Mga Batayang Estadistika

| Nilai Portofolio | $ 1,025,290,042 |

| Posisi Saat Ini | 174 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

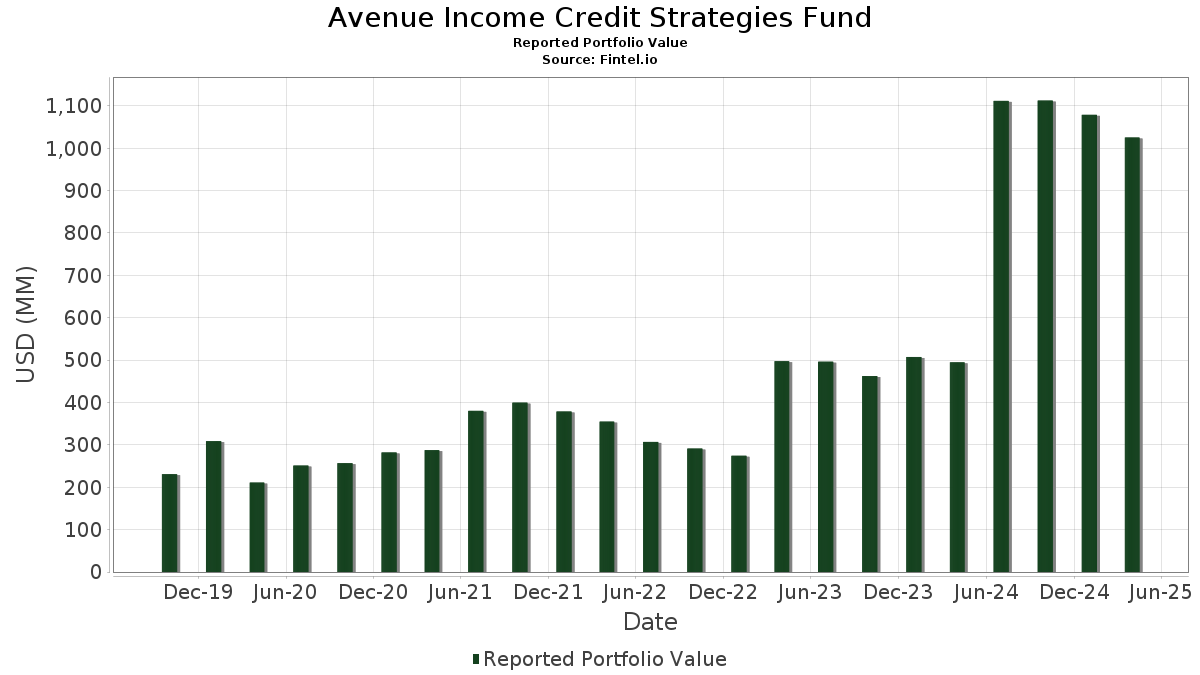

Avenue Income Credit Strategies Fund telah mengungkapkan total kepemilikan 174 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,025,290,042 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Avenue Income Credit Strategies Fund adalah State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls (US:GVMXX) , EnQuest PLC (GB:US29357JAC09) , 888 Acquisitions Ltd (GI:XS2498543102) , Summer BC Holdco A Sarl (LU:XS2067265392) , and BCP V Modular Services Finance PLC (GB:XS2397448346) . Posisi baru Avenue Income Credit Strategies Fund meliputi: EnQuest PLC (GB:US29357JAC09) , 888 Acquisitions Ltd (GI:XS2498543102) , Summer BC Holdco A Sarl (LU:XS2067265392) , BCP V Modular Services Finance PLC (GB:XS2397448346) , and Affinity Gaming (US:US00842XAA72) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 12.64 | 1.6937 | 1.6937 | ||

| 14.50 | 1.9441 | 1.4356 | ||

| 8.42 | 1.1286 | 1.1286 | ||

| 8.29 | 1.1112 | 1.1112 | ||

| 8.14 | 1.0910 | 1.0910 | ||

| 8.10 | 1.0855 | 1.0855 | ||

| 6.91 | 0.9261 | 0.9261 | ||

| 6.38 | 0.8550 | 0.8550 | ||

| 16.74 | 2.2434 | 0.8027 | ||

| 5.95 | 0.7979 | 0.7979 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 5.11 | 0.6848 | -0.7265 | ||

| 6.23 | 0.8355 | -0.6356 | ||

| -4.38 | -0.5871 | -0.5871 | ||

| -3.79 | -0.5083 | -0.5083 | ||

| -3.64 | -0.4876 | -0.4876 | ||

| 4.61 | 0.6175 | -0.3824 | ||

| 10.34 | 1.3853 | -0.3519 | ||

| 14.30 | 1.9171 | -0.3172 | ||

| 7.58 | 1.0164 | -0.3036 | ||

| 17.80 | 2.3854 | -0.2420 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-13 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 30.95 | -10.60 | 30.95 | -10.60 | 4.1481 | -0.1680 | |||

| Project Grand UK PLC / DBT (XS2848793688) | 22.84 | 7.67 | 3.0613 | 0.4165 | |||||

| US29357JAC09 / EnQuest PLC | 22.80 | -3.57 | 3.0559 | 0.1079 | |||||

| WBAD / Walgreens Boots Alliance, Inc. - Depositary Receipt (Common Stock) | 19.31 | 2.91 | 2.5889 | 0.2490 | |||||

| Connect Finco SARL / Connect US Finco LLC / DBT (US20752TAB08) | 19.22 | 8.20 | 2.5758 | 0.3614 | |||||

| XS2498543102 / 888 Acquisitions Ltd | 18.84 | 8.14 | 2.5254 | 0.3530 | |||||

| XS2067265392 / Summer BC Holdco A Sarl | 18.20 | 8.53 | 2.4399 | 0.3485 | |||||

| Fiesta Purchaser Inc / DBT (US31659AAB26) | 18.18 | 0.36 | 2.4371 | 0.1782 | |||||

| XS2397448346 / BCP V Modular Services Finance PLC | 18.13 | 6.85 | 2.4296 | 0.3145 | |||||

| US00842XAA72 / Affinity Gaming | 17.80 | -15.55 | 2.3854 | -0.2420 | |||||

| Venture Global LNG Inc / DBT (US92332YAF88) | 17.59 | -7.98 | 2.3574 | -0.0257 | |||||

| US56085RAA86 / MAJORDRIVE HOLDINGS IV LLC 6.375% 06/01/2029 144A | 17.01 | -7.20 | 2.2795 | -0.0055 | |||||

| CMPR / Cimpress plc | 16.74 | 44.85 | 2.2434 | 0.8027 | |||||

| BRTSG8EN8 / Staples, Inc., Term Loan | 16.40 | 1.13 | 2.1981 | 0.1763 | |||||

| Sherwood Financing PLC / DBT (XS2953609687) | 14.63 | 7.24 | 1.9604 | 0.2599 | |||||

| Organon & Co / Organon Foreign Debt Co-Issuer BV / DBT (US68622FAB76) | 14.50 | 255.66 | 1.9441 | 1.4356 | |||||

| XS2198191962 / Vertical Holdco GmbH | 14.30 | -20.19 | 1.9171 | -0.3172 | |||||

| Landesbank Baden-Wuerttemberg / DBT (DE000LB4XHX4) | 14.05 | 6.43 | 1.8828 | 0.2373 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 14.05 | -1.24 | 1.8827 | 0.1093 | |||||

| XS2615006470 / Monitchem HoldCo 3 SA | 13.98 | 5.79 | 1.8740 | 0.2261 | |||||

| XS2294187690 / Laboratoire Eimer Selas | 13.85 | 7.43 | 1.8564 | 0.2490 | |||||

| US69073TAU79 / Owens-Brockway Glass Container, Inc. | 13.67 | 27.53 | 1.8322 | 0.4958 | |||||

| US603374AH26 / Minerva Luxembourg SA | 13.36 | 1.27 | 1.7909 | 0.1459 | |||||

| XS2660424008 / Iceland Bondco PLC | 13.26 | 8.40 | 1.7769 | 0.2521 | |||||

| Bellis Acquisition Co PLC / DBT (XS2811958839) | 13.21 | 4.75 | 1.7710 | 0.1982 | |||||

| XS2400445362 / Bracken MidCo1 PLC | 13.02 | 7.27 | 1.7448 | 0.2317 | |||||

| US71654QDE98 / Petroleos Mexicanos | 13.00 | -1.19 | 1.7421 | 0.1020 | |||||

| XS2618867159 / Cheplapharm Arzneimittel GmbH | 12.81 | 50.23 | 1.7173 | 0.6540 | |||||

| Summer BidCo BV / DBT (XS2758100296) | 12.80 | 10.09 | 1.7154 | 0.2660 | |||||

| CD&R Firefly Bidco Limited 2024 GBP Term Loan B5 / LON (000000000) | 12.64 | 1.6937 | 1.6937 | ||||||

| XS2649707846 / HT Troplast GmbH | 12.12 | 4.25 | 1.6239 | 0.1749 | |||||

| US013305AA52 / Albion Financing 2SARL | 11.85 | -0.93 | 1.5877 | 0.0969 | |||||

| CNR / Core Natural Resources, Inc. | 11.51 | -12.41 | 1.5432 | -0.0956 | |||||

| Stonegate Pub Co Financing 2019 PLC / DBT (XS2870874117) | 11.50 | 7.32 | 1.5412 | 0.2052 | |||||

| Waga Bondco Ltd / DBT (XS2982063583) | 11.26 | 5.17 | 1.5086 | 0.1742 | |||||

| US83370RAC25 / Societe Generale SA | 10.90 | -0.38 | 1.4610 | 0.0967 | |||||

| CD&R Smokey Buyer Inc / Radio Systems Corp / DBT (US12515KAA60) | 10.77 | -13.83 | 1.4436 | -0.1149 | |||||

| Helios Software Holdings Inc / ION Corporate Solutions Finance Sarl / DBT (XS2808409390) | 10.45 | 6.76 | 1.4012 | 0.1804 | |||||

| US12543DBN93 / CHS/Community Health Systems Inc | 10.43 | 0.25 | 1.3986 | 0.1008 | |||||

| XS2615006637 / Monitchem HoldCo 3 SA | 10.36 | 5.79 | 1.3882 | 0.1675 | |||||

| US45074JAA25 / ITT Holdings LLC | 10.34 | -2.31 | 1.3855 | 0.0663 | |||||

| US640695AA01 / Neptune Bidco US Inc | 10.34 | -25.82 | 1.3853 | -0.3519 | |||||

| US12543DBM11 / CHS/Community Health Systems Inc | 10.33 | 0.07 | 1.3848 | 0.0975 | |||||

| Aston Martin Capital Holdings Ltd / DBT (US04625HAJ86) | 10.09 | -13.43 | 1.3520 | -0.1007 | |||||

| XS2189356996 / Ardagh Packaging Finance PLC / Ardagh Holdings USA Inc | 10.04 | 7.16 | 1.3456 | 0.1775 | |||||

| US03846JX543 / Egypt Government International Bond | 9.92 | -5.52 | 1.3290 | 0.0205 | |||||

| Colombia Government International Bonds / DBT (US195325EQ44) | 9.85 | -6.04 | 1.3202 | 0.0132 | |||||

| eG Global Finance PLC / DBT (XS2719998952) | 9.79 | 7.93 | 1.3117 | 0.1812 | |||||

| Summer BidCo BV / DBT (XS2758100536) | 9.52 | 10.10 | 1.2759 | 0.1978 | |||||

| US72431PAA03 / NCI Building Systems Inc 8.00% 04/15/2026 144A | 9.44 | 3.21 | 1.2658 | 0.1249 | |||||

| SOIL / Saturn Oil & Gas Inc. | 9.16 | -11.71 | 1.2281 | -0.0658 | |||||

| XS2623257503 / Motion Finco Sarl | 9.02 | 2.22 | 1.2087 | 0.1089 | |||||

| XS2649707929 / HT Troplast GmbH | 9.01 | 4.25 | 1.2078 | 0.1301 | |||||

| XS1071551391 / Deutsche Bank AG | 8.73 | 5.58 | 1.1699 | 0.1390 | |||||

| Samarco Mineracao SA / DBT (USP8405QAA78) | 8.68 | -0.50 | 1.1629 | 0.0758 | |||||

| US21925DAA72 / Cornerstone Building Brands, Inc. | 8.59 | 19.64 | 1.1516 | 0.2562 | |||||

| Belfius Bank SA / DBT (BE6357126372) | 8.48 | 5.71 | 1.1367 | 0.1365 | |||||

| OMI / Owens & Minor, Inc. | 8.42 | 1.1286 | 1.1286 | ||||||

| HYLN / Hyliion Holdings Corp. | 8.29 | 1.1112 | 1.1112 | ||||||

| PrestigeBidCo GmbH / DBT (XS2848951856) | 8.14 | 8.06 | 1.0911 | 0.1519 | |||||

| Saavi Energia Sarl / DBT (US78518PAA30) | 8.14 | 1.0910 | 1.0910 | ||||||

| USC3535CAP35 / COMPANY GUAR REGS 06/31 8.625 | 8.10 | 1.0855 | 1.0855 | ||||||

| XS2397447538 / BCP V Modular Services Finance II plc | 7.70 | 5.65 | 1.0324 | 0.1235 | |||||

| NBR / Nabors Industries Ltd. | 7.58 | -28.38 | 1.0164 | -0.3036 | |||||

| Hilcorp Energy I LP / Hilcorp Finance Co / DBT (US431318BG88) | 7.43 | -10.82 | 0.9964 | -0.0430 | |||||

| VTLE / Vital Energy, Inc. | 7.13 | -21.23 | 0.9552 | -0.1728 | |||||

| US08263DAA46 / Benteler International AG | 6.96 | -3.97 | 0.9331 | 0.0292 | |||||

| INTU NEW MONEY NOTES PIK / DBT (000000000) | 6.91 | 0.9261 | 0.9261 | ||||||

| US87927VAV09 / Telecom Italia Capital 7.721% Guaranteed Notes 6/4/38 | 6.84 | 0.90 | 0.9172 | 0.0716 | |||||

| Nova Alexandre III SAS / DBT (XS2800794997) | 6.40 | 10.57 | 0.8583 | 0.1362 | |||||

| TrueNoord Capital DAC / DBT (US89785GAA67) | 6.38 | 0.8550 | 0.8550 | ||||||

| US18912UAA07 / Cloud Software Group Inc | 6.31 | -1.64 | 0.8461 | 0.0460 | |||||

| US335934AT24 / First Quantum Minerals Ltd | 6.23 | -48.31 | 0.8355 | -0.6356 | |||||

| XS2405483301 / FAURECIA /EUR/ REGD REG S 2.75000000 | 5.95 | 0.7979 | 0.7979 | ||||||

| US92943TAA16 / WE Soda Investments Holding PLC | 5.87 | -0.76 | 0.7871 | 0.0494 | |||||

| USF8500RAB80 / Societe Generale SA | 5.59 | -0.21 | 0.7486 | 0.0508 | |||||

| TPB / Turning Point Brands, Inc. | 5.49 | 0.7363 | 0.7363 | ||||||

| Edge Finco PLC / DBT (XS2914010314) | 5.41 | 7.35 | 0.7247 | 0.0967 | |||||

| Iliad Holding SASU / DBT (US449691AF14) | 5.29 | -1.77 | 0.7085 | 0.0376 | |||||

| US55337PAA03 / MIWD Holdco II LLC / MIWD Finance Corp | 5.17 | 591.57 | 0.6925 | 0.5950 | |||||

| US05765WAA18 / TIBCO Software Inc | 5.11 | -54.86 | 0.6848 | -0.7265 | |||||

| Nova Alexandre III SAS / DBT (XS2800795374) | 4.74 | 10.59 | 0.6356 | 0.1009 | |||||

| Dcli Bidco LLC / DBT (US233104AA67) | 4.61 | -43.79 | 0.6175 | -0.3824 | |||||

| FM / First Quantum Minerals Ltd. | 4.17 | 0.5595 | 0.5595 | ||||||

| 1261229 BC Ltd / DBT (US68288AAA51) | 4.04 | 0.5411 | 0.5411 | ||||||

| OEG Finance PLC / DBT (XS2906227868) | 4.01 | 5.67 | 0.5373 | 0.0643 | |||||

| ECPG / Encore Capital Group, Inc. | 3.97 | -1.49 | 0.5320 | 0.0296 | |||||

| Amber Finco PLC 2024 EUR Term Loan / LON (000000000) | 3.95 | 0.5297 | 0.5297 | ||||||

| US516806AJ59 / Vital Energy Inc | 3.91 | -20.28 | 0.5237 | -0.0874 | |||||

| Braskem Netherlands Finance BV / DBT (US10554TAJ43) | 3.72 | -7.54 | 0.4980 | -0.0030 | |||||

| Bellis Acquisition Co PLC / DBT (XS2811959050) | 3.61 | 4.76 | 0.4836 | 0.0541 | |||||

| XS2606019383 / IHO Verwaltungs GmbH | 3.55 | 8.10 | 0.4757 | 0.0663 | |||||

| US45674GAB05 / INEOS Quattro Finance 2 Plc | 3.39 | -8.16 | 0.4540 | -0.0059 | |||||

| Fibercop SpA / DBT (US683879AH36) | 3.24 | -5.62 | 0.4349 | 0.0063 | |||||

| IHS / IHS Holding Limited | 2.89 | -1.83 | 0.3874 | 0.0202 | |||||

| VIRI / Viridien Société anonyme | 2.84 | 0.3802 | 0.3802 | ||||||

| US126307AZ02 / CSC Holdings, LLC | 2.81 | -4.06 | 0.3772 | 0.0115 | |||||

| Motel One GmbH/Muenchen / DBT (XS2811764120) | 2.75 | 6.59 | 0.3688 | 0.0470 | |||||

| US126307BA42 / CSC Holdings, LLC | 2.71 | -13.61 | 0.3635 | -0.0278 | |||||

| US126307BB25 / CSC HOLDINGS LLC COMPANY GUAR 144A 12/30 4.125 | 2.69 | -9.18 | 0.3606 | -0.0089 | |||||

| USN9836ZAA68 / Ziggo Bond Co BV | 2.66 | -2.60 | 0.3563 | 0.0161 | |||||

| Hilcorp Energy I LP / Hilcorp Finance Co / DBT (US431318BE31) | 2.55 | -11.89 | 0.3417 | -0.0190 | |||||

| Summer BC Holdco B SARL / DBT (XS2998755552) | 2.54 | 0.3407 | 0.3407 | ||||||

| IHS / IHS Holding Limited | 2.50 | -2.00 | 0.3345 | 0.0171 | |||||

| Azule Energy Finance Plc / DBT (US05501YAA64) | 2.41 | -4.59 | 0.3235 | 0.0082 | |||||

| VOD / Vodafone Group Public Limited Company - Depositary Receipt (Common Stock) | 2.39 | -2.53 | 0.3208 | 0.0147 | |||||

| AMT / American Tower Corporation | 2.20 | 1.29 | 0.2947 | 0.0240 | |||||

| US02154CAH60 / Altice Financing SA | 2.12 | -5.69 | 0.2842 | 0.0039 | |||||

| Motel One GmbH/Muenchen / DBT (XS2811764476) | 2.06 | 6.61 | 0.2766 | 0.0352 | |||||

| CONSEN / Consolidated Energy Finance SA | 2.01 | 0.2690 | 0.2690 | ||||||

| US040114HT09 / Argentine Republic Government International Bond | 1.97 | -1.80 | 0.2637 | 0.0139 | |||||

| Digicel Intermediate Holdings Ltd / Digicel International Finance Ltd / Difl US / DBT (USG27753AA36) | 1.50 | 0.47 | 0.2016 | 0.0150 | |||||

| XS2390152986 / Altice France SA/France | 1.45 | 0.1950 | 0.1950 | ||||||

| NEW COTAI BOND / DBT (000000000) | 1.43 | 0.1917 | 0.1917 | ||||||

| XS2332975007 / Altice France SA/France | 1.35 | 0.1815 | 0.1815 | ||||||

| US516806AH93 / Laredo Petroleum Inc | 1.13 | -15.98 | 0.1509 | -0.0162 | |||||

| Impala Bidco 0 Limited GBP Term Loan / LON (000000000) | 0.98 | 0.1320 | 0.1320 | ||||||

| US12543DBH26 / CHS/COMMUNITY HEALTH SYS SR SECURED 144A 01/29 6 | 0.92 | 2.23 | 0.1230 | 0.0110 | |||||

| US038461AM14 / Egypt Government International Bond | 0.89 | -9.30 | 0.1189 | -0.0031 | |||||

| US88632QAE35 / Picard Midco, Inc. | 0.85 | 1.80 | 0.1140 | 0.0098 | |||||

| XS1796266754 / Ivory Coast Government International Bond | 0.78 | 1.03 | 0.1048 | 0.0083 | |||||

| US345525AE90 / Foresight Energy LLC / Foresight Energy Finance Corp | 0.07 | 0.64 | 0.0857 | 0.0857 | |||||

| XS1775617464 / Egypt Government International Bond | 0.64 | -9.25 | 0.0856 | -0.0021 | |||||

| US71654QCC42 / Petroleos Mexicanos Bond | 0.59 | -2.49 | 0.0788 | 0.0036 | |||||

| STUDIO CITY INTL ADR / EC (000000000) | 0.18 | 0.54 | 0.0723 | 0.0723 | |||||

| XS2348767323 / BOI Finance BV | 0.52 | 7.97 | 0.0691 | 0.0095 | |||||

| US00434G2B53 / Access Bank PLC | 0.51 | -2.13 | 0.0677 | 0.0032 | |||||

| XS1843433472 / Ukraine Railways Via Rail Capital Markets PLC | 0.47 | 5.83 | 0.0634 | 0.0077 | |||||

| QUIPOR / International Airport Finance SA | 0.47 | -2.49 | 0.0630 | 0.0029 | |||||

| US65412JAB98 / Nigeria Government International Bond | 0.45 | -9.11 | 0.0602 | -0.0014 | |||||

| US279158AS81 / Ecopetrol SA | 0.41 | -2.84 | 0.0550 | 0.0023 | |||||

| US126307BK24 / CSC Holdings LLC | 0.39 | -15.32 | 0.0520 | -0.0051 | |||||

| US040114HU71 / Argentine Republic Government International Bond | 0.38 | -3.32 | 0.0507 | 0.0019 | |||||

| US536333AB32 / Liquid Telecommunications Financing Plc | 0.33 | -5.20 | 0.0440 | 0.0007 | |||||

| Yinson Boronia Production BV / DBT (US98584XAA37) | 0.32 | -1.53 | 0.0430 | 0.0024 | |||||

| US716564AB55 / Petroleos del Peru SA | 0.32 | -3.03 | 0.0429 | 0.0016 | |||||

| MSC / Studio City International Holdings Limited - Depositary Receipt (Common Stock) | 0.10 | 0.00 | 0.29 | -39.37 | 0.0386 | -0.0207 | |||

| TBC Bank JSC / DBT (US48128XAD57) | 0.29 | -1.71 | 0.0385 | 0.0020 | |||||

| YKBNK / Yapi ve Kredi Bankasi A.S. | 0.27 | -2.91 | 0.0359 | 0.0016 | |||||

| NEW COTAI EQUITY / EC (000000000) | 0.97 | 0.22 | 0.0297 | 0.0297 | |||||

| KAISAG / Kaisa Group Holdings Ltd | 0.15 | -22.73 | 0.0206 | -0.0042 | |||||

| TR APPAREL HOLDINGS APRIL 26 / EC (000000000) | 0.00 | 0.12 | 0.0158 | 0.0158 | |||||

| TR APPAREL HOLDINGS APRIL 25 / EC (000000000) | 0.00 | 0.06 | 0.0079 | 0.0079 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0.05 | 0.0074 | 0.0074 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.03 | 0.0035 | 0.0035 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0.03 | 0.0034 | 0.0034 | ||||||

| GB00H240B223 / LME Nickel Base Metal | 0.02 | 0.0023 | 0.0023 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.01 | 0.0017 | 0.0017 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0.01 | 0.0012 | 0.0012 | ||||||

| US55292HAJ23 / MLN U.S. HoldCo LLC | 0.00 | 0.00 | 0.0006 | 0.0000 | |||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| US799ESCAK47 / Mesquite Energy Corp - Escrow | 0.00 | -33.33 | 0.0003 | -0.0001 | |||||

| US55292HAL78 / MLN U.S. HoldCo LLC | 0.00 | 0.00 | 0.0003 | 0.0000 | |||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.00 | 0.0000 | 0.0000 | ||||||

| GB00H240B223 / LME Nickel Base Metal | 0.00 | 0.0000 | 0.0000 | ||||||

| PURCHASED USD / SOLD HKD / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.00 | 0.0000 | 0.0000 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0.00 | 0.0000 | 0.0000 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0.00 | 0.0000 | 0.0000 | ||||||

| BIS INDUSTRIES (ARTSONIG) / EC (000000000) | 0.80 | 0.00 | 0.0000 | 0.0000 | |||||

| GB00H240B223 / LME Nickel Base Metal | 0.00 | 0.0000 | 0.0000 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.00 | -0.0000 | -0.0000 | ||||||

| THUNDERBIRD RESOURCES EQUITY / EC (000000000) | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0.00 | -0.0000 | -0.0000 | ||||||

| GB00H240B223 / LME Nickel Base Metal | 0.00 | -0.0000 | -0.0000 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0.00 | -0.0000 | -0.0000 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.00 | -0.0000 | -0.0000 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.00 | -0.0001 | -0.0001 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.00 | -0.0003 | -0.0003 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.00 | -0.0004 | -0.0004 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | -0.01 | -0.0007 | -0.0007 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | -0.01 | -0.0010 | -0.0010 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | -0.01 | -0.0012 | -0.0012 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0.02 | -0.0023 | -0.0023 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.02 | -0.0028 | -0.0028 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | -0.03 | -0.0040 | -0.0040 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.04 | -0.0053 | -0.0053 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -3.64 | -0.4876 | -0.4876 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -3.79 | -0.5083 | -0.5083 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | -4.38 | -0.5871 | -0.5871 |