Mga Batayang Estadistika

| Nilai Portofolio | $ 11,577,481,480 |

| Posisi Saat Ini | 105 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

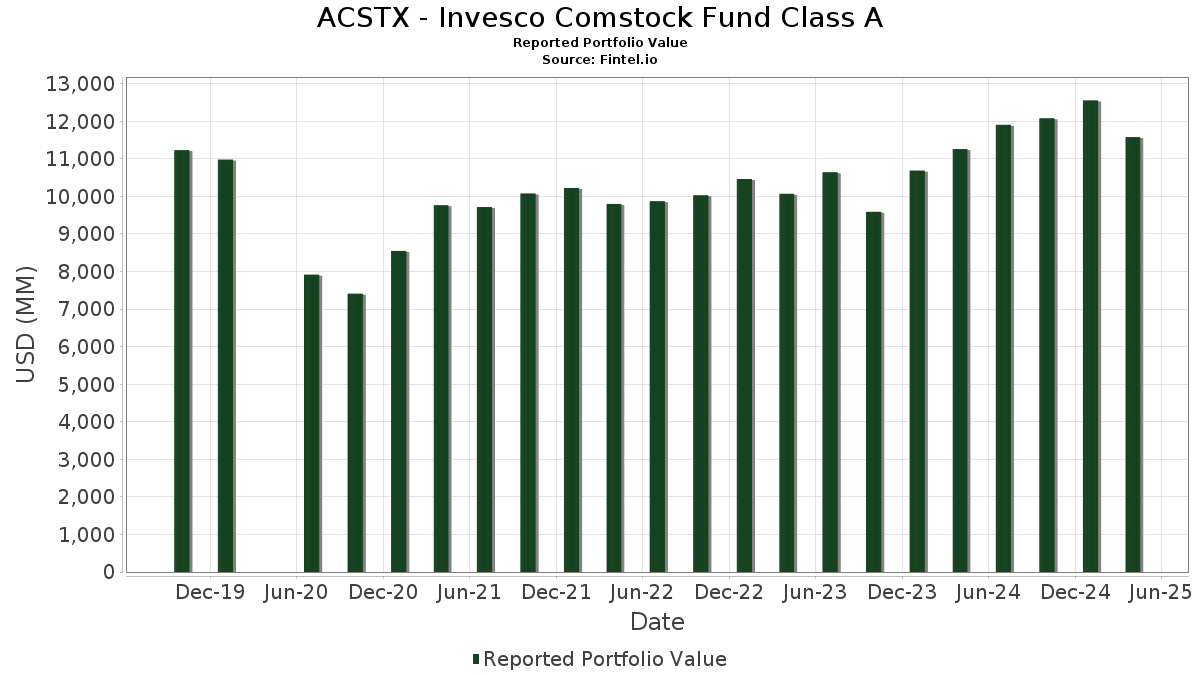

ACSTX - Invesco Comstock Fund Class A telah mengungkapkan total kepemilikan 105 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 11,577,481,480 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama ACSTX - Invesco Comstock Fund Class A adalah Wells Fargo & Company (US:WFC) , Bank of America Corporation (US:BAC) , Microsoft Corporation (US:MSFT) , Cisco Systems, Inc. (US:CSCO) , and CVS Health Corporation (US:CVS) . Posisi baru ACSTX - Invesco Comstock Fund Class A meliputi: Restaurant Brands International Inc. (US:QSR) , NIKE, Inc. (US:NKE) , Evergy, Inc. (US:EVRG) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.03 | 130.51 | 1.1306 | 1.1306 | |

| 253.95 | 253.95 | 2.2000 | 0.7582 | |

| 1.48 | 83.22 | 0.7209 | 0.7209 | |

| 4.14 | 276.12 | 2.3920 | 0.5915 | |

| 1.08 | 199.38 | 1.7272 | 0.5401 | |

| 0.40 | 97.21 | 0.8421 | 0.5030 | |

| 2.62 | 194.34 | 1.6835 | 0.4997 | |

| 136.94 | 136.94 | 1.1863 | 0.4084 | |

| 0.22 | 89.24 | 0.7731 | 0.3937 | |

| 0.63 | 43.76 | 0.3791 | 0.3791 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.19 | 37.85 | 0.3279 | -1.0608 | |

| 0.07 | 17.10 | 0.1481 | -0.6895 | |

| 0.77 | 55.70 | 0.4825 | -0.6759 | |

| 0.09 | 49.42 | 0.4281 | -0.5526 | |

| 1.43 | 226.53 | 1.9624 | -0.3837 | |

| 0.26 | 68.81 | 0.5961 | -0.3612 | |

| 1.56 | 124.97 | 1.0826 | -0.3412 | |

| 1.53 | 161.03 | 1.3950 | -0.3382 | |

| 0.42 | 229.73 | 1.9901 | -0.3346 | |

| 4.53 | 167.11 | 1.4477 | -0.2894 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-30 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| WFC / Wells Fargo & Company | 5.10 | -3.55 | 362.19 | -13.08 | 3.1376 | -0.2215 | |||

| BAC / Bank of America Corporation | 8.80 | 6.67 | 350.82 | -8.12 | 3.0391 | -0.0388 | |||

| MSFT / Microsoft Corporation | 0.73 | 0.00 | 286.80 | -4.77 | 2.4845 | 0.0568 | |||

| CSCO / Cisco Systems, Inc. | 4.82 | 7.97 | 278.36 | 2.86 | 2.4114 | 0.2299 | |||

| CVS / CVS Health Corporation | 4.14 | 4.66 | 276.12 | 23.62 | 2.3920 | 0.5915 | |||

| US8252524066 / Invesco Treasury Portfolio, Institutional Class | 253.95 | 41.99 | 253.95 | 41.99 | 2.2000 | 0.7582 | |||

| PM / Philip Morris International Inc. | 1.39 | -24.69 | 237.34 | -0.89 | 2.0561 | 0.1257 | |||

| META / Meta Platforms, Inc. | 0.42 | 0.00 | 229.73 | -20.34 | 1.9901 | -0.3346 | |||

| GOOGL / Alphabet Inc. | 1.43 | 0.00 | 226.53 | -22.16 | 1.9624 | -0.3837 | |||

| STT / State Street Corporation | 2.53 | 14.03 | 222.85 | -1.14 | 1.9306 | 0.1133 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 3.96 | 0.00 | 217.58 | 1.12 | 1.8849 | 0.1504 | |||

| ELV / Elevance Health, Inc. | 0.50 | 5.18 | 210.51 | 11.79 | 1.8236 | 0.3057 | |||

| SYY / Sysco Corporation | 2.95 | 0.00 | 210.40 | -2.08 | 1.8227 | 0.0905 | |||

| JCI / Johnson Controls International plc | 2.43 | -14.64 | 203.85 | -8.18 | 1.7660 | -0.0238 | |||

| NXPI / NXP Semiconductors N.V. | 1.08 | 53.20 | 199.38 | 35.39 | 1.7272 | 0.5401 | |||

| RBGPF / Reckitt Benckiser Group plc | 3.03 | 5.62 | 195.70 | 3.09 | 1.6954 | 0.1651 | |||

| SRE / Sempra | 2.62 | 47.76 | 194.34 | 32.33 | 1.6835 | 0.4997 | |||

| KMB / Kimberly-Clark Corporation | 1.43 | 0.00 | 188.34 | 1.39 | 1.6316 | 0.1342 | |||

| CTSH / Cognizant Technology Solutions Corporation | 2.53 | 36.38 | 185.98 | 21.46 | 1.6111 | 0.3768 | |||

| HBAN / Huntington Bancshares Incorporated | 12.62 | 7.37 | 183.43 | -9.30 | 1.5891 | -0.0412 | |||

| FDX / FedEx Corporation | 0.87 | 11.41 | 182.30 | -11.53 | 1.5793 | -0.0817 | |||

| CVX / Chevron Corporation | 1.32 | -9.57 | 179.66 | -17.53 | 1.5564 | -0.1997 | |||

| C / Citigroup Inc. | 2.62 | 0.00 | 179.01 | -16.03 | 1.5508 | -0.1677 | |||

| AZN / Astrazeneca plc | 1.23 | 0.00 | 176.69 | 2.06 | 1.5306 | 0.1351 | |||

| KDP / Keurig Dr Pepper Inc. | 5.11 | 0.00 | 176.62 | 7.76 | 1.5301 | 0.2088 | |||

| ETN / Eaton Corporation plc | 0.60 | 21.22 | 175.99 | 9.31 | 1.5246 | 0.2268 | |||

| JNJ / Johnson & Johnson | 1.11 | -11.03 | 173.02 | -8.59 | 1.4989 | -0.0270 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.92 | 13.52 | 169.43 | 0.86 | 1.4678 | 0.1136 | |||

| AIG / American International Group, Inc. | 2.05 | -16.41 | 167.44 | -7.49 | 1.4505 | -0.0085 | |||

| CFG / Citizens Financial Group, Inc. | 4.53 | 0.00 | 167.11 | -22.45 | 1.4477 | -0.2894 | |||

| SU / Suncor Energy Inc. | 4.65 | -12.34 | 164.12 | -17.64 | 1.4218 | -0.1845 | |||

| EMR / Emerson Electric Co. | 1.53 | -7.41 | 161.03 | -25.11 | 1.3950 | -0.3382 | |||

| EBAY / eBay Inc. | 2.22 | 15.98 | 150.98 | 17.14 | 1.3079 | 0.2690 | |||

| FITB / Fifth Third Bancorp | 4.12 | 0.00 | 147.99 | -18.89 | 1.2820 | -0.1888 | |||

| MRK / Merck & Co., Inc. | 1.73 | 5.52 | 147.28 | -9.03 | 1.2759 | -0.0292 | |||

| D / Dominion Energy, Inc. | 2.70 | -9.76 | 146.93 | -11.73 | 1.2729 | -0.0689 | |||

| CTVA / Corteva, Inc. | 2.36 | 0.00 | 146.58 | -5.03 | 1.2698 | 0.0257 | |||

| COP / ConocoPhillips | 1.58 | 0.00 | 140.83 | -9.82 | 1.2200 | -0.0389 | |||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 136.94 | 41.90 | 136.94 | 41.90 | 1.1863 | 0.4084 | |||

| MTB / M&T Bank Corporation | 0.78 | 0.00 | 132.68 | -15.64 | 1.1494 | -0.1185 | |||

| BDX / Becton, Dickinson and Company | 0.63 | 0.00 | 131.41 | -16.36 | 1.1384 | -0.1281 | |||

| QSR / Restaurant Brands International Inc. | 2.03 | 130.51 | 1.1306 | 1.1306 | |||||

| CHTR / Charter Communications, Inc. | 0.33 | 0.00 | 130.32 | 13.42 | 1.1289 | 0.2027 | |||

| CAT / Caterpillar Inc. | 0.42 | 0.00 | 129.03 | -16.74 | 1.1178 | -0.1314 | |||

| SBUX / Starbucks Corporation | 1.56 | -4.82 | 124.97 | -29.24 | 1.0826 | -0.3412 | |||

| DPZ / Domino's Pizza, Inc. | 0.24 | 0.00 | 120.09 | 9.18 | 1.0403 | 0.1537 | |||

| ABIT / Anheuser-Busch InBev SA/NV | 1.82 | 0.00 | 119.80 | 33.75 | 1.0378 | 0.3158 | |||

| CF / CF Industries Holdings, Inc. | 1.49 | 0.00 | 116.90 | -15.01 | 1.0127 | -0.0961 | |||

| MET / MetLife, Inc. | 1.54 | 3.55 | 116.17 | -9.79 | 1.0064 | -0.0317 | |||

| TXT / Textron Inc. | 1.65 | 18.03 | 116.11 | 8.56 | 1.0058 | 0.1436 | |||

| MDT / Medtronic plc | 1.37 | 0.00 | 115.95 | -6.67 | 1.0045 | 0.0030 | |||

| LVS / Las Vegas Sands Corp. | 2.98 | 6.63 | 109.43 | -14.68 | 0.9480 | -0.0860 | |||

| CMCSA / Comcast Corporation | 3.09 | 0.00 | 105.72 | 1.60 | 0.9159 | 0.0771 | |||

| XOM / Exxon Mobil Corporation | 1.00 | -23.65 | 105.68 | -24.50 | 0.9155 | -0.2129 | |||

| DIS / The Walt Disney Company | 1.15 | 0.00 | 104.79 | -19.56 | 0.9078 | -0.1423 | |||

| SBAC / SBA Communications Corporation | 0.40 | 87.58 | 97.21 | 131.10 | 0.8421 | 0.5030 | |||

| IP / International Paper Company | 2.03 | 0.00 | 92.71 | -17.89 | 0.8032 | -0.1070 | |||

| FFIV / F5, Inc. | 0.35 | -16.11 | 92.42 | -25.29 | 0.8006 | -0.1965 | |||

| QCOM / QUALCOMM Incorporated | 0.62 | -3.62 | 91.70 | -17.25 | 0.7944 | -0.0990 | |||

| UNH / UnitedHealth Group Incorporated | 0.22 | 150.04 | 89.24 | 89.64 | 0.7731 | 0.3937 | |||

| ALL / The Allstate Corporation | 0.45 | -30.03 | 88.70 | -27.83 | 0.7684 | -0.2223 | |||

| HSIC / Henry Schein, Inc. | 1.30 | -15.86 | 84.17 | -31.67 | 0.7291 | -0.2638 | |||

| NKE / NIKE, Inc. | 1.48 | 83.22 | 0.7209 | 0.7209 | |||||

| INTC / Intel Corporation | 4.00 | 0.00 | 80.38 | 3.45 | 0.6963 | 0.0700 | |||

| BMY / Bristol-Myers Squibb Company | 1.58 | 0.00 | 79.41 | -14.84 | 0.6879 | -0.0638 | |||

| GEHC / GE HealthCare Technologies Inc. | 1.08 | -4.33 | 76.16 | -23.80 | 0.6597 | -0.1459 | |||

| HES / Hess Corporation | 0.59 | 0.00 | 75.82 | -7.18 | 0.6569 | -0.0016 | |||

| DXC / DXC Technology Company | 4.81 | 0.00 | 74.61 | -28.55 | 0.6463 | -0.1954 | |||

| HUM / Humana Inc. | 0.26 | -35.21 | 68.81 | -42.06 | 0.5961 | -0.3612 | |||

| UNVGY / Universal Music Group N.V. - Depositary Receipt (Common Stock) | 2.33 | 0.00 | 68.59 | 5.43 | 0.5942 | 0.0697 | |||

| TEN / Tenaris S.A. | 3.68 | 0.00 | 61.35 | -11.77 | 0.5315 | -0.0290 | |||

| EQT / EQT Corporation | 1.23 | -28.03 | 60.63 | -30.40 | 0.5252 | -0.1769 | |||

| IQV / IQVIA Holdings Inc. | 0.38 | -10.33 | 59.28 | -30.94 | 0.5136 | -0.1784 | |||

| ICLR / ICON Public Limited Company | 0.39 | 177.36 | 59.17 | 110.99 | 0.5126 | 0.2865 | |||

| WBD / Warner Bros. Discovery, Inc. | 6.57 | 0.00 | 56.92 | -16.95 | 0.4931 | -0.0594 | |||

| KO / The Coca-Cola Company | 0.77 | -66.08 | 55.70 | -61.24 | 0.4825 | -0.6759 | |||

| BAX / Baxter International Inc. | 1.65 | 0.00 | 51.30 | -4.27 | 0.4444 | 0.0124 | |||

| GS / The Goldman Sachs Group, Inc. | 0.09 | -52.49 | 49.42 | -59.38 | 0.4281 | -0.5526 | |||

| EVRG / Evergy, Inc. | 0.63 | 43.76 | 0.3791 | 0.3791 | |||||

| COF / Capital One Financial Corporation | 0.24 | -16.17 | 42.82 | 2.99 | 0.3710 | -0.0379 | |||

| GE / General Electric Company | 0.19 | -77.81 | 37.85 | -78.03 | 0.3279 | -1.0608 | |||

| Invesco Private Prime Fund / STIV (N/A) | 30.13 | 30.13 | 0.2610 | 0.2610 | |||||

| LNG / Cheniere Energy, Inc. | 0.07 | -84.08 | 17.10 | -83.54 | 0.1481 | -0.6895 | |||

| Invesco Private Government Fund / STIV (N/A) | 11.55 | 11.55 | 0.1001 | 0.1001 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.96 | 0.0083 | 0.0083 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.48 | 0.0042 | 0.0042 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.41 | 0.0035 | 0.0035 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.35 | 0.0030 | 0.0030 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.31 | 0.0027 | 0.0027 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.12 | 0.0010 | 0.0010 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.08 | 0.0007 | 0.0007 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.04 | 0.0004 | 0.0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0.02 | 0.0002 | 0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.00 | -0.0000 | -0.0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.02 | -0.0002 | -0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.03 | -0.0002 | -0.0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.03 | -0.0003 | -0.0003 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.03 | -0.0003 | -0.0003 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.03 | -0.0003 | -0.0003 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.09 | -0.0007 | -0.0007 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.09 | -0.0008 | -0.0008 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0.25 | -0.0022 | -0.0022 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -4.55 | -0.0394 | -0.0394 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -6.40 | -0.0554 | -0.0554 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -7.61 | -0.0660 | -0.0660 |