Mga Batayang Estadistika

| Nilai Portofolio | $ 690,466,534 |

| Posisi Saat Ini | 164 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

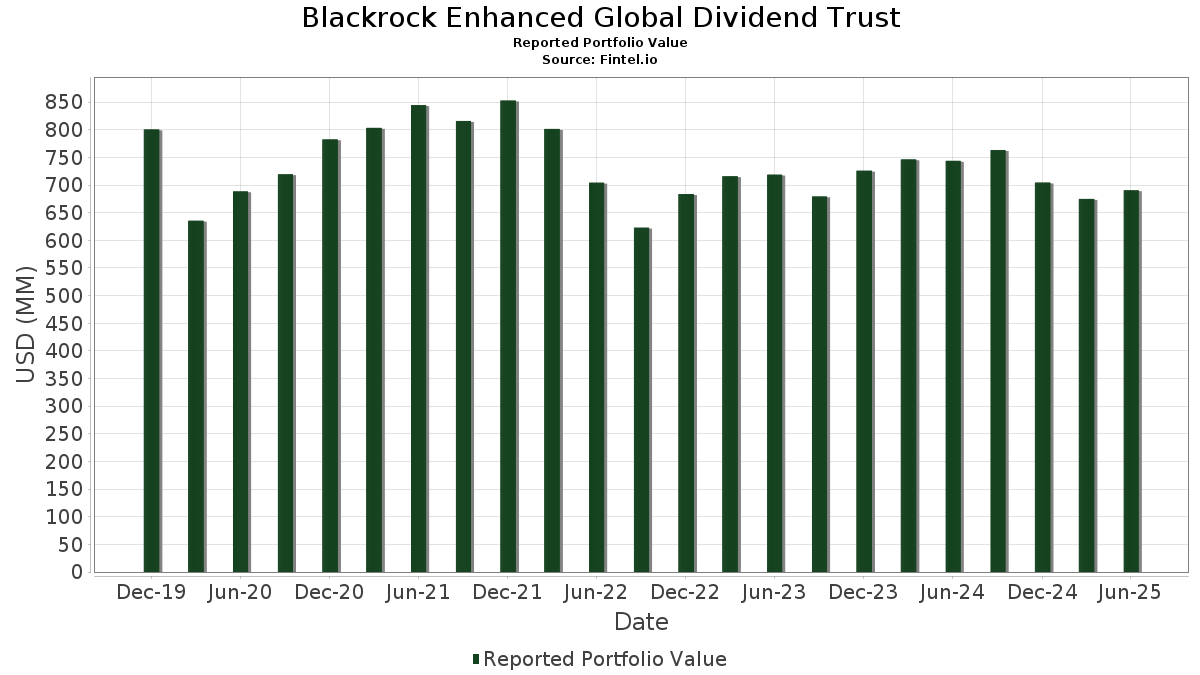

Blackrock Enhanced Global Dividend Trust telah mengungkapkan total kepemilikan 164 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 690,466,534 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Blackrock Enhanced Global Dividend Trust adalah Microsoft Corporation (US:MSFT) , Broadcom Inc. (US:AVGO) , Taiwan Semiconductor Manufacturing Company Limited (TW:2330) , Astrazeneca plc (CH:AZN) , and CMS Energy Corporation (US:CMS) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.19 | 17.11 | 2.4765 | 1.4256 | |

| 0.10 | 28.21 | 4.0834 | 1.4136 | |

| 9.75 | 9.75 | 1.4120 | 0.8794 | |

| 0.08 | 39.53 | 5.7226 | 0.7155 | |

| 3.03 | 14.79 | 2.1405 | 0.5821 | |

| 0.74 | 27.06 | 3.9171 | 0.5310 | |

| 0.88 | 14.11 | 2.0425 | 0.5263 | |

| 0.08 | 16.94 | 2.4523 | 0.4928 | |

| 0.03 | 19.73 | 2.8559 | 0.4084 | |

| 0.05 | 9.97 | 1.4436 | 0.4050 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.11 | 7.04 | 1.0190 | -1.1787 | |

| 0.31 | 10.77 | 1.5591 | -0.7327 | |

| 0.05 | 14.31 | 2.0720 | -0.6813 | |

| 0.24 | 10.28 | 1.4886 | -0.6793 | |

| 0.18 | 6.71 | 0.9713 | -0.6360 | |

| 0.04 | 8.09 | 1.1712 | -0.3633 | |

| 0.27 | 11.88 | 1.7199 | -0.3545 | |

| 0.08 | 15.11 | 2.1876 | -0.3384 | |

| 0.96 | 14.71 | 2.1295 | -0.2902 | |

| 0.12 | 11.58 | 1.6756 | -0.2847 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.08 | -11.77 | 39.53 | 16.91 | 5.7226 | 0.7155 | |||

| AVGO / Broadcom Inc. | 0.10 | -4.97 | 28.21 | 56.46 | 4.0834 | 1.4136 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 0.74 | -8.87 | 27.06 | 18.34 | 3.9171 | 0.5310 | |||

| AZN / Astrazeneca plc | 0.16 | 0.00 | 22.26 | -5.23 | 3.2214 | -0.2557 | |||

| CMS / CMS Energy Corporation | 0.29 | 26.22 | 20.34 | 16.43 | 2.9447 | 0.3573 | |||

| KO / The Coca-Cola Company | 0.29 | 19.21 | 20.32 | 17.77 | 2.9406 | 0.3863 | |||

| META / Meta Platforms, Inc. | 0.03 | -6.79 | 19.73 | 19.37 | 2.8559 | 0.4084 | |||

| REL N / RELX PLC | 0.33 | -10.39 | 17.79 | -3.65 | 2.5757 | -0.1591 | |||

| CSA / Accenture plc | 0.06 | 0.00 | 17.56 | -4.22 | 2.5415 | -0.1727 | |||

| CL / Colgate-Palmolive Company | 0.19 | 148.49 | 17.11 | 141.06 | 2.4765 | 1.4256 | |||

| WMT / Walmart Inc. | 0.17 | -10.91 | 17.00 | -0.77 | 2.4601 | -0.0760 | |||

| ORCL / Oracle Corporation | 0.08 | -18.13 | 16.94 | 28.02 | 2.4523 | 0.4928 | |||

| GE / General Electric Company | 0.06 | -19.87 | 16.23 | 3.05 | 2.3488 | 0.0172 | |||

| PH / Parker-Hannifin Corporation | 0.02 | 0.00 | 15.36 | 14.90 | 2.2232 | 0.2440 | |||

| HUBB / Hubbell Incorporated | 0.04 | 0.00 | 15.23 | 23.42 | 2.2039 | 0.3772 | |||

| ABBV / AbbVie Inc. | 0.08 | 0.00 | 15.11 | -11.41 | 2.1876 | -0.3384 | |||

| NOV / Novo Nordisk A/S | 0.22 | 10.45 | 15.05 | 11.93 | 2.1781 | 0.1875 | |||

| ALLE / Allegion plc | 0.10 | 0.00 | 14.85 | 10.47 | 2.1502 | 0.1591 | |||

| KPN / Koninklijke KPN N.V. | 3.03 | 22.00 | 14.79 | 40.51 | 2.1405 | 0.5821 | |||

| BBVA / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0.96 | -20.21 | 14.71 | -9.97 | 2.1295 | -0.2902 | |||

| AAPL / Apple Inc. | 0.07 | 0.00 | 14.66 | -7.64 | 2.1214 | -0.2281 | |||

| GOOGL / Alphabet Inc. | 0.08 | -20.38 | 14.63 | -9.27 | 2.1178 | -0.2697 | |||

| AI / L'Air Liquide S.A. | 0.07 | 0.00 | 14.50 | 8.56 | 2.0992 | 0.1211 | |||

| UNH / UnitedHealth Group Incorporated | 0.05 | 29.24 | 14.31 | -23.02 | 2.0720 | -0.6813 | |||

| TU / TELUS Corporation | 0.88 | 23.07 | 14.11 | 37.81 | 2.0425 | 0.5263 | |||

| ZURN / Zurich Insurance Group AG | 0.02 | 0.00 | 13.84 | 0.25 | 2.0033 | -0.0410 | |||

| ICE / Intercontinental Exchange, Inc. | 0.08 | -10.10 | 13.78 | -4.38 | 1.9944 | -0.1393 | |||

| OTIS / Otis Worldwide Corporation | 0.14 | 0.00 | 13.38 | -4.05 | 1.9372 | -0.1281 | |||

| HD / The Home Depot, Inc. | 0.03 | 0.00 | 12.70 | 0.04 | 1.8388 | -0.0414 | |||

| CFG / Citizens Financial Group, Inc. | 0.27 | -22.35 | 11.88 | -15.19 | 1.7199 | -0.3545 | |||

| SAN / Santander UK plc - Preferred Stock | 0.12 | 0.00 | 11.58 | -12.56 | 1.6756 | -0.2847 | |||

| BA. / BAE Systems plc | 0.43 | -12.92 | 11.27 | 11.92 | 1.6311 | 0.1402 | |||

| TWW / Taylor Wimpey plc | 6.77 | 0.00 | 11.04 | 16.06 | 1.5983 | 0.1896 | |||

| SHEL / Shell plc | 0.31 | -27.49 | 10.77 | -30.41 | 1.5591 | -0.7327 | |||

| CRM / Salesforce, Inc. | 0.04 | 0.00 | 10.63 | 1.61 | 1.5394 | -0.0103 | |||

| MCO / Moody's Corporation | 0.02 | -12.01 | 10.47 | -5.22 | 1.5161 | -0.1203 | |||

| SCHW / The Charles Schwab Corporation | 0.11 | -12.80 | 10.45 | 1.64 | 1.5133 | -0.0098 | |||

| MTB / M&T Bank Corporation | 0.05 | 0.00 | 10.29 | 8.53 | 1.4897 | 0.0855 | |||

| 2454 / MediaTek Inc. | 0.24 | -49.69 | 10.28 | -34.71 | 1.4886 | -0.6793 | |||

| AMAT / Applied Materials, Inc. | 0.06 | 0.00 | 10.17 | 26.16 | 1.4717 | 0.2783 | |||

| AIZ / Assurant, Inc. | 0.05 | 51.02 | 9.97 | 42.21 | 1.4436 | 0.4050 | |||

| RSG / Republic Services, Inc. | 0.04 | 36.52 | 9.91 | 39.01 | 1.4350 | 0.3791 | |||

| 6273 / SMC Corporation | 0.03 | 0.00 | 9.78 | 0.14 | 1.4161 | -0.0304 | |||

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 9.75 | 171.19 | 9.75 | 171.17 | 1.4120 | 0.8794 | |||

| UNP / Union Pacific Corporation | 0.04 | -19.83 | 8.09 | -21.93 | 1.1712 | -0.3633 | |||

| MA / Mastercard Incorporated | 0.01 | 0.00 | 7.29 | 2.53 | 1.0556 | 0.0023 | |||

| WMB / The Williams Companies, Inc. | 0.11 | -54.87 | 7.04 | -52.57 | 1.0190 | -1.1787 | |||

| BKR / Baker Hughes Company | 0.18 | -29.13 | 6.71 | -38.18 | 0.9713 | -0.6360 | |||

| AceVector Limited / EC (000000000) | 0.57 | 0.20 | 0.0283 | 0.0283 | |||||

| GIMB / Gimv NV | 0.00 | 0.0000 | 0.0000 | ||||||

| LBHI GUARANTEE CLAIM USD LBHI GUAR TCL USD / LON (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.00 | -0.0000 | -0.0000 | ||||||

| JUL25 6273 JP C @ 58004.7 / DE (000000000) | 0.00 | -0.0000 | -0.0000 | ||||||

| MASTERCARD INC / DE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.00 | -0.0002 | -0.0002 | ||||||

| JUL25 REN NA C @ 48.0704 / DE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.00 | -0.0003 | -0.0003 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.00 | -0.0003 | -0.0003 | ||||||

| ABBVIE INC / DE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.00 | -0.0003 | -0.0003 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0004 | -0.0004 | ||||||

| JUL25 KPN NA C @ 4.2714 / DE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| COCA-COLA CO/THE / DE (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| HOME DEPOT INC/THE / DE (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| COLGATE-PALMOLIVE CO / DE (000000000) | -0.00 | -0.0006 | -0.0006 | ||||||

| JUL25 BBVA SM C @ 14.1059 / DE (000000000) | -0.00 | -0.0006 | -0.0006 | ||||||

| TELUS CORP / DE (000000000) | -0.00 | -0.0007 | -0.0007 | ||||||

| BAKER HUGHES CO / DE (000000000) | -0.01 | -0.0008 | -0.0008 | ||||||

| TELUS CORP / DE (000000000) | -0.01 | -0.0008 | -0.0008 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.01 | -0.0008 | -0.0008 | ||||||

| ASSURANT INC / DE (000000000) | -0.01 | -0.0010 | -0.0010 | ||||||

| MASTERCARD INC / DE (000000000) | -0.01 | -0.0010 | -0.0010 | ||||||

| JUL25 NOVO B DC C @ 494.331 / DE (000000000) | -0.01 | -0.0011 | -0.0011 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.01 | -0.0012 | -0.0012 | ||||||

| ABBVIE INC / DE (000000000) | -0.01 | -0.0012 | -0.0012 | ||||||

| ACCENTURE PLC / DE (000000000) | -0.01 | -0.0012 | -0.0012 | ||||||

| TELUS CORP / DE (000000000) | -0.01 | -0.0013 | -0.0013 | ||||||

| JUL25 KPN NA C @ 4.2259 / DE (000000000) | -0.01 | -0.0014 | -0.0014 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.01 | -0.0015 | -0.0015 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.01 | -0.0015 | -0.0015 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.01 | -0.0016 | -0.0016 | ||||||

| APPLE INC / DE (000000000) | -0.01 | -0.0019 | -0.0019 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.01 | -0.0021 | -0.0021 | ||||||

| JUL25 BA. LN C @ 21.0092 / DE (000000000) | -0.01 | -0.0021 | -0.0021 | ||||||

| APPLIED MATERIALS INC / DE (000000000) | -0.01 | -0.0021 | -0.0021 | ||||||

| JUL25 REN NA C @ 47.4165 / DE (000000000) | -0.01 | -0.0021 | -0.0021 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.02 | -0.0022 | -0.0022 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.02 | -0.0024 | -0.0024 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.02 | -0.0026 | -0.0026 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.02 | -0.0027 | -0.0027 | ||||||

| UNION PACIFIC CORP / DE (000000000) | -0.02 | -0.0027 | -0.0027 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.02 | -0.0028 | -0.0028 | ||||||

| ALPHABET INC / DE (000000000) | -0.02 | -0.0028 | -0.0028 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.02 | -0.0030 | -0.0030 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.02 | -0.0031 | -0.0031 | ||||||

| GENERAL ELECTRIC CO / DE (000000000) | -0.02 | -0.0031 | -0.0031 | ||||||

| ABBVIE INC / DE (000000000) | -0.02 | -0.0031 | -0.0031 | ||||||

| BAKER HUGHES CO / DE (000000000) | -0.02 | -0.0031 | -0.0031 | ||||||

| AUG25 KPN NA C @ 4.086 / DE (000000000) | -0.02 | -0.0033 | -0.0033 | ||||||

| UNITEDHEALTH GROUP INC / DE (000000000) | -0.02 | -0.0036 | -0.0036 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.03 | -0.0036 | -0.0036 | ||||||

| REPUBLIC SERVICES INC / DE (000000000) | -0.03 | -0.0037 | -0.0037 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.03 | -0.0038 | -0.0038 | ||||||

| REPUBLIC SERVICES INC / DE (000000000) | -0.03 | -0.0039 | -0.0039 | ||||||

| TELUS CORP / DE (000000000) | -0.03 | -0.0040 | -0.0040 | ||||||

| AIZ US FLEX / DE (000000000) | -0.03 | -0.0040 | -0.0040 | ||||||

| SALESFORCE INC / DE (000000000) | -0.03 | -0.0044 | -0.0044 | ||||||

| JUL25 KPN NA C @ 4.1778 / DE (000000000) | -0.03 | -0.0045 | -0.0045 | ||||||

| M+T BANK CORP / DE (000000000) | -0.03 | -0.0045 | -0.0045 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.03 | -0.0045 | -0.0045 | ||||||

| ACCENTURE PLC / DE (000000000) | -0.03 | -0.0047 | -0.0047 | ||||||

| CMS ENERGY CORP / DE (000000000) | -0.03 | -0.0048 | -0.0048 | ||||||

| SALESFORCE INC / DE (000000000) | -0.03 | -0.0048 | -0.0048 | ||||||

| CL 4JL5 94.0 C FLEX OPTION / DE (000000000) | -0.03 | -0.0050 | -0.0050 | ||||||

| MICROSOFT CORP / DE (000000000) | -0.04 | -0.0053 | -0.0053 | ||||||

| ALPHABET INC / DE (000000000) | -0.04 | -0.0059 | -0.0059 | ||||||

| WILLIAMS COS INC/THE / DE (000000000) | -0.04 | -0.0061 | -0.0061 | ||||||

| WALMART INC / DE (000000000) | -0.04 | -0.0062 | -0.0062 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.04 | -0.0063 | -0.0063 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.04 | -0.0063 | -0.0063 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.04 | -0.0065 | -0.0065 | ||||||

| APPLE INC / DE (000000000) | -0.05 | -0.0070 | -0.0070 | ||||||

| APPLIED MATERIALS INC / DE (000000000) | -0.05 | -0.0071 | -0.0071 | ||||||

| ACCENTURE PLC / DE (000000000) | -0.05 | -0.0071 | -0.0071 | ||||||

| WILLIAMS COS INC/THE / DE (000000000) | -0.05 | -0.0074 | -0.0074 | ||||||

| ALPHABET INC / DE (000000000) | -0.05 | -0.0075 | -0.0075 | ||||||

| ALLE US FLEX / DE (000000000) | -0.06 | -0.0080 | -0.0080 | ||||||

| COLGATE-PALMOLIVE CO / DE (000000000) | -0.06 | -0.0080 | -0.0080 | ||||||

| WILLIAMS COS INC/THE / DE (000000000) | -0.06 | -0.0084 | -0.0084 | ||||||

| WALMART INC / DE (000000000) | -0.06 | -0.0088 | -0.0088 | ||||||

| COCA-COLA CO/THE / DE (000000000) | -0.06 | -0.0088 | -0.0088 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.06 | -0.0093 | -0.0093 | ||||||

| CHARLES SCHWAB CORP/THE / DE (000000000) | -0.07 | -0.0097 | -0.0097 | ||||||

| HOME DEPOT INC/THE / DE (000000000) | -0.07 | -0.0101 | -0.0101 | ||||||

| M+T BANK CORP / DE (000000000) | -0.07 | -0.0101 | -0.0101 | ||||||

| COCA-COLA CO/THE / DE (000000000) | -0.08 | -0.0112 | -0.0112 | ||||||

| AUG25 AZN LN C @ 105.6969 / DE (000000000) | -0.08 | -0.0122 | -0.0122 | ||||||

| CHARLES SCHWAB CORP/THE / DE (000000000) | -0.09 | -0.0124 | -0.0124 | ||||||

| ORACLE CORP / DE (000000000) | -0.09 | -0.0130 | -0.0130 | ||||||

| MOODY'S CORP / DE (000000000) | -0.09 | -0.0132 | -0.0132 | ||||||

| MOODY'S CORP / DE (000000000) | -0.10 | -0.0139 | -0.0139 | ||||||

| BROADCOM INC / DE (000000000) | -0.11 | -0.0152 | -0.0152 | ||||||

| META PLATFORMS INC / DE (000000000) | -0.11 | -0.0153 | -0.0153 | ||||||

| CMS ENERGY CORP / DE (000000000) | -0.11 | -0.0154 | -0.0154 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.11 | -0.0159 | -0.0159 | ||||||

| APPLE INC / DE (000000000) | -0.11 | -0.0160 | -0.0160 | ||||||

| APPLIED MATERIALS INC / DE (000000000) | -0.12 | -0.0170 | -0.0170 | ||||||

| HUBBELL INC / DE (000000000) | -0.12 | -0.0180 | -0.0180 | ||||||

| CITIZENS FINANCIAL GROUP INC / DE (000000000) | -0.12 | -0.0181 | -0.0181 | ||||||

| MTB US FLEX / DE (000000000) | -0.16 | -0.0225 | -0.0225 | ||||||

| META PLATFORMS INC / DE (000000000) | -0.16 | -0.0227 | -0.0227 | ||||||

| OTIS WORLDWIDE CORP / DE (000000000) | -0.16 | -0.0231 | -0.0231 | ||||||

| ALLE US FLEX / DE (000000000) | -0.16 | -0.0231 | -0.0231 | ||||||

| CFG US FLEX / DE (000000000) | -0.16 | -0.0235 | -0.0235 | ||||||

| HUBB US FLEX / DE (000000000) | -0.16 | -0.0238 | -0.0238 | ||||||

| ICE US FLEX / DE (000000000) | -0.18 | -0.0261 | -0.0261 | ||||||

| ORACLE CORP / DE (000000000) | -0.19 | -0.0269 | -0.0269 | ||||||

| META PLATFORMS INC / DE (000000000) | -0.19 | -0.0274 | -0.0274 | ||||||

| GENERAL ELECTRIC CO / DE (000000000) | -0.23 | -0.0328 | -0.0328 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.28 | -0.0405 | -0.0405 | ||||||

| BROADCOM INC / DE (000000000) | -0.29 | -0.0423 | -0.0423 | ||||||

| MICROSOFT CORP / DE (000000000) | -0.30 | -0.0437 | -0.0437 | ||||||

| PARKER-HANNIFIN CORP / DE (000000000) | -0.38 | -0.0546 | -0.0546 | ||||||

| BROADCOM INC / DE (000000000) | -0.45 | -0.0647 | -0.0647 | ||||||

| MICROSOFT CORP / DE (000000000) | -0.62 | -0.0897 | -0.0897 | ||||||

| ORACLE CORP / DE (000000000) | -0.71 | -0.1027 | -0.1027 |