Mga Batayang Estadistika

| Nilai Portofolio | $ 41,957,332,122 |

| Posisi Saat Ini | 80 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

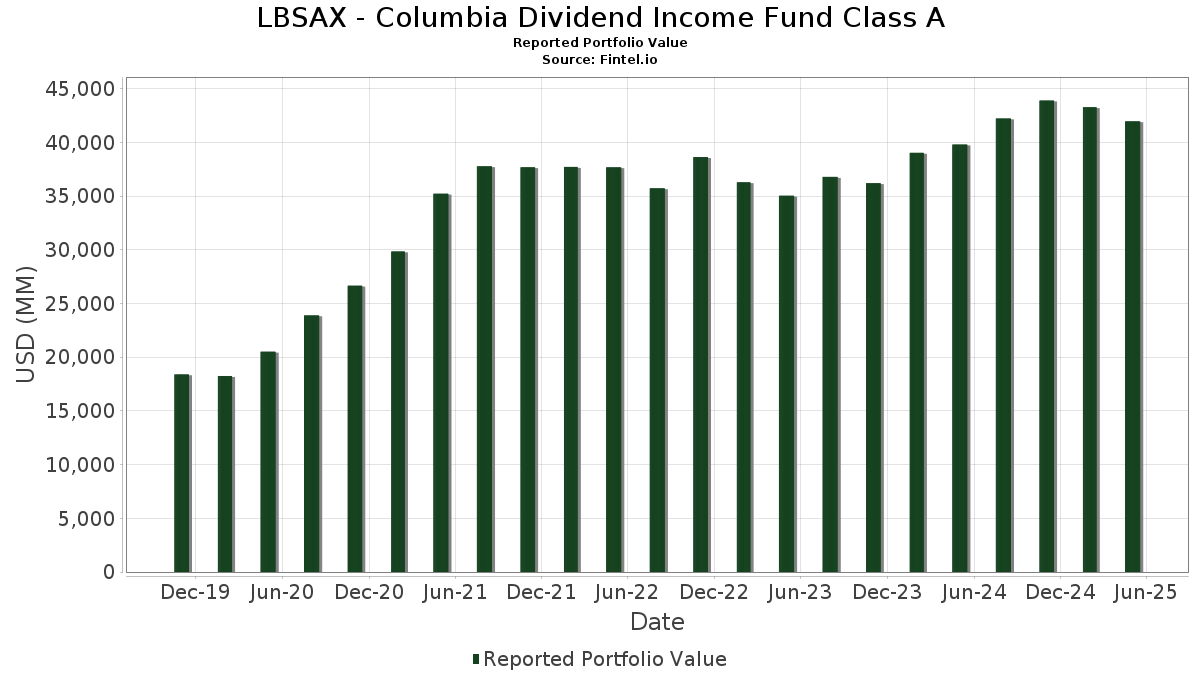

LBSAX - Columbia Dividend Income Fund Class A telah mengungkapkan total kepemilikan 80 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 41,957,332,122 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama LBSAX - Columbia Dividend Income Fund Class A adalah JPMorgan Chase & Co. (US:JPM) , Microsoft Corporation (US:MSFT) , Walmart Inc. (US:WMT) , Johnson & Johnson (US:JNJ) , and Exxon Mobil Corporation (US:XOM) . Posisi baru LBSAX - Columbia Dividend Income Fund Class A meliputi: Altria Group, Inc. (US:MO) , Welltower Inc. (US:WELL) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.75 | 487.44 | 1.1598 | 0.7467 | |

| 5.15 | 311.90 | 0.7421 | 0.7421 | |

| 1.55 | 247.51 | 0.5889 | 0.5889 | |

| 2.03 | 223.01 | 0.5306 | 0.5306 | |

| 4.09 | 989.76 | 2.3550 | 0.4543 | |

| 0.79 | 252.29 | 0.6003 | 0.3494 | |

| 5.45 | 616.16 | 1.4661 | 0.3367 | |

| 0.84 | 129.29 | 0.3076 | 0.3076 | |

| 2.52 | 798.72 | 1.9005 | 0.2757 | |

| 1.31 | 564.36 | 1.3428 | 0.2614 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.14 | 345.13 | 0.8212 | -1.2114 | |

| 4.17 | 570.66 | 1.3578 | -0.7152 | |

| 4.46 | 829.42 | 1.9735 | -0.4868 | |

| 3.20 | 246.05 | 0.5854 | -0.3743 | |

| 2.59 | 280.73 | 0.6680 | -0.3395 | |

| 1.24 | 226.39 | 0.5387 | -0.2872 | |

| 3.47 | 188.29 | 0.4480 | -0.2843 | |

| 2.26 | 291.42 | 0.6934 | -0.2729 | |

| 9.02 | 435.71 | 1.0367 | -0.2175 | |

| 12.51 | 1,235.44 | 2.9396 | -0.1909 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-25 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JPM / JPMorgan Chase & Co. | 7.03 | -1.03 | 1,856.92 | -1.27 | 4.4183 | 0.0792 | |||

| MSFT / Microsoft Corporation | 3.05 | -10.42 | 1,404.45 | 3.88 | 3.3417 | 0.2228 | |||

| WMT / Walmart Inc. | 12.51 | -9.06 | 1,235.44 | -8.96 | 2.9396 | -0.1909 | |||

| JNJ / Johnson & Johnson | 6.81 | -1.03 | 1,057.68 | -6.91 | 2.5166 | -0.1046 | |||

| XOM / Exxon Mobil Corporation | 10.30 | 8.45 | 1,053.51 | -0.34 | 2.5067 | 0.0679 | |||

| PG / The Procter & Gamble Company | 5.95 | -1.03 | 1,011.61 | -3.28 | 2.4070 | -0.0059 | |||

| AVGO / Broadcom Inc. | 4.09 | -1.03 | 989.76 | 20.13 | 2.3550 | 0.4543 | |||

| HD / The Home Depot, Inc. | 2.53 | -1.03 | 930.70 | -8.09 | 2.2145 | -0.1217 | |||

| CSCO / Cisco Systems, Inc. | 14.55 | -1.03 | 917.07 | -2.68 | 2.1821 | 0.0081 | |||

| CB / Chubb Limited | 2.87 | 6.75 | 853.45 | 11.14 | 2.0307 | 0.2591 | |||

| BAC / Bank of America Corporation | 19.13 | -1.03 | 844.20 | -5.26 | 2.0087 | -0.0470 | |||

| ABBV / AbbVie Inc. | 4.46 | -12.65 | 829.42 | -22.23 | 1.9735 | -0.4868 | |||

| WFC / Wells Fargo & Company | 10.72 | -1.03 | 801.72 | -5.50 | 1.9076 | -0.0497 | |||

| T / AT&T Inc. | 28.78 | -1.03 | 800.08 | 0.38 | 1.9037 | 0.0649 | |||

| IBM / International Business Machines Corporation | 3.08 | -1.03 | 798.81 | 1.57 | 1.9007 | 0.0863 | |||

| ACN / Accenture plc | 2.52 | 24.75 | 798.72 | 13.41 | 1.9005 | 0.2757 | |||

| MMC / Marsh & McLennan Companies, Inc. | 3.36 | -1.03 | 784.05 | -2.77 | 1.8656 | 0.0053 | |||

| PH / Parker-Hannifin Corporation | 1.14 | -1.03 | 759.89 | -1.59 | 1.8081 | 0.0266 | |||

| MCD / McDonald's Corporation | 2.37 | -1.03 | 743.28 | 0.74 | 1.7686 | 0.0665 | |||

| 19766H239 / COLUMBIA SHORT TERM CASH FUND | 727.29 | -10.14 | 727.07 | -10.16 | 1.7300 | -0.1370 | |||

| HON / Honeywell International Inc. | 3.14 | -1.03 | 712.30 | 5.38 | 1.6948 | 0.1354 | |||

| CMCSA / Comcast Corporation | 19.82 | -1.03 | 685.17 | -4.64 | 1.6303 | -0.0274 | |||

| ADI / Analog Devices, Inc. | 3.20 | -1.03 | 683.88 | -7.95 | 1.6272 | -0.0867 | |||

| CME / CME Group Inc. | 2.32 | -1.03 | 670.57 | 12.71 | 1.5955 | 0.2230 | |||

| ADP / Automatic Data Processing, Inc. | 2.05 | -1.03 | 665.71 | 2.22 | 1.5840 | 0.0816 | |||

| ABT / Abbott Laboratories | 4.78 | -1.03 | 638.56 | -4.21 | 1.5194 | -0.0184 | |||

| MS / Morgan Stanley | 4.83 | -1.03 | 618.71 | -4.81 | 1.4721 | -0.0273 | |||

| DIS / The Walt Disney Company | 5.45 | 26.71 | 616.16 | 25.86 | 1.4661 | 0.3367 | |||

| V / Visa Inc. | 1.69 | 8.33 | 615.36 | 9.07 | 1.4642 | 0.1627 | |||

| BK / The Bank of New York Mellon Corporation | 6.89 | -1.03 | 610.14 | -1.41 | 1.4518 | 0.0241 | |||

| CVX / Chevron Corporation | 4.17 | -26.31 | 570.66 | -36.49 | 1.3578 | -0.7152 | |||

| TT / Trane Technologies plc | 1.31 | -1.03 | 564.36 | 20.40 | 1.3428 | 0.2614 | |||

| WM / Waste Management, Inc. | 2.26 | -1.03 | 544.27 | 2.45 | 1.2950 | 0.0695 | |||

| LIN / Linde plc | 1.13 | -1.03 | 530.08 | -0.92 | 1.2613 | 0.0271 | |||

| BLK / BlackRock, Inc. | 0.54 | -1.03 | 528.43 | -0.82 | 1.2573 | 0.0282 | |||

| SO / The Southern Company | 5.61 | 7.59 | 504.93 | 7.85 | 1.2014 | 0.1213 | |||

| UNP / Union Pacific Corporation | 2.26 | -1.03 | 501.27 | -11.07 | 1.1927 | -0.1077 | |||

| MDLZ / Mondelez International, Inc. | 7.41 | -1.03 | 499.88 | 3.99 | 1.1894 | 0.0805 | |||

| KO / The Coca-Cola Company | 6.84 | -16.44 | 493.26 | -15.40 | 1.1737 | -0.1714 | |||

| PNC / The PNC Financial Services Group, Inc. | 2.82 | -1.03 | 490.25 | -10.37 | 1.1665 | -0.0953 | |||

| GD / General Dynamics Corporation | 1.75 | 146.89 | 487.44 | 172.19 | 1.1598 | 0.7467 | |||

| NOC / Northrop Grumman Corporation | 0.98 | -1.03 | 474.77 | 3.91 | 1.1297 | 0.0756 | |||

| ETR / Entergy Corporation | 5.67 | 8.20 | 472.11 | 3.21 | 1.1233 | 0.0680 | |||

| TJX / The TJX Companies, Inc. | 3.68 | -1.03 | 466.70 | 0.67 | 1.1104 | 0.0409 | |||

| BMY / Bristol-Myers Squibb Company | 9.02 | -1.03 | 435.71 | -19.85 | 1.0367 | -0.2175 | |||

| KLAC / KLA Corporation | 0.55 | -1.03 | 420.05 | 5.68 | 0.9995 | 0.0825 | |||

| ITW / Illinois Tool Works Inc. | 1.62 | -1.03 | 396.19 | -8.12 | 0.9427 | -0.0520 | |||

| LRCX / Lam Research Corporation | 4.84 | -1.03 | 391.32 | 4.19 | 0.9311 | 0.0647 | |||

| MDT / Medtronic plc | 4.66 | -1.03 | 387.05 | -10.75 | 0.9209 | -0.0795 | |||

| UNH / UnitedHealth Group Incorporated | 1.14 | -38.38 | 345.13 | -60.83 | 0.8212 | -1.2114 | |||

| MO / Altria Group, Inc. | 5.15 | 311.90 | 0.7421 | 0.7421 | |||||

| AEP / American Electric Power Company, Inc. | 2.96 | -1.03 | 306.04 | -3.42 | 0.7282 | -0.0028 | |||

| COP / ConocoPhillips | 3.58 | 39.61 | 305.84 | 20.18 | 0.7277 | 0.1406 | |||

| VLO / Valero Energy Corporation | 2.26 | -29.48 | 291.42 | -30.43 | 0.6934 | -0.2729 | |||

| CSX / CSX Corporation | 9.18 | -1.03 | 290.12 | -2.33 | 0.6903 | 0.0051 | |||

| EOG / EOG Resources, Inc. | 2.59 | -24.84 | 280.73 | -35.72 | 0.6680 | -0.3395 | |||

| EBAY / eBay Inc. | 3.68 | -1.03 | 269.42 | 11.86 | 0.6411 | 0.0854 | |||

| WEC / WEC Energy Group, Inc. | 2.42 | -1.03 | 260.47 | -0.33 | 0.6198 | 0.0168 | |||

| ETN / Eaton Corporation plc | 0.79 | 112.54 | 252.29 | 132.01 | 0.6003 | 0.3494 | |||

| TEL / TE Connectivity plc | 1.55 | 247.51 | 0.5889 | 0.5889 | |||||

| MRK / Merck & Co., Inc. | 3.20 | -28.99 | 246.05 | -40.86 | 0.5854 | -0.3743 | |||

| PEP / PepsiCo, Inc. | 1.77 | -1.03 | 232.54 | -15.23 | 0.5533 | -0.0795 | |||

| AEE / Ameren Corporation | 2.36 | -1.03 | 228.90 | -5.59 | 0.5447 | -0.0147 | |||

| TXN / Texas Instruments Incorporated | 1.24 | -32.22 | 226.39 | -36.76 | 0.5387 | -0.2872 | |||

| GILD / Gilead Sciences, Inc. | 2.03 | 223.01 | 0.5306 | 0.5306 | |||||

| PKG / Packaging Corporation of America | 1.14 | -1.03 | 220.35 | -10.28 | 0.5243 | -0.0423 | |||

| CMI / Cummins Inc. | 0.68 | -1.03 | 218.61 | -13.58 | 0.5202 | -0.0634 | |||

| NEE / NextEra Energy, Inc. | 2.92 | -1.03 | 205.93 | -0.37 | 0.4900 | 0.0132 | |||

| AVB / AvalonBay Communities, Inc. | 0.98 | -1.03 | 203.57 | -9.52 | 0.4844 | -0.0347 | |||

| PEG / Public Service Enterprise Group Incorporated | 2.41 | -1.03 | 195.69 | -1.18 | 0.4656 | 0.0088 | |||

| GIS / General Mills, Inc. | 3.47 | -33.73 | 188.29 | -40.69 | 0.4480 | -0.2843 | |||

| PLD / Prologis, Inc. | 1.73 | -1.03 | 187.75 | -13.27 | 0.4467 | -0.0526 | |||

| PSA / Public Storage | 0.61 | -1.03 | 187.65 | 0.53 | 0.4465 | 0.0159 | |||

| BX / Blackstone Inc. | 1.34 | -1.03 | 185.58 | -14.79 | 0.4416 | -0.0608 | |||

| CMS / CMS Energy Corporation | 2.60 | -1.03 | 182.33 | -4.85 | 0.4338 | -0.0082 | |||

| QCOM / QUALCOMM Incorporated | 1.24 | -1.03 | 179.85 | -8.57 | 0.4279 | -0.0259 | |||

| AVY / Avery Dennison Corporation | 0.96 | -1.03 | 169.96 | -6.42 | 0.4044 | -0.0146 | |||

| DTE / DTE Energy Company | 1.15 | -1.03 | 156.64 | 1.15 | 0.3727 | 0.0155 | |||

| BDX / Becton, Dickinson and Company | 0.90 | -1.03 | 154.96 | -24.26 | 0.3687 | -0.1033 | |||

| WELL / Welltower Inc. | 0.84 | 129.29 | 0.3076 | 0.3076 |