Mga Batayang Estadistika

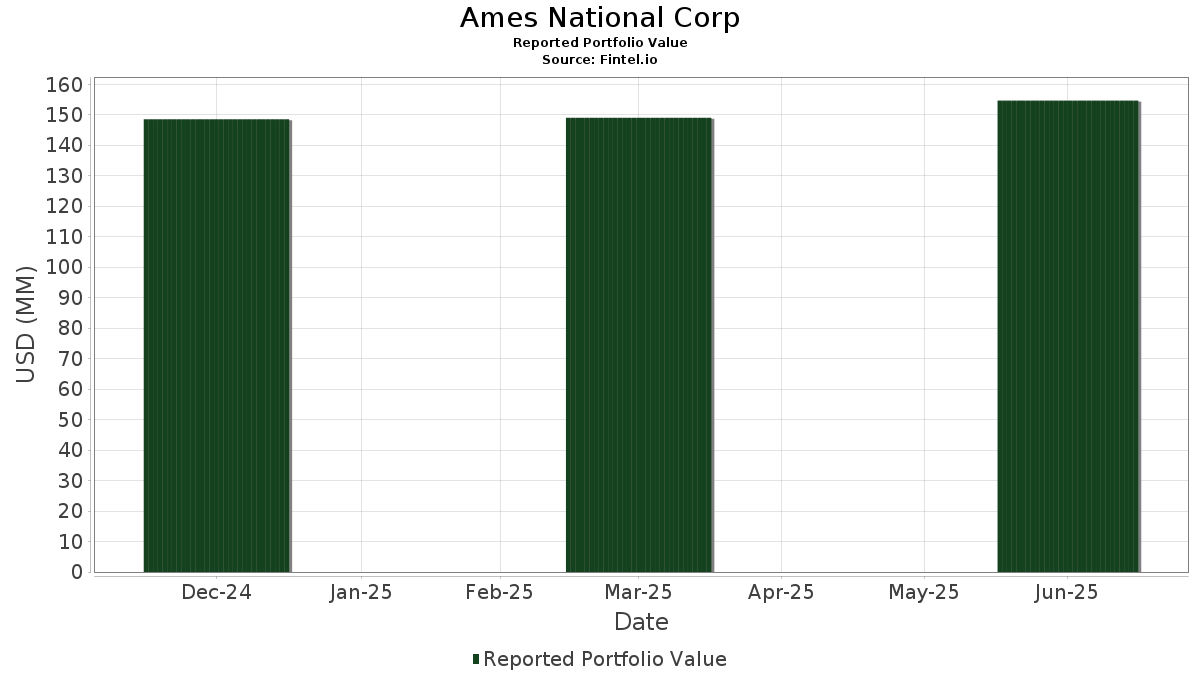

| Nilai Portofolio | $ 154,641,627 |

| Posisi Saat Ini | 65 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Ames National Corp telah mengungkapkan total kepemilikan 65 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 154,641,627 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Ames National Corp adalah iShares Trust - iShares Core S&P 500 ETF (US:IVV) , Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF (US:BSV) , Vanguard Bond Index Funds - Vanguard Total Bond Market ETF (US:BND) , iShares Trust - iShares Core U.S. Aggregate Bond ETF (US:AGG) , and Microsoft Corporation (US:MSFT) . Posisi baru Ames National Corp meliputi: ConocoPhillips (US:COP) , International Business Machines Corporation (US:IBM) , Kimberly-Clark Corporation (US:KMB) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.34 | 0.2198 | 0.2198 | |

| 0.01 | 0.89 | 0.3553 | 0.2042 | |

| 0.00 | 0.23 | 0.1485 | 0.1485 | |

| 0.00 | 0.21 | 0.1341 | 0.1341 | |

| 0.00 | 0.27 | 0.1083 | 0.1083 | |

| 0.00 | 0.21 | 0.0848 | 0.0848 | |

| 0.03 | 0.26 | 0.1047 | 0.0128 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 34.33 | 13.6688 | -6.6176 | |

| 0.14 | 10.84 | 4.3171 | -3.2763 | |

| 0.14 | 10.42 | 4.1504 | -3.1919 | |

| 0.10 | 10.40 | 4.1413 | -3.1819 | |

| 0.09 | 4.36 | 1.7345 | -1.3701 | |

| 0.02 | 8.57 | 3.4120 | -1.3393 | |

| 0.06 | 5.52 | 2.1964 | -1.3174 | |

| 0.07 | 5.17 | 2.0570 | -1.0918 | |

| 0.02 | 3.77 | 1.4998 | -0.9124 | |

| 0.01 | 3.01 | 1.1966 | -0.9062 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-12 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.06 | 2.77 | 34.33 | 13.56 | 13.6688 | -6.6176 | |||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.14 | -4.69 | 10.84 | -4.18 | 4.3171 | -3.2763 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.14 | -4.96 | 10.42 | -4.73 | 4.1504 | -3.1919 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.10 | -4.96 | 10.40 | -4.69 | 4.1413 | -3.1819 | |||

| MSFT / Microsoft Corporation | 0.02 | -8.66 | 8.57 | 21.03 | 3.4120 | -1.3393 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.06 | -2.55 | 5.52 | 5.35 | 2.1964 | -1.3174 | |||

| VXUS / Vanguard STAR Funds - Vanguard Total International Stock ETF | 0.07 | -1.04 | 5.17 | 10.10 | 2.0570 | -1.0918 | |||

| VTIP / Vanguard Malvern Funds - Vanguard Short-Term Inflation-Protected Securities ETF | 0.09 | -6.53 | 4.36 | -5.84 | 1.7345 | -1.3701 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.02 | -3.12 | 3.77 | 4.79 | 1.4998 | -0.9124 | |||

| AAPL / Apple Inc. | 0.02 | -3.31 | 3.74 | -10.69 | 2.4192 | -0.3923 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.01 | -6.70 | 3.42 | 14.42 | 1.3618 | -0.6441 | |||

| GOEPPINGER ENTERPRISES INC / (GEI001202) | 0.00 | 3.34 | 0.0000 | ||||||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.01 | 0.00 | 3.12 | 10.60 | 1.2428 | -0.6513 | |||

| HD / The Home Depot, Inc. | 0.01 | -4.13 | 3.01 | -4.09 | 1.1966 | -0.9062 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.05 | 2.35 | 2.91 | 8.81 | 1.1604 | -0.6373 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -6.60 | 2.46 | 10.41 | 0.9801 | -0.5164 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -4.65 | 2.27 | -13.03 | 0.9041 | -0.8480 | |||

| JNJ / Johnson & Johnson | 0.01 | -3.75 | 2.02 | -7.31 | 0.8036 | -0.6575 | |||

| GOOG / Alphabet Inc. | 0.01 | -0.64 | 1.93 | 12.84 | 0.7668 | -0.3787 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.02 | 7.75 | 1.84 | 12.67 | 0.7331 | -0.3641 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -0.59 | 1.83 | 0.33 | 0.7295 | -0.4957 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 3.69 | 1.76 | 14.63 | 0.6992 | -0.3290 | |||

| TRV / The Travelers Companies, Inc. | 0.01 | -3.17 | 1.71 | -2.00 | 0.6826 | -0.4919 | |||

| PG / The Procter & Gamble Company | 0.01 | -10.40 | 1.63 | -16.21 | 0.6503 | -0.6582 | |||

| MCD / McDonald's Corporation | 0.01 | -6.50 | 1.55 | -12.55 | 0.6190 | -0.5739 | |||

| CVX / Chevron Corporation | 0.01 | -27.56 | 1.46 | -2.67 | 0.5812 | -0.4250 | |||

| UNP / Union Pacific Corporation | 0.01 | 58.76 | 1.38 | 0.15 | 0.5481 | -0.3742 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 1.14 | 1.03 | 13.76 | 0.4083 | -0.1969 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 0.00 | 0.98 | -9.37 | 0.3894 | -0.3346 | |||

| WMT / Walmart Inc. | 0.01 | -0.56 | 0.96 | 10.71 | 0.3830 | -0.1998 | |||

| ATLO / Ames National Corporation | 0.05 | 21.32 | 0.92 | 23.39 | 0.3656 | -0.1340 | |||

| WFC / Wells Fargo & Company | 0.01 | 255.18 | 0.89 | 296.44 | 0.3553 | 0.2042 | |||

| GD / General Dynamics Corporation | 0.00 | 0.00 | 0.80 | 7.09 | 0.3190 | -0.1835 | |||

| MRK / Merck & Co., Inc. | 0.01 | -3.62 | 0.74 | -14.99 | 0.2936 | -0.2886 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.02 | -20.45 | 0.72 | -20.64 | 0.4655 | -0.1428 | |||

| V / Visa Inc. | 0.00 | -3.62 | 0.71 | -2.34 | 0.2826 | -0.2052 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | 0.57 | 0.70 | 4.31 | 0.2796 | -0.1723 | |||

| BLK / BlackRock, Inc. | 0.00 | -13.23 | 0.70 | -3.84 | 0.2795 | -0.2102 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 0.68 | -40.42 | 0.2701 | -0.4941 | |||

| BX / Blackstone Inc. | 0.00 | 0.00 | 0.58 | 6.97 | 0.2323 | -0.1336 | |||

| NSC / Norfolk Southern Corporation | 0.00 | 0.00 | 0.56 | 8.06 | 0.2242 | -0.1255 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.54 | 10.39 | 0.2160 | -0.1136 | |||

| PPG / PPG Industries, Inc. | 0.00 | -0.61 | 0.52 | 3.39 | 0.2070 | -0.1304 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.50 | 14.03 | 0.2009 | -0.0962 | |||

| NKE / NIKE, Inc. | 0.01 | 3.16 | 0.46 | 15.46 | 0.1847 | -0.0849 | |||

| DE / Deere & Company | 0.00 | -14.18 | 0.46 | -7.06 | 0.1839 | -0.1494 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.00 | 0.00 | 0.45 | 3.42 | 0.1805 | -0.1138 | |||

| PEP / PepsiCo, Inc. | 0.00 | -22.83 | 0.45 | -32.01 | 0.1777 | -0.2630 | |||

| AFL / Aflac Incorporated | 0.00 | 0.00 | 0.43 | -5.13 | 0.1694 | -0.1317 | |||

| T / AT&T Inc. | 0.01 | 0.00 | 0.41 | 2.53 | 0.1618 | -0.1047 | |||

| DIS / The Walt Disney Company | 0.00 | 0.00 | 0.40 | 25.79 | 0.1596 | -0.0545 | |||

| PFE / Pfizer Inc. | 0.02 | 0.00 | 0.39 | -4.40 | 0.1560 | -0.1189 | |||

| SYY / Sysco Corporation | 0.01 | -8.36 | 0.39 | -7.67 | 0.1537 | -0.1263 | |||

| VZ / Verizon Communications Inc. | 0.01 | -12.40 | 0.38 | -16.34 | 0.1510 | -0.1535 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 0.00 | 0.36 | -4.23 | 0.1443 | -0.1100 | |||

| KO / The Coca-Cola Company | 0.00 | 0.00 | 0.35 | -1.13 | 0.1394 | -0.0984 | |||

| COP / ConocoPhillips | 0.00 | 0.34 | 0.2198 | 0.2198 | |||||

| RTX / RTX Corporation | 0.00 | 0.00 | 0.33 | 10.30 | 0.1325 | -0.0701 | |||

| ABT / Abbott Laboratories | 0.00 | 0.00 | 0.32 | 2.60 | 0.1259 | -0.0811 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.27 | 0.1083 | 0.1083 | |||||

| DNP / DNP Select Income Fund Inc. | 0.03 | 93.90 | 0.26 | 92.65 | 0.1047 | 0.0128 | |||

| LNT / Alliant Energy Corporation | 0.00 | -25.41 | 0.26 | -29.81 | 0.1032 | -0.1449 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.23 | 0.1485 | 0.1485 | |||||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.00 | 0.21 | 0.0848 | 0.0848 | |||||

| KMB / Kimberly-Clark Corporation | 0.00 | 0.21 | 0.1341 | 0.1341 | |||||

| CASY / Casey's General Stores, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EMR / Emerson Electric Co. | 0.00 | -100.00 | 0.00 | 0.0000 |