Mga Batayang Estadistika

| Nilai Portofolio | $ 82,323,821 |

| Posisi Saat Ini | 43 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

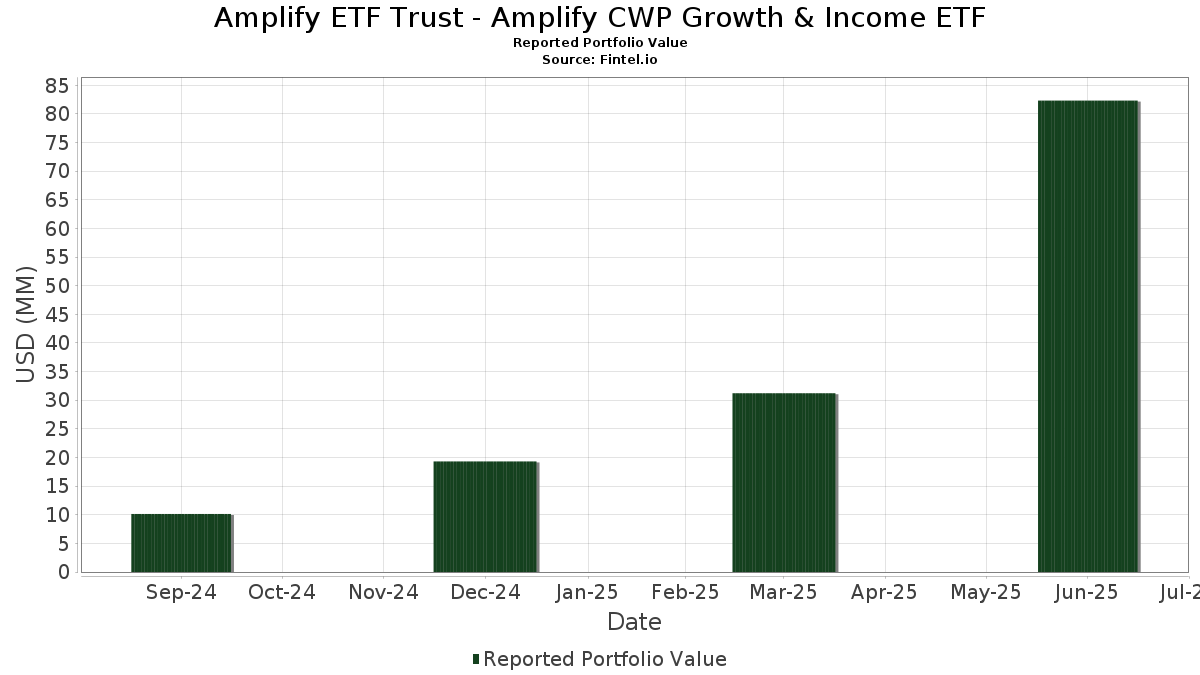

Amplify ETF Trust - Amplify CWP Growth & Income ETF telah mengungkapkan total kepemilikan 43 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 82,323,821 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Amplify ETF Trust - Amplify CWP Growth & Income ETF adalah NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Meta Platforms, Inc. (US:META) , and Amazon.com, Inc. (US:AMZN) . Posisi baru Amplify ETF Trust - Amplify CWP Growth & Income ETF meliputi: e.l.f. Beauty, Inc. (US:ELF) , The Boeing Company (US:BA) , The Coca-Cola Company (US:KO) , Jabil Inc. (US:JBL) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 9.51 | 11.7852 | 2.6131 | |

| 0.01 | 3.81 | 4.7175 | 1.6563 | |

| 0.01 | 7.23 | 8.9648 | 1.6393 | |

| 0.02 | 2.26 | 2.8051 | 1.6045 | |

| 0.02 | 1.17 | 1.4447 | 0.9362 | |

| 0.01 | 5.20 | 6.4477 | 0.7605 | |

| 0.00 | 3.83 | 4.7427 | 0.7604 | |

| 0.00 | 0.60 | 0.7455 | 0.7455 | |

| 0.01 | 1.15 | 1.4207 | 0.7246 | |

| 0.00 | 0.58 | 0.7138 | 0.7138 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 5.86 | 7.2650 | -1.5826 | |

| 0.01 | 2.03 | 2.5182 | -1.4390 | |

| 0.00 | 0.92 | 1.1353 | -0.9194 | |

| 0.00 | 1.03 | 1.2741 | -0.9168 | |

| 0.00 | 0.47 | 0.5887 | -0.8995 | |

| 0.00 | 0.16 | 0.1972 | -0.6017 | |

| 0.00 | 0.41 | 0.5099 | -0.5872 | |

| 0.01 | 1.63 | 2.0150 | -0.3877 | |

| 0.00 | 1.37 | 1.6988 | -0.3287 | |

| 0.02 | 4.22 | 5.2282 | -0.3218 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-27 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.06 | 127.28 | 9.51 | 231.37 | 11.7852 | 2.6131 | |||

| MSFT / Microsoft Corporation | 0.01 | 138.15 | 7.23 | 215.63 | 8.9648 | 1.6393 | |||

| AAPL / Apple Inc. | 0.03 | 129.24 | 5.86 | 111.78 | 7.2650 | -1.5826 | |||

| META / Meta Platforms, Inc. | 0.01 | 128.28 | 5.20 | 192.36 | 6.4477 | 0.7605 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 129.18 | 4.78 | 164.27 | 5.9230 | 0.1438 | |||

| GOOGL / Alphabet Inc. | 0.02 | 113.15 | 4.22 | 142.91 | 5.2282 | -0.3218 | |||

| NFLX / Netflix, Inc. | 0.00 | 113.85 | 3.83 | 207.23 | 4.7427 | 0.7604 | |||

| AVGO / Broadcom Inc. | 0.01 | 141.36 | 3.81 | 297.60 | 4.7175 | 1.6563 | |||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 3.49 | 202.36 | 3.49 | 202.43 | 4.3235 | 0.6364 | |||

| AMD / Advanced Micro Devices, Inc. | 0.02 | 336.19 | 2.26 | 503.20 | 2.8051 | 1.6045 | |||

| V / Visa Inc. | 0.01 | 128.79 | 2.21 | 131.97 | 2.7350 | -0.3076 | |||

| TSLA / Tesla, Inc. | 0.01 | 33.87 | 2.03 | 64.05 | 2.5182 | -1.4390 | |||

| COR / Cencora, Inc. | 0.01 | 100.55 | 1.63 | 116.38 | 2.0150 | -0.3877 | |||

| MCK / McKesson Corporation | 0.00 | 105.11 | 1.56 | 123.53 | 1.9321 | -0.2987 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 155.52 | 1.52 | 128.31 | 1.8799 | -0.2437 | |||

| ALL / The Allstate Corporation | 0.01 | 128.70 | 1.42 | 122.29 | 1.7561 | -0.2806 | |||

| ORCL / Oracle Corporation | 0.01 | 165.60 | 1.39 | 316.12 | 1.7283 | 0.6553 | |||

| LLY / Eli Lilly and Company | 0.00 | 128.91 | 1.37 | 116.09 | 1.6988 | -0.3287 | |||

| HOOD / Robinhood Markets, Inc. | 0.01 | 73.70 | 1.30 | 291.24 | 1.6060 | 0.5462 | |||

| COST / Costco Wholesale Corporation | 0.00 | 147.42 | 1.28 | 159.11 | 1.5879 | 0.0068 | |||

| RTX / RTX Corporation | 0.01 | 128.31 | 1.25 | 151.71 | 1.5518 | -0.0381 | |||

| HON / Honeywell International Inc. | 0.01 | 128.46 | 1.23 | 151.53 | 1.5248 | -0.0400 | |||

| SPF / Spotify Technology S.A. | 0.00 | 263.25 | 1.17 | 657.79 | 1.4477 | -0.0726 | |||

| CSCO / Cisco Systems, Inc. | 0.02 | 551.59 | 1.17 | 632.70 | 1.4447 | 0.9362 | |||

| RBLX / Roblox Corporation | 0.01 | 191.60 | 1.15 | 428.11 | 1.4207 | 0.7246 | |||

| LIN / Linde plc | 0.00 | 144.10 | 1.12 | 146.36 | 1.3842 | -0.0670 | |||

| PG / The Procter & Gamble Company | 0.01 | 128.60 | 1.10 | 113.57 | 1.3671 | -0.2824 | |||

| DASH / DoorDash, Inc. | 0.00 | 127.40 | 1.05 | 207.35 | 1.2960 | 0.2064 | |||

| AMGN / Amgen Inc. | 0.00 | 67.32 | 1.03 | 49.93 | 1.2741 | -0.9168 | |||

| HWM / Howmet Aerospace Inc. | 0.01 | 188.96 | 0.96 | 315.58 | 1.1901 | 0.4499 | |||

| HD / The Home Depot, Inc. | 0.00 | 42.42 | 0.92 | 42.52 | 1.1353 | -0.9194 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 192.70 | 0.78 | 250.90 | 0.9660 | 0.2564 | |||

| ELF / e.l.f. Beauty, Inc. | 0.00 | 0.60 | 0.7455 | 0.7455 | |||||

| BA / The Boeing Company | 0.00 | 0.58 | 0.7138 | 0.7138 | |||||

| KO / The Coca-Cola Company | 0.01 | 0.52 | 0.6392 | 0.6392 | |||||

| EQIX / Equinix, Inc. | 0.00 | 4.55 | 0.47 | 1.94 | 0.5887 | -0.8995 | |||

| JBL / Jabil Inc. | 0.00 | 0.46 | 0.5742 | 0.5742 | |||||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 9.24 | 0.41 | 19.83 | 0.5099 | -0.5872 | |||

| PLTR / Palantir Technologies Inc. | 0.00 | 0.39 | 0.4806 | 0.4806 | |||||

| PEP / PepsiCo, Inc. | 0.00 | -27.71 | 0.16 | -36.14 | 0.1972 | -0.6017 | |||

| VZ / Verizon Communications Inc. | 0.00 | 92.96 | 0.01 | 83.33 | 0.0147 | -0.0059 | |||

| Palantir Technologies Inc / DE (N/A) | -0.01 | -0.0071 | -0.0071 | ||||||

| T-Mobile US Inc / DE (N/A) | -0.06 | -0.0686 | -0.0686 |