Mga Batayang Estadistika

| Nilai Portofolio | $ 261,190,343 |

| Posisi Saat Ini | 57 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

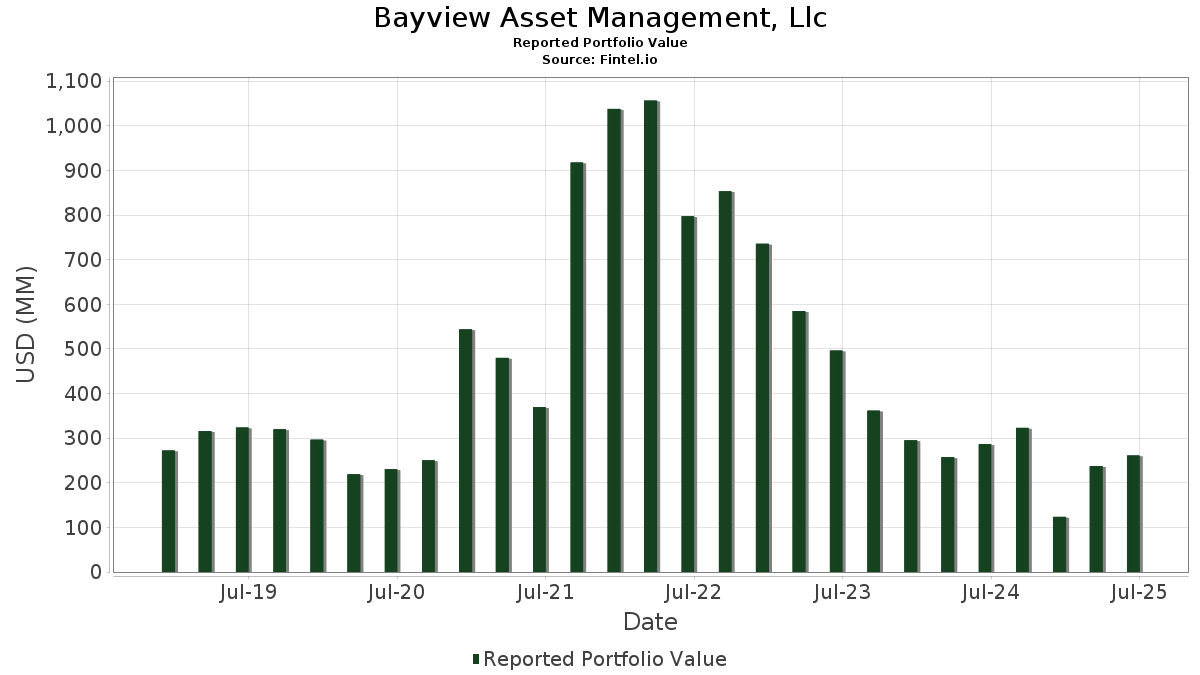

Bayview Asset Management, Llc telah mengungkapkan total kepemilikan 57 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 261,190,343 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Bayview Asset Management, Llc adalah SPDR S&P 500 ETF (US:SPY) , Guild Holdings Company (US:GHLD) , Banc of California, Inc. (US:BANC) , Berkshire Hills Bancorp, Inc. (US:BHLB) , and SPDR Series Trust - SPDR S&P Regional Banking ETF (US:KRE) . Posisi baru Bayview Asset Management, Llc meliputi: The Travelers Companies, Inc. (US:TRV) , The Hartford Insurance Group, Inc. (US:HIG) , Annaly Capital Management, Inc. (US:NLY) , Zions Bancorporation, National Association (US:ZION) , and The Allstate Corporation (US:ALL) . Industri unggulan Bayview Asset Management, Llc adalah "Real Estate" (sic 65) , "Holding And Other Investment Offices" (sic 67) , and "Non-depository Credit Institutions" (sic 61) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.60 | 31.55 | 12.0793 | 1.7987 | |

| 0.04 | 4.10 | 1.5697 | 1.5697 | |

| 0.04 | 3.23 | 1.2383 | 1.2383 | |

| 0.02 | 5.80 | 2.2199 | 1.1871 | |

| 0.01 | 2.68 | 1.0243 | 1.0243 | |

| 0.02 | 2.54 | 0.9715 | 0.9715 | |

| 0.12 | 2.35 | 0.9007 | 0.9007 | |

| 0.05 | 2.26 | 0.8662 | 0.8662 | |

| 0.05 | 2.26 | 0.8662 | 0.8662 | |

| 0.05 | 2.15 | 0.8230 | 0.8230 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.16 | 100.22 | 38.3687 | -2.3782 | |

| 0.02 | 1.82 | 0.6956 | -1.3850 | |

| 0.12 | 7.42 | 2.8423 | -1.3466 | |

| 0.00 | 0.00 | -0.6908 | ||

| 0.99 | 13.95 | 5.3423 | -0.5914 | |

| 0.00 | 0.00 | -0.5219 | ||

| 0.34 | 8.63 | 3.3058 | -0.4822 | |

| 0.00 | 0.31 | 0.1201 | -0.4087 | |

| 0.01 | 1.27 | 0.4854 | -0.3578 | |

| 0.00 | 0.63 | 0.2414 | -0.3148 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-01-14 | GHLD / Guild Holdings Company | 1,226,873 | 1,500,517 | 22.30 | 7.10 | 20.34 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-13 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Put | 0.16 | -6.24 | 100.22 | 3.56 | 38.3687 | -2.3782 | ||

| GHLD / Guild Holdings Company | 1.60 | 0.00 | 31.55 | 29.21 | 12.0793 | 1.7987 | |||

| BANC / Banc of California, Inc. | 0.99 | 0.00 | 13.95 | -0.99 | 5.3423 | -0.5914 | |||

| BHLB / Berkshire Hills Bancorp, Inc. | 0.34 | 0.00 | 8.63 | -4.02 | 3.3058 | -0.4822 | |||

| KRE / SPDR Series Trust - SPDR S&P Regional Banking ETF | Put | 0.12 | -28.57 | 7.42 | -25.38 | 2.8423 | -1.3466 | ||

| JPM / JPMorgan Chase & Co. | Put | 0.02 | 100.00 | 5.80 | 136.36 | 2.2199 | 1.1871 | ||

| KRE / SPDR Series Trust - SPDR S&P Regional Banking ETF | Call | 0.07 | 50.00 | 4.45 | 56.72 | 1.7054 | 0.5085 | ||

| BK / The Bank of New York Mellon Corporation | Put | 0.04 | 4.10 | 1.5697 | 1.5697 | ||||

| BAC / Bank of America Corporation | Put | 0.07 | 87.50 | 3.55 | 112.64 | 1.3588 | 0.6560 | ||

| BK / The Bank of New York Mellon Corporation | 0.04 | 3.23 | 1.2383 | 1.2383 | |||||

| PNC / The PNC Financial Services Group, Inc. | Put | 0.01 | 0.00 | 2.80 | 6.07 | 1.0706 | -0.0395 | ||

| TRV / The Travelers Companies, Inc. | Put | 0.01 | 2.68 | 1.0243 | 1.0243 | ||||

| STT / State Street Corporation | Put | 0.03 | 0.00 | 2.66 | 18.77 | 1.0178 | 0.0754 | ||

| JPM / JPMorgan Chase & Co. | 0.01 | -0.63 | 2.61 | 17.47 | 0.9990 | 0.0635 | |||

| C / Citigroup Inc. | Put | 0.03 | 0.00 | 2.55 | 19.92 | 0.9777 | 0.0810 | ||

| HIG / The Hartford Insurance Group, Inc. | Call | 0.02 | 2.54 | 0.9715 | 0.9715 | ||||

| NTRS / Northern Trust Corporation | Put | 0.02 | -33.33 | 2.54 | -14.33 | 0.9709 | -0.2752 | ||

| NLY / Annaly Capital Management, Inc. | Put | 0.12 | 2.35 | 0.9007 | 0.9007 | ||||

| RF / Regions Financial Corporation | Put | 0.10 | 0.00 | 2.35 | 8.24 | 0.9005 | -0.0144 | ||

| SCHW / The Charles Schwab Corporation | Put | 0.03 | 25.00 | 2.28 | 45.75 | 0.8733 | 0.2141 | ||

| USB / U.S. Bancorp | Put | 0.05 | 2.26 | 0.8662 | 0.8662 | ||||

| USB / U.S. Bancorp | 0.05 | 2.26 | 0.8662 | 0.8662 | |||||

| FISI / Financial Institutions, Inc. | 0.09 | 9.36 | 2.25 | 12.56 | 0.8611 | 0.0195 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | -20.00 | 2.24 | -15.14 | 0.8565 | -0.2536 | |||

| TFC / Truist Financial Corporation | Put | 0.05 | 2.15 | 0.8230 | 0.8230 | ||||

| ZION / Zions Bancorporation, National Association | Put | 0.04 | 2.08 | 0.7954 | 0.7954 | ||||

| ALL / The Allstate Corporation | Call | 0.01 | 2.01 | 0.7707 | 0.7707 | ||||

| BAC / Bank of America Corporation | 0.04 | 15.49 | 2.01 | 31.01 | 0.7700 | 0.1234 | |||

| RF / Regions Financial Corporation | 0.08 | -16.00 | 1.98 | -9.11 | 0.7564 | -0.1585 | |||

| STT / State Street Corporation | 0.02 | -8.75 | 1.94 | 8.38 | 0.7430 | -0.0109 | |||

| ITB / iShares Trust - iShares U.S. Home Construction ETF | Call | 0.02 | -62.43 | 1.82 | -63.25 | 0.6956 | -1.3850 | ||

| TRV / The Travelers Companies, Inc. | 0.01 | 1.79 | 0.6863 | 0.6863 | |||||

| NLY / Annaly Capital Management, Inc. | 0.10 | 1.79 | 0.6845 | 0.6845 | |||||

| FLG / Flagstar Financial, Inc. | 0.17 | 0.00 | 1.77 | -8.78 | 0.6764 | -0.1390 | |||

| WSBC / WesBanco, Inc. | 0.05 | 343.02 | 1.71 | 353.05 | 0.6539 | 0.4950 | |||

| IYR / iShares Trust - iShares U.S. Real Estate ETF | Put | 0.02 | 1.71 | 0.6531 | 0.6531 | ||||

| C / Citigroup Inc. | 0.02 | -32.20 | 1.70 | -18.72 | 0.6518 | -0.2300 | |||

| BPOP / Popular, Inc. | 0.01 | 13.23 | 1.58 | 35.05 | 0.6037 | 0.1123 | |||

| SCHW / The Charles Schwab Corporation | 0.02 | 64.19 | 1.57 | 91.36 | 0.6026 | 0.2563 | |||

| REM / iShares Trust - iShares Mortgage Real Estate ETF | Put | 0.07 | 1.53 | 0.5853 | 0.5853 | ||||

| BUSE / First Busey Corporation | 0.06 | 173.87 | 1.47 | 190.53 | 0.5641 | 0.3503 | |||

| BKU / BankUnited, Inc. | 0.04 | 45.45 | 1.42 | 50.26 | 0.5450 | 0.1463 | |||

| NTRS / Northern Trust Corporation | 0.01 | -50.74 | 1.27 | -36.71 | 0.4854 | -0.3578 | |||

| TFC / Truist Financial Corporation | 0.03 | 1.18 | 0.4526 | 0.4526 | |||||

| FAF / First American Financial Corporation | 0.02 | 14.34 | 1.18 | 6.90 | 0.4510 | -0.0127 | |||

| ZION / Zions Bancorporation, National Association | 0.02 | 1.04 | 0.3977 | 0.3977 | |||||

| ONB / Old National Bancorp | 0.05 | 0.00 | 1.00 | 0.71 | 0.3814 | -0.0351 | |||

| TMHC / Taylor Morrison Home Corporation | 0.02 | 0.00 | 0.99 | 2.38 | 0.3783 | -0.0284 | |||

| RITM / Rithm Capital Corp. | 0.09 | 0.00 | 0.99 | -1.40 | 0.3782 | -0.0436 | |||

| PHM / PulteGroup, Inc. | 0.01 | -34.70 | 0.98 | -33.04 | 0.3767 | -0.2417 | |||

| ESNT / Essent Group Ltd. | 0.01 | 0.00 | 0.75 | 5.22 | 0.2860 | -0.0129 | |||

| DHI / D.R. Horton, Inc. | 0.00 | -52.94 | 0.63 | -52.27 | 0.2414 | -0.3148 | |||

| UMBF / UMB Financial Corporation | 0.01 | 0.58 | 0.2214 | 0.2214 | |||||

| GL / Globe Life Inc. | 0.00 | -40.00 | 0.37 | -43.47 | 0.1428 | -0.1345 | |||

| FNB / F.N.B. Corporation | 0.03 | 0.36 | 0.1396 | 0.1396 | |||||

| JLL / Jones Lang LaSalle Incorporated | 0.00 | -75.80 | 0.31 | -75.06 | 0.1201 | -0.4087 | |||

| MTH / Meritage Homes Corporation | 0.00 | 0.00 | 0.26 | -5.80 | 0.0999 | -0.0164 | |||

| FAF / First American Financial Corporation | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.6908 | |||

| HBAN / Huntington Bancshares Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WBS / Webster Financial Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| JLL / Jones Lang LaSalle Incorporated | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.5219 | |||

| SPGI / S&P Global Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MA / Mastercard Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| V / Visa Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HBAN / Huntington Bancshares Incorporated | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| AVB / AvalonBay Communities, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WBS / Webster Financial Corporation | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| AVB / AvalonBay Communities, Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| SPGI / S&P Global Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| V / Visa Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| MA / Mastercard Incorporated | Put | 0.00 | -100.00 | 0.00 | 0.0000 |