Mga Batayang Estadistika

| Nilai Portofolio | $ 222,214,419 |

| Posisi Saat Ini | 96 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

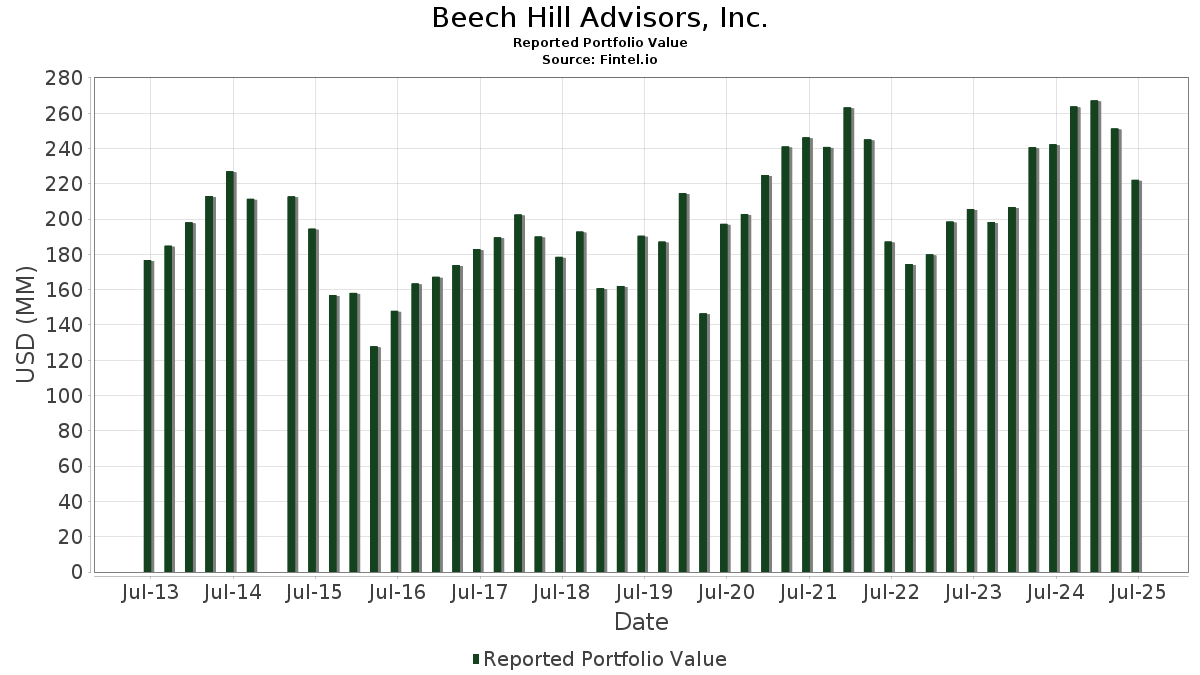

Beech Hill Advisors, Inc. telah mengungkapkan total kepemilikan 96 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 222,214,419 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Beech Hill Advisors, Inc. adalah Meta Platforms, Inc. (US:META) , Amazon.com, Inc. (US:AMZN) , Alphabet Inc. (US:GOOGL) , Broadcom Inc. (US:AVGO) , and Uber Technologies, Inc. (US:UBER) . Posisi baru Beech Hill Advisors, Inc. meliputi: The Trade Desk, Inc. (US:TTD) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 2.25 | 1.0145 | 1.0145 | |

| 0.01 | 1.44 | 0.6492 | 0.6492 | |

| 0.03 | 4.48 | 2.0174 | 0.5899 | |

| 0.02 | 6.53 | 2.9405 | 0.4762 | |

| 0.02 | 5.00 | 2.2494 | 0.4620 | |

| 0.01 | 3.73 | 1.6777 | 0.4486 | |

| 0.01 | 1.73 | 0.7800 | 0.3777 | |

| 0.01 | 6.33 | 2.8466 | 0.3368 | |

| 0.02 | 3.71 | 1.6707 | 0.3092 | |

| 0.01 | 1.46 | 0.6550 | 0.2968 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 5.91 | 2.6593 | -0.7812 | |

| 0.04 | 7.86 | 3.5376 | -0.7411 | |

| 0.03 | 3.69 | 1.6611 | -0.4045 | |

| 0.02 | 3.57 | 1.6049 | -0.3829 | |

| 0.04 | 3.04 | 1.3673 | -0.3413 | |

| 0.04 | 2.84 | 1.2784 | -0.3389 | |

| 0.01 | 3.07 | 1.3812 | -0.2921 | |

| 0.01 | 2.79 | 1.2556 | -0.2690 | |

| 0.04 | 3.26 | 1.4664 | -0.2430 | |

| 0.04 | 7.60 | 3.4218 | -0.2272 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-30 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| META / Meta Platforms, Inc. | 0.01 | -27.51 | 8.85 | -7.17 | 3.9805 | 0.1882 | |||

| AMZN / Amazon.com, Inc. | 0.04 | -36.59 | 7.86 | -26.89 | 3.5376 | -0.7411 | |||

| GOOGL / Alphabet Inc. | 0.04 | -27.23 | 7.60 | -17.07 | 3.4218 | -0.2272 | |||

| AVGO / Broadcom Inc. | 0.02 | -35.90 | 6.53 | 5.54 | 2.9405 | 0.4762 | |||

| UBER / Uber Technologies, Inc. | 0.07 | -32.26 | 6.52 | -13.26 | 2.9353 | -0.0572 | |||

| MSFT / Microsoft Corporation | 0.01 | -24.30 | 6.33 | 0.30 | 2.8466 | 0.3368 | |||

| AAPL / Apple Inc. | 0.03 | -26.00 | 5.91 | -31.65 | 2.6593 | -0.7812 | |||

| ORCL / Oracle Corporation | 0.02 | -28.83 | 5.00 | 11.29 | 2.2494 | 0.4620 | |||

| ETN / Eaton Corporation plc | 0.01 | -24.45 | 4.65 | -0.77 | 2.0926 | 0.2275 | |||

| ABBV / AbbVie Inc. | 0.02 | -8.44 | 4.61 | -18.89 | 2.0760 | -0.1873 | |||

| DIS / The Walt Disney Company | 0.04 | -23.60 | 4.60 | -4.01 | 2.0711 | 0.1630 | |||

| AMAT / Applied Materials, Inc. | 0.02 | -27.90 | 4.48 | -9.03 | 2.0180 | 0.0560 | |||

| BX / Blackstone Inc. | 0.03 | 16.80 | 4.48 | 24.99 | 2.0174 | 0.5899 | |||

| NFLX / Netflix, Inc. | 0.00 | -36.36 | 4.37 | -8.62 | 1.9670 | 0.0635 | |||

| QCOM / QUALCOMM Incorporated | 0.02 | -23.98 | 3.97 | -21.20 | 1.7856 | -0.2180 | |||

| IBM / International Business Machines Corporation | 0.01 | -12.69 | 3.85 | 3.52 | 1.7345 | 0.2525 | |||

| DLR / Digital Realty Trust, Inc. | 0.02 | -19.22 | 3.77 | -1.72 | 1.6971 | 0.1700 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.01 | -1.57 | 3.73 | 20.73 | 1.6777 | 0.4486 | |||

| NVDA / NVIDIA Corporation | 0.02 | -25.56 | 3.71 | 8.51 | 1.6707 | 0.3092 | |||

| TJX / The TJX Companies, Inc. | 0.03 | -29.86 | 3.69 | -28.88 | 1.6611 | -0.4045 | |||

| FSLR / First Solar, Inc. | 0.02 | -19.55 | 3.57 | 5.34 | 1.6072 | 0.2579 | |||

| EXPE / Expedia Group, Inc. | 0.02 | -28.84 | 3.57 | -28.59 | 1.6049 | -0.3829 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -17.15 | 3.50 | -2.07 | 1.5731 | 0.1524 | |||

| MDT / Medtronic plc | 0.04 | -21.79 | 3.26 | -24.14 | 1.4664 | -0.2430 | |||

| HD / The Home Depot, Inc. | 0.01 | -10.85 | 3.20 | -10.80 | 1.4383 | 0.0121 | |||

| MRK / Merck & Co., Inc. | 0.04 | -11.80 | 3.12 | -22.22 | 1.4053 | -0.1925 | |||

| V / Visa Inc. | 0.01 | -27.95 | 3.07 | -27.00 | 1.3812 | -0.2921 | |||

| NEE / NextEra Energy, Inc. | 0.04 | -27.73 | 3.04 | -29.23 | 1.3673 | -0.3413 | |||

| BA.PRA / The Boeing Company - Preferred Security | 0.04 | -18.49 | 2.94 | -7.34 | 1.3237 | 0.0601 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.04 | -23.83 | 2.84 | -30.10 | 1.2784 | -0.3389 | |||

| CRM / Salesforce, Inc. | 0.01 | -28.32 | 2.79 | -27.15 | 1.2556 | -0.2690 | |||

| KO / The Coca-Cola Company | 0.04 | -17.77 | 2.75 | -18.78 | 1.2384 | -0.1099 | |||

| BA / The Boeing Company | 0.01 | -6.35 | 2.72 | 15.07 | 1.2234 | 0.2830 | |||

| WMT / Walmart Inc. | 0.03 | -20.43 | 2.69 | -11.37 | 1.2108 | 0.0025 | |||

| GTLS / Chart Industries, Inc. | 0.02 | -30.81 | 2.68 | -21.08 | 1.2049 | -0.1453 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -1.21 | 2.51 | -0.28 | 1.1311 | 0.1280 | |||

| JNJ / Johnson & Johnson | 0.02 | -17.12 | 2.36 | -23.69 | 1.0629 | -0.1684 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.01 | -34.95 | 2.35 | -23.77 | 1.0564 | -0.1693 | |||

| FCX / Freeport-McMoRan Inc. | 0.05 | -1.01 | 2.35 | 13.39 | 1.0559 | 0.2321 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.01 | -17.77 | 2.33 | -23.13 | 1.0488 | -0.1577 | |||

| VICI / VICI Properties Inc. | 0.07 | -18.62 | 2.31 | -18.67 | 1.0393 | -0.0907 | |||

| AMT / American Tower Corporation | 0.01 | -16.10 | 2.29 | -14.81 | 1.0305 | -0.0389 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 2.25 | 1.0145 | 1.0145 | |||||

| PYPL / PayPal Holdings, Inc. | 0.03 | -24.75 | 2.20 | -14.27 | 0.9897 | -0.0315 | |||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 0.02 | -6.66 | 2.18 | 5.02 | 0.9795 | 0.1547 | |||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.01 | -6.14 | 2.17 | 3.33 | 0.9780 | 0.1408 | |||

| EXAS / Exact Sciences Corporation | 0.04 | -32.41 | 2.15 | -17.05 | 0.9684 | -0.0638 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | -35.95 | 2.08 | -18.27 | 0.9345 | -0.0765 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 8.93 | 1.98 | -11.24 | 0.8924 | 0.0033 | |||

| MCD / McDonald's Corporation | 0.01 | -12.50 | 1.85 | -18.16 | 0.8319 | -0.0670 | |||

| KVUE / Kenvue Inc. | 0.09 | -18.99 | 1.84 | -29.29 | 0.8259 | -0.2071 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 24.14 | 1.73 | 71.58 | 0.7800 | 0.3777 | |||

| WMB / The Williams Companies, Inc. | 0.03 | -16.95 | 1.73 | -12.71 | 0.7791 | -0.0102 | |||

| PFE / Pfizer Inc. | 0.07 | -12.39 | 1.68 | -16.21 | 0.7542 | -0.0416 | |||

| FDX / FedEx Corporation | 0.01 | 0.00 | 1.65 | -6.77 | 0.7442 | 0.0384 | |||

| ABT / Abbott Laboratories | 0.01 | -3.10 | 1.49 | -0.60 | 0.6702 | 0.0737 | |||

| MU / Micron Technology, Inc. | 0.01 | 14.00 | 1.46 | 61.67 | 0.6550 | 0.2968 | |||

| LEN / Lennar Corporation | 0.01 | 1.44 | 0.6492 | 0.6492 | |||||

| O / Realty Income Corporation | 0.02 | -14.82 | 1.32 | -15.39 | 0.5937 | -0.0270 | |||

| ALB / Albemarle Corporation | 0.02 | -7.93 | 1.30 | -19.86 | 0.5829 | -0.0605 | |||

| ADBE / Adobe Inc. | 0.00 | -1.26 | 1.27 | -0.39 | 0.5714 | 0.0640 | |||

| DUK / Duke Energy Corporation | 0.01 | -13.05 | 1.27 | -15.90 | 0.5714 | -0.0293 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.01 | -0.86 | 1.26 | -8.48 | 0.5684 | 0.0192 | |||

| CAT / Caterpillar Inc. | 0.00 | -14.47 | 1.26 | 0.64 | 0.5678 | 0.0690 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | -22.24 | 1.22 | -23.03 | 0.5505 | -0.0822 | |||

| GSCE / GS Connect S&P GSCI Enhanced Commodity Total Return ETN | 0.00 | 7.89 | 1.21 | 39.88 | 0.5446 | 0.2000 | |||

| WDAY / Workday, Inc. | 0.00 | -26.71 | 1.18 | -24.65 | 0.5311 | -0.0925 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.02 | 6.51 | 1.13 | 12.03 | 0.5074 | 0.1067 | |||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.01 | 1.00 | 1.03 | 13.64 | 0.4616 | 0.1025 | |||

| EXC / Exelon Corporation | 0.02 | -9.89 | 1.00 | -15.08 | 0.4488 | -0.0186 | |||

| CB / Chubb Limited | 0.00 | -8.02 | 0.86 | -11.76 | 0.3885 | -0.0009 | |||

| LIN / Linde plc | 0.00 | 0.00 | 0.70 | 0.72 | 0.3167 | 0.0387 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -11.90 | 0.69 | -20.14 | 0.3089 | -0.0332 | |||

| BB / BlackBerry Limited | 0.14 | 0.00 | 0.65 | 21.46 | 0.2931 | 0.0797 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 0.65 | 4.68 | 0.2918 | 0.0453 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | 0.00 | 0.62 | 17.51 | 0.2811 | 0.0697 | |||

| CLF / Cleveland-Cliffs Inc. | 0.08 | 13.74 | 0.59 | 5.22 | 0.2633 | 0.0419 | |||

| XBI / SPDR Series Trust - SPDR S&P Biotech ETF | 0.01 | -5.86 | 0.52 | -3.72 | 0.2333 | 0.0190 | |||

| WELL / Welltower Inc. | 0.00 | 0.00 | 0.50 | 0.40 | 0.2248 | 0.0267 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | -19.61 | 0.50 | -26.80 | 0.2241 | -0.0462 | |||

| ICLN / iShares Trust - iShares Global Clean Energy ETF | 0.04 | -6.07 | 0.48 | 7.81 | 0.2176 | 0.0391 | |||

| BAC / Bank of America Corporation | 0.01 | -4.93 | 0.46 | 7.80 | 0.2055 | 0.0369 | |||

| D / Dominion Energy, Inc. | 0.01 | 0.00 | 0.44 | 0.93 | 0.1958 | 0.0240 | |||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.42 | -10.49 | 0.1885 | 0.0025 | |||

| HHH / Howard Hughes Holdings Inc. | 0.01 | -44.48 | 0.34 | -49.40 | 0.1526 | -0.1142 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -50.88 | 0.33 | -45.79 | 0.1479 | -0.0932 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.00 | 0.00 | 0.30 | 3.09 | 0.1354 | 0.0194 | |||

| FLRN / SPDR Series Trust - SPDR Bloomberg Investment Grade Floating Rate ETF | 0.01 | -10.10 | 0.26 | -10.07 | 0.1167 | 0.0019 | |||

| SCI / Service Corporation International | 0.00 | 0.00 | 0.24 | 1.26 | 0.1092 | 0.0141 | |||

| CVX / Chevron Corporation | 0.00 | -0.77 | 0.24 | -14.95 | 0.1076 | -0.0044 | |||

| HUM / Humana Inc. | 0.00 | 11.56 | 0.24 | 3.07 | 0.1062 | 0.0151 | |||

| WYNN / Wynn Resorts, Limited | 0.00 | 0.00 | 0.23 | 12.50 | 0.1054 | 0.0223 | |||

| ZTS / Zoetis Inc. | 0.00 | 0.00 | 0.23 | -5.28 | 0.1050 | 0.0070 | |||

| TTD / The Trade Desk, Inc. | 0.00 | 0.23 | 0.1020 | 0.1020 | |||||

| XLRE / The Select Sector SPDR Trust - The Real Estate Select Sector SPDR Fund | 0.01 | -6.09 | 0.21 | -6.96 | 0.0963 | 0.0047 | |||

| XLP / The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund | 0.00 | -8.78 | 0.21 | -9.65 | 0.0928 | 0.0021 | |||

| UPS / United Parcel Service, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TOL / Toll Brothers, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GOOG / Alphabet Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | -100.00 | 0.00 | 0.0000 |