Mga Batayang Estadistika

| Nilai Portofolio | $ 945,813,843 |

| Posisi Saat Ini | 207 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

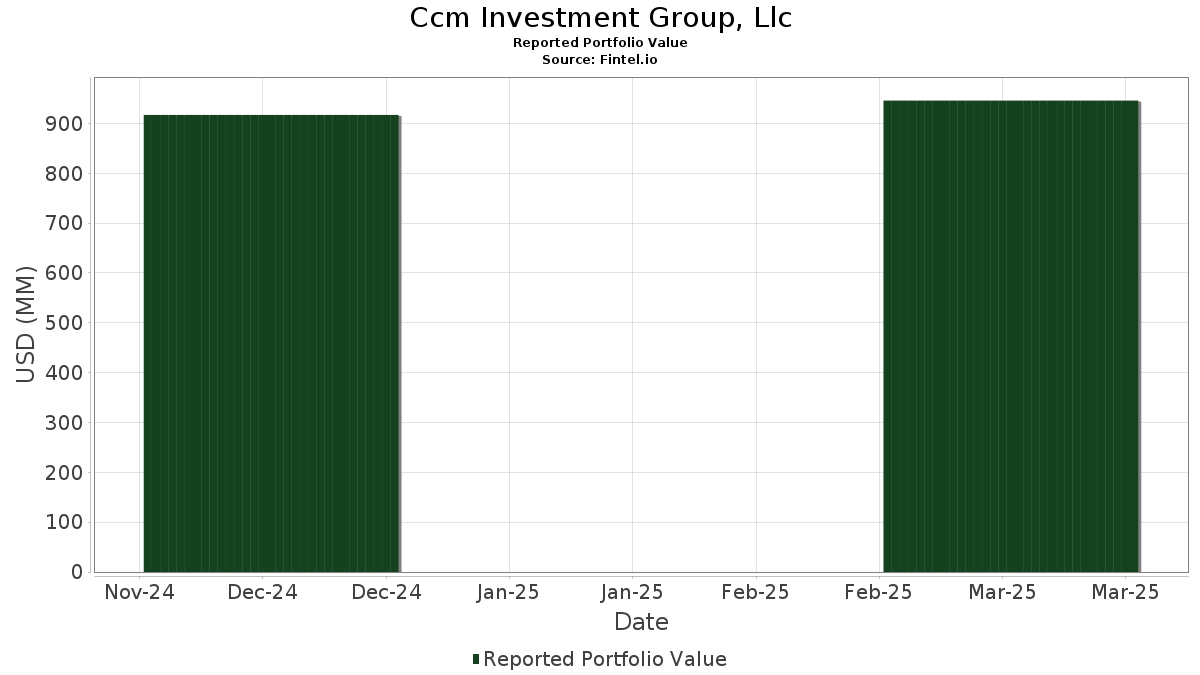

Ccm Investment Group, Llc telah mengungkapkan total kepemilikan 207 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 945,813,843 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Ccm Investment Group, Llc adalah iShares Trust - iShares Core MSCI International Developed Markets ETF (US:IDEV) , Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF (US:VEA) , American Century ETF Trust - Avantis U.S. Small Cap Value ETF (US:AVUV) , Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF (US:VWO) , and American Century ETF Trust - Avantis Real Estate ETF (US:AVRE) . Posisi baru Ccm Investment Group, Llc meliputi: General Dynamics Corporation (US:GD) , Applied Materials, Inc. (US:AMAT) , Charter Communications, Inc. (US:CHTR) , Centene Corporation (US:CNC) , and Occidental Petroleum Corporation (US:OXY) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.44 | 99.65 | 10.5364 | 0.5842 | |

| 0.06 | 5.99 | 0.6331 | 0.4767 | |

| 0.01 | 3.98 | 0.4208 | 0.4208 | |

| 0.02 | 3.47 | 0.3664 | 0.3664 | |

| 0.72 | 50.44 | 5.3325 | 0.3490 | |

| 0.01 | 2.90 | 0.3066 | 0.3066 | |

| 0.05 | 2.77 | 0.2929 | 0.2929 | |

| 1.90 | 97.17 | 10.2736 | 0.2586 | |

| 0.05 | 2.44 | 0.2575 | 0.2575 | |

| 0.01 | 2.38 | 0.2513 | 0.2513 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.01 | 88.11 | 9.3161 | -1.1439 | |

| 0.00 | 0.00 | -0.5051 | ||

| 0.00 | 0.00 | -0.4136 | ||

| 0.00 | 0.00 | -0.3836 | ||

| 0.10 | 21.53 | 2.2761 | -0.3672 | |

| 0.00 | 0.00 | -0.3314 | ||

| 0.00 | 0.00 | -0.2627 | ||

| 0.00 | 0.00 | -0.2379 | ||

| 0.00 | 0.00 | -0.2285 | ||

| 0.00 | 0.00 | -0.2074 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-05-12 untuk periode pelaporan 2025-03-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IDEV / iShares Trust - iShares Core MSCI International Developed Markets ETF | 1.44 | 1.39 | 99.65 | 9.19 | 10.5364 | 0.5842 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 1.90 | -1.28 | 97.17 | 5.80 | 10.2736 | 0.2586 | |||

| AVUV / American Century ETF Trust - Avantis U.S. Small Cap Value ETF | 1.01 | 1.39 | 88.11 | -8.14 | 9.3161 | -1.1439 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 1.26 | 4.13 | 57.27 | 6.96 | 6.0551 | 0.2165 | |||

| AVRE / American Century ETF Trust - Avantis Real Estate ETF | 1.20 | 1.39 | 51.43 | 4.23 | 5.4373 | 0.0573 | |||

| AVDV / American Century ETF Trust - Avantis International Small Cap Value ETF | 0.72 | 1.39 | 50.44 | 10.36 | 5.3325 | 0.3490 | |||

| AVES / American Century ETF Trust - Avantis Emerging Markets Value ETF | 0.80 | 5.68 | 37.75 | 8.25 | 3.9913 | 0.1884 | |||

| AAPL / Apple Inc. | 0.10 | 2.79 | 21.53 | -11.19 | 2.2761 | -0.3672 | |||

| XOM / Exxon Mobil Corporation | 0.08 | 0.54 | 9.56 | 11.93 | 1.0111 | 0.0793 | |||

| JNJ / Johnson & Johnson | 0.05 | 0.79 | 8.34 | 15.11 | 0.8813 | 0.0917 | |||

| PG / The Procter & Gamble Company | 0.05 | -3.27 | 8.06 | -2.72 | 0.8517 | -0.0513 | |||

| PM / Philip Morris International Inc. | 0.05 | -1.04 | 7.64 | 27.95 | 0.8079 | 0.1567 | |||

| CVX / Chevron Corporation | 0.05 | 0.34 | 7.61 | 16.50 | 0.8049 | 0.0922 | |||

| 0QZ1 / AT&T Inc. | 0.26 | -6.78 | 7.20 | 16.20 | 0.7609 | 0.0855 | |||

| HD / The Home Depot, Inc. | 0.02 | -6.07 | 7.00 | -13.61 | 0.7398 | -0.1434 | |||

| CSCO / Cisco Systems, Inc. | 0.11 | -12.17 | 6.61 | -9.70 | 0.6989 | -0.0993 | |||

| ABBV / AbbVie Inc. | 0.03 | 38.30 | 6.54 | 61.12 | 0.6915 | 0.2489 | |||

| CMCSA / Comcast Corporation | 0.18 | 26.19 | 6.45 | 23.58 | 0.6823 | 0.1129 | |||

| MO / Altria Group, Inc. | 0.10 | 3.14 | 6.07 | 15.16 | 0.6419 | 0.0670 | |||

| CI / The Cigna Group | 0.02 | 7.52 | 6.07 | 27.01 | 0.6419 | 0.1207 | |||

| AMGN / Amgen Inc. | 0.02 | 1.63 | 6.06 | 20.31 | 0.6409 | 0.0915 | |||

| COP / ConocoPhillips | 0.06 | 295.92 | 5.99 | 317.50 | 0.6331 | 0.4767 | |||

| MCK / McKesson Corporation | 0.01 | -11.82 | 5.92 | 3.21 | 0.6255 | 0.0005 | |||

| CAT / Caterpillar Inc. | 0.02 | 28.91 | 5.85 | 17.09 | 0.6188 | 0.0737 | |||

| PFE / Pfizer Inc. | 0.23 | 5.04 | 5.77 | 0.23 | 0.6104 | -0.0177 | |||

| UNP / Union Pacific Corporation | 0.02 | -2.96 | 5.76 | -1.12 | 0.6090 | -0.0261 | |||

| BMY / Bristol-Myers Squibb Company | 0.10 | -7.60 | 5.75 | -1.08 | 0.6077 | -0.0258 | |||

| KO / The Coca-Cola Company | 0.08 | 12.90 | 5.72 | 28.08 | 0.6048 | 0.1178 | |||

| GILD / Gilead Sciences, Inc. | 0.05 | -13.75 | 5.70 | 4.80 | 0.6030 | 0.0095 | |||

| MRK / Merck & Co., Inc. | 0.06 | 27.19 | 5.67 | 15.35 | 0.5998 | 0.0636 | |||

| MDT / Medtronic plc | 0.06 | -1.64 | 5.48 | 8.26 | 0.5795 | 0.0274 | |||

| UPS / United Parcel Service, Inc. | 0.05 | 19.22 | 5.47 | 4.31 | 0.5781 | 0.0066 | |||

| LMT / Lockheed Martin Corporation | 0.01 | 16.73 | 5.44 | 6.62 | 0.5754 | 0.0188 | |||

| EOG / EOG Resources, Inc. | 0.04 | -4.82 | 5.33 | -0.07 | 0.5640 | -0.0182 | |||

| LOW / Lowe's Companies, Inc. | 0.02 | 1.08 | 5.32 | -6.42 | 0.5624 | -0.0574 | |||

| HON / Honeywell International Inc. | 0.03 | -10.88 | 5.31 | -17.28 | 0.5617 | -0.1386 | |||

| HCA / HCA Healthcare, Inc. | 0.02 | 4.71 | 5.20 | 20.05 | 0.5503 | 0.0775 | |||

| PEP / PepsiCo, Inc. | 0.03 | 29.88 | 5.16 | 27.77 | 0.5460 | 0.1053 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -9.97 | 5.15 | -16.40 | 0.5444 | -0.1272 | |||

| MMM / 3M Company | 0.04 | -15.68 | 5.14 | -5.41 | 0.5436 | -0.0492 | |||

| PSX / Phillips 66 | 0.04 | -1.76 | 5.08 | 6.82 | 0.5366 | 0.0185 | |||

| LRCX / Lam Research Corporation | 0.07 | -8.50 | 4.99 | -7.92 | 0.5277 | -0.0633 | |||

| CL / Colgate-Palmolive Company | 0.05 | 13.85 | 4.97 | 16.42 | 0.5256 | 0.0599 | |||

| AZO / AutoZone, Inc. | 0.00 | -14.30 | 4.81 | 1.43 | 0.5087 | -0.0085 | |||

| MPC / Marathon Petroleum Corporation | 0.03 | -8.61 | 4.75 | -2.88 | 0.5023 | -0.0311 | |||

| CSX / CSX Corporation | 0.16 | 2.29 | 4.68 | -7.37 | 0.4945 | -0.0561 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | -18.98 | 4.67 | -3.27 | 0.4940 | -0.0328 | |||

| VLO / Valero Energy Corporation | 0.04 | -2.15 | 4.65 | 7.59 | 0.4914 | 0.0203 | |||

| ELV / Elevance Health, Inc. | 0.01 | -19.97 | 4.62 | -6.26 | 0.4890 | -0.0490 | |||

| ITW / Illinois Tool Works Inc. | 0.02 | 4.85 | 4.53 | 1.39 | 0.4785 | -0.0083 | |||

| MCD / McDonald's Corporation | 0.01 | -5.08 | 4.50 | 0.65 | 0.4762 | -0.0118 | |||

| TGT / Target Corporation | 0.04 | 10.87 | 4.07 | -14.90 | 0.4300 | -0.0912 | |||

| GD / General Dynamics Corporation | 0.01 | 3.98 | 0.4208 | 0.4208 | |||||

| NOC / Northrop Grumman Corporation | 0.01 | 3.17 | 3.94 | 13.29 | 0.4164 | 0.0372 | |||

| KMB / Kimberly-Clark Corporation | 0.03 | 10.64 | 3.82 | 19.18 | 0.4042 | 0.0544 | |||

| ADI / Analog Devices, Inc. | 0.02 | 5.07 | 3.57 | -0.36 | 0.3776 | -0.0133 | |||

| AMAT / Applied Materials, Inc. | 0.02 | 3.47 | 0.3664 | 0.3664 | |||||

| NEM / Newmont Corporation | 0.07 | 12.70 | 3.40 | 46.46 | 0.3590 | 0.1062 | |||

| KMI / Kinder Morgan, Inc. | 0.11 | -11.76 | 3.23 | -8.50 | 0.3413 | -0.0434 | |||

| HPQ / HP Inc. | 0.11 | 0.69 | 3.16 | -13.91 | 0.3338 | -0.0661 | |||

| GIS / General Mills, Inc. | 0.05 | 10.40 | 3.09 | 3.00 | 0.3270 | -0.0005 | |||

| NSC / Norfolk Southern Corporation | 0.01 | 7.85 | 2.91 | 6.47 | 0.3081 | 0.0097 | |||

| CAH / Cardinal Health, Inc. | 0.02 | -8.63 | 2.90 | 5.72 | 0.3067 | 0.0075 | |||

| CHTR / Charter Communications, Inc. | 0.01 | 2.90 | 0.3066 | 0.3066 | |||||

| EBAY / eBay Inc. | 0.04 | -26.79 | 2.88 | -20.78 | 0.3044 | -0.0918 | |||

| DOW / Dow Inc. | 0.08 | 15.71 | 2.86 | 0.81 | 0.3026 | -0.0070 | |||

| LHX / L3Harris Technologies, Inc. | 0.01 | 4.04 | 2.86 | 3.44 | 0.3023 | 0.0009 | |||

| CNC / Centene Corporation | 0.05 | 2.77 | 0.2929 | 0.2929 | |||||

| CTSH / Cognizant Technology Solutions Corporation | 0.04 | -16.44 | 2.69 | -17.34 | 0.2842 | -0.0705 | |||

| EMR / Emerson Electric Co. | 0.02 | -16.75 | 2.59 | -27.21 | 0.2738 | -0.1142 | |||

| JCI / Johnson Controls International plc | 0.03 | 11.32 | 2.51 | 12.12 | 0.2651 | 0.0212 | |||

| OXY / Occidental Petroleum Corporation | 0.05 | 2.44 | 0.2575 | 0.2575 | |||||

| LEN / Lennar Corporation | 0.02 | 51.78 | 2.41 | 26.98 | 0.2549 | 0.0478 | |||

| FERG / Ferguson Enterprises Inc. | 0.01 | 2.38 | 0.2513 | 0.2513 | |||||

| DVN / Devon Energy Corporation | 0.06 | 2.32 | 0.2454 | 0.2454 | |||||

| CTRA / Coterra Energy Inc. | 0.08 | 2.26 | 0.2388 | 0.2388 | |||||

| KHC / The Kraft Heinz Company | 0.07 | 10.13 | 2.26 | 9.68 | 0.2385 | 0.0143 | |||

| YUM / Yum! Brands, Inc. | 0.01 | -2.49 | 2.21 | 13.80 | 0.2337 | 0.0218 | |||

| SYY / Sysco Corporation | 0.03 | 4.98 | 2.14 | 1.91 | 0.2259 | -0.0028 | |||

| KR / The Kroger Co. | 0.03 | -13.00 | 2.11 | -5.22 | 0.2228 | -0.0196 | |||

| DHI / D.R. Horton, Inc. | 0.02 | 2.10 | 0.2216 | 0.2216 | |||||

| IP / International Paper Company | 0.04 | 21.01 | 1.99 | 20.04 | 0.2104 | 0.0296 | |||

| ADM / Archer-Daniels-Midland Company | 0.04 | 1.98 | 0.2098 | 0.2098 | |||||

| STLD / Steel Dynamics, Inc. | 0.02 | 4.47 | 1.98 | 13.82 | 0.2091 | 0.0196 | |||

| CMI / Cummins Inc. | 0.01 | -27.67 | 1.96 | -34.81 | 0.2068 | -0.1203 | |||

| NVR / NVR, Inc. | 0.00 | 17.70 | 1.91 | 3.41 | 0.2020 | 0.0005 | |||

| LYB / LyondellBasell Industries N.V. | 0.03 | -6.92 | 1.86 | -11.22 | 0.1968 | -0.0318 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.02 | 8.68 | 1.81 | 17.41 | 0.1919 | 0.0234 | |||

| PHM / PulteGroup, Inc. | 0.02 | 15.75 | 1.77 | 8.19 | 0.1872 | 0.0087 | |||

| BBY / Best Buy Co., Inc. | 0.02 | -0.53 | 1.74 | -16.09 | 0.1842 | -0.0421 | |||

| EA / Electronic Arts Inc. | 0.01 | 1.62 | 0.1718 | 0.1718 | |||||

| BLDR / Builders FirstSource, Inc. | 0.01 | 1.75 | 1.60 | -11.64 | 0.1694 | -0.0283 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | -9.21 | 1.55 | -25.02 | 0.1638 | -0.0616 | |||

| OMC / Omnicom Group Inc. | 0.02 | 14.36 | 1.52 | 6.95 | 0.1610 | 0.0057 | |||

| BKR / Baker Hughes Company | 0.04 | -37.18 | 1.52 | -33.93 | 0.1605 | -0.0899 | |||

| DGX / Quest Diagnostics Incorporated | 0.01 | -10.00 | 1.51 | -0.26 | 0.1599 | -0.0054 | |||

| VRSN / VeriSign, Inc. | 0.01 | -23.22 | 1.51 | -6.09 | 0.1599 | -0.0157 | |||

| KDP / Keurig Dr Pepper Inc. | 0.04 | 1.49 | 0.1577 | 0.1577 | |||||

| DRI / Darden Restaurants, Inc. | 0.01 | -26.82 | 1.48 | -19.62 | 0.1560 | -0.0442 | |||

| CSL / Carlisle Companies Incorporated | 0.00 | 37.68 | 1.43 | 27.95 | 0.1516 | 0.0294 | |||

| RS / Reliance, Inc. | 0.00 | 3.54 | 1.43 | 11.28 | 0.1513 | 0.0112 | |||

| MAS / Masco Corporation | 0.02 | -2.20 | 1.39 | -7.40 | 0.1470 | -0.0167 | |||

| CLX / The Clorox Company | 0.01 | 11.42 | 1.34 | 0.98 | 0.1414 | -0.0030 | |||

| TXT / Textron Inc. | 0.02 | 4.90 | 1.34 | 0.07 | 0.1412 | -0.0044 | |||

| NTAP / NetApp, Inc. | 0.01 | -16.29 | 1.32 | -36.48 | 0.1396 | -0.0870 | |||

| CF / CF Industries Holdings, Inc. | 0.02 | 0.23 | 1.30 | -7.74 | 0.1375 | -0.0161 | |||

| 0LD5 / Tapestry, Inc. | 0.02 | -29.90 | 1.24 | -25.21 | 0.1312 | -0.0497 | |||

| GPC / Genuine Parts Company | 0.01 | -5.73 | 1.24 | -3.59 | 0.1308 | -0.0091 | |||

| WSM / Williams-Sonoma, Inc. | 0.01 | -32.26 | 1.23 | -42.24 | 0.1298 | -0.1021 | |||

| TSN / Tyson Foods, Inc. | 0.02 | 10.51 | 1.22 | 20.61 | 0.1288 | 0.0187 | |||

| FOXA / Fox Corporation | 0.02 | -8.71 | 1.21 | 2.29 | 0.1275 | -0.0011 | |||

| LH / Labcorp Holdings Inc. | 0.01 | -6.24 | 1.20 | -5.79 | 0.1273 | -0.0120 | |||

| AMCR / Amcor plc | 0.12 | -15.73 | 1.14 | -12.99 | 0.1205 | -0.0224 | |||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.01 | -1.33 | 1.10 | -3.60 | 0.1162 | -0.0081 | |||

| DOX / Amdocs Limited | 0.01 | -1.00 | 1.06 | 5.57 | 0.1122 | 0.0026 | |||

| MTD / Mettler-Toledo International Inc. | 0.00 | -7.60 | 1.06 | -10.86 | 0.1120 | -0.0176 | |||

| LKQ / LKQ Corporation | 0.03 | 1.04 | 0.1100 | 0.1100 | |||||

| SJM / The J. M. Smucker Company | 0.01 | 4.22 | 0.98 | 10.34 | 0.1039 | 0.0068 | |||

| EMN / Eastman Chemical Company | 0.01 | -8.25 | 0.95 | -12.08 | 0.1008 | -0.0174 | |||

| AWM / Skyworks Solutions, Inc. | 0.01 | -12.61 | 0.95 | -36.64 | 0.1008 | -0.0633 | |||

| MOS / The Mosaic Company | 0.03 | 0.92 | 0.0972 | 0.0972 | |||||

| IPG / The Interpublic Group of Companies, Inc. | 0.03 | 4.74 | 0.91 | -0.87 | 0.0959 | -0.0039 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.00 | -19.52 | 0.90 | -29.88 | 0.0953 | -0.0448 | |||

| SNA / Snap-on Incorporated | 0.00 | -6.13 | 0.90 | -9.03 | 0.0949 | -0.0127 | |||

| HAL / Halliburton Company | 0.04 | 0.90 | 0.0948 | 0.0948 | |||||

| TOL / Toll Brothers, Inc. | 0.01 | 15.10 | 0.89 | -4.10 | 0.0940 | -0.0071 | |||

| ACI / Albertsons Companies, Inc. | 0.04 | 0.87 | 0.0920 | 0.0920 | |||||

| CAG / Conagra Brands, Inc. | 0.03 | 26.44 | 0.85 | 22.00 | 0.0903 | 0.0139 | |||

| HRB / H&R Block, Inc. | 0.02 | 4.58 | 0.84 | 8.48 | 0.0893 | 0.0044 | |||

| UHS / Universal Health Services, Inc. | 0.00 | 3.95 | 0.84 | 8.42 | 0.0886 | 0.0044 | |||

| OVV / Ovintiv Inc. | 0.02 | 0.83 | 0.0875 | 0.0875 | |||||

| OC / Owens Corning | 0.01 | 17.95 | 0.82 | -0.73 | 0.0865 | -0.0034 | |||

| SCI / Service Corporation International | 0.01 | 3.48 | 0.82 | 3.42 | 0.0864 | 0.0003 | |||

| PKG / Packaging Corporation of America | 0.00 | 0.81 | 0.0855 | 0.0855 | |||||

| ACM / AECOM | 0.01 | 37.61 | 0.81 | 19.03 | 0.0854 | 0.0114 | |||

| CDW / CDW Corporation | 0.00 | -21.96 | 0.80 | -27.26 | 0.0844 | -0.0353 | |||

| HOLX / Hologic, Inc. | 0.01 | 32.03 | 0.79 | 12.01 | 0.0839 | 0.0067 | |||

| QRVO / Qorvo, Inc. | 0.01 | -25.93 | 0.79 | -24.08 | 0.0830 | -0.0297 | |||

| BBWI / Bath & Body Works, Inc. | 0.02 | -4.34 | 0.76 | -23.83 | 0.0808 | -0.0286 | |||

| AOS / A. O. Smith Corporation | 0.01 | 4.68 | 0.75 | 0.94 | 0.0797 | -0.0017 | |||

| NXST / Nexstar Media Group, Inc. | 0.00 | 18.73 | 0.75 | 33.33 | 0.0796 | 0.0180 | |||

| CHRD / Chord Energy Corporation | 0.01 | 0.75 | 0.0791 | 0.0791 | |||||

| DVA / DaVita Inc. | 0.00 | -19.95 | 0.70 | -19.75 | 0.0744 | -0.0212 | |||

| MAN / ManpowerGroup Inc. | 0.01 | 4.48 | 0.70 | 7.85 | 0.0742 | 0.0032 | |||

| PINC / Premier, Inc. | 0.04 | 4.92 | 0.70 | -5.28 | 0.0739 | -0.0066 | |||

| MUSA / Murphy USA Inc. | 0.00 | -6.39 | 0.67 | -13.92 | 0.0714 | -0.0141 | |||

| RHI / Robert Half Inc. | 0.01 | 14.96 | 0.67 | -11.90 | 0.0713 | -0.0122 | |||

| FOX / Fox Corporation | 0.01 | -26.77 | 0.66 | -19.73 | 0.0693 | -0.0197 | |||

| MSM / MSC Industrial Direct Co., Inc. | 0.01 | 0.65 | 0.0686 | 0.0686 | |||||

| BAH / Booz Allen Hamilton Holding Corporation | 0.01 | 0.64 | 0.0675 | 0.0675 | |||||

| LPX / Louisiana-Pacific Corporation | 0.01 | -3.72 | 0.63 | -14.69 | 0.0669 | -0.0141 | |||

| WHR / Whirlpool Corporation | 0.01 | 0.63 | 0.0664 | 0.0664 | |||||

| AM / Antero Midstream Corporation | 0.03 | -14.15 | 0.63 | 1.63 | 0.0662 | -0.0010 | |||

| LOPE / Grand Canyon Education, Inc. | 0.00 | -30.49 | 0.62 | -25.63 | 0.0651 | -0.0252 | |||

| JBL / Jabil Inc. | 0.00 | -50.49 | 0.61 | -53.14 | 0.0647 | -0.0778 | |||

| ARW / Arrow Electronics, Inc. | 0.01 | -4.59 | 0.61 | -11.98 | 0.0646 | -0.0111 | |||

| CROX / Crocs, Inc. | 0.01 | 3.12 | 0.61 | 0.66 | 0.0641 | -0.0017 | |||

| COLM / Columbia Sportswear Company | 0.01 | -3.95 | 0.58 | -13.35 | 0.0618 | -0.0118 | |||

| RL / Ralph Lauren Corporation | 0.00 | -26.93 | 0.58 | -32.09 | 0.0618 | -0.0321 | |||

| 1GNTX / Gentex Corporation | 0.02 | 16.12 | 0.57 | -4.98 | 0.0605 | -0.0052 | |||

| SGI / Somnigroup International Inc. | 0.01 | -31.09 | 0.57 | -29.46 | 0.0598 | -0.0276 | |||

| FBIN / Fortune Brands Innovations, Inc. | 0.01 | 22.40 | 0.56 | 8.98 | 0.0591 | 0.0032 | |||

| ALSN / Allison Transmission Holdings, Inc. | 0.01 | 3.08 | 0.56 | -8.25 | 0.0588 | -0.0074 | |||

| M / Macy's, Inc. | 0.04 | 5.03 | 0.55 | -19.77 | 0.0580 | -0.0166 | |||

| DBX / Dropbox, Inc. | 0.02 | 4.46 | 0.55 | -8.25 | 0.0577 | -0.0072 | |||

| SAIC / Science Applications International Corporation | 0.00 | 62.01 | 0.54 | 64.35 | 0.0576 | 0.0215 | |||

| TER / Teradyne, Inc. | 0.01 | -19.27 | 0.54 | -47.30 | 0.0568 | -0.0543 | |||

| FMC / FMC Corporation | 0.01 | 65.61 | 0.53 | 44.05 | 0.0564 | 0.0160 | |||

| DDS / Dillard's, Inc. | 0.00 | -22.61 | 0.53 | -36.94 | 0.0562 | -0.0357 | |||

| CCK / Crown Holdings, Inc. | 0.01 | 0.52 | 0.0552 | 0.0552 | |||||

| LSTR / Landstar System, Inc. | 0.00 | 12.26 | 0.51 | -4.14 | 0.0539 | -0.0040 | |||

| AN / AutoNation, Inc. | 0.00 | -26.57 | 0.51 | -30.74 | 0.0536 | -0.0263 | |||

| SCCO / Southern Copper Corporation | 0.01 | 43.29 | 0.49 | 47.45 | 0.0520 | 0.0156 | |||

| ALLE / Allegion plc | 0.00 | 4.67 | 0.49 | 2.51 | 0.0520 | -0.0003 | |||

| POOL / Pool Corporation | 0.00 | 0.49 | 0.0519 | 0.0519 | |||||

| LENB / Lennar Corp. - Class B | 0.00 | 79.19 | 0.48 | 47.11 | 0.0512 | 0.0153 | |||

| EXP / Eagle Materials Inc. | 0.00 | 13.59 | 0.48 | 1.92 | 0.0506 | -0.0006 | |||

| PVH / PVH Corp. | 0.01 | 18.32 | 0.48 | -27.62 | 0.0505 | -0.0214 | |||

| FLO / Flowers Foods, Inc. | 0.03 | 26.88 | 0.48 | 16.67 | 0.0503 | 0.0058 | |||

| BC / Brunswick Corporation | 0.01 | 19.43 | 0.47 | -1.05 | 0.0501 | -0.0021 | |||

| NEU / NewMarket Corporation | 0.00 | 0.00 | 0.46 | 3.83 | 0.0488 | 0.0003 | |||

| DXC / DXC Technology Company | 0.03 | -17.48 | 0.45 | -29.66 | 0.0479 | -0.0223 | |||

| HRL / Hormel Foods Corporation | 0.01 | 4.97 | 0.44 | 2.09 | 0.0465 | -0.0005 | |||

| TNL / Travel + Leisure Co. | 0.01 | -15.42 | 0.43 | -21.49 | 0.0456 | -0.0143 | |||

| TTC / The Toro Company | 0.01 | 38.12 | 0.42 | 25.76 | 0.0439 | 0.0078 | |||

| CIVI / Civitas Resources, Inc. | 0.01 | 0.41 | 0.0436 | 0.0436 | |||||

| HII / Huntington Ingalls Industries, Inc. | 0.00 | 0.41 | 0.0431 | 0.0431 | |||||

| BYD / Boyd Gaming Corporation | 0.01 | 2.95 | 0.40 | -5.44 | 0.0424 | -0.0038 | |||

| G / Genpact Limited | 0.01 | -21.88 | 0.40 | -8.55 | 0.0420 | -0.0053 | |||

| INGR / Ingredion Incorporated | 0.00 | 0.00 | 0.40 | -1.74 | 0.0418 | -0.0020 | |||

| LECO / Lincoln Electric Holdings, Inc. | 0.00 | 0.00 | 0.39 | 1.29 | 0.0416 | -0.0008 | |||

| AYI / Acuity Inc. | 0.00 | -17.84 | 0.39 | -26.88 | 0.0412 | -0.0169 | |||

| BWA / BorgWarner Inc. | 0.01 | 0.38 | 0.0404 | 0.0404 | |||||

| SON / Sonoco Products Company | 0.01 | 18.88 | 0.36 | 14.15 | 0.0376 | 0.0037 | |||

| MHK / Mohawk Industries, Inc. | 0.00 | 0.00 | 0.34 | -3.97 | 0.0358 | -0.0027 | |||

| CPB / The Campbell's Company | 0.01 | 0.34 | 0.0357 | 0.0357 | |||||

| POST / Post Holdings, Inc. | 0.00 | -18.99 | 0.33 | -17.94 | 0.0354 | -0.0090 | |||

| SMG / The Scotts Miracle-Gro Company | 0.01 | 35.61 | 0.33 | 14.19 | 0.0349 | 0.0033 | |||

| VAC / Marriott Vacations Worldwide Corporation | 0.00 | 0.31 | 0.0331 | 0.0331 | |||||

| NWL / Newell Brands Inc. | 0.05 | -15.39 | 0.31 | -46.02 | 0.0323 | -0.0293 | |||

| DLB / Dolby Laboratories, Inc. | 0.00 | -41.99 | 0.30 | -40.55 | 0.0319 | -0.0235 | |||

| PAG / Penske Automotive Group, Inc. | 0.00 | -19.75 | 0.30 | -26.37 | 0.0314 | -0.0125 | |||

| KBR / KBR, Inc. | 0.01 | 0.30 | 0.0312 | 0.0312 | |||||

| HOG / Harley-Davidson, Inc. | 0.01 | 35.74 | 0.28 | 14.69 | 0.0298 | 0.0031 | |||

| VFC / V.F. Corporation | 0.02 | -8.77 | 0.26 | -33.16 | 0.0273 | -0.0148 | |||

| AGCO / AGCO Corporation | 0.00 | -33.51 | 0.24 | -33.24 | 0.0251 | -0.0136 | |||

| SEE / Sealed Air Corporation | 0.01 | 4.72 | 0.22 | -9.88 | 0.0232 | -0.0033 | |||

| ASH / Ashland Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0235 | ||||

| EEFT / Euronet Worldwide, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0687 | ||||

| GPN / Global Payments Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2379 | ||||

| STZ / Constellation Brands, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2074 | ||||

| ADP / Automatic Data Processing, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4136 | ||||

| LBTYK / Liberty Global Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0463 | ||||

| CLF / Cleveland-Cliffs Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0460 | ||||

| CRI / Carter's, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0772 | ||||

| LBTYA / Liberty Global Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0466 | ||||

| WH / Wyndham Hotels & Resorts, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0489 | ||||

| MDLZ / Mondelez International, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5051 | ||||

| HSY / The Hershey Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1369 | ||||

| OLN / Olin Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0625 | ||||

| GEN / Gen Digital Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0842 | ||||

| JNPR / Juniper Networks, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0647 | ||||

| DPZ / Domino's Pizza, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0718 | ||||

| WEN / The Wendy's Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0433 | ||||

| GDDY / GoDaddy Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1386 | ||||

| SNRE / Sunrise Communications AG - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.0628 | ||||

| SPB / Spectrum Brands Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0339 | ||||

| MGM / MGM Resorts International | 0.00 | -100.00 | 0.00 | -100.00 | -0.0739 | ||||

| KSS / Kohl's Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0607 | ||||

| CHH / Choice Hotels International, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0284 | ||||

| CE / Celanese Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0407 | ||||

| FANG / Diamondback Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2627 | ||||

| CPAY / Corpay, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1884 | ||||

| ROST / Ross Stores, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2285 | ||||

| FIS / Fidelity National Information Services, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3836 | ||||

| HUN / Huntsman Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0561 | ||||

| NUE / Nucor Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.3314 | ||||

| RH / RH | 0.00 | -100.00 | 0.00 | -100.00 | -0.0451 |