Mga Batayang Estadistika

| Nilai Portofolio | $ 549,232,181 |

| Posisi Saat Ini | 166 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

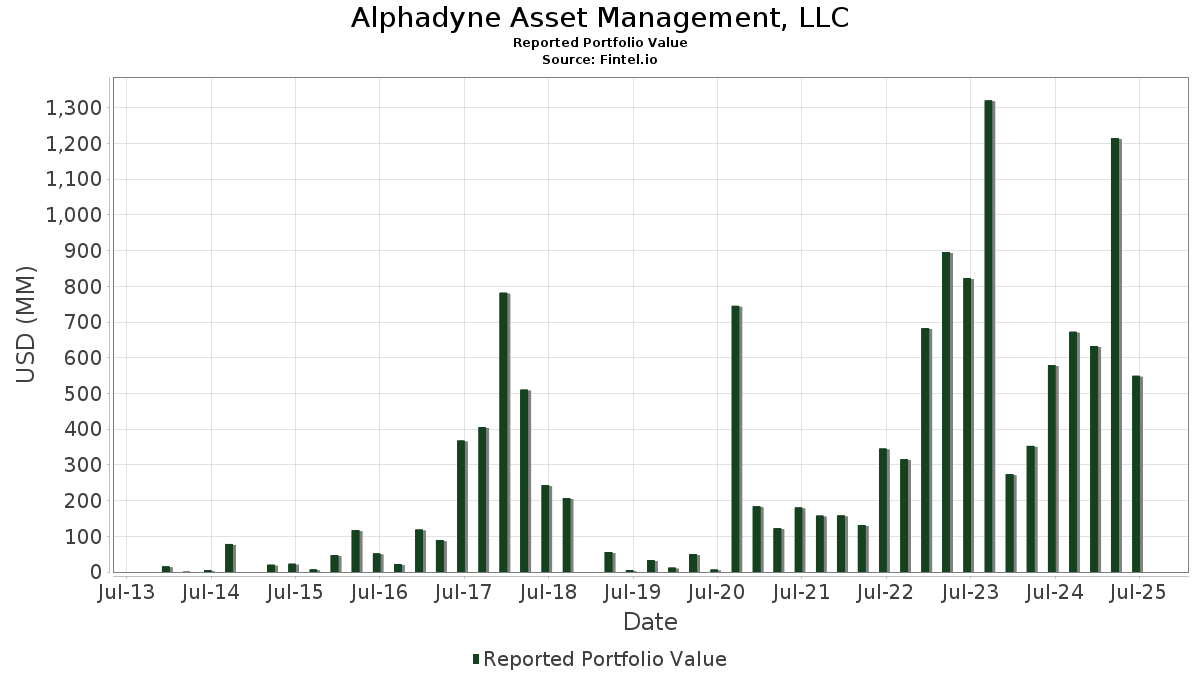

Alphadyne Asset Management, LLC telah mengungkapkan total kepemilikan 166 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 549,232,181 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Alphadyne Asset Management, LLC adalah SPDR Gold Trust (US:GLD) , iShares Trust - iShares China Large-Cap ETF (US:FXI) , SPDR Gold Trust (US:GLD) , VanEck ETF Trust - VanEck Gold Miners ETF (US:GDX) , and Invesco QQQ Trust, Series 1 (US:QQQ) . Posisi baru Alphadyne Asset Management, LLC meliputi: ServiceNow, Inc. (US:NOW) , Meta Platforms, Inc. (US:META) , Morgan Stanley (US:MS) , ServiceNow, Inc. (US:NOW) , and Broadcom Inc. (US:AVGO) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.03 | 314.80 | 57.3160 | 45.6708 | |

| 0.44 | 22.91 | 4.1706 | 2.6565 | |

| 0.99 | 36.39 | 6.6247 | 2.5077 | |

| 0.02 | 12.43 | 2.2635 | 2.2635 | |

| 0.02 | 7.38 | 1.3445 | 1.3445 | |

| 0.09 | 7.75 | 1.4103 | 0.9017 | |

| 0.08 | 22.95 | 4.1792 | 0.8527 | |

| 0.04 | 3.75 | 0.6819 | 0.6819 | |

| 0.07 | 6.12 | 1.1151 | 0.6281 | |

| 0.07 | 3.36 | 0.6109 | 0.6109 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -44.8724 | ||

| 0.11 | 4.16 | 0.7573 | -14.8243 | |

| 0.02 | 2.49 | 0.4528 | -13.0452 | |

| 0.04 | 4.41 | 0.8032 | -1.1284 | |

| 0.00 | 0.00 | -0.4870 | ||

| 0.00 | 0.40 | 0.0723 | -0.0965 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GLD / SPDR Gold Trust | Put | 1.03 | 110.41 | 314.80 | 122.60 | 57.3160 | 45.6708 | ||

| FXI / iShares Trust - iShares China Large-Cap ETF | Put | 0.99 | -29.05 | 36.39 | -27.22 | 6.6247 | 2.5077 | ||

| GLD / SPDR Gold Trust | Call | 0.08 | -46.29 | 22.95 | -43.18 | 4.1792 | 0.8527 | ||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | Call | 0.44 | 10.00 | 22.91 | 24.57 | 4.1706 | 2.6565 | ||

| QQQ / Invesco QQQ Trust, Series 1 | 0.02 | 12.43 | 2.2635 | 2.2635 | |||||

| C / Citigroup Inc. | Call | 0.09 | 4.60 | 7.75 | 25.40 | 1.4103 | 0.9017 | ||

| GLD / SPDR Gold Trust | 0.02 | 7.38 | 1.3445 | 1.3445 | |||||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | Put | 0.07 | 0.00 | 6.12 | 3.57 | 1.1151 | 0.6281 | ||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | Put | 0.04 | -78.07 | 4.41 | -81.20 | 0.8032 | -1.1284 | ||

| FXI / iShares Trust - iShares China Large-Cap ETF | 0.11 | -97.86 | 4.16 | -97.80 | 0.7573 | -14.8243 | |||

| HOOD / Robinhood Markets, Inc. | Call | 0.04 | 3.75 | 0.6819 | 0.6819 | ||||

| URNM / Sprott Funds Trust - Sprott Uranium Miners ETF | Call | 0.07 | 3.36 | 0.6109 | 0.6109 | ||||

| NOW / ServiceNow, Inc. | Call | 0.00 | 2.57 | 0.4680 | 0.4680 | ||||

| META / Meta Platforms, Inc. | Call | 0.00 | 2.51 | 0.4569 | 0.4569 | ||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.02 | -98.23 | 2.49 | -98.48 | 0.4528 | -13.0452 | |||

| META / Meta Platforms, Inc. | Put | 0.00 | 2.36 | 0.4300 | 0.4300 | ||||

| MS / Morgan Stanley | Call | 0.02 | 2.20 | 0.4001 | 0.4001 | ||||

| NOW / ServiceNow, Inc. | Put | 0.00 | 2.06 | 0.3744 | 0.3744 | ||||

| AVGO / Broadcom Inc. | Call | 0.01 | 1.96 | 0.3563 | 0.3563 | ||||

| ADBE / Adobe Inc. | Call | 0.00 | 1.82 | 0.3311 | 0.3311 | ||||

| IBM / International Business Machines Corporation | Call | 0.01 | 1.77 | 0.3220 | 0.3220 | ||||

| JPM / JPMorgan Chase & Co. | Call | 0.01 | 1.74 | 0.3167 | 0.3167 | ||||

| TGT / Target Corporation | Call | 0.02 | 1.66 | 0.3018 | 0.3018 | ||||

| MSFT / Microsoft Corporation | Call | 0.00 | 1.49 | 0.2717 | 0.2717 | ||||

| MRK / Merck & Co., Inc. | Call | 0.02 | 1.49 | 0.2710 | 0.2710 | ||||

| NVDA / NVIDIA Corporation | Call | 0.01 | 1.49 | 0.2704 | 0.2704 | ||||

| WFC / Wells Fargo & Company | Put | 0.02 | 1.48 | 0.2699 | 0.2699 | ||||

| WFC / Wells Fargo & Company | Call | 0.02 | 1.47 | 0.2670 | 0.2670 | ||||

| UPS / United Parcel Service, Inc. | Call | 0.01 | 1.38 | 0.2518 | 0.2518 | ||||

| AMZN / Amazon.com, Inc. | Call | 0.01 | 1.36 | 0.2477 | 0.2477 | ||||

| LLY / Eli Lilly and Company | Put | 0.00 | 1.33 | 0.2413 | 0.2413 | ||||

| MS / Morgan Stanley | Put | 0.01 | 1.30 | 0.2359 | 0.2359 | ||||

| NVDA / NVIDIA Corporation | Put | 0.01 | 1.30 | 0.2359 | 0.2359 | ||||

| NKE / NIKE, Inc. | Put | 0.02 | 1.27 | 0.2315 | 0.2315 | ||||

| PYPL / PayPal Holdings, Inc. | Put | 0.02 | 1.26 | 0.2300 | 0.2300 | ||||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | Call | 0.03 | 1.23 | 0.2248 | 0.2248 | ||||

| MRK / Merck & Co., Inc. | Put | 0.02 | 1.23 | 0.2234 | 0.2234 | ||||

| SBUX / Starbucks Corporation | Call | 0.01 | 1.20 | 0.2186 | 0.2186 | ||||

| ORCL / Oracle Corporation | Call | 0.01 | 1.18 | 0.2150 | 0.2150 | ||||

| SBUX / Starbucks Corporation | Put | 0.01 | 1.15 | 0.2102 | 0.2102 | ||||

| ISRG / Intuitive Surgical, Inc. | Put | 0.00 | 1.14 | 0.2078 | 0.2078 | ||||

| ADBE / Adobe Inc. | Put | 0.00 | 1.08 | 0.1972 | 0.1972 | ||||

| NFLX / Netflix, Inc. | Call | 0.00 | 1.07 | 0.1951 | 0.1951 | ||||

| ORCL / Oracle Corporation | Put | 0.00 | 1.05 | 0.1911 | 0.1911 | ||||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 1.04 | 0.1888 | 0.1888 | |||||

| AVGO / Broadcom Inc. | Put | 0.00 | 0.96 | 0.1757 | 0.1757 | ||||

| ITB / iShares Trust - iShares U.S. Home Construction ETF | 0.01 | 0.94 | 0.1713 | 0.1713 | |||||

| NFLX / Netflix, Inc. | Put | 0.00 | 0.94 | 0.1707 | 0.1707 | ||||

| AAPL / Apple Inc. | Call | 0.00 | 0.90 | 0.1644 | 0.1644 | ||||

| MU / Micron Technology, Inc. | Call | 0.01 | 0.90 | 0.1638 | 0.1638 | ||||

| PEP / PepsiCo, Inc. | Put | 0.01 | 0.90 | 0.1635 | 0.1635 | ||||

| AMD / Advanced Micro Devices, Inc. | Put | 0.01 | 0.87 | 0.1576 | 0.1576 | ||||

| BAC / Bank of America Corporation | Call | 0.02 | 0.86 | 0.1568 | 0.1568 | ||||

| MRVL / Marvell Technology, Inc. | Put | 0.01 | 0.84 | 0.1536 | 0.1536 | ||||

| DLTR / Dollar Tree, Inc. | Call | 0.01 | 0.83 | 0.1515 | 0.1515 | ||||

| AXP / American Express Company | Put | 0.00 | 0.83 | 0.1510 | 0.1510 | ||||

| AAPL / Apple Inc. | Put | 0.00 | 0.82 | 0.1494 | 0.1494 | ||||

| ISRG / Intuitive Surgical, Inc. | Call | 0.00 | 0.82 | 0.1484 | 0.1484 | ||||

| LOW / Lowe's Companies, Inc. | Put | 0.00 | 0.80 | 0.1454 | 0.1454 | ||||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | Call | 0.01 | 0.79 | 0.1430 | 0.1430 | ||||

| MU / Micron Technology, Inc. | Put | 0.01 | 0.78 | 0.1414 | 0.1414 | ||||

| TMO / Thermo Fisher Scientific Inc. | Call | 0.00 | 0.77 | 0.1403 | 0.1403 | ||||

| TGT / Target Corporation | Put | 0.01 | 0.77 | 0.1401 | 0.1401 | ||||

| GOOGL / Alphabet Inc. | Put | 0.00 | 0.76 | 0.1380 | 0.1380 | ||||

| NKE / NIKE, Inc. | Call | 0.01 | 0.74 | 0.1345 | 0.1345 | ||||

| MMM / 3M Company | Put | 0.00 | 0.73 | 0.1330 | 0.1330 | ||||

| FDX / FedEx Corporation | Put | 0.00 | 0.73 | 0.1324 | 0.1324 | ||||

| VST / Vistra Corp. | Put | 0.00 | 0.70 | 0.1270 | 0.1270 | ||||

| DIS / The Walt Disney Company | Call | 0.01 | 0.69 | 0.1264 | 0.1264 | ||||

| NEM / Newmont Corporation | Put | 0.01 | 0.69 | 0.1262 | 0.1262 | ||||

| TMO / Thermo Fisher Scientific Inc. | Put | 0.00 | 0.69 | 0.1255 | 0.1255 | ||||

| GEV / GE Vernova Inc. | Call | 0.00 | 0.69 | 0.1252 | 0.1252 | ||||

| NET / Cloudflare, Inc. | Put | 0.00 | 0.69 | 0.1248 | 0.1248 | ||||

| AMZN / Amazon.com, Inc. | Put | 0.00 | 0.68 | 0.1238 | 0.1238 | ||||

| DECK / Deckers Outdoor Corporation | Put | 0.01 | 0.67 | 0.1220 | 0.1220 | ||||

| DIS / The Walt Disney Company | Put | 0.01 | 0.67 | 0.1219 | 0.1219 | ||||

| CRM / Salesforce, Inc. | Put | 0.00 | 0.65 | 0.1192 | 0.1192 | ||||

| CEG / Constellation Energy Corporation | Put | 0.00 | 0.65 | 0.1175 | 0.1175 | ||||

| QCOM / QUALCOMM Incorporated | Call | 0.00 | 0.64 | 0.1160 | 0.1160 | ||||

| APP / AppLovin Corporation | Call | 0.00 | 0.63 | 0.1147 | 0.1147 | ||||

| PLTR / Palantir Technologies Inc. | Put | 0.00 | 0.63 | 0.1142 | 0.1142 | ||||

| LLY / Eli Lilly and Company | Call | 0.00 | 0.62 | 0.1135 | 0.1135 | ||||

| QCOM / QUALCOMM Incorporated | Put | 0.00 | 0.62 | 0.1131 | 0.1131 | ||||

| ZS / Zscaler, Inc. | Call | 0.00 | 0.57 | 0.1029 | 0.1029 | ||||

| CELH / Celsius Holdings, Inc. | Put | 0.01 | 0.56 | 0.1014 | 0.1014 | ||||

| GOOG / Alphabet Inc. | Put | 0.00 | 0.53 | 0.0969 | 0.0969 | ||||

| APP / AppLovin Corporation | Put | 0.00 | 0.53 | 0.0956 | 0.0956 | ||||

| PLTR / Palantir Technologies Inc. | Call | 0.00 | 0.52 | 0.0943 | 0.0943 | ||||

| CAT / Caterpillar Inc. | Put | 0.00 | 0.50 | 0.0919 | 0.0919 | ||||

| INTC / Intel Corporation | Put | 0.02 | 0.50 | 0.0905 | 0.0905 | ||||

| GS / The Goldman Sachs Group, Inc. | Put | 0.00 | 0.50 | 0.0902 | 0.0902 | ||||

| AXP / American Express Company | Call | 0.00 | 0.48 | 0.0871 | 0.0871 | ||||

| NEM / Newmont Corporation | Call | 0.01 | 0.47 | 0.0859 | 0.0859 | ||||

| VST / Vistra Corp. | Call | 0.00 | 0.47 | 0.0847 | 0.0847 | ||||

| INTC / Intel Corporation | Call | 0.02 | 0.46 | 0.0836 | 0.0836 | ||||

| PYPL / PayPal Holdings, Inc. | 0.01 | 0.46 | 0.0832 | 0.0832 | |||||

| TXN / Texas Instruments Incorporated | Put | 0.00 | 0.46 | 0.0832 | 0.0832 | ||||

| XOM / Exxon Mobil Corporation | Call | 0.00 | 0.45 | 0.0824 | 0.0824 | ||||

| CVNA / Carvana Co. | Put | 0.00 | 0.44 | 0.0798 | 0.0798 | ||||

| PYPL / PayPal Holdings, Inc. | Call | 0.01 | 0.42 | 0.0771 | 0.0771 | ||||

| AMAT / Applied Materials, Inc. | Put | 0.00 | 0.42 | 0.0767 | 0.0767 | ||||

| BLK / BlackRock, Inc. | Put | 0.00 | 0.42 | 0.0764 | 0.0764 | ||||

| RBLX / Roblox Corporation | Call | 0.00 | 0.41 | 0.0747 | 0.0747 | ||||

| GOOG / Alphabet Inc. | Call | 0.00 | 0.41 | 0.0743 | 0.0743 | ||||

| BAC / Bank of America Corporation | Put | 0.01 | 0.40 | 0.0732 | 0.0732 | ||||

| LLY / Eli Lilly and Company | 0.00 | 0.40 | 0.0725 | 0.0725 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | Call | 0.00 | -77.42 | 0.40 | -80.67 | 0.0723 | -0.0965 | ||

| MMM / 3M Company | Call | 0.00 | 0.38 | 0.0693 | 0.0693 | ||||

| JPM / JPMorgan Chase & Co. | Put | 0.00 | 0.38 | 0.0686 | 0.0686 | ||||

| CVNA / Carvana Co. | Call | 0.00 | 0.37 | 0.0675 | 0.0675 | ||||

| GOOGL / Alphabet Inc. | Call | 0.00 | 0.37 | 0.0674 | 0.0674 | ||||

| GS / The Goldman Sachs Group, Inc. | Call | 0.00 | 0.35 | 0.0644 | 0.0644 | ||||

| TEM / Tempus AI, Inc. | Put | 0.01 | 0.35 | 0.0636 | 0.0636 | ||||

| PEP / PepsiCo, Inc. | Call | 0.00 | 0.32 | 0.0577 | 0.0577 | ||||

| BLK / BlackRock, Inc. | Call | 0.00 | 0.31 | 0.0573 | 0.0573 | ||||

| DECK / Deckers Outdoor Corporation | 0.00 | 0.30 | 0.0544 | 0.0544 | |||||

| MSFT / Microsoft Corporation | Put | 0.00 | 0.30 | 0.0543 | 0.0543 | ||||

| IBM / International Business Machines Corporation | Put | 0.00 | 0.29 | 0.0537 | 0.0537 | ||||

| MRVL / Marvell Technology, Inc. | Call | 0.00 | 0.29 | 0.0536 | 0.0536 | ||||

| PFE / Pfizer Inc. | Put | 0.01 | 0.29 | 0.0534 | 0.0534 | ||||

| RBLX / Roblox Corporation | Put | 0.00 | 0.28 | 0.0517 | 0.0517 | ||||

| CAT / Caterpillar Inc. | Call | 0.00 | 0.27 | 0.0495 | 0.0495 | ||||

| AMD / Advanced Micro Devices, Inc. | Call | 0.00 | 0.27 | 0.0491 | 0.0491 | ||||

| DLTR / Dollar Tree, Inc. | Put | 0.00 | 0.27 | 0.0487 | 0.0487 | ||||

| AMAT / Applied Materials, Inc. | Call | 0.00 | 0.26 | 0.0467 | 0.0467 | ||||

| NET / Cloudflare, Inc. | 0.00 | 0.25 | 0.0459 | 0.0459 | |||||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.25 | 0.0454 | 0.0454 | |||||

| MRVL / Marvell Technology, Inc. | 0.00 | 0.25 | 0.0452 | 0.0452 | |||||

| PEP / PepsiCo, Inc. | 0.00 | 0.25 | 0.0448 | 0.0448 | |||||

| CEG / Constellation Energy Corporation | 0.00 | 0.24 | 0.0444 | 0.0444 | |||||

| FDX / FedEx Corporation | 0.00 | 0.24 | 0.0428 | 0.0428 | |||||

| MCD / McDonald's Corporation | Put | 0.00 | 0.23 | 0.0426 | 0.0426 | ||||

| FDX / FedEx Corporation | Call | 0.00 | 0.23 | 0.0414 | 0.0414 | ||||

| XOM / Exxon Mobil Corporation | Put | 0.00 | 0.23 | 0.0412 | 0.0412 | ||||

| CRM / Salesforce, Inc. | 0.00 | 0.22 | 0.0410 | 0.0410 | |||||

| AMGN / Amgen Inc. | Put | 0.00 | 0.22 | 0.0407 | 0.0407 | ||||

| ZS / Zscaler, Inc. | Put | 0.00 | 0.22 | 0.0400 | 0.0400 | ||||

| CELH / Celsius Holdings, Inc. | 0.00 | 0.21 | 0.0387 | 0.0387 | |||||

| GEV / GE Vernova Inc. | Put | 0.00 | 0.21 | 0.0385 | 0.0385 | ||||

| UPS / United Parcel Service, Inc. | Put | 0.00 | 0.18 | 0.0331 | 0.0331 | ||||

| LOW / Lowe's Companies, Inc. | Call | 0.00 | 0.18 | 0.0323 | 0.0323 | ||||

| TEM / Tempus AI, Inc. | 0.00 | 0.17 | 0.0311 | 0.0311 | |||||

| CEG / Constellation Energy Corporation | Call | 0.00 | 0.16 | 0.0294 | 0.0294 | ||||

| ITB / iShares Trust - iShares U.S. Home Construction ETF | Call | 0.00 | 0.16 | 0.0288 | 0.0288 | ||||

| TXN / Texas Instruments Incorporated | 0.00 | 0.15 | 0.0280 | 0.0280 | |||||

| CRM / Salesforce, Inc. | Call | 0.00 | 0.14 | 0.0248 | 0.0248 | ||||

| PFE / Pfizer Inc. | 0.01 | 0.14 | 0.0248 | 0.0248 | |||||

| AMGN / Amgen Inc. | 0.00 | 0.13 | 0.0242 | 0.0242 | |||||

| SBUX / Starbucks Corporation | 0.00 | 0.13 | 0.0239 | 0.0239 | |||||

| CELH / Celsius Holdings, Inc. | Call | 0.00 | 0.13 | 0.0228 | 0.0228 | ||||

| DECK / Deckers Outdoor Corporation | Call | 0.00 | 0.12 | 0.0225 | 0.0225 | ||||

| NET / Cloudflare, Inc. | Call | 0.00 | 0.12 | 0.0214 | 0.0214 | ||||

| AMAT / Applied Materials, Inc. | 0.00 | 0.10 | 0.0187 | 0.0187 | |||||

| CAT / Caterpillar Inc. | 0.00 | 0.10 | 0.0181 | 0.0181 | |||||

| NEM / Newmont Corporation | 0.00 | 0.10 | 0.0175 | 0.0175 | |||||

| AMGN / Amgen Inc. | Call | 0.00 | 0.08 | 0.0153 | 0.0153 | ||||

| AMD / Advanced Micro Devices, Inc. | 0.00 | 0.08 | 0.0150 | 0.0150 | |||||

| GOOGL / Alphabet Inc. | 0.00 | 0.08 | 0.0148 | 0.0148 | |||||

| MCD / McDonald's Corporation | 0.00 | 0.08 | 0.0140 | 0.0140 | |||||

| VST / Vistra Corp. | 0.00 | 0.07 | 0.0134 | 0.0134 | |||||

| MMM / 3M Company | 0.00 | 0.06 | 0.0105 | 0.0105 | |||||

| PFE / Pfizer Inc. | Call | 0.00 | 0.03 | 0.0062 | 0.0062 | ||||

| MCD / McDonald's Corporation | Call | 0.00 | 0.03 | 0.0053 | 0.0053 | ||||

| PLTR / Palantir Technologies Inc. | 0.00 | 0.02 | 0.0038 | 0.0038 | |||||

| MU / Micron Technology, Inc. | 0.00 | 0.02 | 0.0038 | 0.0038 | |||||

| TEM / Tempus AI, Inc. | Call | 0.00 | 0.01 | 0.0023 | 0.0023 | ||||

| FCX / Freeport-McMoRan Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| FXI / iShares Trust - iShares China Large-Cap ETF | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.4870 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| QQQ / Invesco QQQ Trust, Series 1 | Call | 0.00 | -100.00 | 0.00 | -100.00 | -44.8724 | |||

| FEZ / SPDR Index Shares Funds - SPDR EURO STOXX 50 ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| KWEB / KraneShares Trust - KraneShares CSI China Internet ETF | Call | 0.00 | -100.00 | 0.00 | 0.0000 |