Mga Batayang Estadistika

| Profil Orang Dalam | CINCINNATI FINANCIAL CORP |

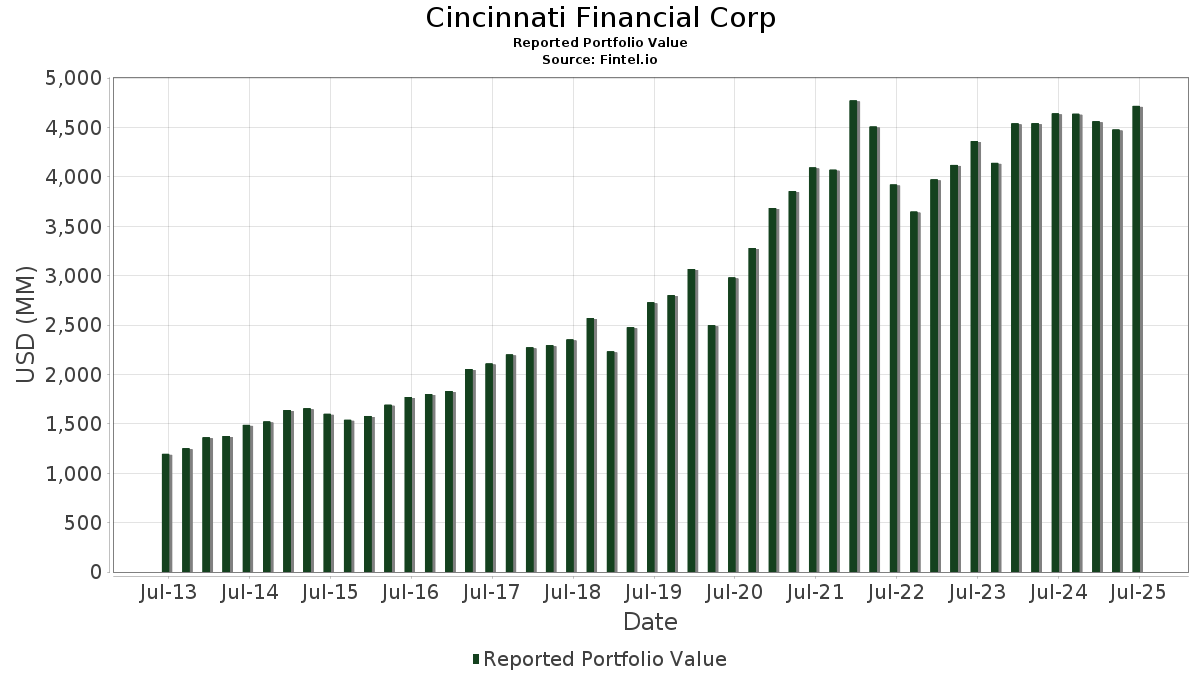

| Nilai Portofolio | $ 4,719,177,895 |

| Posisi Saat Ini | 53 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Cincinnati Financial Corp telah mengungkapkan total kepemilikan 53 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 4,719,177,895 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Cincinnati Financial Corp adalah Apple Inc. (US:AAPL) , Broadcom Inc. (US:AVGO) , CME Group Inc. (US:CME) , Microsoft Corporation (US:MSFT) , and Philip Morris International Inc. (US:PM) . Posisi baru Cincinnati Financial Corp meliputi: Ares Management Corporation (US:ARES) , Western Alliance Bancorporation (US:WAL) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.72 | 475.47 | 10.0753 | 3.6274 | |

| 0.49 | 244.30 | 5.1768 | 1.0604 | |

| 0.93 | 65.78 | 1.3939 | 0.4322 | |

| 0.11 | 18.71 | 0.3964 | 0.3964 | |

| 1.10 | 200.65 | 4.2519 | 0.3476 | |

| 0.15 | 17.73 | 0.3757 | 0.2677 | |

| 0.45 | 106.13 | 2.2488 | 0.2413 | |

| 2.55 | 176.68 | 3.7438 | 0.2353 | |

| 0.17 | 23.52 | 0.4983 | 0.2177 | |

| 0.84 | 195.04 | 4.1329 | 0.1735 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.47 | 146.26 | 3.0992 | -2.3829 | |

| 2.80 | 573.86 | 12.1602 | -1.7732 | |

| 0.57 | 105.21 | 2.2294 | -0.4220 | |

| 0.45 | 130.79 | 2.7714 | -0.3505 | |

| 0.34 | 104.79 | 2.2206 | -0.3133 | |

| 0.36 | 105.14 | 2.2279 | -0.2189 | |

| 0.34 | 101.02 | 2.1407 | -0.2140 | |

| 0.82 | 90.59 | 1.9196 | -0.2105 | |

| 0.43 | 156.21 | 3.3101 | -0.1761 | |

| 0.73 | 65.26 | 1.3830 | -0.1683 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-07 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 2.80 | -0.44 | 573.86 | -8.05 | 12.1602 | -1.7732 | |||

| AVGO / Broadcom Inc. | 1.72 | 0.00 | 475.47 | 64.64 | 10.0753 | 3.6274 | |||

| CME / CME Group Inc. | 1.00 | 0.00 | 276.17 | 3.89 | 5.8521 | -0.0827 | |||

| MSFT / Microsoft Corporation | 0.49 | 0.00 | 244.30 | 32.50 | 5.1768 | 1.0604 | |||

| PM / Philip Morris International Inc. | 1.10 | 0.00 | 200.65 | 14.74 | 4.2519 | 0.3476 | |||

| HON / Honeywell International Inc. | 0.84 | 0.00 | 195.04 | 9.98 | 4.1329 | 0.1735 | |||

| CSCO / Cisco Systems, Inc. | 2.55 | 0.00 | 176.68 | 12.43 | 3.7438 | 0.2353 | |||

| HD / The Home Depot, Inc. | 0.43 | 0.00 | 156.21 | 0.04 | 3.3101 | -0.1761 | |||

| DOV / Dover Corporation | 0.84 | 0.00 | 154.57 | 4.30 | 3.2754 | -0.0334 | |||

| QCOM / QUALCOMM Incorporated | 0.96 | 0.00 | 152.49 | 3.68 | 3.2313 | -0.0525 | |||

| NSC / Norfolk Southern Corporation | 0.59 | 0.00 | 150.43 | 8.07 | 3.1876 | 0.0799 | |||

| UNH / UnitedHealth Group Incorporated | 0.47 | 0.00 | 146.26 | -40.44 | 3.0992 | -2.3829 | |||

| MCD / McDonald's Corporation | 0.45 | 0.00 | 130.79 | -6.47 | 2.7714 | -0.3505 | |||

| TJX / The TJX Companies, Inc. | 0.87 | 0.00 | 107.00 | 1.39 | 2.2674 | -0.0889 | |||

| ADI / Analog Devices, Inc. | 0.45 | 0.00 | 106.13 | 18.02 | 2.2488 | 0.2413 | |||

| ABBV / AbbVie Inc. | 0.57 | 0.00 | 105.21 | -11.41 | 2.2294 | -0.4220 | |||

| CB / Chubb Limited | 0.36 | 0.00 | 105.14 | -4.06 | 2.2279 | -0.2189 | |||

| SNA / Snap-on Incorporated | 0.34 | 0.00 | 104.79 | -7.66 | 2.2206 | -0.3133 | |||

| ACN / Accenture plc | 0.34 | 0.00 | 101.02 | -4.21 | 2.1407 | -0.2140 | |||

| MDLZ / Mondelez International, Inc. | 1.45 | 0.00 | 97.65 | -0.60 | 2.0693 | -0.1242 | |||

| RPM / RPM International Inc. | 0.82 | 0.00 | 90.59 | -5.05 | 1.9196 | -0.2105 | |||

| ADP / Automatic Data Processing, Inc. | 0.23 | 0.00 | 71.78 | 0.94 | 1.5210 | -0.0667 | |||

| VLO / Valero Energy Corporation | 0.51 | 0.00 | 69.18 | 1.78 | 1.4659 | -0.0516 | |||

| MCHP / Microchip Technology Incorporated | 0.93 | 5.06 | 65.78 | 52.72 | 1.3939 | 0.4322 | |||

| PNW / Pinnacle West Capital Corporation | 0.73 | 0.00 | 65.26 | -6.07 | 1.3830 | -0.1683 | |||

| PLD / Prologis, Inc. | 0.59 | 0.00 | 62.02 | -5.97 | 1.3142 | -0.1583 | |||

| AMT / American Tower Corporation | 0.20 | 0.00 | 44.56 | 1.57 | 0.9443 | -0.0352 | |||

| APD / Air Products and Chemicals, Inc. | 0.15 | 0.00 | 41.15 | -4.36 | 0.8720 | -0.0887 | |||

| USB / U.S. Bancorp | 0.76 | 0.00 | 34.55 | 7.18 | 0.7321 | 0.0124 | |||

| ABT / Abbott Laboratories | 0.24 | 0.00 | 32.34 | 2.53 | 0.6854 | -0.0189 | |||

| MMM / 3M Company | 0.21 | 0.00 | 32.12 | 3.66 | 0.6807 | -0.0112 | |||

| JNJ / Johnson & Johnson | 0.20 | 0.00 | 30.70 | -7.89 | 0.6506 | -0.0936 | |||

| BLK / BlackRock, Inc. | 0.03 | 0.00 | 30.26 | 10.86 | 0.6413 | 0.0318 | |||

| CMCSA / Comcast Corporation | 0.78 | 0.00 | 27.72 | -3.28 | 0.5874 | -0.0525 | |||

| LAM RESEARCH ORD / (US5128073) | 0.28 | 26.99 | 0.0000 | ||||||

| JPM / JPMorgan Chase & Co. | 0.09 | 0.00 | 26.09 | 18.18 | 0.5529 | 0.0600 | |||

| OC / Owens Corning | 0.17 | 94.32 | 23.52 | 87.10 | 0.4983 | 0.2177 | |||

| VZ / Verizon Communications Inc. | 0.49 | 0.00 | 21.06 | -4.61 | 0.4463 | -0.0466 | |||

| HAS / Hasbro, Inc. | 0.26 | 0.00 | 19.24 | 20.05 | 0.4076 | 0.0499 | |||

| ARES / Ares Management Corporation | 0.11 | 18.71 | 0.3964 | 0.3964 | |||||

| DG / Dollar General Corporation | 0.15 | 181.82 | 17.73 | 266.58 | 0.3757 | 0.2677 | |||

| PEP / PepsiCo, Inc. | 0.13 | 0.00 | 16.84 | -11.94 | 0.3567 | -0.0701 | |||

| T / AT&T Inc. | 0.53 | 0.00 | 15.40 | 2.34 | 0.3262 | -0.0097 | |||

| PFE / Pfizer Inc. | 0.58 | 0.00 | 14.04 | -4.34 | 0.2975 | -0.0302 | |||

| LYB / LyondellBasell Industries N.V. | 0.22 | 0.00 | 12.84 | -17.81 | 0.2722 | -0.0767 | |||

| RTX / RTX Corporation | 0.07 | 0.00 | 10.37 | 10.24 | 0.2197 | 0.0097 | |||

| ENB / Enbridge Inc. | 0.19 | 0.00 | 8.42 | 2.27 | 0.1785 | -0.0054 | |||

| PG / The Procter & Gamble Company | 0.05 | 0.00 | 7.95 | -6.50 | 0.1685 | -0.0214 | |||

| NEE / NextEra Energy, Inc. | 0.09 | 79.17 | 5.97 | 75.49 | 0.1265 | 0.0505 | |||

| CVX / Chevron Corporation | 0.04 | 0.00 | 5.03 | -14.41 | 0.1066 | -0.0246 | |||

| DUK / Duke Energy Corporation | 0.04 | 0.00 | 4.58 | -3.26 | 0.0970 | -0.0086 | |||

| WAL / Western Alliance Bancorporation | 0.05 | 3.90 | 0.0826 | 0.0826 | |||||

| NSA / National Storage Affiliates Trust | 0.08 | 0.00 | 2.62 | -18.79 | 0.0556 | -0.0166 | |||

| LRCX / Lam Research Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |