Mga Batayang Estadistika

| Nilai Portofolio | $ 600,235,415 |

| Posisi Saat Ini | 109 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

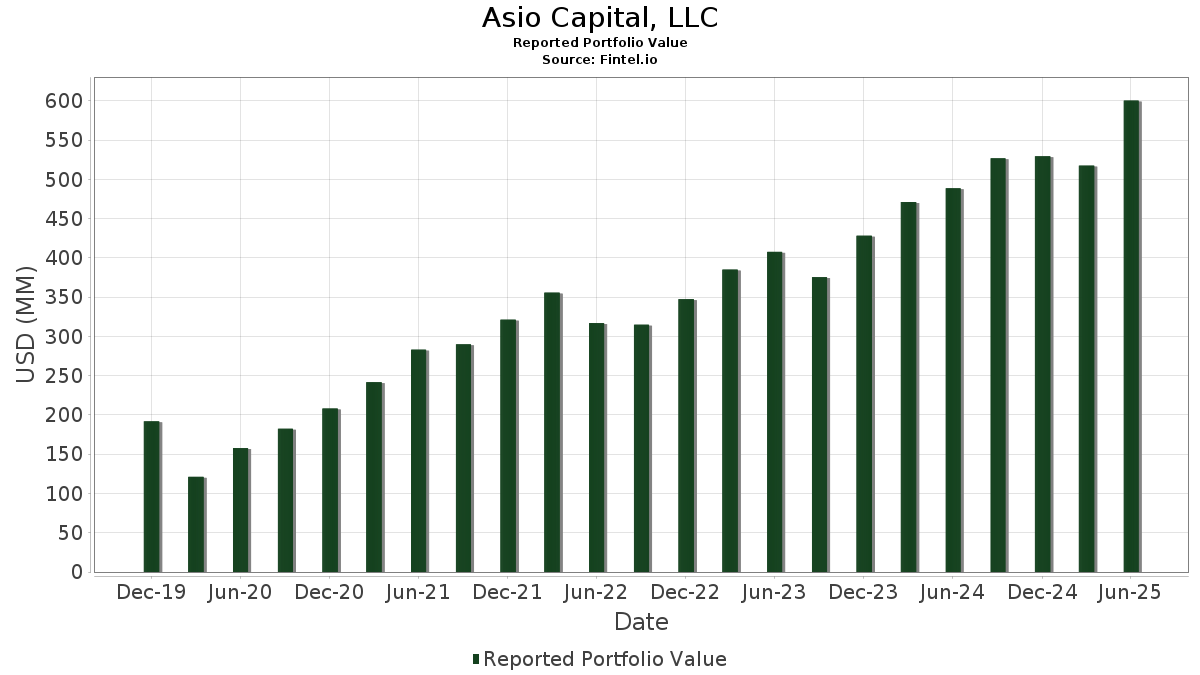

Asio Capital, LLC telah mengungkapkan total kepemilikan 109 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 600,235,415 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Asio Capital, LLC adalah iShares Trust - iShares Core S&P 500 ETF (US:IVV) , Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares (US:NVDD) , J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Municipal ETF (US:JMUB) , Meta Platforms, Inc. (US:META) , and Microsoft Corporation (US:MSFT) . Posisi baru Asio Capital, LLC meliputi: Vanguard Municipal Bond Funds - Vanguard Tax-Exempt Bond ETF (US:VTEB) , Franklin Templeton ETF Trust - Franklin Dynamic Municipal Bond ETF (US:FLMI) , PIMCO ETF Trust - PIMCO Municipal Income Opportunities Active Exchange-Traded Fund (US:MINO) , American Express Company (US:AXP) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.11 | 65.45 | 10.9044 | 1.7886 | |

| 0.21 | 10.21 | 1.7005 | 1.7005 | |

| 0.24 | 5.90 | 0.9832 | 0.9832 | |

| 0.13 | 5.89 | 0.9820 | 0.9820 | |

| 0.17 | 26.58 | 4.4279 | 0.9627 | |

| 0.05 | 15.01 | 2.5010 | 0.7740 | |

| 0.01 | 4.85 | 0.8085 | 0.7559 | |

| 0.38 | 12.37 | 2.0608 | 0.7360 | |

| 0.01 | 3.34 | 0.5559 | 0.5559 | |

| 0.00 | 3.20 | 0.5331 | 0.5331 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.08 | 8.28 | 1.3801 | -2.8774 | |

| 0.49 | 24.57 | 4.0930 | -1.3623 | |

| 0.10 | 10.43 | 1.7371 | -1.2957 | |

| 0.15 | 12.03 | 2.0049 | -0.9782 | |

| 0.01 | 0.95 | 0.1590 | -0.7406 | |

| 0.02 | 6.38 | 1.0624 | -0.5166 | |

| 0.01 | 1.26 | 0.2096 | -0.4990 | |

| 0.02 | 3.85 | 0.6407 | -0.4409 | |

| 0.06 | 11.80 | 1.9666 | -0.4226 | |

| 0.11 | 5.18 | 0.8624 | -0.2610 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-17 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.11 | 25.58 | 65.45 | 38.77 | 10.9044 | 1.7886 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.17 | 1.69 | 26.58 | 48.23 | 4.4279 | 0.9627 | |||

| JMUB / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Municipal ETF | 0.49 | -12.33 | 24.57 | -12.96 | 4.0930 | -1.3623 | |||

| META / Meta Platforms, Inc. | 0.02 | 3.43 | 17.89 | 32.45 | 2.9802 | 0.3701 | |||

| MSFT / Microsoft Corporation | 0.03 | 2.25 | 16.17 | 35.49 | 2.6938 | 0.3874 | |||

| AVGO / Broadcom Inc. | 0.05 | 2.04 | 15.01 | 68.00 | 2.5010 | 0.7740 | |||

| GOOG / Alphabet Inc. | 0.08 | -0.73 | 14.68 | 12.72 | 2.4453 | -0.0713 | |||

| AMZN / Amazon.com, Inc. | 0.06 | 6.24 | 13.61 | 22.51 | 2.2670 | 0.1203 | |||

| VXF / Vanguard Index Funds - Vanguard Extended Market ETF | 0.06 | 2.92 | 12.44 | 15.14 | 2.0729 | -0.0156 | |||

| TMSL / T. Rowe Price Exchange-Traded Funds, Inc. - T. Rowe Price Small-Mid Cap ETF | 0.38 | 67.69 | 12.37 | 80.46 | 2.0608 | 0.7360 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.15 | -22.58 | 12.03 | -22.04 | 2.0049 | -0.9782 | |||

| AAPL / Apple Inc. | 0.06 | 3.38 | 11.80 | -4.51 | 1.9666 | -0.4226 | |||

| JMBS / Janus Detroit Street Trust - Janus Henderson Mortgage-Backed Securities ETF | 0.26 | 4.00 | 11.70 | 3.66 | 1.9488 | -0.2321 | |||

| PANW / Palo Alto Networks, Inc. | 0.05 | 1.65 | 10.74 | 21.90 | 1.7896 | 0.0866 | |||

| UBER / Uber Technologies, Inc. | 0.11 | 1.78 | 10.44 | 30.34 | 1.7385 | 0.1911 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.10 | -36.43 | 10.43 | -33.56 | 1.7371 | -1.2957 | |||

| VTEB / Vanguard Municipal Bond Funds - Vanguard Tax-Exempt Bond ETF | 0.21 | 10.21 | 1.7005 | 1.7005 | |||||

| NFLX / Netflix, Inc. | 0.01 | -16.84 | 9.74 | 19.43 | 1.6231 | 0.0464 | |||

| IGIB / iShares Trust - iShares 5-10 Year Investment Grade Corporate Bond ETF | 0.18 | 53.53 | 9.40 | 55.78 | 1.5661 | 0.3998 | |||

| V / Visa Inc. | 0.03 | 3.63 | 9.00 | 4.98 | 1.4994 | -0.1574 | |||

| GEV / GE Vernova Inc. | 0.02 | 4.49 | 8.44 | 81.13 | 1.4053 | 0.5052 | |||

| MUB / iShares Trust - iShares National Muni Bond ETF | 0.08 | -62.05 | 8.28 | -62.40 | 1.3801 | -2.8774 | |||

| CRM / Salesforce, Inc. | 0.03 | 3.15 | 7.04 | 4.81 | 1.1723 | -0.1251 | |||

| C / Citigroup Inc. | 0.08 | 25.21 | 6.83 | 50.14 | 1.1384 | 0.2588 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 2.38 | 6.62 | 37.17 | 1.1030 | 0.1702 | |||

| HCA / HCA Healthcare, Inc. | 0.02 | 0.86 | 6.59 | 11.82 | 1.0984 | -0.0411 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | 31.03 | 6.38 | -21.95 | 1.0624 | -0.5166 | |||

| DECK / Deckers Outdoor Corporation | 0.06 | 3.66 | 6.09 | -4.44 | 1.0152 | -0.2172 | |||

| ELV / Elevance Health, Inc. | 0.02 | 7.07 | 5.98 | -4.26 | 0.9961 | -0.2108 | |||

| FLMI / Franklin Templeton ETF Trust - Franklin Dynamic Municipal Bond ETF | 0.24 | 5.90 | 0.9832 | 0.9832 | |||||

| MINO / PIMCO ETF Trust - PIMCO Municipal Income Opportunities Active Exchange-Traded Fund | 0.13 | 5.89 | 0.9820 | 0.9820 | |||||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | 7.48 | 5.64 | 29.99 | 0.9395 | 0.1011 | |||

| CRH / CRH plc | 0.06 | 2.90 | 5.56 | 7.38 | 0.9260 | -0.0744 | |||

| APH / Amphenol Corporation | 0.05 | 1.21 | 5.39 | 52.37 | 0.8988 | 0.2145 | |||

| PWR / Quanta Services, Inc. | 0.01 | 3.29 | 5.34 | 53.66 | 0.8889 | 0.2178 | |||

| BINC / BlackRock ETF Trust II - iShares Flexible Income Active ETF | 0.10 | 13.58 | 5.31 | 14.57 | 0.8843 | -0.0110 | |||

| BAC / Bank of America Corporation | 0.11 | -21.47 | 5.18 | -10.96 | 0.8624 | -0.2610 | |||

| OMF / OneMain Holdings, Inc. | 0.09 | 8.08 | 5.10 | 26.03 | 0.8497 | 0.0676 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 5.43 | 5.05 | 32.51 | 0.8420 | 0.1048 | |||

| DELL / Dell Technologies Inc. | 0.04 | 20.64 | 5.03 | 62.30 | 0.8377 | 0.2388 | |||

| FANG / Diamondback Energy, Inc. | 0.04 | 5.96 | 5.00 | -8.94 | 0.8332 | -0.2283 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.01 | 42.03 | 4.96 | 105.22 | 0.8261 | 0.3590 | |||

| TSCO / Tractor Supply Company | 0.09 | 3.26 | 4.94 | -1.10 | 0.8224 | -0.1423 | |||

| CFG / Citizens Financial Group, Inc. | 0.11 | 6.10 | 4.93 | 15.89 | 0.8217 | -0.0009 | |||

| LOW / Lowe's Companies, Inc. | 0.02 | 4.40 | 4.91 | -0.69 | 0.8178 | -0.1375 | |||

| BLDR / Builders FirstSource, Inc. | 0.04 | 137.99 | 4.90 | 122.31 | 0.8168 | 0.3905 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | 2,088.12 | 4.85 | 1,683.82 | 0.8085 | 0.7559 | |||

| SNV / Synovus Financial Corp. | 0.09 | 1.72 | 4.65 | 12.53 | 0.7754 | -0.0239 | |||

| LLY / Eli Lilly and Company | 0.01 | 11.75 | 4.61 | 5.49 | 0.7681 | -0.0767 | |||

| ADBE / Adobe Inc. | 0.01 | -9.05 | 4.53 | -8.27 | 0.7544 | -0.1995 | |||

| TEL / TE Connectivity plc | 0.03 | 3.75 | 4.52 | 23.82 | 0.7527 | 0.0476 | |||

| KKR / KKR & Co. Inc. | 0.03 | 64.15 | 4.38 | 88.88 | 0.7301 | 0.2817 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.06 | 3.68 | 4.17 | -4.84 | 0.6946 | -0.1523 | |||

| WFC / Wells Fargo & Company | 0.05 | 3.56 | 4.10 | 15.57 | 0.6827 | -0.0026 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.06 | 5.82 | 4.01 | 0.60 | 0.6674 | -0.1021 | |||

| IR / Ingersoll Rand Inc. | 0.05 | 4.03 | 3.96 | 8.10 | 0.6602 | -0.0481 | |||

| FDX / FedEx Corporation | 0.02 | -26.36 | 3.85 | -31.28 | 0.6407 | -0.4409 | |||

| CROX / Crocs, Inc. | 0.04 | 4.24 | 3.77 | -0.61 | 0.6279 | -0.1048 | |||

| LRCX / Lam Research Corporation | 0.04 | 28.99 | 3.76 | 72.77 | 0.6269 | 0.2058 | |||

| FI / Fiserv, Inc. | 0.02 | 45.65 | 3.75 | 13.71 | 0.6245 | -0.0126 | |||

| ACN / Accenture plc | 0.01 | 5.37 | 3.64 | 0.92 | 0.6060 | -0.0905 | |||

| NEE / NextEra Energy, Inc. | 0.05 | 6.02 | 3.59 | 3.82 | 0.5983 | -0.0702 | |||

| AXP / American Express Company | 0.01 | 3.34 | 0.5559 | 0.5559 | |||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 3.20 | 0.5331 | 0.5331 | |||||

| PH / Parker-Hannifin Corporation | 0.00 | 3.15 | 0.5253 | 0.5253 | |||||

| SNPS / Synopsys, Inc. | 0.01 | 7.22 | 3.13 | 28.21 | 0.5210 | 0.0495 | |||

| JNJ / Johnson & Johnson | 0.02 | -11.48 | 3.11 | -18.46 | 0.5181 | -0.2190 | |||

| DKNG / DraftKings Inc. | 0.07 | 14.42 | 3.10 | 47.73 | 0.5158 | 0.1109 | |||

| MS / Morgan Stanley | 0.02 | 1.13 | 3.01 | 22.08 | 0.5021 | 0.0251 | |||

| DIS / The Walt Disney Company | 0.02 | 11.02 | 2.91 | 39.49 | 0.4844 | 0.0815 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.04 | 5.79 | 2.71 | 1.65 | 0.4519 | -0.0638 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 3.21 | 2.70 | 21.97 | 0.4505 | 0.0221 | |||

| MEDP / Medpace Holdings, Inc. | 0.01 | 16.93 | 2.67 | 20.42 | 0.4441 | 0.0164 | |||

| DUK / Duke Energy Corporation | 0.02 | 13.11 | 2.45 | 9.46 | 0.4089 | -0.0246 | |||

| EXP / Eagle Materials Inc. | 0.01 | 6.52 | 2.26 | -3.01 | 0.3759 | -0.0736 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | 0.00 | 2.18 | 6.02 | 0.3640 | -0.0341 | |||

| PG / The Procter & Gamble Company | 0.01 | 2.32 | 2.15 | -4.32 | 0.3577 | -0.0761 | |||

| ONON / On Holding AG | 0.04 | 6.43 | 2.14 | 26.17 | 0.3559 | 0.0286 | |||

| JPST / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Ultra-Short Income ETF | 0.04 | 1.77 | 0.2955 | 0.2955 | |||||

| XOM / Exxon Mobil Corporation | 0.01 | -62.14 | 1.26 | -65.68 | 0.2096 | -0.4990 | |||

| ABBV / AbbVie Inc. | 0.01 | -0.35 | 0.96 | -11.69 | 0.1598 | -0.0502 | |||

| PEP / PepsiCo, Inc. | 0.01 | -76.71 | 0.95 | -79.51 | 0.1590 | -0.7406 | |||

| COST / Costco Wholesale Corporation | 0.00 | -2.61 | 0.70 | 1.89 | 0.1171 | -0.0162 | |||

| HD / The Home Depot, Inc. | 0.00 | -0.84 | 0.65 | -0.77 | 0.1078 | -0.0183 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.03 | -12.33 | 0.58 | -14.45 | 0.0967 | -0.0345 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 38.69 | 0.55 | 53.35 | 0.0915 | 0.0222 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | 0.00 | 0.45 | 4.95 | 0.0742 | -0.0078 | |||

| GOOGL / Alphabet Inc. | 0.00 | 1.43 | 0.42 | 15.53 | 0.0707 | -0.0003 | |||

| SCHG / Schwab Strategic Trust - Schwab U.S. Large-Cap Growth ETF | 0.01 | 0.00 | 0.40 | 16.62 | 0.0667 | 0.0004 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 13.94 | 0.39 | 3.70 | 0.0655 | -0.0076 | |||

| TJX / The TJX Companies, Inc. | 0.00 | 14.19 | 0.37 | 15.84 | 0.0623 | -0.0001 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.01 | -2.81 | 0.36 | -3.51 | 0.0596 | -0.0120 | |||

| WMT / Walmart Inc. | 0.00 | 23.18 | 0.35 | 37.35 | 0.0590 | 0.0091 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | -1.46 | 0.31 | -0.63 | 0.0523 | -0.0087 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.00 | 0.00 | 0.31 | 5.78 | 0.0519 | -0.0049 | |||

| SHW / The Sherwin-Williams Company | 0.00 | -1.09 | 0.31 | -2.51 | 0.0518 | -0.0100 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -1.73 | 0.31 | 6.27 | 0.0510 | -0.0047 | |||

| ORCL / Oracle Corporation | 0.00 | 0.29 | 0.0481 | 0.0481 | |||||

| LHX / L3Harris Technologies, Inc. | 0.00 | -3.44 | 0.28 | 15.64 | 0.0469 | -0.0001 | |||

| LIN / Linde plc | 0.00 | 9.23 | 0.28 | 9.92 | 0.0463 | -0.0025 | |||

| MDLZ / Mondelez International, Inc. | 0.00 | 11.51 | 0.27 | 10.53 | 0.0456 | -0.0021 | |||

| CTBI / Community Trust Bancorp, Inc. | 0.00 | -5.26 | 0.25 | -0.40 | 0.0418 | -0.0069 | |||

| DE / Deere & Company | 0.00 | 5.32 | 0.24 | 14.22 | 0.0402 | -0.0007 | |||

| STE / STERIS plc | 0.00 | 0.00 | 0.23 | 5.88 | 0.0391 | -0.0037 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.00 | 0.00 | 0.23 | 8.33 | 0.0391 | -0.0029 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.00 | -5.06 | 0.23 | 0.87 | 0.0388 | -0.0058 | |||

| FNDF / Schwab Strategic Trust - Schwab Fundamental International Equity ETF | 0.01 | 0.22 | 0.0365 | 0.0365 | |||||

| SPYV / SPDR Series Trust - SPDR Portfolio S&P 500 Value ETF | 0.00 | 0.20 | 0.0340 | 0.0340 | |||||

| MA / Mastercard Incorporated | 0.00 | 0.20 | 0.0338 | 0.0338 | |||||

| HON / Honeywell International Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DVY / iShares Trust - iShares Select Dividend ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FITB / Fifth Third Bancorp | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HYMB / SPDR Series Trust - SPDR Nuveen ICE High Yield Municipal Bond ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NOC / Northrop Grumman Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TFC / Truist Financial Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |