Mga Batayang Estadistika

| Nilai Portofolio | $ 4,483,672,336 |

| Posisi Saat Ini | 107 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

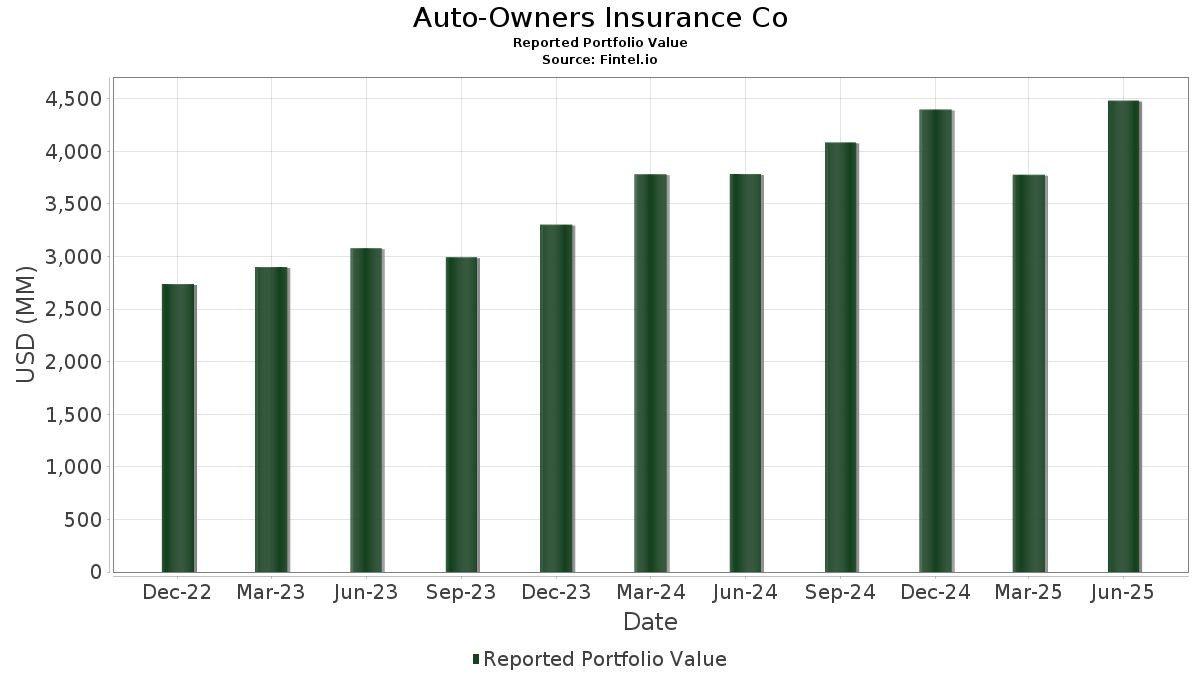

Auto-Owners Insurance Co telah mengungkapkan total kepemilikan 107 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 4,483,672,336 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Auto-Owners Insurance Co adalah SPDR Index Shares Funds - SPDR Portfolio Developed World ex-US ETF (US:SPDW) , iShares Trust - iShares Core S&P Total U.S. Stock Market ETF (US:ITOT) , SPDR Series Trust - SPDR NYSE Technology ETF (US:XNTK) , Schwab Strategic Trust - Schwab Fundamental International Equity ETF (US:FNDF) , and iShares Trust - iShares MSCI EAFE Value ETF (US:EFV) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 8.35 | 333.83 | 7.4454 | 6.5213 | |

| 1.52 | 360.78 | 8.0466 | 5.9011 | |

| 3.96 | 251.57 | 5.6108 | 3.7198 | |

| 2.99 | 404.23 | 9.0156 | 3.5436 | |

| 2.41 | 183.46 | 4.0917 | 3.2035 | |

| 0.17 | 125.70 | 2.8034 | 2.4488 | |

| 0.00 | 113.69 | 2.5357 | 2.1883 | |

| 0.13 | 66.49 | 1.4830 | 1.2927 | |

| 0.11 | 53.49 | 1.1931 | 1.0085 | |

| 1.03 | 42.07 | 0.9384 | 0.9065 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.58 | 24.21 | 0.5399 | -11.2911 | |

| 1.75 | 50.14 | 1.1182 | -6.8375 | |

| 0.01 | 0.56 | 0.0125 | -6.4262 | |

| 0.00 | 0.93 | 0.0081 | -5.7551 | |

| 0.36 | 21.61 | 0.1884 | -4.3398 | |

| 0.18 | 31.41 | 0.2738 | -2.3875 | |

| 0.00 | 1.45 | 0.0324 | -2.2686 | |

| 0.58 | 103.03 | 0.8981 | -2.0292 | |

| 0.45 | 18.79 | 0.4190 | -1.3346 | |

| 0.02 | 3.54 | 0.0308 | -1.2391 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-01 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPDW / SPDR Index Shares Funds - SPDR Portfolio Developed World ex-US ETF | 17.58 | 240.82 | 711.65 | 251.45 | 6.2032 | 0.8444 | |||

| ITOT / iShares Trust - iShares Core S&P Total U.S. Stock Market ETF | 2.99 | 8.79 | 404.23 | 95.50 | 9.0156 | 3.5436 | |||

| XNTK / SPDR Series Trust - SPDR NYSE Technology ETF | 1.52 | 2.66 | 360.78 | 345.02 | 8.0466 | 5.9011 | |||

| FNDF / Schwab Strategic Trust - Schwab Fundamental International Equity ETF | 8.35 | 788.64 | 333.83 | 856.00 | 7.4454 | 6.5213 | |||

| EFV / iShares Trust - iShares MSCI EAFE Value ETF | 3.96 | 296.70 | 251.57 | 252.07 | 5.6108 | 3.7198 | |||

| IDEV / iShares Trust - iShares Core MSCI International Developed Markets ETF | 2.41 | 358.99 | 183.46 | 446.67 | 4.0917 | 3.2035 | |||

| GE / General Electric Company | 0.50 | 162.46 | 129.38 | 147.82 | 1.1278 | -0.2539 | |||

| META / Meta Platforms, Inc. | 0.17 | 420.00 | 125.70 | 838.10 | 2.8034 | 2.4488 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | -98.37 | 113.69 | 766.22 | 2.5357 | 2.1883 | |||

| GOOG / Alphabet Inc. | 0.58 | 0.00 | 103.03 | -6.85 | 0.8981 | -2.0292 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.72 | 125.23 | 96.54 | 137.95 | 0.8415 | -0.2322 | |||

| SPYD / SPDR Series Trust - SPDR Portfolio S&P 500 High Dividend ETF | 2.05 | 192.40 | 86.94 | 176.87 | 0.7578 | -0.0732 | |||

| IUSV / iShares Trust - iShares Core S&P U.S. Value ETF | 0.86 | 68.16 | 81.78 | 70.52 | 0.7128 | -0.5564 | |||

| AMZN / Amazon.com, Inc. | 0.36 | 0.00 | 78.61 | 0.00 | 1.7532 | -0.3271 | |||

| GEV / GE Vernova Inc. | 0.13 | 281.35 | 66.49 | 824.80 | 1.4830 | 1.2927 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 1.31 | 46.17 | 64.83 | -12.55 | 1.4459 | -0.5161 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 1.05 | 418.47 | 59.62 | 84.68 | 0.5197 | -0.3347 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.25 | -72.72 | 59.01 | 36.46 | 0.5144 | -0.6301 | |||

| SPMD / SPDR Series Trust - SPDR Portfolio S&P 400 Mid Cap ETF | 1.04 | 248.65 | 56.56 | 217.34 | 0.4930 | 0.0213 | |||

| MMM / 3M Company | 0.35 | 0.00 | 53.97 | 17.93 | 1.2036 | -0.0074 | |||

| MSFT / Microsoft Corporation | 0.11 | 486.62 | 53.49 | 667.14 | 1.1931 | 1.0085 | |||

| DVYE / iShares, Inc. - iShares Emerging Markets Dividend ETF | 1.75 | -31.70 | 50.14 | -83.32 | 1.1182 | -6.8375 | |||

| JNJ / Johnson & Johnson | 0.31 | -21.12 | 47.77 | 207.62 | 1.0655 | 0.6545 | |||

| RTX / RTX Corporation | 0.32 | -23.47 | 46.48 | 157.74 | 0.4052 | -0.0721 | |||

| HII / Huntington Ingalls Industries, Inc. | 0.19 | -58.93 | 45.15 | 399.76 | 0.3936 | 0.1545 | |||

| PEP / PepsiCo, Inc. | 0.33 | -20.45 | 43.48 | 72.99 | 0.3790 | -0.2861 | |||

| DOW / Dow Inc. | 1.61 | 44,650.00 | 42.66 | 4,960.38 | 0.3718 | 0.3495 | |||

| PII / Polaris Inc. | 1.03 | 13,103.21 | 42.07 | 3,394.35 | 0.9384 | 0.9065 | |||

| CSCO / Cisco Systems, Inc. | 0.59 | -3.53 | 40.87 | 8.29 | 0.3563 | -0.6426 | |||

| KO / The Coca-Cola Company | 0.55 | 1,475.06 | 38.93 | 1,423.52 | 0.3393 | 0.2717 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.92 | 73.28 | 35.44 | 130.43 | 0.3089 | -0.0981 | |||

| DGRO / iShares Trust - iShares Core Dividend Growth ETF | 0.51 | 126.35 | 32.90 | 135.15 | 0.7337 | 0.3635 | |||

| BAX / Baxter International Inc. | 1.05 | 1,192.55 | 31.79 | 72.80 | 0.2771 | -0.2098 | |||

| BDX / Becton, Dickinson and Company | 0.18 | 1,224.77 | 31.41 | -68.76 | 0.2738 | -2.3875 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 1.00 | 122.22 | 31.01 | 41.77 | 0.2703 | -0.3086 | |||

| MSM / MSC Industrial Direct Co., Inc. | 0.35 | 1,118.87 | 29.42 | 707.24 | 0.2564 | 0.1600 | |||

| VCR / Vanguard World Fund - Vanguard Consumer Discretionary ETF | 0.08 | 55.99 | 29.23 | 590.15 | 0.2548 | 0.1427 | |||

| KOF / Coca-Cola FEMSA, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.30 | 5,257.14 | 29.02 | 5,601.18 | 0.2529 | 0.2395 | |||

| USB / U.S. Bancorp | 0.62 | 1,760.23 | 28.28 | 250.36 | 0.2465 | 0.0329 | |||

| DD / DuPont de Nemours, Inc. | 0.40 | 123.96 | 27.51 | 262.06 | 0.2398 | 0.0387 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.35 | 803.64 | 26.15 | 806.73 | 0.2279 | 0.1516 | |||

| XLRE / The Select Sector SPDR Trust - The Real Estate Select Sector SPDR Fund | 0.58 | -95.63 | 24.21 | -94.58 | 0.5399 | -11.2911 | |||

| IEMG / iShares, Inc. - iShares Core MSCI Emerging Markets ETF | 0.36 | -89.22 | 21.61 | -87.37 | 0.1884 | -4.3398 | |||

| HMC / Honda Motor Co., Ltd. - Depositary Receipt (Common Stock) | 0.66 | 167.61 | 18.90 | -28.38 | 0.1648 | -0.5337 | |||

| FMC / FMC Corporation | 0.45 | 8.47 | 18.79 | -71.65 | 0.4190 | -1.3346 | |||

| AMSF / AMERISAFE, Inc. | 0.43 | 0.00 | 18.67 | -15.15 | 0.1627 | -0.4196 | |||

| CCL / Carnival Corporation & plc | 0.65 | 28.98 | 18.28 | -38.29 | 0.4077 | -0.3762 | |||

| KHC / The Kraft Heinz Company | 0.53 | 226.47 | 13.57 | 151.18 | 0.1183 | -0.0247 | |||

| AVB / AvalonBay Communities, Inc. | 0.07 | 537.25 | 13.23 | 8,271.52 | 0.1153 | 0.1111 | |||

| TFC / Truist Financial Corporation | 0.29 | 2,241.46 | 12.38 | 698.26 | 0.1079 | 0.0669 | |||

| INTC / Intel Corporation | 0.49 | 24.12 | 10.99 | -43.94 | 0.0958 | -0.4229 | |||

| K / Kellanova | 0.14 | 369.10 | 10.74 | 214.43 | 0.0937 | 0.0032 | |||

| WDAY / Workday, Inc. | 0.04 | 43.73 | 9.62 | 102.74 | 0.0839 | -0.0418 | |||

| EBGEF / Enbridge Inc. - Preferred Stock | 0.18 | 4,273.87 | 8.12 | 1,691.83 | 0.0708 | 0.0588 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.02 | -97.51 | 6.38 | -84.09 | 0.0556 | -1.0058 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.05 | 606.13 | 5.46 | 822.64 | 0.0476 | 0.0319 | |||

| AAPL / Apple Inc. | 0.03 | 0.00 | 5.13 | -18.07 | 0.1144 | -0.0513 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 300.84 | 4.65 | 739.89 | 0.0406 | 0.0259 | |||

| T / AT&T Inc. | 0.14 | 98.02 | 4.18 | -71.20 | 0.0933 | -0.2911 | |||

| PG / The Procter & Gamble Company | 0.03 | 171.97 | 4.16 | 637.41 | 0.0363 | 0.0213 | |||

| SCZ / iShares Trust - iShares MSCI EAFE Small-Cap ETF | 0.05 | -52.19 | 3.80 | -56.89 | 0.0331 | -0.2003 | |||

| TD / The Toronto-Dominion Bank | 0.05 | 4,877.98 | 3.74 | 1,503.43 | 0.0326 | 0.0264 | |||

| ORCL / Oracle Corporation | 0.02 | -94.87 | 3.54 | -92.63 | 0.0308 | -1.2391 | |||

| SYK / Stryker Corporation | 0.01 | 97.92 | 3.28 | 50.53 | 0.0286 | -0.0291 | |||

| HDV / iShares Trust - iShares Core High Dividend ETF | 0.02 | -91.74 | 2.79 | -93.23 | 0.0622 | -1.0273 | |||

| AMAT / Applied Materials, Inc. | 0.01 | 0.00 | 2.38 | 12.54 | 0.0207 | -0.0352 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.02 | -67.13 | 2.04 | -80.82 | 0.0178 | -0.2634 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -98.55 | 1.70 | -86.41 | 0.0148 | -0.3158 | |||

| LIN / Linde plc | 0.00 | -97.91 | 1.45 | -98.33 | 0.0324 | -2.2686 | |||

| HWM / Howmet Aerospace Inc. | 0.01 | 175.80 | 1.31 | 102.63 | 0.0114 | -0.0057 | |||

| BLK / BlackRock, Inc. | 0.00 | -87.23 | 1.26 | 29.66 | 0.0110 | -0.0147 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | -97.42 | 1.25 | -96.43 | 0.0109 | -0.9135 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 127.78 | 1.24 | -30.98 | 0.0108 | -0.0368 | |||

| ABT / Abbott Laboratories | 0.01 | 0.00 | 1.14 | 20.21 | 0.0099 | -0.0151 | |||

| ECL / Ecolab Inc. | 0.00 | -99.64 | 0.97 | -96.91 | 0.0085 | -0.8215 | |||

| CARR / Carrier Global Corporation | 0.01 | 552.73 | 0.94 | 105.95 | 0.0082 | -0.0039 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | -80.85 | 0.93 | -78.71 | 0.0081 | -0.1077 | |||

| SNA / Snap-on Incorporated | 0.00 | -99.72 | 0.93 | -99.58 | 0.0081 | -5.7551 | |||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.01 | -26.49 | 0.90 | 3.33 | 0.0079 | -0.0152 | |||

| SYY / Sysco Corporation | 0.01 | -78.18 | 0.84 | -68.98 | 0.0073 | -0.0644 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.01 | 2,279.53 | 0.80 | 103.05 | 0.0070 | -0.0035 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | -96.82 | 0.71 | -97.13 | 0.0159 | -0.6429 | |||

| DOV / Dover Corporation | 0.00 | -97.95 | 0.71 | -95.07 | 0.0062 | -0.3769 | |||

| AVGO / Broadcom Inc. | 0.00 | -99.63 | 0.66 | -95.94 | 0.0057 | -0.4229 | |||

| AEM / Agnico Eagle Mines Limited | 0.01 | 0.00 | 0.64 | 52.13 | 0.0143 | 0.0031 | |||

| OTIS / Otis Worldwide Corporation | 0.01 | 27.86 | 0.63 | -34.34 | 0.0055 | -0.0200 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | -99.82 | 0.63 | -98.27 | 0.0055 | -0.9597 | |||

| MRK / Merck & Co., Inc. | 0.01 | -91.90 | 0.58 | -98.51 | 0.0050 | -1.0218 | |||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.01 | -99.87 | 0.56 | -99.77 | 0.0125 | -6.4262 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.05 | 47.24 | 0.55 | -93.59 | 0.0048 | -0.2227 | |||

| GHM / Graham Corporation | 0.01 | 4.76 | 0.54 | 68.42 | 0.0047 | -0.0038 | |||

| CME / CME Group Inc. | 0.00 | -99.35 | 0.54 | -97.69 | 0.0047 | -0.6137 | |||

| CL / Colgate-Palmolive Company | 0.01 | -1.01 | 0.51 | 101.19 | 0.0044 | -0.0023 | |||

| DELL / Dell Technologies Inc. | 0.00 | -99.47 | 0.51 | -98.38 | 0.0044 | -0.8250 | |||

| GM / General Motors Company | 0.01 | -98.94 | 0.48 | -98.46 | 0.0042 | -0.8219 | |||

| MCO / Moody's Corporation | 0.00 | -97.93 | 0.47 | -89.37 | 0.0041 | -0.1122 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.00 | -5.86 | 0.47 | 43.25 | 0.0041 | -0.0046 | |||

| VZ / Verizon Communications Inc. | 0.01 | -79.10 | 0.43 | -2.91 | 0.0097 | -0.0022 | |||

| COST / Costco Wholesale Corporation | 0.00 | -89.63 | 0.43 | -10.90 | 0.0037 | -0.0089 | |||

| VOD / Vodafone Group Public Limited Company - Depositary Receipt (Common Stock) | 0.04 | 68.88 | 0.42 | 70.56 | 0.0037 | -0.0029 | |||

| ADI / Analog Devices, Inc. | 0.00 | 0.00 | 0.41 | 12.23 | 0.0036 | -0.0062 | |||

| CVS / CVS Health Corporation | 0.01 | 45.05 | 0.39 | -46.65 | 0.0034 | -0.0160 | |||

| WBD / Warner Bros. Discovery, Inc. | 0.02 | 5.27 | 0.27 | -88.60 | 0.0024 | -0.0601 | |||

| MT / ArcelorMittal S.A. - Depositary Receipt (Common Stock) | 0.01 | -94.09 | 0.25 | -91.71 | 0.0022 | -0.0789 | |||

| UNP / Union Pacific Corporation | 0.00 | -99.84 | 0.24 | -99.21 | 0.0020 | -0.7891 | |||

| FTV / Fortive Corporation | 0.00 | -96.85 | 0.23 | -97.89 | 0.0020 | -0.2822 | |||

| HI / Hillenbrand, Inc. | 0.01 | 49.30 | 0.21 | -72.69 | 0.0018 | -0.0185 | |||

| GOLD / Barrick Mining Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |