Mga Batayang Estadistika

| Nilai Portofolio | $ 819,187,077 |

| Posisi Saat Ini | 110 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

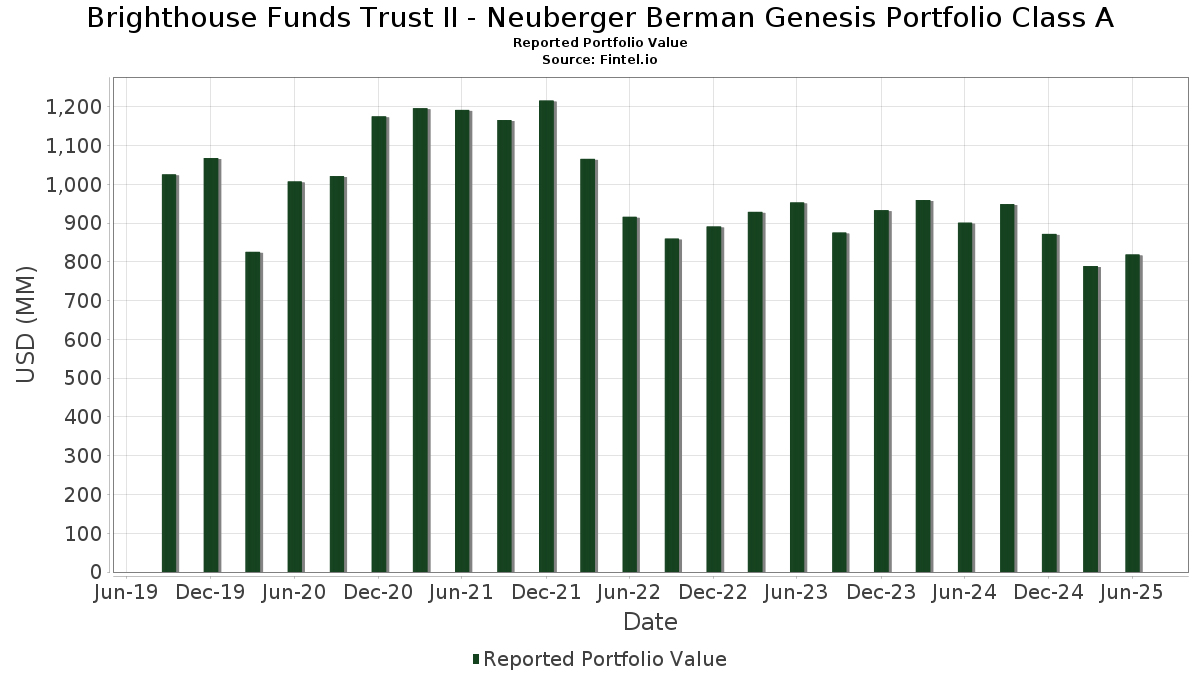

Brighthouse Funds Trust II - Neuberger Berman Genesis Portfolio Class A telah mengungkapkan total kepemilikan 110 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 819,187,077 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Brighthouse Funds Trust II - Neuberger Berman Genesis Portfolio Class A adalah Valmont Industries, Inc. (US:VMI) , Texas Roadhouse, Inc. (US:TXRH) , RBC Bearings Incorporated (US:RBC) , FirstService Corporation (US:FSV) , and Kirby Corporation (US:KEX) . Posisi baru Brighthouse Funds Trust II - Neuberger Berman Genesis Portfolio Class A meliputi: Murphy USA Inc. (US:MUSA) , Saia, Inc. (US:SAIA) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 9.72 | 1.1873 | 1.1873 | ||

| 0.01 | 3.78 | 0.4617 | 0.4617 | |

| 0.15 | 6.74 | 0.8232 | 0.4152 | |

| 0.45 | 4.28 | 0.5228 | 0.4008 | |

| 0.07 | 7.74 | 0.9454 | 0.3915 | |

| 0.08 | 9.00 | 1.0992 | 0.3711 | |

| 0.01 | 2.79 | 0.3406 | 0.3406 | |

| 0.09 | 5.04 | 0.6152 | 0.3294 | |

| 0.45 | 10.33 | 1.2619 | 0.3114 | |

| 0.06 | 7.98 | 0.9751 | 0.2875 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 8.11 | 0.9901 | -0.5021 | |

| 0.03 | 12.38 | 1.5119 | -0.4854 | |

| 0.03 | 6.26 | 0.7644 | -0.4473 | |

| 0.06 | 8.15 | 0.9948 | -0.4254 | |

| 0.11 | 8.14 | 0.9946 | -0.3814 | |

| 0.02 | 2.33 | 0.2840 | -0.3787 | |

| 0.02 | 5.08 | 0.6206 | -0.3734 | |

| 0.13 | 6.82 | 0.8332 | -0.3490 | |

| 0.07 | 11.79 | 1.4402 | -0.2726 | |

| 0.03 | 8.69 | 1.0611 | -0.2582 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-27 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VMI / Valmont Industries, Inc. | 0.05 | -0.73 | 15.90 | 13.61 | 1.9416 | 0.1678 | |||

| TXRH / Texas Roadhouse, Inc. | 0.08 | -0.72 | 14.45 | 11.65 | 1.7653 | 0.1244 | |||

| RBC / RBC Bearings Incorporated | 0.04 | -18.52 | 14.31 | -2.56 | 1.7474 | -0.1138 | |||

| FSV / FirstService Corporation | 0.08 | -0.73 | 14.24 | 4.46 | 1.7398 | 0.0112 | |||

| KEX / Kirby Corporation | 0.12 | -0.73 | 14.16 | 11.46 | 1.7295 | 0.1191 | |||

| HAE / Haemonetics Corporation | 0.19 | -0.73 | 13.92 | 16.55 | 1.6999 | 0.1861 | |||

| LFUS / Littelfuse, Inc. | 0.06 | 4.29 | 12.89 | 20.20 | 1.5737 | 0.2148 | |||

| TTEK / Tetra Tech, Inc. | 0.35 | -0.73 | 12.55 | 22.05 | 1.5326 | 0.2293 | |||

| CHE / Chemed Corporation | 0.03 | -0.72 | 12.38 | -21.44 | 1.5119 | -0.4854 | |||

| SPXC / SPX Technologies, Inc. | 0.07 | -3.34 | 12.32 | 25.86 | 1.5044 | 0.2638 | |||

| MANH / Manhattan Associates, Inc. | 0.06 | -0.73 | 12.26 | 13.29 | 1.4975 | 0.1256 | |||

| CNX / CNX Resources Corporation | 0.36 | -0.73 | 12.08 | 6.21 | 1.4758 | 0.0337 | |||

| POWI / Power Integrations, Inc. | 0.22 | 3.93 | 12.05 | 15.05 | 1.4719 | 0.1440 | |||

| PB / Prosperity Bancshares, Inc. | 0.17 | 9.40 | 11.86 | 7.66 | 1.4483 | 0.0522 | |||

| ESAB / ESAB Corporation | 0.10 | -0.73 | 11.86 | 2.73 | 1.4483 | -0.0150 | |||

| NXST / Nexstar Media Group, Inc. | 0.07 | -9.57 | 11.79 | -12.73 | 1.4402 | -0.2726 | |||

| CBU / Community Financial System, Inc. | 0.20 | 7.59 | 11.51 | 7.60 | 1.4055 | 0.0499 | |||

| ESE / ESCO Technologies Inc. | 0.06 | -0.73 | 11.29 | 19.70 | 1.3789 | 0.1833 | |||

| LSCC / Lattice Semiconductor Corporation | 0.23 | 3.70 | 11.21 | -3.15 | 1.3691 | -0.0980 | |||

| TYL / Tyler Technologies, Inc. | 0.02 | -0.73 | 11.06 | 1.23 | 1.3510 | -0.0342 | |||

| FICO / Fair Isaac Corporation | 0.01 | -9.10 | 10.99 | -9.90 | 1.3424 | -0.2039 | |||

| CVLT / Commvault Systems, Inc. | 0.06 | -21.62 | 10.57 | -13.39 | 1.2906 | -0.2560 | |||

| ACA / Arcosa, Inc. | 0.12 | -0.73 | 10.49 | 11.62 | 1.2809 | 0.0899 | |||

| GTES / Gates Industrial Corporation plc | 0.45 | 10.15 | 10.33 | 37.78 | 1.2619 | 0.3114 | |||

| WSO / Watsco, Inc. | 0.02 | -0.73 | 10.01 | -13.75 | 1.2222 | -0.2485 | |||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 9.72 | 1.1873 | 1.1873 | ||||||

| ATR / AptarGroup, Inc. | 0.06 | -0.73 | 9.54 | 4.67 | 1.1646 | 0.0097 | |||

| MKSI / MKS Inc. | 0.10 | -0.73 | 9.48 | 23.07 | 1.1580 | 0.1814 | |||

| CFR / Cullen/Frost Bankers, Inc. | 0.07 | 18.00 | 9.01 | 21.15 | 1.1003 | 0.1577 | |||

| FSS / Federal Signal Corporation | 0.08 | 8.30 | 9.00 | 56.71 | 1.0992 | 0.3711 | |||

| AWI / Armstrong World Industries, Inc. | 0.05 | -0.73 | 8.73 | 14.47 | 1.0668 | 0.0995 | |||

| KAI / Kadant Inc. | 0.03 | -11.41 | 8.69 | -16.53 | 1.0611 | -0.2582 | |||

| QLYS / Qualys, Inc. | 0.06 | -0.73 | 8.56 | 12.63 | 1.0455 | 0.0821 | |||

| GBCI / Glacier Bancorp, Inc. | 0.20 | 20.12 | 8.56 | 17.02 | 1.0453 | 0.1182 | |||

| UCB / United Community Banks, Inc. | 0.29 | 15.69 | 8.51 | 22.52 | 1.0388 | 0.1588 | |||

| LNN / Lindsay Corporation | 0.06 | -0.73 | 8.24 | 13.18 | 1.0070 | 0.0836 | |||

| SPSC / SPS Commerce, Inc. | 0.06 | -29.10 | 8.15 | -27.30 | 0.9948 | -0.4254 | |||

| RLI / RLI Corp. | 0.11 | -16.55 | 8.14 | -24.98 | 0.9946 | -0.3814 | |||

| EXP / Eagle Materials Inc. | 0.04 | -24.38 | 8.11 | -31.14 | 0.9901 | -0.5021 | |||

| TTC / The Toro Company | 0.11 | 5.23 | 8.02 | 2.23 | 0.9800 | -0.0149 | |||

| AEIS / Advanced Energy Industries, Inc. | 0.06 | 5.87 | 7.98 | 47.20 | 0.9751 | 0.2875 | |||

| ROL / Rollins, Inc. | 0.14 | -0.73 | 7.98 | 3.66 | 0.9743 | -0.0012 | |||

| SXI / Standex International Corporation | 0.05 | -0.72 | 7.92 | -3.74 | 0.9671 | -0.0757 | |||

| IDA / IDACORP, Inc. | 0.07 | 22.13 | 7.83 | 21.34 | 0.9557 | 0.1381 | |||

| WTM / White Mountains Insurance Group, Ltd. | 0.00 | 41.33 | 7.76 | 31.78 | 0.9472 | 0.2012 | |||

| BFAM / Bright Horizons Family Solutions Inc. | 0.06 | -0.73 | 7.75 | -3.43 | 0.9465 | -0.0707 | |||

| UMBF / UMB Financial Corporation | 0.07 | 70.31 | 7.74 | 77.16 | 0.9454 | 0.3915 | |||

| CIGI / Colliers International Group Inc. | 0.06 | -0.73 | 7.65 | 6.83 | 0.9343 | 0.0266 | |||

| GGG / Graco Inc. | 0.09 | -0.73 | 7.63 | 2.21 | 0.9324 | -0.0145 | |||

| SYBT / Stock Yards Bancorp, Inc. | 0.10 | 11.88 | 7.54 | 27.95 | 0.9214 | 0.1740 | |||

| BRC / Brady Corporation | 0.11 | 37.62 | 7.54 | 32.42 | 0.9214 | 0.1992 | |||

| TDW / Tidewater Inc. | 0.16 | 4.15 | 7.52 | 13.67 | 0.9182 | 0.0798 | |||

| CR / Crane Company | 0.04 | -0.73 | 7.34 | 23.08 | 0.8962 | 0.1404 | |||

| TSCO / Tractor Supply Company | 0.14 | -0.73 | 7.25 | -4.92 | 0.8859 | -0.0812 | |||

| AWR / American States Water Company | 0.09 | 23.96 | 7.16 | 20.77 | 0.8743 | 0.1230 | |||

| ESI / Element Solutions Inc | 0.31 | -0.73 | 7.13 | -0.54 | 0.8705 | -0.0380 | |||

| WINA / Winmark Corporation | 0.02 | -0.73 | 7.11 | 17.93 | 0.8679 | 0.1041 | |||

| CRAI / CRA International, Inc. | 0.04 | -0.73 | 6.98 | 7.40 | 0.8528 | 0.0286 | |||

| EPAC / Enerpac Tool Group Corp. | 0.17 | 4.87 | 6.97 | -5.18 | 0.8517 | -0.0806 | |||

| CSW / CSW Industrials, Inc. | 0.02 | -10.77 | 6.93 | -12.21 | 0.8461 | -0.1541 | |||

| HLI / Houlihan Lokey, Inc. | 0.04 | -0.73 | 6.86 | 10.61 | 0.8378 | 0.0517 | |||

| TECH / Bio-Techne Corporation | 0.13 | -16.64 | 6.82 | -26.85 | 0.8332 | -0.3490 | |||

| WLY / John Wiley & Sons, Inc. | 0.15 | 109.07 | 6.74 | 109.45 | 0.8232 | 0.4152 | |||

| EXPO / Exponent, Inc. | 0.09 | -11.72 | 6.70 | -18.64 | 0.8185 | -0.2256 | |||

| FFIN / First Financial Bankshares, Inc. | 0.19 | 13.87 | 6.66 | 14.06 | 0.8136 | 0.0733 | |||

| CPK / Chesapeake Utilities Corporation | 0.05 | 31.63 | 6.47 | 23.22 | 0.7908 | 0.1247 | |||

| FOUR / Shift4 Payments, Inc. | 0.06 | -0.73 | 6.40 | 20.41 | 0.7817 | 0.1079 | |||

| VERX / Vertex, Inc. | 0.18 | -0.73 | 6.37 | 0.20 | 0.7784 | -0.0279 | |||

| US82983N1081 / Sitio Royalties Corp | 0.34 | -3.22 | 6.29 | -10.47 | 0.7684 | -0.1225 | |||

| ABG / Asbury Automotive Group, Inc. | 0.03 | -39.38 | 6.26 | -34.52 | 0.7644 | -0.4473 | |||

| HAYW / Hayward Holdings, Inc. | 0.45 | -0.73 | 6.19 | -1.59 | 0.7562 | -0.0413 | |||

| JKHY / Jack Henry & Associates, Inc. | 0.03 | -0.73 | 6.15 | -2.04 | 0.7512 | -0.0448 | |||

| IBP / Installed Building Products, Inc. | 0.03 | 17.10 | 6.14 | 23.18 | 0.7497 | 0.1179 | |||

| SSD / Simpson Manufacturing Co., Inc. | 0.04 | -0.72 | 5.98 | -1.84 | 0.7299 | -0.0419 | |||

| STC / Stewart Information Services Corporation | 0.09 | 0.00 | 5.97 | -8.77 | 0.7291 | -0.1003 | |||

| NPO / Enpro Inc. | 0.03 | -0.73 | 5.62 | 17.53 | 0.6870 | 0.0803 | |||

| VSEC / VSE Corporation | 0.04 | -0.73 | 5.48 | 8.38 | 0.6698 | 0.0283 | |||

| HLNE / Hamilton Lane Incorporated | 0.04 | -0.72 | 5.16 | -5.09 | 0.6305 | -0.0590 | |||

| BMI / Badger Meter, Inc. | 0.02 | -0.72 | 5.11 | 27.82 | 0.6247 | 0.1174 | |||

| LKFN / Lakeland Financial Corporation | 0.08 | 18.16 | 5.10 | 22.15 | 0.6232 | 0.0937 | |||

| FND / Floor & Decor Holdings, Inc. | 0.07 | -0.73 | 5.10 | -6.28 | 0.6230 | -0.0670 | |||

| STVN / Stevanato Group S.p.A. | 0.21 | -0.73 | 5.09 | 18.75 | 0.6213 | 0.0784 | |||

| POOL / Pool Corporation | 0.02 | -29.22 | 5.08 | -35.20 | 0.6206 | -0.3734 | |||

| BL / BlackLine, Inc. | 0.09 | 91.07 | 5.04 | 123.43 | 0.6152 | 0.3294 | |||

| TREX / Trex Company, Inc. | 0.09 | 31.65 | 5.01 | 23.24 | 0.6114 | 0.0964 | |||

| UFPT / UFP Technologies, Inc. | 0.02 | -0.73 | 4.67 | 20.17 | 0.5706 | 0.0778 | |||

| SITE / SiteOne Landscape Supply, Inc. | 0.04 | -0.73 | 4.67 | -1.14 | 0.5705 | -0.0284 | |||

| VNOM / Viper Energy, Inc. | 0.12 | -0.73 | 4.48 | -16.15 | 0.5467 | -0.1301 | |||

| AMSF / AMERISAFE, Inc. | 0.10 | -0.73 | 4.39 | -17.40 | 0.5364 | -0.1375 | |||

| CWST / Casella Waste Systems, Inc. | 0.04 | -0.73 | 4.34 | 2.70 | 0.5299 | -0.0055 | |||

| OII / Oceaneering International, Inc. | 0.21 | -4.04 | 4.32 | -8.82 | 0.5275 | -0.0731 | |||

| CCCS / CCC Intelligent Solutions Holdings Inc. | 0.45 | 326.64 | 4.28 | 344.91 | 0.5228 | 0.4008 | |||

| WST / West Pharmaceutical Services, Inc. | 0.02 | -0.73 | 4.17 | -2.98 | 0.5095 | -0.0355 | |||

| KN / Knowles Corporation | 0.23 | 29.26 | 4.10 | 49.87 | 0.5010 | 0.1540 | |||

| TRNS / Transcat, Inc. | 0.05 | -0.73 | 3.98 | 14.62 | 0.4857 | 0.0459 | |||

| MUSA / Murphy USA Inc. | 0.01 | 3.78 | 0.4617 | 0.4617 | |||||

| NOVT / Novanta Inc. | 0.03 | -0.73 | 3.72 | 0.08 | 0.4542 | -0.0167 | |||

| CHD / Church & Dwight Co., Inc. | 0.03 | -0.72 | 3.31 | -13.34 | 0.4047 | -0.0799 | |||

| WHD / Cactus, Inc. | 0.07 | -5.14 | 3.22 | -9.51 | 0.3930 | -0.0578 | |||

| HGTY / Hagerty, Inc. | 0.31 | 2.11 | 3.09 | 14.22 | 0.3777 | 0.0344 | |||

| TVK / TerraVest Industries Inc. | 0.02 | 0.00 | 3.03 | 25.72 | 0.3697 | 0.0645 | |||

| WSC / WillScot Holdings Corporation | 0.11 | -0.73 | 2.91 | -2.15 | 0.3552 | -0.0216 | |||

| SAIA / Saia, Inc. | 0.01 | 2.79 | 0.3406 | 0.3406 | |||||

| WDFC / WD-40 Company | 0.01 | -13.63 | 2.79 | -19.26 | 0.3405 | -0.0972 | |||

| REVG / REV Group, Inc. | 0.05 | 348.01 | 2.60 | 576.10 | 0.3180 | 0.2691 | |||

| CRVL / CorVel Corporation | 0.02 | -51.54 | 2.33 | -55.53 | 0.2840 | -0.3787 | |||

| MLR / Miller Industries, Inc. | 0.05 | 20.88 | 2.22 | 26.83 | 0.2714 | 0.0493 | |||

| VVV / Valvoline Inc. | 0.05 | 0.00 | 2.03 | 8.78 | 0.2482 | 0.0114 | |||

| TPL / Texas Pacific Land Corporation | 0.00 | -0.76 | 1.94 | -20.87 | 0.2366 | -0.0738 | |||

| CMDXF / Computer Modelling Group Ltd. | 0.30 | -0.73 | 1.59 | -6.21 | 0.1936 | -0.0207 |