Mga Batayang Estadistika

| Nilai Portofolio | $ 502,746,809 |

| Posisi Saat Ini | 96 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

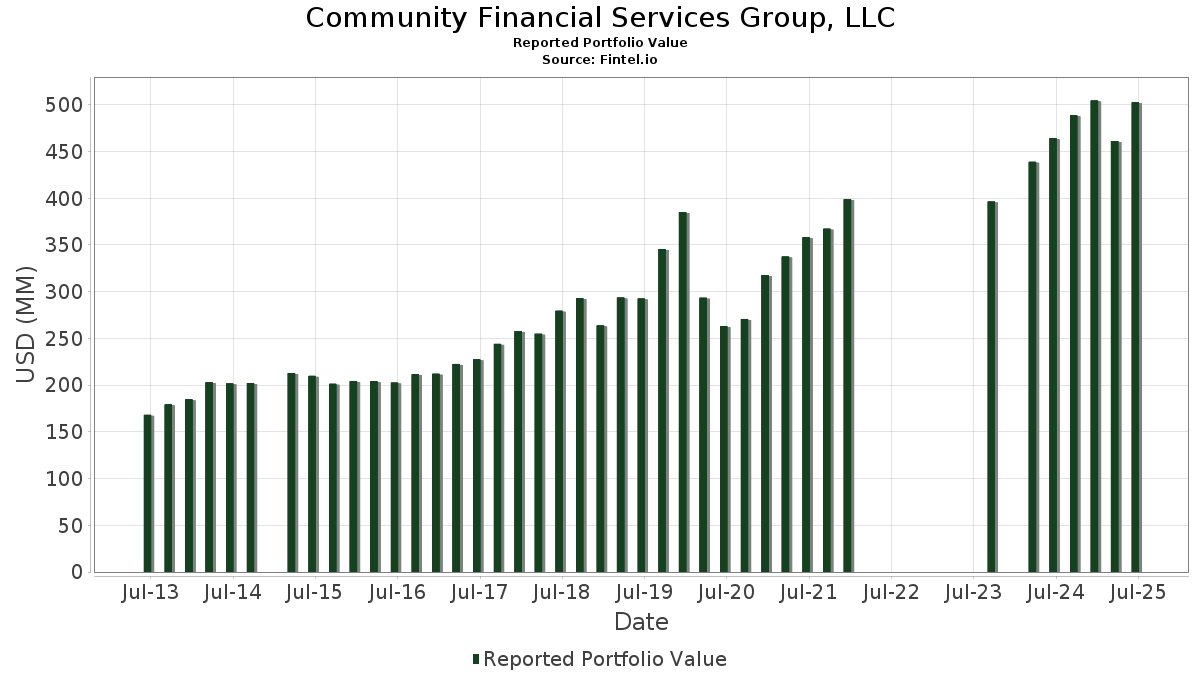

Community Financial Services Group, LLC telah mengungkapkan total kepemilikan 96 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 502,746,809 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Community Financial Services Group, LLC adalah Microsoft Corporation (US:MSFT) , iShares Trust - iShares 7-10 Year Treasury Bond ETF (US:IEF) , Apple Inc. (US:AAPL) , Broadcom Inc. (US:AVGO) , and Exxon Mobil Corporation (US:XOM) . Posisi baru Community Financial Services Group, LLC meliputi: S&P Global Inc. (US:SPGI) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.12 | 23.61 | 4.6953 | 1.8013 | |

| 0.02 | 11.97 | 2.3811 | 1.3372 | |

| 0.06 | 8.10 | 1.6114 | 1.2282 | |

| 0.05 | 6.14 | 1.2204 | 1.1517 | |

| 0.17 | 18.49 | 3.6768 | 1.0995 | |

| 0.07 | 18.57 | 1.9039 | 0.6247 | |

| 0.07 | 34.70 | 3.5577 | 0.5754 | |

| 0.00 | 5.57 | 0.5713 | 0.5713 | |

| 0.01 | 2.47 | 0.4914 | 0.4546 | |

| 0.10 | 15.96 | 1.6366 | 0.4185 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 2.18 | 0.2235 | -0.4803 | |

| 0.01 | 4.44 | 0.4548 | -0.3606 | |

| 0.35 | 33.21 | 3.4046 | -0.1811 | |

| 0.04 | 14.73 | 1.5103 | -0.1318 | |

| 0.01 | 11.57 | 1.1863 | -0.1193 | |

| 0.05 | 7.31 | 0.7492 | -0.1056 | |

| 0.01 | 7.58 | 0.7773 | -0.1042 | |

| 0.06 | 6.01 | 0.6167 | -0.0969 | |

| 0.00 | 1.70 | 0.1747 | -0.0956 | |

| 0.02 | 2.30 | 0.2357 | -0.0738 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-18 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.07 | -1.75 | 34.70 | 30.19 | 3.5577 | 0.5754 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.35 | 3.19 | 33.21 | 3.62 | 3.4046 | -0.1811 | |||

| AAPL / Apple Inc. | 0.12 | -1.20 | 23.61 | -8.74 | 4.6953 | 1.8013 | |||

| AVGO / Broadcom Inc. | 0.07 | -1.35 | 18.57 | 62.42 | 1.9039 | 0.6247 | |||

| XOM / Exxon Mobil Corporation | 0.17 | -11.47 | 18.49 | -19.75 | 3.6768 | 1.0995 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.10 | 0.58 | 15.96 | 46.63 | 1.6366 | 0.4185 | |||

| QUAL / iShares Trust - iShares MSCI USA Quality Factor ETF | 0.08 | 1.43 | 15.26 | 8.51 | 1.5648 | -0.0089 | |||

| V / Visa Inc. | 0.04 | -0.93 | 14.73 | 0.37 | 1.5103 | -0.1318 | |||

| AMZN / Amazon.com, Inc. | 0.06 | -2.90 | 13.72 | 11.96 | 1.4071 | 0.0356 | |||

| JPM / JPMorgan Chase & Co. | 0.05 | 0.75 | 13.61 | 19.07 | 1.3949 | 0.1164 | |||

| GOOG / Alphabet Inc. | 0.07 | -2.18 | 12.72 | 11.07 | 1.3045 | 0.0227 | |||

| META / Meta Platforms, Inc. | 0.02 | 0.19 | 11.97 | 28.31 | 2.3811 | 1.3372 | |||

| WMT / Walmart Inc. | 0.12 | -0.37 | 11.79 | 10.97 | 1.2091 | 0.0200 | |||

| COST / Costco Wholesale Corporation | 0.01 | -5.27 | 11.57 | -0.84 | 1.1863 | -0.1193 | |||

| GVI / iShares Trust - iShares Intermediate Government/Credit Bond ETF | 0.10 | 3.32 | 11.02 | 4.07 | 1.1302 | -0.0549 | |||

| ETN / Eaton Corporation plc | 0.03 | 1.39 | 10.19 | 33.16 | 1.0445 | 0.1885 | |||

| NOW / ServiceNow, Inc. | 0.01 | 0.94 | 9.59 | 30.35 | 0.9828 | 0.1600 | |||

| PANW / Palo Alto Networks, Inc. | 0.04 | 0.93 | 9.18 | 21.05 | 0.9409 | 0.0926 | |||

| EMR / Emerson Electric Co. | 0.06 | 94.52 | 8.10 | 136.59 | 1.6114 | 1.2282 | |||

| BAC / Bank of America Corporation | 0.17 | 3.54 | 8.00 | 17.41 | 0.8202 | 0.0579 | |||

| KLAC / KLA Corporation | 0.01 | 1.51 | 7.60 | 33.75 | 0.7789 | 0.1434 | |||

| LLY / Eli Lilly and Company | 0.01 | 1.96 | 7.58 | -3.77 | 0.7773 | -0.1042 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.05 | 2.31 | 7.31 | -4.36 | 0.7492 | -0.1056 | |||

| AXP / American Express Company | 0.02 | -1.46 | 7.29 | 16.82 | 0.7470 | 0.0492 | |||

| LIN / Linde plc | 0.02 | 2.04 | 7.12 | 2.82 | 0.7302 | -0.0449 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.04 | 1.22 | 7.01 | 7.35 | 0.7184 | -0.0119 | |||

| JEPI / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Equity Premium Income ETF | 0.11 | 1.60 | 6.44 | 1.08 | 0.6599 | -0.0525 | |||

| ABT / Abbott Laboratories | 0.05 | 874.72 | 6.14 | 900.82 | 1.2204 | 1.1517 | |||

| PH / Parker-Hannifin Corporation | 0.01 | 30.00 | 6.02 | 49.38 | 0.6172 | 0.1663 | |||

| PLD / Prologis, Inc. | 0.06 | 0.29 | 6.01 | -5.69 | 0.6167 | -0.0969 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.03 | -7.77 | 6.01 | 25.84 | 0.6157 | 0.0818 | |||

| BLK / BlackRock, Inc. | 0.01 | 0.26 | 6.00 | 11.16 | 0.6150 | 0.0112 | |||

| NEE / NextEra Energy, Inc. | 0.08 | 1.66 | 5.83 | -0.44 | 0.5977 | -0.0575 | |||

| ABBV / AbbVie Inc. | 0.03 | 216.37 | 5.83 | 180.32 | 0.5973 | 0.3647 | |||

| NFLX / Netflix, Inc. | 0.00 | 5.57 | 0.5713 | 0.5713 | |||||

| VLTO / Veralto Corporation | 0.05 | 1.67 | 5.48 | 5.33 | 0.5613 | -0.0203 | |||

| WM / Waste Management, Inc. | 0.02 | 1.79 | 5.26 | 0.59 | 0.5388 | -0.0457 | |||

| MCD / McDonald's Corporation | 0.02 | 2.58 | 5.19 | -4.05 | 0.5322 | -0.0731 | |||

| VRSK / Verisk Analytics, Inc. | 0.01 | 0.02 | 4.65 | 4.68 | 0.4770 | -0.0202 | |||

| LOW / Lowe's Companies, Inc. | 0.02 | 2.45 | 4.48 | -2.55 | 0.4590 | -0.0550 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 2.19 | 4.44 | -39.13 | 0.4548 | -0.3606 | |||

| ECL / Ecolab Inc. | 0.02 | -0.40 | 4.29 | 5.85 | 0.4393 | -0.0136 | |||

| SCHW / The Charles Schwab Corporation | 0.05 | -7.53 | 4.25 | 7.78 | 0.4362 | -0.0055 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.05 | 1,432.27 | 4.20 | -3.61 | 0.8351 | 0.3478 | |||

| ANET / Arista Networks Inc | 0.04 | -0.69 | 3.83 | 31.12 | 0.3932 | 0.0660 | |||

| DHR / Danaher Corporation | 0.02 | 5.21 | 3.83 | 1.38 | 0.3923 | -0.0300 | |||

| MDLZ / Mondelez International, Inc. | 0.05 | 1.99 | 3.25 | 1.37 | 0.3332 | -0.0255 | |||

| HD / The Home Depot, Inc. | 0.01 | -0.58 | 3.13 | -0.54 | 0.3212 | -0.0312 | |||

| TJX / The TJX Companies, Inc. | 0.02 | -1.32 | 2.57 | 0.04 | 0.2634 | -0.0239 | |||

| ORCL / Oracle Corporation | 0.01 | 379.67 | 2.47 | 650.76 | 0.4914 | 0.4546 | |||

| ADI / Analog Devices, Inc. | 0.01 | 1.04 | 2.37 | 19.30 | 0.2434 | 0.0207 | |||

| CVX / Chevron Corporation | 0.02 | -2.92 | 2.30 | -16.92 | 0.2357 | -0.0738 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -1.35 | 2.24 | -0.40 | 0.2293 | -0.0220 | |||

| CSCO / Cisco Systems, Inc. | 0.03 | -15.62 | 2.20 | -5.13 | 0.2258 | -0.0339 | |||

| MRK / Merck & Co., Inc. | 0.03 | -60.70 | 2.18 | -65.34 | 0.2235 | -0.4803 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -1.12 | 1.75 | 9.23 | 0.1796 | 0.0001 | |||

| GLW / Corning Incorporated | 0.03 | -17.04 | 1.72 | -4.71 | 0.1764 | -0.0256 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -22.68 | 1.70 | -29.47 | 0.1747 | -0.0956 | |||

| VBR / Vanguard Index Funds - Vanguard Small-Cap Value ETF | 0.01 | -14.75 | 1.65 | -10.75 | 0.1695 | -0.0378 | |||

| VOT / Vanguard Index Funds - Vanguard Mid-Cap Growth ETF | 0.01 | -16.14 | 1.64 | -2.50 | 0.1679 | -0.0200 | |||

| VLO / Valero Energy Corporation | 0.01 | -17.63 | 1.63 | -16.19 | 0.1668 | -0.0503 | |||

| ACN / Accenture plc | 0.00 | -16.16 | 1.35 | -19.71 | 0.1383 | -0.0496 | |||

| ATO / Atmos Energy Corporation | 0.01 | 1.54 | 1.16 | 1.22 | 0.1188 | -0.0093 | |||

| AMT / American Tower Corporation | 0.01 | -0.51 | 1.11 | 1.00 | 0.1141 | -0.0091 | |||

| EWC / iShares, Inc. - iShares MSCI Canada ETF | 0.02 | 0.38 | 0.99 | 13.75 | 0.1019 | 0.0042 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -21.53 | 0.92 | -13.25 | 0.0947 | -0.0245 | |||

| ICLN / iShares Trust - iShares Global Clean Energy ETF | 0.06 | -15.31 | 0.78 | -2.87 | 0.0797 | -0.0098 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.23 | 0.75 | 14.29 | 0.0771 | 0.0034 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -23.18 | 0.62 | -9.54 | 0.0632 | -0.0131 | |||

| RF / Regions Financial Corporation | 0.02 | 0.00 | 0.59 | 8.10 | 0.0603 | -0.0005 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.00 | -6.50 | 0.47 | 1.51 | 0.0483 | -0.0036 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.00 | 0.00 | 0.46 | -1.08 | 0.0470 | -0.0049 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.00 | 0.43 | -7.79 | 0.0437 | -0.0081 | |||

| MA / Mastercard Incorporated | 0.00 | -7.45 | 0.42 | -5.22 | 0.0429 | -0.0064 | |||

| VCIT / Vanguard Scottsdale Funds - Vanguard Intermediate-Term Corporate Bond ETF | 0.00 | 0.00 | 0.41 | 1.50 | 0.0417 | -0.0032 | |||

| MTB / M&T Bank Corporation | 0.00 | 0.00 | 0.36 | 8.41 | 0.0371 | -0.0002 | |||

| SPGI / S&P Global Inc. | 0.00 | 0.35 | 0.0695 | 0.0695 | |||||

| CATH / Global X Funds - Global X S&P 500 Catholic Values ETF | 0.00 | -2.90 | 0.34 | 8.28 | 0.0349 | -0.0002 | |||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.00 | 0.00 | 0.33 | 10.17 | 0.0334 | 0.0004 | |||

| PFE / Pfizer Inc. | 0.01 | -20.02 | 0.32 | -23.46 | 0.0643 | 0.0170 | |||

| BX / Blackstone Inc. | 0.00 | 0.00 | 0.32 | 7.05 | 0.0327 | -0.0006 | |||

| HON / Honeywell International Inc. | 0.00 | -27.79 | 0.31 | -20.52 | 0.0314 | -0.0117 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.00 | -15.73 | 0.30 | -4.44 | 0.0309 | -0.0044 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 6.45 | 0.30 | -13.26 | 0.0309 | -0.0080 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.00 | 0.00 | 0.29 | 18.55 | 0.0302 | 0.0024 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.00 | 0.29 | 18.44 | 0.0297 | 0.0024 | |||

| CINF / Cincinnati Financial Corporation | 0.00 | -13.62 | 0.29 | -12.77 | 0.0294 | -0.0075 | |||

| DUK / Duke Energy Corporation | 0.00 | -17.99 | 0.27 | -20.70 | 0.0280 | -0.0105 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.00 | 0.00 | 0.25 | 2.46 | 0.0257 | -0.0017 | |||

| PGR / The Progressive Corporation | 0.00 | 0.00 | 0.24 | -5.58 | 0.0243 | -0.0038 | |||

| EFG / iShares Trust - iShares MSCI EAFE Growth ETF | 0.00 | 0.00 | 0.23 | 11.82 | 0.0233 | 0.0006 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.00 | 0.23 | 0.0233 | 0.0233 | |||||

| IUSG / iShares Trust - iShares Core S&P U.S. Growth ETF | 0.00 | 0.22 | 0.0225 | 0.0225 | |||||

| AMAT / Applied Materials, Inc. | 0.00 | 0.21 | 0.0220 | 0.0220 | |||||

| VTR / Ventas, Inc. | 0.00 | -31.96 | 0.21 | -37.50 | 0.0215 | -0.0161 | |||

| BIBL / Northern Lights Fund Trust IV - Inspire 100 ETF | 0.00 | 0.20 | 0.0208 | 0.0208 | |||||

| BBY / Best Buy Co., Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNB / Union Bankshares, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DCI / Donaldson Company, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WY / Weyerhaeuser Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ZTS / Zoetis Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ADBE / Adobe Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |