Mga Batayang Estadistika

| Nilai Portofolio | $ 332,080,942 |

| Posisi Saat Ini | 338 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

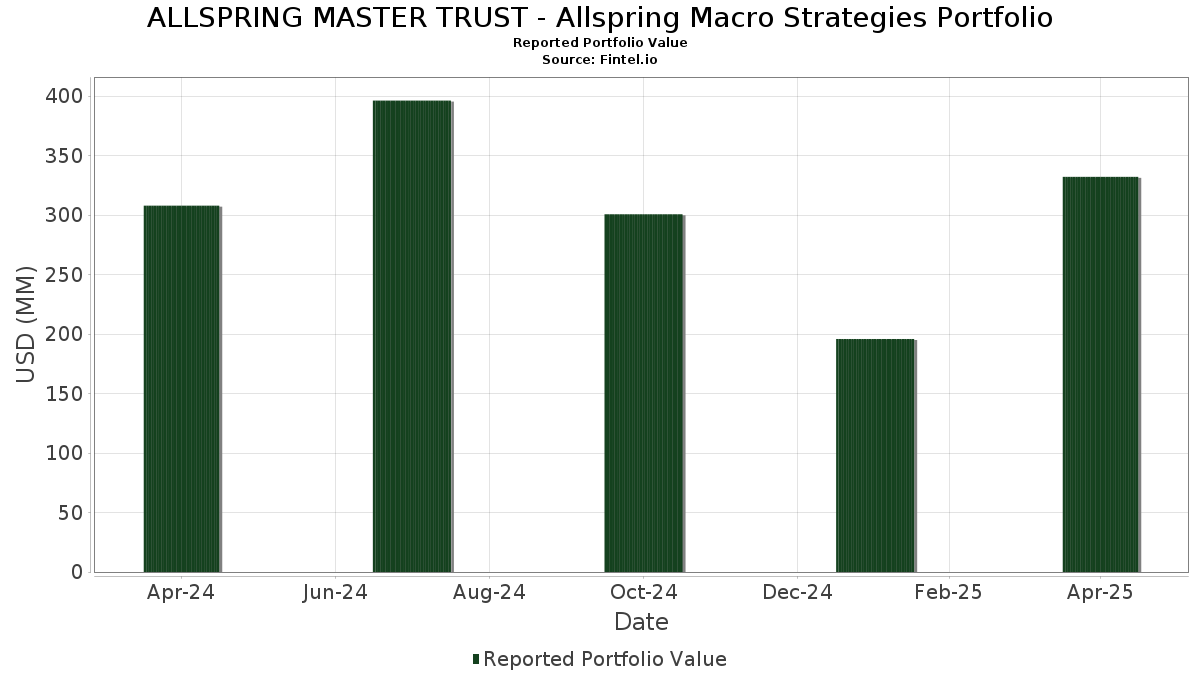

ALLSPRING MASTER TRUST - Allspring Macro Strategies Portfolio telah mengungkapkan total kepemilikan 338 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 332,080,942 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama ALLSPRING MASTER TRUST - Allspring Macro Strategies Portfolio adalah United States Treasury Inflation Indexed Bonds (US:US91282CCM10) , United States Treasury Inflation Indexed Bonds (US:US9128283R96) , US TREASURY I/L 2.375% 10-15-28 (US:US91282CJH51) , United States Treasury Inflation Indexed Bonds (US:US91282CDX65) , and Usa Treasury Bonds 3 5/8% Tii 30yr Bd 4/15/28 (US:US912810FD55) . Posisi baru ALLSPRING MASTER TRUST - Allspring Macro Strategies Portfolio meliputi: United States Treasury Inflation Indexed Bonds (US:US91282CCM10) , United States Treasury Inflation Indexed Bonds (US:US9128283R96) , US TREASURY I/L 2.375% 10-15-28 (US:US91282CJH51) , United States Treasury Inflation Indexed Bonds (US:US91282CDX65) , and Usa Treasury Bonds 3 5/8% Tii 30yr Bd 4/15/28 (US:US912810FD55) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 55.71 | 55.71 | 25.2593 | 25.2593 | |

| 55.71 | 55.71 | 25.2593 | 25.2593 | |

| 2.56 | 53.64 | 24.3232 | 24.3232 | |

| 2.56 | 53.64 | 24.3232 | 24.3232 | |

| 5.00 | 2.2693 | 2.2166 | ||

| 4.77 | 2.1640 | 2.1640 | ||

| 3.17 | 1.4367 | 1.4367 | ||

| 3.17 | 1.4367 | 1.4367 | ||

| 2.73 | 1.2369 | 1.2369 | ||

| 1.32 | 0.6000 | 0.6000 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -2.86 | -1.2985 | -1.2985 | ||

| -2.86 | -1.2985 | -1.2985 | ||

| -1.68 | -0.7625 | -0.7625 | ||

| -1.42 | -0.6426 | -0.6426 | ||

| -1.42 | -0.6426 | -0.6426 | ||

| -0.98 | -0.4433 | -0.4433 | ||

| -0.96 | -0.4359 | -0.4359 | ||

| -0.96 | -0.4359 | -0.4359 | ||

| -0.90 | -0.4081 | -0.4081 | ||

| -0.90 | -0.4081 | -0.4081 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-25 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ALLSPRING GOVERNMENT MONEY MAR / STIV (000000000) | 55.71 | 55.71 | 25.2593 | 25.2593 | |||||

| ALLSPRING GOVERNMENT MONEY MAR / STIV (000000000) | 55.71 | 55.71 | 25.2593 | 25.2593 | |||||

| MACRO STRAT SPE INV CAYMAN LTD / EC (000000000) | 2.56 | 53.64 | 24.3232 | 24.3232 | |||||

| MACRO STRAT SPE INV CAYMAN LTD / EC (000000000) | 2.56 | 53.64 | 24.3232 | 24.3232 | |||||

| US91282CCM10 / United States Treasury Inflation Indexed Bonds | 6.89 | 3.80 | 3.1252 | -0.0187 | |||||

| US9128283R96 / United States Treasury Inflation Indexed Bonds | 6.84 | 3.23 | 3.1037 | -0.0356 | |||||

| US91282CJH51 / US TREASURY I/L 2.375% 10-15-28 | 6.80 | 2.95 | 3.0844 | -0.0442 | |||||

| US91282CDX65 / United States Treasury Inflation Indexed Bonds | 6.78 | 3.75 | 3.0741 | -0.0197 | |||||

| US912810FD55 / Usa Treasury Bonds 3 5/8% Tii 30yr Bd 4/15/28 | 6.73 | 2.50 | 3.0538 | -0.0574 | |||||

| US912810QV35 / United States Treasury Inflation Indexed Bonds | 6.51 | 1.04 | 2.9526 | -0.0985 | |||||

| US912810PS15 / United States Treasury Inflation Indexed Bonds | 5.00 | 4,408.11 | 2.2693 | 2.2166 | |||||

| MSCI EAFE JUN25 / DE (000000000) | 4.77 | 2.1640 | 2.1640 | ||||||

| US91282CBF77 / United States Treasury Inflation Indexed Bonds | 4.26 | 3.85 | 1.9314 | -0.0105 | |||||

| US912810FH69 / Usa Treasury Notes 3 7/8% 30yr Notes 04/15/2029 | 4.02 | 2.84 | 1.8212 | -0.0280 | |||||

| US91282CDC29 / UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 | 3.84 | 2.59 | 1.7401 | -0.0311 | |||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CML27) | 3.17 | 1.4367 | 1.4367 | ||||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CML27) | 3.17 | 1.4367 | 1.4367 | ||||||

| US912810TE82 / United States Treasury Inflation Indexed Bonds | 2.93 | -0.98 | 1.3294 | -0.0723 | |||||

| US912828Z377 / United States Treasury Inflation Indexed Bonds | 2.73 | 1.2369 | 1.2369 | ||||||

| US912810QF84 / United States Treasury Inflation Indexed Bonds | 2.28 | 81.82 | 1.0343 | 0.4401 | |||||

| US9128287D64 / United States Treasury Inflation Indexed Bonds | 2.26 | 3.68 | 1.0229 | -0.0071 | |||||

| AMT / American Tower Corporation | 0.01 | 0.00 | 2.10 | 21.84 | 0.9539 | 0.1366 | |||

| EQIX / Equinix, Inc. | 0.00 | 0.00 | 1.85 | -5.77 | 0.8372 | -0.0907 | |||

| WELL / Welltower Inc. | 0.01 | 0.00 | 1.71 | 11.83 | 0.7759 | 0.0513 | |||

| PLD / Prologis, Inc. | 0.01 | 0.00 | 1.52 | -14.30 | 0.6877 | -0.1502 | |||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CJY84) | 1.43 | 3.02 | 0.6501 | -0.0088 | |||||

| GOLD 100 OZ FUTR JUN25 / DCO (000000000) | 1.32 | 0.6000 | 0.6000 | ||||||

| GOLD 100 OZ FUTR JUN25 / DCO (000000000) | 1.32 | 0.6000 | 0.6000 | ||||||

| US912810TP30 / US TREASURY I/L 1.5% 02-15-53 | 1.31 | 0.5951 | 0.5951 | ||||||

| AUST 10Y BOND FUT JUN25 / DIR (000000000) | 1.18 | 0.5364 | 0.5364 | ||||||

| AUST 10Y BOND FUT JUN25 / DIR (000000000) | 1.18 | 0.5364 | 0.5364 | ||||||

| US9128282L36 / United States Treasury Inflation Indexed Bonds | 1.17 | 930.97 | 0.5286 | 0.4751 | |||||

| SBAC / SBA Communications Corporation | 0.00 | -8.60 | 1.11 | 12.64 | 0.5012 | 0.0365 | |||

| SUI / Sun Communities, Inc. | 0.01 | 0.00 | 1.09 | -1.71 | 0.4961 | -0.0305 | |||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 1.08 | 0.4876 | 0.4876 | ||||||

| EURO-BUND FUTURE JUN25 / DIR (000000000) | 0.99 | 0.4500 | 0.4500 | ||||||

| EURO-BUND FUTURE JUN25 / DIR (000000000) | 0.99 | 0.4500 | 0.4500 | ||||||

| EURO-BUND FUTURE JUN25 / DIR (000000000) | 0.99 | 0.4500 | 0.4500 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.98 | 0.4434 | 0.4434 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.98 | 0.4434 | 0.4434 | ||||||

| EXR / Extra Space Storage Inc. | 0.01 | 0.00 | 0.94 | -4.86 | 0.4266 | -0.0416 | |||

| EURO-BUXL 30Y BND JUN25 / DIR (000000000) | 0.91 | 0.4139 | 0.4139 | ||||||

| EURO-BUXL 30Y BND JUN25 / DIR (000000000) | 0.91 | 0.4139 | 0.4139 | ||||||

| SPG / Simon Property Group, Inc. | 0.01 | 0.00 | 0.87 | -9.56 | 0.3949 | -0.0606 | |||

| PURCHASED CZK / SOLD USD / DFE (000000000) | 0.87 | 0.3941 | 0.3941 | ||||||

| PURCHASED CZK / SOLD USD / DFE (000000000) | 0.87 | 0.3941 | 0.3941 | ||||||

| IRM / Iron Mountain Incorporated | 0.01 | 29.30 | 0.85 | 14.25 | 0.3855 | 0.0329 | |||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.84 | 0.3802 | 0.3802 | ||||||

| MAA / Mid-America Apartment Communities, Inc. | 0.01 | 0.00 | 0.81 | 4.64 | 0.3683 | 0.0008 | |||

| VICI / VICI Properties Inc. | 0.03 | 11.30 | 0.80 | 19.76 | 0.3631 | 0.0464 | |||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0.79 | 0.3601 | 0.3601 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0.79 | 0.3601 | 0.3601 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0.79 | 0.3595 | 0.3595 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0.79 | 0.3595 | 0.3595 | ||||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CLE92) | 0.79 | 2.87 | 0.3577 | -0.0050 | |||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CLE92) | 0.79 | 2.87 | 0.3577 | -0.0050 | |||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | 0.73 | 0.3291 | 0.3291 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | 0.73 | 0.3291 | 0.3291 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | 0.73 | 0.3291 | 0.3291 | ||||||

| US912810QP66 / United States Treasury Inflation Indexed Bonds | 0.69 | 1.33 | 0.3123 | -0.0092 | |||||

| CPT / Camden Property Trust | 0.01 | 0.00 | 0.69 | 0.00 | 0.3114 | -0.0135 | |||

| CAN 10YR BOND FUT JUN25 / DIR (000000000) | 0.67 | 0.3034 | 0.3034 | ||||||

| CAN 10YR BOND FUT JUN25 / DIR (000000000) | 0.67 | 0.3034 | 0.3034 | ||||||

| CAN 10YR BOND FUT JUN25 / DIR (000000000) | 0.67 | 0.3034 | 0.3034 | ||||||

| AMH / American Homes 4 Rent | 0.02 | 0.00 | 0.67 | 7.94 | 0.3023 | 0.0099 | |||

| TRNO / Terreno Realty Corporation | 0.01 | -11.92 | 0.66 | -24.17 | 0.3005 | -0.1132 | |||

| INVH / Invitation Homes Inc. | 0.02 | 0.00 | 0.66 | 9.80 | 0.3001 | 0.0146 | |||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.66 | 0.2990 | 0.2990 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.66 | 0.2990 | 0.2990 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.66 | 0.2990 | 0.2990 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0.63 | 0.2850 | 0.2850 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.62 | 0.2825 | 0.2825 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.62 | 0.2825 | 0.2825 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.62 | 0.2825 | 0.2825 | ||||||

| JPN YEN CURR FUT JUN25 / DFE (000000000) | 0.62 | 0.2796 | 0.2796 | ||||||

| JPN YEN CURR FUT JUN25 / DFE (000000000) | 0.62 | 0.2796 | 0.2796 | ||||||

| CCI / Crown Castle Inc. | 0.01 | 0.00 | 0.53 | 18.57 | 0.2405 | 0.0285 | |||

| PURCHASED HUF / SOLD USD / DFE (000000000) | 0.50 | 0.2267 | 0.2267 | ||||||

| PURCHASED HUF / SOLD USD / DFE (000000000) | 0.50 | 0.2267 | 0.2267 | ||||||

| FR / First Industrial Realty Trust, Inc. | 0.01 | 0.00 | 0.50 | -10.93 | 0.2258 | -0.0388 | |||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.49 | 0.2203 | 0.2203 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.49 | 0.2203 | 0.2203 | ||||||

| E-MINI RUSS 1000 VJUN25 / DE (000000000) | 0.48 | 0.2169 | 0.2169 | ||||||

| E-MINI RUSS 1000 VJUN25 / DE (000000000) | 0.48 | 0.2169 | 0.2169 | ||||||

| LONG GILT FUTURE JUN25 / DIR (000000000) | 0.44 | 0.2015 | 0.2015 | ||||||

| LONG GILT FUTURE JUN25 / DIR (000000000) | 0.44 | 0.2015 | 0.2015 | ||||||

| PURCHASED SEK / SOLD USD / DFE (000000000) | 0.44 | 0.1985 | 0.1985 | ||||||

| PURCHASED SEK / SOLD USD / DFE (000000000) | 0.44 | 0.1985 | 0.1985 | ||||||

| PURCHASED BRL / SOLD USD / DFE (000000000) | 0.44 | 0.1981 | 0.1981 | ||||||

| IRT / Independence Realty Trust, Inc. | 0.02 | 0.00 | 0.42 | 0.95 | 0.1927 | -0.0062 | |||

| SOYBEAN OIL FUTR JUL25 / DCO (000000000) | 0.42 | 0.1922 | 0.1922 | ||||||

| SOYBEAN OIL FUTR JUL25 / DCO (000000000) | 0.42 | 0.1922 | 0.1922 | ||||||

| CUBE / CubeSmart | 0.01 | 0.00 | 0.42 | -2.58 | 0.1891 | -0.0134 | |||

| IBEX 35 INDX FUTR MAY25 / DE (000000000) | 0.41 | 0.1845 | 0.1845 | ||||||

| GLPI / Gaming and Leisure Properties, Inc. | 0.01 | 0.00 | 0.36 | -1.09 | 0.1642 | -0.0092 | |||

| PURCHASED NZD / SOLD USD / DFE (000000000) | 0.36 | 0.1616 | 0.1616 | ||||||

| PURCHASED PLN / SOLD USD / DFE (000000000) | 0.35 | 0.1605 | 0.1605 | ||||||

| PURCHASED PLN / SOLD USD / DFE (000000000) | 0.35 | 0.1605 | 0.1605 | ||||||

| FRT / Federal Realty Investment Trust | 0.00 | 0.00 | 0.34 | -13.49 | 0.1545 | -0.0319 | |||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.33 | 0.1483 | 0.1483 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0.32 | 0.1467 | 0.1467 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0.32 | 0.1467 | 0.1467 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0.32 | 0.1467 | 0.1467 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0.31 | 0.1418 | 0.1418 | ||||||

| PURCHASED NZD / SOLD USD / DFE (000000000) | 0.31 | 0.1416 | 0.1416 | ||||||

| PURCHASED HUF / SOLD USD / DFE (000000000) | 0.30 | 0.1363 | 0.1363 | ||||||

| PURCHASED HUF / SOLD USD / DFE (000000000) | 0.30 | 0.1363 | 0.1363 | ||||||

| LME ZINC FUTURE JUN25 / DCO (000000000) | 0.30 | 0.1351 | 0.1351 | ||||||

| FCPT / Four Corners Property Trust, Inc. | 0.01 | 0.00 | 0.29 | 1.77 | 0.1310 | -0.0032 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.00 | 0.00 | 0.28 | -25.33 | 0.1272 | -0.0508 | |||

| PURCHASED KRW / SOLD USD / DFE (000000000) | 0.25 | 0.1126 | 0.1126 | ||||||

| PURCHASED KRW / SOLD USD / DFE (000000000) | 0.25 | 0.1126 | 0.1126 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0.23 | 0.1056 | 0.1056 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | 0.23 | 0.1056 | 0.1056 | ||||||

| PURCHASED HUF / SOLD USD / DFE (000000000) | 0.22 | 0.1000 | 0.1000 | ||||||

| PURCHASED HUF / SOLD USD / DFE (000000000) | 0.22 | 0.1000 | 0.1000 | ||||||

| LME PRI ALUM FUTR MAY25 / DCO (000000000) | 0.21 | 0.0939 | 0.0939 | ||||||

| LME PRI ALUM FUTR MAY25 / DCO (000000000) | 0.21 | 0.0939 | 0.0939 | ||||||

| LME PRI ALUM FUTR MAY25 / DCO (000000000) | 0.21 | 0.0939 | 0.0939 | ||||||

| REXR / Rexford Industrial Realty, Inc. | 0.01 | 0.21 | 0.0937 | 0.0937 | |||||

| PURCHASED KRW / SOLD USD / DFE (000000000) | 0.20 | 0.0920 | 0.0920 | ||||||

| PURCHASED KRW / SOLD USD / DFE (000000000) | 0.20 | 0.0920 | 0.0920 | ||||||

| PURCHASED CLP / SOLD USD / DFE (000000000) | 0.19 | 0.0865 | 0.0865 | ||||||

| PURCHASED CLP / SOLD USD / DFE (000000000) | 0.19 | 0.0865 | 0.0865 | ||||||

| PURCHASED CLP / SOLD USD / DFE (000000000) | 0.19 | 0.0865 | 0.0865 | ||||||

| PURCHASED NOK / SOLD USD / DFE (000000000) | 0.19 | 0.0864 | 0.0864 | ||||||

| LME NICKEL FUTURE MAY25 / DCO (000000000) | 0.18 | 0.0836 | 0.0836 | ||||||

| LME NICKEL FUTURE MAY25 / DCO (000000000) | 0.18 | 0.0836 | 0.0836 | ||||||

| BRENT CRUDE FUTR JUL25 / DCO (000000000) | 0.17 | 0.0751 | 0.0751 | ||||||

| BRENT CRUDE FUTR JUL25 / DCO (000000000) | 0.17 | 0.0751 | 0.0751 | ||||||

| E-MINI RUSS 2000 JUN25 / DE (000000000) | 0.16 | 0.0748 | 0.0748 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.16 | 0.0736 | 0.0736 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.16 | 0.0736 | 0.0736 | ||||||

| WTI CRUDE FUTURE JUN25 / DCO (000000000) | 0.16 | 0.0734 | 0.0734 | ||||||

| US912810RW09 / United States Treasury Inflation Indexed Bonds | 0.15 | 0.0700 | 0.0700 | ||||||

| LME LEAD FUTURE JUN25 / DCO (000000000) | 0.15 | 0.0698 | 0.0698 | ||||||

| LME LEAD FUTURE JUN25 / DCO (000000000) | 0.15 | 0.0698 | 0.0698 | ||||||

| SUGAR 11 (WORLD) JUL25 / DCO (000000000) | 0.15 | 0.0666 | 0.0666 | ||||||

| SUGAR 11 (WORLD) JUL25 / DCO (000000000) | 0.15 | 0.0666 | 0.0666 | ||||||

| PURCHASED PLN / SOLD USD / DFE (000000000) | 0.15 | 0.0660 | 0.0660 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | 0.14 | 0.0617 | 0.0617 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | 0.14 | 0.0617 | 0.0617 | ||||||

| EURO-OAT FUTURE JUN25 / DIR (000000000) | 0.13 | 0.0589 | 0.0589 | ||||||

| EURO-OAT FUTURE JUN25 / DIR (000000000) | 0.13 | 0.0589 | 0.0589 | ||||||

| PURCHASED USD / SOLD ZAR / DFE (000000000) | 0.13 | 0.0575 | 0.0575 | ||||||

| PURCHASED USD / SOLD ZAR / DFE (000000000) | 0.13 | 0.0575 | 0.0575 | ||||||

| PURCHASED USD / SOLD ZAR / DFE (000000000) | 0.13 | 0.0575 | 0.0575 | ||||||

| MSCI EMGMKT JUN25 / DE (000000000) | 0.13 | 0.0569 | 0.0569 | ||||||

| MSCI EMGMKT JUN25 / DE (000000000) | 0.13 | 0.0569 | 0.0569 | ||||||

| US912810PV44 / United States Treasury Inflation Indexed Bonds | 0.12 | 3.33 | 0.0564 | -0.0008 | |||||

| US91282CEJ62 / United States Treasury Inflation Indexed Bonds | 0.12 | 3.39 | 0.0556 | -0.0008 | |||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0.12 | 0.0550 | 0.0550 | ||||||

| US91282CFR79 / United States Treasury Inflation Indexed Bonds | 0.12 | 2.56 | 0.0548 | -0.0009 | |||||

| US912828V491 / United States Treasury Inflation Indexed Bonds | 0.12 | 3.51 | 0.0535 | -0.0009 | |||||

| PURCHASED NZD / SOLD USD / DFE (000000000) | 0.11 | 0.0519 | 0.0519 | ||||||

| PURCHASED NZD / SOLD USD / DFE (000000000) | 0.11 | 0.0519 | 0.0519 | ||||||

| US912828Y388 / United States Treasury Inflation Indexed Bonds | 0.11 | 0.0515 | 0.0515 | ||||||

| US9128285W63 / United States Treasury Inflation Indexed Bonds | 0.11 | 0.0510 | 0.0510 | ||||||

| US91282CGK18 / U.S. Treasury Inflation Linked Notes | 0.11 | 0.0509 | 0.0509 | ||||||

| US91282CEZ05 / U.S. Treasury Inflation Linked Notes | 0.11 | 0.0509 | 0.0509 | ||||||

| PURCHASED BRL / SOLD USD / DFE (000000000) | 0.11 | 0.0503 | 0.0503 | ||||||

| PURCHASED BRL / SOLD USD / DFE (000000000) | 0.11 | 0.0503 | 0.0503 | ||||||

| LME LEAD FUTURE MAY25 / DCO (000000000) | 0.11 | 0.0500 | 0.0500 | ||||||

| US912810PZ57 / United States Treasury Inflation Indexed Bonds | 0.11 | 0.0494 | 0.0494 | ||||||

| US91282CGW55 / United States Treasury Inflation Indexed Bonds | 0.11 | 0.0485 | 0.0485 | ||||||

| US912828ZZ63 / United States Treasury Inflation Indexed Bonds | 0.11 | 0.0477 | 0.0477 | ||||||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 0.10 | 0.97 | 0.0474 | -0.0018 | |||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CLV18) | 0.10 | 0.0467 | 0.0467 | ||||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CLV18) | 0.10 | 0.0467 | 0.0467 | ||||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CLV18) | 0.10 | 0.0467 | 0.0467 | ||||||

| LME LEAD FUTURE JUN25 / DCO (000000000) | 0.10 | 0.0462 | 0.0462 | ||||||

| LME LEAD FUTURE JUN25 / DCO (000000000) | 0.10 | 0.0462 | 0.0462 | ||||||

| PURCHASED CZK / SOLD USD / DFE (000000000) | 0.09 | 0.0413 | 0.0413 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0.08 | 0.0369 | 0.0369 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0.08 | 0.0369 | 0.0369 | ||||||

| G3651J115 / ORDINARY SHARES | 0.07 | 0.0339 | 0.0339 | ||||||

| PURCHASED USD / SOLD CLP / DFE (000000000) | 0.07 | 0.0309 | 0.0309 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | 0.07 | 0.0298 | 0.0298 | ||||||

| LME NICKEL FUTURE MAY25 / DCO (000000000) | 0.05 | 0.0244 | 0.0244 | ||||||

| LME NICKEL FUTURE MAY25 / DCO (000000000) | 0.05 | 0.0244 | 0.0244 | ||||||

| LEAN HOGS FUTURE JUN25 / DCO (000000000) | 0.05 | 0.0227 | 0.0227 | ||||||

| PURCHASED MXN / SOLD USD / DFE (000000000) | 0.05 | 0.0222 | 0.0222 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | 0.05 | 0.0212 | 0.0212 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | 0.05 | 0.0212 | 0.0212 | ||||||

| PURCHASED KRW / SOLD USD / DFE (000000000) | 0.05 | 0.0211 | 0.0211 | ||||||

| PURCHASED KRW / SOLD USD / DFE (000000000) | 0.05 | 0.0211 | 0.0211 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0.04 | 0.0189 | 0.0189 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0.04 | 0.0189 | 0.0189 | ||||||

| LME NICKEL FUTURE JUN25 / DCO (000000000) | 0.04 | 0.0161 | 0.0161 | ||||||

| LME NICKEL FUTURE JUN25 / DCO (000000000) | 0.04 | 0.0161 | 0.0161 | ||||||

| COCOA FUTURE JUL25 / DCO (000000000) | 0.03 | 0.0143 | 0.0143 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.03 | 0.0133 | 0.0133 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.03 | 0.0133 | 0.0133 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0.03 | 0.0133 | 0.0133 | ||||||

| PURCHASED NOK / SOLD USD / DFE (000000000) | 0.03 | 0.0125 | 0.0125 | ||||||

| PURCHASED NOK / SOLD USD / DFE (000000000) | 0.03 | 0.0125 | 0.0125 | ||||||

| PURCHASED NOK / SOLD USD / DFE (000000000) | 0.03 | 0.0125 | 0.0125 | ||||||

| PURCHASED USD / SOLD PLN / DFE (000000000) | 0.02 | 0.0109 | 0.0109 | ||||||

| LOW SU GASOIL G JUN25 / DCO (000000000) | 0.02 | 0.0104 | 0.0104 | ||||||

| IFSC NIFTY 50 FUT MAY25 / DE (000000000) | 0.02 | 0.0090 | 0.0090 | ||||||

| IFSC NIFTY 50 FUT MAY25 / DE (000000000) | 0.02 | 0.0090 | 0.0090 | ||||||

| COFFEE 'C' FUTURE JUL25 / DCO (000000000) | 0.01 | 0.0065 | 0.0065 | ||||||

| COFFEE 'C' FUTURE JUL25 / DCO (000000000) | 0.01 | 0.0065 | 0.0065 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | 0.01 | 0.0028 | 0.0028 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | 0.01 | 0.0028 | 0.0028 | ||||||

| LME ZINC FUTURE MAY25 / DCO (000000000) | 0.01 | 0.0025 | 0.0025 | ||||||

| SILVER FUTURE JUL25 / DCO (000000000) | 0.00 | 0.0016 | 0.0016 | ||||||

| SILVER FUTURE JUL25 / DCO (000000000) | 0.00 | 0.0016 | 0.0016 | ||||||

| GASOLINE RBOB FUT JUN25 / DCO (000000000) | 0.00 | 0.0006 | 0.0006 | ||||||

| GASOLINE RBOB FUT JUN25 / DCO (000000000) | 0.00 | 0.0006 | 0.0006 | ||||||

| CORN FUTURE JUL25 / DCO (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| PURCHASED USD / SOLD SEK / DFE (000000000) | -0.00 | -0.0007 | -0.0007 | ||||||

| PURCHASED USD / SOLD SEK / DFE (000000000) | -0.00 | -0.0007 | -0.0007 | ||||||

| PURCHASED KRW / SOLD USD / DFE (000000000) | -0.01 | -0.0028 | -0.0028 | ||||||

| PURCHASED KRW / SOLD USD / DFE (000000000) | -0.01 | -0.0028 | -0.0028 | ||||||

| LME ZINC FUTURE JUN25 / DCO (000000000) | -0.01 | -0.0031 | -0.0031 | ||||||

| PURCHASED USD / SOLD NOK / DFE (000000000) | -0.01 | -0.0066 | -0.0066 | ||||||

| PURCHASED USD / SOLD NOK / DFE (000000000) | -0.01 | -0.0066 | -0.0066 | ||||||

| LME PRI ALUM FUTR JUN25 / DCO (000000000) | -0.02 | -0.0107 | -0.0107 | ||||||

| SOYBEAN MEAL FUTR JUL25 / DCO (000000000) | -0.03 | -0.0115 | -0.0115 | ||||||

| SOYBEAN MEAL FUTR JUL25 / DCO (000000000) | -0.03 | -0.0115 | -0.0115 | ||||||

| LME ZINC FUTURE MAY25 / DCO (000000000) | -0.03 | -0.0122 | -0.0122 | ||||||

| LME ZINC FUTURE MAY25 / DCO (000000000) | -0.03 | -0.0122 | -0.0122 | ||||||

| LME ZINC FUTURE MAY25 / DCO (000000000) | -0.03 | -0.0122 | -0.0122 | ||||||

| COTTON NO.2 FUTR JUL25 / DCO (000000000) | -0.03 | -0.0136 | -0.0136 | ||||||

| PURCHASED USD / SOLD INR / DFE (000000000) | -0.04 | -0.0159 | -0.0159 | ||||||

| PURCHASED USD / SOLD CLP / DFE (000000000) | -0.04 | -0.0160 | -0.0160 | ||||||

| NASDAQ 100 E-MINI JUN25 / DE (000000000) | -0.04 | -0.0166 | -0.0166 | ||||||

| NASDAQ 100 E-MINI JUN25 / DE (000000000) | -0.04 | -0.0166 | -0.0166 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0.05 | -0.0214 | -0.0214 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0.05 | -0.0214 | -0.0214 | ||||||

| PURCHASED USD / SOLD HUF / DFE (000000000) | -0.05 | -0.0240 | -0.0240 | ||||||

| NY HARB ULSD FUT JUN25 / DCO (000000000) | -0.06 | -0.0253 | -0.0253 | ||||||

| NY HARB ULSD FUT JUN25 / DCO (000000000) | -0.06 | -0.0253 | -0.0253 | ||||||

| NY HARB ULSD FUT JUN25 / DCO (000000000) | -0.06 | -0.0253 | -0.0253 | ||||||

| NATURAL GAS FUTR JUL25 / DCO (000000000) | -0.06 | -0.0263 | -0.0263 | ||||||

| NATURAL GAS FUTR JUL25 / DCO (000000000) | -0.06 | -0.0263 | -0.0263 | ||||||

| NATURAL GAS FUTR JUL25 / DCO (000000000) | -0.06 | -0.0263 | -0.0263 | ||||||

| PURCHASED USD / SOLD NOK / DFE (000000000) | -0.06 | -0.0277 | -0.0277 | ||||||

| PURCHASED USD / SOLD NOK / DFE (000000000) | -0.06 | -0.0277 | -0.0277 | ||||||

| PURCHASED USD / SOLD CZK / DFE (000000000) | -0.07 | -0.0331 | -0.0331 | ||||||

| PURCHASED USD / SOLD MXN / DFE (000000000) | -0.07 | -0.0339 | -0.0339 | ||||||

| PURCHASED USD / SOLD MXN / DFE (000000000) | -0.07 | -0.0339 | -0.0339 | ||||||

| PURCHASED USD / SOLD MXN / DFE (000000000) | -0.07 | -0.0339 | -0.0339 | ||||||

| LME LEAD FUTURE MAY25 / DCO (000000000) | -0.08 | -0.0341 | -0.0341 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.08 | -0.0354 | -0.0354 | ||||||

| SOYBEAN FUTURE JUL25 / DCO (000000000) | -0.09 | -0.0400 | -0.0400 | ||||||

| SOYBEAN FUTURE JUL25 / DCO (000000000) | -0.09 | -0.0400 | -0.0400 | ||||||

| CBOE VIX FUTURE MAY25 / DE (000000000) | -0.11 | -0.0480 | -0.0480 | ||||||

| CBOE VIX FUTURE MAY25 / DE (000000000) | -0.11 | -0.0480 | -0.0480 | ||||||

| CBOE VIX FUTURE MAY25 / DE (000000000) | -0.11 | -0.0480 | -0.0480 | ||||||

| PURCHASED USD / SOLD NOK / DFE (000000000) | -0.12 | -0.0539 | -0.0539 | ||||||

| PURCHASED USD / SOLD NOK / DFE (000000000) | -0.12 | -0.0539 | -0.0539 | ||||||

| PURCHASED USD / SOLD NOK / DFE (000000000) | -0.12 | -0.0539 | -0.0539 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | -0.12 | -0.0550 | -0.0550 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | -0.12 | -0.0550 | -0.0550 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | -0.13 | -0.0575 | -0.0575 | ||||||

| PURCHASED ZAR / SOLD USD / DFE (000000000) | -0.13 | -0.0575 | -0.0575 | ||||||

| PURCHASED USD / SOLD BRL / DFE (000000000) | -0.13 | -0.0582 | -0.0582 | ||||||

| PURCHASED USD / SOLD PLN / DFE (000000000) | -0.14 | -0.0634 | -0.0634 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | -0.14 | -0.0646 | -0.0646 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | -0.14 | -0.0646 | -0.0646 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | -0.17 | -0.0792 | -0.0792 | ||||||

| PURCHASED USD / SOLD PLN / DFE (000000000) | -0.18 | -0.0832 | -0.0832 | ||||||

| PURCHASED USD / SOLD PLN / DFE (000000000) | -0.18 | -0.0832 | -0.0832 | ||||||

| PURCHASED USD / SOLD NOK / DFE (000000000) | -0.19 | -0.0864 | -0.0864 | ||||||

| WHEAT FUTURE(CBT) JUL25 / DCO (000000000) | -0.20 | -0.0897 | -0.0897 | ||||||

| LIVE CATTLE FUTR JUN25 / DCO (000000000) | -0.20 | -0.0923 | -0.0923 | ||||||

| LIVE CATTLE FUTR JUN25 / DCO (000000000) | -0.20 | -0.0923 | -0.0923 | ||||||

| US 5YR NOTE (CBT) JUN25 / DIR (000000000) | -0.20 | -0.0925 | -0.0925 | ||||||

| US 5YR NOTE (CBT) JUN25 / DIR (000000000) | -0.20 | -0.0925 | -0.0925 | ||||||

| JPN 10Y BOND(OSE) JUN25 / DIR (000000000) | -0.21 | -0.0930 | -0.0930 | ||||||

| JPN 10Y BOND(OSE) JUN25 / DIR (000000000) | -0.21 | -0.0930 | -0.0930 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | -0.22 | -0.0996 | -0.0996 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | -0.22 | -0.0996 | -0.0996 | ||||||

| PURCHASED USD / SOLD IDR / DFE (000000000) | -0.22 | -0.0996 | -0.0996 | ||||||

| PURCHASED USD / SOLD HUF / DFE (000000000) | -0.23 | -0.1034 | -0.1034 | ||||||

| PURCHASED USD / SOLD HUF / DFE (000000000) | -0.23 | -0.1034 | -0.1034 | ||||||

| PURCHASED USD / SOLD SEK / DFE (000000000) | -0.23 | -0.1056 | -0.1056 | ||||||

| PURCHASED IDR / SOLD USD / DFE (000000000) | -0.23 | -0.1056 | -0.1056 | ||||||

| LME COPPER FUTURE JUN25 / DCO (000000000) | -0.23 | -0.1056 | -0.1056 | ||||||

| LME COPPER FUTURE JUN25 / DCO (000000000) | -0.23 | -0.1056 | -0.1056 | ||||||

| PURCHASED USD / SOLD SEK / DFE (000000000) | -0.23 | -0.1057 | -0.1057 | ||||||

| SPI 200 FUTURES JUN25 / DE (000000000) | -0.25 | -0.1127 | -0.1127 | ||||||

| PURCHASED USD / SOLD HUF / DFE (000000000) | -0.26 | -0.1177 | -0.1177 | ||||||

| PURCHASED USD / SOLD MXN / DFE (000000000) | -0.26 | -0.1179 | -0.1179 | ||||||

| PURCHASED USD / SOLD NOK / DFE (000000000) | -0.26 | -0.1200 | -0.1200 | ||||||

| PURCHASED USD / SOLD NOK / DFE (000000000) | -0.26 | -0.1200 | -0.1200 | ||||||

| PURCHASED USD / SOLD KRW / DFE (000000000) | -0.27 | -0.1215 | -0.1215 | ||||||

| PURCHASED USD / SOLD KRW / DFE (000000000) | -0.27 | -0.1215 | -0.1215 | ||||||

| KC HRW WHEAT FUT JUL25 / DCO (000000000) | -0.28 | -0.1259 | -0.1259 | ||||||

| KC HRW WHEAT FUT JUL25 / DCO (000000000) | -0.28 | -0.1259 | -0.1259 | ||||||

| LME PRI ALUM FUTR MAY25 / DCO (000000000) | -0.30 | -0.1364 | -0.1364 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.31 | -0.1383 | -0.1383 | ||||||

| DAX INDEX FUTURE JUN25 / DE (000000000) | -0.31 | -0.1384 | -0.1384 | ||||||

| PURCHASED USD / SOLD NZD / DFE (000000000) | -0.31 | -0.1416 | -0.1416 | ||||||

| PURCHASED USD / SOLD NZD / DFE (000000000) | -0.31 | -0.1416 | -0.1416 | ||||||

| PURCHASED USD / SOLD NZD / DFE (000000000) | -0.31 | -0.1416 | -0.1416 | ||||||

| PURCHASED USD / SOLD NZD / DFE (000000000) | -0.31 | -0.1421 | -0.1421 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.32 | -0.1450 | -0.1450 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.32 | -0.1450 | -0.1450 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0.32 | -0.1450 | -0.1450 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0.34 | -0.1528 | -0.1528 | ||||||

| PURCHASED USD / SOLD CHF / DFE (000000000) | -0.34 | -0.1560 | -0.1560 | ||||||

| PURCHASED USD / SOLD CHF / DFE (000000000) | -0.34 | -0.1560 | -0.1560 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0.37 | -0.1675 | -0.1675 | ||||||

| PURCHASED USD / SOLD SEK / DFE (000000000) | -0.37 | -0.1689 | -0.1689 | ||||||

| PURCHASED USD / SOLD BRL / DFE (000000000) | -0.39 | -0.1746 | -0.1746 | ||||||

| PURCHASED USD / SOLD BRL / DFE (000000000) | -0.39 | -0.1746 | -0.1746 | ||||||

| ENX / Euronext N.V. | -0.41 | -0.1842 | -0.1842 | ||||||

| PURCHASED USD / SOLD CLP / DFE (000000000) | -0.42 | -0.1921 | -0.1921 | ||||||

| PURCHASED USD / SOLD CLP / DFE (000000000) | -0.42 | -0.1921 | -0.1921 | ||||||

| PURCHASED USD / SOLD CZK / DFE (000000000) | -0.46 | -0.2088 | -0.2088 | ||||||

| PURCHASED USD / SOLD CZK / DFE (000000000) | -0.46 | -0.2088 | -0.2088 | ||||||

| PURCHASED USD / SOLD CZK / DFE (000000000) | -0.46 | -0.2088 | -0.2088 | ||||||

| DJ US REAL ESTATE JUN25 / DE (000000000) | -0.46 | -0.2091 | -0.2091 | ||||||

| DJ US REAL ESTATE JUN25 / DE (000000000) | -0.46 | -0.2091 | -0.2091 | ||||||

| PURCHASED USD / SOLD INR / DFE (000000000) | -0.46 | -0.2103 | -0.2103 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.49 | -0.2203 | -0.2203 | ||||||

| FTSE 100 IDX FUT JUN25 / DE (000000000) | -0.56 | -0.2525 | -0.2525 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.56 | -0.2536 | -0.2536 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.56 | -0.2536 | -0.2536 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | -0.57 | -0.2568 | -0.2568 | ||||||

| PURCHASED USD / SOLD INR / DFE (000000000) | -0.57 | -0.2577 | -0.2577 | ||||||

| PURCHASED USD / SOLD BRL / DFE (000000000) | -0.61 | -0.2760 | -0.2760 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | -0.63 | -0.2849 | -0.2849 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | -0.63 | -0.2849 | -0.2849 | ||||||

| PURCHASED USD / SOLD CHF / DFE (000000000) | -0.79 | -0.3581 | -0.3581 | ||||||

| EURO STOXX 50 JUN25 / DE (000000000) | -0.90 | -0.4081 | -0.4081 | ||||||

| EURO STOXX 50 JUN25 / DE (000000000) | -0.90 | -0.4081 | -0.4081 | ||||||

| S+P/TSX 60 IX FUT JUN25 / DE (000000000) | -0.96 | -0.4359 | -0.4359 | ||||||

| S+P/TSX 60 IX FUT JUN25 / DE (000000000) | -0.96 | -0.4359 | -0.4359 | ||||||

| PURCHASED USD / SOLD INR / DFE (000000000) | -0.98 | -0.4433 | -0.4433 | ||||||

| S+P500 EMINI FUT JUN25 / DE (000000000) | -1.42 | -0.6426 | -0.6426 | ||||||

| S+P500 EMINI FUT JUN25 / DE (000000000) | -1.42 | -0.6426 | -0.6426 | ||||||

| US 10YR NOTE (CBT)JUN25 / DIR (000000000) | -1.68 | -0.7625 | -0.7625 | ||||||

| TOPIX INDX FUTR JUN25 / DE (000000000) | -2.86 | -1.2985 | -1.2985 | ||||||

| TOPIX INDX FUTR JUN25 / DE (000000000) | -2.86 | -1.2985 | -1.2985 |