Mga Batayang Estadistika

| Nilai Portofolio | $ 1,310,737,394 |

| Posisi Saat Ini | 100 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

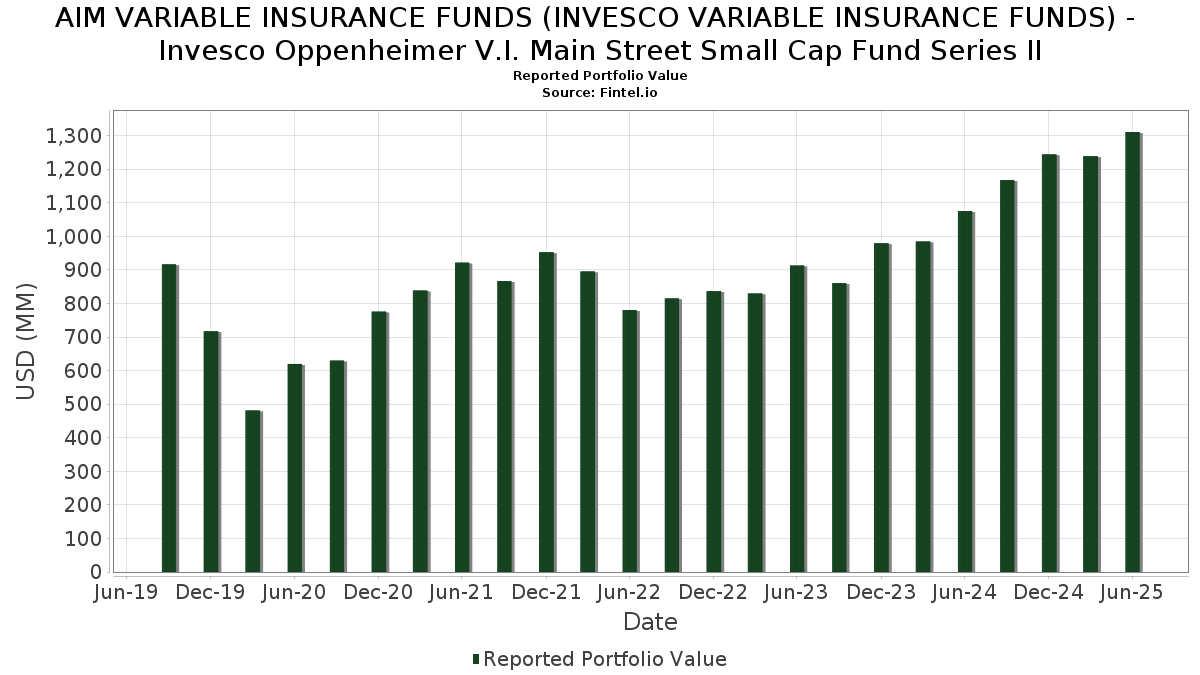

AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - Invesco Oppenheimer V.I. Main Street Small Cap Fund Series II telah mengungkapkan total kepemilikan 100 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,310,737,394 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - Invesco Oppenheimer V.I. Main Street Small Cap Fund Series II adalah AutoNation, Inc. (US:AN) , Itron, Inc. (US:ITRI) , Wintrust Financial Corporation (US:WTFC) , Casella Waste Systems, Inc. (US:CWST) , and Zurn Elkay Water Solutions Corporation (US:ZWS) . Posisi baru AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - Invesco Oppenheimer V.I. Main Street Small Cap Fund Series II meliputi: Wyndham Hotels & Resorts, Inc. (US:WH) , Kodiak Gas Services, Inc. (US:KGS) , Tarsus Pharmaceuticals, Inc. (US:TARS) , LENZ Therapeutics, Inc. (US:LENZ) , and Caris Life Sciences, Inc. (US:CAI) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 167.71 | 167.71 | 15.5447 | 15.5447 | |

| 66.00 | 66.00 | 6.1174 | 6.1174 | |

| 0.13 | 10.82 | 1.0031 | 1.0031 | |

| 0.31 | 10.63 | 0.9856 | 0.9856 | |

| 0.11 | 7.01 | 0.6502 | 0.6502 | |

| 0.14 | 5.86 | 0.5432 | 0.5432 | |

| 9.00 | 9.00 | 0.8340 | 0.4250 | |

| 0.45 | 16.45 | 1.5246 | 0.4218 | |

| 0.17 | 22.18 | 2.0558 | 0.3667 | |

| 0.12 | 23.89 | 2.2144 | 0.3510 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.10 | 8.25 | 0.7648 | -0.7348 | |

| 0.56 | 8.51 | 0.7886 | -0.6141 | |

| 0.89 | 16.23 | 1.5041 | -0.5858 | |

| 0.06 | 10.11 | 0.9375 | -0.3632 | |

| 0.20 | 11.81 | 1.0944 | -0.3578 | |

| 0.20 | 14.95 | 1.3853 | -0.2643 | |

| 0.18 | 9.19 | 0.8521 | -0.2582 | |

| 0.15 | 13.91 | 1.2892 | -0.2537 | |

| 0.06 | 7.49 | 0.6938 | -0.1854 | |

| 0.27 | 14.16 | 1.3126 | -0.1742 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-27 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Invesco Private Prime Fund / STIV (N/A) | 167.71 | 167.71 | 15.5447 | 15.5447 | |||||

| Invesco Private Government Fund / STIV (N/A) | 66.00 | 66.00 | 6.1174 | 6.1174 | |||||

| AN / AutoNation, Inc. | 0.12 | 15.16 | 23.89 | 41.28 | 2.2144 | 0.3510 | |||

| ITRI / Itron, Inc. | 0.17 | 15.16 | 22.18 | 44.70 | 2.0558 | 0.3667 | |||

| WTFC / Wintrust Financial Corporation | 0.17 | 15.16 | 20.97 | 26.95 | 1.9432 | 0.1235 | |||

| CWST / Casella Waste Systems, Inc. | 0.17 | 15.16 | 19.21 | 19.15 | 1.7809 | 0.0040 | |||

| ZWS / Zurn Elkay Water Solutions Corporation | 0.50 | 3.37 | 18.21 | 14.62 | 1.6876 | -0.0629 | |||

| BDC / Belden Inc. | 0.15 | 15.16 | 17.79 | 33.01 | 1.6488 | 0.1752 | |||

| NPO / Enpro Inc. | 0.09 | 6.08 | 17.06 | 25.59 | 1.5817 | 0.0844 | |||

| ESAB / ESAB Corporation | 0.14 | 9.42 | 17.03 | 13.22 | 1.5783 | -0.0789 | |||

| PFSI / PennyMac Financial Services, Inc. | 0.17 | 9.06 | 16.98 | 8.55 | 1.5738 | -0.1498 | |||

| AHR / American Healthcare REIT, Inc. | 0.45 | 35.54 | 16.45 | 64.36 | 1.5246 | 0.4218 | |||

| ADMA / ADMA Biologics, Inc. | 0.89 | -6.78 | 16.23 | -14.44 | 1.5041 | -0.5858 | |||

| DORM / Dorman Products, Inc. | 0.13 | 15.16 | 15.81 | 17.19 | 1.4651 | -0.0212 | |||

| EPRT / Essential Properties Realty Trust, Inc. | 0.49 | 56.45 | 15.78 | 52.95 | 1.4624 | 0.3257 | |||

| LRN / Stride, Inc. | 0.11 | -0.60 | 15.66 | 14.08 | 1.4516 | -0.0611 | |||

| NOG / Northern Oil and Gas, Inc. | 0.55 | 15.16 | 15.53 | 8.00 | 1.4398 | -0.1452 | |||

| TRNO / Terreno Realty Corporation | 0.27 | 25.18 | 15.25 | 11.03 | 1.4137 | -0.1001 | |||

| DFY / Definity Financial Corporation | 0.26 | -14.05 | 15.07 | 12.75 | 1.3972 | -0.0761 | |||

| SLGN / Silgan Holdings Inc. | 0.28 | 15.16 | 15.03 | 22.06 | 1.3931 | 0.0361 | |||

| KFY / Korn Ferry | 0.20 | -7.65 | 14.95 | -0.16 | 1.3853 | -0.2643 | |||

| CMC / Commercial Metals Company | 0.30 | 27.38 | 14.68 | 35.41 | 1.3607 | 0.1661 | |||

| ALGM / Allegro MicroSystems, Inc. | 0.42 | -2.31 | 14.42 | 32.92 | 1.3362 | 0.1410 | |||

| MTSI / MACOM Technology Solutions Holdings, Inc. | 0.10 | -1.53 | 14.40 | 40.58 | 1.3342 | 0.2058 | |||

| KBH / KB Home | 0.27 | 15.16 | 14.16 | 4.96 | 1.3126 | -0.1742 | |||

| ALSN / Allison Transmission Holdings, Inc. | 0.15 | 0.05 | 13.91 | -0.66 | 1.2892 | -0.2537 | |||

| CATY / Cathay General Bancorp | 0.30 | 6.02 | 13.63 | 12.17 | 1.2631 | -0.0756 | |||

| INFA / Informatica Inc. | 0.56 | 12.07 | 13.61 | 56.37 | 1.2619 | 0.3026 | |||

| OUT / OUTFRONT Media Inc. | 0.83 | 15.16 | 13.53 | 16.44 | 1.2545 | -0.0263 | |||

| CPK / Chesapeake Utilities Corporation | 0.11 | 30.53 | 13.49 | 22.19 | 1.2502 | 0.0338 | |||

| GH / Guardant Health, Inc. | 0.26 | -0.93 | 13.36 | 21.03 | 1.2384 | 0.0219 | |||

| AL / Air Lease Corporation | 0.23 | 15.16 | 13.20 | 39.43 | 1.2235 | 0.1802 | |||

| AIR / AAR Corp. | 0.19 | 15.16 | 13.11 | 41.49 | 1.2150 | 0.1941 | |||

| VC / Visteon Corporation | 0.14 | 15.16 | 12.93 | 38.42 | 1.1985 | 0.1692 | |||

| COLB / Columbia Banking System, Inc. | 0.55 | 26.39 | 12.93 | 18.48 | 1.1984 | -0.0040 | |||

| FHI / Federated Hermes, Inc. | 0.29 | 5.51 | 12.83 | 14.69 | 1.1890 | -0.0435 | |||

| WBS / Webster Financial Corporation | 0.23 | 15.16 | 12.80 | 21.97 | 1.1863 | 0.0300 | |||

| GTES / Gates Industrial Corporation plc | 0.55 | 15.16 | 12.77 | 44.07 | 1.1839 | 0.2069 | |||

| HUBG / Hub Group, Inc. | 0.37 | 15.16 | 12.46 | 3.57 | 1.1547 | -0.1707 | |||

| SLAB / Silicon Laboratories Inc. | 0.08 | 15.15 | 12.36 | 50.74 | 1.1456 | 0.2421 | |||

| ABM / ABM Industries Incorporated | 0.26 | 15.16 | 12.18 | 14.79 | 1.1292 | -0.0403 | |||

| POR / Portland General Electric Company | 0.29 | 25.24 | 11.88 | 14.10 | 1.1014 | -0.0463 | |||

| BRBR / BellRing Brands, Inc. | 0.20 | 15.16 | 11.81 | -10.40 | 1.0944 | -0.3578 | |||

| BGC / BGC Group, Inc. | 1.15 | 15.16 | 11.75 | 28.47 | 1.0888 | 0.0812 | |||

| ITGR / Integer Holdings Corporation | 0.10 | 15.16 | 11.70 | 20.00 | 1.0844 | 0.0100 | |||

| EHC / Encompass Health Corporation | 0.09 | 15.16 | 11.63 | 39.43 | 1.0780 | 0.1588 | |||

| KNF / Knife River Corporation | 0.13 | 15.16 | 10.96 | 4.21 | 1.0156 | -0.1429 | |||

| WH / Wyndham Hotels & Resorts, Inc. | 0.13 | 10.82 | 1.0031 | 1.0031 | |||||

| BTSG / BrightSpring Health Services, Inc. | 0.45 | 34.09 | 10.65 | 74.88 | 0.9871 | 0.3160 | |||

| KGS / Kodiak Gas Services, Inc. | 0.31 | 10.63 | 0.9856 | 0.9856 | |||||

| FSS / Federal Signal Corporation | 0.10 | 15.16 | 10.31 | 66.63 | 0.9553 | 0.2737 | |||

| PPBI / Pacific Premier Bancorp, Inc. | 0.48 | 15.16 | 10.20 | 13.91 | 0.9450 | -0.0412 | |||

| ASND / Ascendis Pharma A/S - Depositary Receipt (Common Stock) | 0.06 | -22.62 | 10.11 | -14.32 | 0.9375 | -0.3632 | |||

| SF / Stifel Financial Corp. | 0.10 | 15.16 | 10.09 | 26.79 | 0.9353 | 0.0583 | |||

| CAKE / The Cheesecake Factory Incorporated | 0.16 | 46.48 | 10.07 | 88.62 | 0.9338 | 0.3453 | |||

| PRGS / Progress Software Corporation | 0.16 | 15.16 | 10.01 | 42.73 | 0.9279 | 0.1550 | |||

| BANC / Banc of California, Inc. | 0.71 | 32.06 | 9.99 | 30.76 | 0.9256 | 0.0840 | |||

| ATMU / Atmus Filtration Technologies Inc. | 0.27 | 15.16 | 9.98 | 14.18 | 0.9253 | -0.0381 | |||

| U / Unity Software Inc. | 0.40 | -7.45 | 9.78 | 14.33 | 0.9067 | -0.0361 | |||

| WSFS / WSFS Financial Corporation | 0.17 | 15.16 | 9.36 | 22.10 | 0.8679 | 0.0229 | |||

| SM / SM Energy Company | 0.37 | 45.77 | 9.25 | 20.28 | 0.8577 | 0.0098 | |||

| ASGN / ASGN Incorporated | 0.18 | 15.16 | 9.19 | -8.76 | 0.8521 | -0.2582 | |||

| BBIO / BridgeBio Pharma, Inc. | 0.21 | 15.16 | 9.13 | 43.84 | 0.8464 | 0.1468 | |||

| US8252524066 / Invesco Treasury Portfolio, Institutional Class | 9.00 | 142.43 | 9.00 | 142.47 | 0.8340 | 0.4250 | |||

| IPAR / Interparfums, Inc. | 0.07 | 45.98 | 8.94 | 68.35 | 0.8283 | 0.2433 | |||

| TWST / Twist Bioscience Corporation | 0.24 | 15.16 | 8.85 | 7.92 | 0.8198 | -0.0834 | |||

| LSCC / Lattice Semiconductor Corporation | 0.18 | 15.16 | 8.72 | 7.56 | 0.8082 | -0.0851 | |||

| HP / Helmerich & Payne, Inc. | 0.56 | 15.16 | 8.51 | -33.17 | 0.7886 | -0.6141 | |||

| NTB / The Bank of N.T. Butterfield & Son Limited | 0.19 | 15.16 | 8.40 | 31.03 | 0.7789 | 0.0721 | |||

| UPWK / Upwork Inc. | 0.62 | 15.16 | 8.39 | 18.60 | 0.7778 | -0.0019 | |||

| RGEN / Repligen Corporation | 0.07 | 15.16 | 8.37 | 12.56 | 0.7757 | -0.0435 | |||

| ATI / ATI Inc. | 0.10 | -63.46 | 8.25 | -39.37 | 0.7648 | -0.7348 | |||

| DBRG / DigitalBridge Group, Inc. | 0.79 | 15.16 | 8.23 | 35.13 | 0.7626 | 0.0917 | |||

| UCB / United Community Banks, Inc. | 0.27 | 15.16 | 8.07 | 21.96 | 0.7480 | 0.0188 | |||

| HAYW / Hayward Holdings, Inc. | 0.57 | 15.16 | 7.88 | 14.16 | 0.7302 | -0.0302 | |||

| SGRY / Surgery Partners, Inc. | 0.35 | 15.16 | 7.83 | 7.79 | 0.7258 | -0.0747 | |||

| MARA / MARA Holdings, Inc. | 0.49 | 15.16 | 7.69 | 57.02 | 0.7132 | 0.1732 | |||

| SKWD / Skyward Specialty Insurance Group, Inc. | 0.13 | 15.16 | 7.64 | 25.77 | 0.7084 | 0.0387 | |||

| TXRH / Texas Roadhouse, Inc. | 0.04 | -1.30 | 7.63 | 11.01 | 0.7068 | -0.0501 | |||

| BLFS / BioLife Solutions, Inc. | 0.35 | 15.16 | 7.55 | 8.61 | 0.7002 | -0.0663 | |||

| INSP / Inspire Medical Systems, Inc. | 0.06 | 15.15 | 7.49 | -6.18 | 0.6938 | -0.1854 | |||

| ADUS / Addus HomeCare Corporation | 0.06 | 15.16 | 7.43 | 34.13 | 0.6888 | 0.0783 | |||

| MQ / Marqeta, Inc. | 1.26 | 15.16 | 7.34 | 62.97 | 0.6805 | 0.1840 | |||

| WSC / WillScot Holdings Corporation | 0.26 | 15.16 | 7.20 | 13.51 | 0.6673 | -0.0317 | |||

| SHOO / Steven Madden, Ltd. | 0.29 | 15.16 | 7.07 | 3.65 | 0.6550 | -0.0962 | |||

| SKY / Champion Homes, Inc. | 0.11 | 7.01 | 0.6502 | 0.6502 | |||||

| COLL / Collegium Pharmaceutical, Inc. | 0.23 | 15.16 | 6.90 | 14.08 | 0.6398 | -0.0270 | |||

| CACI / CACI International Inc | 0.01 | 15.14 | 6.81 | 49.58 | 0.6309 | 0.1295 | |||

| OCFC / OceanFirst Financial Corp. | 0.38 | 15.16 | 6.69 | 19.22 | 0.6197 | 0.0017 | |||

| BHLB / Berkshire Hills Bancorp, Inc. | 0.25 | 15.16 | 6.25 | 10.52 | 0.5794 | -0.0438 | |||

| MKSI / MKS Inc. | 0.06 | -23.06 | 6.09 | -4.62 | 0.5640 | -0.1390 | |||

| AGCO / AGCO Corporation | 0.06 | 15.16 | 5.96 | 28.35 | 0.5526 | 0.0407 | |||

| TARS / Tarsus Pharmaceuticals, Inc. | 0.14 | 5.86 | 0.5432 | 0.5432 | |||||

| SLNO / Soleno Therapeutics, Inc. | 0.07 | 15.16 | 5.47 | 35.03 | 0.5067 | 0.0606 | |||

| RARE / Ultragenyx Pharmaceutical Inc. | 0.13 | 15.16 | 4.88 | 15.65 | 0.4519 | -0.0127 | |||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 4.85 | 142.27 | 4.85 | 142.35 | 0.4493 | 0.2288 | |||

| MRUS / Merus N.V. | 0.07 | 15.16 | 3.66 | 43.94 | 0.3389 | 0.0590 | |||

| GPCR / Structure Therapeutics Inc. - Depositary Receipt (Common Stock) | 0.10 | 15.16 | 2.02 | 38.01 | 0.1868 | 0.0258 | |||

| LENZ / LENZ Therapeutics, Inc. | 0.06 | 1.76 | 0.1627 | 0.1627 | |||||

| CAI / Caris Life Sciences, Inc. | 0.05 | 1.21 | 0.1123 | 0.1123 |