Mga Batayang Estadistika

| Nilai Portofolio | $ 952,844,877 |

| Posisi Saat Ini | 112 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

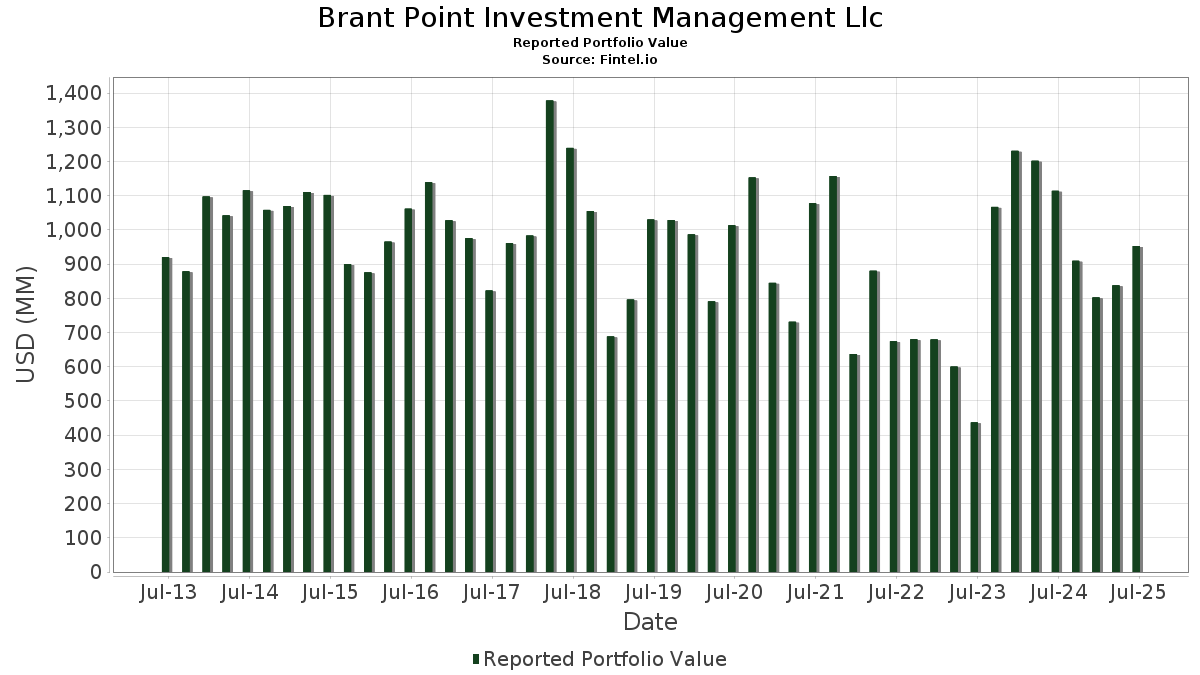

Brant Point Investment Management Llc telah mengungkapkan total kepemilikan 112 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 952,844,877 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Brant Point Investment Management Llc adalah SPDR S&P 500 ETF (US:SPY) , SPDR S&P 500 ETF (US:SPY) , iShares Trust - iShares Russell 2000 ETF (US:IWM) , iShares Trust - iShares Russell 2000 ETF (US:IWM) , and SPDR S&P MidCap 400 ETF Trust (US:MDY) . Posisi baru Brant Point Investment Management Llc meliputi: JFrog Ltd. (US:FROG) , nCino, Inc. (US:NCNO) , Globus Medical, Inc. (US:GMED) , Hinge Health, Inc. (US:HNGE) , and Birkenstock Holding plc (US:BIRK) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 166.82 | 11.8324 | 5.1555 | |

| 0.12 | 5.05 | 0.5296 | 0.5296 | |

| 0.12 | 3.36 | 0.3524 | 0.3524 | |

| 0.00 | 4.77 | 0.3385 | 0.3385 | |

| 0.00 | 3.07 | 0.3227 | 0.3227 | |

| 0.06 | 2.85 | 0.2987 | 0.2987 | |

| 0.06 | 2.70 | 0.2839 | 0.2839 | |

| 0.06 | 2.35 | 0.2462 | 0.2462 | |

| 0.03 | 3.33 | 0.2359 | 0.2359 | |

| 0.04 | 2.23 | 0.2340 | 0.2340 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 91.71 | 6.5050 | -7.4245 | |

| 0.00 | 123.57 | 8.7648 | -3.9213 | |

| 0.06 | 11.00 | 0.7805 | -1.1289 | |

| 0.00 | 0.00 | -0.9376 | ||

| 0.00 | 0.00 | -0.8766 | ||

| 0.00 | 0.00 | -0.7046 | ||

| 0.04 | 11.23 | 0.7963 | -0.6477 | |

| 0.00 | 45.32 | 3.2144 | -0.6062 | |

| 0.00 | 0.00 | -0.5939 | ||

| 0.09 | 7.22 | 0.5124 | -0.5440 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-13 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Call | 0.00 | 170.00 | 166.82 | 198.22 | 11.8324 | 5.1555 | ||

| SPY / SPDR S&P 500 ETF | Put | 0.00 | 5.26 | 123.57 | 16.26 | 8.7648 | -3.9213 | ||

| IWM / iShares Trust - iShares Russell 2000 ETF | Put | 0.00 | -27.35 | 91.71 | -21.41 | 6.5050 | -7.4245 | ||

| IWM / iShares Trust - iShares Russell 2000 ETF | Call | 0.00 | 60.00 | 51.79 | 73.07 | 3.6734 | 0.1017 | ||

| MDY / SPDR S&P MidCap 400 ETF Trust | Put | 0.00 | 33.33 | 45.32 | 41.58 | 3.2144 | -0.6062 | ||

| APH / Amphenol Corporation | 0.17 | -2.94 | 17.27 | 46.12 | 1.2249 | -0.1857 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.15 | 1,244.73 | 13.48 | -15.39 | 1.4143 | -0.4870 | |||

| WSBC / WesBanco, Inc. | 0.42 | 32.88 | 13.28 | 35.76 | 0.9423 | -0.2258 | |||

| META / Meta Platforms, Inc. | 0.02 | 2.70 | 11.98 | 31.51 | 0.8496 | -0.2375 | |||

| FLEX / Flex Ltd. | 0.23 | 2.03 | 11.36 | 53.97 | 0.8056 | -0.0749 | |||

| AJG / Arthur J. Gallagher & Co. | 0.04 | 0.08 | 11.23 | -7.20 | 0.7963 | -0.6477 | |||

| PFGC / Performance Food Group Company | 0.13 | -0.53 | 11.12 | 10.64 | 0.7891 | -0.4110 | |||

| FI / Fiserv, Inc. | 0.06 | -11.89 | 11.00 | -31.21 | 0.7805 | -1.1289 | |||

| THC / Tenet Healthcare Corporation | 0.06 | -4.28 | 11.00 | 25.26 | 0.7805 | -0.2681 | |||

| USFD / US Foods Holding Corp. | 0.14 | -7.29 | 10.59 | 9.08 | 0.7511 | -0.4077 | |||

| AMZN / Amazon.com, Inc. | 0.05 | 4.08 | 10.42 | 20.02 | 0.7394 | -0.2973 | |||

| FI / Fiserv, Inc. | Put | 0.00 | 88.82 | 10.19 | 47.43 | 0.7227 | -0.1023 | ||

| LPLA / LPL Financial Holdings Inc. | 0.02 | 4.10 | 9.04 | 19.32 | 0.6414 | -0.2632 | |||

| ACM / AECOM | 0.07 | -0.56 | 7.81 | 21.03 | 0.5540 | -0.2163 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.02 | 6.14 | 7.23 | -13.52 | 0.5127 | -0.4849 | |||

| UNM / Unum Group | 0.09 | -17.67 | 7.22 | -18.37 | 0.5124 | -0.5440 | |||

| SHW / The Sherwin-Williams Company | 0.02 | -0.60 | 6.74 | -2.25 | 0.4777 | -0.3448 | |||

| TTMI / TTM Technologies, Inc. | 0.16 | -27.61 | 6.54 | 44.07 | 0.4641 | -0.0779 | |||

| COHR / Coherent Corp. | 0.07 | 146.36 | 6.51 | 238.46 | 0.4619 | 0.2322 | |||

| WCN / Waste Connections, Inc. | 0.03 | 1.02 | 6.46 | -3.37 | 0.4582 | -0.3397 | |||

| GDDY / GoDaddy Inc. | 0.04 | -0.26 | 6.40 | -0.30 | 0.4540 | -0.3124 | |||

| UMBF / UMB Financial Corporation | 0.06 | 32.84 | 6.21 | 38.18 | 0.4405 | -0.0960 | |||

| CR / Crane Company | 0.03 | -0.42 | 6.17 | 23.46 | 0.4379 | -0.1590 | |||

| HCA / HCA Healthcare, Inc. | 0.02 | 0.00 | 6.12 | 10.87 | 0.4343 | -0.2249 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.01 | -8.68 | 6.05 | 16.62 | 0.4290 | -0.1900 | |||

| NXPI / NXP Semiconductors N.V. | 0.03 | 0.65 | 5.86 | 15.70 | 0.4156 | -0.1888 | |||

| CRH / CRH plc | 0.06 | -11.20 | 5.71 | -7.32 | 0.4047 | -0.3303 | |||

| COOPER COS INC / (216648402) | 0.08 | 5.64 | 0.0000 | ||||||

| VNT / Vontier Corporation | 0.15 | 51.38 | 5.55 | 70.04 | 0.3933 | 0.0041 | |||

| VRT / Vertiv Holdings Co | 0.04 | 3.40 | 5.29 | 83.94 | 0.3752 | 0.0319 | |||

| THC / Tenet Healthcare Corporation | Put | 0.00 | 50.00 | 5.28 | 96.28 | 0.3745 | 0.0534 | ||

| DBD / Diebold Nixdorf, Incorporated | 0.09 | -23.34 | 5.25 | -2.87 | 0.3723 | -0.2727 | |||

| MAS / Masco Corporation | 0.08 | -4.80 | 5.19 | -11.89 | 0.3680 | -0.3348 | |||

| CLH / Clean Harbors, Inc. | 0.02 | -25.76 | 5.09 | -12.91 | 0.3608 | -0.3364 | |||

| CLS / Celestica Inc. | 0.03 | 7.73 | 5.05 | 113.40 | 0.3582 | 0.0757 | |||

| FROG / JFrog Ltd. | 0.12 | 5.05 | 0.5296 | 0.5296 | |||||

| MOD / Modine Manufacturing Company | 0.05 | 4.79 | 4.92 | 34.49 | 0.3493 | -0.0878 | |||

| KRE / SPDR Series Trust - SPDR S&P Regional Banking ETF | 0.08 | -0.56 | 4.84 | 3.89 | 0.3430 | -0.2126 | |||

| VSEC / VSE Corporation | 0.04 | 0.06 | 4.79 | 9.21 | 0.3397 | -0.1837 | |||

| EQIX / Equinix, Inc. | Put | 0.00 | 4.77 | 0.3385 | 0.3385 | ||||

| GOOG / Alphabet Inc. | 0.03 | 48.43 | 4.72 | 68.56 | 0.3351 | 0.0005 | |||

| PTC / PTC Inc. | 0.03 | 5.66 | 4.62 | 17.53 | 0.3277 | -0.1415 | |||

| SARO / StandardAero, Inc. | 0.14 | -5.51 | 4.49 | 12.24 | 0.3182 | -0.1588 | |||

| ZTS / Zoetis Inc. | 0.03 | 5.75 | 4.41 | 0.16 | 0.3125 | -0.2125 | |||

| NVT / nVent Electric plc | 0.06 | 4.94 | 4.33 | 46.63 | 0.3074 | -0.0454 | |||

| KNSL / Kinsale Capital Group, Inc. | 0.01 | 0.00 | 4.30 | -0.58 | 0.3052 | -0.2114 | |||

| EQIX / Equinix, Inc. | 0.01 | -0.55 | 4.30 | -2.98 | 0.3049 | -0.2239 | |||

| SAIA / Saia, Inc. | 0.02 | -14.50 | 4.19 | -32.96 | 0.2969 | -0.4483 | |||

| ON / ON Semiconductor Corporation | 0.08 | -0.23 | 4.14 | 28.50 | 0.2936 | -0.0909 | |||

| RRX / Regal Rexnord Corporation | 0.03 | 47.48 | 4.04 | 87.82 | 0.2866 | 0.0298 | |||

| ROAD / Construction Partners, Inc. | 0.04 | -49.82 | 3.95 | -25.79 | 0.2802 | -0.3553 | |||

| SSB / SouthState Corporation | 0.04 | 14.98 | 3.94 | 14.02 | 0.2793 | -0.1330 | |||

| TSCO / Tractor Supply Company | 0.07 | 5.74 | 3.66 | 1.22 | 0.2598 | -0.1722 | |||

| KNF / Knife River Corporation | 0.04 | -25.84 | 3.59 | -32.88 | 0.2545 | -0.3837 | |||

| WCC / WESCO International, Inc. | 0.02 | 74.57 | 3.56 | 108.20 | 0.2523 | 0.0484 | |||

| ADI / Analog Devices, Inc. | 0.01 | 98.80 | 3.54 | 134.64 | 0.3718 | 0.1916 | |||

| XBI / SPDR Series Trust - SPDR S&P Biotech ETF | 0.04 | -16.23 | 3.42 | -14.33 | 0.2426 | -0.2340 | |||

| NCNO / nCino, Inc. | 0.12 | 3.36 | 0.3524 | 0.3524 | |||||

| BRO / Brown & Brown, Inc. | 0.03 | 3.33 | 0.2359 | 0.2359 | |||||

| CWST / Casella Waste Systems, Inc. | 0.03 | -0.99 | 3.12 | 2.46 | 0.2216 | -0.1424 | |||

| GMED / Globus Medical, Inc. | Call | 0.00 | 3.07 | 0.3227 | 0.3227 | ||||

| ODFL / Old Dominion Freight Line, Inc. | 0.02 | -0.16 | 3.05 | -2.06 | 0.3198 | -0.0515 | |||

| HNGE / Hinge Health, Inc. | 0.06 | 2.85 | 0.2987 | 0.2987 | |||||

| YUM / Yum! Brands, Inc. | 0.02 | 61.32 | 2.83 | 51.94 | 0.2005 | -0.0216 | |||

| BIRK / Birkenstock Holding plc | 0.06 | 2.70 | 0.2839 | 0.2839 | |||||

| VSEC / VSE Corporation | Put | 0.00 | 2.62 | 0.1858 | 0.1858 | ||||

| WAL / Western Alliance Bancorporation | 0.03 | 1.97 | 2.61 | 3.50 | 0.1848 | -0.1157 | |||

| SCI / Service Corporation International | 0.03 | -30.93 | 2.60 | -29.91 | 0.1848 | -0.2587 | |||

| PRI / Primerica, Inc. | 0.01 | 11.33 | 2.56 | 7.08 | 0.1814 | -0.1037 | |||

| CHDN / Churchill Downs Incorporated | 0.02 | 0.00 | 2.52 | -9.06 | 0.1788 | -0.1520 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.03 | -28.90 | 2.47 | -29.52 | 0.1752 | -0.2431 | |||

| TREX / Trex Company, Inc. | 0.05 | -24.04 | 2.45 | -28.90 | 0.1736 | -0.2374 | |||

| CHE / Chemed Corporation | 0.01 | -12.92 | 2.43 | -31.11 | 0.1727 | -0.2490 | |||

| HD / The Home Depot, Inc. | 0.01 | 119.30 | 2.38 | 119.43 | 0.1690 | 0.0394 | |||

| CHWY / Chewy, Inc. | 0.06 | 2.35 | 0.2462 | 0.2462 | |||||

| AMRZ / Amrize AG | 0.04 | 2.23 | 0.2340 | 0.2340 | |||||

| FROG / JFrog Ltd. | Put | 0.00 | 2.19 | 0.2303 | 0.2303 | ||||

| NICE / NICE Ltd. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 2.19 | 9.56 | 0.1552 | -0.0832 | |||

| PAHC / Phibro Animal Health Corporation | 0.09 | -17.61 | 2.18 | -1.49 | 0.1548 | -0.1096 | |||

| FUN / Six Flags Entertainment Corporation | 0.07 | 259.56 | 2.16 | 206.96 | 0.1533 | 0.0692 | |||

| GUSH / Direxion Shares ETF Trust - Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares | 0.09 | -0.56 | 2.12 | -15.78 | 0.1507 | -0.1505 | |||

| PRKS / United Parks & Resorts Inc. | 0.04 | -39.65 | 2.11 | -37.39 | 0.1495 | -0.2525 | |||

| BCO / The Brink's Company | 0.02 | 0.87 | 2.07 | 4.54 | 0.1471 | -0.0897 | |||

| HCA / HCA Healthcare, Inc. | Put | 0.00 | -16.67 | 1.92 | -7.62 | 0.1359 | -0.1116 | ||

| AZZ / AZZ Inc. | Call | 0.00 | 1.89 | 0.1983 | 0.1983 | ||||

| SCHW / The Charles Schwab Corporation | 0.02 | -32.46 | 1.82 | -21.28 | 0.1294 | -0.1472 | |||

| GPN / Global Payments Inc. | 0.02 | -55.83 | 1.78 | -63.90 | 0.1264 | -0.4626 | |||

| CACI / CACI International Inc | 0.00 | 31.41 | 1.75 | 70.80 | 0.1241 | 0.0018 | |||

| SKWD / Skyward Specialty Insurance Group, Inc. | 0.03 | 200.63 | 1.72 | 228.74 | 0.1217 | 0.0593 | |||

| AJG / Arthur J. Gallagher & Co. | Put | 0.00 | -66.67 | 1.60 | -69.10 | 0.1135 | -0.5046 | ||

| GRDN / Guardian Pharmacy Services, Inc. | 0.07 | 1.50 | 0.1061 | 0.1061 | |||||

| ALK / Alaska Air Group, Inc. | 0.03 | -64.72 | 1.47 | -64.55 | 0.1039 | -0.3893 | |||

| POOL / Pool Corporation | 0.00 | -17.47 | 1.43 | -24.44 | 0.1011 | -0.1241 | |||

| OSIS / OSI Systems, Inc. | 0.01 | -53.27 | 1.35 | -45.97 | 0.0957 | -0.2022 | |||

| ADI / Analog Devices, Inc. | Call | 0.00 | 1.19 | 0.1249 | 0.1249 | ||||

| ICLR / ICON Public Limited Company | 0.01 | -50.00 | 1.02 | -58.43 | 0.0722 | -0.2202 | |||

| APG / APi Group Corporation | 0.02 | -0.59 | 1.00 | 41.93 | 0.0711 | -0.0132 | |||

| BHB / Bar Harbor Bankshares | 0.03 | 60.45 | 0.95 | 63.06 | 0.0674 | -0.0022 | |||

| UBER / Uber Technologies, Inc. | 0.01 | 0.93 | 0.0979 | 0.0979 | |||||

| BSIG / BrightSphere Investment Group Inc. | 0.03 | 0.93 | 0.0977 | 0.0977 | |||||

| TPR / Tapestry, Inc. | 0.01 | -0.60 | 0.86 | 24.03 | 0.0611 | -0.0219 | |||

| MD / Pediatrix Medical Group, Inc. | 0.05 | -0.59 | 0.78 | -1.52 | 0.0550 | -0.0390 | |||

| DNOW / DNOW Inc. | 0.05 | 0.74 | 0.0778 | 0.0778 | |||||

| GMED / Globus Medical, Inc. | 0.01 | 0.59 | 0.0619 | 0.0619 | |||||

| ARMK / Aramark | 0.01 | 0.42 | 0.0297 | 0.0297 | |||||

| IESC / IES Holdings, Inc. | 0.00 | -86.50 | 0.36 | -75.80 | 0.0252 | -0.1500 | |||

| VSCO / Victoria's Secret & Co. | 0.01 | -88.23 | 0.19 | -88.31 | 0.0137 | -0.1834 | |||

| WCN / Waste Connections, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.3495 | |||

| ICUI / ICU Medical, Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| ALK / Alaska Air Group, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.2350 | |||

| POOL / Pool Corporation | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.3800 | |||

| TPR / Tapestry, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.3362 | |||

| NVT / nVent Electric plc | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.2503 | |||

| PRMB / Primo Brands Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HD / The Home Depot, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.4374 | |||

| PBI / Pitney Bowes Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BBWI / Bath & Body Works, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PYPL / PayPal Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NXPI / NXP Semiconductors N.V. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.2269 | |||

| PTC / PTC Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.1849 | |||

| CLH / Clean Harbors, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.2000 | |||

| PFGC / Performance Food Group Company | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.8766 | |||

| GAP / The Gap, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FTDR / Frontdoor, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| DAL / Delta Air Lines, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3599 | ||||

| FTDR / Frontdoor, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| COOPER COS INC / (216648402) | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| APH / Amphenol Corporation | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.7046 | |||

| CART / Maplebear Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| AIR / AAR Corp. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| MUSA / Murphy USA Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TMO / Thermo Fisher Scientific Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.5939 | |||

| TEAM / Atlassian Corporation | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| GPN / Global Payments Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.3506 | |||

| MOD / Modine Manufacturing Company | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.0916 | |||

| ICUI / ICU Medical, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WCC / WESCO International, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.1909 | |||

| PRKS / United Parks & Resorts Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.2512 | |||

| FTAI / FTAI Aviation Ltd. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| AIR / AAR Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AZZ / AZZ Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2794 | ||||

| RRX / Regal Rexnord Corporation | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.0679 | |||

| USFD / US Foods Holding Corp. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.9376 |