Mga Batayang Estadistika

| Nilai Portofolio | $ 188,036,737 |

| Posisi Saat Ini | 60 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

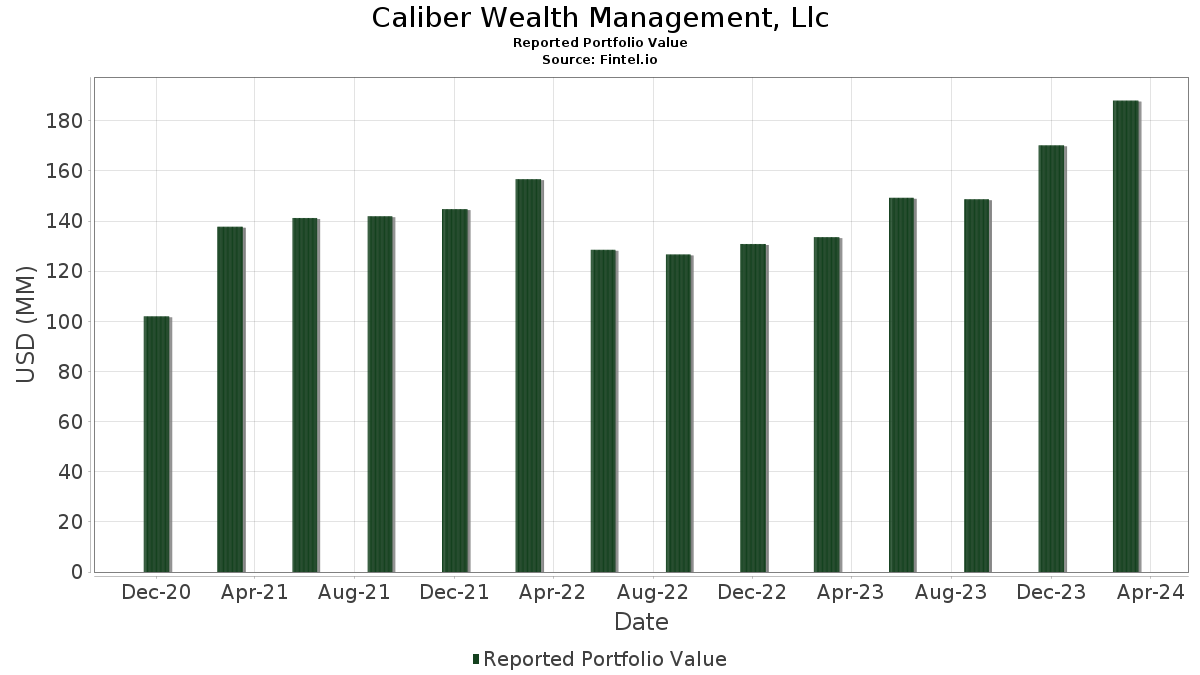

Caliber Wealth Management, Llc telah mengungkapkan total kepemilikan 60 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 188,036,737 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Caliber Wealth Management, Llc adalah SPDR S&P 500 ETF (US:SPY) , iShares Trust - iShares MSCI USA Quality Factor ETF (US:QUAL) , Vanguard Index Funds - Vanguard Mid-Cap ETF (US:VO) , Vanguard Index Funds - Vanguard Small-Cap ETF (US:VB) , and Vanguard World Fund - Vanguard Information Technology ETF (US:VGT) . Posisi baru Caliber Wealth Management, Llc meliputi: PGIM ETF Trust - PGIM Ultra Short Bond ETF (US:PULS) , Vanguard Whitehall Funds - Vanguard Emerging Markets Government Bond ETF (US:VWOB) , lululemon athletica inc. (US:LULU) , Asana, Inc. (US:ASAN) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 2.62 | 1.3910 | 1.3910 | |

| 0.15 | 3.99 | 2.1213 | 1.1175 | |

| 0.04 | 1.91 | 1.0146 | 1.0146 | |

| 0.03 | 1.81 | 0.9637 | 0.9637 | |

| 0.03 | 2.35 | 1.2524 | 0.3283 | |

| 0.00 | 3.50 | 1.8597 | 0.2283 | |

| 0.01 | 3.15 | 1.6755 | 0.1618 | |

| 0.00 | 0.30 | 0.1615 | 0.1615 | |

| 0.13 | 5.82 | 3.0944 | 0.1385 | |

| 0.02 | 3.10 | 1.6501 | 0.1374 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.21 | 2.73 | 1.4498 | -0.7050 | |

| 0.10 | 1.08 | 0.5745 | -0.6976 | |

| 0.01 | 2.13 | 1.1337 | -0.5069 | |

| 0.02 | 2.96 | 1.5739 | -0.4747 | |

| 0.01 | 4.07 | 2.1656 | -0.3847 | |

| 0.10 | 4.40 | 2.3416 | -0.3548 | |

| 0.04 | 1.68 | 0.8957 | -0.3521 | |

| 0.02 | 2.90 | 1.5403 | -0.3470 | |

| 0.12 | 1.83 | 0.9725 | -0.2517 | |

| 0.01 | 6.41 | 3.4095 | -0.2288 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2024-04-25 untuk periode pelaporan 2024-03-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | 0.05 | -0.99 | 26.93 | 8.96 | 14.3225 | -0.2009 | |||

| QUAL / iShares Trust - iShares MSCI USA Quality Factor ETF | 0.09 | -2.54 | 15.30 | 8.86 | 8.1389 | -0.1221 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.03 | 3.96 | 6.71 | 11.66 | 3.5708 | 0.0372 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.03 | 3.26 | 6.68 | 10.65 | 3.5531 | 0.0050 | |||

| VGT / Vanguard World Fund - Vanguard Information Technology ETF | 0.01 | -4.42 | 6.41 | 3.55 | 3.4095 | -0.2288 | |||

| IHDG / WisdomTree Trust - WisdomTree International Hedged Quality Dividend Growth Fund | 0.13 | 5.72 | 5.82 | 15.67 | 3.0944 | 0.1385 | |||

| AVGO / Broadcom Inc. | 0.00 | -4.21 | 4.44 | 13.77 | 2.3601 | 0.0679 | |||

| FBND / Fidelity Merrimack Street Trust - Fidelity Total Bond ETF | 0.10 | -2.50 | 4.40 | -4.03 | 2.3416 | -0.3548 | |||

| PANW / Palo Alto Networks, Inc. | 0.01 | -2.63 | 4.07 | -6.18 | 2.1656 | -0.3847 | |||

| FALN / iShares Trust - iShares Fallen Angels USD Bond ETF | 0.15 | 129.49 | 3.99 | 133.49 | 2.1213 | 1.1175 | |||

| MSFT / Microsoft Corporation | 0.01 | -1.06 | 3.77 | 10.69 | 2.0049 | 0.0037 | |||

| CRM / Salesforce, Inc. | 0.01 | -2.52 | 3.57 | 11.59 | 1.8991 | 0.0184 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.00 | -0.91 | 3.50 | 25.94 | 1.8597 | 0.2283 | |||

| NOW / ServiceNow, Inc. | 0.00 | -2.15 | 3.44 | 5.62 | 1.8290 | -0.0847 | |||

| GOOG / Alphabet Inc. | 0.02 | -2.16 | 3.27 | 5.72 | 1.7413 | -0.0787 | |||

| COST / Costco Wholesale Corporation | 0.00 | -0.14 | 3.22 | 10.82 | 1.7112 | 0.0053 | |||

| MAR / Marriott International, Inc. | 0.01 | -0.86 | 3.19 | 10.92 | 1.6961 | 0.0065 | |||

| AXP / American Express Company | 0.01 | 0.63 | 3.15 | 22.28 | 1.6755 | 0.1618 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 0.54 | 3.15 | 18.53 | 1.6739 | 0.1137 | |||

| GD / General Dynamics Corporation | 0.01 | 0.08 | 3.12 | 8.85 | 1.6613 | -0.0245 | |||

| ORCL / Oracle Corporation | 0.02 | 1.16 | 3.10 | 20.51 | 1.6501 | 0.1374 | |||

| SCHW / The Charles Schwab Corporation | 0.04 | 0.91 | 3.03 | 6.10 | 1.6088 | -0.0665 | |||

| HD / The Home Depot, Inc. | 0.01 | 2.14 | 2.98 | 13.03 | 1.5873 | 0.0361 | |||

| ZS / Zscaler, Inc. | 0.02 | -2.36 | 2.96 | -15.12 | 1.5739 | -0.4747 | |||

| SHOP / Shopify Inc. | 0.04 | -0.29 | 2.94 | -1.21 | 1.5641 | -0.1855 | |||

| AAPL / Apple Inc. | 0.02 | 1.24 | 2.90 | -9.81 | 1.5403 | -0.3470 | |||

| WMT / Walmart Inc. | 0.05 | 211.68 | 2.86 | 18.98 | 1.5201 | 0.1082 | |||

| RUN / Sunrun Inc. | 0.21 | 10.72 | 2.73 | -25.66 | 1.4498 | -0.7050 | |||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0.05 | 2.62 | 1.3910 | 1.3910 | |||||

| UNH / UnitedHealth Group Incorporated | 0.01 | 2.55 | 2.61 | -3.66 | 1.3877 | -0.2037 | |||

| DHR / Danaher Corporation | 0.01 | 4.07 | 2.56 | 12.35 | 1.3603 | 0.0225 | |||

| RTX / RTX Corporation | 0.03 | 3.40 | 2.54 | 19.85 | 1.3521 | 0.1057 | |||

| HON / Honeywell International Inc. | 0.01 | 3.04 | 2.48 | 0.85 | 1.3213 | -0.1264 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 2.45 | 2.46 | 4.68 | 1.3087 | -0.0723 | |||

| PEP / PepsiCo, Inc. | 0.01 | 6.11 | 2.39 | 9.37 | 1.2732 | -0.0133 | |||

| CELH / Celsius Holdings, Inc. | 0.03 | -1.55 | 2.35 | 49.75 | 1.2524 | 0.3283 | |||

| MDT / Medtronic plc | 0.03 | -0.70 | 2.34 | 5.07 | 1.2447 | -0.0644 | |||

| ABNB / Airbnb, Inc. | 0.01 | 0.85 | 2.16 | 22.16 | 1.1497 | 0.1102 | |||

| LULU / lululemon athletica inc. | 0.01 | -0.07 | 2.13 | -23.67 | 1.1337 | -0.5069 | |||

| WM / Waste Management, Inc. | 0.01 | 1.49 | 2.13 | 20.76 | 1.1327 | 0.0966 | |||

| SYK / Stryker Corporation | 0.01 | 2.28 | 2.10 | 22.27 | 1.1187 | 0.1075 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 6.69 | 2.07 | 0.83 | 1.1007 | -0.1051 | |||

| PULS / PGIM ETF Trust - PGIM Ultra Short Bond ETF | 0.04 | 1.91 | 1.0146 | 1.0146 | |||||

| ASAN / Asana, Inc. | 0.12 | 7.71 | 1.83 | -12.24 | 0.9725 | -0.2517 | |||

| VWOB / Vanguard Whitehall Funds - Vanguard Emerging Markets Government Bond ETF | 0.03 | 1.81 | 0.9637 | 0.9637 | |||||

| SRLN / SSGA Active Trust - SPDR Blackstone Senior Loan ETF | 0.04 | -21.03 | 1.68 | -20.68 | 0.8957 | -0.3521 | |||

| ADBE / Adobe Inc. | 0.00 | 18.02 | 1.20 | -0.17 | 0.6379 | -0.0681 | |||

| RIVN / Rivian Automotive, Inc. | 0.10 | 6.91 | 1.08 | -50.09 | 0.5745 | -0.6976 | |||

| NKLA / Nikola Corporation | 1.03 | 0.05 | 1.07 | 19.04 | 0.5685 | 0.0404 | |||

| SCHB / Schwab Strategic Trust - Schwab U.S. Broad Market ETF | 0.01 | 0.30 | 0.58 | 9.98 | 0.3108 | -0.0014 | |||

| TSLA / Tesla, Inc. | 0.00 | 7.75 | 0.47 | -23.79 | 0.2507 | -0.1127 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 14.08 | 0.35 | 25.82 | 0.1844 | 0.0223 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.00 | 0.48 | 0.33 | 6.03 | 0.1779 | -0.0075 | |||

| COOK / Traeger, Inc. | 0.13 | -21.74 | 0.33 | -27.56 | 0.1738 | -0.0910 | |||

| NVDA / NVIDIA Corporation | 0.00 | 0.30 | 0.1615 | 0.1615 | |||||

| SOFI / SoFi Technologies, Inc. | 0.04 | -12.56 | 0.28 | -36.01 | 0.1489 | -0.1075 | |||

| DOMO / Domo, Inc. | 0.02 | 18.94 | 0.15 | 3.42 | 0.0805 | -0.0058 | |||

| PRPL / Purple Innovation, Inc. | 0.03 | 32.33 | 0.06 | 128.00 | 0.0306 | 0.0155 | |||

| LULU / lululemon athletica inc. | Call | 0.00 | 0.00 | 0.0023 | 0.0023 | ||||

| ASAN / Asana, Inc. | Call | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.00 | -100.00 | 0.00 | 0.0000 |