Mga Batayang Estadistika

| Nilai Portofolio | $ 3,049,449,894 |

| Posisi Saat Ini | 454 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

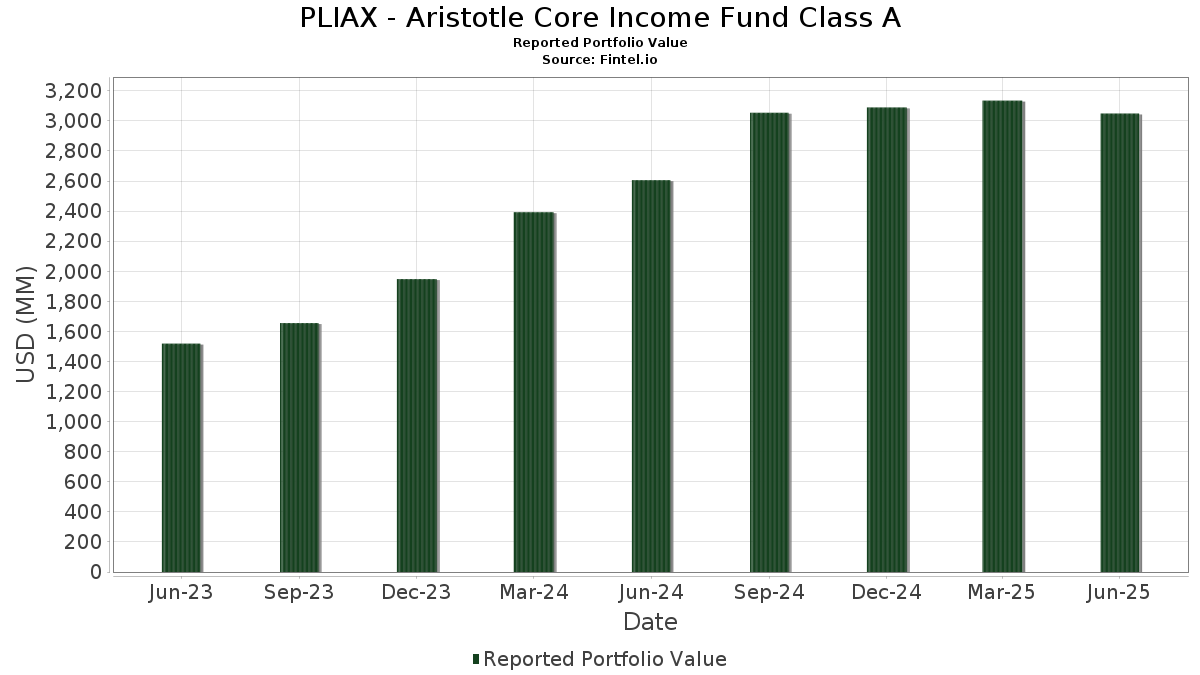

PLIAX - Aristotle Core Income Fund Class A telah mengungkapkan total kepemilikan 454 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 3,049,449,894 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PLIAX - Aristotle Core Income Fund Class A adalah US TREASURY NOTE 4.5% 11-15-33 (US:US91282CJJ18) , US TNOTE 3.875% DUE 08/15/2033 (US:US91282CHT18) , United States Treasury Note/Bond (US:US912810TT51) , US TREASURY N/B 4.75% 11-15-53 (US:US912810TV08) , and United States Treasury Note/Bond (US:US91282CFF32) . Posisi baru PLIAX - Aristotle Core Income Fund Class A meliputi: US TREASURY NOTE 4.5% 11-15-33 (US:US91282CJJ18) , US TNOTE 3.875% DUE 08/15/2033 (US:US91282CHT18) , United States Treasury Note/Bond (US:US912810TT51) , US TREASURY N/B 4.75% 11-15-53 (US:US912810TV08) , and United States Treasury Note/Bond (US:US91282CFF32) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 44.65 | 44.65 | 1.4625 | 1.4625 | |

| 74.62 | 2.4441 | 0.8363 | ||

| 15.91 | 0.5213 | 0.5213 | ||

| 15.56 | 0.5098 | 0.5098 | ||

| 12.80 | 0.4192 | 0.4192 | ||

| 12.10 | 0.3965 | 0.3965 | ||

| 10.50 | 0.3441 | 0.3441 | ||

| 10.18 | 0.3334 | 0.3334 | ||

| 10.02 | 0.3281 | 0.3281 | ||

| 9.13 | 0.2992 | 0.2992 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 26.46 | 0.8668 | -0.5101 | ||

| 5.00 | 0.1638 | -0.3162 | ||

| 2.67 | 0.0876 | -0.2627 | ||

| 4.07 | 0.1335 | -0.2519 | ||

| 5.06 | 0.1659 | -0.2084 | ||

| 7.94 | 0.2602 | -0.1895 | ||

| 18.66 | 0.6114 | -0.1820 | ||

| 8.85 | 0.2899 | -0.1747 | ||

| 5.56 | 0.1821 | -0.1694 | ||

| 5.56 | 0.1821 | -0.1694 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| United States Treasury Note/Bond / DBT (US91282CMM00) | 74.62 | 47.38 | 2.4441 | 0.8363 | |||||

| United States Treasury Note/Bond / DBT (US91282CLW90) | 48.67 | 0.05 | 1.5944 | 0.0493 | |||||

| US BANK MMDA - USBGFS 9 / STIV (N/A) | 44.65 | 44.65 | 1.4625 | 1.4625 | |||||

| United States Treasury Note/Bond / DBT (US91282CLF67) | 39.07 | 0.18 | 1.2797 | 0.0412 | |||||

| US91282CJJ18 / US TREASURY NOTE 4.5% 11-15-33 | 36.99 | 0.33 | 1.2117 | 0.0408 | |||||

| US91282CHT18 / US TNOTE 3.875% DUE 08/15/2033 | 33.49 | 0.49 | 1.0971 | 0.0386 | |||||

| US912810TT51 / United States Treasury Note/Bond | 30.38 | -3.06 | 0.9952 | -0.0001 | |||||

| United States Treasury Note/Bond / DBT (US91282CJZ59) | 29.70 | -15.81 | 0.9727 | -0.1474 | |||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 26.66 | -3.05 | 0.8734 | -0.0000 | |||||

| United States Treasury Note/Bond / DBT (US912810TX63) | 26.46 | -38.96 | 0.8668 | -0.5101 | |||||

| United States Treasury Note/Bond / DBT (US912810UF39) | 26.44 | -2.23 | 0.8660 | 0.0072 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 25.54 | -5.45 | 0.8366 | -0.0213 | |||||

| US91282CFF32 / United States Treasury Note/Bond | 24.91 | 0.89 | 0.8161 | 0.0319 | |||||

| United States Treasury Note/Bond / DBT (US91282CKQ32) | 23.37 | 0.21 | 0.7654 | 0.0249 | |||||

| Seasoned Credit Risk Transfer Trust Series 2025-1 / ABS-MBS (US35563PYZ60) | 23.24 | -0.44 | 0.7612 | 0.0199 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 21.05 | -5.06 | 0.6897 | -0.0146 | |||||

| US31418ET751 / Fannie Mae Pool | 20.31 | -4.30 | 0.6654 | -0.0087 | |||||

| United States Treasury Note/Bond / DBT (US91282CMR96) | 20.19 | 0.65 | 0.6613 | 0.0243 | |||||

| US31418EVA53 / Fannie Mae Pool | 19.47 | -3.89 | 0.6376 | -0.0056 | |||||

| US91282CGM73 / United States Treasury Note/Bond | 19.29 | 0.65 | 0.6317 | 0.0232 | |||||

| United States Treasury Note/Bond / DBT (US912810TZ12) | 18.85 | -2.21 | 0.6174 | 0.0053 | |||||

| US91282CEP23 / WI TREASURY N/B REGD 2.87500000 | 18.66 | -25.29 | 0.6114 | -0.1820 | |||||

| US91282CHC82 / United States Treasury Note/Bond | 18.12 | 0.66 | 0.5935 | 0.0218 | |||||

| US3140XML794 / Federal National Mortgage Association, Inc. | 17.74 | -5.80 | 0.5810 | -0.0170 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 17.34 | 1.08 | 0.5680 | 0.0232 | |||||

| US912810SZ21 / United States Treasury Note/Bond | 17.31 | -3.19 | 0.5669 | -0.0008 | |||||

| AssuredPartners Inc / LON (US04621HAW34) | 16.12 | -5.97 | 0.5281 | -0.0164 | |||||

| Colossus Acquireco LLC / LON (N/A) | 15.91 | 0.5213 | 0.5213 | ||||||

| FFH.PRH / Fairfax Financial Holdings Limited - Preferred Stock | 15.56 | 0.5098 | 0.5098 | ||||||

| Ginnie Mae II Pool / ABS-MBS (US3618N5C494) | 15.40 | -1.06 | 0.5045 | 0.0101 | |||||

| Bank of America Corp / DBT (US06051GMD87) | 15.01 | 1.92 | 0.4916 | 0.0240 | |||||

| Whatabrands LLC / LON (US96244UAJ60) | 14.95 | 0.21 | 0.4897 | 0.0159 | |||||

| Bravo Residential Funding Trust Series 2025-NQM1 / ABS-MBS (US10569MAC73) | 14.89 | -4.27 | 0.4878 | -0.0063 | |||||

| US89364MCA09 / TRANSDIGM INC | 14.72 | -16.57 | 0.4822 | -0.0782 | |||||

| US912810TA60 / U.S. Treasury Bonds | 14.61 | -2.05 | 0.4787 | 0.0049 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 14.18 | 42.37 | 0.4646 | 0.1482 | |||||

| OBX 2025-NQM4 Trust / ABS-MBS (US67120QAA40) | 13.67 | -3.35 | 0.4478 | -0.0014 | |||||

| US3132DWD674 / Freddie Mac Pool | 13.41 | -2.00 | 0.4392 | 0.0047 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 13.16 | -2.25 | 0.4311 | 0.0035 | |||||

| US912810TR95 / United States Treasury Note/Bond | 13.05 | -3.17 | 0.4276 | -0.0005 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 12.98 | 1.35 | 0.4252 | 0.0185 | |||||

| US3132DWJL81 / Freddie Mac Pool | 12.92 | -2.42 | 0.4233 | 0.0027 | |||||

| US36179XBR61 / GNMA | 12.91 | -3.31 | 0.4229 | -0.0012 | |||||

| KDP / Keurig Dr Pepper Inc. | 12.80 | 0.4192 | 0.4192 | ||||||

| Palmer Square Loan Funding 2024-2 Ltd / ABS-CBDO (US69703RAC97) | 12.71 | 0.17 | 0.4164 | 0.0134 | |||||

| BNP / BNP Paribas SA | 12.49 | 1.77 | 0.4092 | 0.0194 | |||||

| RY.PRM / Royal Bank of Canada - Preferred Stock | 12.44 | -0.99 | 0.4075 | 0.0085 | |||||

| OBX 2025-NQM2 Trust / ABS-MBS (US67120VAA35) | 12.43 | -5.35 | 0.4070 | -0.0099 | |||||

| US91282CBL46 / United States Treasury Note/Bond | 12.12 | -5.12 | 0.3969 | -0.0087 | |||||

| United States Treasury Note/Bond / DBT (US91282CNF40) | 12.10 | 0.3965 | 0.3965 | ||||||

| A1ES34 / The AES Corporation - Depositary Receipt (Common Stock) | 12.09 | 0.49 | 0.3960 | 0.0139 | |||||

| US55336V3087 / MPLX LP | 12.05 | -13.62 | 0.3949 | -0.0483 | |||||

| US61747YEF88 / Morgan Stanley | 12.03 | 2.49 | 0.3940 | 0.0213 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 11.96 | -19.87 | 0.3916 | -0.0822 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 11.88 | 1.12 | 0.3891 | 0.0160 | |||||

| PG&E Recovery Funding LLC / DBT (US71710TAJ79) | 11.84 | -1.40 | 0.3877 | 0.0065 | |||||

| US15963CAC01 / Chariot Buyer LLC, 1st Lien Term Loan | 11.82 | 0.84 | 0.3872 | 0.0149 | |||||

| US68245XAH26 / 1011778 BC ULC / New Red Finance Inc | 11.70 | 1.92 | 0.3832 | 0.0187 | |||||

| DK0009391104 / JYSKE REALKREDIT A/S /DKK/ REGD SER 321E 1.00000000 | 11.65 | 1.18 | 0.3816 | 0.0160 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 11.62 | -14.60 | 0.3807 | -0.0515 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 11.61 | 1.67 | 0.3804 | 0.0177 | |||||

| US63942PAA12 / Navient Private Education Refi Loan Trust 2022-B | 11.35 | -4.93 | 0.3716 | -0.0073 | |||||

| Wand NewCo 3 Inc / LON (US93369PAM68) | 11.29 | -7.41 | 0.3698 | -0.0174 | |||||

| C1NP34 / CenterPoint Energy, Inc. - Depositary Receipt (Common Stock) | 11.13 | -14.06 | 0.3645 | -0.0467 | |||||

| US23329PAB67 / DNB Bank ASA | 11.08 | -0.09 | 0.3630 | 0.0107 | |||||

| United States Treasury Note/Bond / DBT (US912810UD80) | 11.00 | -2.21 | 0.3602 | 0.0031 | |||||

| Navient Private Education Refi Loan Trust 2024-A / ABS-O (US63943CAA99) | 10.88 | -7.08 | 0.3565 | -0.0154 | |||||

| Atlas Warehouse Lending Co LP / DBT (US049463AE27) | 10.87 | 0.52 | 0.3560 | 0.0126 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 10.80 | 249.05 | 0.3536 | 0.2554 | |||||

| GLP Capital LP / GLP Financing II Inc / DBT (US361841AT63) | 10.62 | 1.31 | 0.3478 | 0.0150 | |||||

| W1AB34 / Westinghouse Air Brake Technologies Corporation - Depositary Receipt (Common Stock) | 10.50 | 0.3441 | 0.3441 | ||||||

| US912810TM09 / United States Treasury Note/Bond | 10.50 | -2.20 | 0.3438 | 0.0030 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 10.48 | 1.09 | 0.3433 | 0.0141 | |||||

| Angel Oak Mortgage Trust 2025-1 / ABS-MBS (US034934AA73) | 10.44 | -2.87 | 0.3421 | 0.0006 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 10.36 | -2.62 | 0.3395 | 0.0015 | |||||

| R1OP34 / Roper Technologies, Inc. - Depositary Receipt (Common Stock) | 10.36 | 0.90 | 0.3393 | 0.0133 | |||||

| Angel Oak Mortgage Trust 2025-2 / ABS-MBS (US03466QAA13) | 10.35 | -2.92 | 0.3392 | 0.0005 | |||||

| US31418EV989 / Fannie Mae Pool | 10.27 | -3.66 | 0.3365 | -0.0021 | |||||

| AIG / American International Group, Inc. - Depositary Receipt (Common Stock) | 10.18 | 0.3334 | 0.3334 | ||||||

| Ford Credit Auto Owner Trust 2024-REV1 / ABS-O (US34533BAA89) | 10.16 | 0.87 | 0.3328 | 0.0129 | |||||

| US912810TJ79 / United States Treasury Note/Bond | 10.11 | -3.05 | 0.3312 | -0.0000 | |||||

| US912810TD00 / United States Treasury Note/Bond | 10.08 | -3.17 | 0.3303 | -0.0004 | |||||

| US49803XAA19 / Kite Realty Group, L.P. | 10.04 | 2.04 | 0.3289 | 0.0164 | |||||

| United States Treasury Note/Bond / DBT (US91282CNC19) | 10.02 | 0.3281 | 0.3281 | ||||||

| US912810RJ97 / United States Treas Bds Bond | 10.01 | -2.26 | 0.3280 | 0.0026 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 10.00 | -0.43 | 0.3274 | 0.0086 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 9.97 | 1.19 | 0.3267 | 0.0137 | |||||

| Neuberger Berman Loan Advisers Clo 43 Ltd / ABS-CBDO (US64134AAL61) | 9.95 | -0.53 | 0.3258 | 0.0082 | |||||

| USP1400MAB48 / Banco Mercantil del Norte SA/Grand Cayman | 9.84 | 2.18 | 0.3222 | 0.0165 | |||||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 9.77 | 1.33 | 0.3200 | 0.0138 | |||||

| US69702HAC25 / Palmer Square Loan Funding Ltd | 9.74 | 0.40 | 0.3189 | 0.0109 | |||||

| SMB Private Education Loan Trust 2024-F / ABS-O (US83207VAA61) | 9.68 | -3.70 | 0.3170 | -0.0021 | |||||

| L1CA34 / Labcorp Holdings Inc. - Depositary Receipt (Common Stock) | 9.34 | 1.53 | 0.3060 | 0.0138 | |||||

| SBA Small Business Investment Cos / ABS-MBS (US831641FX82) | 9.31 | 0.83 | 0.3051 | 0.0118 | |||||

| OBX 2025-NQM3 Trust / ABS-MBS (US67448YAC84) | 9.31 | -3.28 | 0.3048 | -0.0007 | |||||

| PRKCM 2025-HOME1 / ABS-MBS (US69382FAA75) | 9.23 | -2.07 | 0.3022 | 0.0030 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 9.22 | -2.61 | 0.3020 | 0.0014 | |||||

| Angel Oak Mortgage Trust 2025-4 / ABS-MBS (US034935AA49) | 9.13 | 0.2992 | 0.2992 | ||||||

| US912810SR05 / United States Treasury Note/Bond - When Issued | 9.02 | -1.76 | 0.2954 | 0.0039 | |||||

| US909318AA56 / United Airlines Pass Through Trust, Series 2018-1, Class AA | 8.93 | -0.50 | 0.2924 | 0.0075 | |||||

| CHI Commercial Mortgage Trust 2025-SFT / ABS-MBS (US16706GAA58) | 8.90 | 1.33 | 0.2915 | 0.0126 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 8.88 | -1.50 | 0.2909 | 0.0046 | |||||

| SON / Sonoco Products Company | 8.86 | 1.71 | 0.2901 | 0.0135 | |||||

| United States Treasury Note/Bond / DBT (US91282CLM19) | 8.85 | -39.50 | 0.2899 | -0.1747 | |||||

| Epicor Software Corp / LON (US29426NAZ78) | 8.79 | 10.32 | 0.2879 | 0.0349 | |||||

| US06051GKC23 / Bank of America Corp. | 8.77 | 123.72 | 0.2874 | 0.1628 | |||||

| US21870FBA66 / CoreLogic, Inc. Term Loan | 8.77 | 10.50 | 0.2872 | 0.0352 | |||||

| Phillips Edison Grocery Center Operating Partnership I LP / DBT (US71845JAC27) | 8.72 | 1.98 | 0.2857 | 0.0141 | |||||

| Northwestern Mutual Life Insurance Co/The / DBT (US668138AF77) | 8.67 | 0.2841 | 0.2841 | ||||||

| US422806AB58 / HEICO Corp. | 8.60 | 1.36 | 0.2818 | 0.0122 | |||||

| US11043XAB91 / British Airways Pass Through Trust, Series 2019-1, Class A | 8.57 | -5.55 | 0.2807 | -0.0075 | |||||

| US44332EAP16 / Hub International Ltd., Term Loan | 8.57 | -34.23 | 0.2806 | -0.1330 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 8.55 | 1.48 | 0.2801 | 0.0125 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 8.48 | 1.75 | 0.2779 | 0.0131 | |||||

| CBRE Services Inc / DBT (US12505BAJ98) | 8.38 | 0.2745 | 0.2745 | ||||||

| JBS USA Holding Lux Sarl/ JBS USA Food Co/ JBS Lux Co Sarl / DBT (US47214BAC28) | 8.37 | 1.11 | 0.2741 | 0.0113 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2024-NQM5 / ABS-MBS (US61777QAA31) | 8.30 | -4.14 | 0.2719 | -0.0031 | |||||

| Angel Oak Mortgage Trust 2025-3 / ABS-MBS (US03466RAA95) | 8.30 | -4.79 | 0.2718 | -0.0050 | |||||

| US06051GKL22 / BAC 3.846 03/08/37 | 8.24 | 1.96 | 0.2699 | 0.0132 | |||||

| US24440EAB39 / Deerfield (Duff & Phelps/Dakota Holdings) T/L B (2/20) | 8.22 | -29.79 | 0.2693 | -0.1026 | |||||

| F2IC34 / Fair Isaac Corporation - Depositary Receipt (Common Stock) | 8.17 | 0.2678 | 0.2678 | ||||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBQ78) | 8.13 | 1.09 | 0.2664 | 0.0109 | |||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 8.06 | 0.91 | 0.2640 | 0.0104 | |||||

| Weir Group Inc / DBT (US94877DAA28) | 8.04 | 0.2633 | 0.2633 | ||||||

| Caesars Entertainment Inc / LON (US12768EAH99) | 8.01 | -35.01 | 0.2623 | -0.1290 | |||||

| VICI / VICI Properties Inc. | 7.94 | -43.91 | 0.2602 | -0.1895 | |||||

| 1011778 BC ULC / LON (XAC6901LAM90) | 7.90 | -19.97 | 0.2588 | -0.0547 | |||||

| JBS USA LUX Sarl / JBS USA Food Co / JBS USA Foods Group / DBT (US472140AA00) | 7.88 | 0.81 | 0.2582 | 0.0098 | |||||

| Angel Oak Mortgage Trust 2025-7 / ABS-MBS (US03466TAA51) | 7.82 | 0.2563 | 0.2563 | ||||||

| US90932LAJ61 / United Airlines 2023-1 Class A Pass Through Trust | 7.80 | 0.06 | 0.2554 | 0.0079 | |||||

| US71654QCB68 / Petroleos Mexicanos | 7.76 | 0.62 | 0.2541 | 0.0093 | |||||

| US281020AT41 / Edison International | 7.75 | -4.31 | 0.2538 | -0.0033 | |||||

| US912828ZQ64 / United States Treasury Note/Bond - When Issued | 7.75 | 1.71 | 0.2537 | 0.0118 | |||||

| IMB / Imperial Brands PLC | 7.72 | 0.98 | 0.2530 | 0.0101 | |||||

| US63941TAA43 / Navient Private Education Refi Loan Trust 2020-E | 7.72 | -6.46 | 0.2529 | -0.0092 | |||||

| US11120VAA17 / Brixmor Operating Partnership LP | 7.71 | 1.14 | 0.2526 | 0.0105 | |||||

| US92840VAQ59 / Vistra Operations Co. LLC | 7.69 | -20.93 | 0.2520 | -0.0570 | |||||

| Indicor LLC / LON (US77669LAK98) | 7.69 | 11.66 | 0.2519 | 0.0332 | |||||

| US361841AR08 / GLP Capital LP / GLP Financing II Inc | 7.66 | 1.66 | 0.2510 | 0.0116 | |||||

| Bank of America Corp / DBT (US06051GMQ90) | 7.62 | 1.82 | 0.2498 | 0.0119 | |||||

| Grant Thornton Advisors LLC / LON (US38821UAD28) | 7.61 | 0.07 | 0.2492 | 0.0078 | |||||

| Central Parent LLC / LON (US15477BAE74) | 7.52 | -3.25 | 0.2464 | -0.0005 | |||||

| US281020AX52 / Edison International | 7.51 | -36.03 | 0.2458 | -0.1268 | |||||

| US87612GAF81 / TARGA RES CORP 6.5% 03/30/2034 | 7.36 | 0.64 | 0.2412 | 0.0088 | |||||

| Virginia Electric and Power Co / DBT (US927804GS79) | 7.32 | -0.19 | 0.2397 | 0.0069 | |||||

| US693475BU84 / PNC Financial Services Group Inc/The | 7.27 | 1.10 | 0.2381 | 0.0098 | |||||

| Oncor Electric Delivery Co LLC / DBT (US68233JCU60) | 7.27 | -0.87 | 0.2381 | 0.0052 | |||||

| US87264ACY91 / T-Mobile USA Inc | 7.25 | 1.36 | 0.2375 | 0.0103 | |||||

| BBVA Mexico SA Institucion De Banca Multiple Grupo Financiero BBVA Mexico/TX / DBT (US07336UAB98) | 7.24 | 1.43 | 0.2372 | 0.0105 | |||||

| 69511JD28 / PACIFICORP | 7.21 | 0.94 | 0.2363 | 0.0093 | |||||

| BRAVO Residential Funding Trust 2025-NQM4 / ABS-MBS (US10570QAE17) | 7.21 | 0.2362 | 0.2362 | ||||||

| Mars Inc / DBT (US571676BA26) | 7.19 | 186.03 | 0.2355 | 0.1556 | |||||

| US65342QAM42 / NEXTERA ENERGY OPERATING REGD 144A P/P 7.25000000 | 7.18 | 4.16 | 0.2352 | 0.0163 | |||||

| US63942MAA80 / Navient Private Education Refi Loan Trust 2022-A | 7.17 | -2.66 | 0.2350 | 0.0009 | |||||

| U1HS34 / Universal Health Services, Inc. - Depositary Receipt (Common Stock) | 7.12 | 1.53 | 0.2333 | 0.0105 | |||||

| Bravo Residential Funding Trust 2025-Nqm3 / ABS-MBS (US105927AC11) | 7.10 | -2.91 | 0.2324 | 0.0003 | |||||

| US36179YHT47 / GOVERNMENT NATIONAL MORTGAGE CORPORATION | 7.08 | -5.80 | 0.2318 | -0.0068 | |||||

| US38141GYB49 / Goldman Sachs Group Inc/The | 7.07 | 1.80 | 0.2315 | 0.0110 | |||||

| ATHS / Athene Holding Ltd. - Corporate Bond/Note | 7.06 | 0.2314 | 0.2314 | ||||||

| AIMCO CLO Series 2018-B / ABS-CBDO (US00900PAQ81) | 7.03 | 0.17 | 0.2302 | 0.0074 | |||||

| VICI Properties LP / DBT (US925650AH69) | 7.01 | 1.51 | 0.2297 | 0.0103 | |||||

| D1TE34 / DTE Energy Company - Depositary Receipt (Common Stock) | 7.01 | 1.18 | 0.2297 | 0.0096 | |||||

| US83206NAA54 / SMB Private Education Loan Trust 2022-B | 7.00 | 0.2294 | 0.2294 | ||||||

| SMB Private Education Loan Trust 2024-C / ABS-O (US83206EAA55) | 6.84 | -2.63 | 0.2240 | 0.0010 | |||||

| AU3FN0029609 / AAI Ltd | 6.83 | 1.55 | 0.2237 | 0.0101 | |||||

| S1RE34 / Sempra - Depositary Receipt (Common Stock) | 6.76 | 0.07 | 0.2214 | 0.0069 | |||||

| AU3FN0029609 / AAI Ltd | 6.70 | 0.2194 | 0.2194 | ||||||

| US912810TG31 / U.S. Treasury Bonds | 6.69 | -3.07 | 0.2191 | -0.0001 | |||||

| 30064K105 / Exacttarget, Inc. | 6.60 | 1.38 | 0.2163 | 0.0095 | |||||

| US638961AA02 / Navient Private Education Refi Loan Trust 2023-A | 6.56 | -4.64 | 0.2148 | -0.0036 | |||||

| USP1507SAG23 / Banco Santander Mexico SA Institucion de Banca Multiple Grupo Financiero Santand | 6.53 | 0.79 | 0.2140 | 0.0081 | |||||

| SMB Private Education Loan Trust 2024-A / ABS-O (US831943AA30) | 6.42 | 3.08 | 0.2103 | 0.0125 | |||||

| 081437AG0 / Bemis Inc Notes 5.65% 08/01/14 | 6.34 | 1.08 | 0.2078 | 0.0085 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 6.30 | 0.2063 | 0.2063 | ||||||

| Ventas Realty LP / DBT (US92277GBA40) | 6.29 | 1.63 | 0.2062 | 0.0095 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 6.28 | 1.60 | 0.2056 | 0.0094 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 6.24 | -2.67 | 0.2044 | 0.0008 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 6.21 | 1.14 | 0.2033 | 0.0084 | |||||

| BRO / Brown & Brown, Inc. | 6.17 | 0.2022 | 0.2022 | ||||||

| 69511JD28 / PACIFICORP | 6.10 | 2.64 | 0.1997 | 0.0110 | |||||

| CMCS34 / Comcast Corporation - Depositary Receipt (Common Stock) | 6.08 | 0.1992 | 0.1992 | ||||||

| Host Hotels & Resorts LP / DBT (US44107TBB17) | 6.04 | -29.42 | 0.1979 | -0.0739 | |||||

| US832696AX63 / J M Smucker Co. | 6.01 | -38.65 | 0.1970 | -0.1143 | |||||

| Palmer Square Loan Funding 2022-4 Ltd / ABS-CBDO (US69702YAL56) | 6.00 | 0.59 | 0.1966 | 0.0071 | |||||

| Verizon Master Trust / ABS-O (US92348KDJ97) | 5.99 | 0.44 | 0.1964 | 0.0068 | |||||

| Palmer Square Loan Funding 2024-1 Ltd / ABS-CBDO (US69703NAC83) | 5.96 | 0.30 | 0.1951 | 0.0065 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 5.95 | -40.80 | 0.1950 | -0.1243 | |||||

| ACA / Crédit Agricole S.A. | 5.93 | 1.63 | 0.1944 | 0.0089 | |||||

| Extra Space Storage LP / DBT (US30225VAS60) | 5.89 | 1.45 | 0.1931 | 0.0086 | |||||

| US50155QAL41 / Kyndryl Holdings, Inc. | 5.87 | 2.85 | 0.1924 | 0.0110 | |||||

| US912810TB44 / T 1 7/8 11/15/51 | 5.85 | -3.26 | 0.1915 | -0.0004 | |||||

| US257375AJ44 / Dominion Energy Gas Holdings LLC | 5.84 | -0.95 | 0.1912 | 0.0040 | |||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 5.79 | 2.92 | 0.1896 | 0.0110 | |||||

| US89231WAA18 / Toyota Auto Loan Extended Note Trust 2023-1 | 5.75 | 0.31 | 0.1883 | 0.0063 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 5.71 | 1.40 | 0.1870 | 0.0082 | |||||

| Vistra Operations Co LLC / DBT (US92840VAU61) | 5.71 | 7.13 | 0.1869 | 0.0178 | |||||

| US95000U3F88 / Wells Fargo & Co. | 5.68 | 1.43 | 0.1860 | 0.0082 | |||||

| BNP / BNP Paribas SA | 5.65 | 0.1850 | 0.1850 | ||||||

| ANTX / AN2 Therapeutics, Inc. | 5.61 | -0.34 | 0.1837 | 0.0050 | |||||

| Husky Injection Molding Systems Ltd / LON (XAC8856UAE82) | 5.56 | -49.78 | 0.1821 | -0.1694 | |||||

| Husky Injection Molding Systems Ltd / LON (XAC8856UAE82) | 5.56 | -49.78 | 0.1821 | -0.1694 | |||||

| Citibank NA / DBT (US17325FBG28) | 5.47 | 1.35 | 0.1792 | 0.0078 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 5.46 | -3.45 | 0.1788 | -0.0008 | |||||

| Six Flags Entertainment Corp / LON (US15018LAN10) | 5.41 | -46.72 | 0.1772 | -0.1452 | |||||

| Flutter Financing BV / LON (XAN3313EAG51) | 5.40 | -27.09 | 0.1769 | -0.0583 | |||||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 5.28 | 1.71 | 0.1730 | 0.0081 | |||||

| Q1UA34 / Quanta Services, Inc. - Depositary Receipt (Common Stock) | 5.27 | 2.43 | 0.1725 | 0.0092 | |||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 5.21 | -44.30 | 0.1706 | -0.1264 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 5.14 | 0.1685 | 0.1685 | ||||||

| US337738BE73 / Fiserv Inc | 5.11 | 0.89 | 0.1673 | 0.0066 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 5.11 | -4.76 | 0.1673 | -0.0030 | |||||

| US3140XGAC38 / 1% 01 Jul 2043 | 5.09 | -2.04 | 0.1667 | 0.0017 | |||||

| US03523TBU16 / Anheuser-Busch InBev Worldwide Inc | 5.09 | 0.16 | 0.1667 | 0.0053 | |||||

| N1IS34 / NiSource Inc. - Depositary Receipt (Common Stock) | 5.09 | 1.36 | 0.1666 | 0.0072 | |||||

| US05400KAJ97 / Avolon TLB Borrower 1 (US) LLC 2023 Term Loan B6 | 5.06 | -57.04 | 0.1659 | -0.2084 | |||||

| N1IS34 / NiSource Inc. - Depositary Receipt (Common Stock) | 5.06 | 2.66 | 0.1658 | 0.0092 | |||||

| US845437BU53 / Southwestern Electric Power Co | 5.05 | 0.70 | 0.1654 | 0.0061 | |||||

| US31418EU999 / Fannie Mae Pool | 5.04 | -2.65 | 0.1650 | 0.0007 | |||||

| US226373AT56 / Crestwood Midstream Partners LP | 5.03 | -0.22 | 0.1648 | 0.0047 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 5.02 | 0.1646 | 0.1646 | ||||||

| AIMCO CLO 10 Ltd / ABS-CBDO (US00901AAS69) | 5.02 | -49.89 | 0.1644 | -0.1536 | |||||

| Elmwood CLO X Ltd / ABS-CBDO (US29002VAN82) | 5.01 | 0.54 | 0.1640 | 0.0059 | |||||

| SeaWorld Parks & Entertainment Inc / LON (US78488CAL46) | 5.00 | -66.92 | 0.1638 | -0.3162 | |||||

| OBX 2025-NQM10 Trust / ABS-MBS (US67121LAA44) | 5.00 | 0.1637 | 0.1637 | ||||||

| US912810TW80 / United States Treasury Note/Bond | 5.00 | -2.21 | 0.1637 | 0.0014 | |||||

| US29273VAQ32 / Energy Transfer LP | 4.98 | 1.42 | 0.1633 | 0.0072 | |||||

| Belron Finance 2019 LLC / LON (US08078UAM53) | 4.98 | -37.53 | 0.1632 | -0.0901 | |||||

| US816851BH17 / Sempra Energy | 4.97 | 0.61 | 0.1628 | 0.0059 | |||||

| PRET 2025-RPL1 Trust / ABS-MBS (US69392FAA57) | 4.96 | -3.84 | 0.1625 | -0.0013 | |||||

| US3132DWG982 / FNCL UMBS 5.5 SD8324 05-01-53 | 4.95 | -3.13 | 0.1623 | -0.0001 | |||||

| US912810RT79 / United States Treas Bds Bond | 4.95 | -2.60 | 0.1621 | 0.0008 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 4.93 | 0.53 | 0.1615 | 0.0057 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 4.91 | 0.1607 | 0.1607 | ||||||

| United States Treasury Note/Bond / DBT (US912810UB25) | 4.90 | -2.25 | 0.1607 | 0.0013 | |||||

| US912810TN81 / United States Treasury Note/Bond | 4.90 | -51.54 | 0.1605 | -0.1606 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 4.90 | -1.47 | 0.1605 | 0.0026 | |||||

| US025537AX91 / American Electric Power Co Inc | 4.89 | 1.37 | 0.1601 | 0.0070 | |||||

| AutoNation Inc / DBT (US05329WAT99) | 4.87 | -23.78 | 0.1596 | -0.0434 | |||||

| Venture Global LNG Inc / EP (US92332YAF88) | 4.87 | -48.77 | 0.1594 | -0.1422 | |||||

| US09951LAA17 / Booz Allen Hamilton Inc | 4.85 | 2.13 | 0.1589 | 0.0080 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 4.83 | 0.81 | 0.1582 | 0.0061 | |||||

| US816851BM02 / Sempra Energy | 4.82 | 2.34 | 0.1579 | 0.0083 | |||||

| US654579AE17 / Nippon Life Insurance Co | 4.77 | 0.1561 | 0.1561 | ||||||

| US44107TBA34 / Host Hotels & Resorts LP | 4.73 | 0.98 | 0.1551 | 0.0062 | |||||

| JP Morgan Mortgage Trust Series 2025-NQM1 / ABS-MBS (US46593QAC24) | 4.71 | -4.33 | 0.1542 | -0.0020 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 4.70 | 1.66 | 0.1541 | 0.0071 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 4.67 | 0.1528 | 0.1528 | ||||||

| High Street Funding Trust III / DBT (US42981FAA93) | 4.66 | 9.85 | 0.1527 | 0.0179 | |||||

| OBX 2025-NQM1 Trust / ABS-MBS (US673914AC13) | 4.66 | -4.43 | 0.1527 | -0.0022 | |||||

| US458140CJ73 / Intel Corp | 4.66 | 1.24 | 0.1525 | 0.0065 | |||||

| COLT 2024-1 Mortgage Loan Trust / ABS-MBS (US19688TAA34) | 4.65 | 0.1524 | 0.1524 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 4.65 | -9.66 | 0.1522 | -0.0111 | |||||

| CMS.PRB / Consumers Energy Company - Preferred Stock | 4.63 | 0.1518 | 0.1518 | ||||||

| US852234AP86 / CORPORATE BONDS | 4.59 | 4.32 | 0.1504 | 0.0106 | |||||

| US575767AT50 / MASSACHUSETTS MUTUAL LIFE INSURANC | 4.57 | -1.49 | 0.1498 | 0.0024 | |||||

| US023765AA88 / American Airlines 2016-2 Class AA Pass Through Trust | 4.56 | -2.69 | 0.1495 | 0.0005 | |||||

| US95000U3D31 / Wells Fargo & Co | 4.56 | 1.63 | 0.1492 | 0.0069 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 4.55 | 0.1490 | 0.1490 | ||||||

| US3140XKHB93 / Fannie Mae Pool | 4.53 | -2.93 | 0.1485 | 0.0002 | |||||

| BroadStreet Partners Inc / LON (US11132VAY56) | 4.53 | 0.73 | 0.1484 | 0.0056 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 4.52 | -2.16 | 0.1480 | 0.0013 | |||||

| Proampac PG Borrower LLC / LON (US74274NAL73) | 4.51 | 74.62 | 0.1477 | 0.0657 | |||||

| Proampac PG Borrower LLC / LON (US74274NAL73) | 4.51 | 74.62 | 0.1477 | 0.0657 | |||||

| US55336VBW90 / MPLX LP | 4.46 | -0.67 | 0.1460 | 0.0035 | |||||

| Medline Borrower LP / LON (US58503UAF03) | 4.46 | -29.33 | 0.1460 | -0.0543 | |||||

| US26444BAB09 / Duke Energy Progress NC Storm Funding LLC, Series A-2 | 4.46 | 0.25 | 0.1459 | 0.0048 | |||||

| US67078AAF03 / nVent Finance Sarl | 4.43 | 2.05 | 0.1452 | 0.0072 | |||||

| 30064K105 / Exacttarget, Inc. | 4.43 | 0.1452 | 0.1452 | ||||||

| US11043XAA19 / British Airways Pass Through Trust, Series 2019-1, Class AA | 4.42 | -2.13 | 0.1447 | 0.0013 | |||||

| Peachtree Corners Funding Trust II / DBT (US70470BAA70) | 4.41 | 0.1444 | 0.1444 | ||||||

| A1DC34 / Agree Realty Corporation - Depositary Receipt (Common Stock) | 4.38 | 0.1434 | 0.1434 | ||||||

| Wrangler Holdco Corp / DBT (US37441QAA94) | 4.38 | 0.1433 | 0.1433 | ||||||

| US46647PDY97 / JPMorgan Chase & Co | 4.35 | 1.19 | 0.1425 | 0.0060 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 4.35 | 0.1424 | 0.1424 | ||||||

| DTE Electric Co / DBT (US23338VAY20) | 4.33 | 0.1418 | 0.1418 | ||||||

| US912810SN90 / UNITED STATES TREASURY BOND 1.25% 05/15/2050 | 4.33 | -3.22 | 0.1417 | -0.0003 | |||||

| US36179XNH51 / Ginnie Mae II Pool | 4.31 | -6.39 | 0.1411 | -0.0050 | |||||

| US01957TAH05 / Allied Universal Holdco LLC 2021 USD Incremental Term Loan B | 4.25 | 0.31 | 0.1392 | 0.0047 | |||||

| US02377BAB27 / American Airlines 2015-2 Class AA Pass Through Trust | 4.24 | 0.93 | 0.1390 | 0.0055 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 4.20 | 0.94 | 0.1377 | 0.0054 | |||||

| Marriott Ownership Resorts Inc / LON (US57163KAJ79) | 4.20 | -45.53 | 0.1375 | -0.1072 | |||||

| Mars Inc / DBT (US571676BC81) | 4.19 | -0.17 | 0.1373 | 0.0040 | |||||

| US636274AE20 / National Grid PLC | 4.15 | 1.96 | 0.1361 | 0.0067 | |||||

| ACA / Crédit Agricole S.A. | 4.15 | 1.32 | 0.1359 | 0.0059 | |||||

| GPJA / Georgia Power Company - Preferred Security | 4.08 | -32.61 | 0.1337 | -0.0587 | |||||

| United States Treasury Note/Bond / DBT (US91282CKW00) | 4.07 | -66.43 | 0.1335 | -0.2519 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 4.04 | 0.1324 | 0.1324 | ||||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 4.03 | -47.80 | 0.1319 | -0.1131 | |||||

| CarVal CLO VI-C Ltd / ABS-CBDO (US14686FAA66) | 4.01 | 0.23 | 0.1313 | 0.0043 | |||||

| US458140BM12 / Intel Corp | 4.00 | 1.27 | 0.1311 | 0.0056 | |||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 3.93 | -0.78 | 0.1288 | 0.0030 | |||||

| US852234AN39 / Block Inc | 3.92 | 0.93 | 0.1284 | 0.0051 | |||||

| JP Morgan Mortgage Trust Series 2024-NQM1 / ABS-MBS (US465983AA20) | 3.89 | -9.72 | 0.1275 | -0.0094 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 3.85 | -8.38 | 0.1261 | -0.0073 | |||||

| United States Treasury Note/Bond / DBT (US91282CMU26) | 3.84 | 0.1257 | 0.1257 | ||||||

| US73108RAB42 / Polaris Newco LLC USD Term Loan B | 3.82 | 1.43 | 0.1253 | 0.0055 | |||||

| US36268DAA00 / GMREV 23-2 A 144A 5.77% 08-11-36/11-13-28 | 3.82 | 0.50 | 0.1251 | 0.0044 | |||||

| GLP Capital LP / GLP Financing II Inc / DBT (US361841AU37) | 3.76 | -0.66 | 0.1232 | 0.0030 | |||||

| US67078AAE38 / nVent Finance Sarl | 3.74 | 1.19 | 0.1226 | 0.0052 | |||||

| H / Hyatt Hotels Corporation | 3.70 | 1.79 | 0.1213 | 0.0058 | |||||

| US02379KAA25 / American Airlines 2021-1 Class A Pass Through Trust | 3.70 | 2.75 | 0.1210 | 0.0068 | |||||

| US31418EWA45 / UMBS, 30 Year | 3.69 | -5.58 | 0.1209 | -0.0033 | |||||

| GS Mortgage-Backed Securities Trust 2025-NQM2 / ABS-MBS (US36272EAA29) | 3.62 | 0.1185 | 0.1185 | ||||||

| US71654QCG55 / Petroleos Mexicanos | 3.60 | 1.52 | 0.1180 | 0.0053 | |||||

| Toyota Auto Loan Extended Note Trust 2025-1 / ABS-O (US891950AA59) | 3.58 | 0.1173 | 0.1173 | ||||||

| US38141GYJ74 / Goldman Sachs Group Inc/The | 3.56 | 1.98 | 0.1166 | 0.0057 | |||||

| Aviation Capital Group LLC / DBT (US05369AAS06) | 3.53 | 1.49 | 0.1158 | 0.0052 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 3.52 | -43.43 | 0.1154 | -0.0824 | |||||

| US668138AA80 / Northwestern Mutual Life Insurance Co. | 3.52 | 0.06 | 0.1154 | 0.0036 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 3.52 | 0.92 | 0.1153 | 0.0045 | |||||

| LHOME Mortgage Trust 2025-RTL1 / ABS-MBS (US50205UAA97) | 3.51 | 0.06 | 0.1151 | 0.0036 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 3.49 | 1.75 | 0.1144 | 0.0054 | |||||

| US292480AJ92 / Enable Midstream Partners LP | 3.46 | 0.29 | 0.1135 | 0.0038 | |||||

| Rio Tinto Finance USA PLC / DBT (US76720AAU07) | 3.46 | 0.99 | 0.1134 | 0.0045 | |||||

| US03066JAE38 / AMCAR_21-3 | 3.43 | 0.82 | 0.1124 | 0.0043 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3.43 | -1.64 | 0.1123 | 0.0016 | |||||

| US36179X5J15 / Ginnie Mae II Pool | 3.39 | -5.83 | 0.1111 | -0.0033 | |||||

| Rocket Cos Inc / DBT (US77311WAA99) | 3.39 | 0.1111 | 0.1111 | ||||||

| LPL Holdings Inc / DBT (US50212YAP97) | 3.34 | 0.1095 | 0.1095 | ||||||

| US3132DWHG15 / Freddie Mac Pool | 3.32 | -2.52 | 0.1089 | 0.0006 | |||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 3.31 | 0.1083 | 0.1083 | ||||||

| US073685AD12 / Beacon Roofing Supply Inc 4.875% 11/01/2025 144a Bond | 3.28 | 0.1074 | 0.1074 | ||||||

| US161175BZ64 / Charter Communications Operating LLC / Charter Communications Operating Capital | 3.27 | 4.68 | 0.1070 | 0.0079 | |||||

| US912810SP49 / United States Treasury Note/Bond | 3.21 | -3.26 | 0.1050 | -0.0002 | |||||

| US00206RKB77 / AT&T INC 3.850000% 06/01/2060 | 3.18 | 0.38 | 0.1043 | 0.0035 | |||||

| US31418EW482 / Fannie Mae Pool | 3.15 | -4.60 | 0.1032 | -0.0017 | |||||

| US3132DWF570 / FNCL UMBS 5.0 SD8288 01-01-53 | 3.10 | -2.30 | 0.1016 | 0.0008 | |||||

| US92343VGK44 / Verizon Communications Inc | 3.09 | 0.19 | 0.1011 | 0.0033 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 3.06 | 2.48 | 0.1003 | 0.0054 | |||||

| US87264ACV52 / T-Mobile USA, Inc. | 3.06 | 1.09 | 0.1001 | 0.0041 | |||||

| METB34 / MetLife, Inc. - Depositary Receipt (Common Stock) | 3.03 | 2.50 | 0.0994 | 0.0054 | |||||

| Neuberger Berman Loan Advisers CLO 49 Ltd / ABS-CBDO (US64135JAN28) | 3.01 | 0.60 | 0.0984 | 0.0036 | |||||

| Mosaic Solar Loan Trust 2025-1 / ABS-O (US61945HAA05) | 2.98 | -8.65 | 0.0976 | -0.0060 | |||||

| US26442EAK64 / Duke Energy Ohio Inc | 2.96 | 0.31 | 0.0969 | 0.0032 | |||||

| Vale Overseas Ltd / DBT (US91911TAS24) | 2.95 | -34.33 | 0.0967 | -0.0461 | |||||

| US641423CF35 / Nevada Power Co | 2.94 | -0.58 | 0.0962 | 0.0024 | |||||

| BCPE Empire Holdings Inc / LON (US05550HAQ83) | 2.93 | -57.34 | 0.0961 | -0.1223 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 2.91 | -49.24 | 0.0955 | -0.0869 | |||||

| US913903BA74 / Universal Health Services Inc | 2.82 | 1.40 | 0.0925 | 0.0041 | |||||

| OCP Aegis CLO 2023-29 Ltd / ABS-CBDO (US67118BAQ68) | 2.75 | -64.32 | 0.0901 | -0.1547 | |||||

| US3132DWHV81 / Freddie Mac Pool | 2.74 | -5.98 | 0.0897 | -0.0028 | |||||

| US913903AW04 / Universal Health Services Inc | 2.68 | -31.45 | 0.0876 | -0.0363 | |||||

| Dynasty Acquisition Co Inc / LON (US26812CAN65) | 2.67 | -75.77 | 0.0876 | -0.2627 | |||||

| Velocity Commercial Capital Loan Trust 2025-1 / ABS-MBS (US922955AA73) | 2.63 | -2.95 | 0.0861 | 0.0001 | |||||

| TK Elevator US Newco Inc / LON (XAD9000BAJ17) | 2.56 | 0.0838 | 0.0838 | ||||||

| US43283LAH42 / Hilton Grand Vacations Borrower LLC 2021 Term Loan B | 2.49 | -50.13 | 0.0815 | -0.0769 | |||||

| OWN Equipment Fund I LLC / ABS-O (US69121NAA63) | 2.47 | -5.08 | 0.0808 | -0.0017 | |||||

| US912810RQ31 / United States Treas Bds Bond | 2.43 | -2.57 | 0.0795 | 0.0004 | |||||

| US925650AD55 / VICI Properties LP | 2.39 | 1.74 | 0.0784 | 0.0037 | |||||

| TK Elevator US Newco Inc / LON (XAD9000BAJ17) | 2.37 | 0.0778 | 0.0778 | ||||||

| US17327CAR43 / Citigroup Inc | 2.33 | -55.87 | 0.0763 | -0.0914 | |||||

| US68267HAA59 / OneMain Financial Issuance Trust, Series 2022-S1, Class A | 2.31 | -14.03 | 0.0757 | -0.0096 | |||||

| US55955EAN85 / Magnetite XXVII Ltd., Series 2020-27A, Class BR | 2.31 | 0.17 | 0.0755 | 0.0024 | |||||

| United Airlines 2024-1 Class AA Pass Through Trust / DBT (US90932WAA18) | 2.29 | 0.13 | 0.0750 | 0.0024 | |||||

| 30064K105 / Exacttarget, Inc. | 2.28 | 1.33 | 0.0747 | 0.0032 | |||||

| US63941GAB05 / NAVSL_20-BA | 2.25 | -7.10 | 0.0738 | -0.0032 | |||||

| US53079EBL74 / Liberty Mutual Group, Inc. | 2.21 | -2.94 | 0.0725 | 0.0001 | |||||

| US345397B777 / Ford Motor Credit Co LLC | 2.17 | 0.93 | 0.0710 | 0.0028 | |||||

| Hilton Grand Vacations Trust 2024-2 / ABS-O (US43283JAA43) | 2.15 | -8.39 | 0.0705 | -0.0041 | |||||

| US78449UAB44 / SMB Private Education Loan Trust 2020-A | 2.09 | -9.87 | 0.0685 | -0.0052 | |||||

| US05971PAC23 / Banco Mercantil del Norte SA/Grand Cayman | 2.08 | 2.47 | 0.0680 | 0.0037 | |||||

| US912810RS96 / United States Treas Bds Bond | 2.07 | -2.49 | 0.0679 | 0.0004 | |||||

| US18948TAF03 / ClubCorp Holdings, Inc. 2023 Term Loan B2 | 2.06 | -14.71 | 0.0675 | -0.0092 | |||||

| US83207DAA63 / SMB PRIVATE EDUCATION LOAN TRUST 2023-C SER 2023-C CL A1A REGD 144A P/P 5.67000000 | 2.06 | -4.59 | 0.0674 | -0.0011 | |||||

| GM Financial Revolving Receivables Trust 2024-1 / ABS-O (US36269KAA34) | 2.04 | 0.89 | 0.0669 | 0.0026 | |||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 2.04 | -59.29 | 0.0668 | -0.0922 | |||||

| US00206RKJ04 / AT&T Inc | 2.01 | -39.50 | 0.0658 | -0.0396 | |||||

| US14315LAE48 / Carlyle Global Market Strategies CLO 2014-3-R Ltd | 2.01 | 0.35 | 0.0657 | 0.0022 | |||||

| TIAA CLO IV Ltd / ABS-CBDO (US88631YAQ08) | 2.00 | 0.45 | 0.0657 | 0.0023 | |||||

| US71710TAB44 / PG&E Energy Recovery Funding LLC, Series A-2 | 1.94 | 0.15 | 0.0636 | 0.0020 | |||||

| US78448YAJ01 / SMB Private Education Loan Trust 2021-A | 1.93 | -1.93 | 0.0632 | 0.0007 | |||||

| US43284MAA62 / Hilton Grand Vacations Borrower Escrow LLC / Hilton Grand Vacations Borrower Esc | 1.92 | 2.61 | 0.0631 | 0.0035 | |||||

| S1RE34 / Sempra - Depositary Receipt (Common Stock) | 1.92 | 1.80 | 0.0629 | 0.0030 | |||||

| US49338CAC73 / KeySpan Gas East Corp | 1.89 | -2.28 | 0.0619 | 0.0005 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 1.89 | 1.73 | 0.0618 | 0.0029 | |||||

| Diageo Investment Corp / DBT (US25245BAE74) | 1.88 | 0.0617 | 0.0617 | ||||||

| LPL Holdings Inc / DBT (US50212YAQ70) | 1.87 | 0.0613 | 0.0613 | ||||||

| US695114DA39 / PACIFICORP | 1.84 | -2.02 | 0.0603 | 0.0006 | |||||

| US599191AA16 / Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd | 1.80 | -11.36 | 0.0591 | -0.0056 | |||||

| US78449CAA62 / SMB PRIVATE EDUCATION LOAN TRU SMB 2022 C A1A 144A | 1.78 | -4.51 | 0.0583 | -0.0009 | |||||

| US11044MAA45 / British Airways 2020-1 Class A Pass Through Trust | 1.74 | -1.25 | 0.0570 | 0.0010 | |||||

| US49803XAA19 / Kite Realty Group, L.P. | 1.72 | 0.0562 | 0.0562 | ||||||

| US345397ZW60 / Ford Motor Credit Co. LLC | 1.71 | 0.59 | 0.0561 | 0.0020 | |||||

| MVW 2024-2 LLC / ABS-O (US55389QAA58) | 1.69 | -6.83 | 0.0554 | -0.0023 | |||||

| US63942HAA95 / NAVIENT STUDENT LOAN TRUST 2020-2 NAVSL 2020-2A A1A | 1.67 | -5.44 | 0.0547 | -0.0014 | |||||

| US29273VAN01 / Energy Transfer LP | 1.66 | 0.54 | 0.0544 | 0.0020 | |||||

| W1EL34 / Welltower Inc. - Depositary Receipt (Common Stock) | 1.66 | 0.0543 | 0.0543 | ||||||

| US88240TAA97 / Texas Electric Market Stabilization Funding N LLC | 1.61 | 0.25 | 0.0527 | 0.0017 | |||||

| GreenSky Home Improvement Issuer Trust 2025-1 / ABS-O (US39571NAD84) | 1.61 | -5.87 | 0.0526 | -0.0016 | |||||

| US26251LAE48 / Dryden 64 CLO Ltd | 1.60 | 0.06 | 0.0524 | 0.0016 | |||||

| US720186AP00 / PIEDMONT NATURAL GAS CO REGD 5.05000000 | 1.55 | -0.83 | 0.0508 | 0.0012 | |||||

| US02377LAA26 / American Airlines Pass Through Trust, Series 2019-1, Class AA | 1.53 | 0.93 | 0.0500 | 0.0019 | |||||

| US26243EAB74 / DRYDEN 53 CLO LTD | 1.50 | 0.07 | 0.0492 | 0.0015 | |||||

| US55336VBT61 / MPLX LP | 1.45 | -1.43 | 0.0475 | 0.0008 | |||||

| Navient Education Loan Trust 2025-A / ABS-O (US63943EAA55) | 1.43 | 0.0467 | 0.0467 | ||||||

| US912810RZ30 / United States Treas Bds Bond | 1.42 | -2.54 | 0.0466 | 0.0003 | |||||

| US64129KBE64 / Neuberger Berman CLO XV | 1.37 | -21.44 | 0.0448 | -0.0105 | |||||

| BANORT / Banco Mercantil del Norte SA/Grand Cayman | 1.32 | -0.08 | 0.0432 | 0.0013 | |||||

| US78450MAA09 / SMB Private Education Loan Trust 2021-E | 1.32 | -5.73 | 0.0432 | -0.0012 | |||||

| US161175BY99 / CHARTER COMM OPER LLC/CAP CORP 3.85% 04/01/2061 | 1.28 | 5.51 | 0.0420 | 0.0034 | |||||

| US63942LAA08 / Navient Private Education Refi Loan Trust 2021-B | 1.26 | -5.07 | 0.0411 | -0.0009 | |||||

| OWN Equipment Fund II LLC / ABS-O (US690912AA86) | 1.20 | 0.0394 | 0.0394 | ||||||

| BBVA Mexico SA Institucion de Banca Multiple Grupo Financiero BBVA Mexico / DBT (US072912AA61) | 1.18 | 1.63 | 0.0388 | 0.0018 | |||||

| AEP Transmission Co LLC / DBT (US00115AAS87) | 1.18 | 0.0385 | 0.0385 | ||||||

| US483548AF00 / Kaman Corp Bond | 1.10 | 0.0359 | 0.0359 | ||||||

| US483548AF00 / Kaman Corp Bond | 1.10 | 0.0359 | 0.0359 | ||||||

| Hilton Grand Vacations Trust 2024-3 / ABS-O (US43283NAA54) | 1.02 | -11.11 | 0.0336 | -0.0030 | |||||

| Dynasty Acquisition Co Inc / LON (US26812CAP14) | 1.02 | -75.76 | 0.0333 | -0.0999 | |||||

| US26245MAJ09 / Dryden 55 CLO Ltd | 1.00 | 0.20 | 0.0328 | 0.0011 | |||||

| Benefit Street Partners CLO XXV Ltd / ABS-CBDO (US08186YAL83) | 1.00 | 0.20 | 0.0328 | 0.0011 | |||||

| US90932MAA36 / United Airlines 2019-2 Class A Pass Through Trust | 0.98 | -3.94 | 0.0320 | -0.0003 | |||||

| US483548AF00 / Kaman Corp Bond | 0.96 | 0.0316 | 0.0316 | ||||||

| US483548AF00 / Kaman Corp Bond | 0.96 | 0.0316 | 0.0316 | ||||||

| US02376LAA35 / American Airlines Pass-Through Trust, Series 2021-1, Class B | 0.95 | 0.32 | 0.0311 | 0.0010 | |||||

| US78449XAA00 / SMB PRIVATE EDUCATION LOAN TRUST 2020-B 1.29% 07/15/2053 144A | 0.94 | -8.53 | 0.0309 | -0.0019 | |||||

| BRAVO Residential Funding Trust 2024-NQM5 / ABS-MBS (US105925AA98) | 0.93 | 0.0304 | 0.0304 | ||||||

| US62848PAA84 / MVW LLC | 0.92 | -9.23 | 0.0300 | -0.0020 | |||||

| Pagaya AI Debt Grantor Trust 2025-1 / ABS-O (US69544NAC11) | 0.90 | 0.00 | 0.0296 | 0.0009 | |||||

| US63942NAA63 / NAVIENT STUDENT LOAN TRUST NAVSL 2021 1A A1A 144A | 0.87 | -6.65 | 0.0286 | -0.0011 | |||||

| US78442GLL85 / SLM Student Loan Trust 2004-3 | 0.87 | -4.71 | 0.0285 | -0.0005 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.85 | 0.0280 | 0.0280 | ||||||

| US80286FAD50 / Santander Drive Auto Receivables Trust, Series 2022-4, Class B | 0.83 | -50.15 | 0.0271 | -0.0256 | |||||

| US483548AF00 / Kaman Corp Bond | 0.80 | 0.0262 | 0.0262 | ||||||

| US483548AF00 / Kaman Corp Bond | 0.80 | 0.0262 | 0.0262 | ||||||

| US483548AF00 / Kaman Corp Bond | 0.80 | 0.0261 | 0.0261 | ||||||

| US483548AF00 / Kaman Corp Bond | 0.80 | 0.0261 | 0.0261 | ||||||

| US90931CAA62 / United Airlines Pass Through Trust, Series 2019-1, Class AA | 0.78 | -0.89 | 0.0256 | 0.0005 | |||||

| US78449PAB58 / SMB Private Education Loan Trust 2018-A | 0.77 | -16.00 | 0.0253 | -0.0039 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.77 | 0.79 | 0.0251 | 0.0010 | |||||

| US46590XAY22 / JBS USA LUX SA / JBS USA Food Co. / JBS USA Finance, Inc. | 0.75 | 1.08 | 0.0245 | 0.0010 | |||||

| US483548AF00 / Kaman Corp Bond | 0.69 | 0.0226 | 0.0226 | ||||||

| US83406TAB89 / SoFi Professional Loan Program 2020-ATrust | 0.69 | -8.17 | 0.0225 | -0.0013 | |||||

| US830867AA59 / Delta Air Lines Inc / SkyMiles IP Ltd | 0.67 | -33.23 | 0.0218 | -0.0099 | |||||

| Neuberger Berman Loan Advisers CLO 31 Ltd / ABS-CBDO (US64132JAW53) | 0.55 | 0.18 | 0.0180 | 0.0006 | |||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 0.51 | 0.0168 | 0.0168 | ||||||

| XS2066744231 / Carnival PLC | 0.51 | -85.38 | 0.0168 | -0.0948 | |||||

| Corp Andina de Fomento / DBT (US219868CM66) | 0.51 | 0.0167 | 0.0167 | ||||||

| US78449TAB70 / SMB PRIVATE EDUCATION LOAN TRUST 2019-A SMB 2019-A A2A | 0.51 | -12.33 | 0.0166 | -0.0018 | |||||

| US63935BAA17 / Navient Private Education Refi Loan Trust 2020-H | 0.50 | -9.32 | 0.0163 | -0.0011 | |||||

| US83401CAB00 / Sofi Professional Loan Program 2019-C LLC | 0.47 | -7.87 | 0.0153 | -0.0008 | |||||

| US78448YAK73 / SMB 21-A A2A2 144A FRN (L+73) 01-15-53 | 0.45 | -5.44 | 0.0148 | -0.0004 | |||||

| BroadStreet Partners Inc / LON (US11132VAY56) | 0.44 | -90.17 | 0.0145 | -0.1284 | |||||

| US63941FAB22 / Navient Private Education Refi Loan Trust 2020-A | 0.37 | -7.98 | 0.0121 | -0.0006 | |||||

| US63941XAA54 / Navient Private Education Refi Loan Trust 2020-F | 0.36 | -6.98 | 0.0118 | -0.0005 | |||||

| US63942BAA26 / Navient Private Education Refi Loan Trust 2021-A | 0.36 | -5.79 | 0.0117 | -0.0003 | |||||

| US83189DAB64 / SMB PRIVATE EDUCATION LOAN TRU SMB 2017 B A2A 144A | 0.36 | -25.52 | 0.0117 | -0.0035 | |||||

| US63941MAB72 / Navient Private Education Refi Loan Trust 2019-E | 0.34 | -11.60 | 0.0113 | -0.0011 | |||||

| US63941KAB17 / Navient Private Education Refi Loan Trust 2020-C | 0.33 | -6.72 | 0.0109 | -0.0004 | |||||

| US78449QAB32 / SMB PRIVATE EDUCATION LOAN TRUST 2018-C SMB 2018-C A2A | 0.33 | -14.17 | 0.0107 | -0.0014 | |||||

| US63941UAA16 / Navient Private Education Refi Loan Trust 2020-G | 0.28 | -6.29 | 0.0093 | -0.0003 | |||||

| US78449LAB45 / SMB Private Education Loan Trust 2018-B | 0.23 | -14.61 | 0.0075 | -0.0010 | |||||

| US78448WAB19 / SMB Private Education Loan Trust 2017-A | 0.17 | -55.30 | 0.0057 | -0.0066 | |||||

| US80286MAD02 / Santander Drive Auto Receivables Trust 2022-2 | 0.15 | -71.35 | 0.0050 | -0.0118 | |||||

| US55400EAA73 / MVW 2020-1 LLC | 0.12 | -8.46 | 0.0039 | -0.0002 |