Mga Batayang Estadistika

| Nilai Portofolio | $ 164,189,000 |

| Posisi Saat Ini | 106 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

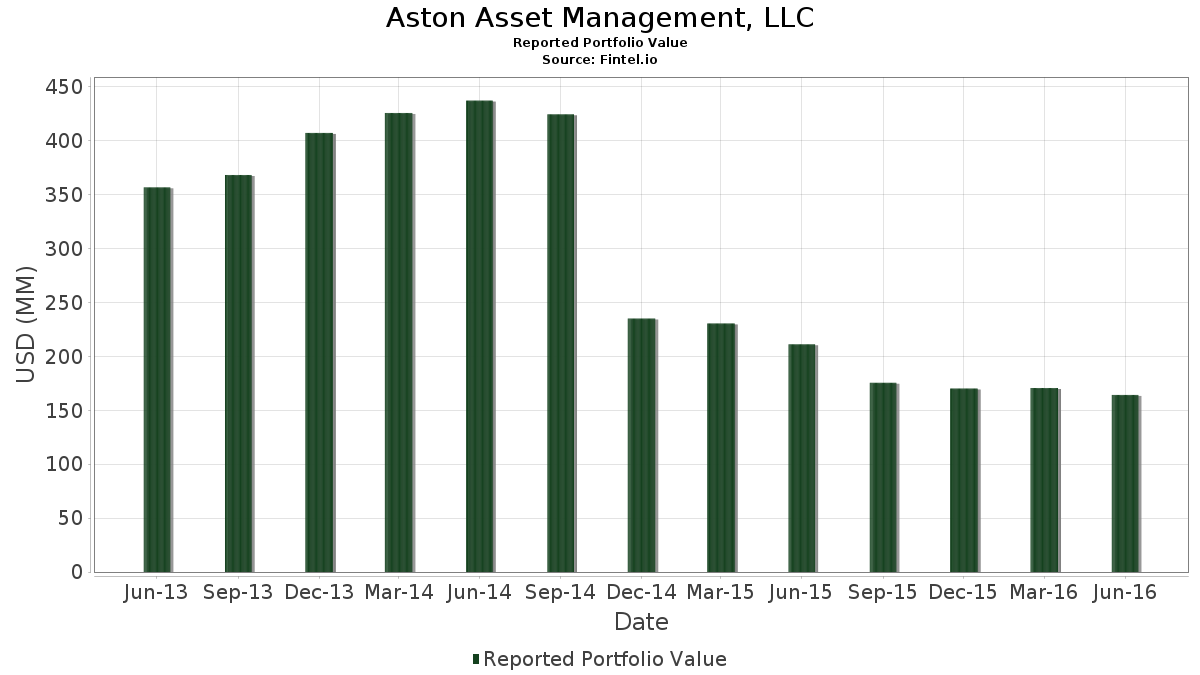

Aston Asset Management, LLC telah mengungkapkan total kepemilikan 106 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 164,189,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Aston Asset Management, LLC adalah ProShares Trust - ProShares Large Cap Core Plus (US:CSM) , Quest Diagnostics Incorporated (US:DGX) , Iron Mountain Incorporated (US:IRM) , Microsoft Corporation (US:MSFT) , and Verizon Communications Inc. (US:VZ) . Posisi baru Aston Asset Management, LLC meliputi: Johnson Controls International plc (US:JCI) , Amgen Inc. (US:AMGN) , TE Connectivity plc (US:TEL) , Cardinal Health, Inc. (US:CAH) , and Stericycle, Inc. (US:SRCL) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 1.55 | 0.9428 | 0.9428 | |

| 0.01 | 1.48 | 0.9014 | 0.9014 | |

| 0.03 | 1.44 | 0.8789 | 0.8789 | |

| 0.01 | 0.99 | 0.6017 | 0.6017 | |

| 0.01 | 0.91 | 0.5567 | 0.5567 | |

| 0.02 | 1.66 | 1.0104 | 0.4126 | |

| 0.02 | 0.64 | 0.3867 | 0.3867 | |

| 0.09 | 3.41 | 2.0769 | 0.3626 | |

| 0.03 | 0.97 | 0.5896 | 0.3094 | |

| 0.03 | 0.79 | 0.4805 | 0.3059 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.0760 | ||

| 0.00 | 0.00 | -0.6623 | ||

| 0.00 | 0.00 | -0.6177 | ||

| 0.00 | 0.00 | -0.6031 | ||

| 0.03 | 0.80 | 0.4866 | -0.5489 | |

| 0.12 | 6.09 | 3.7110 | -0.5163 | |

| 0.00 | 0.00 | -0.4864 | ||

| 0.01 | 0.32 | 0.1943 | -0.3619 | |

| 0.01 | 0.43 | 0.2637 | -0.3423 | |

| 0.04 | 2.10 | 1.2784 | -0.3421 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2016-08-11 untuk periode pelaporan 2016-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CSM / ProShares Trust - ProShares Large Cap Core Plus | 0.12 | -16.48 | 6.09 | -15.53 | 3.7110 | -0.5163 | |||

| DGX / Quest Diagnostics Incorporated | 0.05 | -9.36 | 3.68 | 3.26 | 2.2389 | 0.1525 | |||

| IRM / Iron Mountain Incorporated | 0.09 | -0.74 | 3.41 | 16.58 | 2.0769 | 0.3626 | |||

| MSFT / Microsoft Corporation | 0.07 | -0.37 | 3.41 | -7.70 | 2.0744 | -0.0881 | |||

| VZ / Verizon Communications Inc. | 0.05 | -0.26 | 2.93 | 2.95 | 1.7827 | 0.1165 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.03 | 0.14 | 2.75 | -3.61 | 1.6755 | 0.0029 | |||

| OMC / Omnicom Group Inc. | 0.03 | -0.31 | 2.75 | -2.31 | 1.6749 | 0.0251 | |||

| INTC / Intel Corporation | 0.08 | 0.18 | 2.57 | 1.58 | 1.5665 | 0.0826 | |||

| FAST / Fastenal Company | 0.06 | -0.28 | 2.56 | -9.68 | 1.5622 | -0.1022 | |||

| MSI / Motorola Solutions, Inc. | 0.04 | 30.24 | 2.55 | 13.62 | 1.5549 | 0.2380 | |||

| WFC / Wells Fargo & Company | 0.05 | 0.04 | 2.54 | -2.08 | 1.5500 | 0.0269 | |||

| JNPR / Juniper Networks, Inc. | 0.11 | -2.28 | 2.46 | -13.83 | 1.4989 | -0.1749 | |||

| USB / U.S. Bancorp | 0.06 | 0.23 | 2.33 | -0.43 | 1.4197 | 0.0477 | |||

| WMT / Walmart Inc. | 0.03 | -0.48 | 2.26 | 5.32 | 1.3752 | 0.1187 | |||

| 887228104 / Time Inc. | 0.13 | -1.42 | 2.18 | 5.12 | 1.3265 | 0.1122 | |||

| GLW / Corning Incorporated | 0.10 | -0.53 | 2.10 | -2.50 | 1.2815 | 0.0167 | |||

| ARNC / Arconic Corporation | 0.23 | -7.62 | 2.10 | -10.60 | 1.2790 | -0.0976 | |||

| CPA / Copa Holdings, S.A. | 0.04 | -1.58 | 2.10 | -24.09 | 1.2784 | -0.3421 | |||

| NYT / The New York Times Company | 0.17 | -3.89 | 2.08 | -6.68 | 1.2674 | -0.0395 | |||

| UPS / United Parcel Service, Inc. | 0.02 | 0.36 | 2.07 | 2.47 | 1.2614 | 0.0769 | |||

| TDC / Teradata Corporation | 0.08 | -3.05 | 2.04 | -7.36 | 1.2413 | -0.0481 | |||

| FTI / TechnipFMC plc | 0.08 | -11.34 | 2.02 | -13.58 | 1.2291 | -0.1394 | |||

| US92220P1057 / Varian Medical Systems, Inc. | 0.02 | -7.10 | 2.01 | -4.51 | 1.2260 | -0.0094 | |||

| OXY / Occidental Petroleum Corporation | 0.03 | -0.49 | 1.99 | 9.79 | 1.2090 | 0.1494 | |||

| FMC / FMC Corporation | 0.04 | -9.71 | 1.98 | 3.50 | 1.2053 | 0.0848 | |||

| CREE / Cree, Inc. | 0.08 | 8.61 | 1.95 | -8.75 | 1.1870 | -0.0648 | |||

| US0549371070 / BB&T Corp. | 0.05 | -0.42 | 1.94 | 6.55 | 1.1785 | 0.1142 | |||

| 74005P104 / Praxair, Inc. | 0.02 | 0.30 | 1.89 | -1.51 | 1.1523 | 0.0265 | |||

| APU / AmeriGas Partners, L.P. | 0.04 | -0.19 | 1.85 | 7.26 | 1.1249 | 0.1157 | |||

| TRI / Thomson Reuters Corporation | 0.04 | 0.36 | 1.81 | 0.17 | 1.1012 | 0.0433 | |||

| VTR / Ventas, Inc. | 0.02 | -21.92 | 1.80 | -9.68 | 1.0969 | -0.0717 | |||

| NFG / National Fuel Gas Company | 0.03 | -0.50 | 1.79 | 13.01 | 1.0896 | 0.1619 | |||

| MAT / Mattel, Inc. | 0.06 | -17.12 | 1.78 | -22.86 | 1.0853 | -0.2685 | |||

| XOM / Exxon Mobil Corporation | 0.02 | -0.46 | 1.77 | 11.62 | 1.0768 | 0.1485 | |||

| AKAM / Akamai Technologies, Inc. | 0.03 | -12.36 | 1.75 | -11.84 | 1.0658 | -0.0975 | |||

| VVC / Vectren Corp. | 0.03 | -0.49 | 1.72 | 3.67 | 1.0494 | 0.0754 | |||

| GEO / The GEO Group, Inc. | 0.05 | -0.92 | 1.72 | -2.33 | 1.0451 | 0.0154 | |||

| CNK / Cinemark Holdings, Inc. | 0.05 | -0.50 | 1.71 | 1.24 | 1.0427 | 0.0517 | |||

| JBL / Jabil Inc. | 0.09 | 6.31 | 1.69 | 1.93 | 1.0281 | 0.0576 | |||

| TGNA / TEGNA Inc. | 0.07 | 14.26 | 1.69 | 12.84 | 1.0275 | 0.1513 | |||

| GNTX / Gentex Corporation | 0.11 | -2.03 | 1.69 | -3.55 | 1.0269 | 0.0024 | |||

| UNP / Union Pacific Corporation | 0.02 | 48.31 | 1.66 | 62.65 | 1.0104 | 0.4126 | |||

| LGF.A / Lions Gate Entertainment Corp. | 0.08 | 31.96 | 1.65 | 22.21 | 1.0055 | 0.2138 | |||

| CMP / Compass Minerals International, Inc. | 0.02 | -0.40 | 1.63 | 4.28 | 0.9952 | 0.0768 | |||

| ATGE / Adtalem Global Education Inc. | 0.09 | 24.84 | 1.63 | 29.02 | 0.9909 | 0.2519 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.03 | 0.16 | 1.61 | 6.20 | 0.9812 | 0.0921 | |||

| NTRS / Northern Trust Corporation | 0.02 | -19.43 | 1.59 | -18.05 | 0.9708 | -0.1691 | |||

| WU / The Western Union Company | 0.08 | 0.70 | 1.59 | 0.13 | 0.9702 | 0.0378 | |||

| EMR / Emerson Electric Co. | 0.03 | -0.51 | 1.56 | -4.58 | 0.9520 | -0.0080 | |||

| JCI / Johnson Controls International plc | 0.03 | 1.55 | 0.9428 | 0.9428 | |||||

| MMP / Magellan Midstream Partners L.P. | 0.02 | -0.04 | 1.55 | 10.42 | 0.9422 | 0.1211 | |||

| OMI / Owens & Minor, Inc. | 0.04 | 0.15 | 1.54 | -7.41 | 0.9355 | -0.0368 | |||

| / McDermott International, Inc. | 0.31 | -7.25 | 1.53 | 12.05 | 0.9343 | 0.1320 | |||

| TWX / Warner Media LLC | 0.02 | -0.03 | 1.51 | 1.34 | 0.9215 | 0.0465 | |||

| AMGN / Amgen Inc. | 0.01 | 1.48 | 0.9014 | 0.9014 | |||||

| TEL / TE Connectivity plc | 0.03 | 1.44 | 0.8789 | 0.8789 | |||||

| UFS / Domtar Corporation | 0.04 | -7.19 | 1.42 | -19.65 | 0.8667 | -0.1712 | |||

| TGT / Target Corporation | 0.02 | 0.18 | 1.41 | -15.04 | 0.8569 | -0.1136 | |||

| TAP / Molson Coors Beverage Company | 0.01 | -0.52 | 1.40 | 4.55 | 0.8545 | 0.0680 | |||

| AGCO / AGCO Corporation | 0.03 | -16.18 | 1.37 | -20.50 | 0.8338 | -0.1754 | |||

| AYR / Aircastle Ltd. | 0.07 | -0.07 | 1.35 | -12.10 | 0.8228 | -0.0779 | |||

| ITRI / Itron, Inc. | 0.03 | -19.68 | 1.34 | -16.98 | 0.8192 | -0.1302 | |||

| WY / Weyerhaeuser Company | 0.05 | -0.10 | 1.34 | -4.00 | 0.8186 | -0.0019 | |||

| ODP / The ODP Corporation | 0.40 | 55.90 | 1.34 | -27.35 | 0.8155 | -0.2646 | |||

| RIG / Transocean Ltd. | 0.11 | 1.32 | 1.33 | 31.82 | 0.8125 | 0.2194 | |||

| X / United States Steel Corporation | 0.08 | -32.20 | 1.30 | -28.82 | 0.7912 | -0.2784 | |||

| SEP / Spectra Energy Partners LP | 0.03 | -0.01 | 1.27 | -1.93 | 0.7747 | 0.0146 | |||

| LEA / Lear Corporation | 0.01 | -9.81 | 1.27 | -17.43 | 0.7735 | -0.1279 | |||

| PH / Parker-Hannifin Corporation | 0.01 | -0.65 | 1.26 | -3.37 | 0.7686 | 0.0032 | |||

| NUAN / Nuance Communications Inc | 0.08 | -7.32 | 1.25 | -22.53 | 0.7583 | -0.1835 | |||

| CBI / Chicago Bridge & Iron Co., N.V. | 0.04 | -0.34 | 1.21 | -5.67 | 0.7394 | -0.0149 | |||

| CVX / Chevron Corporation | 0.01 | -0.59 | 1.19 | 9.25 | 0.7266 | 0.0866 | |||

| CME / CME Group Inc. | 0.01 | -30.45 | 1.14 | -29.47 | 0.6937 | -0.2528 | |||

| WERN / Werner Enterprises, Inc. | 0.05 | 2.10 | 1.14 | -13.67 | 0.6925 | -0.0794 | |||

| MSM / MSC Industrial Direct Co., Inc. | 0.02 | -0.05 | 1.12 | -7.59 | 0.6821 | -0.0282 | |||

| SCHL / Scholastic Corporation | 0.03 | -7.09 | 1.08 | -1.46 | 0.6584 | 0.0155 | |||

| BWA / BorgWarner Inc. | 0.04 | 9.12 | 1.06 | -16.11 | 0.6438 | -0.0947 | |||

| QCOM / QUALCOMM Incorporated | 0.02 | -0.43 | 1.04 | 4.31 | 0.6340 | 0.0491 | |||

| WHR / Whirlpool Corporation | 0.01 | -11.37 | 1.02 | -18.08 | 0.6237 | -0.1089 | |||

| CAH / Cardinal Health, Inc. | 0.01 | 0.99 | 0.6017 | 0.6017 | |||||

| RJF / Raymond James Financial, Inc. | 0.02 | -21.04 | 0.99 | -18.23 | 0.6011 | -0.1062 | |||

| H01531104 / Allied World Assurance Company Holding AG | 0.03 | 101.40 | 0.97 | 102.51 | 0.5896 | 0.3094 | |||

| PEP / PepsiCo, Inc. | 0.01 | 0.03 | 0.96 | 3.33 | 0.5853 | 0.0403 | |||

| SRCL / Stericycle, Inc. | 0.01 | 0.91 | 0.5567 | 0.5567 | |||||

| GGB / Gerdau S.A. - Depositary Receipt (Common Stock) | 0.50 | -7.53 | 0.91 | -5.49 | 0.5561 | -0.0101 | |||

| DCI / Donaldson Company, Inc. | 0.02 | -7.12 | 0.86 | 0.00 | 0.5220 | 0.0197 | |||

| 89376V100 / TransMontaigne Partners LP | 0.02 | -0.96 | 0.84 | 11.07 | 0.5134 | 0.0686 | |||

| IPG / The Interpublic Group of Companies, Inc. | 0.03 | -55.11 | 0.80 | -54.78 | 0.4866 | -0.5489 | |||

| US2168311072 / Cooper Tire & Rubber Co | 0.03 | 228.41 | 0.79 | 164.77 | 0.4805 | 0.3059 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | -40.78 | 0.75 | -39.64 | 0.4544 | -0.2700 | |||

| NCMI / National CineMedia, Inc. | 0.05 | 0.55 | 0.73 | 2.38 | 0.4452 | 0.0268 | |||

| BMS / Bemis Co., Inc. | 0.01 | -0.31 | 0.73 | -0.82 | 0.4434 | 0.0132 | |||

| CSGS / CSG Systems International, Inc. | 0.02 | -0.10 | 0.71 | -10.84 | 0.4306 | -0.0341 | |||

| SBRA / Sabra Health Care REIT, Inc. | 0.03 | 0.57 | 0.69 | 3.29 | 0.4202 | 0.0288 | |||

| WSBC / WesBanco, Inc. | 0.02 | 0.64 | 0.3867 | 0.3867 | |||||

| BG / Bunge Global SA | 0.01 | 107.93 | 0.62 | 117.42 | 0.3800 | 0.2118 | |||

| UIS / Unisys Corporation | 0.08 | -7.17 | 0.61 | -12.18 | 0.3734 | -0.0357 | |||

| SYBT / Stock Yards Bancorp, Inc. | 0.02 | 49.30 | 0.59 | 9.41 | 0.3612 | 0.0435 | |||

| F / Ford Motor Company | 0.05 | 0.45 | 0.58 | -6.47 | 0.3520 | -0.0102 | |||

| CODI / Compass Diversified | 0.03 | 0.18 | 0.51 | 6.24 | 0.3112 | 0.0293 | |||

| NVDA / NVIDIA Corporation | 0.01 | -68.26 | 0.43 | -58.12 | 0.2637 | -0.3423 | |||

| CNA / CNA Financial Corporation | 0.01 | -0.43 | 0.42 | -2.76 | 0.2576 | 0.0027 | |||

| CINF / Cincinnati Financial Corporation | 0.01 | -46.17 | 0.42 | -38.30 | 0.2570 | -0.1438 | |||

| ATNI / ATN International, Inc. | 0.00 | 0.15 | 0.36 | 2.82 | 0.2223 | 0.0143 | |||

| UNIT / Unity Group LLC | 0.01 | -0.96 | 0.35 | 27.90 | 0.2150 | 0.0532 | |||

| US2782651036 / Eaton Vance Corp. | 0.01 | -68.17 | 0.32 | -66.39 | 0.1943 | -0.3619 | |||

| OC / Owens Corning | 0.00 | -100.00 | 0.00 | -100.00 | -0.1682 | ||||

| KSS / Kohl's Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.6177 | ||||

| ADT / ADT Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0760 | ||||

| RCI / Rogers Communications Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4864 | ||||

| NUE / Nucor Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.6623 | ||||

| RSG / Republic Services, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6031 |