Mga Batayang Estadistika

| Nilai Portofolio | $ 1,209,766,832 |

| Posisi Saat Ini | 41 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

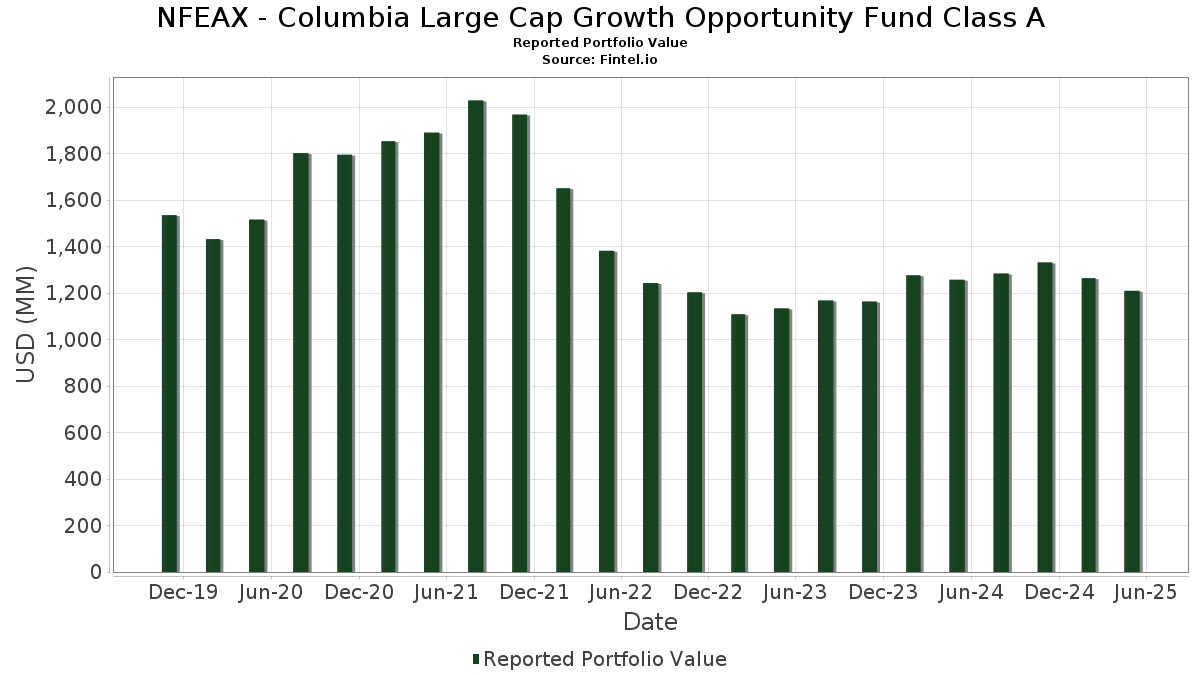

NFEAX - Columbia Large Cap Growth Opportunity Fund Class A telah mengungkapkan total kepemilikan 41 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,209,766,832 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama NFEAX - Columbia Large Cap Growth Opportunity Fund Class A adalah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Amazon.com, Inc. (US:AMZN) , Alphabet Inc. (US:GOOGL) , and Meta Platforms, Inc. (US:META) . Posisi baru NFEAX - Columbia Large Cap Growth Opportunity Fund Class A meliputi: Synopsys, Inc. (US:SNPS) , GS Connect S&P GSCI Enhanced Commodity Total Return ETN (US:GSCE) , Cencora, Inc. (US:COR) , ON Semiconductor Corporation (US:ON) , and Realty Income Corporation (US:O) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 17.97 | 1.4852 | 1.4852 | |

| 0.35 | 161.25 | 13.3273 | 1.4683 | |

| 0.03 | 17.69 | 1.4618 | 1.4618 | |

| 0.05 | 15.27 | 1.2623 | 1.2623 | |

| 0.31 | 12.82 | 1.0595 | 1.0595 | |

| 0.22 | 12.72 | 1.0514 | 1.0514 | |

| 0.16 | 38.93 | 3.2175 | 0.7041 | |

| 1.00 | 135.03 | 11.1601 | 0.3656 | |

| 0.10 | 15.10 | 1.2477 | 0.3497 | |

| 0.06 | 3.63 | 0.2997 | 0.2997 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.14 | 18.28 | 1.5109 | -2.9679 | |

| 0.00 | 0.00 | -1.2851 | ||

| 0.11 | 68.25 | 5.6410 | -1.1620 | |

| 0.05 | 35.89 | 2.9664 | -1.0492 | |

| 0.32 | 65.11 | 5.3808 | -0.8421 | |

| 0.06 | 14.09 | 1.1644 | -0.7256 | |

| 0.00 | 0.00 | -0.3857 | ||

| 0.24 | 20.61 | 1.7031 | -0.3818 | |

| 0.02 | 2.94 | 0.2433 | -0.3646 | |

| 0.05 | 19.91 | 1.6458 | -0.3577 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-25 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.35 | -7.22 | 161.25 | 7.59 | 13.3273 | 1.4683 | |||

| NVDA / NVIDIA Corporation | 1.00 | -8.50 | 135.03 | -1.02 | 11.1601 | 0.3656 | |||

| AMZN / Amazon.com, Inc. | 0.47 | -0.33 | 97.04 | -3.74 | 8.0202 | 0.0437 | |||

| GOOGL / Alphabet Inc. | 0.42 | -0.33 | 72.78 | 0.53 | 6.0152 | 0.2868 | |||

| META / Meta Platforms, Inc. | 0.11 | -18.08 | 68.25 | -20.62 | 5.6410 | -1.1620 | |||

| AAPL / Apple Inc. | 0.32 | -0.33 | 65.11 | -17.22 | 5.3808 | -0.8421 | |||

| V / Visa Inc. | 0.12 | -1.90 | 43.83 | -1.23 | 3.6226 | 0.1114 | |||

| AVGO / Broadcom Inc. | 0.16 | 0.97 | 38.93 | 22.55 | 3.2175 | 0.7041 | |||

| LLY / Eli Lilly and Company | 0.05 | -11.74 | 35.89 | -29.28 | 2.9664 | -1.0492 | |||

| COST / Costco Wholesale Corporation | 0.03 | -6.26 | 34.28 | -7.02 | 2.8332 | -0.0838 | |||

| TSLA / Tesla, Inc. | 0.09 | -21.02 | 30.50 | -6.61 | 2.5208 | -0.0632 | |||

| NOW / ServiceNow, Inc. | 0.02 | 3.41 | 23.36 | 12.46 | 1.9305 | 0.2871 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.05 | -25.10 | 21.24 | -9.39 | 1.7551 | -0.0993 | |||

| ISRG / Intuitive Surgical, Inc. | 0.04 | -5.99 | 21.21 | -9.40 | 1.7527 | -0.0993 | |||

| UBER / Uber Technologies, Inc. | 0.24 | -29.37 | 20.61 | -21.80 | 1.7031 | -0.3818 | |||

| ADBE / Adobe Inc. | 0.05 | -16.91 | 19.91 | -21.35 | 1.6458 | -0.3577 | |||

| CTAS / Cintas Corporation | 0.08 | -18.59 | 18.57 | -11.14 | 1.5351 | -0.1187 | |||

| TJX / The TJX Companies, Inc. | 0.14 | -78.62 | 18.28 | -66.10 | 1.5109 | -2.9679 | |||

| PANW / Palo Alto Networks, Inc. | 0.09 | -11.77 | 18.19 | -10.85 | 1.5036 | -0.1111 | |||

| SNPS / Synopsys, Inc. | 0.04 | 17.97 | 1.4852 | 1.4852 | |||||

| GSCE / GS Connect S&P GSCI Enhanced Commodity Total Return ETN | 0.03 | 17.69 | 1.4618 | 1.4618 | |||||

| PG / The Procter & Gamble Company | 0.10 | -9.10 | 17.26 | -11.16 | 1.4265 | -0.1108 | |||

| TEL / TE Connectivity plc | 0.11 | -10.22 | 16.91 | -6.70 | 1.3975 | -0.0364 | |||

| COR / Cencora, Inc. | 0.05 | 15.27 | 1.2623 | 1.2623 | |||||

| TKO / TKO Group Holdings, Inc. | 0.10 | 26.97 | 15.10 | 33.02 | 1.2477 | 0.3497 | |||

| EQIX / Equinix, Inc. | 0.02 | -16.85 | 14.50 | -18.30 | 1.1982 | -0.2059 | |||

| ETN / Eaton Corporation plc | 0.04 | -17.24 | 14.10 | -9.66 | 1.1654 | -0.0696 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.06 | -37.10 | 14.09 | -41.02 | 1.1644 | -0.7256 | |||

| AME / AMETEK, Inc. | 0.08 | -16.37 | 13.84 | -21.03 | 1.1435 | -0.2428 | |||

| ON / ON Semiconductor Corporation | 0.31 | 12.82 | 1.0595 | 1.0595 | |||||

| NKE / NIKE, Inc. | 0.21 | 21.08 | 12.82 | -22.82 | 1.0593 | -0.2613 | |||

| O / Realty Income Corporation | 0.22 | 12.72 | 1.0514 | 1.0514 | |||||

| TEAM / Atlassian Corporation | 0.06 | -1.90 | 12.62 | -28.35 | 1.0429 | -0.3505 | |||

| EXPE / Expedia Group, Inc. | 0.08 | 4.15 | 12.59 | -12.27 | 1.0406 | -0.0949 | |||

| DDOG / Datadog, Inc. | 0.10 | -18.19 | 11.42 | -17.26 | 0.9435 | -0.1481 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.02 | -22.78 | 10.87 | -28.85 | 0.8987 | -0.3105 | |||

| GTLB / GitLab Inc. | 0.17 | -8.66 | 7.76 | -30.96 | 0.6416 | -0.2481 | |||

| INSM / Insmed Incorporated | 0.07 | -27.10 | 5.06 | -37.67 | 0.4181 | -0.2240 | |||

| MRUS / Merus N.V. | 0.06 | 3.63 | 0.2997 | 0.2997 | |||||

| 19766H239 / COLUMBIA SHORT TERM CASH FUND | 3.54 | -37.32 | 3.54 | -37.34 | 0.2923 | -0.1542 | |||

| NTRA / Natera, Inc. | 0.02 | -62.21 | 2.94 | -61.69 | 0.2433 | -0.3646 | |||

| BURL / Burlington Stores, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2851 | ||||

| EXAS / Exact Sciences Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.3857 |