Mga Batayang Estadistika

| Nilai Portofolio | $ 103,669,287 |

| Posisi Saat Ini | 48 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

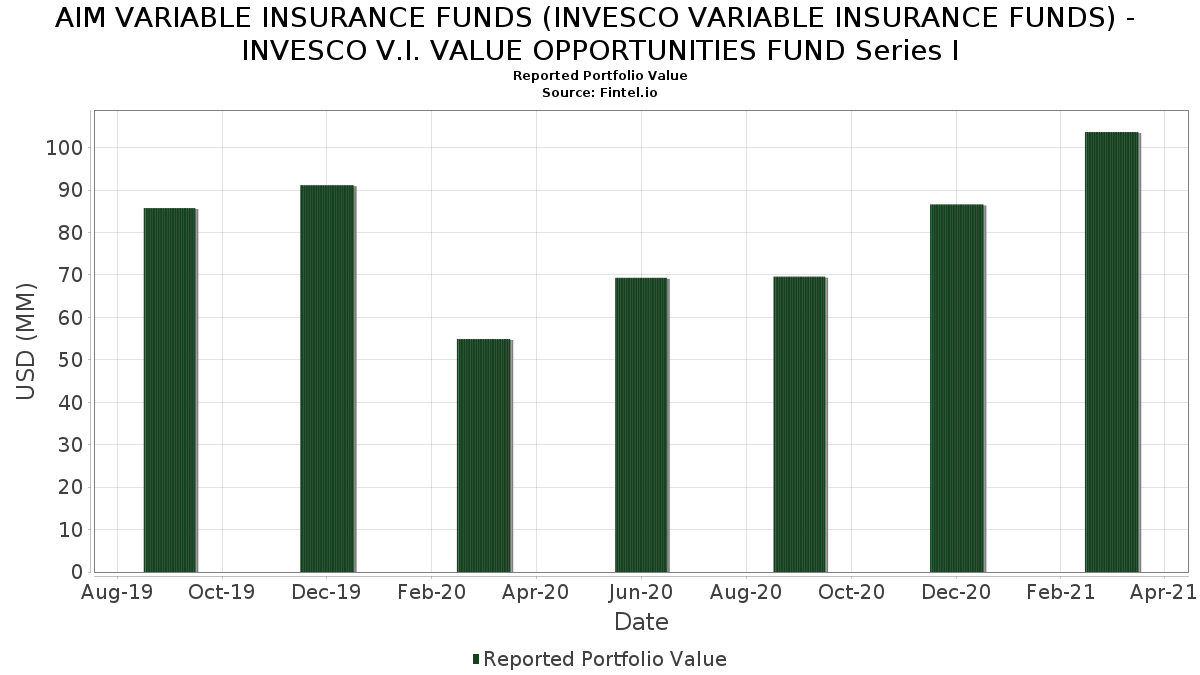

AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - INVESCO V.I. VALUE OPPORTUNITIES FUND Series I telah mengungkapkan total kepemilikan 48 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 103,669,287 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - INVESCO V.I. VALUE OPPORTUNITIES FUND Series I adalah The Goldman Sachs Group, Inc. (US:GS) , Booking Holdings Inc. (US:BKNG) , Wells Fargo & Company (US:WFC) , AECOM (US:ACM) , and Athene Holding Ltd - Class A (US:ATH) . Posisi baru AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - INVESCO V.I. VALUE OPPORTUNITIES FUND Series I meliputi: Travel + Leisure Co. (US:TNL) , Devon Energy Corporation (US:DVN) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 3.22 | 3.1127 | 3.1127 | |

| 0.05 | 2.71 | 2.6208 | 2.2281 | |

| 0.09 | 1.66 | 1.5985 | 1.5435 | |

| 0.08 | 2.99 | 2.8881 | 1.2820 | |

| 0.12 | 2.96 | 2.8563 | 0.8231 | |

| 0.01 | 3.27 | 3.1545 | 0.7937 | |

| 1.24 | 1.24 | 1.1997 | 0.7882 | |

| 0.01 | 0.98 | 0.9443 | 0.6918 | |

| 1.09 | 1.09 | 1.0498 | 0.6897 | |

| 0.02 | 0.50 | 0.4853 | 0.4853 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.7160 | ||

| 0.03 | 2.84 | 2.7425 | -0.9150 | |

| 0.00 | 0.05 | 0.0453 | -0.7149 | |

| 0.00 | 4.16 | 4.0163 | -0.5511 | |

| 0.03 | 2.10 | 2.0298 | -0.4390 | |

| 0.04 | 1.83 | 1.7700 | -0.3763 | |

| 0.05 | 3.30 | 3.1914 | -0.3086 | |

| 0.01 | 1.86 | 1.7960 | -0.2674 | |

| 0.03 | 1.92 | 1.8516 | -0.2656 | |

| 0.16 | 2.21 | 2.1358 | -0.2270 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2021-05-26 untuk periode pelaporan 2021-03-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GS / The Goldman Sachs Group, Inc. | 0.01 | -1.54 | 4.19 | 22.08 | 4.0422 | 0.1037 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.00 | 4.16 | 4.60 | 4.0163 | -0.5511 | |||

| WFC / Wells Fargo & Company | 0.09 | -2.97 | 3.70 | 25.61 | 3.5769 | 0.1895 | |||

| ACM / AECOM | 0.06 | -0.88 | 3.60 | 27.67 | 3.4761 | 0.2367 | |||

| ATH / Athene Holding Ltd - Class A | 0.07 | 6.44 | 3.50 | 24.36 | 3.3779 | 0.1466 | |||

| C / Citigroup Inc. | 0.05 | 0.00 | 3.50 | 17.98 | 3.3774 | -0.0279 | |||

| MAN / ManpowerGroup Inc. | 0.04 | 7.03 | 3.46 | 17.40 | 3.3429 | -0.0449 | |||

| ORCL / Oracle Corporation | 0.05 | 0.00 | 3.30 | 8.47 | 3.1914 | -0.3086 | |||

| ANTM / Anthem Inc | 0.01 | 42.19 | 3.27 | 59.01 | 3.1545 | 0.7937 | |||

| UNVR / Univar Solutions Inc | 0.15 | 5.97 | 3.25 | 20.06 | 3.1390 | 0.0291 | |||

| TNL / Travel + Leisure Co. | 0.05 | 3.22 | 3.1127 | 3.1127 | |||||

| 872307903 / TCF Financial Corporation | 0.06 | -1.96 | 3.02 | 23.06 | 2.9120 | 0.0965 | |||

| KBR / KBR, Inc. | 0.08 | 72.35 | 2.99 | 113.88 | 2.8881 | 1.2820 | |||

| USFD / US Foods Holding Corp. | 0.08 | 21.98 | 2.96 | 39.60 | 2.8605 | 0.4228 | |||

| NLSN / Nielsen Holdings plc | 0.12 | 38.68 | 2.96 | 67.16 | 2.8563 | 0.8231 | |||

| EQH / Equitable Holdings, Inc. | 0.09 | -1.02 | 2.85 | 26.16 | 2.7533 | 0.1574 | |||

| SPB / Spectrum Brands Holdings, Inc. | 0.03 | -17.12 | 2.84 | -10.81 | 2.7425 | -0.9150 | |||

| HUN / Huntsman Corporation | 0.10 | 8.26 | 2.80 | 24.16 | 2.7007 | 0.1129 | |||

| AER / AerCap Holdings N.V. | 0.05 | 516.00 | 2.71 | 695.60 | 2.6208 | 2.2281 | |||

| MPC / Marathon Petroleum Corporation | 0.05 | 0.00 | 2.68 | 29.30 | 2.5880 | 0.2075 | |||

| DAN / Dana Incorporated | 0.11 | -0.82 | 2.65 | 23.66 | 2.5547 | 0.0963 | |||

| US2243991054 / Crane Co. | 0.03 | 0.00 | 2.61 | 20.95 | 2.5213 | 0.0410 | |||

| CI / The Cigna Group | 0.01 | 9.47 | 2.51 | 27.16 | 2.4280 | 0.1559 | |||

| JBL / Jabil Inc. | 0.05 | 0.00 | 2.37 | 22.67 | 2.2891 | 0.0687 | |||

| LKQ / LKQ Corporation | 0.06 | 0.00 | 2.35 | 20.15 | 2.2688 | 0.0219 | |||

| MTG / MGIC Investment Corporation | 0.16 | -2.56 | 2.21 | 7.54 | 2.1358 | -0.2270 | |||

| NVT / nVent Electric plc | 0.08 | -1.16 | 2.14 | 18.43 | 2.0674 | -0.0089 | |||

| FANG / Diamondback Energy, Inc. | 0.03 | -35.59 | 2.10 | -2.19 | 2.0298 | -0.4390 | |||

| PXD / Pioneer Natural Resources Company | 0.01 | 1.02 | 2.09 | 128.87 | 2.0143 | 0.3513 | |||

| AXTA / Axalta Coating Systems Ltd. | 0.07 | 12.26 | 2.09 | 16.35 | 2.0139 | -0.0459 | |||

| CNC / Centene Corporation | 0.03 | -2.28 | 1.92 | 4.07 | 1.8516 | -0.2656 | |||

| CSL / Carlisle Companies Incorporated | 0.01 | -1.74 | 1.86 | 3.51 | 1.7960 | -0.2674 | |||

| SEE / Sealed Air Corporation | 0.04 | -1.96 | 1.83 | -1.93 | 1.7700 | -0.3763 | |||

| ESI / Element Solutions Inc | 0.09 | 3,251.85 | 1.66 | 3,421.28 | 1.5985 | 1.5435 | |||

| PSX / Phillips 66 | 0.02 | -1.92 | 1.25 | 14.30 | 1.2048 | -0.0486 | |||

| US8252524066 / Invesco Treasury Portfolio, Institutional Class | 1.24 | 246.78 | 1.24 | 246.93 | 1.1997 | 0.7882 | |||

| RDN / Radian Group Inc. | 0.05 | -1.92 | 1.19 | 12.64 | 1.1451 | -0.0646 | |||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 1.09 | 246.78 | 1.09 | 247.28 | 1.0498 | 0.6897 | |||

| WCC / WESCO International, Inc. | 0.01 | 303.57 | 0.98 | 346.12 | 0.9443 | 0.6918 | |||

| US8252527291 / Invesco Liquid Assets Portfolio, Institutional Class | 0.84 | 189.58 | 0.84 | 190.03 | 0.8151 | 0.4803 | |||

| DVN / Devon Energy Corporation | 0.02 | 0.50 | 0.4853 | 0.4853 | |||||

| 2RR / Alibaba Group Holding Limited | 0.02 | 700.00 | 0.43 | -2.71 | 0.4154 | -0.0926 | |||

| CIEN / Ciena Corporation | 0.00 | 0.00 | 0.25 | 3.80 | 0.2378 | -0.0354 | |||

| BLDR / Builders FirstSource, Inc. | 0.01 | -1.96 | 0.23 | 11.06 | 0.2239 | -0.0152 | |||

| NCLH / Norwegian Cruise Line Holdings Ltd. | 0.01 | 0.00 | 0.16 | 9.03 | 0.1519 | -0.0147 | |||

| SLM / SLM Corporation | 0.00 | 0.00 | 0.08 | 46.30 | 0.0764 | 0.0137 | |||

| MET / MetLife, Inc. | 0.00 | -9.83 | 0.06 | 17.02 | 0.0538 | -0.0010 | |||

| ENR / Energizer Holdings, Inc. | 0.00 | -93.70 | 0.05 | -93.04 | 0.0453 | -0.7149 | |||

| / Wyndham Destinations, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.7160 |