Mga Batayang Estadistika

| Nilai Portofolio | $ 70,675,000 |

| Posisi Saat Ini | 26 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

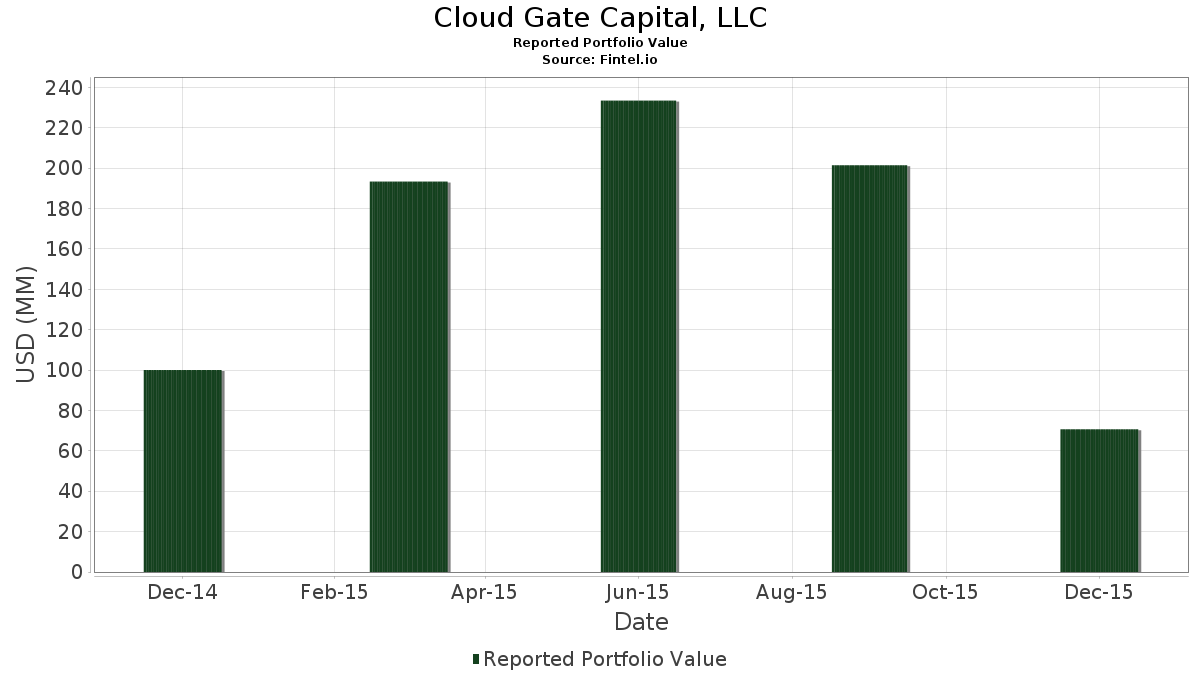

Cloud Gate Capital, LLC telah mengungkapkan total kepemilikan 26 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 70,675,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Cloud Gate Capital, LLC adalah Macy's, Inc. (US:M) , Cheniere Energy Partners, L.P. - Limited Partnership (US:CQP) , CVS Health Corporation (US:CVS) , Ventas, Inc. (US:VTR) , and Beamr Imaging Ltd. (US:BMR) . Posisi baru Cloud Gate Capital, LLC meliputi: Macy's, Inc. (US:M) , CBS Corp. (US:19041P105) , Labcorp Holdings Inc. (US:LH) , Capital Senior Living Corp. (US:CSU) , and Extended Stay America Inc (US:US30224P2002) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.17 | 5.96 | 8.4400 | 8.4400 | |

| 0.24 | 3.57 | 5.0555 | 5.0555 | |

| 0.22 | 5.61 | 7.9349 | 4.9788 | |

| 0.06 | 2.98 | 4.2122 | 4.2122 | |

| 0.09 | 4.91 | 6.9473 | 3.6560 | |

| 0.02 | 2.39 | 3.3831 | 3.3831 | |

| 0.05 | 5.00 | 7.0817 | 3.1708 | |

| 0.10 | 2.18 | 3.0860 | 3.0860 | |

| 0.07 | 2.76 | 3.9024 | 2.4834 | |

| 0.03 | 2.39 | 3.3774 | 2.0031 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -6.0523 | ||

| 0.00 | 0.00 | -5.7266 | ||

| 0.00 | 0.00 | -5.0399 | ||

| 0.00 | 0.00 | -4.4983 | ||

| 0.07 | 1.20 | 1.7036 | -3.7336 | |

| 0.00 | 0.00 | -3.7113 | ||

| 0.00 | 0.00 | -3.6984 | ||

| 0.00 | 0.00 | -2.6448 | ||

| 0.00 | 0.00 | -2.5967 | ||

| 0.00 | 0.00 | -2.2491 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2016-02-16 untuk periode pelaporan 2015-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| M / Macy's, Inc. | 0.17 | 5.96 | 8.4400 | 8.4400 | |||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 0.22 | -4.86 | 5.61 | -5.81 | 7.9349 | 4.9788 | |||

| CVS / CVS Health Corporation | 0.05 | -37.28 | 5.00 | -36.46 | 7.0817 | 3.1708 | |||

| VTR / Ventas, Inc. | 0.09 | -26.40 | 4.91 | -25.93 | 6.9473 | 3.6560 | |||

| BMR / Beamr Imaging Ltd. | 0.16 | -67.51 | 3.81 | -61.47 | 5.3937 | 0.4814 | |||

| BERY / Berry Global Group, Inc. | 0.10 | -79.10 | 3.65 | -74.85 | 5.1673 | -2.0423 | |||

| APO / Apollo Global Management, Inc. | 0.24 | -42.82 | 3.57 | -49.48 | 5.0555 | 5.0555 | |||

| CQH / Cheniere Energy Partners LP Holdings, LLC | 0.19 | -64.74 | 3.32 | -67.73 | 4.6990 | -0.4110 | |||

| SPG / Simon Property Group, Inc. | 0.02 | -48.70 | 3.24 | -45.70 | 4.5858 | 1.6222 | |||

| 19041P105 / CBS Corp. | 0.06 | 2.98 | 4.2122 | 4.2122 | |||||

| SCI / Service Corporation International | 0.11 | -38.83 | 2.84 | -41.29 | 4.0198 | 1.6173 | |||

| CONE / CyrusOne Inc | 0.07 | -15.85 | 2.76 | -3.50 | 3.9024 | 2.4834 | |||

| SLRC / SLR Investment Corp. | 0.16 | -61.00 | 2.67 | -59.52 | 3.7821 | 0.5037 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.12 | -40.24 | 2.47 | -44.23 | 3.4892 | 1.2937 | |||

| LH / Labcorp Holdings Inc. | 0.02 | 2.39 | 3.3831 | 3.3831 | |||||

| / Delphi Technologies PLC | 0.03 | -23.50 | 2.39 | -13.76 | 3.3774 | 2.0031 | |||

| UAL / United Airlines Holdings, Inc. | 0.04 | -57.12 | 2.27 | -53.66 | 3.2119 | 0.7795 | |||

| CSU / Capital Senior Living Corp. | 0.10 | 2.18 | 3.0860 | 3.0860 | |||||

| STAG / STAG Industrial, Inc. | 0.09 | -71.63 | 1.73 | -71.27 | 2.4436 | -0.5409 | |||

| DAL / Delta Air Lines, Inc. | 0.03 | -62.09 | 1.49 | -57.19 | 2.1054 | 0.3796 | |||

| BKD / Brookdale Senior Living Inc. | 0.07 | -86.32 | 1.20 | -89.01 | 1.7036 | -3.7336 | |||

| US30224P2002 / Extended Stay America Inc | 0.07 | 1.14 | 1.6158 | 1.6158 | |||||

| HST / Host Hotels & Resorts, Inc. | 0.07 | -78.92 | 1.08 | -79.55 | 1.5310 | -1.0965 | |||

| SUN / Sunoco LP - Limited Partnership | 0.03 | 1.06 | 1.5012 | 1.5012 | |||||

| HOT / Starwood Hotels & Resorts Worldwide, Inc. | 0.01 | 0.86 | 1.2140 | 1.2140 | |||||

| UAL / United Airlines Holdings, Inc. | Put | 0.04 | 0.08 | 0.1160 | 0.1160 | ||||

| ECPG / Encore Capital Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.9587 | ||||

| ARI / Apollo Commercial Real Estate Finance, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.2491 | ||||

| AXL / American Axle & Manufacturing Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.0406 | ||||

| PRAA / PRA Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.6984 | ||||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -4.4983 | ||||

| STON / StoneMor Inc | 0.00 | -100.00 | 0.00 | -100.00 | -1.4875 | ||||

| TMX / Terminix Global Holdings Inc | 0.00 | -100.00 | 0.00 | -100.00 | -2.5967 | ||||

| FDX / FedEx Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -6.0523 | ||||

| CBRE / CBRE Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -5.0399 | ||||

| / Delphi Technologies PLC | 0.00 | -100.00 | 0.00 | -100.00 | -1.2929 | ||||

| MGM / MGM Resorts International | 0.00 | -100.00 | 0.00 | -100.00 | -2.6448 | ||||

| RRTS / Roadrunner Transportation Systems, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.6022 | ||||

| PAGP / Plains GP Holdings, L.P. - Limited Partnership | 0.00 | -100.00 | 0.00 | -100.00 | -1.1946 | ||||

| PAA / Plains All American Pipeline, L.P. - Limited Partnership | 0.00 | -100.00 | 0.00 | -100.00 | -1.2437 | ||||

| BX / Blackstone Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.7113 | ||||

| R / Ryder System, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.4617 | ||||

| CP / Canadian Pacific Kansas City Limited | 0.00 | -100.00 | 0.00 | -100.00 | -5.7266 |