Mga Batayang Estadistika

| Nilai Portofolio | $ 3,490,929,679 |

| Posisi Saat Ini | 175 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

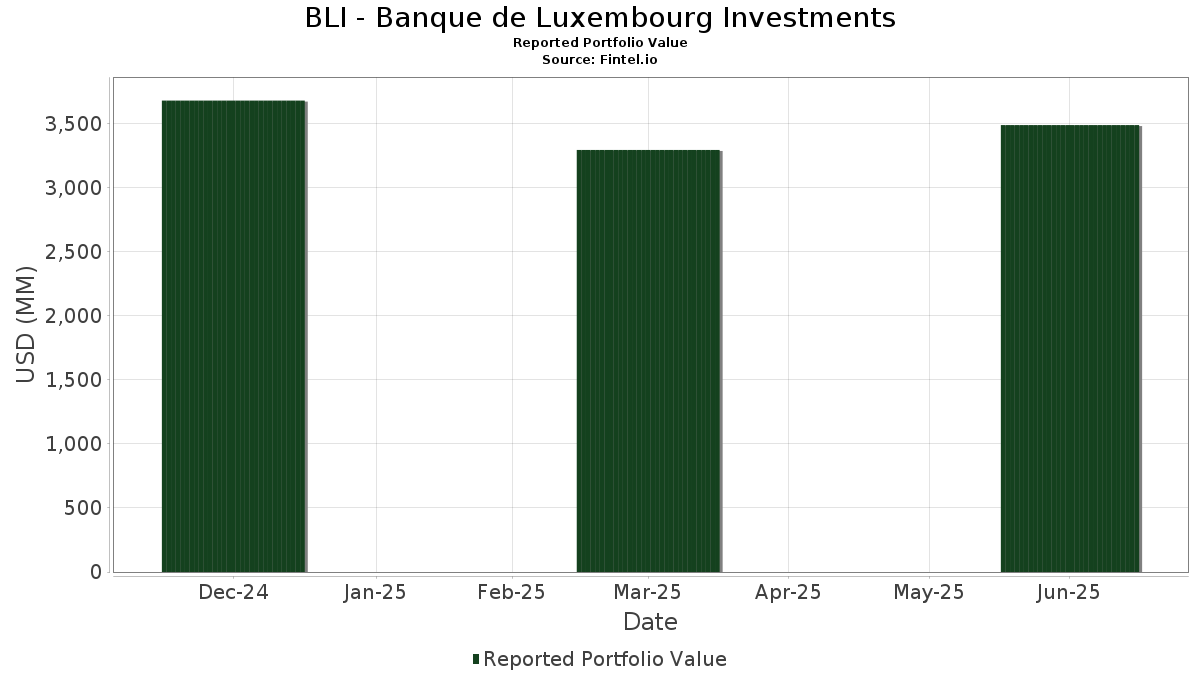

BLI - Banque de Luxembourg Investments telah mengungkapkan total kepemilikan 175 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 3,490,929,679 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama BLI - Banque de Luxembourg Investments adalah Microsoft Corporation (US:MSFT) , Visa Inc. (US:V) , Alphabet Inc. (US:GOOGL) , Mastercard Incorporated (US:MA) , and Canadian National Railway Company (US:CNI) . Posisi baru BLI - Banque de Luxembourg Investments meliputi: Meta Platforms, Inc. (US:META) , Eli Lilly and Company (US:LLY) , Texas Pacific Land Corporation (US:TPL) , VeriSign, Inc. (US:VRSN) , and Netflix, Inc. (US:NFLX) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.51 | 251.78 | 7.2125 | 0.8729 | |

| 0.16 | 47.88 | 1.3714 | 0.5571 | |

| 0.03 | 18.92 | 0.5421 | 0.5421 | |

| 0.02 | 18.61 | 0.5330 | 0.5330 | |

| 0.10 | 17.52 | 0.5018 | 0.4718 | |

| 0.01 | 14.03 | 0.4020 | 0.4020 | |

| 0.26 | 59.78 | 1.7124 | 0.3935 | |

| 0.05 | 13.63 | 0.3905 | 0.3905 | |

| 0.01 | 12.17 | 0.3486 | 0.3486 | |

| 0.02 | 13.60 | 0.3897 | 0.3470 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.14 | 42.42 | 1.2152 | -0.7294 | |

| 0.11 | 33.23 | 0.9519 | -0.7122 | |

| 0.13 | 28.41 | 0.8137 | -0.7051 | |

| 0.09 | 48.75 | 1.3964 | -0.5830 | |

| 0.32 | 23.02 | 0.6594 | -0.5295 | |

| 0.36 | 72.54 | 2.0780 | -0.5241 | |

| 0.35 | 47.41 | 1.3581 | -0.5004 | |

| 0.15 | 24.12 | 0.6910 | -0.4593 | |

| 0.36 | 81.45 | 2.3333 | -0.4504 | |

| 0.42 | 51.31 | 1.4699 | -0.3807 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-13 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.51 | -8.13 | 251.78 | 20.47 | 7.2125 | 0.8729 | |||

| V / Visa Inc. | 0.35 | 1.55 | 121.62 | 3.43 | 3.4838 | -0.0831 | |||

| GOOGL / Alphabet Inc. | 0.66 | -0.86 | 118.43 | 14.87 | 3.3925 | 0.2652 | |||

| MA / Mastercard Incorporated | 0.20 | 3.07 | 109.13 | 5.09 | 3.1260 | -0.0240 | |||

| CNI / Canadian National Railway Company | 0.91 | 1.28 | 94.15 | 7.35 | 2.6971 | 0.0365 | |||

| UNP / Union Pacific Corporation | 0.40 | 5.53 | 93.48 | 5.36 | 2.6779 | -0.0135 | |||

| AMZN / Amazon.com, Inc. | 0.36 | -23.52 | 81.45 | -11.24 | 2.3333 | -0.4504 | |||

| RMD / ResMed Inc. | 0.29 | -15.09 | 73.95 | -1.33 | 2.1183 | -0.1550 | |||

| AAPL / Apple Inc. | 0.36 | -8.51 | 72.54 | -15.43 | 2.0780 | -0.5241 | |||

| NVDA / NVIDIA Corporation | 0.43 | -11.30 | 68.41 | 27.79 | 1.9596 | 0.3358 | |||

| PEP / PepsiCo, Inc. | 0.52 | 20.57 | 67.85 | 6.02 | 1.9437 | 0.0023 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.26 | -0.76 | 59.78 | 37.49 | 1.7124 | 0.3935 | |||

| ADBE / Adobe Inc. | 0.15 | -1.97 | 59.39 | -1.78 | 1.7013 | -0.1330 | |||

| FNV / Franco-Nevada Corporation | 0.35 | 0.00 | 56.95 | 3.91 | 1.6315 | -0.0311 | |||

| KMB / Kimberly-Clark Corporation | 0.42 | 0.00 | 54.17 | -8.96 | 1.5518 | -0.2533 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.10 | -17.17 | 52.53 | 6.00 | 1.5049 | 0.0015 | |||

| CL / Colgate-Palmolive Company | 0.59 | 7.43 | 52.48 | 2.84 | 1.5032 | -0.0447 | |||

| TJX / The TJX Companies, Inc. | 0.42 | -19.55 | 51.31 | -15.89 | 1.4699 | -0.3807 | |||

| ROL / Rollins, Inc. | 0.90 | -7.45 | 50.48 | -1.87 | 1.4459 | -0.1144 | |||

| ROP / Roper Technologies, Inc. | 0.09 | -22.89 | 48.75 | -25.30 | 1.3964 | -0.5830 | |||

| ACN / Accenture plc | 0.16 | 83.39 | 47.88 | 78.34 | 1.3714 | 0.5571 | |||

| ABT / Abbott Laboratories | 0.35 | -24.79 | 47.41 | -22.62 | 1.3581 | -0.5004 | |||

| ZTS / Zoetis Inc. | 0.28 | -3.79 | 43.40 | -7.73 | 1.2433 | -0.1836 | |||

| VRSK / Verisk Analytics, Inc. | 0.14 | -36.95 | 42.42 | -33.83 | 1.2152 | -0.7294 | |||

| MDLZ / Mondelez International, Inc. | 0.62 | -10.90 | 42.13 | -10.68 | 1.2070 | -0.2240 | |||

| WPM / Wheaton Precious Metals Corp. | 0.43 | 0.00 | 38.90 | 15.44 | 1.1143 | 0.0921 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.17 | 12.19 | 36.66 | 6.50 | 1.0501 | 0.0060 | |||

| ENB / Enbridge Inc. | 0.81 | 0.00 | 36.60 | 1.55 | 1.0485 | -0.0448 | |||

| WAT / Waters Corporation | 0.10 | -19.35 | 36.11 | -21.40 | 1.0345 | -0.3592 | |||

| AEM / Agnico Eagle Mines Limited | 0.30 | 0.00 | 35.51 | 8.89 | 1.0172 | 0.0280 | |||

| CAT / Caterpillar Inc. | 0.09 | -9.20 | 34.72 | 6.13 | 0.9944 | 0.0022 | |||

| UNH / UnitedHealth Group Incorporated | 0.11 | 0.96 | 33.23 | -39.43 | 0.9519 | -0.7122 | |||

| RGLD / Royal Gold, Inc. | 0.18 | 0.00 | 32.46 | 8.37 | 0.9297 | 0.0212 | |||

| BKNG / Booking Holdings Inc. | 0.01 | -28.36 | 30.05 | -11.85 | 0.8609 | -0.1732 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.07 | -9.20 | 28.52 | -25.76 | 0.8171 | -0.3484 | |||

| LOW / Lowe's Companies, Inc. | 0.13 | -42.14 | 28.41 | -43.26 | 0.8137 | -0.7051 | |||

| MCO / Moody's Corporation | 0.05 | 6.37 | 25.90 | 12.70 | 0.7419 | 0.0448 | |||

| ALC / Alcon Inc. | 0.28 | -25.12 | 24.77 | -30.38 | 0.7096 | -0.3697 | |||

| XYL / Xylem Inc. | 0.19 | 22.22 | 24.29 | 31.43 | 0.6959 | 0.1352 | |||

| STZ / Constellation Brands, Inc. | 0.15 | -27.67 | 24.12 | -36.39 | 0.6910 | -0.4593 | |||

| NKE / NIKE, Inc. | 0.32 | -48.48 | 23.02 | -41.27 | 0.6594 | -0.5295 | |||

| PAYX / Paychex, Inc. | 0.15 | 16.93 | 21.67 | 11.61 | 0.6208 | 0.0318 | |||

| CMI / Cummins Inc. | 0.07 | -28.15 | 21.64 | -25.35 | 0.6198 | -0.2594 | |||

| SITE / SiteOne Landscape Supply, Inc. | 0.17 | -0.23 | 20.86 | -1.18 | 0.5976 | -0.0428 | |||

| EFX / Equifax Inc. | 0.08 | 19.64 | 20.43 | 27.72 | 0.5854 | 0.1000 | |||

| DHR / Danaher Corporation | 0.10 | -26.70 | 20.40 | -29.10 | 0.5844 | -0.2884 | |||

| JNJ / Johnson & Johnson | 0.13 | 86.12 | 20.02 | 73.55 | 0.5735 | 0.2236 | |||

| AVGO / Broadcom Inc. | 0.07 | -48.08 | 19.90 | -17.18 | 0.5700 | -0.1588 | |||

| NDSN / Nordson Corporation | 0.09 | -6.26 | 19.31 | 0.75 | 0.5532 | -0.0282 | |||

| META / Meta Platforms, Inc. | 0.03 | 18.92 | 0.5421 | 0.5421 | |||||

| CNM / Core & Main, Inc. | 0.31 | -8.07 | 18.85 | 14.60 | 0.5398 | 0.0410 | |||

| LLY / Eli Lilly and Company | 0.02 | 18.61 | 0.5330 | 0.5330 | |||||

| BSY / Bentley Systems, Incorporated | 0.35 | -5.39 | 18.37 | 25.65 | 0.5263 | 0.0827 | |||

| JKHY / Jack Henry & Associates, Inc. | 0.10 | -5.47 | 17.86 | -5.46 | 0.5117 | -0.0615 | |||

| AMAT / Applied Materials, Inc. | 0.10 | 1,297.30 | 17.52 | 1,667.71 | 0.5018 | 0.4718 | |||

| MSCI / MSCI Inc. | 0.03 | -32.35 | 17.23 | -30.07 | 0.4936 | -0.2538 | |||

| NOW / ServiceNow, Inc. | 0.02 | -4.94 | 17.11 | 22.02 | 0.4902 | 0.0648 | |||

| IEX / IDEX Corporation | 0.09 | -2.52 | 16.39 | -4.84 | 0.4696 | -0.0529 | |||

| AGI / Alamos Gold Inc. | 0.60 | 20.00 | 15.80 | 18.66 | 0.4526 | 0.0487 | |||

| PAYC / Paycom Software, Inc. | 0.07 | -8.48 | 15.70 | -4.77 | 0.4497 | -0.0504 | |||

| ADSK / Autodesk, Inc. | 0.05 | 26.40 | 15.19 | 47.66 | 0.4352 | 0.1231 | |||

| MANH / Manhattan Associates, Inc. | 0.07 | 18.88 | 14.65 | 35.38 | 0.4197 | 0.0914 | |||

| TYL / Tyler Technologies, Inc. | 0.03 | -4.20 | 14.58 | -3.81 | 0.4177 | -0.0421 | |||

| MASI / Masimo Corporation | 0.09 | -14.33 | 14.58 | -11.74 | 0.4177 | -0.0835 | |||

| ORCL / Oracle Corporation | 0.07 | -6.90 | 14.44 | 39.17 | 0.4135 | 0.0989 | |||

| CHE / Chemed Corporation | 0.03 | 9.36 | 14.37 | 1.15 | 0.4117 | -0.0193 | |||

| ADP / Automatic Data Processing, Inc. | 0.05 | 214.86 | 14.14 | 218.19 | 0.4050 | 0.2702 | |||

| TPL / Texas Pacific Land Corporation | 0.01 | 14.03 | 0.4020 | 0.4020 | |||||

| HON / Honeywell International Inc. | 0.06 | -28.71 | 13.85 | -22.31 | 0.3968 | -0.1441 | |||

| AME / AMETEK, Inc. | 0.08 | 44.13 | 13.77 | 52.95 | 0.3945 | 0.1214 | |||

| VRSN / VeriSign, Inc. | 0.05 | 13.63 | 0.3905 | 0.3905 | |||||

| KLAC / KLA Corporation | 0.02 | 631.58 | 13.60 | 868.11 | 0.3897 | 0.3470 | |||

| POOL / Pool Corporation | 0.04 | -5.74 | 12.97 | -12.23 | 0.3714 | -0.0767 | |||

| CDW / CDW Corporation | 0.07 | -5.30 | 12.68 | 4.19 | 0.3633 | -0.0059 | |||

| LII / Lennox International Inc. | 0.02 | -11.02 | 12.37 | -8.55 | 0.3543 | -0.0560 | |||

| GGG / Graco Inc. | 0.14 | -16.32 | 12.32 | -13.44 | 0.3531 | -0.0788 | |||

| WSO / Watsco, Inc. | 0.03 | -6.00 | 12.31 | -18.11 | 0.3525 | -0.1033 | |||

| NFLX / Netflix, Inc. | 0.01 | 12.17 | 0.3486 | 0.3486 | |||||

| ZBRA / Zebra Technologies Corporation | 0.04 | -6.27 | 12.03 | 3.41 | 0.3445 | -0.0083 | |||

| SNPS / Synopsys, Inc. | 0.02 | 11.96 | 0.3426 | 0.3426 | |||||

| EXPO / Exponent, Inc. | 0.16 | 13.59 | 11.90 | 2.60 | 0.3409 | -0.0109 | |||

| SPGI / S&P Global Inc. | 0.02 | 0.00 | 11.59 | 3.19 | 0.3321 | -0.0087 | |||

| ANSS / ANSYS, Inc. | 0.03 | 17.19 | 11.59 | 28.61 | 0.3321 | 0.0587 | |||

| WST / West Pharmaceutical Services, Inc. | 0.05 | -5.70 | 11.58 | -6.97 | 0.3316 | -0.0458 | |||

| ANET / Arista Networks Inc | 0.12 | 257.89 | 11.49 | 357.25 | 0.3290 | 0.2528 | |||

| BMY / Bristol-Myers Squibb Company | 0.25 | 0.00 | 11.45 | -22.65 | 0.3279 | -0.1210 | |||

| CHD / Church & Dwight Co., Inc. | 0.12 | -0.85 | 11.35 | -13.74 | 0.3252 | -0.0740 | |||

| TECH / Bio-Techne Corporation | 0.22 | 0.93 | 11.19 | -10.76 | 0.3207 | -0.0599 | |||

| ULTA / Ulta Beauty, Inc. | 0.02 | -6.00 | 10.77 | 20.04 | 0.3084 | 0.0363 | |||

| BURL / Burlington Stores, Inc. | 0.05 | 1.32 | 10.63 | -1.52 | 0.3045 | -0.0229 | |||

| YUMC / Yum China Holdings, Inc. | 0.24 | -37.23 | 10.56 | -45.33 | 0.3026 | -0.2835 | |||

| COST / Costco Wholesale Corporation | 0.01 | 10.05 | 0.2878 | 0.2878 | |||||

| IQV / IQVIA Holdings Inc. | 0.06 | -27.61 | 9.72 | -35.63 | 0.2784 | -0.1796 | |||

| LIN / Linde plc | 0.02 | 296.15 | 9.55 | 300.80 | 0.2735 | 0.2012 | |||

| MTD / Mettler-Toledo International Inc. | 0.01 | -10.11 | 9.47 | -9.40 | 0.2714 | -0.0458 | |||

| BDX / Becton, Dickinson and Company | 0.06 | 0.00 | 9.39 | -24.78 | 0.2691 | -0.1097 | |||

| QLYS / Qualys, Inc. | 0.07 | -12.98 | 9.26 | -3.35 | 0.2654 | -0.0254 | |||

| PG / The Procter & Gamble Company | 0.06 | 447.70 | 9.13 | 422.01 | 0.2616 | 0.2085 | |||

| LFUS / Littelfuse, Inc. | 0.04 | -33.33 | 9.07 | -25.03 | 0.2598 | -0.1071 | |||

| PODD / Insulet Corporation | 0.03 | -33.02 | 8.95 | -18.83 | 0.2564 | -0.0781 | |||

| NEM / Newmont Corporation | 0.15 | 0.00 | 8.65 | 18.24 | 0.2479 | 0.0259 | |||

| DPZ / Domino's Pizza, Inc. | 0.02 | -7.50 | 8.26 | -7.50 | 0.2365 | -0.0342 | |||

| GMED / Globus Medical, Inc. | 0.14 | 12.85 | 8.13 | -8.70 | 0.2329 | -0.0372 | |||

| VEEV / Veeva Systems Inc. | 0.03 | 0.00 | 7.96 | 21.21 | 0.2281 | 0.0288 | |||

| COO / The Cooper Companies, Inc. | 0.11 | -10.85 | 7.89 | -24.17 | 0.2259 | -0.0896 | |||

| GOOG / Alphabet Inc. | 0.04 | 7.82 | 0.2241 | 0.2241 | |||||

| CLX / The Clorox Company | 0.07 | -13.90 | 7.74 | -29.77 | 0.2218 | -0.1126 | |||

| KO / The Coca-Cola Company | 0.11 | 415.25 | 7.55 | 415.79 | 0.2162 | 0.1718 | |||

| TSCO / Tractor Supply Company | 0.14 | -5.03 | 7.22 | -8.02 | 0.2067 | -0.0312 | |||

| TXN / Texas Instruments Incorporated | 0.03 | 243.06 | 7.19 | 303.59 | 0.2059 | 0.1519 | |||

| LOGI / Logitech International S.A. | 0.08 | 19.73 | 6.75 | 27.57 | 0.1934 | 0.0329 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.12 | 6.66 | 0.1908 | 0.1908 | |||||

| LKQ / LKQ Corporation | 0.18 | -54.48 | 6.63 | -59.31 | 0.1900 | -0.3044 | |||

| AOS / A. O. Smith Corporation | 0.10 | -18.19 | 6.58 | -18.00 | 0.1886 | -0.0550 | |||

| SRE / Sempra | 0.09 | 6.49 | 0.1858 | 0.1858 | |||||

| KOF / Coca-Cola FEMSA, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.07 | -6.80 | 6.46 | -4.53 | 0.1852 | -0.0202 | |||

| FDX / FedEx Corporation | 0.03 | -28.80 | 6.45 | -32.46 | 0.1848 | -0.1049 | |||

| MRK / Merck & Co., Inc. | 0.08 | 6.19 | 0.1774 | 0.1774 | |||||

| RACE / Ferrari N.V. | 0.01 | 5.76 | 0.1649 | 0.1649 | |||||

| CCU / Compañía Cervecerías Unidas S.A. - Depositary Receipt (Common Stock) | 0.43 | -13.86 | 5.61 | -27.42 | 0.1606 | -0.0737 | |||

| ETN / Eaton Corporation plc | 0.02 | -28.32 | 5.45 | -7.50 | 0.1562 | -0.0226 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | 5.36 | 0.1535 | 0.1535 | |||||

| PSA / Public Storage | 0.02 | 5.27 | 0.1511 | 0.1511 | |||||

| SPG / Simon Property Group, Inc. | 0.03 | 4.94 | 0.1416 | 0.1416 | |||||

| EW / Edwards Lifesciences Corporation | 0.06 | 4.81 | 0.1377 | 0.1377 | |||||

| BLK / BlackRock, Inc. | 0.00 | 4.61 | 0.1320 | 0.1320 | |||||

| AAON / AAON, Inc. | 0.06 | 4.57 | 0.1309 | 0.1309 | |||||

| ITW / Illinois Tool Works Inc. | 0.02 | 4.56 | 0.1307 | 0.1307 | |||||

| LECO / Lincoln Electric Holdings, Inc. | 0.02 | 8.59 | 4.50 | 19.63 | 0.1289 | 0.0148 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.05 | 4.45 | 0.1275 | 0.1275 | |||||

| LRCX / Lam Research Corporation | 0.04 | 4.25 | 0.1216 | 0.1216 | |||||

| WMS / Advanced Drainage Systems, Inc. | 0.04 | 11.88 | 4.15 | 20.08 | 0.1189 | 0.0141 | |||

| DCI / Donaldson Company, Inc. | 0.06 | 0.00 | 4.12 | 3.91 | 0.1181 | -0.0023 | |||

| MMM / 3M Company | 0.03 | 4.10 | 0.1175 | 0.1175 | |||||

| CDNS / Cadence Design Systems, Inc. | 0.01 | 773.33 | 4.00 | 940.89 | 0.1145 | 0.1028 | |||

| UPS / United Parcel Service, Inc. | 0.04 | -28.37 | 3.93 | -33.82 | 0.1127 | -0.0676 | |||

| LULU / lululemon athletica inc. | 0.02 | 3.83 | 0.1097 | 0.1097 | |||||

| CTAS / Cintas Corporation | 0.02 | 3.69 | 0.1056 | 0.1056 | |||||

| TT / Trane Technologies plc | 0.01 | 3.67 | 0.1052 | 0.1052 | |||||

| DECK / Deckers Outdoor Corporation | 0.03 | 3.58 | 0.1027 | 0.1027 | |||||

| MMC / Marsh & McLennan Companies, Inc. | 0.02 | 3.56 | 0.1019 | 0.1019 | |||||

| DHI / D.R. Horton, Inc. | 0.03 | 3.49 | 0.0999 | 0.0999 | |||||

| BFB / Brown-Forman Corp. - Class B | 0.13 | -54.48 | 3.36 | -64.95 | 0.0961 | -0.1943 | |||

| CME / CME Group Inc. | 0.01 | 3.35 | 0.0960 | 0.0960 | |||||

| SHW / The Sherwin-Williams Company | 0.01 | 3.15 | 0.0901 | 0.0901 | |||||

| APH / Amphenol Corporation | 0.03 | 3.14 | 0.0901 | 0.0901 | |||||

| GRMN / Garmin Ltd. | 0.01 | 3.08 | 0.0883 | 0.0883 | |||||

| GWW / W.W. Grainger, Inc. | 0.00 | 2.88 | 0.0825 | 0.0825 | |||||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | 2.87 | 0.0821 | 0.0821 | |||||

| NVR / NVR, Inc. | 0.00 | 2.65 | 0.0760 | 0.0760 | |||||

| WSM / Williams-Sonoma, Inc. | 0.01 | 2.45 | 0.0701 | 0.0701 | |||||

| APP / AppLovin Corporation | 0.01 | 2.34 | 0.0669 | 0.0669 | |||||

| PHM / PulteGroup, Inc. | 0.02 | 2.30 | 0.0659 | 0.0659 | |||||

| ELV / Elevance Health, Inc. | 0.01 | 2.29 | 0.0656 | 0.0656 | |||||

| AMP / Ameriprise Financial, Inc. | 0.00 | 2.27 | 0.0650 | 0.0650 | |||||

| GILD / Gilead Sciences, Inc. | 0.02 | -7.82 | 2.22 | -8.58 | 0.0635 | -0.0101 | |||

| AMGN / Amgen Inc. | 0.01 | 0.00 | 2.16 | -9.56 | 0.0618 | -0.0106 | |||

| WFC / Wells Fargo & Company | 0.03 | 0.00 | 1.99 | 12.65 | 0.0569 | 0.0034 | |||

| PBA / Pembina Pipeline Corporation | 0.05 | 0.00 | 1.97 | -6.81 | 0.0564 | -0.0077 | |||

| SYK / Stryker Corporation | 0.00 | -11.04 | 1.90 | -3.80 | 0.0545 | -0.0055 | |||

| ADI / Analog Devices, Inc. | 0.01 | -59.06 | 1.86 | -51.81 | 0.0532 | -0.0636 | |||

| ABBV / AbbVie Inc. | 0.01 | -15.26 | 1.82 | -24.62 | 0.0522 | -0.0211 | |||

| EBAY / eBay Inc. | 0.02 | 0.00 | 1.76 | 10.06 | 0.0505 | 0.0019 | |||

| JCI / Johnson Controls International plc | 0.02 | 0.00 | 1.67 | 32.07 | 0.0478 | 0.0095 | |||

| AMRZ / Amrize AG | 0.03 | 1.39 | 0.0399 | 0.0399 | |||||

| EMR / Emerson Electric Co. | 0.01 | 0.00 | 1.28 | 22.79 | 0.0366 | 0.0050 | |||

| KEYS / Keysight Technologies, Inc. | 0.01 | -66.81 | 1.25 | -63.68 | 0.0358 | -0.0685 | |||

| A / Agilent Technologies, Inc. | 0.01 | 0.00 | 1.14 | 2.24 | 0.0328 | -0.0012 | |||

| ECL / Ecolab Inc. | 0.00 | -54.95 | 1.10 | -51.63 | 0.0314 | -0.0373 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 1.09 | 18.35 | 0.0312 | 0.0033 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 0.00 | 1.08 | -6.96 | 0.0310 | -0.0043 | |||

| CVX / Chevron Corporation | 0.01 | 0.00 | 0.95 | -13.35 | 0.0272 | -0.0060 | |||

| TREX / Trex Company, Inc. | 0.01 | -2.97 | 0.54 | -6.93 | 0.0154 | -0.0021 | |||

| MRNA / Moderna, Inc. | 0.01 | 0.00 | 0.37 | -12.56 | 0.0106 | -0.0022 | |||

| TER / Teradyne, Inc. | 0.00 | 0.00 | 0.29 | 9.47 | 0.0083 | 0.0003 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HUBB / Hubbell Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FERG / Ferguson Enterprises Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MU / Micron Technology, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |