Mga Batayang Estadistika

| Nilai Portofolio | $ 121,563,129 |

| Posisi Saat Ini | 50 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

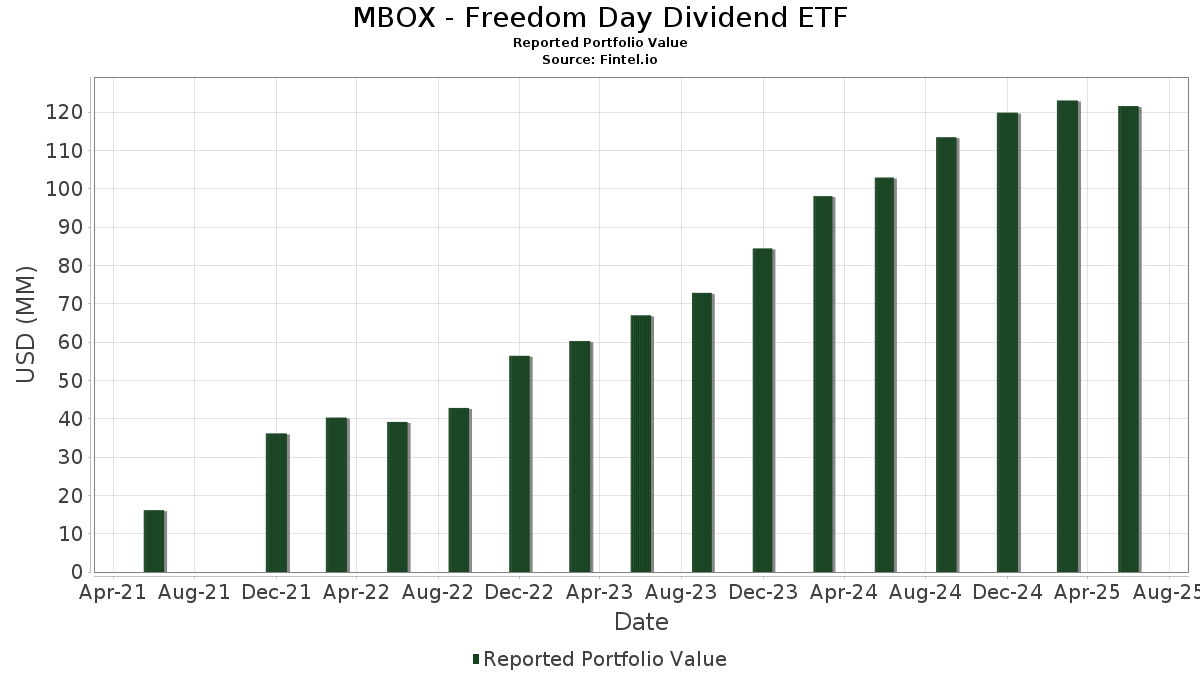

MBOX - Freedom Day Dividend ETF telah mengungkapkan total kepemilikan 50 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 121,563,129 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama MBOX - Freedom Day Dividend ETF adalah Broadcom Inc. (US:AVGO) , JPMorgan Chase & Co. (US:JPM) , KLA Corporation (US:KLAC) , Morgan Stanley (US:MS) , and Energy Transfer LP - Limited Partnership (US:ET) . Posisi baru MBOX - Freedom Day Dividend ETF meliputi: Novartis AG - Depositary Receipt (Common Stock) (US:NVS) , Voya Financial, Inc. (US:VOYA) , QUALCOMM Incorporated (US:QCOM) , Exxon Mobil Corporation (US:XOM) , and Lamar Advertising Company (US:LAMR) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 2.54 | 2.1000 | 2.1000 | |

| 0.04 | 2.53 | 2.0900 | 2.0900 | |

| 0.02 | 2.53 | 2.0900 | 2.0900 | |

| 0.02 | 2.49 | 2.0500 | 2.0500 | |

| 0.02 | 2.39 | 1.9700 | 1.9700 | |

| 0.02 | 1.92 | 1.5900 | 1.5900 | |

| 0.04 | 1.85 | 1.5300 | 1.5300 | |

| 0.01 | 3.62 | 2.9900 | 1.1500 | |

| 0.00 | 2.58 | 2.1300 | 0.7000 | |

| 0.00 | 3.26 | 2.6900 | 0.6200 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 1.89 | 1.5600 | -0.4400 | |

| 0.59 | 0.4800 | -0.3600 | ||

| 0.04 | 2.32 | 1.9200 | -0.3300 | |

| 0.01 | 2.21 | 1.8300 | -0.3000 | |

| 0.02 | 2.71 | 2.2400 | -0.2900 | |

| 0.02 | 2.57 | 2.1200 | -0.2900 | |

| 0.01 | 2.23 | 1.8400 | -0.2400 | |

| 0.03 | 1.98 | 1.6400 | -0.2400 | |

| 0.01 | 2.89 | 2.3900 | -0.2100 | |

| 0.02 | 1.95 | 1.6100 | -0.1300 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-29 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AVGO / Broadcom Inc. | 0.01 | -2.41 | 3.62 | 60.69 | 2.9900 | 1.1500 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -2.37 | 3.55 | 15.39 | 2.9300 | 0.4200 | |||

| KLAC / KLA Corporation | 0.00 | -2.41 | 3.26 | 28.59 | 2.6900 | 0.6200 | |||

| MS / Morgan Stanley | 0.02 | -2.40 | 3.09 | 17.87 | 2.5500 | 0.4100 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.16 | 5.60 | 2.98 | 3.00 | 2.4600 | 0.1000 | |||

| RSG / Republic Services, Inc. | 0.01 | -3.20 | 2.95 | -1.40 | 2.4400 | 0.0000 | |||

| PGR / The Progressive Corporation | 0.01 | -3.64 | 2.89 | -9.11 | 2.3900 | -0.2100 | |||

| DE / Deere & Company | 0.01 | -2.58 | 2.88 | 5.54 | 2.3700 | 0.1500 | |||

| KR / The Kroger Co. | 0.04 | -2.42 | 2.83 | 3.40 | 2.3400 | 0.1100 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.09 | 3.61 | 2.83 | -5.92 | 2.3400 | -0.1100 | |||

| MSFT / Microsoft Corporation | 0.01 | -2.36 | 2.78 | 29.42 | 2.2900 | 0.5400 | |||

| CINF / Cincinnati Financial Corporation | 0.02 | -3.29 | 2.74 | -2.49 | 2.2600 | -0.0300 | |||

| AEM / Agnico Eagle Mines Limited | 0.02 | -20.43 | 2.71 | -12.69 | 2.2400 | -0.2900 | |||

| TRV / The Travelers Companies, Inc. | 0.01 | -2.40 | 2.64 | -1.24 | 2.1800 | 0.0000 | |||

| OZK / Bank OZK | 0.05 | -2.43 | 2.58 | 5.69 | 2.1300 | 0.1300 | |||

| ASML / ASML Holding N.V. | 0.00 | 21.24 | 2.58 | 46.64 | 2.1300 | 0.7000 | |||

| EOG / EOG Resources, Inc. | 0.02 | -6.90 | 2.57 | -13.20 | 2.1200 | -0.2900 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.02 | 2.54 | 2.1000 | 2.1000 | |||||

| VOYA / Voya Financial, Inc. | 0.04 | 2.53 | 2.0900 | 2.0900 | |||||

| QCOM / QUALCOMM Incorporated | 0.02 | 2.53 | 2.0900 | 2.0900 | |||||

| CI / The Cigna Group | 0.01 | -2.42 | 2.52 | -1.95 | 2.0800 | -0.0100 | |||

| XOM / Exxon Mobil Corporation | 0.02 | 2.49 | 2.0500 | 2.0500 | |||||

| HRB / H&R Block, Inc. | 0.04 | -2.43 | 2.42 | -2.46 | 2.0000 | -0.0200 | |||

| HD / The Home Depot, Inc. | 0.01 | -2.41 | 2.41 | -2.39 | 1.9900 | -0.0200 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.01 | -2.38 | 2.41 | -4.18 | 1.9900 | -0.0600 | |||

| TSCO / Tractor Supply Company | 0.05 | -2.43 | 2.40 | -6.53 | 1.9800 | -0.1200 | |||

| MLI / Mueller Industries, Inc. | 0.03 | -2.42 | 2.40 | 1.83 | 1.9800 | 0.0600 | |||

| LAMR / Lamar Advertising Company | 0.02 | 2.39 | 1.9700 | 1.9700 | |||||

| NXST / Nexstar Media Group, Inc. | 0.01 | -2.38 | 2.36 | -5.79 | 1.9500 | -0.0900 | |||

| ACN / Accenture plc | 0.01 | -2.35 | 2.35 | -6.45 | 1.9400 | -0.1100 | |||

| CF / CF Industries Holdings, Inc. | 0.03 | -2.43 | 2.33 | 14.90 | 1.9200 | 0.2700 | |||

| GRMN / Garmin Ltd. | 0.01 | -2.37 | 2.33 | -6.17 | 1.9200 | -0.1000 | |||

| FNF / Fidelity National Financial, Inc. | 0.04 | -2.42 | 2.32 | -15.94 | 1.9200 | -0.3300 | |||

| CNQ / Canadian Natural Resources Limited | 0.07 | -2.43 | 2.32 | -0.52 | 1.9100 | 0.0100 | |||

| INGR / Ingredion Incorporated | 0.02 | 6.33 | 2.32 | 6.68 | 1.9100 | 0.1400 | |||

| AMGN / Amgen Inc. | 0.01 | -2.42 | 2.23 | -12.57 | 1.8400 | -0.2400 | |||

| WSO / Watsco, Inc. | 0.01 | -2.28 | 2.21 | -15.12 | 1.8300 | -0.3000 | |||

| MDLZ / Mondelez International, Inc. | 0.03 | -2.43 | 2.14 | -3.03 | 1.7700 | -0.0300 | |||

| MPC / Marathon Petroleum Corporation | 0.01 | -2.39 | 2.14 | 11.28 | 1.7700 | 0.2000 | |||

| HSY / The Hershey Company | 0.01 | 6.62 | 2.13 | 3.45 | 1.7600 | 0.0800 | |||

| VICI / VICI Properties Inc. | 0.06 | -2.42 | 2.09 | -2.47 | 1.7300 | -0.0200 | |||

| MRK / Merck & Co., Inc. | 0.03 | -2.42 | 1.98 | -13.94 | 1.6400 | -0.2400 | |||

| PLD / Prologis, Inc. | 0.02 | -2.41 | 1.95 | -8.23 | 1.6100 | -0.1300 | |||

| WSM / Williams-Sonoma, Inc. | 0.01 | -2.43 | 1.95 | 0.83 | 1.6100 | 0.0300 | |||

| RHP / Ryman Hospitality Properties, Inc. | 0.02 | 1.92 | 1.5900 | 1.5900 | |||||

| TAP / Molson Coors Beverage Company | 0.04 | -2.41 | 1.89 | -22.89 | 1.5600 | -0.4400 | |||

| EIX / Edison International | 0.04 | 1.85 | 1.5300 | 1.5300 | |||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.03 | 13.33 | 1.84 | 12.61 | 1.5200 | 0.1900 | |||

| OC / Owens Corning | 0.01 | -2.41 | 1.80 | -6.05 | 1.4900 | -0.0700 | |||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 0.59 | -43.15 | 0.4800 | -0.3600 |