Mga Batayang Estadistika

| Nilai Portofolio | $ 336,206,319 |

| Posisi Saat Ini | 45 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

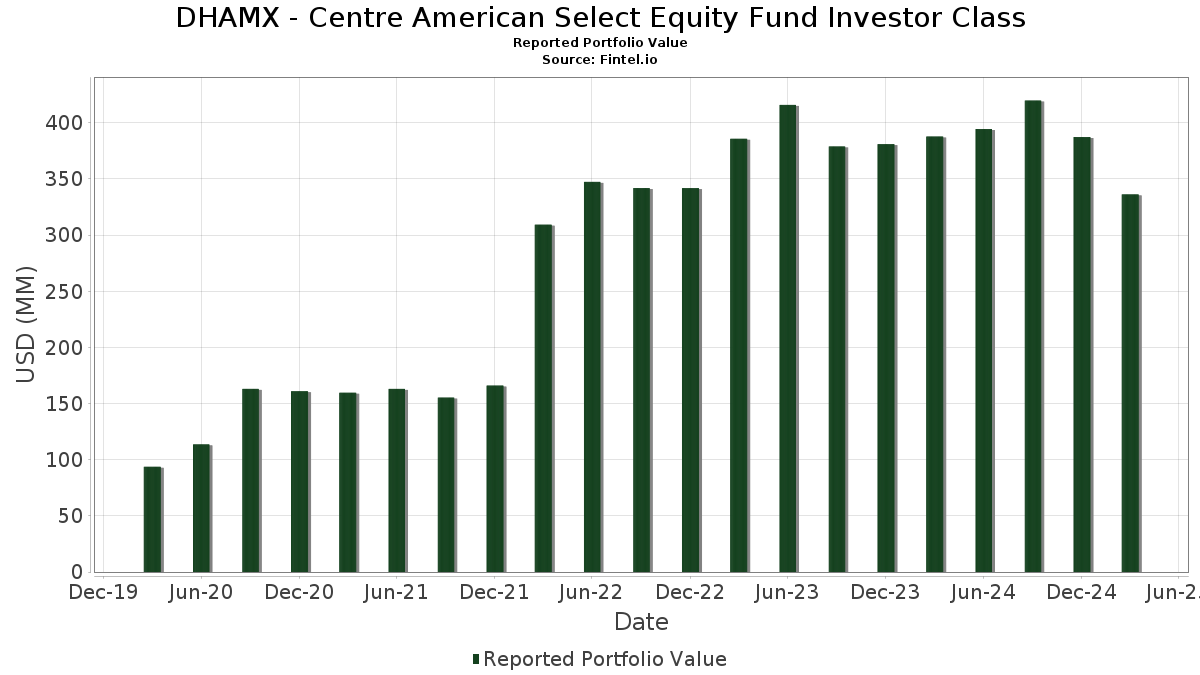

DHAMX - Centre American Select Equity Fund Investor Class telah mengungkapkan total kepemilikan 45 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 336,206,319 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama DHAMX - Centre American Select Equity Fund Investor Class adalah Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Amazon.com, Inc. (US:AMZN) , and Paramount Global (US:PARA) . Posisi baru DHAMX - Centre American Select Equity Fund Investor Class meliputi: United States Steel Corporation (MX:X) , Regeneron Pharmaceuticals, Inc. (US:REGN) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 8.31 | 2.4690 | 2.4690 | |

| 0.19 | 8.03 | 2.3875 | 2.3875 | |

| 0.01 | 7.10 | 2.1094 | 2.1094 | |

| 0.08 | 6.59 | 1.9596 | 1.9596 | |

| 0.02 | 8.01 | 2.3799 | 1.6920 | |

| 0.05 | 18.53 | 5.5091 | 0.9054 | |

| 0.00 | 2.86 | 0.8491 | 0.8491 | |

| 0.05 | 4.54 | 1.3485 | 0.6473 | |

| 0.91 | 10.93 | 3.2498 | 0.5868 | |

| 0.18 | 7.40 | 2.2000 | 0.5342 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.9955 | ||

| 0.02 | 2.90 | 0.8632 | -1.9131 | |

| 0.00 | 0.00 | -1.6536 | ||

| 0.16 | 17.73 | 5.2709 | -1.4805 | |

| 0.02 | 5.13 | 1.5251 | -0.6598 | |

| 0.05 | 7.16 | 2.1294 | -0.4090 | |

| 0.11 | 23.94 | 7.1152 | -0.3647 | |

| 0.10 | 8.16 | 2.4245 | -0.3399 | |

| 0.03 | 4.40 | 1.3068 | -0.3132 | |

| 0.04 | 6.70 | 1.9905 | -0.3024 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-05-28 untuk periode pelaporan 2025-03-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.11 | -6.94 | 23.94 | -17.45 | 7.1152 | -0.3647 | |||

| MSFT / Microsoft Corporation | 0.05 | 16.61 | 18.53 | 3.85 | 5.5091 | 0.9054 | |||

| NVDA / NVIDIA Corporation | 0.16 | -16.05 | 17.73 | -32.25 | 5.2709 | -1.4805 | |||

| AMZN / Amazon.com, Inc. | 0.07 | -7.15 | 13.00 | -19.47 | 3.8655 | -0.3005 | |||

| PARA / Paramount Global | 0.91 | -7.38 | 10.93 | 5.90 | 3.2498 | 0.5868 | |||

| MDT / Medtronic plc | 0.11 | -7.16 | 10.18 | 4.43 | 3.0253 | 0.5115 | |||

| MO / Altria Group, Inc. | 0.16 | -7.16 | 9.56 | 6.57 | 2.8419 | 0.5276 | |||

| META / Meta Platforms, Inc. | 0.02 | -7.16 | 9.47 | -8.61 | 2.8145 | 0.1419 | |||

| TSN / Tyson Foods, Inc. | 0.14 | -7.15 | 8.86 | 3.13 | 2.6324 | 0.4176 | |||

| PFE / Pfizer Inc. | 0.34 | -7.15 | 8.63 | -11.32 | 2.5642 | 0.0549 | |||

| AMGN / Amgen Inc. | 0.03 | 8.31 | 2.4690 | 2.4690 | |||||

| IFF / International Flavors & Fragrances Inc. | 0.11 | -7.11 | 8.29 | -14.74 | 2.4654 | -0.0439 | |||

| MKC / McCormick & Company, Incorporated | 0.10 | -29.50 | 8.16 | -23.89 | 2.4245 | -0.3399 | |||

| JAZZ / Jazz Pharmaceuticals plc | 0.06 | -7.31 | 8.05 | -6.56 | 2.3922 | 0.1705 | |||

| X / United States Steel Corporation | 0.19 | 8.03 | 2.3875 | 2.3875 | |||||

| ADBE / Adobe Inc. | 0.02 | 375.51 | 8.01 | 205.69 | 2.3799 | 1.6920 | |||

| HAS / Hasbro, Inc. | 0.13 | -7.16 | 7.92 | 2.11 | 2.3543 | 0.3534 | |||

| UPS / United Parcel Service, Inc. | 0.07 | -0.01 | 7.67 | -12.78 | 2.2786 | 0.0114 | |||

| FMC / FMC Corporation | 0.18 | 32.06 | 7.40 | 14.62 | 2.2000 | 0.5342 | |||

| CL / Colgate-Palmolive Company | 0.08 | -3.94 | 7.32 | -1.00 | 2.1771 | 0.2688 | |||

| CLX / The Clorox Company | 0.05 | -19.71 | 7.16 | -27.20 | 2.1294 | -0.4090 | |||

| BIIB / Biogen Inc. | 0.05 | 9.71 | 7.14 | -1.83 | 2.1217 | 0.2461 | |||

| HXL / Hexcel Corporation | 0.13 | 12.26 | 7.11 | -1.96 | 2.1136 | 0.2428 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.01 | 7.10 | 2.1094 | 2.1094 | |||||

| MU / Micron Technology, Inc. | 0.08 | 37.04 | 7.08 | 52.89 | 2.1045 | 0.4759 | |||

| INCY / Incyte Corporation | 0.12 | -7.16 | 7.06 | -18.61 | 2.0987 | -0.1390 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -21.81 | 6.94 | 2.37 | 2.0634 | 0.3461 | |||

| GOOGL / Alphabet Inc. | 0.04 | -7.78 | 6.70 | -24.66 | 1.9905 | -0.3024 | |||

| CF / CF Industries Holdings, Inc. | 0.08 | 6.59 | 1.9596 | 1.9596 | |||||

| GNRC / Generac Holdings Inc. | 0.05 | -6.95 | 6.20 | -24.00 | 1.8418 | -0.2610 | |||

| GOOG / Alphabet Inc. | 0.04 | -7.78 | 5.71 | -24.35 | 1.6976 | -0.2497 | |||

| TSLA / Tesla, Inc. | 0.02 | -5.61 | 5.13 | -39.43 | 1.5251 | -0.6598 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -22.05 | 5.07 | -5.44 | 1.5083 | 0.1490 | |||

| LLY / Eli Lilly and Company | 0.01 | -7.77 | 4.83 | -1.33 | 1.4369 | 0.1732 | |||

| MRK / Merck & Co., Inc. | 0.05 | 106.38 | 4.54 | 69.95 | 1.3485 | 0.6473 | |||

| V / Visa Inc. | 0.01 | -13.46 | 4.45 | 15.54 | 1.3217 | 0.3471 | |||

| AVGO / Broadcom Inc. | 0.03 | 559.06 | 4.40 | -31.27 | 1.3068 | -0.3132 | |||

| XOM / Exxon Mobil Corporation | 0.03 | -20.47 | 3.73 | -17.85 | 1.1099 | -0.0411 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -20.84 | 3.52 | -18.60 | 1.0459 | -0.0487 | |||

| MA / Mastercard Incorporated | 0.01 | -22.90 | 3.24 | -12.26 | 0.9636 | 0.0116 | |||

| COST / Costco Wholesale Corporation | 0.00 | -26.17 | 2.98 | 5.79 | 0.8859 | 0.1459 | |||

| JNJ / Johnson & Johnson | 0.02 | -76.47 | 2.90 | -73.02 | 0.8632 | -1.9131 | |||

| PG / The Procter & Gamble Company | 0.02 | -21.33 | 2.90 | -18.72 | 0.8626 | -0.0415 | |||

| NFLX / Netflix, Inc. | 0.00 | 2.86 | 0.8491 | 0.8491 | |||||

| FXFXX / First American Funds Inc - First American Treasury Obligations Fund Class X | 0.89 | 2,752.49 | 0.89 | 2,764.52 | 0.2640 | 0.2560 | |||

| BDX / Becton, Dickinson and Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.9955 | ||||

| TU / TELUS Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.6536 |