Mga Batayang Estadistika

| Nilai Portofolio | $ 42,980,000 |

| Posisi Saat Ini | 27 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

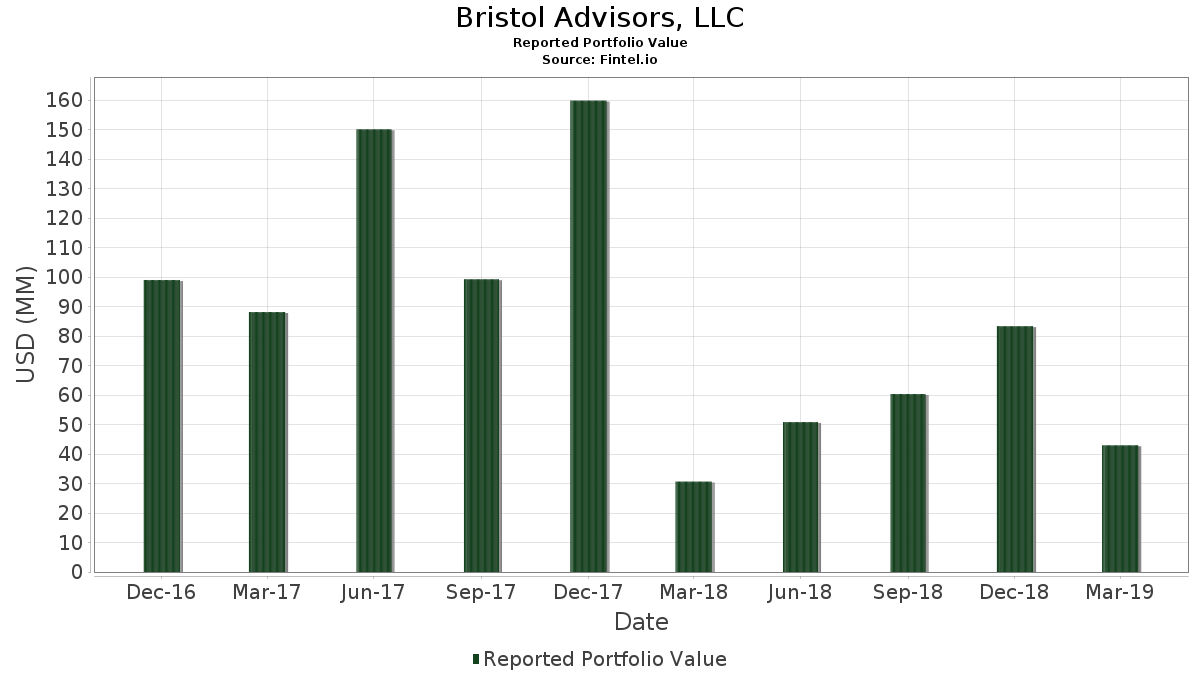

Bristol Advisors, LLC telah mengungkapkan total kepemilikan 27 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 42,980,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Bristol Advisors, LLC adalah SPDR S&P 500 ETF (US:SPY) , Exacttarget, Inc. (US:30064K105) , Altria Group, Inc. (US:MO) , The Home Depot, Inc. (US:HD) , and QUALCOMM Incorporated (US:QCOM) . Posisi baru Bristol Advisors, LLC meliputi: Itaú Unibanco Holding S.A. - Depositary Receipt (Common Stock) (US:ITUB) , Invesco CurrencyShares British Pound Sterling Trust (US:FXB) , NIO Inc. - Depositary Receipt (Common Stock) (US:NIO) , Exacttarget, Inc. (US:30064K105) , and NIO Inc. - Depositary Receipt (Common Stock) (US:NIO) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 14.01 | 32.5989 | 32.5989 | |

| 0.09 | 5.07 | 11.7985 | 11.5502 | |

| 0.05 | 2.74 | 6.3820 | 6.3820 | |

| 0.51 | 7.82 | 18.2015 | 5.8616 | |

| 0.01 | 2.80 | 6.5170 | 5.7961 | |

| 0.12 | 2.06 | 4.8046 | 4.8046 | |

| 0.10 | 1.24 | 2.8758 | 2.8758 | |

| 0.04 | 1.37 | 3.1829 | 2.3409 | |

| 0.01 | 0.60 | 1.3983 | 1.3983 | |

| 0.01 | 0.52 | 1.2168 | 1.2168 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -32.2962 | ||

| 0.00 | 0.00 | -5.0928 | ||

| 0.00 | 0.00 | -3.1749 | ||

| 0.04 | 1.41 | 3.2690 | -2.9310 | |

| 0.00 | 0.00 | -1.3506 | ||

| 0.00 | 0.00 | -1.2366 | ||

| 0.01 | 0.28 | 0.6561 | -1.1958 | |

| 0.00 | 0.00 | -1.0663 | ||

| 0.00 | 0.00 | -0.8000 | ||

| 0.00 | 0.00 | -0.7269 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2019-04-29 untuk periode pelaporan 2019-03-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | 0.05 | 14.01 | 32.5989 | 32.5989 | |||||

| 30064K105 / Exacttarget, Inc. | 0.51 | -34.65 | 7.82 | -23.96 | 18.2015 | 5.8616 | |||

| MO / Altria Group, Inc. | 0.09 | 2,002.38 | 5.07 | 2,349.76 | 11.7985 | 11.5502 | |||

| HD / The Home Depot, Inc. | 0.01 | 317.14 | 2.80 | 366.06 | 6.5170 | 5.7961 | |||

| QCOM / QUALCOMM Incorporated | 0.05 | 12.91 | 2.74 | 13.16 | 6.3820 | 6.3820 | |||

| ARCC / Ares Capital Corporation | 0.12 | 2.06 | 4.8046 | 4.8046 | |||||

| T / AT&T Inc. | 0.04 | -75.26 | 1.41 | -72.82 | 3.2690 | -2.9310 | |||

| STAA / STAAR Surgical Company | 0.04 | 81.82 | 1.37 | 94.87 | 3.1829 | 2.3409 | |||

| CSSE / Chicken Soup for the Soul Entertainment, Inc. | 0.10 | 0.00 | 1.24 | 64.36 | 2.8758 | 2.8758 | |||

| VOD / Vodafone Group Public Limited Company - Depositary Receipt (Common Stock) | 0.04 | -5.03 | 0.79 | -10.44 | 1.8357 | 0.7790 | |||

| PM / Philip Morris International Inc. | 0.01 | 0.60 | 1.3983 | 1.3983 | |||||

| SLB / Schlumberger Limited | 0.01 | 0.52 | 1.2168 | 1.2168 | |||||

| WFC / Wells Fargo & Company | 0.01 | -25.83 | 0.43 | -22.24 | 1.0005 | 0.3372 | |||

| LUMN / Lumen Technologies, Inc. | 0.03 | -36.08 | 0.39 | -49.42 | 0.9097 | -0.0174 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.33 | 0.7701 | 0.7701 | |||||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.01 | -84.55 | 0.28 | -81.74 | 0.6561 | -1.1958 | |||

| ITUB / Itaú Unibanco Holding S.A. - Depositary Receipt (Common Stock) | 0.03 | 0.28 | 0.6515 | 0.6515 | |||||

| KMI / Kinder Morgan, Inc. | 0.01 | 0.23 | 0.5398 | 0.5398 | |||||

| FXB / Invesco CurrencyShares British Pound Sterling Trust | 0.00 | 0.22 | 0.5095 | 0.5095 | |||||

| AKBA / Akebia Therapeutics, Inc. | 0.02 | 0.00 | 0.16 | 48.11 | 0.3653 | 0.2381 | |||

| DGP / DB Gold Double Long ETN | 0.02 | -18.06 | 0.15 | -18.38 | 0.3513 | 0.3513 | |||

| EKSO / Ekso Bionics Holdings, Inc. | 0.02 | 0.00 | 0.05 | 100.00 | 0.1117 | 0.0829 | |||

| NIO / NIO Inc. - Depositary Receipt (Common Stock) | Call | 0.05 | 0.01 | 0.0233 | 0.0233 | ||||

| 30064K105 / Exacttarget, Inc. | Call | 0.25 | 0.01 | 0.0140 | 0.0140 | ||||

| NIO / NIO Inc. - Depositary Receipt (Common Stock) | Put | 0.05 | 0.01 | 0.0116 | 0.0116 | ||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | Put | 0.06 | 0.00 | 0.0023 | 0.0023 | ||||

| SPY / SPDR S&P 500 ETF | Call | 0.01 | 0.00 | 0.0023 | 0.0023 | ||||

| GOLD / Barrick Mining Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| 74347W148 / PROSHARES ULTRA VIX ST FU | Put | 0.01 | 0.00 | 0.0000 | 0.0000 | ||||

| 74347W148 / PROSHARES ULTRA VIX ST FU | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.0228 | |||

| TSLA / Tesla, Inc. | Put | 0.04 | 0.00 | 0.0000 | 0.0000 | ||||

| ACN / Accenture plc | 0.00 | -100.00 | 0.00 | -100.00 | -0.7269 | ||||

| NWL / Newell Brands Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4078 | ||||

| F / Ford Motor Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| 30064K105 / Exacttarget, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.0168 | |||

| AMT / American Tower Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.5122 | ||||

| CSCO / Cisco Systems, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -5.0928 | ||||

| WMT / Walmart Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2795 | ||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.0024 | |||

| CVS / CVS Health Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -3.1749 | ||||

| AAPL / Apple Inc. | Put | 0.03 | -79.55 | 0.00 | -100.00 | -0.0048 | |||

| CMCSA / Comcast Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.0663 | ||||

| BMY / Bristol-Myers Squibb Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.5673 | ||||

| AAPL / Apple Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -32.2962 | ||||

| EP.PRC / El Paso Energy Capital Trust I - Preferred Security | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AAPL / Apple Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | 0.0000 | |||

| T / AT&T Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.0096 | |||

| D / Dominion Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5314 | ||||

| ABBV / AbbVie Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5421 | ||||

| IBM / International Business Machines Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.2591 | ||||

| GILD / Gilead Sciences, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.3506 | ||||

| KO / The Coca-Cola Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| JPM / JPMorgan Chase & Co. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| VLO / Valero Energy Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.4498 | ||||

| GE / General Electric Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.3634 | ||||

| BAC / Bank of America Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| BAC / Bank of America Corporation | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| AMGN / Amgen Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| BX / Blackstone Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| C / Citigroup Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| DIS / The Walt Disney Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| JNJ / Johnson & Johnson | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| MRK / Merck & Co., Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| MCD / McDonald's Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| CME / CME Group Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| LRCX / Lam Research Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.8000 | ||||

| FL / Foot Locker, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2675 | ||||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -100.00 | 0.00 | -100.00 | -1.2366 |