Mga Batayang Estadistika

| Nilai Portofolio | $ 174,440,547 |

| Posisi Saat Ini | 54 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

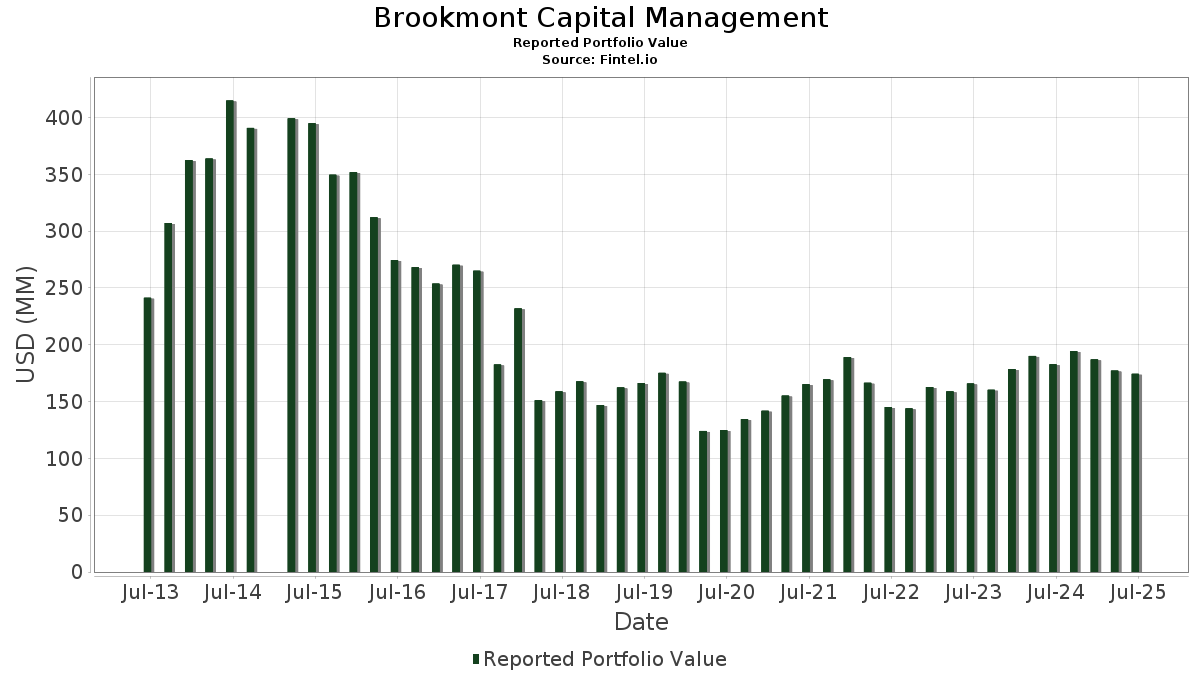

Brookmont Capital Management telah mengungkapkan total kepemilikan 54 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 174,440,547 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Brookmont Capital Management adalah The Home Depot, Inc. (US:HD) , Microsoft Corporation (US:MSFT) , Arthur J. Gallagher & Co. (US:AJG) , Abbott Laboratories (US:ABT) , and JPMorgan Chase & Co. (US:JPM) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 5.35 | 3.0681 | 0.7554 | |

| 0.16 | 59.59 | 34.1619 | 0.4778 | |

| 0.02 | 4.54 | 2.6046 | 0.4120 | |

| 0.04 | 2.48 | 1.4229 | 0.3616 | |

| 0.01 | 1.37 | 0.7870 | 0.2715 | |

| 0.01 | 3.21 | 1.8409 | 0.2551 | |

| 0.02 | 4.58 | 2.6263 | 0.2315 | |

| 0.07 | 3.10 | 1.7778 | 0.1775 | |

| 0.00 | 1.64 | 0.9375 | 0.1542 | |

| 0.00 | 0.20 | 0.1151 | 0.1151 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 1.56 | 0.8962 | -1.0734 | |

| 0.05 | 3.94 | 2.2562 | -0.5496 | |

| 0.02 | 5.29 | 3.0344 | -0.2734 | |

| 0.03 | 2.51 | 1.4365 | -0.2264 | |

| 0.01 | 4.11 | 2.3579 | -0.2075 | |

| 0.01 | 1.92 | 1.0994 | -0.1878 | |

| 0.02 | 3.82 | 2.1888 | -0.1809 | |

| 0.05 | 3.16 | 1.8119 | -0.1614 | |

| 0.01 | 1.48 | 0.8505 | -0.1534 | |

| 0.03 | 2.59 | 1.4844 | -0.1451 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-18 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HD / The Home Depot, Inc. | 0.16 | -0.22 | 59.59 | -0.18 | 34.1619 | 0.4778 | |||

| MSFT / Microsoft Corporation | 0.01 | -1.46 | 5.35 | 30.58 | 3.0681 | 0.7554 | |||

| AJG / Arthur J. Gallagher & Co. | 0.02 | -2.63 | 5.29 | -9.71 | 3.0344 | -0.2734 | |||

| ABT / Abbott Laboratories | 0.04 | -3.11 | 5.18 | -0.65 | 2.9691 | 0.0275 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -15.47 | 5.12 | -0.10 | 2.9358 | 0.0435 | |||

| HON / Honeywell International Inc. | 0.02 | -1.86 | 4.58 | 7.94 | 2.6263 | 0.2315 | |||

| LHX / L3Harris Technologies, Inc. | 0.02 | -2.44 | 4.54 | 16.91 | 2.6046 | 0.4120 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.06 | -2.04 | 4.22 | -5.87 | 2.4181 | -0.1104 | |||

| GILD / Gilead Sciences, Inc. | 0.04 | -2.44 | 4.16 | -3.46 | 2.3867 | -0.0468 | |||

| MCD / McDonald's Corporation | 0.01 | -3.28 | 4.11 | -9.52 | 2.3579 | -0.2075 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.06 | -0.87 | 3.94 | -1.45 | 2.2606 | 0.0026 | |||

| WFC / Wells Fargo & Company | 0.05 | -29.08 | 3.94 | -20.86 | 2.2562 | -0.5496 | |||

| PG / The Procter & Gamble Company | 0.02 | -2.76 | 3.82 | -9.07 | 2.1888 | -0.1809 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.05 | -2.35 | 3.68 | -7.17 | 2.1089 | -0.1268 | |||

| ACN / Accenture plc | 0.01 | -2.15 | 3.34 | -6.28 | 1.9162 | -0.0961 | |||

| CMCSA / Comcast Corporation | 0.09 | -2.40 | 3.28 | -5.61 | 1.8800 | -0.0801 | |||

| ADI / Analog Devices, Inc. | 0.01 | -3.19 | 3.21 | 14.27 | 1.8409 | 0.2551 | |||

| DD / DuPont de Nemours, Inc. | 0.05 | -1.60 | 3.16 | -9.64 | 1.8119 | -0.1614 | |||

| BAC / Bank of America Corporation | 0.07 | -3.58 | 3.10 | 9.34 | 1.7778 | 0.1775 | |||

| USB / U.S. Bancorp | 0.07 | -2.06 | 3.07 | 4.96 | 1.7589 | 0.1096 | |||

| UPS / United Parcel Service, Inc. | 0.03 | -2.30 | 2.59 | -10.35 | 1.4844 | -0.1451 | |||

| COP / ConocoPhillips | 0.03 | -0.50 | 2.51 | -15.00 | 1.4365 | -0.2264 | |||

| MCHP / Microchip Technology Incorporated | 0.04 | -9.22 | 2.48 | 31.95 | 1.4229 | 0.3616 | |||

| EQIX / Equinix, Inc. | 0.00 | -2.36 | 2.47 | -4.74 | 1.4167 | -0.0470 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | -3.79 | 2.35 | 2.04 | 1.3453 | 0.0477 | |||

| PEP / PepsiCo, Inc. | 0.01 | -4.55 | 1.92 | -15.96 | 1.0994 | -0.1878 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | 0.18 | 1.64 | 17.80 | 0.9375 | 0.1542 | |||

| JNJ / Johnson & Johnson | 0.01 | -3.40 | 1.61 | -10.99 | 0.9242 | -0.0980 | |||

| AMGN / Amgen Inc. | 0.01 | -1.00 | 1.60 | -11.33 | 0.9155 | -0.1002 | |||

| CVX / Chevron Corporation | 0.01 | -47.68 | 1.56 | -55.21 | 0.8962 | -1.0734 | |||

| RTX / RTX Corporation | 0.01 | -24.36 | 1.48 | -16.64 | 0.8505 | -0.1534 | |||

| NVDA / NVIDIA Corporation | 0.01 | 3.07 | 1.37 | 50.27 | 0.7870 | 0.2715 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.44 | 1.29 | 10.97 | 0.7368 | 0.0834 | |||

| SRE / Sempra | 0.02 | -2.23 | 1.26 | 3.78 | 0.7251 | 0.0377 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.01 | 0.12 | 1.18 | 0.42 | 0.6788 | 0.0134 | |||

| EVRG / Evergy, Inc. | 0.02 | -2.58 | 1.18 | -2.64 | 0.6779 | -0.0072 | |||

| EMN / Eastman Chemical Company | 0.02 | -1.84 | 1.13 | -16.80 | 0.6473 | -0.1187 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.01 | -1.37 | 0.99 | -5.10 | 0.5656 | -0.0209 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.01 | 0.41 | 0.85 | 6.67 | 0.4866 | 0.0379 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.01 | 0.37 | 0.83 | 4.91 | 0.4783 | 0.0295 | |||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.01 | 0.07 | 0.71 | 0.57 | 0.4064 | 0.0088 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.01 | 0.01 | 0.67 | 9.34 | 0.3828 | 0.0384 | |||

| BIV / Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF | 0.01 | 0.10 | 0.53 | 1.15 | 0.3042 | 0.0081 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.00 | -6.87 | 0.49 | -1.60 | 0.2815 | -0.0005 | |||

| BWXT / BWX Technologies, Inc. | 0.00 | 2.28 | 0.45 | 49.33 | 0.2554 | 0.0871 | |||

| SYK / Stryker Corporation | 0.00 | 5.27 | 0.38 | 12.13 | 0.2175 | 0.0262 | |||

| XOM / Exxon Mobil Corporation | 0.00 | 0.00 | 0.36 | -9.23 | 0.2088 | -0.0179 | |||

| AVGO / Broadcom Inc. | 0.00 | 9.86 | 0.36 | 81.00 | 0.2079 | 0.0948 | |||

| DIS / The Walt Disney Company | 0.00 | 4.56 | 0.29 | 31.65 | 0.1646 | 0.0413 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 12.60 | 0.29 | 30.00 | 0.1641 | 0.0397 | |||

| CTAS / Cintas Corporation | 0.00 | 9.40 | 0.28 | 18.64 | 0.1606 | 0.0274 | |||

| AAPL / Apple Inc. | 0.00 | 13.04 | 0.22 | 4.67 | 0.1284 | 0.0074 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.00 | 0.00 | 0.22 | 3.26 | 0.1274 | 0.0059 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.20 | 0.1151 | 0.1151 |