Mga Batayang Estadistika

| Nilai Portofolio | $ 117,282,611 |

| Posisi Saat Ini | 36 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

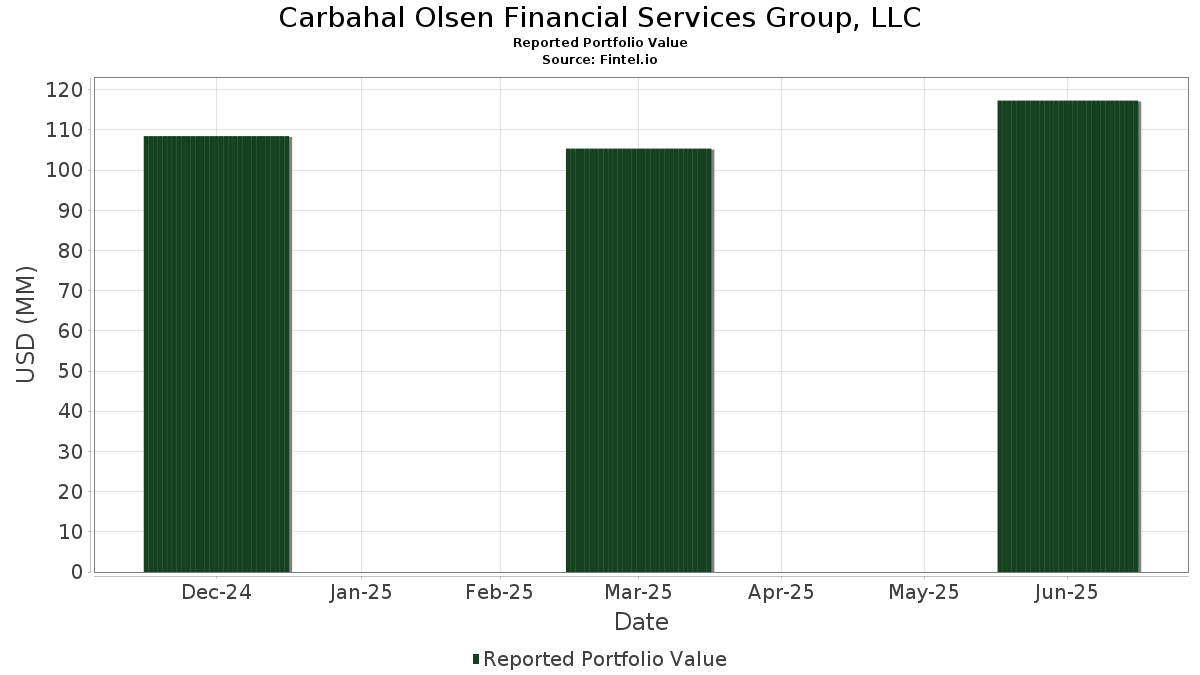

Carbahal Olsen Financial Services Group, LLC telah mengungkapkan total kepemilikan 36 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 117,282,611 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Carbahal Olsen Financial Services Group, LLC adalah iShares Trust - iShares Core S&P 500 ETF (US:IVV) , Invesco QQQ Trust, Series 1 (US:QQQ) , iShares Trust - iShares S&P 500 Growth ETF (US:IVW) , iShares Trust - iShares Core MSCI EAFE ETF (US:IEFA) , and iShares Trust - iShares Core U.S. Aggregate Bond ETF (US:AGG) . Posisi baru Carbahal Olsen Financial Services Group, LLC meliputi: Oklo Inc. (US:OKLO) , International Business Machines Corporation (US:IBM) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.15 | 16.31 | 13.9041 | 0.7669 | |

| 0.03 | 16.47 | 14.0402 | 0.6658 | |

| 0.05 | 29.82 | 25.4277 | 0.4476 | |

| 0.01 | 0.28 | 0.2387 | 0.2387 | |

| 0.00 | 0.21 | 0.1792 | 0.1792 | |

| 0.00 | 0.40 | 0.3394 | 0.1322 | |

| 0.00 | 0.99 | 0.8438 | 0.1273 | |

| 0.00 | 0.38 | 0.3208 | 0.0758 | |

| 0.00 | 0.57 | 0.4831 | 0.0735 | |

| 0.00 | 0.31 | 0.2662 | 0.0348 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.11 | 10.86 | 9.2600 | -0.6145 | |

| 0.03 | 6.02 | 5.1325 | -0.4618 | |

| 0.01 | 1.85 | 1.5740 | -0.3357 | |

| 0.12 | 6.44 | 5.4890 | -0.2601 | |

| 0.01 | 1.82 | 1.5531 | -0.2111 | |

| 0.00 | 1.16 | 0.9895 | -0.2062 | |

| 0.00 | 0.27 | 0.2332 | -0.1007 | |

| 0.00 | 0.33 | 0.2812 | -0.0841 | |

| 0.15 | 12.84 | 10.9514 | -0.0729 | |

| 0.00 | 0.25 | 0.2104 | -0.0633 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-25 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.05 | 2.56 | 29.82 | 13.33 | 25.4277 | 0.4476 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.03 | -0.65 | 16.47 | 16.88 | 14.0402 | 0.6658 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.15 | -0.65 | 16.31 | 17.84 | 13.9041 | 0.7669 | |||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.15 | 0.23 | 12.84 | 10.60 | 10.9514 | -0.0729 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.11 | 4.11 | 10.86 | 4.41 | 9.2600 | -0.6145 | |||

| FDVV / Fidelity Covington Trust - Fidelity High Dividend ETF | 0.12 | 1.35 | 6.44 | 6.29 | 5.4890 | -0.2601 | |||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.03 | -0.38 | 6.02 | 2.14 | 5.1325 | -0.4618 | |||

| IWO / iShares Trust - iShares Russell 2000 Growth ETF | 0.01 | 0.07 | 4.22 | 11.82 | 3.5978 | 0.0154 | |||

| AAPL / Apple Inc. | 0.01 | -0.64 | 1.85 | -8.20 | 1.5740 | -0.3357 | |||

| DVY / iShares Trust - iShares Select Dividend ETF | 0.01 | -0.90 | 1.82 | -1.99 | 1.5531 | -0.2111 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 1.01 | 1.16 | -7.86 | 0.9895 | -0.2062 | |||

| MSFT / Microsoft Corporation | 0.00 | -1.04 | 0.99 | 31.17 | 0.8438 | 0.1273 | |||

| IWN / iShares Trust - iShares Russell 2000 Value ETF | 0.01 | -0.14 | 0.81 | 4.36 | 0.6940 | -0.0464 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.57 | 31.32 | 0.4831 | 0.0735 | |||

| BKFOF / Brookfield Corporation - Preferred Stock | 0.01 | 0.00 | 0.47 | 18.05 | 0.4023 | 0.0228 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.00 | -1.67 | 0.41 | -2.84 | 0.3502 | -0.0507 | |||

| ITOT / iShares Trust - iShares Core S&P Total U.S. Stock Market ETF | 0.00 | 64.78 | 0.40 | 82.57 | 0.3394 | 0.1322 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.00 | 0.00 | 0.39 | 4.53 | 0.3349 | -0.0219 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.39 | -5.58 | 0.3323 | -0.0597 | |||

| NVDA / NVIDIA Corporation | 0.00 | 0.04 | 0.38 | 45.74 | 0.3208 | 0.0758 | |||

| SEIC / SEI Investments Company | 0.00 | 0.00 | 0.36 | 15.81 | 0.3065 | 0.0117 | |||

| T / AT&T Inc. | 0.01 | 0.21 | 0.35 | 2.62 | 0.3015 | -0.0258 | |||

| AMAT / Applied Materials, Inc. | 0.00 | 0.16 | 0.34 | 26.30 | 0.2912 | 0.0346 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.00 | 0.00 | 0.34 | -6.35 | 0.2893 | -0.0552 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | -13.39 | 0.33 | -14.32 | 0.2812 | -0.0841 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.00 | 0.33 | -7.84 | 0.2807 | -0.0586 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.31 | 28.40 | 0.2662 | 0.0348 | |||

| WFC / Wells Fargo & Company | 0.00 | 0.00 | 0.29 | 11.83 | 0.2500 | 0.0006 | |||

| OKLO / Oklo Inc. | 0.01 | 0.28 | 0.2387 | 0.2387 | |||||

| BMRN / BioMarin Pharmaceutical Inc. | 0.00 | 0.00 | 0.27 | -22.22 | 0.2332 | -0.1007 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.00 | 0.26 | -11.15 | 0.2243 | -0.0576 | |||

| CRM / Salesforce, Inc. | 0.00 | 0.00 | 0.25 | 1.61 | 0.2152 | -0.0204 | |||

| CVX / Chevron Corporation | 0.00 | 0.00 | 0.25 | -14.58 | 0.2104 | -0.0633 | |||

| CAT / Caterpillar Inc. | 0.00 | 1.13 | 0.24 | 19.12 | 0.2077 | 0.0132 | |||

| ACN / Accenture plc | 0.00 | 0.00 | 0.24 | -4.00 | 0.2046 | -0.0332 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.21 | 0.1792 | 0.1792 |