Mga Batayang Estadistika

| Nilai Portofolio | $ 4,077,113,097 |

| Posisi Saat Ini | 110 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

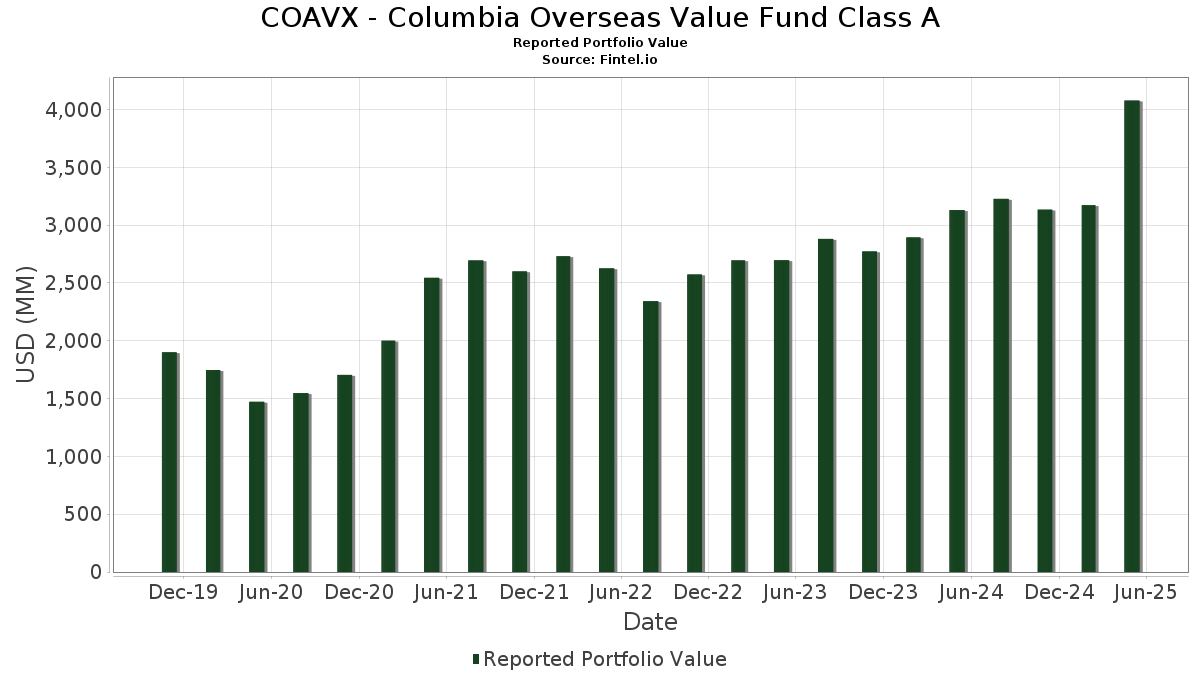

COAVX - Columbia Overseas Value Fund Class A telah mengungkapkan total kepemilikan 110 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 4,077,113,097 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama COAVX - Columbia Overseas Value Fund Class A adalah Banco Santander, S.A. (IT:1SANX) , Shell plc (NL:SHELL) , TotalEnergies SE (CH:FP) , AXA SA (FR:CS) , and Engie SA (FR:ENGI) . Posisi baru COAVX - Columbia Overseas Value Fund Class A meliputi: Iyogin Holdings Inc (JP:JP3149700001) , BW LPG Limited (GB:BWLPGO) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.53 | 97.56 | 2.3763 | 1.7549 | |

| 109.62 | 85.51 | 2.0827 | 0.8420 | |

| 2.64 | 36.94 | 0.8998 | 0.7888 | |

| 5.25 | 91.96 | 2.2398 | 0.6526 | |

| 17.75 | 63.55 | 1.5478 | 0.6028 | |

| 11.99 | 49.08 | 1.1955 | 0.5965 | |

| 9.78 | 49.34 | 1.2018 | 0.5297 | |

| 1.57 | 35.47 | 0.8639 | 0.5140 | |

| 0.37 | 83.63 | 2.0369 | 0.4793 | |

| 12.35 | 51.95 | 1.2654 | 0.4771 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 3.19 | 67.84 | 1.6523 | -0.9313 | |

| 0.38 | 23.80 | 0.5797 | -0.6004 | |

| 0.66 | 65.34 | 1.5913 | -0.5690 | |

| 0.29 | 31.17 | 0.7593 | -0.5598 | |

| 3.99 | 131.69 | 3.2076 | -0.5151 | |

| 1.85 | 108.93 | 2.6531 | -0.4609 | |

| 1.71 | 47.24 | 1.1506 | -0.4526 | |

| 0.87 | 30.12 | 0.7335 | -0.4047 | |

| 0.82 | 42.09 | 1.0252 | -0.3900 | |

| 2.02 | 53.64 | 1.3065 | -0.3631 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-25 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 1SANX / Banco Santander, S.A. | 16.74 | 2.98 | 133.51 | 27.99 | 3.2518 | 0.0092 | |||

| SHELL / Shell plc | 3.99 | 11.37 | 131.69 | 9.97 | 3.2076 | -0.5151 | |||

| FP / TotalEnergies SE | 1.85 | 11.37 | 108.93 | 8.73 | 2.6531 | -0.4609 | |||

| CS / AXA SA | 2.19 | 11.37 | 103.32 | 34.26 | 2.5166 | 0.1244 | |||

| ENGI / Engie SA | 4.55 | 9.25 | 98.16 | 31.81 | 2.3908 | 0.0760 | |||

| EFV / iShares Trust - iShares MSCI EAFE Value ETF | 1.53 | 339.38 | 97.56 | 388.02 | 2.3763 | 1.7549 | |||

| IMB / Imperial Brands PLC | 2.46 | 35.76 | 93.48 | 46.31 | 2.2768 | 0.2908 | |||

| EONGY / E.ON SE - Depositary Receipt (Common Stock) | 5.25 | 31.07 | 91.96 | 80.10 | 2.2398 | 0.6526 | |||

| ASRNL / ASR Nederland N.V. | 1.35 | 6.44 | 86.30 | 28.63 | 2.1019 | 0.0164 | |||

| BKP / Piraeus Financial Holdings S.A. | 12.93 | 9.65 | 86.11 | 54.70 | 2.0973 | 0.3671 | |||

| BCP / Banco Comercial Português, S.A. | 109.62 | 53.10 | 85.51 | 114.23 | 2.0827 | 0.8420 | |||

| SMFNF / Sumitomo Mitsui Financial Group, Inc. | 3.32 | 9.01 | 85.40 | 10.01 | 2.0800 | -0.3330 | |||

| BIRG / Bank of Ireland Group plc | 6.16 | 14.79 | 84.61 | 33.41 | 2.0608 | 0.0894 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.37 | 60.61 | 83.63 | 66.89 | 2.0369 | 0.4793 | |||

| BNP / BNP Paribas SA | 0.88 | 24.28 | 77.38 | 43.62 | 1.8846 | 0.2100 | |||

| SKXJF / Sankyo Co., Ltd. | 4.39 | 11.37 | 76.64 | 37.13 | 1.8667 | 0.1293 | |||

| NST / Northern Star Resources Limited | 5.55 | 5.86 | 75.47 | 33.26 | 1.8382 | 0.0777 | |||

| INGA / ING Groep N.V. - Depositary Receipt (Common Stock) | 3.19 | -31.60 | 67.84 | -18.38 | 1.6523 | -0.9313 | |||

| SAN / Santander UK plc - Preferred Stock | 0.66 | 3.71 | 65.34 | -5.99 | 1.5913 | -0.5690 | |||

| SHAOF / SHIMAMURA Co., Ltd. | 0.94 | 11.36 | 65.06 | 34.69 | 1.5846 | 0.0832 | |||

| EMAAR / Emaar Properties PJSC | 17.75 | 115.62 | 63.55 | 109.03 | 1.5478 | 0.6028 | |||

| ORXCF / ORIX Corporation | 2.95 | 11.37 | 62.52 | 13.64 | 1.5229 | -0.1873 | |||

| CCJ / Cameco Corporation | 1.02 | 41.39 | 59.56 | 87.92 | 1.4507 | 0.4654 | |||

| 0WH / WH Group Limited | 64.40 | 15.28 | 59.23 | 29.77 | 1.4426 | 0.0239 | |||

| 7167 / Mebuki Financial Group,Inc. | 11.99 | 22.43 | 59.10 | 42.20 | 1.4394 | 0.1476 | |||

| BTL / BT Group plc | 23.44 | 11.37 | 56.76 | 33.73 | 1.3824 | 0.0631 | |||

| TCAP / TP ICAP Group PLC | 15.30 | 11.37 | 54.08 | 19.90 | 1.3173 | -0.0849 | |||

| TPX / TOPPAN Holdings Inc. | 2.02 | 11.37 | 53.64 | -0.13 | 1.3065 | -0.3631 | |||

| FUJHY / Subaru Corporation - Depositary Receipt (Common Stock) | 2.85 | 1.41 | 52.32 | 0.40 | 1.2742 | -0.3454 | |||

| BOF / BOC Hong Kong (Holdings) Limited | 12.35 | 71.72 | 51.95 | 104.87 | 1.2654 | 0.4771 | |||

| DCNSF / Dai-ichi Life Holdings, Inc. | 6.65 | 345.48 | 51.90 | 17.27 | 1.2642 | -0.1116 | |||

| FMS / Fresenius Medical Care AG - Depositary Receipt (Common Stock) | 0.91 | 34.63 | 51.88 | 57.69 | 1.2635 | 0.2409 | |||

| MKS / Marks and Spencer Group plc | 9.78 | 102.92 | 49.34 | 128.21 | 1.2018 | 0.5297 | |||

| BBAS3 / Banco do Brasil S.A. | 11.99 | 187.91 | 49.08 | 154.73 | 1.1955 | 0.5965 | |||

| MARA / Marubeni Corporation | 2.40 | 11.36 | 48.63 | 43.35 | 1.1846 | 0.1300 | |||

| JR0 / Just Group plc | 23.92 | 33.91 | 48.29 | 28.69 | 1.1762 | 0.0097 | |||

| UPMMY / UPM-Kymmene Oyj - Depositary Receipt (Common Stock) | 1.71 | -3.84 | 47.24 | -8.41 | 1.1506 | -0.4526 | |||

| 8053 / Sumitomo Corporation | 1.81 | 11.37 | 46.17 | 26.30 | 1.1244 | -0.0118 | |||

| TYTMF / Tokyo Tatemono Co., Ltd. | 2.51 | 22.00 | 44.51 | 35.32 | 1.0841 | 0.0617 | |||

| DWBOF / Daiwabo Holdings Co., Ltd. | 2.54 | 11.37 | 42.72 | 8.46 | 1.0405 | -0.1839 | |||

| PRX / Prosus N.V. | 0.82 | -20.74 | 42.09 | -7.55 | 1.0252 | -0.3900 | |||

| Z1L / Lerøy Seafood Group ASA | 9.46 | 11.37 | 41.31 | 3.16 | 1.0061 | -0.2386 | |||

| ADRNY / Koninklijke Ahold Delhaize N.V. - Depositary Receipt (Common Stock) | 0.94 | 25.25 | 39.61 | 50.01 | 0.9649 | 0.1440 | |||

| PAAS / Pan American Silver Corp. | 1.57 | 23.28 | 38.22 | 26.18 | 0.9309 | -0.0107 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.33 | 11.37 | 37.66 | 18.13 | 0.9173 | -0.0737 | |||

| VEM / Venture Corporation Limited | 4.39 | 11.37 | 37.66 | 2.26 | 0.9172 | -0.2275 | |||

| DEC / Diversified Energy Company PLC | 2.64 | 885.84 | 36.94 | 934.76 | 0.8998 | 0.7888 | |||

| MSMKF / MatsukiyoCocokara & Co. | 1.81 | 18.08 | 36.58 | 56.40 | 0.8911 | 0.1639 | |||

| BUR / Burford Capital Limited | 2.82 | 11.37 | 36.21 | -8.19 | 0.8819 | -0.3441 | |||

| 9404 / Nippon Television Holdings, Inc. | 1.57 | 160.54 | 35.47 | 215.06 | 0.8639 | 0.5140 | |||

| JBSS3 / JBS S.A. | 5.02 | -0.58 | 35.18 | 33.11 | 0.8570 | 0.0353 | |||

| 3132 / Macnica Holdings, Inc. | 2.57 | 11.37 | 34.02 | 21.61 | 0.8286 | -0.0410 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.10 | 0.71 | 33.68 | -2.04 | 0.8204 | -0.2484 | |||

| 59Z / MediPal Holdings Corporation | 2.13 | 18.03 | 33.35 | 26.23 | 0.8124 | -0.0090 | |||

| FGR / FirstGroup plc | 0.23 | 27.53 | 31.21 | 74.63 | 0.7601 | 0.2046 | |||

| JAZZ / Jazz Pharmaceuticals plc | 0.29 | -2.44 | 31.17 | -26.54 | 0.7593 | -0.5598 | |||

| 109 / Kinden Corporation | 1.14 | 11.37 | 30.77 | 42.73 | 0.7494 | 0.0793 | |||

| VOD / Vodafone Group Public Limited Company - Depositary Receipt (Common Stock) | 29.51 | 11.37 | 30.60 | 30.82 | 0.7454 | 0.0182 | |||

| 0WP / WPP plc | 3.79 | 11.37 | 30.57 | 10.87 | 0.7446 | -0.1125 | |||

| XST / Sanwa Holdings Corporation | 0.87 | -21.96 | 30.12 | -17.75 | 0.7335 | -0.4047 | |||

| KGX / KION GROUP AG | 0.53 | 11.37 | 24.83 | 28.38 | 0.6047 | 0.0035 | |||

| SW / Smurfit Westrock Plc | 0.57 | 11.37 | 24.59 | -7.33 | 0.5989 | -0.2259 | |||

| 8001 / ITOCHU Corporation | 0.46 | 11.35 | 24.58 | 33.73 | 0.5987 | 0.0274 | |||

| JD. / JD Sports Fashion Plc | 21.41 | 11.37 | 24.28 | 27.85 | 0.5913 | 0.0010 | |||

| DCCPF / DCC plc | 0.38 | -32.00 | 23.80 | -37.31 | 0.5797 | -0.6004 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.32 | -9.72 | 23.06 | -13.73 | 0.5617 | -0.2692 | |||

| SDGCF / Sundrug Co.,Ltd. | 0.71 | 11.36 | 22.19 | 26.39 | 0.5406 | -0.0053 | |||

| VET / Vermilion Energy Inc. | 3.38 | 11.37 | 22.03 | -14.71 | 0.5365 | -0.2662 | |||

| 111770 KS / Youngone Corp | 0.50 | 11.37 | 21.98 | 49.89 | 0.5353 | 0.0795 | |||

| PUR / Paladin Energy Ltd | 5.34 | 11.37 | 21.47 | 2.87 | 0.5230 | -0.1258 | |||

| BZU / Air New Zealand Limited | 0.42 | 35.42 | 21.42 | 54.40 | 0.5217 | 0.0905 | |||

| TOM / Toyota Motor Corporation | 1.09 | 11.38 | 20.70 | 16.89 | 0.5043 | -0.0463 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.19 | 11.37 | 20.67 | 22.90 | 0.5033 | -0.0193 | |||

| GOB / Compagnie de Saint-Gobain S.A. | 0.18 | -12.79 | 20.00 | -1.88 | 0.4871 | -0.1465 | |||

| DUE / Dürr Aktiengesellschaft | 0.76 | 11.37 | 19.80 | 10.37 | 0.4823 | -0.0754 | |||

| IPHB / Impala Platinum Holdings Limited | 2.70 | 24.16 | 19.44 | 88.77 | 0.4734 | 0.1533 | |||

| 19766H239 / COLUMBIA SHORT TERM CASH FUND | 19.36 | 221.38 | 19.35 | 221.31 | 0.4713 | 0.2841 | |||

| UUUU / Energy Fuels Inc. | 3.87 | 11.37 | 18.92 | 32.19 | 0.4609 | 0.0159 | |||

| SBLK / Star Bulk Carriers Corp. | 1.13 | 24.01 | 18.71 | 30.99 | 0.4558 | 0.0117 | |||

| JP3149700001 / Iyogin Holdings Inc | 1.68 | 18.25 | 0.4444 | 0.4444 | |||||

| FLUT / Flutter Entertainment plc | 0.07 | 630.88 | 18.19 | 571.22 | 0.4431 | 0.3572 | |||

| SHHPF / Ship Healthcare Holdings, Inc. | 1.23 | 4.14 | 15.83 | 4.76 | 0.3855 | -0.0841 | |||

| MRK / Marks Electrical Group PLC | 0.12 | -0.01 | 15.67 | -7.73 | 0.3817 | -0.1463 | |||

| BWLPGO / BW LPG Limited | 1.46 | 15.27 | 0.3720 | 0.3720 | |||||

| TECK / Teck Resources Limited | 0.22 | -30.88 | 8.29 | -36.51 | 0.2019 | -0.2039 | |||

| INSM / Insmed Incorporated | 0.11 | 11.37 | 7.77 | -4.77 | 0.1893 | -0.0644 | |||

| BEZQ / Bezeq The Israel Telecommunication Corp. Ltd | 4.61 | -37.78 | 7.20 | -41.32 | 0.1753 | -0.2059 | |||

| BWLPG / BW LPG Limited | 0.55 | 11.37 | 5.58 | -2.33 | 0.1358 | -0.0416 | |||

| AUSTRALIA DOLLAR / DFE (000000000) | 1.59 | 0.0386 | 0.0386 | ||||||

| NORWAY KRONA / DFE (000000000) | 1.13 | 0.0275 | 0.0275 | ||||||

| SWEDISH KRONA / DFE (000000000) | 1.04 | 0.0253 | 0.0253 | ||||||

| KOREAN WON / DFE (000000000) | 0.52 | 0.0127 | 0.0127 | ||||||

| BRITISH POUND / DFE (000000000) | 0.18 | 0.0044 | 0.0044 | ||||||

| BRITISH POUND / DFE (000000000) | 0.18 | 0.0044 | 0.0044 | ||||||

| EURO COUNTRIES / DFE (000000000) | 0.06 | 0.0014 | 0.0014 | ||||||

| EURO COUNTRIES / DFE (000000000) | 0.06 | 0.0014 | 0.0014 | ||||||

| AUSTRALIA DOLLAR / DFE (000000000) | 0.03 | 0.0007 | 0.0007 | ||||||

| SWISS FRANC / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| LKOH / PJSC LUKOIL | 0.11 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| SWISS FRANC / DFE (000000000) | -0.01 | -0.0003 | -0.0003 | ||||||

| SWISS FRANC / DFE (000000000) | -0.01 | -0.0003 | -0.0003 | ||||||

| DANISH KRONA / DFE (000000000) | -0.02 | -0.0004 | -0.0004 | ||||||

| JAPANESE YEN / DFE (000000000) | -0.02 | -0.0005 | -0.0005 | ||||||

| Cameco Corp / DE (000000000) | -0.06 | -0.0014 | -0.0014 | ||||||

| Cameco Corp / DE (000000000) | -0.10 | -0.0024 | -0.0024 | ||||||

| US DOLLARS / DFE (000000000) | -0.11 | -0.0028 | -0.0028 | ||||||

| US DOLLARS / DFE (000000000) | -0.16 | -0.0039 | -0.0039 | ||||||

| US DOLLARS / DFE (000000000) | -0.62 | -0.0150 | -0.0150 | ||||||

| US DOLLARS / DFE (000000000) | -0.62 | -0.0150 | -0.0150 | ||||||

| SWISS FRANC / DFE (000000000) | -1.10 | -0.0268 | -0.0268 | ||||||

| US DOLLARS / DFE (000000000) | -1.51 | -0.0367 | -0.0367 |