Mga Batayang Estadistika

| Nilai Portofolio | $ 141,459,000 |

| Posisi Saat Ini | 45 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

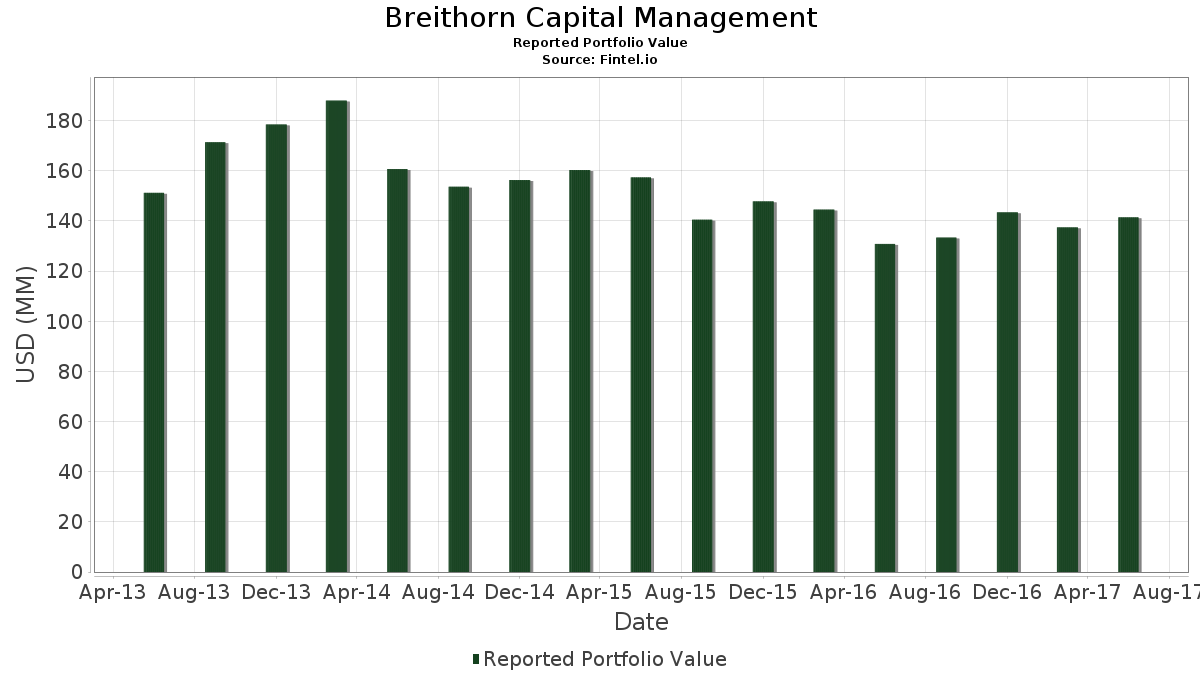

Breithorn Capital Management telah mengungkapkan total kepemilikan 45 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 141,459,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Breithorn Capital Management adalah General Communication, Inc. (US:GNCMB) , General Motors Company (US:GM) , Jefferies Financial Group Inc. (US:JEF) , Blue Bird Corporation (US:BLBD) , and ARRIS International plc (US:ARRS) . Posisi baru Breithorn Capital Management meliputi: Cincinnati Bell, Inc. (US:CBB) , Gilead Sciences, Inc. (US:GILD) , B&G Foods, Inc. (US:BGS) , AMAG Pharmaceuticals, Inc. (US:US00163U1060) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.24 | 8.66 | 6.1219 | 6.1219 | |

| 0.25 | 6.59 | 4.6579 | 4.6579 | |

| 0.38 | 6.45 | 4.5617 | 4.5617 | |

| 0.22 | 6.17 | 4.3589 | 4.3589 | |

| 0.03 | 5.37 | 3.7933 | 3.7933 | |

| 0.14 | 5.24 | 3.7007 | 3.7007 | |

| 0.11 | 5.07 | 3.5869 | 3.5869 | |

| 0.08 | 5.06 | 3.5777 | 3.5777 | |

| 0.26 | 5.00 | 3.5332 | 3.5332 | |

| 0.20 | 4.87 | 3.4441 | 3.4441 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.20 | 3.79 | 2.6757 | -3.1226 | |

| 0.19 | 6.71 | 4.7434 | -0.4067 | |

| 0.37 | 2.88 | 2.0324 | -0.3495 | |

| 0.09 | 5.46 | 3.8612 | -0.2595 | |

| 0.00 | 0.34 | 0.2439 | -0.1395 | |

| 0.01 | 0.56 | 0.3980 | -0.1134 | |

| 0.03 | 0.53 | 0.3711 | -0.0741 | |

| 0.01 | 0.64 | 0.4553 | -0.0518 | |

| 0.00 | 0.29 | 0.2057 | -0.0438 | |

| 0.00 | 0.22 | 0.1555 | -0.0365 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2017-08-14 untuk periode pelaporan 2017-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GNCMB / General Communication, Inc. | 0.24 | -3.70 | 8.66 | 69.64 | 6.1219 | 6.1219 | |||

| GM / General Motors Company | 0.19 | -4.05 | 6.71 | -5.21 | 4.7434 | -0.4067 | |||

| JEF / Jefferies Financial Group Inc. | 0.25 | -3.98 | 6.59 | -3.39 | 4.6579 | 4.6579 | |||

| BLBD / Blue Bird Corporation | 0.38 | -3.76 | 6.45 | -4.60 | 4.5617 | 4.5617 | |||

| ARRS / ARRIS International plc | 0.22 | 5.35 | 6.17 | 11.60 | 4.3589 | 4.3589 | |||

| AIG / American International Group, Inc. | 0.09 | -3.71 | 5.46 | -3.57 | 3.8612 | -0.2595 | |||

| MCK / McKesson Corporation | 0.03 | 9.10 | 5.37 | 21.10 | 3.7933 | 3.7933 | |||

| VOYA / Voya Financial, Inc. | 0.14 | 7.71 | 5.24 | 4.66 | 3.7007 | 3.7007 | |||

| LH / Labcorp Holdings Inc. | 0.03 | -3.91 | 5.16 | 3.24 | 3.6498 | 0.0115 | |||

| FNF / Fidelity National Financial, Inc. | 0.11 | -13.67 | 5.07 | -0.61 | 3.5869 | 3.5869 | |||

| C / Citigroup Inc. | 0.08 | -4.09 | 5.06 | 7.22 | 3.5777 | 3.5777 | |||

| CBB / Cincinnati Bell, Inc. | 0.26 | 5.00 | 3.5332 | 3.5332 | |||||

| OI / O-I Glass, Inc. | 0.20 | -3.99 | 4.87 | 12.70 | 3.4441 | 3.4441 | |||

| PRGO / Perrigo Company plc | 0.06 | -4.08 | 4.85 | 9.11 | 3.4278 | 3.4278 | |||

| MHO / M/I Homes, Inc. | 0.17 | -3.96 | 4.74 | 11.91 | 3.3536 | 3.3536 | |||

| GILD / Gilead Sciences, Inc. | 0.07 | 4.68 | 3.3070 | 3.3070 | |||||

| ASC / Ardmore Shipping Corporation | 0.56 | -3.96 | 4.54 | -2.76 | 3.2087 | 3.2087 | |||

| AMG / Affiliated Managers Group, Inc. | 0.03 | -3.38 | 4.52 | -2.25 | 3.1967 | 3.1967 | |||

| CPN / Calpine Corp. | 0.33 | -3.94 | 4.42 | 17.64 | 3.1210 | 3.1210 | |||

| / XL Group Ltd. | 0.09 | -29.80 | 3.98 | -22.86 | 2.8128 | 2.8128 | |||

| KLIC / Kulicke and Soffa Industries, Inc. | 0.20 | -49.27 | 3.79 | -52.51 | 2.6757 | -3.1226 | |||

| ALSN / Allison Transmission Holdings, Inc. | 0.08 | -4.19 | 3.17 | -0.35 | 2.2374 | 2.2374 | |||

| BGS / B&G Foods, Inc. | 0.08 | 2.90 | 2.0536 | 2.0536 | |||||

| QMCO / Quantum Corporation | 0.37 | -90.22 | 2.88 | -12.19 | 2.0324 | -0.3495 | |||

| KLXI / KLX Inc. | 0.06 | -3.98 | 2.86 | 7.40 | 2.0204 | 2.0204 | |||

| BW / Babcock & Wilcox Enterprises, Inc. | 0.24 | -4.14 | 2.77 | 20.71 | 1.9575 | 1.9575 | |||

| US00163U1060 / AMAG Pharmaceuticals, Inc. | 0.14 | 2.64 | 1.8691 | 1.8691 | |||||

| CBI / Chicago Bridge & Iron Co., N.V. | 0.13 | -4.02 | 2.62 | -38.43 | 1.8521 | 1.8521 | |||

| GSM / Ferroglobe PLC | 0.19 | -3.59 | 2.22 | 11.51 | 1.5679 | 1.5679 | |||

| EXPR / Express, Inc. | 0.30 | -3.90 | 2.02 | -28.79 | 1.4266 | 1.4266 | |||

| US26885G1094 / Era Group Inc. | 0.08 | -74.06 | 0.75 | -81.50 | 0.5316 | 0.5316 | |||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.03 | -7.08 | 0.70 | -9.97 | 0.4977 | 0.4977 | |||

| TXT / Textron Inc. | 0.01 | -6.69 | 0.64 | -7.60 | 0.4553 | -0.0518 | |||

| CSX / CSX Corporation | 0.01 | -31.70 | 0.56 | -19.91 | 0.3980 | -0.1134 | |||

| NRG / NRG Energy, Inc. | 0.03 | -6.84 | 0.53 | -14.22 | 0.3711 | -0.0741 | |||

| IR / Ingersoll Rand Inc. | 0.00 | -8.65 | 0.35 | 2.66 | 0.2453 | -0.0006 | |||

| CI / The Cigna Group | 0.00 | -42.78 | 0.34 | -34.54 | 0.2439 | -0.1395 | |||

| CVX / Chevron Corporation | 0.00 | -3.62 | 0.30 | -6.44 | 0.2156 | -0.0216 | |||

| MNKKQ / Mallinckrodt Plc | 0.01 | -7.12 | 0.30 | -6.46 | 0.2149 | -0.0215 | |||

| IBM / International Business Machines Corporation | 0.00 | -4.06 | 0.29 | -15.16 | 0.2057 | -0.0438 | |||

| EMN / Eastman Chemical Company | 0.00 | -9.21 | 0.29 | -5.54 | 0.2050 | -0.0183 | |||

| CCK / Crown Holdings, Inc. | 0.00 | -8.65 | 0.28 | 2.91 | 0.2001 | -0.0000 | |||

| AAPL / Apple Inc. | 0.00 | -7.18 | 0.26 | -6.79 | 0.1845 | 0.1845 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.23 | 4.02 | 0.1647 | 0.0017 | |||

| FLR / Fluor Corporation | 0.00 | -3.99 | 0.22 | -16.67 | 0.1555 | -0.0365 | |||

| DYN / Dyne Therapeutics, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| ATGE / Adtalem Global Education Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| JAX / J. Alexanders Holdings Inc | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 |