Mga Batayang Estadistika

| Nilai Portofolio | $ 393,834,208 |

| Posisi Saat Ini | 200 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

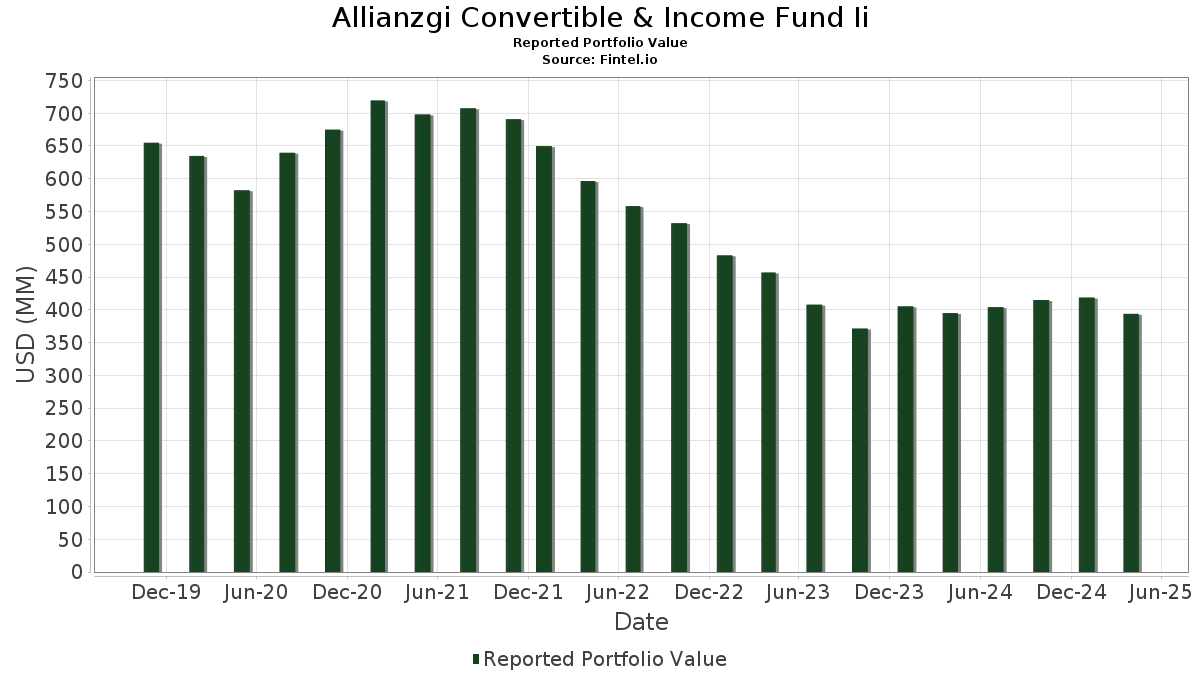

Allianzgi Convertible & Income Fund Ii telah mengungkapkan total kepemilikan 200 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 393,834,208 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Allianzgi Convertible & Income Fund Ii adalah Blackrock Liquidity Funds - BlackRock Liquidity Funds FedFund Portfolio Institutional Class (US:TFDXX) , The Boeing Company - Preferred Security (US:BA.PRA) , Wells Fargo & Company - Preferred Stock (US:WFC.PRL) , CONV. NOTE (US:US55024UAD19) , and LIBERTY BROADBAND CORP (US:US530307AE75) . Posisi baru Allianzgi Convertible & Income Fund Ii meliputi: CONV. NOTE (US:US55024UAD19) , LIBERTY BROADBAND CORP (US:US530307AE75) , CONVERTIBLE ZERO (US:US90353TAJ97) , Coinbase Global Inc (US:US19260QAB32) , and CONV. NOTE (US:US40637HAD17) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 6.04 | 6.04 | 2.4782 | 2.4782 | |

| 3.81 | 1.5637 | 1.5637 | ||

| 4.65 | 1.9086 | 1.4285 | ||

| 0.05 | 2.47 | 1.0161 | 1.0161 | |

| 2.47 | 1.0129 | 1.0129 | ||

| 2.37 | 0.9751 | 0.9751 | ||

| 2.35 | 0.9631 | 0.9631 | ||

| 0.05 | 2.29 | 0.9420 | 0.9420 | |

| 0.05 | 2.22 | 0.9095 | 0.9095 | |

| 2.19 | 0.8988 | 0.8988 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 3.57 | 1.4674 | -1.1408 | ||

| 1.45 | 0.5968 | -0.9105 | ||

| 0.88 | 0.3632 | -0.7741 | ||

| 3.44 | 1.4119 | -0.7434 | ||

| 1.15 | 0.4714 | -0.5357 | ||

| 1.24 | 0.5102 | -0.4871 | ||

| 1.99 | 0.8151 | -0.4136 | ||

| 1.07 | 0.4376 | -0.4034 | ||

| 1.24 | 0.5075 | -0.3663 | ||

| 1.02 | 0.4195 | -0.3606 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-25 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TFDXX / Blackrock Liquidity Funds - BlackRock Liquidity Funds FedFund Portfolio Institutional Class | 10.16 | -1.75 | 10.16 | -1.75 | 4.1719 | 0.3118 | |||

| BA.PRA / The Boeing Company - Preferred Security | 0.13 | 3.65 | 7.92 | 6.06 | 3.2499 | 0.4640 | |||

| W1EL34 / Welltower Inc. - Depositary Receipt (Common Stock) | 7.64 | 18.43 | 3.1365 | 0.7286 | |||||

| WFC.PRL / Wells Fargo & Company - Preferred Stock | 0.01 | -1.71 | 7.36 | -3.93 | 3.0201 | 0.1622 | |||

| L1YV34 / Live Nation Entertainment, Inc. - Depositary Receipt (Common Stock) | 6.25 | 5.63 | 2.5643 | 0.3572 | |||||

| DREYFUS GOVERNMENT CASH MANAGE / STIV (000000000) | 6.04 | 6.04 | 2.4782 | 2.4782 | |||||

| MSTRD / Strategy Inc - Depositary Receipt (Common Stock) | 5.31 | 10.12 | 2.1806 | 0.3807 | |||||

| T1SO34 / The Southern Company - Depositary Receipt (Common Stock) | 4.89 | 12.26 | 2.0086 | 0.3822 | |||||

| US55024UAD19 / CONV. NOTE | 4.82 | 27.84 | 1.9796 | 0.5719 | |||||

| US530307AE75 / LIBERTY BROADBAND CORP | 4.65 | 261.43 | 1.9086 | 1.4285 | |||||

| US90353TAJ97 / CONVERTIBLE ZERO | 4.56 | 14.29 | 1.8723 | 0.3830 | |||||

| SNOWD / Snowflake Inc. - Depositary Receipt (Common Stock) | 4.01 | -12.30 | 1.6477 | -0.0605 | |||||

| US19260QAB32 / Coinbase Global Inc | 3.86 | 2.01 | 1.5831 | 0.1724 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 3.81 | 1.5637 | 1.5637 | ||||||

| US40637HAD17 / CONV. NOTE | 3.69 | 37.25 | 1.5159 | 0.5118 | |||||

| US26142RAB06 / DraftKings, Inc. | 3.68 | 0.30 | 1.5112 | -0.0008 | |||||

| US893647BT37 / TransDigm Inc | 3.59 | 0.65 | 1.4723 | 0.1425 | |||||

| US252131AK39 / CONV. NOTE | 3.57 | -49.07 | 1.4674 | -1.1408 | |||||

| D1LR34 / Digital Realty Trust, Inc. - Depositary Receipt (Common Stock) | 3.48 | 20.75 | 1.4293 | 0.3535 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 3.44 | -40.46 | 1.4119 | -0.7434 | |||||

| US18915MAC10 / CONVERTIBLE ZERO | 3.29 | 8.77 | 1.3495 | 0.2215 | |||||

| US852234AJ27 / CONVERTIBLE ZERO | 3.20 | 110.51 | 1.3156 | 0.7215 | |||||

| US82452JAD19 / SHIFT4 PAYMENTS INC | 3.14 | 0.71 | 1.2902 | 0.1253 | |||||

| Rexford Industrial Realty LP / DBT (US76169XAD66) | 3.11 | 163.25 | 1.2765 | 0.8357 | |||||

| D1DG34 / Datadog, Inc. - Depositary Receipt (Common Stock) | 3.07 | -24.42 | 1.2624 | -0.2560 | |||||

| US83406FAA03 / SOFI TECHNOLOGIES INC | 2.96 | 12.63 | 1.2155 | 0.2344 | |||||

| US02043QAB32 / CONV. NOTE | 2.93 | -10.17 | 1.2051 | -0.0142 | |||||

| N2TN34 / Nutanix, Inc. - Depositary Receipt (Common Stock) | 2.90 | -4.48 | 1.1921 | 0.0578 | |||||

| US02376RAF91 / American Airlines Group Inc | 2.82 | -21.17 | 1.1587 | -0.1777 | |||||

| US34960PAE16 / Fortress Transportation & Infrastructure Investors LLC | 2.80 | 0.18 | 1.1504 | 0.1067 | |||||

| Nationstar Mortgage Holdings Inc / DBT (US63861CAF68) | 2.79 | -17.21 | 1.1458 | -0.1124 | |||||

| G2WR34 / Guidewire Software, Inc. - Depositary Receipt (Common Stock) | 2.67 | -14.47 | 1.0970 | -0.0687 | |||||

| US62886HBD26 / NCL Corp Ltd | 2.56 | -17.79 | 1.0512 | -0.1112 | |||||

| Seagate HDD Cayman / DBT (US81180WBP59) | 2.54 | 4.31 | 1.0431 | 0.1341 | |||||

| Seagate HDD Cayman / DBT (US81180WBL46) | 2.54 | 19.12 | 1.0414 | 0.2466 | |||||

| UGI / UGI Corporation | 2.52 | 75.77 | 1.0366 | 0.5002 | |||||

| SHOP / Shopify Inc. | 2.51 | 20.51 | 1.0305 | 0.2532 | |||||

| Shift4 Payments LLC / Shift4 Payments Finance Sub Inc / DBT (US82453AAB35) | 2.48 | -1.24 | 1.0182 | 0.0811 | |||||

| KKR.PRD / KKR & Co. Inc. - Preferred Stock | 0.05 | 2.47 | 1.0161 | 1.0161 | |||||

| American Water Capital Corp / DBT (US03040WBE49) | 2.47 | 1.0129 | 1.0129 | ||||||

| US82967NBC11 / Sirius XM Radio Inc | 2.45 | 0.00 | 1.0054 | 0.0913 | |||||

| Caesars Entertainment Inc / DBT (US12769GAD25) | 2.45 | -3.05 | 1.0045 | 0.0624 | |||||

| Panther Escrow Issuer LLC / DBT (US69867RAA59) | 2.43 | 11.84 | 0.9969 | 0.1866 | |||||

| US16115QAF72 / Chart Industries Inc | 2.41 | -0.70 | 0.9904 | 0.0837 | |||||

| POST / Post Holdings, Inc. | 2.41 | 17.82 | 0.9885 | 0.2257 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 2.37 | 0.9751 | 0.9751 | ||||||

| US668771AL22 / NortonLifeLock Inc | 2.37 | -4.09 | 0.9723 | 0.0507 | |||||

| Jazz Investments I Ltd / DBT (US472145AG66) | 2.35 | 0.9631 | 0.9631 | ||||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 2.33 | 44.10 | 0.9582 | 0.3535 | |||||

| OSIS / OSI Systems, Inc. | 2.31 | -22.13 | 0.9464 | -0.1586 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0.05 | 2.29 | 0.9420 | 0.9420 | |||||

| US62482BAB80 / MOZART DEBT MERGER SUB INC | 2.26 | -2.00 | 0.9260 | 0.0671 | |||||

| US698884AE30 / PAR Technology Corporation | 2.25 | 3.69 | 0.9224 | 0.1136 | |||||

| US17888HAB96 / Civitas Resources Inc | 2.23 | 3.28 | 0.9172 | 0.1101 | |||||

| US98423FAB58 / Xometry Inc | 2.22 | -3.65 | 0.9116 | 0.0512 | |||||

| MROCL / Microchip Technology Incorporated - Preferred Stock | 0.05 | 2.22 | 0.9095 | 0.9095 | |||||

| EquipmentShare.com Inc / DBT (US29450YAB56) | 2.20 | -4.18 | 0.9033 | 0.0460 | |||||

| TXNM / TXNM Energy, Inc. | 2.19 | 0.8988 | 0.8988 | ||||||

| GVA / Granite Construction Incorporated | 2.13 | -23.65 | 0.8766 | -0.1669 | |||||

| US097751BZ39 / Bombardier, Inc. | 2.13 | -1.02 | 0.8755 | 0.0713 | |||||

| US20717MAB90 / CONVERTIBLE ZERO | 2.13 | 52.40 | 0.8745 | 0.3189 | |||||

| US46284VAP67 / Iron Mountain, Inc. | 2.11 | -0.14 | 0.8666 | 0.0777 | |||||

| US98980GAB86 / CONV. NOTE | 2.09 | 88.22 | 0.8594 | 0.4443 | |||||

| Rivian Automotive Inc / DBT (US76954AAB98) | 2.08 | 3.89 | 0.8549 | 0.1067 | |||||

| Organon & Co / Organon Foreign Debt Co-Issuer BV / DBT (US68622FAB76) | 2.07 | -12.60 | 0.8490 | -0.0340 | |||||

| US053773BH95 / Avis Budget Car Rental LLC / Avis Budget Finance Inc | 2.06 | -3.92 | 0.8464 | 0.0455 | |||||

| Galaxy Digital Holdings LP / DBT (US36317GAB23) | 2.06 | -17.26 | 0.8446 | -0.0836 | |||||

| US12008RAR84 / Builders FirstSource Inc | 2.05 | -0.73 | 0.8423 | 0.0711 | |||||

| Quikrete Holdings Inc / DBT (US74843PAB67) | 2.05 | 39.92 | 0.8407 | 0.2944 | |||||

| Williams Scotsman Inc / DBT (US96949VAN38) | 2.05 | 0.8402 | 0.8402 | ||||||

| US12429TAD63 / Mauser Packaging Solutions Holding Co | 2.04 | 52.55 | 0.8357 | 0.3374 | |||||

| US80874YBC30 / Scientific Games International Inc | 2.03 | -0.39 | 0.8316 | 0.0725 | |||||

| ARES.PRB / Ares Management Corporation - Preferred Security | 0.04 | -0.68 | 2.01 | -19.22 | 0.8252 | -0.1033 | |||

| Rivian Automotive Inc / DBT (US76954AAD54) | 2.01 | -6.91 | 0.8240 | 0.0195 | |||||

| US36168QAQ73 / GFL Environmental Inc | 2.00 | 0.20 | 0.8195 | 0.0760 | |||||

| US88033GDK31 / Tenet Healthcare Corp | 1.99 | -39.68 | 0.8151 | -0.4136 | |||||

| US98379KAB89 / XPO INC | 1.96 | -16.77 | 0.8050 | -0.0744 | |||||

| IMAX / IMAX Corporation | 1.96 | -0.81 | 0.8049 | 0.0671 | |||||

| CLF / Cleveland-Cliffs Inc. | 1.95 | 18.48 | 0.8004 | 0.1860 | |||||

| W1DC34 / Western Digital Corporation - Depositary Receipt (Common Stock) | 1.94 | -3.58 | 0.7968 | 0.0455 | |||||

| MACOM Technology Solutions Holdings Inc / DBT (US55405YAC49) | 1.93 | 22.57 | 0.7937 | 0.2050 | |||||

| US69867DAC20 / Panther BF Aggregator 2 LP / Panther Finance Co Inc | 1.93 | 11.48 | 0.7933 | 0.1462 | |||||

| B2UR34 / Burlington Stores, Inc. - Depositary Receipt (Common Stock) | 1.90 | -34.77 | 0.7811 | -0.3077 | |||||

| ATEC / Alphatec Holdings, Inc. | 1.85 | 0.7590 | 0.7590 | ||||||

| US65339F7134 / NEXTERA ENERGY INC 6.926% PC 09/01/2025 | 0.05 | 2.79 | 1.82 | -4.60 | 0.7493 | 0.0353 | |||

| AEIS / Advanced Energy Industries, Inc. | 1.81 | -1.68 | 0.7433 | 0.0558 | |||||

| TCOM / Trip.com Group Limited - Depositary Receipt (Common Stock) | 1.77 | -33.57 | 0.7248 | -0.2671 | |||||

| US70932MAD92 / PennyMac Financial Services Inc | 1.76 | -0.45 | 0.7213 | 0.0628 | |||||

| US45784PAK75 / CONV. NOTE | 1.74 | -31.69 | 0.7135 | -0.2357 | |||||

| WFRD / Weatherford International plc | 1.72 | -14.99 | 0.7061 | -0.0488 | |||||

| US12653CAK45 / CNX Resources Corp. | 1.72 | -2.44 | 0.7049 | 0.0480 | |||||

| US10806XAB82 / Bridgebio Pharma, Inc. | 1.70 | -1.74 | 0.6961 | 0.0519 | |||||

| Performance Food Group Inc / DBT (US71376LAF76) | 1.69 | -0.18 | 0.6941 | 0.0620 | |||||

| BTSGU / BrightSpring Health Services, Inc. | 0.03 | 16.46 | 1.69 | -11.98 | 0.6941 | -0.0228 | |||

| US1248EPCT83 / CCO Holdings LLC | 1.68 | 0.60 | 0.6914 | 0.0666 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 1.68 | 14.87 | 0.6885 | 0.1436 | |||||

| E2XA34 / Exact Sciences Corporation - Depositary Receipt (Common Stock) | 1.67 | -23.16 | 0.6854 | -0.1254 | |||||

| 1011778 BC ULC / New Red Finance Inc / DBT (US68245XAR08) | 1.66 | 0.18 | 0.6819 | 0.0633 | |||||

| LBTYB / Liberty Global Ltd. | 1.66 | 0.55 | 0.6819 | 0.0654 | |||||

| US87901JAH86 / TEGNA Inc | 1.64 | -0.84 | 0.6750 | 0.0560 | |||||

| Stonepeak Nile Parent LLC / DBT (US861932AA97) | 1.63 | 0.6711 | 0.6711 | ||||||

| Permian Resources Operating LLC / DBT (US71424VAB62) | 1.63 | -2.45 | 0.6705 | 0.0457 | |||||

| HPE.PRC / Hewlett Packard Enterprise Company - Preferred Security | 0.03 | -22.51 | 1.63 | -36.35 | 0.6701 | -0.2872 | |||

| US65343HAA95 / Nexstar Escrow, Inc. | 1.62 | 0.43 | 0.6671 | 0.0633 | |||||

| Concentra Health Services Inc / DBT (US20600DAA19) | 1.62 | -0.98 | 0.6663 | 0.0545 | |||||

| AAR Escrow Issuer LLC / DBT (US00253PAA66) | 1.62 | 0.12 | 0.6662 | 0.0614 | |||||

| SUN / Sunoco LP - Limited Partnership | 1.60 | 0.6581 | 0.6581 | ||||||

| US88632QAE35 / Picard Midco, Inc. | 1.60 | 0.6572 | 0.6572 | ||||||

| P2OD34 / Insulet Corporation - Depositary Receipt (Common Stock) | 1.60 | 0.6556 | 0.6556 | ||||||

| US697435AF27 / CONV. NOTE | 1.59 | 20.61 | 0.6516 | 0.1603 | |||||

| US579063AB46 / Condor Merger Sub Inc | 1.59 | -12.29 | 0.6508 | -0.0240 | |||||

| US389284AA85 / Gray Television Inc | 1.56 | -29.21 | 0.6391 | -0.1815 | |||||

| US89386MAA62 / Transocean Titan Financing Ltd | 1.55 | -12.51 | 0.6348 | -0.0251 | |||||

| GPI / Group 1 Automotive, Inc. | 1.54 | -9.52 | 0.6325 | -0.0029 | |||||

| CC / The Chemours Company | 1.53 | 25.59 | 0.6290 | 0.1737 | |||||

| US89422GAA58 / Travere Therapeutics, Inc. | 1.52 | 13.10 | 0.6239 | 0.1223 | |||||

| US382550BR12 / Goodyear Tire & Rubber Co/The | 1.52 | 77.34 | 0.6235 | 0.3036 | |||||

| Waste Pro USA Inc / DBT (US94107JAC71) | 1.49 | 16.88 | 0.6116 | 0.1361 | |||||

| GH / Guardant Health, Inc. | 1.49 | 0.6104 | 0.6104 | ||||||

| US816850AF86 / Semtech Corp | 1.46 | 0.62 | 0.5980 | 0.0577 | |||||

| US30212PBE43 / CONVERTIBLE ZERO | 1.45 | -67.07 | 0.5968 | -0.9105 | |||||

| US682189AS48 / CONVERTIBLE ZERO | 1.45 | -23.47 | 0.5960 | -0.0912 | |||||

| VIAV / Viavi Solutions Inc. | 1.44 | 26.47 | 0.5927 | 0.1667 | |||||

| IRTC / iRhythm Technologies, Inc. | 1.44 | 0.5924 | 0.5924 | ||||||

| S2YN34 / Synaptics Incorporated - Depositary Receipt (Common Stock) | 1.40 | -17.04 | 0.5738 | -0.0548 | |||||

| BE / Bloom Energy Corporation | 1.39 | -5.95 | 0.5710 | 0.0191 | |||||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 1.33 | -33.27 | 0.5470 | -0.1981 | |||||

| ITRI / Itron, Inc. | 1.33 | 121.87 | 0.5460 | 0.3224 | |||||

| US83304AAB26 / CONV. NOTE | 1.32 | -17.60 | 0.5406 | -0.0557 | |||||

| US55955DAB64 / MAGNITE INC CONV 0.25% 03/15/2026 | 1.31 | 2.02 | 0.5385 | 0.0586 | |||||

| US94419LAP67 / CONV. NOTE | 1.30 | 4.01 | 0.5324 | 0.0671 | |||||

| US20451RAB87 / Compass Group Diversified Holdings LLC | 1.29 | -40.13 | 0.5306 | -0.2750 | |||||

| US29415FAB04 / CONV. NOTE | 1.29 | -5.84 | 0.5305 | 0.0185 | |||||

| US912909AT54 / UNITED STATES STEEL CORP NEW CONV 5% 11/01/2026 | 1.29 | 0.16 | 0.5299 | 0.0491 | |||||

| US531229AQ58 / CONV. NOTE | 1.29 | -18.95 | 0.5285 | -0.0644 | |||||

| US1248EPCS01 / CCO Holdings LLC / CCO Holdings Capital Corp. | 1.26 | 0.88 | 0.5158 | 0.0508 | |||||

| US457669AB50 / INSMED INC CONV 0.75% 06/01/2028 | 1.25 | -45.98 | 0.5130 | -0.3500 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 1.25 | 0.5126 | 0.5126 | ||||||

| I1RM34 / Iron Mountain Incorporated - Depositary Receipt (Common Stock) | 1.25 | -0.40 | 0.5123 | 0.0449 | |||||

| WESCO Distribution Inc / DBT (US95081QAS30) | 1.24 | 0.5109 | 0.5109 | ||||||

| Alignment Healthcare Inc / DBT (US01625VAA26) | 1.24 | -53.50 | 0.5102 | -0.4871 | |||||

| US17302XAN66 / CITGO Petroleum Corp. | 1.24 | -3.20 | 0.5094 | 0.0311 | |||||

| US84921RAB69 / Spotify USA Inc | 1.24 | -56.06 | 0.5075 | -0.3663 | |||||

| U2ST34 / Unity Software Inc. - Depositary Receipt (Common Stock) | 1.24 | 0.5073 | 0.5073 | ||||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 1.23 | 0.5064 | 0.5064 | ||||||

| US443628AH54 / Hudbay Minerals Inc | 1.23 | -0.65 | 0.5048 | 0.0428 | |||||

| US29365BAB99 / Entegris Escrow Corp | 1.23 | 0.08 | 0.5040 | 0.0463 | |||||

| US031652BK50 / Amkor Technology Inc 6.625% 09/15/2027 144A | 1.22 | -0.33 | 0.5025 | 0.0443 | |||||

| US81282UAG76 / SeaWorld Parks & Entertainment Inc | 1.22 | -1.70 | 0.4995 | 0.0378 | |||||

| US04288BAB62 / Arsenal AIC Parent LLC | 1.21 | -0.41 | 0.4974 | 0.0433 | |||||

| US589889AA22 / Merit Medical Systems Inc | 1.21 | -43.27 | 0.4965 | -0.2991 | |||||

| US35908MAD20 / FRONTIER COMMUNICATIONS HOLDINGS | 1.20 | -44.46 | 0.4943 | -0.3143 | |||||

| Capstone Copper Corp / DBT (US14071LAA61) | 1.20 | 0.4922 | 0.4922 | ||||||

| SMCI / Super Micro Computer, Inc. - Depositary Receipt (Common Stock) | 1.19 | 0.4899 | 0.4899 | ||||||

| US86333MAA62 / Stride 1.125% Due 09-01-2027 | 1.19 | -10.62 | 0.4878 | -0.0403 | |||||

| Amer Sports Co / DBT (US02352NAA72) | 1.18 | -27.84 | 0.4857 | -0.1259 | |||||

| Adient Global Holdings Ltd / DBT (US00687YAD76) | 1.17 | 0.4786 | 0.4786 | ||||||

| NGL Energy Operating LLC / NGL Energy Finance Corp / DBT (US62922LAD01) | 1.15 | -11.42 | 0.4717 | -0.0121 | |||||

| US665530AB71 / Northern Oil and Gas Inc | 1.15 | -8.38 | 0.4714 | 0.0037 | |||||

| M2PM34 / MP Materials Corp. - Depositary Receipt (Common Stock) | 1.15 | -57.47 | 0.4714 | -0.5357 | |||||

| O2NS34 / ON Semiconductor Corporation - Depositary Receipt (Common Stock) | 1.15 | -32.61 | 0.4713 | -0.1642 | |||||

| SM / SM Energy Company | 1.14 | -30.69 | 0.4675 | -0.1457 | |||||

| US69354NAE67 / PRA Group Inc | 1.13 | -1.91 | 0.4645 | 0.0338 | |||||

| US63938CAN83 / Navient Corp | 1.11 | -2.29 | 0.4562 | 0.0316 | |||||

| R2GE34 / Repligen Corporation - Depositary Receipt (Common Stock) | 1.11 | -0.09 | 0.4548 | 0.0411 | |||||

| US880349AU90 / Tenneco Inc | 1.10 | 0.09 | 0.4530 | 0.0415 | |||||

| Affirm Holdings Inc / DBT (US00827BAC00) | 1.07 | -52.73 | 0.4376 | -0.4034 | |||||

| US819047AB70 / CONVERTIBLE ZERO | 1.06 | -42.19 | 0.4350 | -0.2491 | |||||

| US897051AC29 / Tronox Inc | 1.05 | -15.16 | 0.4321 | -0.0311 | |||||

| UPSTD / Upstart Holdings, Inc. - Depositary Receipt (Common Stock) | 1.02 | -51.12 | 0.4195 | -0.3606 | |||||

| PSN / Parsons Corporation | 1.02 | 0.4176 | 0.4176 | ||||||

| Lions Gate Capital Holdings 1 Inc / DBT (US535939AA09) | 0.95 | 1.07 | 0.3891 | 0.0391 | |||||

| US588056BA87 / Mercer International Inc | 0.93 | -7.26 | 0.3833 | 0.0075 | |||||

| US902104AC24 / II-VI Inc | 0.93 | -0.53 | 0.3833 | 0.0330 | |||||

| FRT / Federal Realty Investment Trust | 0.91 | -29.05 | 0.3742 | -0.1053 | |||||

| ALB.PRA / Albemarle Corporation - Preferred Stock | 0.03 | 0.00 | 0.89 | -24.47 | 0.3666 | -0.0743 | |||

| US780153BQ43 / CONV. NOTE | 0.88 | -70.98 | 0.3632 | -0.7741 | |||||

| US05464CAB72 / CONV. NOTE | 0.88 | -52.94 | 0.3617 | -0.3365 | |||||

| US501797AW48 / L Brands Inc | 0.87 | 0.00 | 0.3572 | 0.0323 | |||||

| US89686QAB23 / Trivium Packaging Finance BV | 0.83 | -1.19 | 0.3409 | 0.0271 | |||||

| RRR / Red Rock Resorts, Inc. | 0.82 | -32.14 | 0.3347 | -0.1139 | |||||

| US02406PBA75 / American Axle & Manufacturing Inc | 0.80 | -3.25 | 0.3300 | 0.0201 | |||||

| Garrett Motion Holdings Inc / Garrett LX I Sarl / DBT (US366504AA61) | 0.80 | 0.3278 | 0.3278 | ||||||

| US171484AJ78 / Churchill Downs Inc | 0.80 | -51.31 | 0.3276 | -0.2836 | |||||

| US91740PAF53 / USA Compression Partners LP / USA Compression Finance Corp | 0.78 | -55.51 | 0.3216 | -0.3357 | |||||

| BBIO / BridgeBio Pharma, Inc. | 0.76 | 0.3116 | 0.3116 | ||||||

| ASTS / AST SpaceMobile, Inc. | 0.74 | 0.3056 | 0.3056 | ||||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 0.69 | 0.2852 | 0.2852 | ||||||

| STRK / Strategy Inc - Preferred Stock | 0.01 | 0.00 | 0.64 | 10.46 | 0.2646 | 0.0469 | |||

| US977852AB88 / Wolfspeed Inc | 0.64 | -30.29 | 0.2636 | -0.0804 | |||||

| RKLB / Rocket Lab Corporation | 0.63 | -61.34 | 0.2592 | -0.3502 | |||||

| IREN / IREN Limited | 0.61 | -55.36 | 0.2498 | -0.2586 | |||||

| US98954MAH43 / ZILLOW GROUP INC CONV 2.75% 05/15/2025 | 0.59 | -59.53 | 0.2416 | -0.3011 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.55 | -49.02 | 0.2239 | -0.1752 | |||||

| GTLS.PRB / Chart Industries, Inc. - Preferred Stock | 0.01 | -28.32 | 0.47 | -51.18 | 0.1947 | -0.1681 | |||

| US45867GAD34 / InterDigital, Inc. | 0.47 | 0.1930 | 0.1930 | ||||||

| LiveStyle Inc. Series B Preferred / EP (000000000) | 0.00 | 0.42 | 0.1723 | 0.1723 | |||||

| CCFLU / CCF Holdings LLC | 6.37 | 0.00 | 0.32 | 0.00 | 0.1307 | 0.0119 | |||

| CCF HOLDINGS LLC CLASS M EQUITY / EC (000000000) | 0.88 | 0.04 | 0.0181 | 0.0181 | |||||

| CCF HLDGS LLC WT CCF HLDGS LLC WTS C / DE (000000000) | 0.03 | 0.0120 | 0.0120 | ||||||

| LiveStyle Inc. Common Stock / EC (000000000) | 0.09 | 0.00 | 0.0000 | 0.0000 | |||||

| EKSN / Erickson Incorporated | 0.01 | 0.00 | 0.00 | 0.0000 | 0.0000 |