Mga Batayang Estadistika

| Nilai Portofolio | $ 110,053,343 |

| Posisi Saat Ini | 76 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

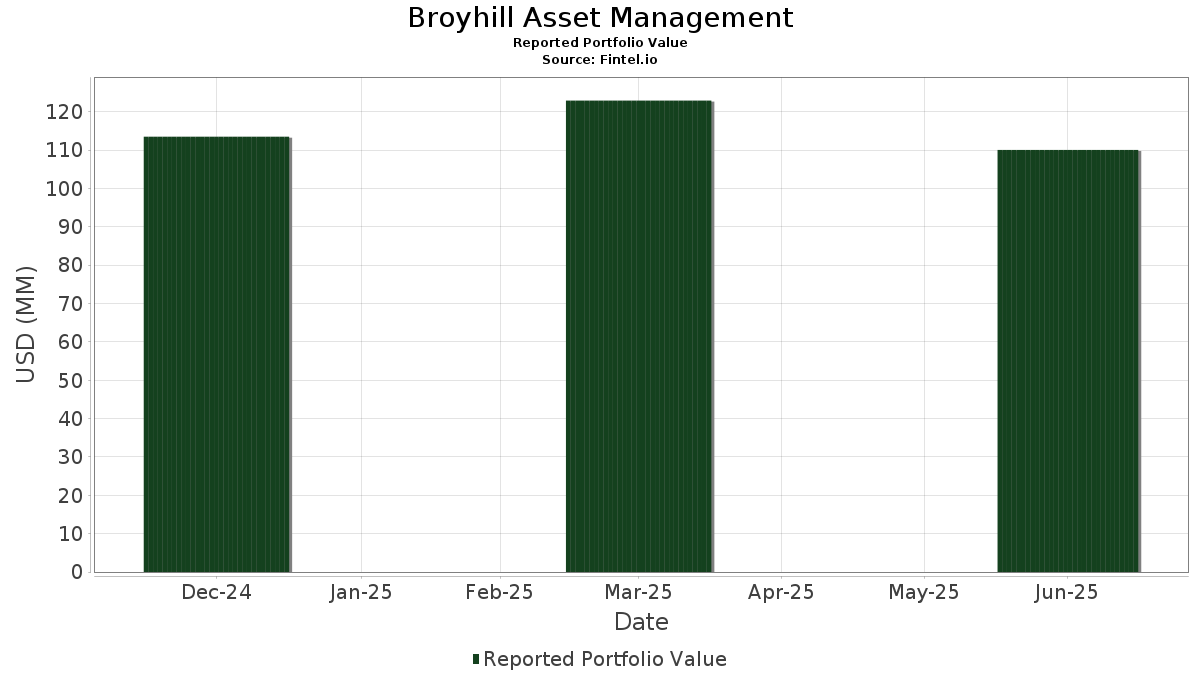

Broyhill Asset Management telah mengungkapkan total kepemilikan 76 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 110,053,343 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Broyhill Asset Management adalah iShares Trust - iShares 1-3 Year Treasury Bond ETF (US:SHY) , Philip Morris International Inc. (US:PM) , Avantor, Inc. (US:AVTR) , Baxter International Inc. (US:BAX) , and NICE Ltd. - Depositary Receipt (Common Stock) (US:NICE) . Posisi baru Broyhill Asset Management meliputi: IQVIA Holdings Inc. (US:IQV) , SPDR S&P 500 ETF (US:SPY) , Thermo Fisher Scientific Inc. (US:TMO) , Lam Research Corporation (US:LRCX) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 3.70 | 3.3579 | 3.3579 | |

| 0.03 | 3.20 | 2.9045 | 2.1487 | |

| 0.00 | 2.48 | 2.2562 | 0.7516 | |

| 0.02 | 2.48 | 2.2521 | 0.6285 | |

| 0.00 | 0.62 | 0.5614 | 0.5614 | |

| 0.06 | 1.54 | 1.4009 | 0.4783 | |

| 0.01 | 1.20 | 1.0910 | 0.4209 | |

| 0.00 | 0.45 | 0.4108 | 0.4108 | |

| 0.02 | 1.77 | 1.6109 | 0.3821 | |

| 0.01 | 2.64 | 2.3973 | 0.3685 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 2.99 | 2.7212 | -1.6911 | |

| 0.06 | 1.74 | 1.5823 | -1.4063 | |

| 0.02 | 3.72 | 3.3836 | -1.2222 | |

| 0.30 | 2.64 | 2.3970 | -1.2001 | |

| 0.00 | 0.45 | 0.4058 | -1.1785 | |

| 0.10 | 1.08 | 0.9852 | -1.1472 | |

| 0.16 | 1.89 | 1.7164 | -0.8459 | |

| 0.13 | 4.03 | 3.6644 | -0.8375 | |

| 0.04 | 6.49 | 5.8937 | -0.3937 | |

| 0.36 | 4.90 | 4.4546 | -0.3595 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.12 | -11.42 | 9.84 | -11.27 | 8.9388 | -0.0815 | |||

| PM / Philip Morris International Inc. | 0.04 | -26.86 | 6.49 | -16.07 | 5.8937 | -0.3937 | |||

| AVTR / Avantor, Inc. | 0.36 | -0.23 | 4.90 | -17.15 | 4.4546 | -0.3595 | |||

| BAX / Baxter International Inc. | 0.13 | -17.62 | 4.03 | -27.13 | 3.6644 | -0.8375 | |||

| NICE / NICE Ltd. - Depositary Receipt (Common Stock) | 0.02 | -39.97 | 3.72 | -34.23 | 3.3836 | -1.2222 | |||

| IQV / IQVIA Holdings Inc. | 0.02 | 3.70 | 3.3579 | 3.3579 | |||||

| FI / Fiserv, Inc. | 0.02 | 22.92 | 3.56 | -4.02 | 3.2305 | 0.2167 | |||

| KOF / Coca-Cola FEMSA, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.04 | -17.93 | 3.52 | -13.03 | 3.2016 | -0.0947 | |||

| DLTR / Dollar Tree, Inc. | 0.03 | 160.79 | 3.20 | 244.03 | 2.9045 | 2.1487 | |||

| FUN / Six Flags Entertainment Corporation | 0.10 | -0.13 | 3.16 | -14.81 | 2.8698 | -0.1460 | |||

| FIS / Fidelity National Information Services, Inc. | 0.04 | -49.35 | 2.99 | -44.79 | 2.7212 | -1.6911 | |||

| BALL / Ball Corporation | 0.05 | -18.57 | 2.99 | -12.28 | 2.7138 | -0.0560 | |||

| BBN / BlackRock Taxable Municipal Bond Trust | 0.17 | -2.31 | 2.72 | -5.65 | 2.4731 | 0.1263 | |||

| GLD / SPDR Gold Trust | 0.01 | 0.00 | 2.64 | 5.82 | 2.3973 | 0.3685 | |||

| NUV / Nuveen Municipal Value Fund, Inc. | 0.30 | -39.79 | 2.64 | -40.33 | 2.3970 | -1.2001 | |||

| MSFT / Microsoft Corporation | 0.00 | 1.32 | 2.48 | 34.29 | 2.2562 | 0.7516 | |||

| CRL / Charles River Laboratories International, Inc. | 0.02 | 23.20 | 2.48 | 24.21 | 2.2521 | 0.6285 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 2.19 | -8.73 | 1.9867 | 0.0380 | |||

| WMG / Warner Music Group Corp. | 0.08 | -10.62 | 2.17 | -22.35 | 1.9677 | -0.3007 | |||

| RTO / Rentokil Initial plc - Depositary Receipt (Common Stock) | 0.09 | -20.56 | 2.13 | -16.77 | 1.9352 | -0.1458 | |||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0.02 | -15.78 | 2.05 | -15.07 | 1.8643 | -0.1010 | |||

| NVG / Nuveen AMT-Free Municipal Credit Income Fund | 0.16 | -37.76 | 1.89 | -40.04 | 1.7164 | -0.8459 | |||

| UBER / Uber Technologies, Inc. | 0.02 | -8.34 | 1.77 | 17.35 | 1.6109 | 0.3821 | |||

| FMS / Fresenius Medical Care AG - Depositary Receipt (Common Stock) | 0.06 | -58.69 | 1.74 | -52.60 | 1.5823 | -1.4063 | |||

| NBB / Nuveen Taxable Municipal Income Fund | 0.10 | -3.71 | 1.64 | -4.92 | 1.4941 | 0.0873 | |||

| NE / Noble Corporation plc | 0.06 | 21.35 | 1.54 | 35.89 | 1.4009 | 0.4783 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -20.52 | 1.32 | -27.53 | 1.1966 | -0.2813 | |||

| AAPL / Apple Inc. | 0.01 | 0.00 | 1.30 | -7.62 | 1.1792 | 0.0362 | |||

| GOOG / Alphabet Inc. | 0.01 | 1.88 | 1.25 | 15.63 | 1.1364 | 0.2568 | |||

| NVDA / NVIDIA Corporation | 0.01 | 0.00 | 1.20 | 45.81 | 1.0910 | 0.4209 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.00 | 0.00 | 1.09 | 22.66 | 0.9894 | 0.2671 | |||

| NEA / Nuveen AMT-Free Quality Municipal Income Fund | 0.10 | -57.58 | 1.08 | -58.64 | 0.9852 | -1.1472 | |||

| V / Visa Inc. | 0.00 | 0.00 | 1.05 | 1.35 | 0.9582 | 0.1114 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.00 | 0.00 | 1.01 | 5.54 | 0.9182 | 0.1390 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.93 | 56.42 | 0.8419 | 0.3599 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -8.08 | 0.82 | 8.71 | 0.7492 | 0.1318 | |||

| BX / Blackstone Inc. | 0.01 | 0.00 | 0.79 | 7.08 | 0.7144 | 0.1167 | |||

| SLV / iShares Silver Trust | 0.02 | 0.00 | 0.75 | 5.90 | 0.6857 | 0.1058 | |||

| META / Meta Platforms, Inc. | 0.00 | -6.06 | 0.74 | 20.23 | 0.6760 | 0.1729 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 0.71 | 15.38 | 0.6407 | 0.1432 | |||

| TFC / Truist Financial Corporation | 0.02 | 0.00 | 0.69 | 4.41 | 0.6242 | 0.0893 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.01 | 0.00 | 0.67 | -7.81 | 0.6124 | 0.0185 | |||

| AVGO / Broadcom Inc. | 0.00 | -9.58 | 0.63 | 48.70 | 0.5723 | 0.2281 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.62 | 0.5614 | 0.5614 | |||||

| DUK / Duke Energy Corporation | 0.01 | 0.00 | 0.59 | -3.28 | 0.5364 | 0.0400 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.59 | 13.98 | 0.5339 | 0.1144 | |||

| SO / The Southern Company | 0.01 | 0.00 | 0.58 | 0.00 | 0.5271 | 0.0546 | |||

| NXP / Nuveen Select Tax-Free Income Portfolio | 0.04 | -25.27 | 0.55 | -26.91 | 0.5038 | -0.1135 | |||

| MS / Morgan Stanley | 0.00 | 0.00 | 0.55 | 20.83 | 0.5011 | 0.1295 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 0.00 | 0.54 | 12.39 | 0.4865 | 0.0991 | |||

| ENB / Enbridge Inc. | 0.01 | 0.00 | 0.50 | 2.26 | 0.4530 | 0.0565 | |||

| NEE / NextEra Energy, Inc. | 0.01 | 3.06 | 0.47 | 0.87 | 0.4243 | 0.0479 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 0.45 | 0.4108 | 0.4108 | |||||

| SCHW / The Charles Schwab Corporation | 0.00 | -80.32 | 0.45 | -77.09 | 0.4058 | -1.1785 | |||

| CB / Chubb Limited | 0.00 | 0.00 | 0.44 | -4.10 | 0.4041 | 0.0270 | |||

| HON / Honeywell International Inc. | 0.00 | 0.00 | 0.41 | 9.97 | 0.3714 | 0.0690 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.40 | 0.00 | 0.3628 | 0.0381 | |||

| ADBE / Adobe Inc. | 0.00 | 28.42 | 0.36 | 29.64 | 0.3304 | 0.1021 | |||

| BTZ / BlackRock Credit Allocation Income Trust | 0.03 | 0.00 | 0.35 | 1.72 | 0.3225 | 0.0390 | |||

| SBUX / Starbucks Corporation | 0.00 | 0.00 | 0.33 | -6.72 | 0.3035 | 0.0126 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.33 | -4.03 | 0.3033 | 0.0207 | |||

| SPLV / Invesco Exchange-Traded Fund Trust II - Invesco S&P 500 Low Volatility ETF | 0.00 | 0.00 | 0.33 | -2.68 | 0.2978 | 0.0242 | |||

| MRK / Merck & Co., Inc. | 0.00 | 0.00 | 0.31 | -11.83 | 0.2851 | -0.0043 | |||

| WM / Waste Management, Inc. | 0.00 | 0.00 | 0.30 | -1.31 | 0.2751 | 0.0259 | |||

| AMAT / Applied Materials, Inc. | 0.00 | 0.00 | 0.30 | 25.96 | 0.2695 | 0.0782 | |||

| CNI / Canadian National Railway Company | 0.00 | 0.00 | 0.29 | 6.72 | 0.2601 | 0.0420 | |||

| LRCX / Lam Research Corporation | 0.00 | 0.26 | 0.2379 | 0.2379 | |||||

| YUM / Yum! Brands, Inc. | 0.00 | 0.00 | 0.22 | -5.93 | 0.2020 | 0.0099 | |||

| RTX / RTX Corporation | 0.00 | 0.00 | 0.22 | 10.00 | 0.2003 | 0.0376 | |||

| FDX / FedEx Corporation | 0.00 | 0.00 | 0.21 | -6.61 | 0.1931 | 0.0077 | |||

| PFE / Pfizer Inc. | 0.01 | 0.00 | 0.21 | -4.19 | 0.1872 | 0.0120 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.00 | 0.00 | 0.20 | -9.37 | 0.1850 | 0.0025 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.00 | 0.20 | 0.1830 | 0.1830 | |||||

| NAN / Nuveen New York Quality Municipal Income Fund | 0.01 | 0.00 | 0.11 | 0.88 | 0.1037 | 0.0111 | |||

| MHN / BlackRock MuniHoldings New York Quality Fund, Inc. | 0.01 | -59.18 | 0.10 | -60.48 | 0.0892 | -0.1131 | |||

| MPW / Medical Properties Trust, Inc. | 0.01 | 0.00 | 0.05 | -28.00 | 0.0492 | -0.0124 | |||

| TDW / Tidewater Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WOW / WideOpenWest, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VAL / Valaris Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CMCSA / Comcast Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MQY / BlackRock MuniYield Quality Fund, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BDX / Becton, Dickinson and Company | 0.00 | -100.00 | 0.00 | 0.0000 |