Mga Batayang Estadistika

| Nilai Portofolio | $ 365,380,000 |

| Posisi Saat Ini | 196 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

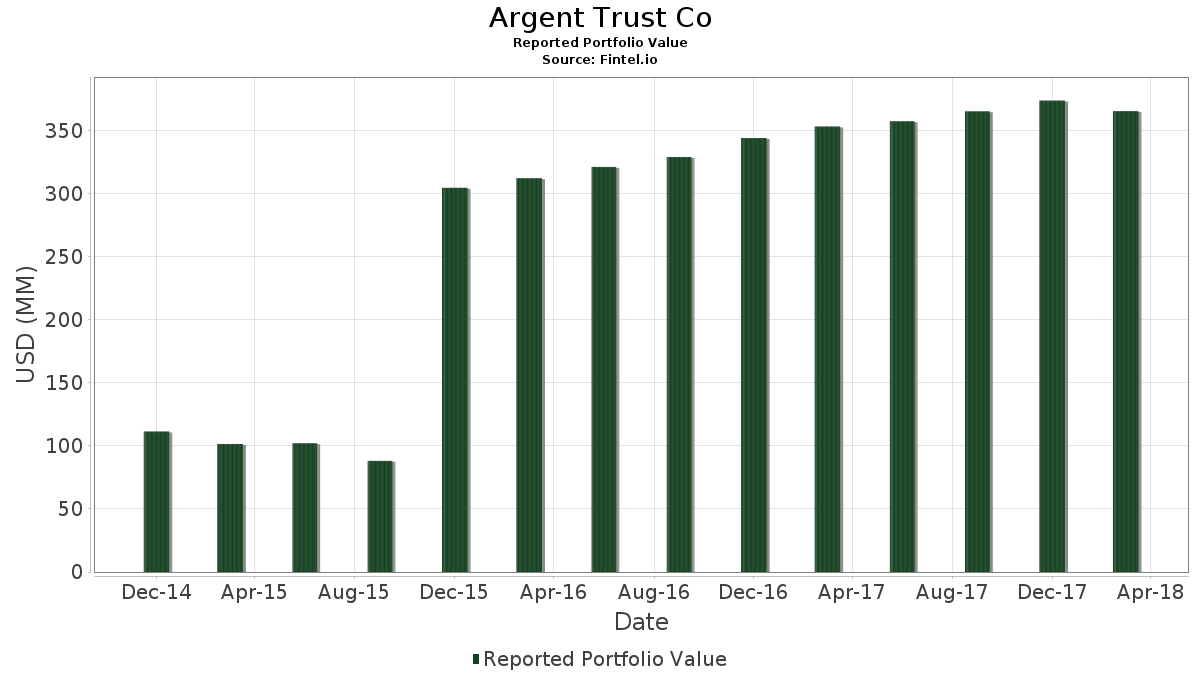

Argent Trust Co telah mengungkapkan total kepemilikan 196 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 365,380,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Argent Trust Co adalah Exxon Mobil Corporation (US:XOM) , Apple Inc. (US:AAPL) , JPMorgan Chase & Co. (US:JPM) , Microsoft Corporation (US:MSFT) , and Chevron Corporation (US:CVX) . Posisi baru Argent Trust Co meliputi: BancorpSouth Bank (US:BXS) , Sprott Physical Gold and Silver Trust (US:CEF) , Zions Bancorporation, National Association (US:ZION) , General Dynamics Corporation (US:GD) , and SEI Investments Company (US:SEIC) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.15 | 4.62 | 1.2644 | 1.2644 | |

| 0.11 | 4.10 | 1.1224 | 1.1224 | |

| 0.04 | 3.94 | 1.0789 | 1.0789 | |

| 0.10 | 2.91 | 0.7970 | 0.7970 | |

| 0.03 | 1.78 | 0.4874 | 0.4874 | |

| 0.01 | 1.72 | 0.4699 | 0.4699 | |

| 0.04 | 1.32 | 0.3621 | 0.3621 | |

| 0.02 | 1.25 | 0.3435 | 0.3435 | |

| 0.04 | 1.09 | 0.2972 | 0.2972 | |

| 0.02 | 1.07 | 0.2918 | 0.2918 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.18 | 13.38 | 3.6611 | -0.4900 | |

| 0.29 | 3.85 | 1.0526 | -0.4088 | |

| 0.33 | 6.49 | 1.7765 | -0.1927 | |

| 0.09 | 6.76 | 1.8512 | -0.1811 | |

| 0.08 | 4.02 | 1.1005 | -0.1669 | |

| 0.08 | 8.71 | 2.3846 | -0.1408 | |

| 0.06 | 8.26 | 2.2618 | -0.1361 | |

| 0.06 | 6.53 | 1.7883 | -0.1285 | |

| 0.11 | 4.06 | 1.1117 | -0.1201 | |

| 0.03 | 5.75 | 1.5732 | -0.1034 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2018-05-11 untuk periode pelaporan 2018-03-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| XOM / Exxon Mobil Corporation | 0.18 | -3.35 | 13.38 | -13.78 | 3.6611 | -0.4900 | |||

| AAPL / Apple Inc. | 0.07 | -2.03 | 12.25 | -2.87 | 3.3538 | -0.0217 | |||

| JPM / JPMorgan Chase & Co. | 0.10 | -1.05 | 11.51 | 1.75 | 3.1496 | 0.1235 | |||

| MSFT / Microsoft Corporation | 0.11 | -6.59 | 10.46 | -0.32 | 2.8620 | 0.0550 | |||

| CVX / Chevron Corporation | 0.08 | 1.34 | 8.71 | -7.69 | 2.3846 | -0.1408 | |||

| JNJ / Johnson & Johnson | 0.06 | 0.54 | 8.26 | -7.79 | 2.2618 | -0.1361 | |||

| BA / The Boeing Company | 0.02 | -12.68 | 7.95 | -2.92 | 2.1747 | -0.0152 | |||

| HON / Honeywell International Inc. | 0.05 | 0.90 | 7.15 | -4.93 | 1.9560 | -0.0554 | |||

| PG / The Procter & Gamble Company | 0.09 | 3.20 | 6.76 | -10.95 | 1.8512 | -0.1811 | |||

| PFE / Pfizer Inc. | 0.19 | 2.99 | 6.65 | 0.91 | 1.8208 | 0.0568 | |||

| PEP / PepsiCo, Inc. | 0.06 | 0.19 | 6.53 | -8.79 | 1.7883 | -0.1285 | |||

| GEL / Genesis Energy, L.P. - Limited Partnership | 0.33 | 0.00 | 6.49 | -11.81 | 1.7765 | -0.1927 | |||

| MMM / 3M Company | 0.03 | -1.64 | 5.75 | -8.27 | 1.5732 | -0.1034 | |||

| INTC / Intel Corporation | 0.11 | -2.07 | 5.74 | 10.49 | 1.5704 | 0.1810 | |||

| GOOGL / Alphabet Inc. | 0.01 | -1.68 | 5.33 | -3.20 | 1.4579 | -0.0144 | |||

| GOOG / Alphabet Inc. | 0.01 | -1.51 | 5.26 | -2.90 | 1.4399 | -0.0098 | |||

| VZ / Verizon Communications Inc. | 0.10 | 6.52 | 4.79 | -3.78 | 1.3107 | -0.0209 | |||

| CSCO / Cisco Systems, Inc. | 0.11 | -1.11 | 4.77 | 10.71 | 1.3066 | 0.1529 | |||

| BAC / Bank of America Corporation | 0.16 | -0.15 | 4.75 | 1.43 | 1.2995 | 0.0470 | |||

| BXS / BancorpSouth Bank | 0.15 | 4.62 | 1.2644 | 1.2644 | |||||

| ABBV / AbbVie Inc. | 0.05 | -4.75 | 4.54 | -6.79 | 1.2434 | -0.0607 | |||

| SLB / Schlumberger Limited | 0.07 | 2.48 | 4.53 | -1.50 | 1.2404 | 0.0093 | |||

| KO / The Coca-Cola Company | 0.10 | -0.08 | 4.29 | -5.42 | 1.1738 | -0.0395 | |||

| IBM / International Business Machines Corporation | 0.03 | -0.48 | 4.23 | -0.47 | 1.1569 | 0.0206 | |||

| SCI / Service Corporation International | 0.11 | -0.11 | 4.10 | 1.01 | 1.1224 | 1.1224 | |||

| V / Visa Inc. | 0.03 | -1.21 | 4.10 | 3.64 | 1.1218 | 0.0637 | |||

| MRK / Merck & Co., Inc. | 0.07 | 3.18 | 4.08 | -0.12 | 1.1161 | 0.0237 | |||

| T / AT&T Inc. | 0.11 | -3.81 | 4.06 | -11.77 | 1.1117 | -0.1201 | |||

| WFC / Wells Fargo & Company | 0.08 | -1.74 | 4.02 | -15.12 | 1.1005 | -0.1669 | |||

| CFR / Cullen/Frost Bankers, Inc. | 0.04 | 0.79 | 3.94 | 12.95 | 1.0789 | 1.0789 | |||

| GE / General Electric Company | 0.29 | -8.83 | 3.85 | -29.59 | 1.0526 | -0.4088 | |||

| WMT / Walmart Inc. | 0.04 | -0.20 | 3.82 | -10.08 | 1.0452 | -0.0911 | |||

| AXP / American Express Company | 0.04 | -1.13 | 3.70 | -7.12 | 1.0135 | -0.0533 | |||

| ITW / Illinois Tool Works Inc. | 0.02 | 2.87 | 3.68 | -3.41 | 1.0069 | -0.0122 | |||

| MCD / McDonald's Corporation | 0.02 | -1.64 | 3.44 | -10.62 | 0.9423 | -0.0883 | |||

| BMY / Bristol-Myers Squibb Company | 0.05 | 0.51 | 3.33 | 3.70 | 0.9117 | 0.0523 | |||

| DIS / The Walt Disney Company | 0.03 | 2.68 | 3.21 | -4.09 | 0.8791 | -0.0170 | |||

| MKC / McCormick & Company, Incorporated | 0.03 | -0.80 | 3.19 | 3.60 | 0.8742 | 0.0493 | |||

| CBTX / CBTX Inc | 0.10 | -9.18 | 2.91 | -9.85 | 0.7970 | 0.7970 | |||

| FDX / FedEx Corporation | 0.01 | -0.93 | 2.71 | -4.68 | 0.7417 | -0.0190 | |||

| ABT / Abbott Laboratories | 0.04 | -1.59 | 2.66 | 3.34 | 0.7277 | 0.0393 | |||

| RTX / RTX Corporation | 0.02 | 6.37 | 2.63 | 4.91 | 0.7198 | 0.0490 | |||

| NOC / Northrop Grumman Corporation | 0.01 | 0.00 | 2.61 | 13.76 | 0.7149 | 0.1006 | |||

| GILD / Gilead Sciences, Inc. | 0.03 | -1.68 | 2.58 | 3.44 | 0.7069 | 0.0388 | |||

| DGX / Quest Diagnostics Incorporated | 0.02 | -0.12 | 2.50 | 1.71 | 0.6842 | 0.0266 | |||

| C.WSA / Citigroup, Inc. | 0.00 | -0.18 | 2.46 | 5.25 | 0.6746 | 0.0480 | |||

| ORCL / Oracle Corporation | 0.05 | 7.88 | 2.42 | 4.40 | 0.6621 | 0.0421 | |||

| META / Meta Platforms, Inc. | 0.01 | 7.80 | 2.38 | -2.38 | 0.6522 | -0.0009 | |||

| CVS / CVS Health Corporation | 0.04 | 10.30 | 2.36 | -5.34 | 0.6456 | -0.0211 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -15.72 | 2.35 | -8.38 | 0.6434 | -0.0431 | |||

| MDT / Medtronic plc | 0.03 | 1.13 | 2.35 | 0.47 | 0.6423 | 0.0173 | |||

| C / Citigroup Inc. | 0.03 | 0.52 | 2.34 | -8.83 | 0.6413 | -0.0464 | |||

| ETR / Entergy Corporation | 0.03 | -1.70 | 2.13 | -4.82 | 0.5835 | -0.0158 | |||

| HAL / Halliburton Company | 0.04 | 1.79 | 2.08 | -2.21 | 0.5690 | 0.0002 | |||

| CELG / Celgene Corp. | 0.02 | 12.40 | 2.06 | -3.92 | 0.5638 | -0.0098 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | 13.22 | 2.02 | 11.92 | 0.5526 | 0.0699 | |||

| COP / ConocoPhillips | 0.03 | -1.13 | 2.02 | 6.77 | 0.5523 | 0.0466 | |||

| USB / U.S. Bancorp | 0.04 | -0.13 | 2.01 | -5.86 | 0.5493 | -0.0211 | |||

| QCOM / QUALCOMM Incorporated | 0.04 | 7.77 | 2.00 | -6.74 | 0.5487 | -0.0265 | |||

| COF / Capital One Financial Corporation | 0.02 | -5.46 | 1.94 | -9.01 | 0.5304 | -0.0395 | |||

| TGT / Target Corporation | 0.03 | -2.25 | 1.91 | 4.04 | 0.5216 | 0.0315 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.03 | -1.37 | 1.89 | -11.08 | 0.5184 | -0.0515 | |||

| HD / The Home Depot, Inc. | 0.01 | 3.51 | 1.89 | -2.67 | 0.5178 | -0.0023 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 4.47 | 1.86 | 29.33 | 0.5093 | 0.1243 | |||

| MET / MetLife, Inc. | 0.04 | -2.58 | 1.82 | -11.57 | 0.4978 | -0.0525 | |||

| CMCSA / Comcast Corporation | 0.05 | -5.16 | 1.81 | -19.09 | 0.4943 | -0.1029 | |||

| DAL / Delta Air Lines, Inc. | 0.03 | 7.81 | 1.78 | 5.51 | 0.4874 | 0.4874 | |||

| UNP / Union Pacific Corporation | 0.01 | 0.30 | 1.72 | 0.53 | 0.4699 | 0.4699 | |||

| LOW / Lowe's Companies, Inc. | 0.02 | 1.48 | 1.65 | -4.13 | 0.4510 | -0.0089 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -1.47 | 1.56 | 3.65 | 0.4278 | 0.0243 | |||

| EMR / Emerson Electric Co. | 0.02 | 0.00 | 1.54 | -1.97 | 0.4228 | 0.0012 | |||

| ALL / The Allstate Corporation | 0.02 | -2.15 | 1.45 | -11.40 | 0.3979 | -0.0411 | |||

| PNR / Pentair plc | 0.02 | -0.66 | 1.37 | -4.06 | 0.3752 | -0.0071 | |||

| MDLZ / Mondelez International, Inc. | 0.03 | 1.00 | 1.36 | -1.52 | 0.3717 | 0.0027 | |||

| GM / General Motors Company | 0.04 | 5.64 | 1.34 | -6.36 | 0.3667 | -0.0161 | |||

| 09348R102 / BLDRS Index Funds Trust | 0.04 | -6.31 | 1.32 | -7.29 | 0.3621 | 0.3621 | |||

| CCL / Carnival Corporation & plc | 0.02 | 3.23 | 1.27 | 2.00 | 0.3481 | 0.0145 | |||

| MGA / Magna International Inc. | 0.02 | -0.85 | 1.25 | -1.34 | 0.3435 | 0.3435 | |||

| PYPL / PayPal Holdings, Inc. | 0.02 | 3.98 | 1.25 | 7.14 | 0.3410 | 0.0298 | |||

| DUK / Duke Energy Corporation | 0.02 | -2.80 | 1.19 | -10.43 | 0.3268 | -0.0299 | |||

| WMB / The Williams Companies, Inc. | 0.05 | 3.13 | 1.19 | -15.91 | 0.3254 | -0.0529 | |||

| COST / Costco Wholesale Corporation | 0.01 | -0.95 | 1.12 | 0.27 | 0.3065 | 0.0077 | |||

| ACN / Accenture plc | 0.01 | 133.62 | 1.12 | 134.10 | 0.3063 | 0.1784 | |||

| VOD / Vodafone Group Public Limited Company - Depositary Receipt (Common Stock) | 0.04 | -10.65 | 1.09 | -22.09 | 0.2972 | 0.2972 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.01 | 3.37 | 1.07 | -0.47 | 0.2928 | 0.0052 | |||

| CL / Colgate-Palmolive Company | 0.01 | -4.35 | 1.07 | -9.10 | 0.2926 | -0.0221 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.02 | -0.85 | 1.07 | 9.45 | 0.2918 | 0.2918 | |||

| BAX / Baxter International Inc. | 0.02 | -1.05 | 1.06 | -0.37 | 0.2912 | 0.0055 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.03 | -5.65 | 1.06 | -8.99 | 0.2909 | -0.0216 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.03 | 0.28 | 1.06 | 10.50 | 0.2909 | 0.2909 | |||

| CSX / CSX Corporation | 0.02 | 1.09 | 1.06 | 2.42 | 0.2890 | 0.0132 | |||

| CB / Chubb Limited | 0.01 | 24.25 | 1.05 | 16.23 | 0.2882 | 0.0458 | |||

| APA / APA Corporation | 0.03 | 5.00 | 1.05 | -4.29 | 0.2868 | -0.0062 | |||

| BWA / BorgWarner Inc. | 0.02 | -12.72 | 0.99 | -14.20 | 0.2712 | -0.0378 | |||

| KR / The Kroger Co. | 0.04 | -2.10 | 0.96 | -14.58 | 0.2630 | -0.0380 | |||

| TWX / Warner Media LLC | 0.01 | 6.14 | 0.93 | 9.73 | 0.2532 | 0.0276 | |||

| AIG / American International Group, Inc. | 0.02 | 1.08 | 0.92 | -7.73 | 0.2515 | -0.0150 | |||

| 61166W101 / Monsanto Co. | 0.01 | -2.60 | 0.92 | -2.76 | 0.2510 | -0.0013 | |||

| CI / The Cigna Group | 0.01 | 11.47 | 0.90 | -7.91 | 0.2455 | -0.0151 | |||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.01 | 1.36 | 0.88 | -2.97 | 0.2417 | 0.2417 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 1.62 | 0.86 | -1.37 | 0.2356 | 0.0021 | |||

| PM / Philip Morris International Inc. | 0.01 | -4.02 | 0.84 | -9.73 | 0.2310 | -0.0192 | |||

| SO / The Southern Company | 0.02 | 30.68 | 0.84 | 21.30 | 0.2291 | 0.0445 | |||

| SWK / Stanley Black & Decker, Inc. | 0.01 | -0.56 | 0.81 | -10.21 | 0.2214 | 0.2214 | |||

| VLO / Valero Energy Corporation | 0.01 | 0.65 | 0.80 | 1.52 | 0.2195 | 0.0081 | |||

| EL / The Estée Lauder Companies Inc. | 0.01 | 26.95 | 0.80 | 49.35 | 0.2195 | 0.2195 | |||

| RTN / Raytheon Co. | 0.00 | -0.13 | 0.80 | 14.74 | 0.2195 | 0.0325 | |||

| / Total S.A. | 0.01 | -2.78 | 0.76 | 1.47 | 0.2075 | 0.2075 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.02 | -0.72 | 0.76 | 1.61 | 0.2069 | 0.2069 | |||

| D / Dominion Energy, Inc. | 0.01 | 0.46 | 0.74 | -16.36 | 0.2014 | -0.0340 | |||

| MO / Altria Group, Inc. | 0.01 | -5.78 | 0.72 | -17.81 | 0.1971 | -0.0373 | |||

| XBI / SPDR Series Trust - SPDR S&P Biotech ETF | 0.01 | 0.00 | 0.70 | 3.38 | 0.1924 | 0.0105 | |||

| AVGO / Broadcom Inc. | 0.00 | -0.51 | 0.69 | -8.84 | 0.1891 | -0.0137 | |||

| FOX / Fox Corporation | 0.02 | 0.00 | 0.67 | 6.31 | 0.1845 | 0.0148 | |||

| FCX / Freeport-McMoRan Inc. | 0.04 | -0.71 | 0.67 | -7.95 | 0.1839 | -0.0114 | |||

| GLW / Corning Incorporated | 0.02 | 0.00 | 0.67 | -12.84 | 0.1839 | -0.0224 | |||

| CCI / Crown Castle Inc. | 0.01 | -0.58 | 0.66 | -2.08 | 0.1801 | 0.1801 | |||

| IVZ / Invesco Ltd. | 0.02 | 13.57 | 0.66 | -0.46 | 0.1793 | 0.0032 | |||

| BCE / BCE Inc. | 0.01 | 0.54 | 0.65 | -9.79 | 0.1765 | 0.1765 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.95 | 0.64 | 1.60 | 0.1738 | 0.0066 | |||

| HUM / Humana Inc. | 0.00 | 7.74 | 0.62 | 16.60 | 0.1711 | 0.1711 | |||

| WDC / Western Digital Corporation | 0.01 | -0.73 | 0.62 | 14.94 | 0.1705 | 0.0255 | |||

| STT / State Street Corporation | 0.01 | 0.79 | 0.62 | 2.81 | 0.1700 | 0.0084 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.01 | -9.10 | 0.62 | -16.80 | 0.1694 | -0.0296 | |||

| OXY / Occidental Petroleum Corporation | 0.01 | 0.04 | 0.62 | -11.86 | 0.1689 | 0.1689 | |||

| LNC / Lincoln National Corporation | 0.01 | -15.16 | 0.61 | -19.21 | 0.1669 | -0.0351 | |||

| DHR / Danaher Corporation | 0.01 | 2.32 | 0.61 | 7.99 | 0.1664 | 0.0158 | |||

| ADBE / Adobe Inc. | 0.00 | 5.56 | 0.60 | 30.22 | 0.1639 | 0.0409 | |||

| MLM / Martin Marietta Materials, Inc. | 0.00 | -3.90 | 0.59 | -9.88 | 0.1623 | -0.0138 | |||

| CEF / Sprott Physical Gold and Silver Trust | 0.04 | 0.59 | 0.1620 | 0.1620 | |||||

| SYF / Synchrony Financial | 0.02 | 13.07 | 0.59 | -1.83 | 0.1617 | 0.0007 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 21.85 | 0.55 | 6.96 | 0.1513 | 0.0130 | |||

| CMA / Comerica Incorporated | 0.01 | 3.53 | 0.54 | 14.32 | 0.1464 | 0.1464 | |||

| NGG / National Grid plc - Depositary Receipt (Common Stock) | 0.01 | 0.60 | 0.52 | -3.51 | 0.1431 | -0.0019 | |||

| KEY / KeyCorp | 0.03 | 28.46 | 0.51 | 24.57 | 0.1401 | 0.1401 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | -3.46 | 0.51 | -6.46 | 0.1388 | -0.0063 | |||

| AMGN / Amgen Inc. | 0.00 | -4.21 | 0.50 | -6.06 | 0.1357 | -0.0055 | |||

| US0549371070 / BB&T Corp. | 0.01 | 1.47 | 0.49 | 6.25 | 0.1349 | 0.1349 | |||

| LEN / Lennar Corporation | 0.01 | 15.41 | 0.49 | 7.66 | 0.1347 | 0.0124 | |||

| M / Macy's, Inc. | 0.02 | 17.99 | 0.49 | 39.43 | 0.1336 | 0.1336 | |||

| JCI / Johnson Controls International plc | 0.01 | -2.48 | 0.48 | -9.68 | 0.1327 | -0.0109 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.01 | -13.28 | 0.48 | -12.64 | 0.1325 | 0.1325 | |||

| ROK / Rockwell Automation, Inc. | 0.00 | 26.85 | 0.47 | 12.47 | 0.1284 | 0.1284 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 56.64 | 0.45 | 96.52 | 0.1237 | 0.1237 | |||

| ROP / Roper Technologies, Inc. | 0.00 | 12.83 | 0.45 | 22.34 | 0.1229 | 0.0247 | |||

| RSG / Republic Services, Inc. | 0.01 | -10.11 | 0.44 | -11.93 | 0.1212 | -0.0133 | |||

| EOG / EOG Resources, Inc. | 0.00 | 15.08 | 0.44 | 12.37 | 0.1193 | 0.0155 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | -3.97 | 0.43 | -12.32 | 0.1188 | -0.0137 | |||

| DVN / Devon Energy Corporation | 0.01 | 20.94 | 0.41 | -7.03 | 0.1122 | -0.0058 | |||

| 74005P104 / Praxair, Inc. | 0.00 | 46.60 | 0.40 | 36.95 | 0.1106 | 0.1106 | |||

| CM / Canadian Imperial Bank of Commerce | 0.00 | 20.98 | 0.40 | 9.59 | 0.1095 | 0.1095 | |||

| PSA / Public Storage | 0.00 | 34.01 | 0.40 | 28.71 | 0.1092 | 0.1092 | |||

| NOV / NOV Inc. | 0.01 | 4.05 | 0.39 | 6.27 | 0.1067 | 0.0085 | |||

| PPL / PPL Corporation | 0.01 | -3.60 | 0.39 | -11.76 | 0.1067 | -0.0115 | |||

| CAT / Caterpillar Inc. | 0.00 | 9.06 | 0.39 | 2.09 | 0.1067 | 0.0045 | |||

| RGLD / Royal Gold, Inc. | 0.00 | 0.00 | 0.38 | 4.63 | 0.1051 | 0.1051 | |||

| AEP / American Electric Power Company, Inc. | 0.01 | -1.95 | 0.38 | -8.67 | 0.1037 | -0.0073 | |||

| NSC / Norfolk Southern Corporation | 0.00 | 0.00 | 0.38 | -6.47 | 0.1029 | -0.0047 | |||

| IP / International Paper Company | 0.01 | -0.93 | 0.37 | -8.64 | 0.1013 | -0.0071 | |||

| PXD / Pioneer Natural Resources Company | 0.00 | 12.70 | 0.37 | 11.93 | 0.1002 | 0.1002 | |||

| PKI / Revvity Inc. | 0.00 | 0.00 | 0.36 | 3.13 | 0.0993 | 0.0052 | |||

| FNV / Franco-Nevada Corporation | 0.01 | 0.00 | 0.36 | -14.49 | 0.0985 | 0.0985 | |||

| DE / Deere & Company | 0.00 | -8.16 | 0.36 | -8.86 | 0.0985 | -0.0072 | |||

| HBI / Hanesbrands Inc. | 0.02 | 0.00 | 0.36 | -11.85 | 0.0977 | 0.0977 | |||

| SFNC / Simmons First National Corporation | 0.01 | 87.71 | 0.34 | -6.58 | 0.0933 | 0.0933 | |||

| GIS / General Mills, Inc. | 0.01 | 0.20 | 0.34 | -23.93 | 0.0922 | -0.0263 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.00 | 11.47 | 0.33 | 0.92 | 0.0900 | 0.0900 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.01 | -1.59 | 0.32 | -8.36 | 0.0870 | -0.0058 | |||

| LLY / Eli Lilly and Company | 0.00 | -1.21 | 0.32 | -9.46 | 0.0865 | 0.0865 | |||

| AWK / American Water Works Company, Inc. | 0.00 | 16.62 | 0.32 | 4.64 | 0.0865 | 0.0865 | |||

| ZION / Zions Bancorporation, National Association | 0.01 | 0.31 | 0.0857 | 0.0857 | |||||

| VTR / Ventas, Inc. | 0.01 | 19.41 | 0.31 | -1.57 | 0.0857 | 0.0006 | |||

| GD / General Dynamics Corporation | 0.00 | 0.31 | 0.0848 | 0.0848 | |||||

| GBCI / Glacier Bancorp, Inc. | 0.01 | 0.00 | 0.31 | -2.52 | 0.0848 | 0.0848 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.01 | 18.60 | 0.31 | 15.79 | 0.0843 | 0.0843 | |||

| FISV / Fiserv, Inc. | 0.00 | 63.71 | 0.30 | -11.08 | 0.0835 | -0.0083 | |||

| SEIC / SEI Investments Company | 0.00 | 0.30 | 0.0832 | 0.0832 | |||||

| AKAM / Akamai Technologies, Inc. | 0.00 | 3.38 | 0.30 | 13.01 | 0.0832 | 0.0112 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | 0.00 | 0.30 | -8.87 | 0.0816 | 0.0816 | |||

| VMC / Vulcan Materials Company | 0.00 | 6.98 | 0.30 | -4.81 | 0.0813 | 0.0813 | |||

| F / Ford Motor Company | 0.03 | -12.60 | 0.29 | -22.57 | 0.0807 | -0.0212 | |||

| BK / The Bank of New York Mellon Corporation | 0.01 | 5.73 | 0.29 | 1.06 | 0.0783 | 0.0026 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.00 | 0.00 | 0.28 | -1.38 | 0.0780 | 0.0007 | |||

| STI / Solidion Technology, Inc. | 0.00 | 23.89 | 0.28 | 30.70 | 0.0769 | 0.0769 | |||

| ATO / Atmos Energy Corporation | 0.00 | -1.92 | 0.28 | -3.78 | 0.0766 | -0.0012 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.01 | 3.02 | 0.28 | -5.10 | 0.0764 | 0.0764 | |||

| WELL / Welltower Inc. | 0.01 | 19.04 | 0.27 | 1.86 | 0.0750 | 0.0030 | |||

| WPM / Wheaton Precious Metals Corp. | 0.01 | 0.25 | 0.0695 | 0.0695 | |||||

| NATI / National Instruments Corp. | 0.00 | 0.00 | 0.25 | 21.57 | 0.0679 | 0.0679 | |||

| LBRDA / Liberty Broadband Corporation | 0.00 | 3.47 | 0.24 | -3.97 | 0.0662 | -0.0012 | |||

| NKE / NIKE, Inc. | 0.00 | 4.35 | 0.24 | 10.65 | 0.0654 | 0.0076 | |||

| KHC / The Kraft Heinz Company | 0.00 | -11.65 | 0.24 | -29.38 | 0.0651 | -0.0250 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.23 | 1.30 | 0.0640 | 0.0022 | |||

| KEX / Kirby Corporation | 0.00 | 0.21 | 0.0575 | 0.0575 | |||||

| MCHP / Microchip Technology Incorporated | 0.00 | -33.60 | 0.20 | -31.08 | 0.0558 | -0.0234 | |||

| EEP / Enbridge Energy Partners, L.P. | 0.02 | -2.87 | 0.16 | -32.23 | 0.0449 | 0.0449 | |||

| SRCL / Stericycle, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0602 | ||||

| PRU / Prudential Financial, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0744 | ||||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| NEE / NextEra Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| CME / CME Group Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| ESRX / Express Scripts Holding Co. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| NWL / Newell Brands Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| TRMB / Trimble Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| FMC / FMC Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| COL / Rockwell Collins, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0720 |