Mga Batayang Estadistika

| Nilai Portofolio | $ 1,636,125,191 |

| Posisi Saat Ini | 79 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

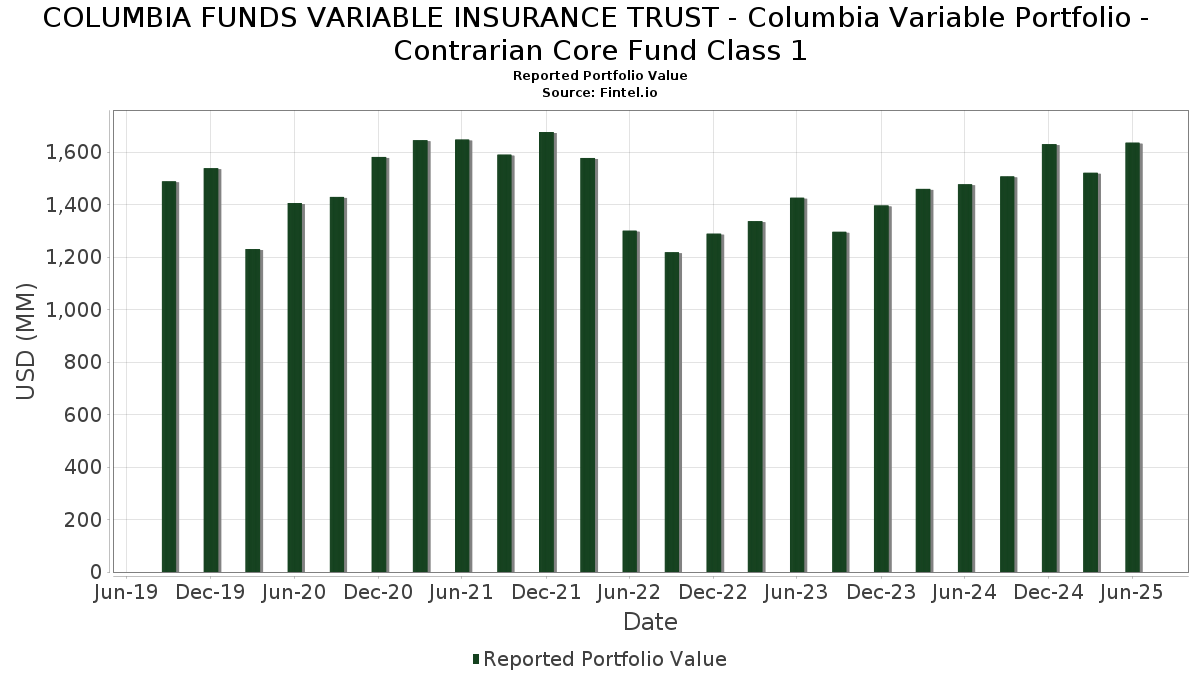

COLUMBIA FUNDS VARIABLE INSURANCE TRUST - Columbia Variable Portfolio - Contrarian Core Fund Class 1 telah mengungkapkan total kepemilikan 79 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,636,125,191 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama COLUMBIA FUNDS VARIABLE INSURANCE TRUST - Columbia Variable Portfolio - Contrarian Core Fund Class 1 adalah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) . Posisi baru COLUMBIA FUNDS VARIABLE INSURANCE TRUST - Columbia Variable Portfolio - Contrarian Core Fund Class 1 meliputi: ConocoPhillips (PE:COP) , Henry Schein, Inc. (US:HSIC) , Jacobs Solutions Inc. (US:J) , Agilent Technologies, Inc. (US:A) , and The Cooper Companies, Inc. (US:COO) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.85 | 134.52 | 8.2202 | 2.7040 | |

| 0.13 | 35.27 | 2.1550 | 2.1550 | |

| 0.29 | 144.98 | 8.8591 | 1.5563 | |

| 0.15 | 13.19 | 0.8059 | 0.8059 | |

| 0.71 | 33.41 | 2.0415 | 0.6276 | |

| 0.13 | 9.74 | 0.5951 | 0.5951 | |

| 0.12 | 8.89 | 0.5430 | 0.5430 | |

| 0.06 | 8.52 | 0.5208 | 0.5208 | |

| 0.07 | 8.30 | 0.5073 | 0.5073 | |

| 0.12 | 8.24 | 0.5035 | 0.5035 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 11.63 | 11.63 | 0.7107 | -2.6823 | |

| 0.39 | 79.47 | 4.8559 | -0.9848 | |

| 0.04 | 7.95 | 0.4857 | -0.9432 | |

| 0.01 | 5.71 | 0.3488 | -0.9093 | |

| 0.07 | 17.15 | 1.0482 | -0.7192 | |

| 0.15 | 20.89 | 1.2767 | -0.6601 | |

| 0.13 | 11.72 | 0.7163 | -0.5967 | |

| 0.03 | 1.60 | 0.0977 | -0.5886 | |

| 0.05 | 19.49 | 1.1912 | -0.5687 | |

| 0.03 | 12.18 | 0.7446 | -0.5189 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.29 | -1.54 | 144.98 | 30.46 | 8.8591 | 1.5563 | |||

| NVDA / NVIDIA Corporation | 0.85 | 9.93 | 134.52 | 60.26 | 8.2202 | 2.7040 | |||

| AAPL / Apple Inc. | 0.39 | -3.20 | 79.47 | -10.59 | 4.8559 | -0.9848 | |||

| AMZN / Amazon.com, Inc. | 0.32 | 2.34 | 70.97 | 18.01 | 4.3370 | 0.3847 | |||

| META / Meta Platforms, Inc. | 0.08 | -2.31 | 58.34 | 25.11 | 3.5649 | 0.5006 | |||

| JPM / JPMorgan Chase & Co. | 0.13 | -4.59 | 38.77 | 12.76 | 2.3688 | 0.1096 | |||

| GOOGL / Alphabet Inc. | 0.21 | 11.81 | 37.10 | 27.42 | 2.2672 | 0.3537 | |||

| AVGO / Broadcom Inc. | 0.13 | 35.27 | 2.1550 | 2.1550 | |||||

| BAC / Bank of America Corporation | 0.71 | 36.93 | 33.41 | 55.27 | 2.0415 | 0.6276 | |||

| GOOG / Alphabet Inc. | 0.19 | 17.13 | 33.25 | 32.99 | 2.0317 | 0.3888 | |||

| LLY / Eli Lilly and Company | 0.04 | -7.45 | 30.38 | -12.65 | 1.8563 | -0.4291 | |||

| UNP / Union Pacific Corporation | 0.12 | 41.17 | 26.92 | 37.49 | 1.6451 | 0.3583 | |||

| BLK / BlackRock, Inc. | 0.03 | -13.56 | 26.51 | -4.17 | 1.6198 | -0.1980 | |||

| BA / The Boeing Company | 0.12 | -2.86 | 25.63 | 19.34 | 1.5663 | 0.1549 | |||

| EBAY / eBay Inc. | 0.34 | -18.63 | 25.40 | -10.54 | 1.5518 | -0.3136 | |||

| INTU / Intuit Inc. | 0.03 | -1.54 | 24.96 | 26.31 | 1.5253 | 0.2266 | |||

| V / Visa Inc. | 0.07 | -2.23 | 23.85 | -0.95 | 1.4575 | -0.1250 | |||

| WFC / Wells Fargo & Company | 0.30 | -3.67 | 23.81 | 7.51 | 1.4552 | -0.0004 | |||

| EA / Electronic Arts Inc. | 0.14 | 29.30 | 22.35 | 42.88 | 1.3654 | 0.3377 | |||

| SCHW / The Charles Schwab Corporation | 0.24 | -10.09 | 22.11 | 4.80 | 1.3513 | -0.0353 | |||

| UBER / Uber Technologies, Inc. | 0.24 | -1.55 | 22.04 | 26.07 | 1.3469 | 0.1979 | |||

| CVX / Chevron Corporation | 0.15 | -17.18 | 20.89 | -29.11 | 1.2767 | -0.6601 | |||

| DIS / The Walt Disney Company | 0.17 | 3.52 | 20.87 | 30.07 | 1.2751 | 0.2208 | |||

| PG / The Procter & Gamble Company | 0.13 | 8.90 | 20.62 | 1.80 | 1.2599 | -0.0710 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.08 | -34.57 | 20.25 | -23.33 | 1.2373 | -0.4981 | |||

| WMT / Walmart Inc. | 0.20 | 38.77 | 19.63 | 54.57 | 1.1994 | 0.3649 | |||

| ELV / Elevance Health, Inc. | 0.05 | -18.60 | 19.49 | -27.21 | 1.1912 | -0.5687 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.04 | -1.46 | 19.03 | -9.51 | 1.1627 | -0.2191 | |||

| ABT / Abbott Laboratories | 0.14 | -1.83 | 18.70 | 0.66 | 1.1427 | -0.0781 | |||

| TSLA / Tesla, Inc. | 0.06 | -11.77 | 17.89 | 8.15 | 1.0933 | 0.0062 | |||

| MA / Mastercard Incorporated | 0.03 | -2.21 | 17.75 | 0.26 | 1.0845 | -0.0788 | |||

| HON / Honeywell International Inc. | 0.07 | -42.01 | 17.15 | -36.22 | 1.0482 | -0.7192 | |||

| AON / Aon plc | 0.05 | 19.09 | 16.59 | 6.46 | 1.0140 | -0.0103 | |||

| RTX / RTX Corporation | 0.11 | 29.48 | 16.40 | 42.74 | 1.0019 | 0.2470 | |||

| AXP / American Express Company | 0.05 | -19.94 | 16.30 | -5.08 | 0.9961 | -0.1325 | |||

| TMUS / T-Mobile US, Inc. | 0.07 | -20.41 | 15.88 | -28.90 | 0.9705 | -0.4974 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.19 | -4.07 | 15.61 | -1.87 | 0.9539 | -0.0915 | |||

| LRCX / Lam Research Corporation | 0.16 | -19.04 | 15.26 | 8.40 | 0.9323 | 0.0074 | |||

| XYZ / Block, Inc. | 0.22 | 11.93 | 15.21 | 39.96 | 0.9294 | 0.2152 | |||

| SNPS / Synopsys, Inc. | 0.03 | 44.36 | 14.98 | 72.59 | 0.9155 | 0.3450 | |||

| DELL / Dell Technologies Inc. | 0.12 | 15.55 | 14.96 | 55.43 | 0.9144 | 0.2817 | |||

| TEL / TE Connectivity plc | 0.09 | -35.08 | 14.95 | -22.51 | 0.9134 | -0.3543 | |||

| AMT / American Tower Corporation | 0.07 | -1.48 | 14.54 | 0.07 | 0.8883 | -0.0663 | |||

| DTE / DTE Energy Company | 0.11 | -8.56 | 14.37 | -12.40 | 0.8782 | -0.2000 | |||

| BSX / Boston Scientific Corporation | 0.13 | -35.11 | 13.99 | -30.91 | 0.8549 | -0.4757 | |||

| SPGI / S&P Global Inc. | 0.03 | 9.93 | 13.55 | 14.09 | 0.8278 | 0.0475 | |||

| EOG / EOG Resources, Inc. | 0.11 | -11.82 | 13.24 | -17.76 | 0.8088 | -0.2488 | |||

| PINS / Pinterest, Inc. | 0.37 | -17.80 | 13.19 | -4.91 | 0.8063 | -0.1055 | |||

| COP / ConocoPhillips | 0.15 | 13.19 | 0.8059 | 0.8059 | |||||

| ACN / Accenture plc | 0.04 | 101.34 | 12.79 | 92.85 | 0.7819 | 0.3459 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.03 | -22.23 | 12.18 | -36.63 | 0.7446 | -0.5189 | |||

| ETN / Eaton Corporation plc | 0.03 | -2.57 | 11.91 | 27.96 | 0.7278 | 0.1161 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.13 | -27.20 | 11.72 | -41.33 | 0.7163 | -0.5967 | |||

| 19766H239 / COLUMBIA SHORT TERM CASH FUND | 11.63 | -77.47 | 11.63 | -77.48 | 0.7107 | -2.6823 | |||

| GEV / GE Vernova Inc. | 0.02 | 29.68 | 11.22 | 124.78 | 0.6857 | 0.3577 | |||

| IFF / International Flavors & Fragrances Inc. | 0.13 | 9.74 | 0.5951 | 0.5951 | |||||

| OKTA / Okta, Inc. | 0.09 | -13.25 | 9.47 | -17.59 | 0.5788 | -0.1764 | |||

| MS / Morgan Stanley | 0.07 | -19.82 | 9.25 | 15.06 | 0.5652 | 0.0861 | |||

| HSIC / Henry Schein, Inc. | 0.12 | 8.89 | 0.5430 | 0.5430 | |||||

| ON / ON Semiconductor Corporation | 0.17 | -32.00 | 8.76 | -12.42 | 0.5351 | -0.1220 | |||

| J / Jacobs Solutions Inc. | 0.06 | 8.52 | 0.5208 | 0.5208 | |||||

| GE / General Electric Company | 0.03 | -0.84 | 8.46 | 27.53 | 0.5169 | 0.0810 | |||

| A / Agilent Technologies, Inc. | 0.07 | 8.30 | 0.5073 | 0.5073 | |||||

| COO / The Cooper Companies, Inc. | 0.12 | 8.24 | 0.5035 | 0.5035 | |||||

| AMAT / Applied Materials, Inc. | 0.04 | -8.33 | 8.05 | 15.63 | 0.4918 | 0.0344 | |||

| ABBV / AbbVie Inc. | 0.04 | -58.74 | 7.95 | -63.45 | 0.4857 | -0.9432 | |||

| PANW / Palo Alto Networks, Inc. | 0.04 | -19.94 | 7.81 | -3.98 | 0.4775 | -0.0573 | |||

| PH / Parker-Hannifin Corporation | 0.01 | 29.31 | 7.41 | 48.59 | 0.4530 | 0.1252 | |||

| AMGN / Amgen Inc. | 0.02 | 6.97 | 0.4257 | 0.4257 | |||||

| TPR / Tapestry, Inc. | 0.08 | -22.12 | 6.71 | -2.87 | 0.4099 | -0.0439 | |||

| ADBE / Adobe Inc. | 0.01 | -70.45 | 5.71 | -70.19 | 0.3488 | -0.9093 | |||

| LULU / lululemon athletica inc. | 0.02 | 18.83 | 5.25 | -0.27 | 0.3208 | -0.0251 | |||

| MCHP / Microchip Technology Incorporated | 0.07 | 4.76 | 0.2911 | 0.2911 | |||||

| SHW / The Sherwin-Williams Company | 0.01 | -2.27 | 4.71 | -3.92 | 0.2879 | -0.0343 | |||

| MRVL / Marvell Technology, Inc. | 0.06 | -49.34 | 4.62 | -36.31 | 0.2822 | -0.1943 | |||

| NKE / NIKE, Inc. | 0.05 | -2.05 | 3.77 | 9.60 | 0.2303 | 0.0044 | |||

| COTY / Coty Inc. | 0.78 | -27.99 | 3.63 | -38.78 | 0.2216 | -0.1677 | |||

| BMRN / BioMarin Pharmaceutical Inc. | 0.03 | -80.32 | 1.60 | -84.70 | 0.0977 | -0.5886 | |||

| CSGP / CoStar Group, Inc. | 0.02 | -64.87 | 1.58 | -64.37 | 0.0963 | -0.1942 | |||

| CSX / CSX Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1544 |