Mga Batayang Estadistika

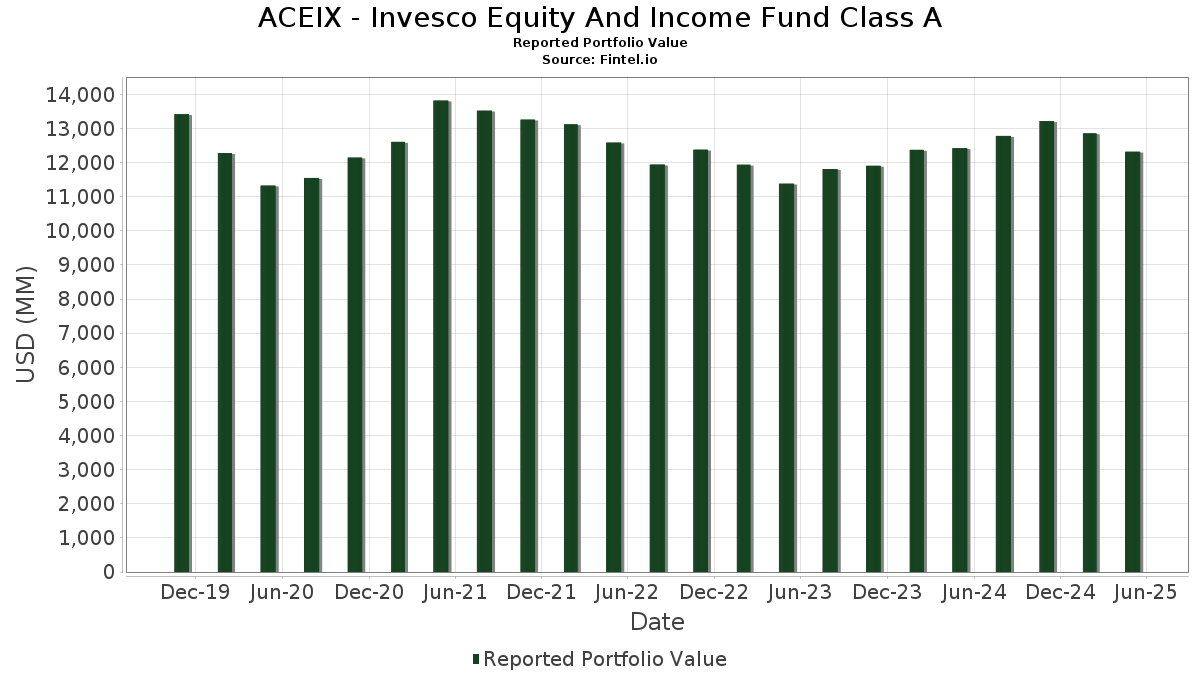

| Nilai Portofolio | $ 12,318,104,417 |

| Posisi Saat Ini | 379 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

ACEIX - Invesco Equity And Income Fund Class A telah mengungkapkan total kepemilikan 379 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 12,318,104,417 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama ACEIX - Invesco Equity And Income Fund Class A adalah Invesco Treasury Portfolio, Institutional Class (US:US8252524066) , Wells Fargo & Company (US:WFC) , Bank of America Corporation (US:BAC) , Amazon.com, Inc. (US:AMZN) , and Microsoft Corporation (US:MSFT) . Posisi baru ACEIX - Invesco Equity And Income Fund Class A meliputi: Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares (US:NVDD) , The Procter & Gamble Company (US:PG) , NIKE, Inc. (US:NKE) , Vertiv Holdings Co (US:VRT) , and GS Finance Corp., Series 0003, Conv. (US:US36255HBY36) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 335.64 | 2.7886 | 2.7886 | ||

| 311.97 | 2.5920 | 2.5920 | ||

| 231.34 | 231.34 | 1.9221 | 1.9221 | |

| 186.87 | 1.5526 | 1.5526 | ||

| 142.51 | 1.1840 | 1.1840 | ||

| 0.74 | 100.20 | 0.8325 | 0.8325 | |

| 0.56 | 95.21 | 0.7911 | 0.7911 | |

| 88.87 | 88.87 | 0.7384 | 0.7384 | |

| 1.42 | 85.97 | 0.7143 | 0.7143 | |

| 0.73 | 79.29 | 0.6588 | 0.6588 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -0.9030 | ||

| 3.68 | 275.07 | 2.2854 | -0.5832 | |

| 0.22 | 50.95 | 0.4233 | -0.4044 | |

| 0.67 | 108.61 | 0.9024 | -0.3549 | |

| 1.24 | 61.38 | 0.5099 | -0.3324 | |

| 0.59 | 101.76 | 0.8455 | -0.2873 | |

| 0.11 | 72.10 | 0.5990 | -0.2854 | |

| 0.93 | 116.45 | 0.9675 | -0.2695 | |

| 0.90 | 122.31 | 1.0162 | -0.1599 | |

| 3.10 | 102.23 | 0.8494 | -0.1497 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-29 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US8252524066 / Invesco Treasury Portfolio, Institutional Class | 355.57 | -2.34 | 355.57 | -2.34 | 2.9543 | 0.0765 | |||

| U.S. Treasury Notes/Bonds / DBT (US91282CMZ13) | 335.64 | 2.7886 | 2.7886 | ||||||

| U.S. Treasury Notes/Bonds / DBT (US91282CMY48) | 311.97 | 2.5920 | 2.5920 | ||||||

| WFC / Wells Fargo & Company | 3.68 | -20.62 | 275.07 | -24.21 | 2.2854 | -0.5832 | |||

| BAC / Bank of America Corporation | 5.91 | -6.69 | 260.76 | -10.68 | 2.1665 | -0.1410 | |||

| Invesco Private Prime Fund / STIV (N/A) | 231.34 | 231.34 | 1.9221 | 1.9221 | |||||

| AMZN / Amazon.com, Inc. | 0.98 | 7.86 | 200.52 | 4.17 | 1.6660 | 0.1445 | |||

| MSFT / Microsoft Corporation | 0.43 | 4.34 | 198.73 | 20.99 | 1.6511 | 0.3529 | |||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 194.18 | -2.31 | 194.18 | -2.31 | 1.6133 | 0.0423 | |||

| U.S. Treasury Notes/Bonds / DBT (US91282CNA52) | 186.87 | 1.5526 | 1.5526 | ||||||

| JCI / Johnson Controls International plc | 1.78 | -21.09 | 180.38 | -6.62 | 1.4986 | -0.0281 | |||

| PM / Philip Morris International Inc. | 1.00 | -3.54 | 179.80 | 12.18 | 1.4939 | 0.2270 | |||

| PH / Parker-Hannifin Corporation | 0.25 | -1.14 | 166.38 | -1.70 | 1.3824 | 0.0445 | |||

| MCHP / Microchip Technology Incorporated | 2.74 | 29.50 | 159.13 | 27.70 | 1.3221 | 0.3372 | |||

| JNJ / Johnson & Johnson | 1.00 | 1.21 | 155.57 | -4.81 | 1.2926 | 0.0008 | |||

| SCHW / The Charles Schwab Corporation | 1.74 | 1.21 | 154.07 | 12.42 | 1.2801 | 0.1968 | |||

| DIS / The Walt Disney Company | 1.34 | 1.21 | 151.48 | 0.53 | 1.2586 | 0.0676 | |||

| WTW / Willis Towers Watson Public Limited Company | 0.48 | -1.09 | 151.10 | -7.82 | 1.2554 | -0.0401 | |||

| U.S. Treasury Notes/Bonds / DBT (US91282CND91) | 142.51 | 1.1840 | 1.1840 | ||||||

| SYY / Sysco Corporation | 1.95 | 6.85 | 142.38 | 3.26 | 1.1830 | 0.0931 | |||

| USFD / US Foods Holding Corp. | 1.76 | 4.91 | 139.30 | 15.80 | 1.1574 | 0.2065 | |||

| MDT / Medtronic plc | 1.59 | 1.21 | 131.53 | -8.74 | 1.0928 | -0.0463 | |||

| PPL / PPL Corporation | 3.70 | 7.18 | 128.60 | 5.78 | 1.0685 | 0.1075 | |||

| FTV / Fortive Corporation | 1.78 | 67.59 | 124.75 | 47.89 | 1.0365 | 0.3698 | |||

| CFG / Citizens Financial Group, Inc. | 3.05 | 1.21 | 122.98 | -10.78 | 1.0218 | -0.0677 | |||

| RTX / RTX Corporation | 0.90 | -19.90 | 122.31 | -17.80 | 1.0162 | -0.1599 | |||

| EMR / Emerson Electric Co. | 1.00 | 1.21 | 119.55 | -0.65 | 0.9932 | 0.0422 | |||

| CBRE / CBRE Group, Inc. | 0.93 | -15.52 | 116.45 | -25.59 | 0.9675 | -0.2695 | |||

| XOM / Exxon Mobil Corporation | 1.14 | 1.21 | 116.21 | -7.00 | 0.9655 | -0.0222 | |||

| CVX / Chevron Corporation | 0.85 | 1.21 | 115.79 | -12.78 | 0.9621 | -0.0873 | |||

| COP / ConocoPhillips | 1.32 | 5.58 | 112.92 | -9.11 | 0.9382 | -0.0438 | |||

| CVS / CVS Health Corporation | 1.76 | 4.93 | 112.88 | 2.24 | 0.9379 | 0.0652 | |||

| SAN / Santander UK plc - Preferred Stock | 1.13 | 1.21 | 112.23 | -8.26 | 0.9325 | -0.0344 | |||

| FIS / Fidelity National Information Services, Inc. | 1.40 | 10.97 | 111.09 | 24.21 | 0.9230 | 0.2161 | |||

| FI / Fiserv, Inc. | 0.67 | -1.15 | 108.61 | -31.72 | 0.9024 | -0.3549 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.61 | 1.21 | 106.54 | -8.34 | 0.8852 | -0.0336 | |||

| CSCO / Cisco Systems, Inc. | 1.63 | 1.21 | 102.92 | -0.48 | 0.8551 | 0.0377 | |||

| SHEL / Shell plc | 3.10 | -18.09 | 102.23 | -19.12 | 0.8494 | -0.1497 | |||

| GOOGL / Alphabet Inc. | 0.59 | -29.60 | 101.76 | -29.00 | 0.8455 | -0.2873 | |||

| KKR / KKR & Co. Inc. | 0.84 | 10.28 | 101.54 | -1.22 | 0.8437 | 0.0312 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.74 | 100.20 | 0.8325 | 0.8325 | |||||

| AIG / American International Group, Inc. | 1.18 | 1.21 | 99.80 | 3.28 | 0.8292 | 0.0654 | |||

| FERG / Ferguson Enterprises Inc. | 0.54 | -9.78 | 97.61 | -7.32 | 0.8110 | -0.0214 | |||

| NSC / Norfolk Southern Corporation | 0.39 | -13.83 | 95.94 | -13.35 | 0.7971 | -0.0780 | |||

| ORCL / Oracle Corporation | 0.58 | 1.21 | 95.88 | 0.88 | 0.7966 | 0.0454 | |||

| GS / The Goldman Sachs Group, Inc. | 0.16 | -16.03 | 95.58 | -18.98 | 0.7942 | -0.1383 | |||

| PG / The Procter & Gamble Company | 0.56 | 95.21 | 0.7911 | 0.7911 | |||||

| SBUX / Starbucks Corporation | 1.11 | 38.39 | 93.08 | 0.32 | 0.7734 | 0.0400 | |||

| TMUS / T-Mobile US, Inc. | 0.37 | 1.21 | 89.00 | -9.11 | 0.7394 | -0.0345 | |||

| Invesco Private Government Fund / STIV (N/A) | 88.87 | 88.87 | 0.7384 | 0.7384 | |||||

| FDX / FedEx Corporation | 0.40 | 1.21 | 88.04 | -16.04 | 0.7315 | -0.0973 | |||

| NKE / NIKE, Inc. | 1.42 | 85.97 | 0.7143 | 0.7143 | |||||

| CTVA / Corteva, Inc. | 1.19 | 1.21 | 84.16 | 13.77 | 0.6992 | 0.1146 | |||

| CNC / Centene Corporation | 1.48 | 1.21 | 83.81 | -1.79 | 0.6963 | 0.0218 | |||

| UNH / UnitedHealth Group Incorporated | 0.27 | 49.91 | 82.48 | -4.71 | 0.6853 | 0.0011 | |||

| CTSH / Cognizant Technology Solutions Corporation | 1.02 | -7.48 | 82.36 | -10.08 | 0.6842 | -0.0397 | |||

| CRM / Salesforce, Inc. | 0.31 | 1.21 | 80.98 | -9.83 | 0.6728 | -0.0370 | |||

| VRT / Vertiv Holdings Co | 0.73 | 79.29 | 0.6588 | 0.6588 | |||||

| BMY / Bristol-Myers Squibb Company | 1.63 | 1.21 | 78.84 | -18.04 | 0.6550 | -0.1053 | |||

| LRCX / Lam Research Corporation | 0.97 | 1.21 | 78.32 | 6.55 | 0.6507 | 0.0697 | |||

| COHR / Coherent Corp. | 1.03 | 6.80 | 77.98 | 7.43 | 0.6479 | 0.0742 | |||

| US36255HBY36 / GS Finance Corp., Series 0003, Conv. | 75.29 | -11.43 | 0.6256 | -0.0464 | |||||

| AEP / American Electric Power Company, Inc. | 0.72 | 1.21 | 74.98 | -1.24 | 0.6229 | 0.0229 | |||

| NXPI / NXP Semiconductors N.V. | 0.39 | 1.21 | 74.42 | -10.28 | 0.6183 | -0.0373 | |||

| ZBRA / Zebra Technologies Corporation | 0.25 | 1.21 | 72.63 | -6.91 | 0.6035 | -0.0133 | |||

| META / Meta Platforms, Inc. | 0.11 | -33.50 | 72.10 | -35.56 | 0.5990 | -0.2854 | |||

| US36255HBG20 / GS Finance Corp., Series 0003, Conv. | 71.64 | -8.49 | 0.5952 | -0.0236 | |||||

| EQT / EQT Corporation | 1.30 | 1.21 | 71.43 | 15.83 | 0.5934 | 0.1060 | |||

| M1CH34 / Microchip Technology Incorporated - Depositary Receipt (Common Stock) | 69.58 | 0.95 | 0.5781 | 0.0333 | |||||

| US40056XCT19 / GS FLOAT 09/25/23 3.75 | 68.11 | 0.5659 | 0.5659 | ||||||

| ALL / The Allstate Corporation | 0.32 | -23.40 | 67.56 | -19.28 | 0.5613 | -0.1002 | |||

| SU / Suncor Energy Inc. | 1.89 | 1.21 | 67.23 | -5.97 | 0.5586 | -0.0065 | |||

| FE / FirstEnergy Corp. | 1.52 | 1.21 | 63.66 | 9.48 | 0.5289 | 0.0693 | |||

| US009066AB74 / CONVERTIBLE ZERO | 63.44 | 0.52 | 0.5271 | 0.0283 | |||||

| M2KS34 / MKS Inc. - Depositary Receipt (Common Stock) | 62.84 | 0.5221 | 0.5221 | ||||||

| GM / General Motors Company | 1.24 | -42.97 | 61.38 | -42.41 | 0.5099 | -0.3324 | |||

| G1PI34 / Global Payments Inc. - Depositary Receipt (Common Stock) | 60.61 | 0.5036 | 0.5036 | ||||||

| PPL Capital Funding, Inc., Conv. / DBT (US69352PAS20) | 59.91 | 0.23 | 0.4978 | 0.0253 | |||||

| MRK / Merck & Co., Inc. | 0.78 | 7.73 | 59.89 | -10.26 | 0.4976 | -0.0299 | |||

| TXT / Textron Inc. | 0.80 | 1.21 | 58.87 | 0.26 | 0.4891 | 0.0250 | |||

| PPG / PPG Industries, Inc. | 0.52 | 1.21 | 57.35 | -0.96 | 0.4765 | 0.0188 | |||

| ELV / Elevance Health, Inc. | 0.15 | -23.59 | 56.79 | -26.10 | 0.4719 | -0.1356 | |||

| U.S. Treasury Notes/Bonds / DBT (US912810UL07) | 56.61 | 0.4703 | 0.4703 | ||||||

| F1EC34 / FirstEnergy Corp. - Depositary Receipt (Common Stock) | 55.47 | 1.54 | 0.4609 | 0.0291 | |||||

| DD / DuPont de Nemours, Inc. | 0.81 | 1.21 | 53.82 | -17.32 | 0.4471 | -0.0674 | |||

| US26210CAC82 / Dropbox, Inc., Conv. | 51.35 | 1.68 | 0.4267 | 0.0275 | |||||

| HUM / Humana Inc. | 0.22 | -43.56 | 50.95 | -51.35 | 0.4233 | -0.4044 | |||

| HAE / Haemonetics Corporation | 50.42 | 0.4189 | 0.4189 | ||||||

| PFE / Pfizer Inc. | 2.13 | -12.22 | 49.96 | -21.99 | 0.4151 | -0.0911 | |||

| US12685JAE55 / Cable One Inc | 48.36 | 0.00 | 0.4018 | 0.0196 | |||||

| GEHC / GE HealthCare Technologies Inc. | 0.64 | 1.21 | 45.36 | -18.27 | 0.3769 | -0.0618 | |||

| US02043QAB32 / CONV. NOTE | 43.78 | 12.64 | 0.3638 | 0.0565 | |||||

| EP.PRC / El Paso Energy Capital Trust I - Preferred Security | 0.88 | 0.00 | 42.98 | 1.05 | 0.3571 | 0.0209 | |||

| US457985AM13 / CONV. NOTE | 42.24 | 0.87 | 0.3510 | 0.0200 | |||||

| CSGS / CSG Systems International, Inc. | 39.44 | 2.83 | 0.3277 | 0.0245 | |||||

| FRT / Federal Realty Investment Trust | 38.69 | -2.35 | 0.3214 | 0.0083 | |||||

| JAZZ / Jazz Pharmaceuticals plc | 36.63 | -6.03 | 0.3044 | -0.0038 | |||||

| US530307AE75 / LIBERTY BROADBAND CORP | 33.23 | -0.26 | 0.2761 | 0.0128 | |||||

| US477839AB04 / CONV. NOTE | 32.88 | -4.16 | 0.2732 | 0.0020 | |||||

| SHOP / Shopify Inc. | 31.66 | -2.37 | 0.2631 | 0.0067 | |||||

| B2HI34 / BILL Holdings, Inc. - Depositary Receipt (Common Stock) | 29.46 | -1.76 | 0.2448 | 0.0077 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 29.02 | 0.2411 | 0.2411 | ||||||

| BOX / Box, Inc. | 26.81 | 7.95 | 0.2228 | 0.0265 | |||||

| US531229AQ58 / CONV. NOTE | 26.19 | 0.00 | 0.2176 | 0.0106 | |||||

| AATRL / Amg Capital Trust II - Preferred Security | 0.48 | 0.00 | 25.92 | 0.70 | 0.2153 | 0.0119 | |||

| US29404KAG13 / CONV. NOTE | 24.67 | 0.00 | 0.2050 | 0.0100 | |||||

| J2AZ34 / Jazz Pharmaceuticals plc - Depositary Receipt (Common Stock) | 23.06 | -10.22 | 0.1916 | -0.0114 | |||||

| U.S. Treasury Notes/Bonds / DBT (US91282CNC19) | 22.84 | 0.1898 | 0.1898 | ||||||

| US65339KBS87 / NextEra Energy Capital Holdings Inc | 22.77 | -0.21 | 0.1892 | 0.0088 | |||||

| US375558BF95 / Gilead Sciences Inc | 22.61 | 0.12 | 0.1879 | 0.0094 | |||||

| BBIO / BridgeBio Pharma, Inc. | 22.28 | 22.02 | 0.1851 | 0.0408 | |||||

| US101137AZ01 / Boston Scientific Corp | 21.84 | 0.70 | 0.1815 | 0.0100 | |||||

| US665531AJ80 / CONV. NOTE | 21.74 | -6.88 | 0.1806 | -0.0039 | |||||

| US98978VAU70 / Zoetis Inc | 21.07 | -0.29 | 0.1751 | 0.0080 | |||||

| US12685JAG04 / CONV. NOTE | 20.77 | -4.65 | 0.1726 | 0.0004 | |||||

| US246114AA00 / Delaware Life Global Funding | 20.22 | 0.47 | 0.1680 | 0.0089 | |||||

| US589889AA22 / Merit Medical Systems Inc | 19.37 | -4.05 | 0.1609 | 0.0014 | |||||

| US89233FHN15 / Toyota Motor Credit Corporation | 17.55 | -0.18 | 0.1458 | 0.0068 | |||||

| US26884UAC36 / EPR Properties | 17.43 | -0.09 | 0.1448 | 0.0069 | |||||

| US459200JZ55 / International Business Machines Corp | 16.89 | 0.34 | 0.1403 | 0.0073 | |||||

| US44932FAA57 / IAC Financeco 2 Inc | 15.95 | 0.92 | 0.1325 | 0.0076 | |||||

| US592173AE84 / Metropolitan Life Insurance Co. | 15.94 | -0.72 | 0.1324 | 0.0055 | |||||

| US097023CW33 / BOEING CO 5.805 5/50 | 15.49 | -2.95 | 0.1287 | 0.0025 | |||||

| US438516CM68 / Honeywell International Inc | 15.40 | -0.81 | 0.1280 | 0.0052 | |||||

| U.S. Treasury Notes/Bonds / DBT (US912810UG12) | 15.23 | 0.1265 | 0.1265 | ||||||

| W1AB34 / Westinghouse Air Brake Technologies Corporation - Depositary Receipt (Common Stock) | 14.73 | 0.1224 | 0.1224 | ||||||

| US539830BH11 / Lockheed Martin Corp | 14.73 | 0.18 | 0.1224 | 0.0062 | |||||

| US09247XAT81 / BlackRock Inc | 14.70 | 0.10 | 0.1221 | 0.0061 | |||||

| US30303M8Q83 / Meta Platforms Inc | 14.65 | -4.85 | 0.1217 | 0.0000 | |||||

| US44932KAA43 / IAC FINANCECO 3 INC | 14.62 | 1.29 | 0.1215 | 0.0074 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 14.24 | 0.1183 | 0.1183 | ||||||

| US6944PL2W87 / Pacific Life Global Funding II | 13.50 | -0.29 | 0.1122 | 0.0051 | |||||

| US26078JAC45 / DuPont de Nemours Inc | 13.22 | 0.1099 | 0.1099 | ||||||

| AAPL / Apple Inc. - Depositary Receipt (Common Stock) | 13.00 | 0.1080 | 0.1080 | ||||||

| GA Global Funding Trust / DBT (US36143L2L80) | 12.71 | 0.01 | 0.1056 | 0.0052 | |||||

| VZ / Verizon Communications Inc. - Depositary Receipt (Common Stock) | 12.62 | 0.1049 | 0.1049 | ||||||

| US02209SBE28 / Altria Group Inc | 12.42 | -2.44 | 0.1032 | 0.0026 | |||||

| US31620MBR60 / FIDELITY NATL INFORMN SVCS INC 1.15% 03/01/2026 | 12.25 | 0.1018 | 0.1018 | ||||||

| US22822VAY74 / Crown Castle International Corp | 12.09 | -0.38 | 0.1004 | 0.0045 | |||||

| US00287YCA55 / ABBVIE INC 4.05% 11/21/2039 | 11.80 | -3.58 | 0.0980 | 0.0013 | |||||

| US778296AF07 / Ross Stores, Inc. | 11.78 | 0.0979 | 0.0979 | ||||||

| US001192AL76 / Southern Co Gas Capital Corp | 11.73 | 0.0975 | 0.0975 | ||||||

| US10922NAH61 / BRIGHTHOUSE FINANCIAL INC | 11.64 | -5.96 | 0.0967 | -0.0011 | |||||

| US573874AF10 / Marvell Technology Inc | 11.34 | 0.99 | 0.0943 | 0.0055 | |||||

| US20030NBS99 / Comcast Corp | 11.21 | 0.30 | 0.0932 | 0.0048 | |||||

| US30231GAT94 / Exxon Mobil Cor Bond | 11.21 | 0.29 | 0.0931 | 0.0048 | |||||

| US285512AD11 / Electronic Arts Inc | 11.19 | -0.13 | 0.0929 | 0.0044 | |||||

| US46647PAM86 / JPMorgan Chase & Co | 10.87 | 0.25 | 0.0903 | 0.0046 | |||||

| US49446RAZ29 / KIMCO REALTY CORP REGD 3.20000000 | 10.83 | -0.37 | 0.0900 | 0.0041 | |||||

| US48255GAA31 / KKR Group Finance Co. XII LLC | 10.80 | -1.20 | 0.0897 | 0.0033 | |||||

| Cisco Systems, Inc. / DBT (US17275RBW16) | 10.65 | 0.60 | 0.0885 | 0.0048 | |||||

| US03522AAH32 / Anheuser-Busch Cos LLC / Anheuser-Busch InBev Worldwide Inc | 10.45 | -0.93 | 0.0868 | 0.0035 | |||||

| State Street Bank and Trust Co. / DBT (US857449AC65) | 10.07 | -0.13 | 0.0837 | 0.0040 | |||||

| US11120VAA17 / Brixmor Operating Partnership LP | 10.02 | -1.54 | 0.0833 | 0.0028 | |||||

| US023135CA22 / Amazon.com Inc | 9.98 | -3.12 | 0.0829 | 0.0015 | |||||

| US20030NCT63 / Comcast Corp Bond | 9.85 | 0.62 | 0.0819 | 0.0045 | |||||

| US166764BL33 / Chevron Corpora Bond | 9.69 | 0.33 | 0.0805 | 0.0042 | |||||

| US50540RAX08 / Laboratory Corp of America Holdings | 9.65 | 0.0802 | 0.0802 | ||||||

| US07274NAL73 / Bayer Us Finance Ii Llc 4.375% 12/15/2028 144a Bond | 9.61 | 0.72 | 0.0799 | 0.0044 | |||||

| US871829AZ02 / Sysco Corp | 9.56 | 0.17 | 0.0795 | 0.0040 | |||||

| US423012AF03 / Heineken NV | 9.52 | 0.42 | 0.0791 | 0.0042 | |||||

| US87264ACQ67 / T-Mobile USA Inc | 9.28 | 0.53 | 0.0771 | 0.0041 | |||||

| US49456BAF85 / Kinder Morgan Inc/DE | 9.05 | 0.15 | 0.0752 | 0.0038 | |||||

| US21036PBB31 / Constellation Brands Inc | 8.97 | 0.0746 | 0.0746 | ||||||

| US22966RAJ59 / CUBESMART LP | 8.95 | -0.38 | 0.0744 | 0.0033 | |||||

| US025676AM95 / American Equity Investment Life Holding Co. | 8.67 | -0.02 | 0.0720 | 0.0035 | |||||

| US637432NY77 / National Rural Utilities Cooperative Finance Corp. | 8.65 | -0.21 | 0.0719 | 0.0034 | |||||

| Dell International LLC / EMC Corp. / DBT (US24703TAN63) | 8.63 | 0.0717 | 0.0717 | ||||||

| US46647PAN69 / JPMorgan Chase & Co | 8.57 | -3.96 | 0.0712 | 0.0007 | |||||

| US68389XBW48 / ORACLE CORP SR UNSECURED 04/40 3.6 | 8.53 | -2.11 | 0.0708 | 0.0020 | |||||

| US172967HA25 / Citigroup Inc | 8.49 | -4.36 | 0.0706 | 0.0004 | |||||

| US110122EB03 / Bristol-Myers Squibb Co | 8.42 | -5.20 | 0.0700 | -0.0002 | |||||

| US55336VBR06 / MPLX LP | 8.39 | 0.0697 | 0.0697 | ||||||

| US03027XBL38 / American Tower Corp | 8.32 | 0.54 | 0.0691 | 0.0037 | |||||

| Foundry JV Holdco LLC / DBT (US350930AJ29) | 8.13 | -2.70 | 0.0676 | 0.0015 | |||||

| US3134A4AA29 / Federal Home Loan Mortgage Corp. | 7.95 | -0.31 | 0.0660 | 0.0030 | |||||

| US24703TAD81 / CORP. NOTE | 7.93 | -0.51 | 0.0658 | 0.0029 | |||||

| US268317AK07 / Electricite de France SA | 7.78 | -4.25 | 0.0646 | 0.0004 | |||||

| US05367AAH68 / Aviation Capital Group LLC | 7.74 | 0.01 | 0.0643 | 0.0031 | |||||

| US62947QBB32 / NXP BV / NXP Funding LLC | 7.70 | 0.05 | 0.0640 | 0.0031 | |||||

| US053807AS28 / Avnet Inc Note M/w Clbl Bond | 7.64 | -0.01 | 0.0634 | 0.0031 | |||||

| US94974BGE48 / Wells Fargo & Co | 7.59 | -4.81 | 0.0630 | 0.0000 | |||||

| US907818FT00 / Union Pacific Corp | 7.56 | -3.36 | 0.0628 | 0.0010 | |||||

| US06051GKD06 / Bank of America Corp | 7.53 | 0.37 | 0.0626 | 0.0033 | |||||

| US594918BJ27 / Microsoft Corp. 3.125% Bond Due 11/3/2025 | 7.49 | 0.27 | 0.0623 | 0.0032 | |||||

| US75884RAZ64 / Regency Centers L.P. | 7.47 | 0.69 | 0.0621 | 0.0034 | |||||

| US55336VAM28 / MPLX LP | 7.39 | -2.87 | 0.0614 | 0.0013 | |||||

| US718172BD03 / Philip Morris International, Inc. | 7.30 | -3.35 | 0.0607 | 0.0010 | |||||

| US79466LAK08 / salesforce.com Inc | 7.29 | -3.74 | 0.0605 | 0.0007 | |||||

| US716973AB84 / Pfizer Investment Enterprises Pte Ltd | 7.26 | -0.07 | 0.0603 | 0.0029 | |||||

| US693475AW59 / The PNC Financial Services Group, Inc. | 7.19 | 0.69 | 0.0597 | 0.0033 | |||||

| US855244AT67 / Starbucks Corp | 7.18 | 0.22 | 0.0596 | 0.0030 | |||||

| US595112BQ52 / Micron Technology Inc. | 7.18 | -0.07 | 0.0596 | 0.0029 | |||||

| US31359MGK36 / Federal Ntnl Mo 6.62530 Due 11/15/30 Bond | 7.10 | -0.15 | 0.0590 | 0.0028 | |||||

| US86765BAP40 / Sunoco Logistics Partners Operations L.P. | 7.09 | -6.09 | 0.0589 | -0.0008 | |||||

| US969457CH11 / Williams Cos Inc/The | 7.05 | -0.25 | 0.0586 | 0.0027 | |||||

| US42824CAW91 / Hewlett Packard Enterprise Co | 6.89 | -0.03 | 0.0573 | 0.0028 | |||||

| US00287YAR09 / AbbVie Inc | 6.88 | -1.35 | 0.0572 | 0.0020 | |||||

| MS / Morgan Stanley | 6.86 | 0.10 | 0.0570 | 0.0028 | |||||

| US98389BAX82 / Xcel Energy, Inc. | 6.83 | -6.01 | 0.0567 | -0.0007 | |||||

| US94974BGP94 / Wells Fargo & Co Bond | 6.82 | 0.18 | 0.0566 | 0.0029 | |||||

| US20030NCJ81 / Comcast Corp. | 6.78 | -2.46 | 0.0564 | 0.0014 | |||||

| US693475BU84 / PNC Financial Services Group Inc/The | 6.72 | -1.31 | 0.0558 | 0.0020 | |||||

| US75513ECX76 / RTX CORP SR UNSEC 6.4% 03-15-54 | 6.64 | -4.49 | 0.0552 | 0.0002 | |||||

| US49177JAP75 / Kenvue Inc | 6.53 | -4.95 | 0.0542 | -0.0001 | |||||

| US55903VBE20 / Warnermedia Holdings Inc | 6.41 | -16.03 | 0.0533 | -0.0071 | |||||

| US775109BG57 / Rogers Communications Inc | 6.29 | -2.36 | 0.0522 | 0.0013 | |||||

| US29278NAR44 / ENERGY TRANSFER OPERATNG COMPANY GUAR 05/50 5 | 6.22 | -7.32 | 0.0517 | -0.0014 | |||||

| US10373QBP46 / BP Capital Markets America Inc | 6.13 | -5.27 | 0.0510 | -0.0002 | |||||

| US11135FBL40 / Broadcom Inc | 6.13 | -0.62 | 0.0509 | 0.0022 | |||||

| US53079EBK91 / Liberty Mutual Group Inc | 5.85 | -7.64 | 0.0486 | -0.0015 | |||||

| US87938WAU71 / Telefonica Emisiones SA | 5.81 | -5.25 | 0.0483 | -0.0002 | |||||

| US38141GVR28 / Goldman Sachs Group Inc/The | 5.80 | 0.17 | 0.0482 | 0.0024 | |||||

| US29379VBQ59 / Enterprise Products Operating LLC | 5.78 | -5.39 | 0.0480 | -0.0003 | |||||

| US55903VBD47 / Warnermedia Holdings Inc | 5.73 | -13.19 | 0.0476 | -0.0046 | |||||

| US87165BAM54 / Synchrony Financial | 5.64 | -0.27 | 0.0468 | 0.0022 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 5.63 | 0.0467 | 0.0467 | ||||||

| US68217FAA03 / Omnicom Group Inc / Omnicom Capital Inc | 5.60 | 0.09 | 0.0466 | 0.0023 | |||||

| US912810FT08 / United States Treasury Note/Bond | 5.60 | -2.00 | 0.0465 | 0.0014 | |||||

| US89417EAJ82 / Travelers Cos., Inc. (The) | 5.59 | -5.16 | 0.0465 | -0.0001 | |||||

| US110122CQ99 / Bristol-Myers Squibb Co | 5.59 | -2.75 | 0.0464 | 0.0010 | |||||

| W1BD34 / Warner Bros. Discovery, Inc. - Depositary Receipt (Common Stock) | 5.59 | 0.0464 | 0.0464 | ||||||

| US06051GGA13 / Bank of America Corp | 5.57 | 0.51 | 0.0463 | 0.0025 | |||||

| US70213BAB71 / PartnerRe Finance B LLC | 5.57 | -0.30 | 0.0462 | 0.0021 | |||||

| US65339KAT79 / NextEra Energy Capital Holdings, Inc. | 5.47 | 0.26 | 0.0455 | 0.0023 | |||||

| US37045XBG07 / General Motors Financial Co Inc | 5.47 | -0.22 | 0.0455 | 0.0021 | |||||

| US02364WBE49 / America Movil S.a.b De C.v 4.375% 07/16/42 | 5.45 | -4.88 | 0.0453 | -0.0000 | |||||

| US133434AD26 / Cameron LNG LLC | 5.42 | 0.02 | 0.0450 | 0.0022 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 5.38 | 0.0447 | 0.0447 | ||||||

| US35177PAL13 / Orange SA | 5.37 | -0.24 | 0.0446 | 0.0021 | |||||

| US172967LP48 / Citigroup Inc (variable) Bond | 5.29 | 0.13 | 0.0439 | 0.0022 | |||||

| US03522AAJ97 / Anheuser-Busch Cos LLC / Anheuser-Busch InBev Worldwide Inc | 5.26 | -3.59 | 0.0437 | 0.0006 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 5.25 | -1.04 | 0.0436 | 0.0017 | |||||

| US00287YDA47 / ABBVIE INC 4.85% 06/15/2044 | 5.22 | -4.83 | 0.0434 | 0.0000 | |||||

| Mars, Inc. / DBT (US571676AW54) | 5.18 | 0.0430 | 0.0430 | ||||||

| US29273VAT70 / Energy Transfer LP | 5.17 | -0.33 | 0.0430 | 0.0020 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 5.16 | 0.0429 | 0.0429 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 5.16 | 0.0428 | 0.0428 | ||||||

| Mars, Inc. / DBT (US571676BA26) | 5.12 | 0.0426 | 0.0426 | ||||||

| US775109AX99 / Rogers Communications Inc. 4.50% 03/15/43 | 5.01 | -3.56 | 0.0417 | 0.0006 | |||||

| LMT / Lockheed Martin Corporation - Depositary Receipt (Common Stock) | 5.00 | -5.28 | 0.0416 | -0.0002 | |||||

| US98138HAG65 / Workday Inc | 4.95 | 0.32 | 0.0411 | 0.0021 | |||||

| US626207YM09 / MUNI ELEC AUTH OF GEORGIA | 4.88 | -6.97 | 0.0406 | -0.0009 | |||||

| US61238QAA67 / LYB Finance Co BV | 4.88 | -0.35 | 0.0406 | 0.0018 | |||||

| US87264ACT07 / T-Mobile USA Inc | 4.85 | -5.31 | 0.0403 | -0.0002 | |||||

| US438127AC63 / Honda Motor Co Ltd | 4.82 | -0.31 | 0.0400 | 0.0018 | |||||

| US65473QBF90 / NiSource, Inc. | 4.81 | -5.07 | 0.0400 | -0.0001 | |||||

| US655844CS56 / Norfolk Southern Corp. | 4.77 | -4.74 | 0.0396 | 0.0001 | |||||

| US816851BH17 / Sempra Energy | 4.75 | -2.22 | 0.0395 | 0.0011 | |||||

| US677050AK26 / Oglethorpe Power Corp. | 4.68 | -5.79 | 0.0389 | -0.0004 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 4.63 | -7.18 | 0.0385 | -0.0010 | |||||

| US30225VAL18 / Extra Space Storage LP | 4.62 | 0.24 | 0.0384 | 0.0020 | |||||

| US07274EAM57 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.875% 11-21-53 | 4.59 | -3.04 | 0.0381 | 0.0007 | |||||

| US91324PDT66 / UnitedHealth Group Inc | 4.56 | -4.04 | 0.0379 | 0.0003 | |||||

| US94974BFY11 / Wells Fargo Bk N Bond | 4.49 | 0.11 | 0.0373 | 0.0019 | |||||

| US37045VAK61 / General Motors Co Bond | 4.46 | -2.41 | 0.0371 | 0.0009 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 4.43 | -2.60 | 0.0368 | 0.0009 | |||||

| US46647PAA49 / JPMorgan Chase & Co | 4.39 | -4.13 | 0.0365 | 0.0003 | |||||

| US92343VGK44 / Verizon Communications Inc | 4.38 | -3.44 | 0.0364 | 0.0005 | |||||

| US84756NAG43 / Spectra Energy Partners, L.P. | 4.38 | -5.06 | 0.0364 | -0.0001 | |||||

| US570535AT11 / Markel Corp | 4.36 | -6.44 | 0.0362 | -0.0006 | |||||

| US46625HRS12 / JPMorgan Chase & Co | 4.31 | 0.23 | 0.0358 | 0.0018 | |||||

| US219023AC21 / Corn Products 6.625% Senior Notes 4/15/37 | 4.28 | -0.99 | 0.0356 | 0.0014 | |||||

| US882389CC14 / Texas Eastn Transmission Corp Senior Notes 7% 07/15/32 | 4.19 | -1.78 | 0.0348 | 0.0011 | |||||

| T-Mobile USA, Inc. / DBT (US87264ADU60) | 4.18 | 0.0348 | 0.0348 | ||||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 4.12 | 0.0343 | 0.0343 | ||||||

| US49456BAG68 / KINDER MORGAN INC COMPANY GUAR 12/34 5.3 | 4.11 | -1.53 | 0.0342 | 0.0012 | |||||

| Mars, Inc. / DBT (US571676BB09) | 4.10 | 0.0340 | 0.0340 | ||||||

| US539830BS75 / Lockheed Martin Corp. | 4.05 | -5.91 | 0.0336 | -0.0004 | |||||

| Molex Electronic Technologies, LLC / DBT (US60856BAE48) | 4.04 | 0.0336 | 0.0336 | ||||||

| US594918BC73 / Microsoft Corp. | 3.93 | -0.51 | 0.0326 | 0.0014 | |||||

| US30225VAJ61 / Extra Space Storage LP | 3.91 | -0.08 | 0.0325 | 0.0016 | |||||

| US907818FG88 / Union Pacific Corp | 3.89 | -6.49 | 0.0323 | -0.0006 | |||||

| US638612AL51 / Nationwide Financial Services, Inc. | 3.83 | -5.53 | 0.0318 | -0.0002 | |||||

| US25470DAL38 / Discovery Communications LLC | 3.77 | -0.16 | 0.0313 | 0.0015 | |||||

| US25468PDK93 / TWDC Enterprises 18 Corp | 3.73 | 0.24 | 0.0310 | 0.0016 | |||||

| 30064K105 / Exacttarget, Inc. | 3.73 | -0.05 | 0.0310 | 0.0015 | |||||

| US744320AY89 / Prudential Financial, Inc. | 3.71 | -4.35 | 0.0308 | 0.0002 | |||||

| US570535AP98 / Markel Corporation 5.0% 03/30/43 | 3.67 | -4.05 | 0.0305 | 0.0003 | |||||

| US98978VAH69 / Zoetis Inc | 3.66 | -3.26 | 0.0304 | 0.0005 | |||||

| US548661EJ29 / Lowe's Cos Inc | 3.60 | -5.91 | 0.0299 | -0.0003 | |||||

| US907818DZ87 / Union Pacific Corp. | 3.51 | -4.93 | 0.0291 | -0.0000 | |||||

| US874054AG47 / Take-Two Interactive Software, Inc. | 3.50 | 0.31 | 0.0291 | 0.0015 | |||||

| US91913YBE95 / Valero Energy Corp | 3.50 | -7.70 | 0.0291 | -0.0009 | |||||

| US09256BAG23 / Blackstone Holdings Finance Co. LLC | 3.50 | -5.99 | 0.0291 | -0.0003 | |||||

| US00206RGQ92 / AT&T Inc | 3.49 | 0.81 | 0.0290 | 0.0016 | |||||

| US037833CJ77 / Apple Inc | 3.46 | 0.20 | 0.0287 | 0.0015 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 3.45 | -5.11 | 0.0287 | -0.0001 | |||||

| US172967KR13 / Citigroup Inc | 3.44 | -5.70 | 0.0286 | -0.0003 | |||||

| US29273RBE80 / Energy Transfer Operating LP | 3.41 | -2.29 | 0.0283 | 0.0007 | |||||

| US909318AA56 / United Airlines Pass Through Trust, Series 2018-1, Class AA | 3.37 | -5.70 | 0.0280 | -0.0002 | |||||

| US655844CD87 / Norfolk Southern Corp. | 3.32 | -5.74 | 0.0276 | -0.0002 | |||||

| Aviation Capital Group LLC / DBT (US05369AAR23) | 3.31 | 0.0275 | 0.0275 | ||||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 3.31 | -1.52 | 0.0275 | 0.0009 | |||||

| Cisco Systems, Inc. / DBT (US17275RBU59) | 3.30 | -5.21 | 0.0274 | -0.0001 | |||||

| US87264ADD46 / T-Mobile USA Inc | 3.22 | -4.76 | 0.0267 | 0.0000 | |||||

| US020002BD26 / Allstate Corp/The | 3.21 | 0.38 | 0.0266 | 0.0014 | |||||

| US91159HHM51 / U.s. Bancorp Bond | 3.20 | 0.22 | 0.0266 | 0.0014 | |||||

| US075887BM03 / Becton, Dickinson and Co. | 3.20 | -4.82 | 0.0266 | 0.0000 | |||||

| Rio Tinto Finance (USA) PLC / DBT (US76720AAV89) | 3.18 | 0.0264 | 0.0264 | ||||||

| US60871RAH30 / Molson Coors Brewing Co | 3.18 | -5.22 | 0.0264 | -0.0001 | |||||

| US210385AE04 / Constellation Energy Generation LLC | 3.14 | -2.64 | 0.0261 | 0.0006 | |||||

| US00774MAZ86 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 3.12 | -3.43 | 0.0260 | 0.0004 | |||||

| US126650BP48 / CVS PASS THROUGH TRUST PASS THRU CE 12/28 6.036 | 3.09 | -6.08 | 0.0257 | -0.0003 | |||||

| US00206RLJ94 / AT&T, Inc. | 3.02 | -4.67 | 0.0251 | 0.0001 | |||||

| IMB / Imperial Brands PLC | 3.01 | -4.29 | 0.0250 | 0.0002 | |||||

| US125523AJ93 / Cigna Corp. | 2.96 | -2.69 | 0.0246 | 0.0006 | |||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 2.93 | 0.0243 | 0.0243 | ||||||

| US913017CW70 / United Technologies Corp | 2.92 | -1.95 | 0.0243 | 0.0007 | |||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 2.85 | 0.0237 | 0.0237 | ||||||

| US48250AAA16 / KKR Group Finance Co III LLC | 2.84 | -5.75 | 0.0236 | -0.0002 | |||||

| US460146CH42 / Intl Paper Co 6.0% 11/15/41 | 2.82 | -5.60 | 0.0234 | -0.0002 | |||||

| US13645RBG83 / Canadian Pacific Railway Co | 2.81 | -3.46 | 0.0234 | 0.0003 | |||||

| US373334KN09 / Georgia Power Co | 2.64 | -4.93 | 0.0220 | -0.0000 | |||||

| US20030NDU28 / Comcast Corp | 2.60 | -5.01 | 0.0216 | -0.0000 | |||||

| US63111XAK72 / Nasdaq Inc | 2.56 | -4.62 | 0.0213 | 0.0001 | |||||

| US172967HS33 / Citigroup Inc | 2.53 | -4.27 | 0.0210 | 0.0001 | |||||

| US90932QAA40 / United Airlines 2014-2 Class A Pass Through Trust | 2.53 | -6.10 | 0.0210 | -0.0003 | |||||

| US75884RAY99 / Regency Centers, L.P. | 2.50 | -4.25 | 0.0208 | 0.0001 | |||||

| US00206RMN97 / AT&T Inc | 2.48 | -4.65 | 0.0206 | 0.0000 | |||||

| US585055BT26 / Medtronic Inc | 2.47 | -1.67 | 0.0206 | 0.0007 | |||||

| N1IS34 / NiSource Inc. - Depositary Receipt (Common Stock) | 2.43 | 0.0202 | 0.0202 | ||||||

| Global Atlantic (Fin) Co. / DBT (US37959GAF46) | 2.40 | -5.91 | 0.0200 | -0.0002 | |||||

| AS Mileage Plan IP Ltd. / DBT (US00218QAB68) | 2.39 | -2.09 | 0.0199 | 0.0006 | |||||

| US767201AD89 / Rio Tinto Finance Usa 7.125% Guaranteed Notes 7/15/28 | 2.35 | -0.17 | 0.0195 | 0.0009 | |||||

| US773903AL39 / Rockwell Automation Inc | 2.32 | 0.78 | 0.0192 | 0.0011 | |||||

| US36264FAN15 / GSK Consumer Healthcare Capital US LLC | 2.23 | -4.58 | 0.0185 | 0.0001 | |||||

| US38141GYK48 / Goldman Sachs Group, Inc. (The) | 2.23 | -3.34 | 0.0185 | 0.0003 | |||||

| US20826FAF36 / ConocoPhillips Co. | 2.20 | -3.56 | 0.0182 | 0.0002 | |||||

| Sixth Street Lending Partners / DBT (US829932AE25) | 2.12 | -0.52 | 0.0176 | 0.0008 | |||||

| AS Mileage Plan IP Ltd. / DBT (US00218QAA85) | 2.10 | -0.76 | 0.0175 | 0.0007 | |||||

| US02377AAA60 / American Airlines Pass Through Trust, Series 2014-1, Class A | 2.04 | -4.82 | 0.0169 | 0.0000 | |||||

| US552676AQ11 / M.d.c. Holdings, Inc. 6.00% 01/15/43 | 1.88 | -12.41 | 0.0156 | -0.0013 | |||||

| US20030NDS71 / CORPORATE BONDS | 1.86 | -5.40 | 0.0154 | -0.0001 | |||||

| US911312AZ91 / United Parcel Service Inc | 1.83 | -6.10 | 0.0152 | -0.0002 | |||||

| Mars, Inc. / DBT (US571676BC81) | 1.83 | 0.0152 | 0.0152 | ||||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 1.79 | 0.0149 | 0.0149 | ||||||

| US824348AX47 / Sherwin-Williams Co/The | 1.36 | -5.67 | 0.0113 | -0.0001 | |||||

| US161175AY09 / Charter Communications Operating LLC / Charter Communications Operating Capital | 1.30 | 0.08 | 0.0108 | 0.0005 | |||||

| U.S. Treasury Bills / DBT (US912797QN08) | 1.30 | 0.0108 | 0.0108 | ||||||

| US595112BT91 / Micron Technology Inc | 1.27 | -5.53 | 0.0105 | -0.0001 | |||||

| US224044CM71 / Cox Communications Inc | 1.13 | -6.61 | 0.0094 | -0.0002 | |||||

| US582839AH96 / Mead Johnson Nutrition Co. | 0.65 | 0.16 | 0.0054 | 0.0003 | |||||

| US29379VAQ68 / Enterprise Products 6.45% 09/01/40 | 0.60 | -2.77 | 0.0050 | 0.0001 | |||||

| US22822VAF85 / Crown Castle International Corp | 0.39 | -5.57 | 0.0032 | -0.0000 | |||||

| US69351UAM53 / PPL Electric Utilities Corp. | 0.38 | -3.03 | 0.0032 | 0.0001 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.14 | 0.0012 | 0.0012 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.04 | 0.0003 | 0.0003 | ||||||

| US24703TAK25 / CORPORATE BONDS | 0.04 | -2.63 | 0.0003 | 0.0000 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.02 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.02 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.02 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.02 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.02 | 0.0001 | 0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.01 | 0.0001 | 0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| US31390C5R33 / Federal National Mortgage Association | 0.00 | 0.00 | 0.0000 | -0.0000 | |||||

| US36206VZN09 / Government National Mortgage Association | 0.00 | 0.0000 | -0.0000 | ||||||

| US36206BUV16 / Government National Mortgage Association | 0.00 | 0.0000 | -0.0000 | ||||||

| US36202DLH25 / GOVT NATL MORTG ASSN 8.00% 01/20/2031 GNMA II | 0.00 | 0.0000 | -0.0000 | ||||||

| US36202DKY66 / Government National Mortgage Association | 0.00 | 0.0000 | 0.0000 | ||||||

| US3128KLAK32 / Federal Home Loan Mortgage Corp. | 0.00 | 0.0000 | 0.0000 | ||||||

| US31292GZZ26 / Federal Home Loan Mortgage Corp. | 0.00 | 0.0000 | 0.0000 | ||||||

| MRVL / Marvell Technology, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9030 | ||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.01 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.01 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.01 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.01 | -0.0001 | -0.0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.02 | -0.0002 | -0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.02 | -0.0002 | -0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.02 | -0.0002 | -0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.02 | -0.0002 | -0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.02 | -0.0002 | -0.0002 | ||||||

| U.S. Treasury 5 Year Notes Future / DIR (N/A) | -0.03 | -0.0002 | -0.0002 | ||||||

| U.S. Treasury Ultra Bonds Future / DIR (N/A) | -0.11 | -0.0009 | -0.0009 | ||||||

| U.S. Treasury 10 Year Notes Future / DIR (N/A) | -0.11 | -0.0009 | -0.0009 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.24 | -0.0020 | -0.0020 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.72 | -0.0060 | -0.0060 |