merck & Co., Inc. | 0.00 | 0.22 | 0.1273 | 0.1273 | |||||

| HSY / The Hershey Company | 0.00 | 0.21 | 0.0001 | 0.0001 | |||||

| OTIS / Otis Worldwide Corporation | 0.00 | 0.21 | 0.1222 | 0.1222 | |||||

| TXN / Texas Instruments Incorporated | 0.00 | -31.02 | 0.20 | -26.64 | 0.0001 | -0.2058 | |||

| VYGR / Voyager Therapeutics, Inc. | 0.02 | 0.00 | 0.13 | 3.08 | 0.0794 | -0.0183 | |||

| TSLA / Tesla, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1751 | ||||

| VZ / Verizon Communications Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6823 | ||||

| BSCM / Invesco Capital Management LLC - Invesco BulletShares 2022 Corporate Bond ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.7432 | ||||

| SMG / The Scotts Miracle-Gro Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1616 |