Mga Batayang Estadistika

| Nilai Portofolio | $ 3,194,792,214 |

| Posisi Saat Ini | 68 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

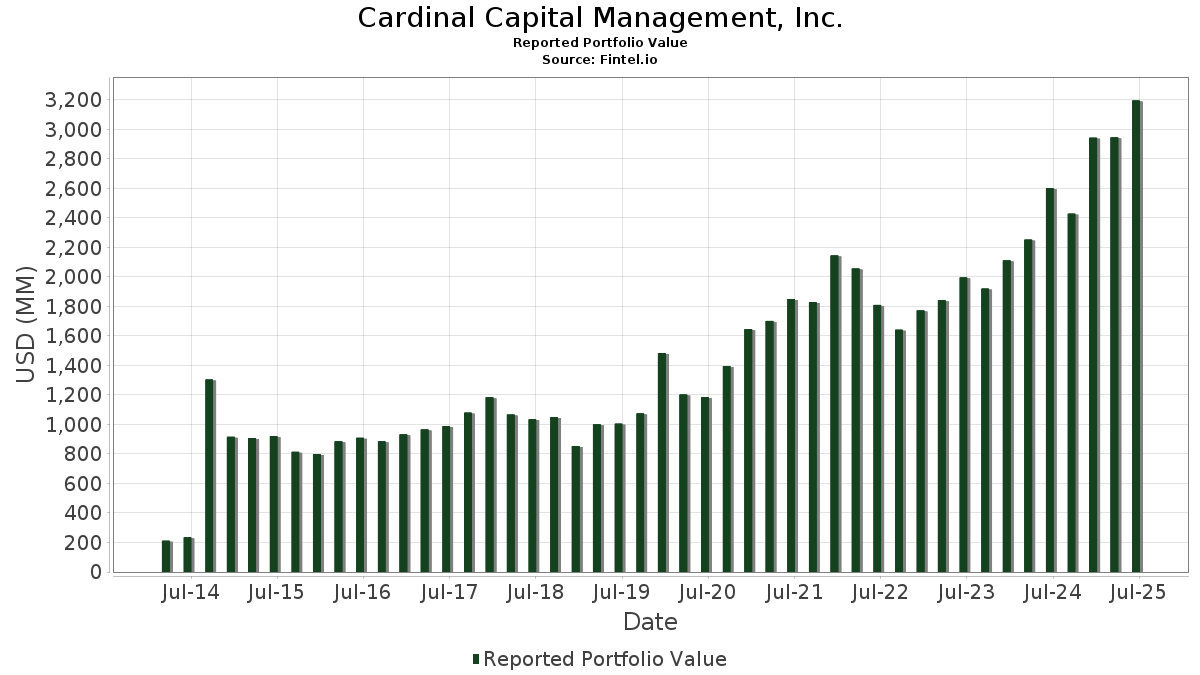

Cardinal Capital Management, Inc. telah mengungkapkan total kepemilikan 68 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 3,194,792,214 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Cardinal Capital Management, Inc. adalah Manulife Financial Corporation (US:MFC) , Canadian Tire Corporation, Limited (US:CDNAF) , Brookfield Corporation - Preferred Stock (US:BKFOF) , Suncor Energy Inc. (US:SU) , and Gildan Activewear Inc. (US:GIL) . Posisi baru Cardinal Capital Management, Inc. meliputi: Analog Devices, Inc. (US:ADI) , Carrier Global Corporation (US:CARR) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.38 | 20.38 | 0.6381 | 0.6294 | |

| 5.57 | 114.03 | 3.5693 | 0.5928 | |

| 1.85 | 130.99 | 4.1002 | 0.5526 | |

| 1.12 | 151.75 | 4.7498 | 0.5176 | |

| 3.70 | 92.77 | 2.9038 | 0.4073 | |

| 2.21 | 136.66 | 4.2775 | 0.3476 | |

| 0.80 | 82.82 | 2.5922 | 0.3365 | |

| 0.14 | 30.68 | 0.9604 | 0.2862 | |

| 1.54 | 89.90 | 2.8138 | 0.2775 | |

| 2.08 | 114.90 | 3.5965 | 0.2760 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 1.52 | 0.0475 | -0.8054 | |

| 2.94 | 110.23 | 3.4502 | -0.5237 | |

| 3.62 | 135.64 | 4.2458 | -0.5219 | |

| 0.17 | 40.51 | 1.2680 | -0.3538 | |

| 4.79 | 153.17 | 4.7945 | -0.3251 | |

| 0.14 | 23.74 | 0.7430 | -0.3115 | |

| 0.19 | 35.41 | 1.1084 | -0.2977 | |

| 2.61 | 118.11 | 3.6970 | -0.2674 | |

| 2.48 | 120.96 | 3.7862 | -0.2030 | |

| 0.12 | 33.38 | 1.0449 | -0.1479 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-11 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MFC / Manulife Financial Corporation | 4.79 | -0.90 | 153.17 | 1.61 | 4.7945 | -0.3251 | |||

| CDNAF / Canadian Tire Corporation, Limited | 1.12 | -7.04 | 151.75 | 21.77 | 4.7498 | 0.5176 | |||

| BKFOF / Brookfield Corporation - Preferred Stock | 2.21 | -0.06 | 136.66 | 18.10 | 4.2775 | 0.3476 | |||

| SU / Suncor Energy Inc. | 3.62 | -0.05 | 135.64 | -3.38 | 4.2458 | -0.5219 | |||

| GIL / Gildan Activewear Inc. | 2.73 | 0.52 | 134.38 | 11.95 | 4.2062 | 0.1295 | |||

| CM / Canadian Imperial Bank of Commerce | 1.85 | -0.54 | 130.99 | 25.40 | 4.1002 | 0.5526 | |||

| GDXD / MicroSectors Gold Miners -3X Inverse Leveraged ETNs due June 29, 2040 | 1.11 | -0.15 | 122.62 | 15.79 | 3.8382 | 0.2416 | |||

| TRP / TC Energy Corporation | 2.48 | -0.31 | 120.96 | 2.98 | 3.7862 | -0.2030 | |||

| RY / Royal Bank of Canada | 0.92 | -0.35 | 120.71 | 16.50 | 3.7784 | 0.2594 | |||

| ENB / Enbridge Inc. | 2.61 | -1.17 | 118.11 | 1.18 | 3.6970 | -0.2674 | |||

| BNS / The Bank of Nova Scotia | 2.08 | 0.84 | 114.90 | 17.52 | 3.5965 | 0.2760 | |||

| SAPIF / Saputo Inc. | 5.57 | 9.78 | 114.03 | 30.11 | 3.5693 | 0.5928 | |||

| PBA / Pembina Pipeline Corporation | 2.94 | 0.43 | 110.23 | -5.80 | 3.4502 | -0.5237 | |||

| CP / Canadian Pacific Kansas City Limited | 1.34 | 0.55 | 106.30 | 13.74 | 3.3272 | 0.1533 | |||

| IFC / Intact Financial Corporation | 0.43 | -1.18 | 99.88 | 12.39 | 3.1264 | 0.1081 | |||

| ELFTY / Element Fleet Management Corp. - Depositary Receipt (Common Stock) | 3.70 | 0.24 | 92.77 | 26.20 | 2.9038 | 0.4073 | |||

| CCDBF / CCL Industries Inc. | 1.54 | 0.90 | 89.90 | 20.37 | 2.8138 | 0.2775 | |||

| NTIOF / National Bank of Canada | 0.80 | -0.20 | 82.82 | 24.69 | 2.5922 | 0.3365 | |||

| CNI / Canadian National Railway Company | 0.73 | 3.11 | 76.18 | 10.31 | 2.3844 | 0.0392 | |||

| SLF / Sun Life Financial Inc. | 1.14 | 0.80 | 75.71 | 17.10 | 2.3696 | 0.1740 | |||

| WFC / Wells Fargo & Company | 0.53 | -4.14 | 42.66 | 6.99 | 1.3352 | -0.0189 | |||

| TMUS / T-Mobile US, Inc. | 0.17 | -5.04 | 40.51 | -15.17 | 1.2680 | -0.3538 | |||

| BKNG / Booking Holdings Inc. | 0.01 | -3.50 | 40.19 | 21.26 | 1.2581 | 0.1324 | |||

| SONY / Sony Group Corporation - Depositary Receipt (Common Stock) | 1.54 | -3.69 | 40.00 | -1.27 | 1.2522 | -0.1239 | |||

| AMAT / Applied Materials, Inc. | 0.21 | -0.60 | 37.54 | 25.39 | 1.1750 | 0.1583 | |||

| SIEGY / Siemens Aktiengesellschaft - Depositary Receipt (Common Stock) | 0.28 | -0.97 | 36.43 | 10.61 | 1.1404 | 0.0218 | |||

| ABBV / AbbVie Inc. | 0.19 | -3.46 | 35.41 | -14.47 | 1.1084 | -0.2977 | |||

| BOWFF / Boardwalk Real Estate Investment Trust | 0.69 | -0.00 | 35.40 | 10.14 | 1.1080 | 0.0165 | |||

| CMI / Cummins Inc. | 0.11 | -2.82 | 35.15 | 1.53 | 1.1002 | -0.0755 | |||

| NTR / Nutrien Ltd. | 0.59 | -0.49 | 34.50 | 16.74 | 1.0798 | 0.0762 | |||

| APD / Air Products and Chemicals, Inc. | 0.12 | -0.62 | 33.38 | -4.95 | 1.0449 | -0.1479 | |||

| NEE / NextEra Energy, Inc. | 0.45 | 0.06 | 30.97 | -2.01 | 0.9693 | -0.1040 | |||

| HD / The Home Depot, Inc. | 0.08 | -2.33 | 30.81 | -2.28 | 0.9642 | -0.1064 | |||

| ORCL / Oracle Corporation | 0.14 | -1.16 | 30.68 | 54.56 | 0.9604 | 0.2862 | |||

| URI / United Rentals, Inc. | 0.04 | 5.98 | 30.67 | 27.41 | 0.9600 | 0.1424 | |||

| HON / Honeywell International Inc. | 0.13 | -2.26 | 29.67 | 7.49 | 0.9287 | -0.0087 | |||

| ENLAY / Enel SpA - Depositary Receipt (Common Stock) | 2.83 | -0.44 | 26.79 | 17.10 | 0.8384 | 0.0615 | |||

| AVGO / Broadcom Inc. | 0.10 | -8.70 | 26.74 | 50.31 | 0.8370 | 0.2328 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.42 | 0.28 | 25.97 | 3.01 | 0.8129 | -0.0433 | |||

| NXPI / NXP Semiconductors N.V. | 0.12 | 2.69 | 25.43 | 18.04 | 0.7959 | 0.0644 | |||

| MDT / Medtronic plc | 0.28 | 1.03 | 24.69 | -1.99 | 0.7727 | -0.0827 | |||

| BDX / Becton, Dickinson and Company | 0.14 | 1.66 | 23.74 | -23.55 | 0.7430 | -0.3115 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.08 | 0.77 | 23.55 | 14.16 | 0.7373 | 0.0365 | |||

| MRK / Merck & Co., Inc. | 0.27 | 1.15 | 21.35 | -10.79 | 0.6682 | -0.1445 | |||

| SBGSY / Schneider Electric S.E. - Depositary Receipt (Common Stock) | 0.38 | 6,793.05 | 20.38 | 7,925.20 | 0.6381 | 0.6294 | |||

| SWK / Stanley Black & Decker, Inc. | 0.30 | -0.21 | 20.16 | -12.06 | 0.6310 | -0.1475 | |||

| GRPU / Granite Real Estate Investment Trust | 0.32 | -0.13 | 16.01 | 8.81 | 0.5010 | 0.0014 | |||

| AP.UN / Allied Properties Real Estate Investment Trust | 1.13 | -0.42 | 14.23 | 10.09 | 0.4456 | 0.0064 | |||

| PEP / PepsiCo, Inc. | 0.11 | -4.61 | 14.11 | -16.00 | 0.4417 | -0.1288 | |||

| EQIX / Equinix, Inc. | 0.02 | -5.47 | 12.88 | -7.77 | 0.4032 | -0.0712 | |||

| CDW / CDW Corporation | 0.07 | -4.53 | 12.85 | 6.38 | 0.4021 | -0.0080 | |||

| COP / ConocoPhillips | 0.12 | -2.89 | 11.13 | -17.02 | 0.3484 | -0.1072 | |||

| GPN / Global Payments Inc. | 0.10 | -6.67 | 8.19 | -23.72 | 0.2565 | -0.1083 | |||

| TU / TELUS Corporation | 0.34 | -11.50 | 5.43 | -0.99 | 0.1698 | -0.0163 | |||

| IBDRY / Iberdrola, S.A. - Depositary Receipt (Common Stock) | 0.03 | -5.41 | 1.98 | 12.86 | 0.0621 | 0.0024 | |||

| CMCSA / Comcast Corporation | 0.04 | -93.75 | 1.52 | -93.96 | 0.0475 | -0.8054 | |||

| USB / U.S. Bancorp | 0.03 | -2.33 | 1.38 | 4.64 | 0.0431 | -0.0016 | |||

| TD / The Toronto-Dominion Bank | 0.02 | 0.00 | 1.27 | 22.64 | 0.0399 | 0.0046 | |||

| DLMAY / Dollarama Inc. - Depositary Receipt (Common Stock) | 0.00 | -4.17 | 0.52 | 26.34 | 0.0162 | 0.0023 | |||

| FTS / Fortis Inc. | 0.01 | -1.72 | 0.48 | 3.02 | 0.0150 | -0.0008 | |||

| MSFT / Microsoft Corporation | 0.00 | -2.87 | 0.42 | 28.83 | 0.0132 | 0.0021 | |||

| BAC / Bank of America Corporation | 0.01 | -2.09 | 0.34 | 11.00 | 0.0108 | 0.0002 | |||

| TXN / Texas Instruments Incorporated | 0.00 | -0.33 | 0.31 | 15.02 | 0.0098 | 0.0006 | |||

| ADI / Analog Devices, Inc. | 0.00 | 0.28 | 0.0089 | 0.0089 | |||||

| CARR / Carrier Global Corporation | 0.00 | 0.28 | 0.0088 | 0.0088 | |||||

| JPM / JPMorgan Chase & Co. | 0.00 | -2.92 | 0.24 | 14.83 | 0.0075 | 0.0004 | |||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.24 | -10.23 | 0.0074 | -0.0016 | |||

| AAPL / Apple Inc. | 0.00 | 0.00 | 0.22 | -7.88 | 0.0070 | -0.0012 | |||

| NNWWF / The North West Company Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GILD / Gilead Sciences, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EMRAF / Emera Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LVMUY / LVMH Moët Hennessy - Louis Vuitton, Société Européenne - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 |