Mga Batayang Estadistika

| Nilai Portofolio | $ 327,760,296 |

| Posisi Saat Ini | 337 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

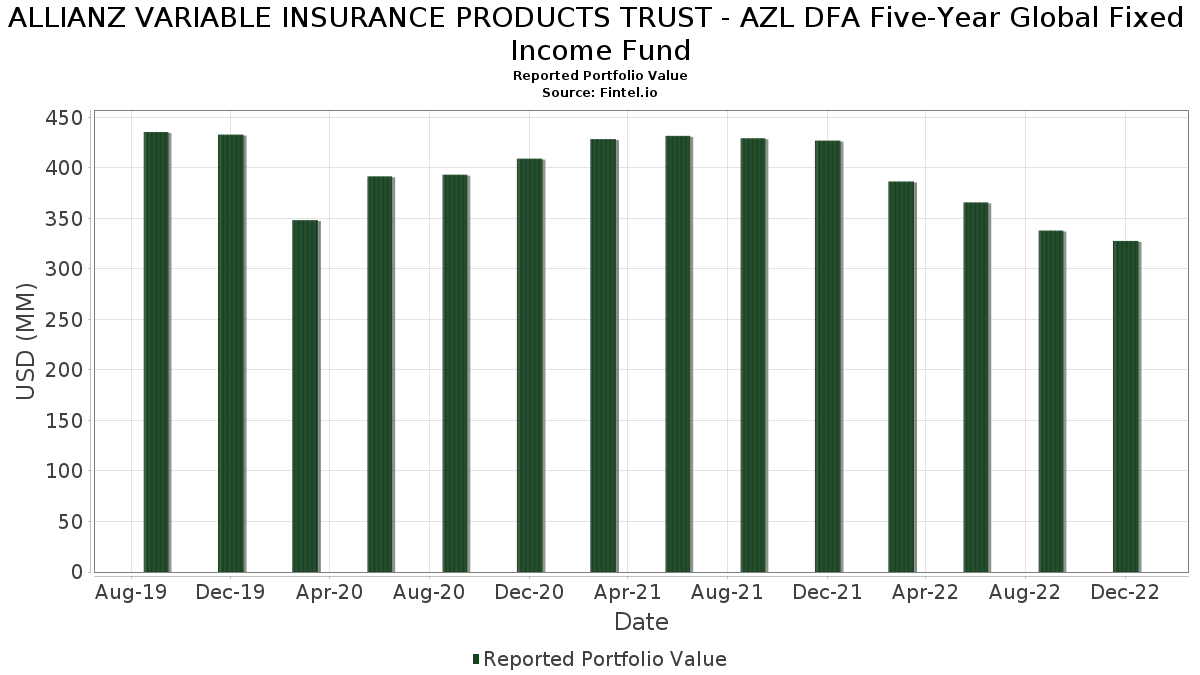

ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL DFA Five-Year Global Fixed Income Fund telah mengungkapkan total kepemilikan 337 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 327,760,296 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL DFA Five-Year Global Fixed Income Fund adalah Dreyfus Treasury Securities Cash Management - Dreyfus Treasury Securities Cash Management Institutional Shares (US:DIRXX) , Denmark Government Bond (DK:DK0009924292) , United States Treasury Note/Bond (US:US91282CBV28) , UST NOTES 0.25% 05/15/2024 (US:US91282CCC38) , and New South Wales Treasury Corp (AU:AU3SG0001373) . Posisi baru ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL DFA Five-Year Global Fixed Income Fund meliputi: Denmark Government Bond (DK:DK0009924292) , United States Treasury Note/Bond (US:US91282CBV28) , UST NOTES 0.25% 05/15/2024 (US:US91282CCC38) , New South Wales Treasury Corp (AU:AU3SG0001373) , and Skandinaviska Enskilda Banken AB (SE:US83051GAT58) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 10.34 | 10.34 | 3.1355 | 2.2702 | |

| 6.02 | 1.8272 | 1.8272 | ||

| 5.33 | 1.6173 | 1.6173 | ||

| 2.78 | 0.8444 | 0.8444 | ||

| 2.66 | 0.8070 | 0.8070 | ||

| 2.19 | 0.6641 | 0.6641 | ||

| 1.84 | 0.5595 | 0.5595 | ||

| 1.46 | 0.4441 | 0.4441 | ||

| 1.44 | 0.4356 | 0.4356 | ||

| 7.57 | 2.2961 | 0.4209 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.71 | 0.2160 | -3.4592 | ||

| 0.53 | 0.1600 | -2.3465 | ||

| 0.21 | 0.0640 | -1.8496 | ||

| 4.53 | 1.3729 | -1.4711 | ||

| -2.89 | -0.8780 | -1.3748 | ||

| 1.43 | 0.4322 | -1.3638 | ||

| -2.48 | -0.7515 | -1.2483 | ||

| -1.04 | -0.3147 | -0.8115 | ||

| -0.92 | -0.2787 | -0.7755 | ||

| -0.61 | -0.1860 | -0.6828 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2023-02-27 untuk periode pelaporan 2022-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| DIRXX / Dreyfus Treasury Securities Cash Management - Dreyfus Treasury Securities Cash Management Institutional Shares | 10.34 | 254.93 | 10.34 | 254.98 | 3.1355 | 2.2702 | |||

| DK0009924292 / Denmark Government Bond | 9.02 | 8.32 | 2.7360 | 0.2616 | |||||

| US91282CBV28 / United States Treasury Note/Bond | 7.57 | 13.22 | 2.2961 | 0.4209 | |||||

| US91282CCC38 / UST NOTES 0.25% 05/15/2024 | 6.02 | 1.8272 | 1.8272 | ||||||

| AU3SG0001373 / New South Wales Treasury Corp | 5.92 | 0.73 | 1.7959 | 0.0497 | |||||

| US83051GAT58 / Skandinaviska Enskilda Banken AB | 5.91 | -2.68 | 1.7936 | -0.0119 | |||||

| XS1785310340 / Asian Development Bank | 5.43 | 9.98 | 1.6478 | 0.1803 | |||||

| IE00B6X95T99 / Ireland Government Bond | 5.33 | 1.6173 | 1.6173 | ||||||

| US91282CDV00 / United States Treasury Note/Bond | 5.28 | 0.42 | 1.6002 | 0.0394 | |||||

| EU000A3K4DJ5 / EUROPEAN UNION | 4.99 | 7.86 | 1.5148 | 0.1393 | |||||

| US748149AQ48 / Province of Quebec Canada | 4.97 | -0.06 | 1.5087 | 0.0299 | |||||

| AU3SG0002421 / Treasury Corp of Victoria | 4.75 | -1.62 | 1.4405 | 0.0062 | |||||

| US91282CDR97 / United States Treasury Note/Bond | 4.53 | -52.71 | 1.3729 | -1.4711 | |||||

| FR0014001L06 / Agence Francaise de Developpement EPIC | 4.27 | -6.79 | 1.2943 | -0.0660 | |||||

| US084670BS67 / Berkshire Hatha Bond | 4.00 | -18.32 | 1.2119 | -0.2416 | |||||

| US742718FP97 / PROCTER & GAMBLE CO SR UNSEC 1.0% 04-23-26 | 3.94 | 0.66 | 1.1946 | 0.0320 | |||||

| IE00B4TV0D44 / Ireland Government Bond | 3.83 | 6.16 | 1.1603 | 0.0897 | |||||

| US29446MAJ18 / Equinor ASA | 3.66 | 1.67 | 1.1100 | 0.0405 | |||||

| US91282CAF86 / United States Treasury Note/Bond | 3.64 | -20.49 | 1.1055 | -0.2565 | |||||

| US459058GQ03 / International Bank for Reconstruction & Development | 3.62 | -0.22 | 1.0966 | 0.0201 | |||||

| US045167FK47 / Asian Development Bank | 3.40 | 0.06 | 1.0306 | 0.0217 | |||||

| BE0000342510 / Kingdom of Belgium Government Bond | 3.39 | 7.75 | 1.0289 | 0.0933 | |||||

| XS1835964625 / Inter-American Development Bank | 3.30 | 28.43 | 1.0017 | 0.2376 | |||||

| FR0014007TY9 / French Republic Government Bond OAT | 3.22 | 7.73 | 0.9769 | 0.0886 | |||||

| CA89117FFK09 / Toronto-Dominion Bank/The | 3.15 | 2.14 | 0.9556 | 0.0392 | |||||

| US961214ER00 / Westpac Banking Corp | 3.03 | -0.53 | 0.9178 | 0.0140 | |||||

| US9128285Z94 / United States Treasury Note/Bond | 2.93 | 0.00 | 0.8883 | 0.0182 | |||||

| XS2441084071 / KOMMUNINVEST I SVERIGE AB | 2.87 | 0.21 | 0.8691 | 0.0193 | |||||

| XS0686487421 / AGENCE FRANCAISE DEVELOP SR UNSECURED REGS 01/24 3.125 | 2.78 | 0.8444 | 0.8444 | ||||||

| NZLGFDT011C6 / NZ LGFA BOND | 2.74 | 13.36 | 0.8312 | 0.1129 | |||||

| XS2152924952 / Oesterreichische Kontrollbank AG | 2.66 | 0.8070 | 0.8070 | ||||||

| AU000XQLQAA7 / Queensland Treasury Corp | 2.65 | 6.71 | 0.8050 | 0.0660 | |||||

| US00254ENA63 / Svensk Exportkredit AB | 2.61 | 0.31 | 0.7929 | 0.0186 | |||||

| CA68333ZAB37 / Province of Ontario Canada | 2.55 | 2.04 | 0.7735 | 0.0309 | |||||

| US500769JM70 / Kreditanstalt fuer Wiederaufbau | 2.50 | 0.48 | 0.7577 | 0.0190 | |||||

| FR0014001VD2 / SFIL SA | 2.49 | -25.74 | 0.7546 | -0.2405 | |||||

| XS2031976678 / Landeskreditbank Baden-Wuerttemberg Foerderbank | 2.48 | 0.00 | 0.7515 | 0.0154 | |||||

| US89114QCP19 / Toronto-Dominion Bank/The | 2.35 | -18.30 | 0.7139 | -0.1418 | |||||

| US68323AFC36 / Province of Ontario Canada | 2.35 | -0.17 | 0.7135 | 0.0132 | |||||

| CA13596Z4B88 / Canadian Imperial Bank of Commerce | 2.34 | 2.14 | 0.7092 | 0.0291 | |||||

| US771196BU52 / Roche Holdings Inc | 2.32 | 0.17 | 0.7045 | 0.0157 | |||||

| AU3CB0235166 / International Finance Corp. | 2.30 | 7.13 | 0.6979 | 0.0599 | |||||

| US676167CD90 / OESTERREICHISCHE KONTROLLBANK GLOBAL 0.5% 09-16-24 | 2.24 | 0.36 | 0.6795 | 0.0163 | |||||

| XS2403919702 / ERSTE ABWICKLUNGSANSTALT | 2.24 | 0.31 | 0.6791 | 0.0159 | |||||

| NL0010733424 / Netherlands Government Bond | 2.22 | 32.70 | 0.6736 | 0.1764 | |||||

| CA06368BJ907 / Bank of Montreal | 2.19 | 2.09 | 0.6654 | 0.0269 | |||||

| NO0010705536 / Norway Government Bond | 2.19 | -28.76 | 0.6650 | -0.2494 | |||||

| XS2155367266 / AFRICAN DEVELOPMENT BANK | 2.19 | 0.6641 | 0.6641 | ||||||

| US023135BX34 / AMAZON.COM INC 1% 05/12/2026 | 1.99 | -37.80 | 0.6035 | -0.3469 | |||||

| US771196BE11 / Roche Holdings Inc | 1.95 | -0.10 | 0.5917 | 0.0117 | |||||

| US023135CD60 / AMZN 2.73 04/13/24 | 1.95 | -0.10 | 0.5916 | 0.0114 | |||||

| US2027A0KD09 / Commonwealth Bank of Australia | 1.94 | -6.86 | 0.5891 | -0.0304 | |||||

| US87031CAD56 / Svensk Exportkredit AB | 1.93 | 0.63 | 0.5846 | 0.0153 | |||||

| US87031CAB90 / Svensk Exportkredit AB | 1.90 | 0.42 | 0.5757 | 0.0142 | |||||

| NZGOVDT423C0 / New Zealand Government Bond | 1.84 | 0.5595 | 0.5595 | ||||||

| CA891160LV34 / Toronto-Dominion Bank | 1.82 | 2.43 | 0.5506 | 0.0240 | |||||

| CA891145T792 / Toronto-Dominion Bank/The | 1.80 | 1.87 | 0.5451 | 0.0209 | |||||

| US961214EH28 / Westpac Banking Corp | 1.79 | -34.41 | 0.5444 | -0.2684 | |||||

| US83051GAR92 / Skandinaviska Enskilda Banken AB | 1.79 | 1.53 | 0.5425 | 0.0192 | |||||

| US87031CAG87 / Svensk Exportkredit AB | 1.76 | -0.45 | 0.5352 | 0.0086 | |||||

| XS2399566962 / FMS WERTMANAGEMENT | 1.76 | 83.89 | 0.5335 | 0.2492 | |||||

| XS1143093976 / Dexia Credit Local SA | 1.75 | 41.90 | 0.5313 | 0.1644 | |||||

| XS2307846555 / Erste Abwicklungsanstalt | 1.71 | 0.65 | 0.5183 | 0.0138 | |||||

| SE0004869071 / Sweden Government Bond | 1.70 | 90.49 | 0.5167 | 0.2509 | |||||

| AU3CB0276426 / Kommunalbanken AS | 1.68 | 7.85 | 0.5087 | 0.0466 | |||||

| US30216BHH87 / Export Development Canada | 1.62 | -0.12 | 0.4926 | 0.0094 | |||||

| SE0005676608 / Sweden Government Bond | 1.62 | 5.54 | 0.4908 | 0.0353 | |||||

| AU3CB0234573 / Westpac Banking Corp | 1.59 | 6.63 | 0.4833 | 0.0391 | |||||

| AU3CB0226637 / BNG Bank NV | 1.56 | 110.36 | 0.4744 | 0.2535 | |||||

| XS2182067277 / DEXIA CREDIT LOCAL GOVT LIQUID REGS 07/23 0.5 | 1.54 | 58.70 | 0.4674 | 0.1786 | |||||

| XS1679039328 / European Investment Bank | 1.54 | 10.09 | 0.4670 | 0.0516 | |||||

| US65559CAB72 / Nordea Bank Abp | 1.51 | -42.82 | 0.4583 | -0.3265 | |||||

| AU3CB0276004 / International Bank for Reconstruction & Development | 1.50 | 8.05 | 0.4561 | 0.0426 | |||||

| XS2404205119 / Kuntarahoitus Oyj | 1.46 | 0.4441 | 0.4441 | ||||||

| US637639AE51 / National Securities Clearing Corp | 1.44 | 0.84 | 0.4381 | 0.0126 | |||||

| US50046PBY07 / Kommuninvest I Sverige AB | 1.44 | -0.14 | 0.4380 | 0.0083 | |||||

| XS1633248148 / CPPIB CAPITAL | 1.44 | 0.4356 | 0.4356 | ||||||

| US91282CBM29 / United States Treasury Note/Bond | 1.43 | -77.74 | 0.4322 | -1.3638 | |||||

| US023135BW50 / Amazon.com Inc | 1.42 | 0.57 | 0.4292 | 0.0110 | |||||

| SE0010469205 / Kommuninvest I Sverige AB | 1.38 | 6.65 | 0.4189 | 0.0341 | |||||

| XS2100726244 / Kreditanstalt fuer Wiederaufbau | 1.38 | 32.08 | 0.4173 | 0.1077 | |||||

| SE0011414010 / Kommuninvest I Sverige AB | 1.36 | 6.68 | 0.4121 | 0.0336 | |||||

| XS0488101527 / SNCF Mobilities EPIC | 1.36 | 6.77 | 0.4117 | 0.0339 | |||||

| AU3CB0289817 / National Australia Bank Ltd | 1.34 | 0.4053 | 0.4053 | ||||||

| XS2013536029 / SVENSKA HNDLSBKN | 1.33 | 42.12 | 0.4023 | 0.1251 | |||||

| FI4000167317 / Finland Government Bond | 1.32 | 7.76 | 0.4006 | 0.0364 | |||||

| XS2364418223 / DEXIA CREDIT LOCAL SA | 1.31 | 0.38 | 0.3977 | 0.0096 | |||||

| XS1808478710 / ALBERTA PROVINCE | 1.31 | 101.69 | 0.3973 | 0.2043 | |||||

| XS2166312939 / OMERS FINANCE TR | 1.30 | 8.45 | 0.3933 | 0.0380 | |||||

| XS2190436357 / L BANK BW FOERDERBANK LOCAL GOVT G REGS 12/24 0.375 | 1.29 | 413.10 | 0.3923 | 0.3173 | |||||

| XS1805260483 / European Investment Bank | 1.27 | 0.3855 | 0.3855 | ||||||

| XS2434510785 / Kommunekredit | 1.25 | 0.32 | 0.3807 | 0.0091 | |||||

| XS1873152638 / Inter-American Development Bank | 1.25 | 508.25 | 0.3801 | 0.3187 | |||||

| XS2464810089 / Nederlandse Waterschapsbank N.V. | 1.21 | 92.04 | 0.3661 | 0.1795 | |||||

| FR0013483526 / Agence Francaise de Developpement EPIC | 1.20 | 7.65 | 0.3629 | 0.0326 | |||||

| XS0368361217 / SNCF SA | 1.19 | 0.3599 | 0.3599 | ||||||

| XS1795387338 / EXPORT DEV CAN | 1.18 | 9.96 | 0.3584 | 0.0393 | |||||

| XS2496002614 / KOMMUNINVEST I SVERIGE LOCAL GOVT G REGS 01/24 3.25 | 1.18 | -0.08 | 0.3582 | 0.0073 | |||||

| US86959LAG86 / Svenska Handelsbanken AB | 1.17 | 0.77 | 0.3553 | 0.0099 | |||||

| EU000A1G0BN7 / European Financial Stability Facility 2.13 02/19/2024 | 1.17 | 70.47 | 0.3539 | 0.1504 | |||||

| DE000A254PM6 / Kreditanstalt fuer Wiederaufbau | 1.13 | 8.27 | 0.3417 | 0.0326 | |||||

| US641062AR54 / Nestle Holdings Inc | 1.11 | -50.56 | 0.3360 | -0.3293 | |||||

| NO0010732555 / Norway Government Bond | 1.10 | 11.66 | 0.3342 | 0.0411 | |||||

| XS2436690734 / Nederlandse Waterschapsbank NV | 1.10 | 0.18 | 0.3337 | 0.0074 | |||||

| XS0630644168 / BNG BANK NV | 1.08 | 0.3263 | 0.3263 | ||||||

| XS0603832782 / AGENCE FRANCAISE DEVELOP | 1.07 | 0.3253 | 0.3253 | ||||||

| AT0000A185T1 / Republic of Austria Government Bond | 1.05 | 7.29 | 0.3171 | 0.0275 | |||||

| FR0012159812 / Caisse d'Amortissement de la Dette Sociale | 1.03 | 7.50 | 0.3133 | 0.0280 | |||||

| XS2156776309 / Province of Alberta Canada | 1.01 | 8.65 | 0.3050 | 0.0299 | |||||

| US771196BS07 / Roche Holdings, Inc | 0.99 | -36.57 | 0.2995 | -0.1630 | |||||

| US4581X0EE44 / Inter-American Development Bank | 0.98 | -0.31 | 0.2971 | 0.0053 | |||||

| CA780086NK64 / Royal Bank of Canada | 0.97 | 2.21 | 0.2951 | 0.0123 | |||||

| US563469UU76 / Province of Manitoba Canada | 0.97 | 0.00 | 0.2950 | 0.0062 | |||||

| US45906M3C38 / International Bank for Reconstruction and Development | 0.97 | -0.21 | 0.2941 | 0.0055 | |||||

| XS2014307800 / Kommunalbanken AS | 0.96 | 0.00 | 0.2913 | 0.0058 | |||||

| US63254AAP30 / National Australia Bank Ltd/New York | 0.96 | 0.84 | 0.2903 | 0.0082 | |||||

| US50046PBW41 / KOMMUNINVEST I SVERIGE AB | 0.96 | 0.21 | 0.2897 | 0.0064 | |||||

| XS2162004209 / Ontario Teachers' Finance Trust | 0.95 | 8.34 | 0.2878 | 0.0277 | |||||

| US961214CX95 / Westpac Banking Corp | 0.94 | 0.97 | 0.2845 | 0.0087 | |||||

| US69376Q2A05 / PSP CAPITAL INC | 0.93 | 0.65 | 0.2829 | 0.0076 | |||||

| US961214EU39 / Westpac Banking Corp | 0.93 | 0.43 | 0.2820 | 0.0070 | |||||

| BE0000334434 / Kingdom of Belgium Government Bond | 0.92 | 7.49 | 0.2789 | 0.0246 | |||||

| EU000A1Z99J2 / European Stability Mechanism | 0.90 | 8.67 | 0.2737 | 0.0271 | |||||

| XS2193877177 / NRW.BANK | 0.89 | 0.2706 | 0.2706 | ||||||

| US05591F2N95 / BNG Bank NV | 0.88 | -0.34 | 0.2677 | 0.0046 | |||||

| XS0410937659 / SNCF Mobilites | 0.87 | 0.2634 | 0.2634 | ||||||

| CA064151WY58 / Bank of Nova Scotia | 0.85 | 2.16 | 0.2585 | 0.0106 | |||||

| US04522KAA43 / Asian Infrastructure Investment Bank (The) | 0.82 | 0.12 | 0.2472 | 0.0051 | |||||

| EU000A1Z99M6 / EUROPEAN STABILITY MECHANISM | 0.81 | 8.61 | 0.2451 | 0.0243 | |||||

| CA459058GJ61 / International Bank for Reconstruction & Development | 0.80 | 2.04 | 0.2433 | 0.0098 | |||||

| XS2108561619 / CPPIB Capital, Inc. | 0.79 | 0.2389 | 0.2389 | ||||||

| XS2394766278 / North Rhine-Westphalia Germany | 0.78 | 0.2381 | 0.2381 | ||||||

| XS1046806821 / Caisse d'Amortissement de la Dette Sociale | 0.78 | -0.26 | 0.2375 | 0.0045 | |||||

| NL0012650469 / Netherlands Government Bond | 0.78 | 0.2364 | 0.2364 | ||||||

| AU3CB0220598 / Landwirtschaftliche Rentenbank | 0.76 | 6.88 | 0.2309 | 0.0193 | |||||

| XS0210467873 / Network Rail Infrastructure Finance PLC | 0.74 | 8.93 | 0.2258 | 0.0228 | |||||

| EU000A1G0EC4 / EFSF | 0.72 | 52.43 | 0.2189 | 0.0783 | |||||

| FI4000391529 / Finland Government Bond | 0.71 | 8.03 | 0.2163 | 0.0200 | |||||

| XS1167203881 / QUEBEC PROVINCE | 0.71 | 8.37 | 0.2163 | 0.0210 | |||||

| DK0009923054 / Denmark Government Bond | 0.71 | -94.45 | 0.2160 | -3.4592 | |||||

| CA037833CY47 / Apple, Inc., Series MPLE | 0.71 | 1.72 | 0.2158 | 0.0081 | |||||

| XS1793297604 / Dexia Credit Local SA | 0.71 | 10.40 | 0.2158 | 0.0243 | |||||

| XS2468318154 / BNG BANK NV SR UNSECURED REGS 04/24 2 | 0.70 | 9.84 | 0.2133 | 0.0230 | |||||

| XS2480504542 / KOMMUNEKREDIT SR UNSECURED REGS 06/24 2 | 0.70 | 9.89 | 0.2124 | 0.0229 | |||||

| XS2349513197 / EUROPEAN INVESTMENT BANK | 0.69 | 11.93 | 0.2080 | 0.0261 | |||||

| AU3CB0224491 / INTL FIN CORP | 0.68 | 6.93 | 0.2060 | 0.0171 | |||||

| AU3CB0223816 / Asian Development Bank | 0.68 | 6.80 | 0.2048 | 0.0170 | |||||

| US166756AE66 / Chevron USA Inc | 0.68 | 0.15 | 0.2048 | 0.0045 | |||||

| AU3CB0291672 / Commonwealth Bank of Australia | 0.67 | 0.2039 | 0.2039 | ||||||

| SE0019175639 / SWEDEN TREASURY BILL | 0.66 | 0.2012 | 0.2012 | ||||||

| CA69363TAK84 / PSP Capital Inc | 0.65 | 2.04 | 0.1972 | 0.0079 | |||||

| BE0000332412 / Kingdom of Belgium Government Bond | 0.64 | 0.1941 | 0.1941 | ||||||

| AT0000A2YPC0 / AUSTRIA TREASURY BILL | 0.64 | 0.1934 | 0.1934 | ||||||

| FR0011755156 / UNEDIC | 0.63 | 7.82 | 0.1925 | 0.0175 | |||||

| XS1856797300 / WESTPAC BANKING | 0.63 | 0.1916 | 0.1916 | ||||||

| XS1489409679 / European Investment Bank | 0.63 | 0.1908 | 0.1908 | ||||||

| XS2079723552 / DNB Bank ASA | 0.63 | 0.1898 | 0.1898 | ||||||

| FR0013344751 / French Republic Government Bond OAT | 0.62 | 0.1880 | 0.1880 | ||||||

| XS2154418144 / SHELL INTL FIN | 0.62 | 0.1866 | 0.1866 | ||||||

| AU3CB0222529 / Kommunalbanken AS | 0.61 | 0.1855 | 0.1855 | ||||||

| EU000A19VVY6 / European Union | 0.61 | 8.38 | 0.1846 | 0.0177 | |||||

| AU3CB0275774 / Asian Development Bank | 0.60 | 8.26 | 0.1829 | 0.0173 | |||||

| XS2191239149 / CPPIB CAPITAL | 0.59 | 9.43 | 0.1797 | 0.0190 | |||||

| US013051EF00 / Province of Alberta Canada | 0.59 | 0.00 | 0.1784 | 0.0036 | |||||

| AT0000A105W3 / Republic of Austria Government Bond | 0.58 | 0.1769 | 0.1769 | ||||||

| EU000A1G0BQ0 / EFSF | 0.58 | 8.46 | 0.1750 | 0.0168 | |||||

| XS2270141729 / KOMMUNALBANKEN AS SR UNSECURED REGS 12/23 0.25 | 0.57 | 0.53 | 0.1744 | 0.0045 | |||||

| XS2036242803 / European Investment Bank | 0.57 | 10.35 | 0.1716 | 0.0193 | |||||

| DE000A3E5XK7 / KREDITANSTALT FUER WIEDERAUFBAU | 0.55 | 8.53 | 0.1662 | 0.0161 | |||||

| EU000A1G0EJ9 / EFSF | 0.54 | 8.40 | 0.1646 | 0.0159 | |||||

| US298785GJ95 / European Investment Bank | 0.53 | -0.19 | 0.1614 | 0.0030 | |||||

| XS1856989121 / L BANK BW FOERDERBANK LOCAL GOVT G REGS 12/23 1.375 | 0.53 | 10.17 | 0.1612 | 0.0178 | |||||

| EU000A1Z99E3 / European Stability Mechanism | 0.53 | -94.64 | 0.1600 | -2.3465 | |||||

| AU3CB0228823 / European Investment Bank | 0.53 | 7.13 | 0.1597 | 0.0137 | |||||

| XS1411405662 / SHELL INTERNATIONAL FIN COMPANY GUAR REGS 05/24 0.75 | 0.52 | 173.54 | 0.1571 | 0.1006 | |||||

| XS1823485039 / OP CORPORATE BK | 0.50 | 9.11 | 0.1527 | 0.0155 | |||||

| XS2106828721 / Export Development Canada | 0.50 | 8.70 | 0.1518 | 0.0151 | |||||

| CA06368AAD24 / Bank of Montreal | 0.50 | 2.05 | 0.1511 | 0.0061 | |||||

| US68323AFB52 / Province of Ontario Canada | 0.49 | -0.40 | 0.1497 | 0.0025 | |||||

| XS1957513580 / OEKB OEST. KONTROLLBANK GOVT GUARANT REGS 12/23 1.25 | 0.47 | 10.05 | 0.1430 | 0.0157 | |||||

| AU3CB0287415 / Westpac Banking Corp. | 0.46 | 0.1387 | 0.1387 | ||||||

| US4581X0CF37 / Inter-American Development Bank | 0.45 | 0.00 | 0.1351 | 0.0026 | |||||

| EFSF / European Financial Stability Facility S.A. - Sovereign or Government Agency Debt | 0.44 | -79.82 | 0.1336 | -0.4227 | |||||

| XS1799045197 / Council Of Europe Development Bank | 0.44 | 8.64 | 0.1336 | 0.0131 | |||||

| US58933YAY14 / Merck & Co Inc | 0.41 | -36.29 | 0.1243 | -0.0665 | |||||

| DE000A2DAJ57 / KFW | 0.41 | 8.24 | 0.1238 | 0.0120 | |||||

| FR0124665995 / UNEDIC | 0.40 | 8.04 | 0.1224 | 0.0113 | |||||

| AU3CB0231736 / Nordic Investment Bank | 0.40 | 7.30 | 0.1205 | 0.0103 | |||||

| XS2100849756 / KOMMUNALBANKEN AS SR UNSECURED REGS 12/24 1 | 0.40 | 158.17 | 0.1199 | 0.0741 | |||||

| US66989HAG39 / Novartis Capital Corp | 0.39 | -0.26 | 0.1189 | 0.0021 | |||||

| ESM / AMUNDI ETF EURO STOXX SMALL CAP | 0.38 | 0.1146 | 0.1146 | ||||||

| US6325C0DZ10 / National Australia Bank Ltd. | 0.37 | 1.08 | 0.1132 | 0.0035 | |||||

| XS1904300909 / NRW Bank | 0.35 | 0.1074 | 0.1074 | ||||||

| XS2049767168 / QUEBEC PROVINCE CDA 0.75% 12/13/2024 REGS | 0.34 | 0.1023 | 0.1023 | ||||||

| AU3CB0289221 / Australia & New Zealand Banking Group Ltd | 0.34 | 0.1016 | 0.1016 | ||||||

| AU3CB0234730 / Royal Bank of Canada | 0.33 | 6.45 | 0.1003 | 0.0080 | |||||

| AU3CB0227460 / ONTARIO PROVINCE | 0.33 | 7.52 | 0.0998 | 0.0086 | |||||

| KFW / Kreditanstalt fuer Wiederaufbau | 0.33 | 7.19 | 0.0997 | 0.0088 | |||||

| AU3CB0287910 / INTER-AMERICAN DEVELOPMENT BANK | 0.33 | 6.91 | 0.0986 | 0.0083 | |||||

| XS0706261368 / Nederlandse Waterschapsbank NV | 0.32 | 0.0974 | 0.0974 | ||||||

| FR0011962398 / French Republic Government Bond OAT | 0.31 | 7.53 | 0.0954 | 0.0084 | |||||

| AU3CB0286763 / National Australia Bank Ltd | 0.31 | 6.14 | 0.0945 | 0.0073 | |||||

| XS2170384130 / Shell International Finance BV | 0.31 | 9.19 | 0.0939 | 0.0098 | |||||

| XS2059665443 / Inter-American Investment Corp | 0.31 | 0.00 | 0.0934 | 0.0020 | |||||

| XS1900750107 / Procter & Gamble Co. (The) | 0.31 | 0.0931 | 0.0931 | ||||||

| XS2101528144 / Kuntarahoitus Oyj | 0.30 | 0.0918 | 0.0918 | ||||||

| NL0011220108 / Netherlands Government Bond | 0.30 | 7.12 | 0.0916 | 0.0080 | |||||

| NZLGFDT008C2 / New Zealand Local Government Funding Agency Bond | 0.30 | 12.45 | 0.0907 | 0.0119 | |||||

| NZGOVDT524C5 / New Zealand Government Bond | 0.30 | -77.37 | 0.0905 | -0.2531 | |||||

| XS1946056766 / Kommunalbanken AS | 0.29 | 0.00 | 0.0891 | 0.0020 | |||||

| XS2133056114 / Berkshire Hathaway, Inc. | 0.29 | 9.13 | 0.0872 | 0.0089 | |||||

| XS2107314663 / International Development Association | 0.29 | 0.0871 | 0.0871 | ||||||

| XS2191421374 / Kommuninvest I Sverige AB | 0.29 | 0.35 | 0.0866 | 0.0022 | |||||

| US037833DT41 / Apple Inc | 0.21 | -65.64 | 0.0645 | -0.1191 | |||||

| XS1857683335 / Toronto-Dominion Bank/The | 0.21 | 0.0642 | 0.0642 | ||||||

| EU000A1ZE225 / European Union | 0.21 | 0.0641 | 0.0641 | ||||||

| XS1855427859 / BNG Bank NV | 0.21 | -97.31 | 0.0640 | -1.8496 | |||||

| XS1686550960 / European Investment Bank | 0.21 | -6.73 | 0.0633 | -0.0008 | |||||

| XS1195056079 / Roche Finance Europe BV | 0.21 | 9.57 | 0.0627 | 0.0067 | |||||

| XS1247736793 / European Investment Bank | 0.21 | 8.42 | 0.0626 | 0.0061 | |||||

| XS1998797663 / NATL AUSTRALIABK | 0.21 | 9.63 | 0.0625 | 0.0068 | |||||

| FR0013244415 / BPIFRANCE | 0.20 | 7.94 | 0.0620 | 0.0057 | |||||

| XS2196322155 / Exxon Mobil Corp | 0.20 | 9.68 | 0.0619 | 0.0064 | |||||

| AU3CB0221661 / Inter-American Development Bank | 0.20 | 7.37 | 0.0619 | 0.0053 | |||||

| XS2156510021 / SVENSKA HNDLSBKN | 0.20 | 8.60 | 0.0615 | 0.0061 | |||||

| EU000A1G0D62 / EFSF EUR REG S (B) 0.4% 02-17-25 | 0.20 | 8.60 | 0.0615 | 0.0060 | |||||

| XS2076154801 / Abbott Ireland Financing DAC | 0.20 | 118.48 | 0.0612 | 0.0337 | |||||

| FR0012682060 / BPIFRANCE | 0.20 | 7.53 | 0.0609 | 0.0054 | |||||

| US30254WAP41 / FMS Wertmanagement | 0.20 | 0.00 | 0.0609 | 0.0012 | |||||

| DE000A1RQDR4 / LAND HESSEN | 0.20 | 8.70 | 0.0607 | 0.0060 | |||||

| XS1185971923 / Nordic Investment Bank | 0.20 | -43.84 | 0.0596 | -0.0443 | |||||

| AU3CB0229227 / Inter-American Development Bank | 0.20 | 7.10 | 0.0596 | 0.0052 | |||||

| XS1171476143 / European Investment Bank | 0.18 | 7.06 | 0.0553 | 0.0045 | |||||

| XS2521786272 / ASIAN DEVELOPMENT BANK SR UNSECURED 12/24 2.5 | 0.18 | 10.76 | 0.0531 | 0.0059 | |||||

| XS2342994170 / Kommunekredit | 0.17 | 0.0509 | 0.0509 | ||||||

| DE000A2GSNW0 / Kreditanstalt fuer Wiederaufbau | 0.16 | 8.11 | 0.0487 | 0.0046 | |||||

| BE6322991462 / Euroclear Bank SA | 0.15 | 8.89 | 0.0448 | 0.0046 | |||||

| XS1280834992 / European Investment Bank | 0.15 | 0.0446 | 0.0446 | ||||||

| XS2120068403 / European Investment Bank | 0.14 | 8.53 | 0.0425 | 0.0042 | |||||

| EU000A1G0DV6 / EFSF | 0.12 | 8.11 | 0.0366 | 0.0035 | |||||

| XS1934544534 / Svensk Exportkredit AB | 0.12 | -83.47 | 0.0358 | -0.1300 | |||||

| XS2182119508 / ONTARIO (PROVINCE OF) /GBP/ REGD REG S 0.50000000 | 0.12 | 10.38 | 0.0355 | 0.0040 | |||||

| XS1875280387 / FMS WERTMANAGE | 0.11 | 0.0343 | 0.0343 | ||||||

| XS0410174659 / SNCF Reseau | 0.11 | 0.0329 | 0.0329 | ||||||

| FR0011619436 / French Republic Government Bond OAT | 0.11 | 0.0322 | 0.0322 | ||||||

| XS1919899960 / EUROFIMA | 0.10 | 9.57 | 0.0314 | 0.0032 | |||||

| XS1935275237 / Kuntarahoitus Oyj | 0.10 | 0.0314 | 0.0314 | ||||||

| FR0014009KS6 / SANFP 0.875 04/06/25 | 0.10 | 9.68 | 0.0310 | 0.0032 | |||||

| XS1169595698 / ONTARIO PROVINCE | 0.10 | 8.60 | 0.0309 | 0.0030 | |||||

| XS2441244535 / NOVO NORDISK FINANCE NETHERLANDS BV | 0.10 | 7.53 | 0.0306 | 0.0030 | |||||

| SE0010948240 / Kommuninvest I Sverige AB | 0.09 | -47.49 | 0.0286 | -0.0133 | |||||

| US166764BW97 / Chevron Corp | 0.09 | 1.09 | 0.0283 | 0.0008 | |||||

| XS1825405878 / Council Of Europe Development Bank | 0.08 | -91.00 | 0.0235 | -0.1950 | |||||

| DE000A254PS3 / Kreditanstalt fuer Wiederaufbau | 0.06 | 8.47 | 0.0195 | 0.0018 | |||||

| BRITISH POUND / DFE (N/A) | 0.04 | -98.03 | 0.0133 | -0.4835 | |||||

| BRITISH POUND / DFE (N/A) | 0.03 | -98.67 | 0.0089 | -0.4879 | |||||

| BRITISH POUND / DFE (N/A) | 0.03 | -98.72 | 0.0088 | -0.4880 | |||||

| NORWEGIAN KRONE / DFE (N/A) | 0.03 | -98.72 | 0.0087 | -0.4881 | |||||

| NORWEGIAN KRONE / DFE (N/A) | 0.03 | -98.81 | 0.0081 | -0.4887 | |||||

| XS0895249620 / BNP PARIBAS | 0.02 | 0.0071 | 0.0071 | ||||||

| BRITISH POUND / DFE (N/A) | 0.02 | -99.13 | 0.0061 | -0.4907 | |||||

| U S DOLLAR / DFE (N/A) | 0.02 | -99.13 | 0.0060 | -0.4908 | |||||

| NORWEGIAN KRONE / DFE (N/A) | 0.02 | -99.17 | 0.0057 | -0.4911 | |||||

| US21688AAS15 / COOPERAT RABOBANK UA/NY | 0.02 | 0.00 | 0.0057 | 0.0002 | |||||

| BRITISH POUND / DFE (N/A) | 0.02 | -99.17 | 0.0055 | -0.4912 | |||||

| BRITISH POUND / DFE (N/A) | 0.02 | -99.22 | 0.0052 | -0.4915 | |||||

| NORWEGIAN KRONE / DFE (N/A) | 0.02 | -99.27 | 0.0049 | -0.4919 | |||||

| US89114TZD70 / Toronto-Dominion Bank/The | 0.02 | -6.25 | 0.0046 | -0.0003 | |||||

| BRITISH POUND / DFE (N/A) | 0.01 | -99.63 | 0.0027 | -0.4941 | |||||

| BRITISH POUND / DFE (N/A) | 0.01 | -99.68 | 0.0021 | -0.4946 | |||||

| U S DOLLAR / DFE (N/A) | 0.01 | -99.72 | 0.0018 | -0.4949 | |||||

| U S DOLLAR / DFE (N/A) | 0.00 | -99.82 | 0.0015 | -0.4953 | |||||

| BRITISH POUND / DFE (N/A) | 0.00 | -99.82 | 0.0014 | -0.4954 | |||||

| AUSTRALIAN DOLLAR / DFE (N/A) | 0.00 | -99.91 | 0.0008 | -0.4960 | |||||

| AUSTRALIAN DOLLAR / DFE (N/A) | 0.00 | -99.95 | 0.0004 | -0.4963 | |||||

| U S DOLLAR / DFE (N/A) | 0.00 | -100.00 | 0.0003 | -0.4965 | |||||

| TFDXX / Blackrock Liquidity Funds - BlackRock Liquidity Funds FedFund Portfolio Institutional Class | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | -0.0588 | |||

| AUSTRALIAN DOLLAR / DFE (N/A) | -0.00 | -100.00 | -0.0001 | -0.4969 | |||||

| U S DOLLAR / DFE (N/A) | -0.00 | -100.00 | -0.0001 | -0.4969 | |||||

| U S DOLLAR / DFE (N/A) | -0.00 | -100.00 | -0.0003 | -0.4971 | |||||

| U S DOLLAR / DFE (N/A) | -0.00 | -100.05 | -0.0003 | -0.4971 | |||||

| U S DOLLAR / DFE (N/A) | -0.00 | -100.05 | -0.0006 | -0.4974 | |||||

| U S DOLLAR / DFE (N/A) | -0.00 | -100.09 | -0.0007 | -0.4975 | |||||

| U S DOLLAR / DFE (N/A) | -0.00 | -100.09 | -0.0009 | -0.4976 | |||||

| AUSTRALIAN DOLLAR / DFE (N/A) | -0.00 | -100.14 | -0.0010 | -0.4978 | |||||

| AUSTRALIAN DOLLAR / DFE (N/A) | -0.00 | -100.14 | -0.0010 | -0.4978 | |||||

| U S DOLLAR / DFE (N/A) | -0.01 | -100.23 | -0.0018 | -0.4986 | |||||

| U S DOLLAR / DFE (N/A) | -0.01 | -100.28 | -0.0019 | -0.4987 | |||||

| BRITISH POUND / DFE (N/A) | -0.01 | -100.32 | -0.0022 | -0.4990 | |||||

| U S DOLLAR / DFE (N/A) | -0.01 | -100.41 | -0.0029 | -0.4996 | |||||

| U S DOLLAR / DFE (N/A) | -0.01 | -100.55 | -0.0037 | -0.5005 | |||||

| U S DOLLAR / DFE (N/A) | -0.01 | -100.55 | -0.0038 | -0.5006 | |||||

| U S DOLLAR / DFE (N/A) | -0.01 | -100.55 | -0.0039 | -0.5007 | |||||

| U S DOLLAR / DFE (N/A) | -0.01 | -100.60 | -0.0040 | -0.5007 | |||||

| U S DOLLAR / DFE (N/A) | -0.01 | -100.60 | -0.0041 | -0.5008 | |||||

| U S DOLLAR / DFE (N/A) | -0.02 | -100.69 | -0.0047 | -0.5015 | |||||

| U S DOLLAR / DFE (N/A) | -0.02 | -100.69 | -0.0048 | -0.5016 | |||||

| U S DOLLAR / DFE (N/A) | -0.02 | -100.73 | -0.0050 | -0.5017 | |||||

| U S DOLLAR / DFE (N/A) | -0.02 | -100.83 | -0.0056 | -0.5024 | |||||

| U S DOLLAR / DFE (N/A) | -0.02 | -100.87 | -0.0058 | -0.5026 | |||||

| U S DOLLAR / DFE (N/A) | -0.02 | -100.87 | -0.0060 | -0.5028 | |||||

| U S DOLLAR / DFE (N/A) | -0.02 | -100.92 | -0.0062 | -0.5029 | |||||

| U S DOLLAR / DFE (N/A) | -0.02 | -101.01 | -0.0067 | -0.5035 | |||||

| U S DOLLAR / DFE (N/A) | -0.02 | -101.01 | -0.0067 | -0.5035 | |||||

| U S DOLLAR / DFE (N/A) | -0.02 | -101.01 | -0.0068 | -0.5035 | |||||

| U S DOLLAR / DFE (N/A) | -0.03 | -101.24 | -0.0083 | -0.5051 | |||||

| U S DOLLAR / DFE (N/A) | -0.03 | -101.33 | -0.0088 | -0.5056 | |||||

| U S DOLLAR / DFE (N/A) | -0.03 | -101.47 | -0.0098 | -0.5066 | |||||

| U S DOLLAR / DFE (N/A) | -0.03 | -101.47 | -0.0100 | -0.5067 | |||||

| U S DOLLAR / DFE (N/A) | -0.03 | -101.56 | -0.0104 | -0.5072 | |||||

| U S DOLLAR / DFE (N/A) | -0.04 | -101.61 | -0.0108 | -0.5076 | |||||

| U S DOLLAR / DFE (N/A) | -0.04 | -101.65 | -0.0110 | -0.5078 | |||||

| U S DOLLAR / DFE (N/A) | -0.04 | -101.65 | -0.0111 | -0.5078 | |||||

| U S DOLLAR / DFE (N/A) | -0.04 | -101.74 | -0.0117 | -0.5085 | |||||

| U S DOLLAR / DFE (N/A) | -0.04 | -101.93 | -0.0128 | -0.5096 | |||||

| U S DOLLAR / DFE (N/A) | -0.04 | -101.97 | -0.0130 | -0.5098 | |||||

| U S DOLLAR / DFE (N/A) | -0.05 | -102.11 | -0.0141 | -0.5109 | |||||

| U S DOLLAR / DFE (N/A) | -0.06 | -102.52 | -0.0168 | -0.5135 | |||||

| U S DOLLAR / DFE (N/A) | -0.06 | -102.75 | -0.0183 | -0.5150 | |||||

| U S DOLLAR / DFE (N/A) | -0.06 | -102.84 | -0.0190 | -0.5158 | |||||

| U S DOLLAR / DFE (N/A) | -0.08 | -103.53 | -0.0234 | -0.5202 | |||||

| U S DOLLAR / DFE (N/A) | -0.09 | -104.27 | -0.0283 | -0.5251 | |||||

| U S DOLLAR / DFE (N/A) | -0.10 | -104.50 | -0.0298 | -0.5266 | |||||

| U S DOLLAR / DFE (N/A) | -0.10 | -104.68 | -0.0312 | -0.5279 | |||||

| U S DOLLAR / DFE (N/A) | -0.10 | -104.72 | -0.0313 | -0.5280 | |||||

| U S DOLLAR / DFE (N/A) | -0.10 | -104.72 | -0.0314 | -0.5282 | |||||

| U S DOLLAR / DFE (N/A) | -0.11 | -105.18 | -0.0343 | -0.5311 | |||||

| U S DOLLAR / DFE (N/A) | -0.12 | -105.28 | -0.0350 | -0.5318 | |||||

| U S DOLLAR / DFE (N/A) | -0.12 | -105.32 | -0.0353 | -0.5321 | |||||

| U S DOLLAR / DFE (N/A) | -0.13 | -105.83 | -0.0385 | -0.5353 | |||||

| U S DOLLAR / DFE (N/A) | -0.21 | -109.50 | -0.0629 | -0.5597 | |||||

| U S DOLLAR / DFE (N/A) | -0.22 | -109.95 | -0.0660 | -0.5628 | |||||

| U S DOLLAR / DFE (N/A) | -0.42 | -119.04 | -0.1262 | -0.6229 | |||||

| U S DOLLAR / DFE (N/A) | -0.61 | -128.12 | -0.1860 | -0.6828 | |||||

| U S DOLLAR / DFE (N/A) | -0.92 | -142.11 | -0.2787 | -0.7755 | |||||

| U S DOLLAR / DFE (N/A) | -1.04 | -147.57 | -0.3147 | -0.8115 | |||||

| U S DOLLAR / DFE (N/A) | -2.48 | -213.62 | -0.7515 | -1.2483 | |||||

| U S DOLLAR / DFE (N/A) | -2.89 | -232.75 | -0.8780 | -1.3748 |