Mga Batayang Estadistika

| Nilai Portofolio | $ 103,022,466 |

| Posisi Saat Ini | 50 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

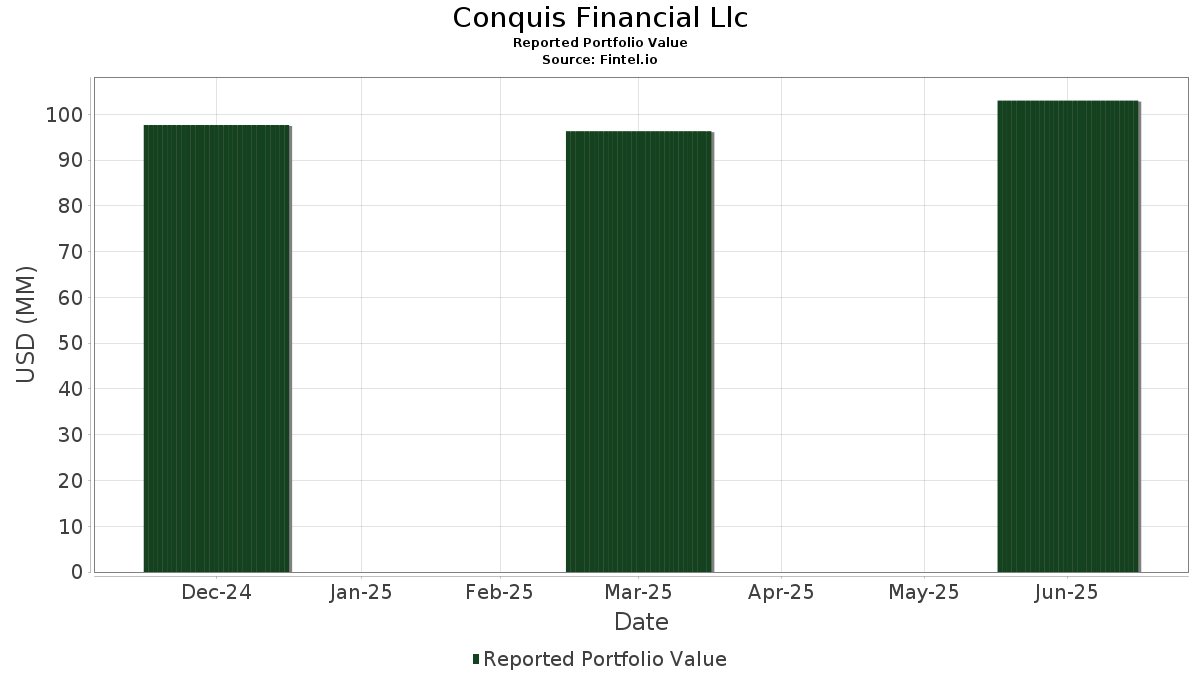

Conquis Financial Llc telah mengungkapkan total kepemilikan 50 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 103,022,466 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Conquis Financial Llc adalah Vanguard Index Funds - Vanguard S&P 500 ETF (US:VOO) , Dimensional ETF Trust - Dimensional World ex U.S. Core Equity 2 ETF (US:DFAX) , Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF (US:BIV) , Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF (US:VIG) , and Schwab Strategic Trust - Schwab International Equity ETF (US:SCHF) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 10.39 | 10.0863 | 6.9262 | |

| 0.52 | 15.16 | 14.7163 | 2.9001 | |

| 0.42 | 9.34 | 9.0680 | 0.7904 | |

| 0.03 | 1.32 | 1.2832 | 0.7882 | |

| 0.03 | 1.51 | 1.4647 | 0.3578 | |

| 0.00 | 0.50 | 0.4808 | 0.0460 | |

| 0.00 | 0.07 | 0.0716 | 0.0118 | |

| 0.00 | 0.49 | 0.4773 | 0.0108 | |

| 0.00 | 0.03 | 0.0316 | 0.0095 | |

| 0.01 | 0.02 | 0.0200 | 0.0076 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 30.79 | 29.8912 | -8.9369 | |

| 0.17 | 13.18 | 12.7901 | -0.8881 | |

| 0.21 | 7.49 | 7.2712 | -0.2944 | |

| 0.02 | 2.62 | 2.5469 | -0.2388 | |

| 0.00 | 0.08 | 0.0787 | -0.1551 | |

| 0.00 | 0.03 | 0.0271 | -0.1483 | |

| 0.03 | 3.81 | 3.7026 | -0.1388 | |

| 0.00 | 1.79 | 1.7402 | -0.1047 | |

| 0.00 | 0.00 | -0.1011 | ||

| 0.01 | 0.35 | 0.3408 | -0.0973 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-11 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.05 | -25.74 | 30.79 | -17.67 | 29.8912 | -8.9369 | |||

| DFAX / Dimensional ETF Trust - Dimensional World ex U.S. Core Equity 2 ETF | 0.52 | 18.81 | 15.16 | 33.19 | 14.7163 | 2.9001 | |||

| BIV / Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF | 0.17 | -1.00 | 13.18 | 0.00 | 12.7901 | -0.8881 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.05 | 222.15 | 10.39 | 241.36 | 10.0863 | 6.9262 | |||

| SCHF / Schwab Strategic Trust - Schwab International Equity ETF | 0.42 | 4.86 | 9.34 | 17.16 | 9.0680 | 0.7904 | |||

| DFAC / Dimensional ETF Trust - Dimensional U.S. Core Equity 2 ETF | 0.21 | -5.39 | 7.49 | 2.77 | 7.2712 | -0.2944 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.03 | -1.37 | 3.81 | 3.08 | 3.7026 | -0.1388 | |||

| VOE / Vanguard Index Funds - Vanguard Mid-Cap Value ETF | 0.02 | -5.06 | 2.62 | -2.24 | 2.5469 | -0.2388 | |||

| ADBE / Adobe Inc. | 0.00 | 0.00 | 1.79 | 0.84 | 1.7402 | -0.1047 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.02 | 3.98 | 1.58 | 4.22 | 1.5350 | -0.0399 | |||

| CMF / iShares Trust - iShares California Muni Bond ETF | 0.03 | 42.88 | 1.51 | 41.46 | 1.4647 | 0.3578 | |||

| NYF / iShares Trust - iShares New York Muni Bond ETF | 0.03 | 179.94 | 1.32 | 177.52 | 1.2832 | 0.7882 | |||

| VTEB / Vanguard Municipal Bond Funds - Vanguard Tax-Exempt Bond ETF | 0.02 | -0.30 | 1.06 | -1.48 | 1.0333 | -0.0884 | |||

| ADSK / Autodesk, Inc. | 0.00 | 0.00 | 0.50 | 18.42 | 0.4808 | 0.0460 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | -1.35 | 0.49 | 9.35 | 0.4773 | 0.0108 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.01 | -25.83 | 0.35 | -16.82 | 0.3408 | -0.0973 | |||

| SHYG / iShares Trust - iShares 0-5 Year High Yield Corporate Bond ETF | 0.00 | -3.65 | 0.19 | -2.51 | 0.1891 | -0.0178 | |||

| VXUS / Vanguard STAR Funds - Vanguard Total International Stock ETF | 0.00 | 0.00 | 0.16 | 11.35 | 0.1530 | 0.0059 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.16 | 10.64 | 0.1517 | 0.0048 | |||

| MMM / 3M Company | 0.00 | 0.00 | 0.13 | 4.03 | 0.1253 | -0.0040 | |||

| WMT / Walmart Inc. | 0.00 | 0.00 | 0.12 | 11.43 | 0.1139 | 0.0042 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.00 | 0.00 | 0.11 | 8.16 | 0.1030 | 0.0003 | |||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.10 | -10.91 | 0.0959 | -0.0185 | |||

| MSFT / Microsoft Corporation | 0.00 | -72.83 | 0.08 | -64.00 | 0.0787 | -0.1551 | |||

| FIVN / Five9, Inc. | 0.00 | 0.00 | 0.08 | -2.47 | 0.0771 | -0.0074 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.07 | 28.07 | 0.0716 | 0.0118 | |||

| PG / The Procter & Gamble Company | 0.00 | -41.08 | 0.06 | -44.83 | 0.0623 | -0.0587 | |||

| HPQ / HP Inc. | 0.00 | 0.00 | 0.05 | -13.21 | 0.0456 | -0.0095 | |||

| AAPL / Apple Inc. | 0.00 | -11.29 | 0.05 | -18.18 | 0.0438 | -0.0134 | |||

| HPE / Hewlett Packard Enterprise Company | 0.00 | 0.00 | 0.04 | 34.48 | 0.0379 | 0.0075 | |||

| ACHR / Archer Aviation Inc. | 0.00 | 0.00 | 0.03 | 52.38 | 0.0316 | 0.0095 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -6.25 | 0.03 | 3.57 | 0.0283 | -0.0015 | |||

| DFAS / Dimensional ETF Trust - Dimensional U.S. Small Cap ETF | 0.00 | -84.51 | 0.03 | -83.93 | 0.0271 | -0.1483 | |||

| SGHT / Sight Sciences, Inc. | 0.01 | 0.00 | 0.02 | 66.67 | 0.0200 | 0.0076 | |||

| INTC / Intel Corporation | 0.00 | -50.00 | 0.02 | -52.78 | 0.0174 | -0.0203 | |||

| SOLV / Solventum Corporation | 0.00 | 0.00 | 0.02 | 0.00 | 0.0156 | -0.0011 | |||

| VTES / Vanguard Wellington Fund - Vanguard Short-Term Tax-Exempt Bond ETF | 0.00 | 0.00 | 0.01 | 0.00 | 0.0120 | -0.0008 | |||

| NVDA / NVIDIA Corporation | 0.00 | 0.00 | 0.01 | 37.50 | 0.0115 | 0.0031 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 0.01 | 50.00 | 0.0091 | 0.0023 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 0.01 | 16.67 | 0.0072 | 0.0005 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0072 | -0.0004 | |||

| GOOGL / Alphabet Inc. | 0.00 | -94.34 | 0.01 | -93.88 | 0.0062 | -0.0959 | |||

| WFC / Wells Fargo & Company | 0.00 | 0.00 | 0.01 | 0.00 | 0.0056 | 0.0002 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.01 | 0.00 | 0.0055 | -0.0002 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0052 | -0.0006 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | 0.00 | 0.01 | 25.00 | 0.0050 | -0.0001 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.00 | -20.00 | 0.0047 | -0.0008 | |||

| ROST / Ross Stores, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0022 | -0.0002 | |||

| BAC.PRL / Bank of America Corporation - Preferred Stock | 0.00 | 0.00 | 0.00 | 0.00 | 0.0012 | -0.0001 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.00 | 0.0006 | 0.0001 | ||||

| KO / The Coca-Cola Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1011 | ||||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | -0.0009 | ||||

| JNJ / Johnson & Johnson | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GEV / GE Vernova Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0105 | ||||

| CSCO / Cisco Systems, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IBM / International Business Machines Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GOOG / Alphabet Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MRK / Merck & Co., Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GEHC / GE HealthCare Technologies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0037 | ||||

| GE / General Electric Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0278 |