Mga Batayang Estadistika

| Nilai Portofolio | $ 150,221,687 |

| Posisi Saat Ini | 278 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

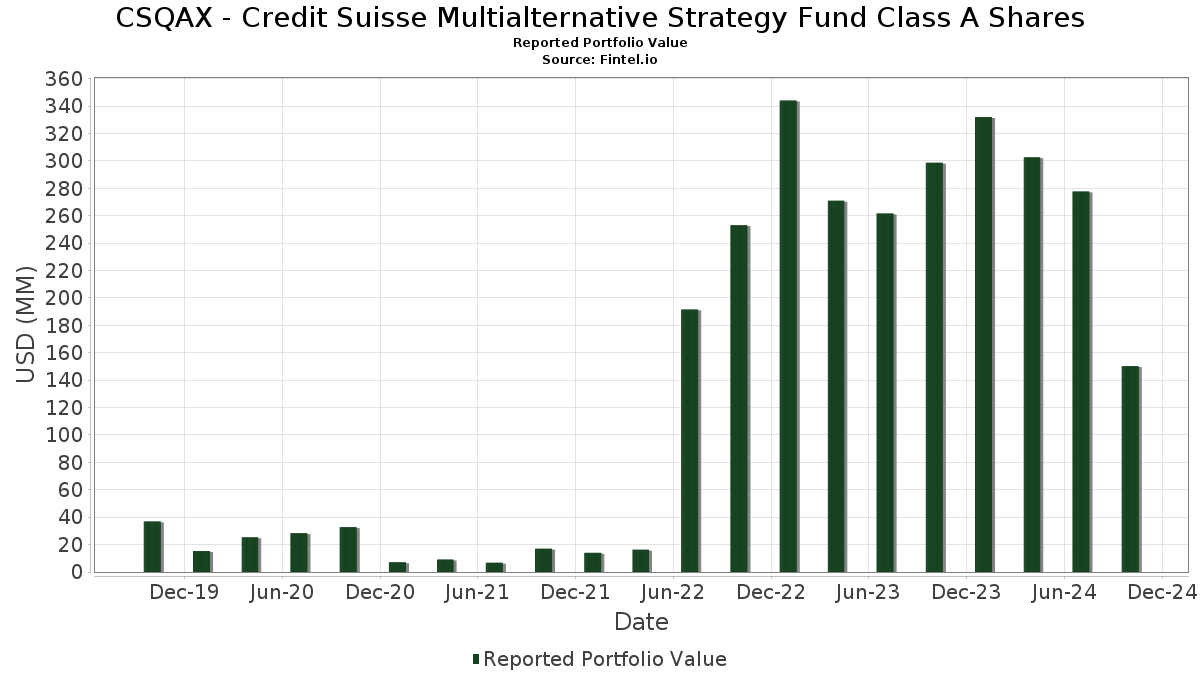

CSQAX - Credit Suisse Multialternative Strategy Fund Class A Shares telah mengungkapkan total kepemilikan 278 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 150,221,687 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama CSQAX - Credit Suisse Multialternative Strategy Fund Class A Shares adalah United States Treasury Bill (US:US912797HP56) , State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls (US:GVMXX) , State Street Navigator Securities Lending Government Money Market Portfolio (US:US8575093013) , Neoen S.A. (FR:NEOEN) , and Axonics, Inc. (US:AXNX) . Posisi baru CSQAX - Credit Suisse Multialternative Strategy Fund Class A Shares meliputi: United States Treasury Bill (US:US912797HP56) , SilverCrest Metals Inc. (US:SILV) , The First Bancshares, Inc. (US:FBMS) , Premier Financial Corp. (US:PFC) , and CrossFirst Bankshares, Inc. (US:CFB) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 14.52 | 6.2423 | 6.2423 | ||

| 6.80 | 2.9233 | 2.9233 | ||

| 6.75 | 2.9036 | 2.9036 | ||

| 6.73 | 2.8952 | 2.8952 | ||

| 5.46 | 5.46 | 2.3469 | 2.2836 | |

| 14.95 | 6.4262 | 0.7010 | ||

| 14.80 | 6.3614 | 0.6967 | ||

| 14.66 | 6.3024 | 0.6948 | ||

| 1.25 | 0.5392 | 0.5392 | ||

| 1.24 | 0.5314 | 0.5314 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 7.80 | 7.80 | 3.3541 | -11.1614 | |

| 0.00 | 0.00 | -0.7292 | ||

| 6.95 | 2.9887 | -0.5440 | ||

| 6.93 | 2.9789 | -0.5400 | ||

| 6.88 | 2.9590 | -0.5375 | ||

| 6.86 | 2.9494 | -0.5341 | ||

| 6.82 | 2.9322 | -0.5274 | ||

| -1.12 | -0.4831 | -0.4831 | ||

| 0.00 | 0.00 | -0.4328 | ||

| -0.99 | -0.4269 | -0.4269 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2024-12-26 untuk periode pelaporan 2024-10-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US912797HP56 / United States Treasury Bill | 14.95 | -27.60 | 6.4262 | 0.7010 | |||||

| U.S. Treasury Bills / STIV (US912797KA41) | 14.80 | -27.57 | 6.3614 | 0.6967 | |||||

| U.S. Treasury Bills / STIV (US912797LB15) | 14.66 | -27.51 | 6.3024 | 0.6948 | |||||

| U.S. Treasury Bills / STIV (US912797MG92) | 14.52 | 6.2423 | 6.2423 | ||||||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 7.80 | -85.10 | 7.80 | -85.10 | 3.3541 | -11.1614 | |||

| U.S. Treasury Bills / STIV (US912796ZV40) | 6.95 | -45.44 | 2.9887 | -0.5440 | |||||

| U.S. Treasury Bills / STIV (US912797JR94) | 6.93 | -45.40 | 2.9789 | -0.5400 | |||||

| U.S. Treasury Bills / STIV (US912797KJ59) | 6.88 | -45.42 | 2.9590 | -0.5375 | |||||

| U.S. Treasury Bills / STIV (US912797KS58) | 6.86 | -45.39 | 2.9494 | -0.5341 | |||||

| U.S. Treasury Bills / STIV (US912797LN52) | 6.82 | -45.34 | 2.9322 | -0.5274 | |||||

| U.S. Treasury Bills / STIV (US912797LW51) | 6.80 | 2.9233 | 2.9233 | ||||||

| U.S. Treasury Bills / STIV (US912797MH75) | 6.75 | 2.9036 | 2.9036 | ||||||

| U.S. Treasury Bills / STIV (US912797MS31) | 6.73 | 2.8952 | 2.8952 | ||||||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 5.46 | 2,294.49 | 5.46 | 2,304.41 | 2.3469 | 2.2836 | |||

| NEOEN / Neoen S.A. | 0.04 | -31.58 | 1.74 | -29.52 | 0.7494 | 0.0635 | |||

| AXNX / Axonics, Inc. | 0.02 | -31.58 | 1.70 | -29.77 | 0.7295 | 0.0596 | |||

| MRO / Marathon Oil Corporation | 0.06 | -31.58 | 1.60 | -32.43 | 0.6872 | 0.0312 | |||

| HTLF / Heartland Financial USA, Inc. | 0.02 | -31.58 | 1.45 | -25.34 | 0.6223 | 0.0848 | |||

| LONG GILT FUTURE DEC24 / DIR (000000000) | 1.25 | 0.5392 | 0.5392 | ||||||

| IBTX / Independent Bank Group, Inc. | 0.02 | -31.58 | 1.24 | -32.40 | 0.5322 | 0.0245 | |||

| CHX / ChampionX Corporation | 0.04 | -31.58 | 1.24 | -43.67 | 0.5322 | -0.0769 | |||

| LME PRI ALUM FUTR NOV24 / DCO (000000000) | 1.24 | 0.5314 | 0.5314 | ||||||

| DFS / Discover Financial Services | 0.01 | -31.59 | 1.15 | -29.48 | 0.4929 | 0.0421 | |||

| SILV / SilverCrest Metals Inc. | 0.11 | 1.10 | 0.4719 | 0.4719 | |||||

| ANSS / ANSYS, Inc. | 0.00 | -31.60 | 0.87 | -30.15 | 0.3748 | 0.0289 | |||

| STLC / Stelco Holdings Inc. | 0.02 | -31.64 | 0.84 | -30.60 | 0.3611 | 0.0258 | |||

| Long: EQS42943 TRS USD R V 01MEIBOR 25 ROLL FLOAT USDL1M -30BP / Short: EQS42943 TRS USD P E MLCSREIS_BA_20241028_S1 / DE (000000000) | 0.68 | 0.2921 | 0.2921 | ||||||

| LME ZINC FUTURE NOV24 / DCO (000000000) | 0.67 | 0.2899 | 0.2899 | ||||||

| CWB / Canadian Western Bank | 0.01 | -31.58 | 0.58 | -18.73 | 0.2484 | 0.0515 | |||

| Long: EQS42914 TRS USD R E BEFSCB18_BC_20241025_L1TRS / Short: EQS42914 TRS USD P F .00000 BULLET 0 FIXEDCOMMODITYTRS / DCO (000000000) | 0.53 | 0.2286 | 0.2286 | ||||||

| X / United States Steel Corporation | 0.01 | -31.58 | 0.49 | -35.33 | 0.2086 | 0.0006 | |||

| LME NICKEL FUTURE NOV24 / DCO (000000000) | 0.41 | 0.1770 | 0.1770 | ||||||

| FBMS / The First Bancshares, Inc. | 0.01 | 0.36 | 0.1553 | 0.1553 | |||||

| PFC / Premier Financial Corp. | 0.01 | 0.33 | 0.1433 | 0.1433 | |||||

| CFB / CrossFirst Bankshares, Inc. | 0.02 | 0.31 | 0.1345 | 0.1345 | |||||

| EWU / iShares Trust - iShares MSCI United Kingdom ETF | 0.01 | 98.99 | 0.30 | 118.12 | 0.1297 | -0.3732 | |||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.25 | 0.1087 | 0.1087 | ||||||

| LME NICKEL FUTURE JAN25 / DCO (000000000) | 0.25 | 0.1057 | 0.1057 | ||||||

| UNCRY / UniCredit S.p.A. - Depositary Receipt (Common Stock) | 0.01 | -7.81 | 0.24 | -0.83 | 0.1035 | 0.0361 | |||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.22 | 0.0940 | 0.0940 | ||||||

| SCBFF / Standard Chartered PLC | 0.02 | -36.67 | 0.18 | -26.16 | 0.0756 | 0.0099 | |||

| PSO / Pearson plc - Depositary Receipt (Common Stock) | 0.01 | -31.43 | 0.17 | -25.96 | 0.0749 | 0.0097 | |||

| ACCYY / Accor SA - Depositary Receipt (Common Stock) | 0.00 | -30.49 | 0.17 | -18.05 | 0.0723 | 0.0153 | |||

| ITB / Imperial Brands PLC | 0.01 | -34.67 | 0.17 | -28.76 | 0.0718 | 0.0069 | |||

| NWG / NatWest Group plc - Depositary Receipt (Common Stock) | 0.04 | -36.40 | 0.17 | -36.78 | 0.0712 | -0.0013 | |||

| HSBC / HSBC Holdings plc - Depositary Receipt (Common Stock) | 0.02 | -28.32 | 0.16 | -28.07 | 0.0709 | 0.0076 | |||

| SHEL / Shell plc | 0.00 | -19.57 | 0.16 | -26.13 | 0.0708 | 0.0090 | |||

| BARC / Barclays PLC | 0.05 | -34.74 | 0.16 | -33.06 | 0.0706 | 0.0024 | |||

| S+P500 EMINI FUT DEC24 / DE (000000000) | 0.16 | 0.0699 | 0.0699 | ||||||

| Long: EQS41518 TRS USD R V 00MSOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS41518 TRS USD P E VWO_CI_20240223_S1 / DE (000000000) | 0.16 | 0.0699 | 0.0699 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.16 | 0.0698 | 0.0698 | ||||||

| 27M / Melrose Industries PLC | 0.03 | -35.00 | 0.16 | -22.97 | 0.0695 | 0.0103 | |||

| COLR / Colruyt Group N.V. | 0.00 | -24.55 | 0.16 | -26.82 | 0.0694 | 0.0083 | |||

| BG / BAWAG Group AG | 0.00 | 0.16 | 0.0693 | 0.0693 | |||||

| Long: EQS42944 TRS USD R E GSISM112_GS_20241028_L1 / Short: EQS42944 TRS USD P F .00000 BULLET -0.6 FIXED / DE (000000000) | 0.16 | 0.0690 | 0.0690 | ||||||

| WTKWY / Wolters Kluwer N.V. - Depositary Receipt (Common Stock) | 0.00 | 0.16 | 0.0690 | 0.0690 | |||||

| STLAP / Stellantis N.V. | 0.01 | 5.37 | 0.16 | -13.59 | 0.0686 | 0.0175 | |||

| EXO / Exor N.V. | 0.00 | -28.07 | 0.16 | -26.17 | 0.0683 | 0.0088 | |||

| AEFC / AEGON Funding Company LLC - Corporate Bond/Note | 0.03 | -29.22 | 0.16 | -31.00 | 0.0680 | 0.0044 | |||

| CNA / Centrica plc | 0.10 | -17.83 | 0.16 | -27.19 | 0.0680 | 0.0078 | |||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.16 | 0.0675 | 0.0675 | ||||||

| IMO / Imperial Oil Limited | 0.00 | -33.71 | 0.16 | -31.28 | 0.0674 | 0.0044 | |||

| JEP / SalMar ASA | 0.00 | -27.95 | 0.16 | -36.33 | 0.0672 | -0.0009 | |||

| CRZBY / Commerzbank AG - Depositary Receipt (Common Stock) | 0.01 | -36.10 | 0.16 | -30.49 | 0.0668 | 0.0047 | |||

| REPYY / Repsol, S.A. - Depositary Receipt (Common Stock) | 0.01 | -18.59 | 0.15 | -29.03 | 0.0666 | 0.0064 | |||

| 1AD / Koninklijke Ahold Delhaize N.V. | 0.00 | -37.06 | 0.15 | -35.71 | 0.0661 | -0.0001 | |||

| MBG / Mercedes-Benz Group AG | 0.00 | 0.15 | 0.0660 | 0.0660 | |||||

| IEA / Informa plc | 0.01 | -26.81 | 0.15 | -31.70 | 0.0659 | 0.0036 | |||

| BNC / Banco Santander, S.A. | 0.03 | 0.15 | 0.0655 | 0.0655 | |||||

| EQNR / Equinor ASA - Depositary Receipt (Common Stock) | 0.01 | -19.12 | 0.15 | -27.75 | 0.0652 | 0.0072 | |||

| DP4B / A.P. Møller - Mærsk A/S | 0.00 | -23.81 | 0.15 | -27.40 | 0.0652 | 0.0074 | |||

| AIBGY / AIB Group plc - Depositary Receipt (Common Stock) | 0.03 | -32.11 | 0.15 | -36.97 | 0.0649 | -0.0012 | |||

| IAG / iA Financial Corporation Inc. | 0.00 | -45.07 | 0.15 | -34.21 | 0.0649 | 0.0016 | |||

| MEG / MEG Energy Corp. | 0.01 | -23.36 | 0.15 | -32.74 | 0.0648 | 0.0029 | |||

| INGA / ING Groep N.V. - Depositary Receipt (Common Stock) | 0.01 | -30.57 | 0.15 | -35.34 | 0.0648 | 0.0003 | |||

| G1A / GEA Group Aktiengesellschaft | 0.00 | -40.62 | 0.15 | -34.21 | 0.0648 | 0.0016 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.03 | -14.90 | 0.15 | -29.58 | 0.0646 | 0.0053 | |||

| CRRFY / Carrefour SA - Depositary Receipt (Common Stock) | 0.01 | -36.34 | 0.15 | -32.58 | 0.0645 | 0.0030 | |||

| RF / Eurazeo SE | 0.00 | -28.66 | 0.15 | -31.02 | 0.0643 | 0.0042 | |||

| GBLBY / Groupe Bruxelles Lambert SA - Depositary Receipt (Common Stock) | 0.00 | -32.56 | 0.15 | -34.93 | 0.0642 | 0.0007 | |||

| WTBCF / Whitbread plc | 0.00 | -33.41 | 0.15 | -31.02 | 0.0642 | 0.0042 | |||

| 3P7 / Pandora A/S | 0.00 | -32.55 | 0.15 | -35.24 | 0.0636 | 0.0004 | |||

| GLPEY / Galp Energia, SGPS, S.A. - Depositary Receipt (Common Stock) | 0.01 | -16.91 | 0.15 | -32.57 | 0.0632 | 0.0027 | |||

| BNR / Burning Rock Biotech Limited - Depositary Receipt (Common Stock) | 0.00 | -29.21 | 0.15 | -35.11 | 0.0629 | 0.0003 | |||

| Berkeley Group Holdings PLC / EC (GB00BP0RGD03) | 0.00 | 0.15 | 0.0625 | 0.0625 | |||||

| Long: EQS41790 TRS USD R V 00MEOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS41790 TRS USD P E SLBUS_CI_20240410_S1 / DE (000000000) | 0.14 | 0.0605 | 0.0605 | ||||||

| TLLB / Trelleborg AB (publ) | 0.00 | -26.64 | 0.14 | -34.43 | 0.0598 | 0.0009 | |||

| BKRIY / Bank of Ireland Group plc - Depositary Receipt (Common Stock) | 0.01 | 0.13 | 0.0576 | 0.0576 | |||||

| BNP / BNP Paribas SA | 0.13 | 0.0574 | 0.0574 | ||||||

| Long: EQS42923 TRS USD R E BXIIMMEU_BC_20241025_L1TRS / Short: EQS42923 TRS USD P F .60000 BULLET 0.6 FIXEDMMODITYTRS / DE (000000000) | 0.12 | 0.0529 | 0.0529 | ||||||

| Long: EQS42939 TRS USD R E ABGSCOT3_GS_20241028_L1TRS / Short: EQS42939 TRS USD P F .00000 BULLET 0 FIXEDCOMMODITYTRS / DCO (000000000) | 0.11 | 0.0486 | 0.0486 | ||||||

| BNP / BNP Paribas SA | 0.11 | 0.0483 | 0.0483 | ||||||

| US 10YR NOTE (CBT)DEC24 / DIR (000000000) | 0.09 | 0.0382 | 0.0382 | ||||||

| Long: EQS42928 TRS USD R E ABGSSA02_GS_20241028_L1TRS / Short: EQS42928 TRS USD P F .00000 BULLET 0 FIXEDCOMMODITYTRS / DCO (000000000) | 0.09 | 0.0378 | 0.0378 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.08 | 0.0357 | 0.0357 | ||||||

| Long: EQS42952 TRS USD R E GSISEVWB_GS_20241028_L1TRS / Short: EQS42952 TRS USD P F .40000 BULLET 0.4 FIXEDMMODITYTRS / DE (000000000) | 0.08 | 0.0347 | 0.0347 | ||||||

| BNP / BNP Paribas SA | 0.08 | 0.0335 | 0.0335 | ||||||

| BNP / BNP Paribas SA | 0.07 | 0.0313 | 0.0313 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.07 | 0.0291 | 0.0291 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.06 | 0.0275 | 0.0275 | ||||||

| EURO STOXX 50 DEC24 / DE (000000000) | 0.06 | 0.0271 | 0.0271 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.06 | 0.0261 | 0.0261 | ||||||

| Long: EQS42735 TRS USD R V 12MSOFR EQS42735_INT EQUITYTRS / Short: EQS42735 TRS USD P E EQS42735_RET EQUITYTRS / DE (000000000) | 0.06 | 0.0240 | 0.0240 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.05 | 0.0229 | 0.0229 | ||||||

| Long: EQS42204 TRS USD R E CBSUS_CI_20240710_L1 / Short: EQS42204 TRS USD P V 12MSOFR 10 ROLL SOFRRATE + 35BPS / DE (000000000) | 0.05 | 0.0221 | 0.0221 | ||||||

| LME ZINC FUTURE JAN25 / DCO (000000000) | 0.05 | 0.0212 | 0.0212 | ||||||

| LME LEAD FUTURE NOV24 / DCO (000000000) | 0.05 | 0.0197 | 0.0197 | ||||||

| CAD CURRENCY FUT DEC24 / DFE (000000000) | 0.04 | 0.0181 | 0.0181 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.04 | 0.0173 | 0.0173 | ||||||

| Long: EQS42054 TRS USD R V 00MEOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS42054 TRS USD P E COPUS_CI_20240605_S2 / DE (000000000) | 0.03 | 0.0141 | 0.0141 | ||||||

| Long: EQS42737 TRS USD R E EQS42737_RET EQUITYTRS / Short: EQS42737 TRS USD P V 12MSOFR EQS42737_INT EQUITYTRS / DE (000000000) | 0.03 | 0.0125 | 0.0125 | ||||||

| BNP / BNP Paribas SA | 0.03 | 0.0116 | 0.0116 | ||||||

| LME LEAD FUTURE JAN25 / DCO (000000000) | 0.03 | 0.0114 | 0.0114 | ||||||

| LME PRI ALUM FUTR JAN25 / DCO (000000000) | 0.02 | 0.0106 | 0.0106 | ||||||

| Long: EQS42917 TRS USD R E BAEIHWSP_BA_20241025_L1TRS / Short: EQS42917 TRS USD P F .00000 25 ROLL 0 FIXEDOMMODITYTRS / DE (000000000) | 0.02 | 0.0100 | 0.0100 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.02 | 0.0096 | 0.0096 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.02 | 0.0093 | 0.0093 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | 0.02 | 0.0092 | 0.0092 | ||||||

| BNP / BNP Paribas SA | 0.02 | 0.0090 | 0.0090 | ||||||

| Long: EQS42927 TRS USD R E ABGSD005_GS_20241028_L1TRS / Short: EQS42927 TRS USD P F .00000 BULLET 0 FIXEDCOMMODITYTRS / DCO (000000000) | 0.02 | 0.0086 | 0.0086 | ||||||

| JPN YEN CURR FUT DEC24 / DFE (000000000) | 0.02 | 0.0084 | 0.0084 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.02 | 0.0082 | 0.0082 | ||||||

| Long: EQS41372 TRS USD R V 12MSOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS41372 TRS USD P E SNPSUS_CI_20240124_S1 / DE (000000000) | 0.02 | 0.0076 | 0.0076 | ||||||

| SILVER FUTURE DEC24 / DCO (000000000) | 0.02 | 0.0074 | 0.0074 | ||||||

| GOLD 100 OZ FUTR DEC24 / DCO (000000000) | 0.02 | 0.0066 | 0.0066 | ||||||

| Long: EQS41788 TRS USD R E EDRUS1_CI_20240410_L1S / Short: EQS41788 TRS USD P V 00MSOFR 10 ROLL SOFRRATE + 35BPS / DE (000000000) | 0.01 | 0.0057 | 0.0057 | ||||||

| Long: EQS42639 TRS USD R E FYBRUS_CI_20240911_L1S / Short: EQS42639 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.01 | 0.0057 | 0.0057 | ||||||

| Long: EQS42055 TRS USD R E SRCLUS_CI_20240605_L1S / Short: EQS42055 TRS USD P V 00MSOFR 10 ROLL SOFRRATE + 35BPS / DE (000000000) | 0.01 | 0.0051 | 0.0051 | ||||||

| 10YR MINI JGB FUT DEC24 / DIR (000000000) | 0.01 | 0.0050 | 0.0050 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.01 | 0.0048 | 0.0048 | ||||||

| Long: EQS42953 TRS USD R V 00MEOFR 10 ROLL FLOAT SOFRRATE -10BP / Short: EQS42953 TRS USD P E BUSEUS_CI_20241030_S1S / DE (000000000) | 0.01 | 0.0046 | 0.0046 | ||||||

| Long: EQS41851 TRS USD R E NVEIUS_CI_20240403_L1 / Short: EQS41851 TRS USD P V 12MSOFR 10 ROLL SOFRRATE + 35BPS / DE (000000000) | 0.01 | 0.0042 | 0.0042 | ||||||

| Long: EQS42781 TRS USD R E LBPHUS_CI_20241016_L1S / Short: EQS42781 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.01 | 0.0039 | 0.0039 | ||||||

| BNP / BNP Paribas SA | 0.01 | 0.0035 | 0.0035 | ||||||

| SX5E DIVIDEND FUT DEC24 / DE (000000000) | 0.01 | 0.0033 | 0.0033 | ||||||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.00 | 0.01 | 0.0032 | 0.0032 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.01 | 0.0030 | 0.0030 | ||||||

| BNP / BNP Paribas SA | 0.01 | 0.0030 | 0.0030 | ||||||

| Long: EQS42554 TRS USD R V 00MEOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS42554 TRS USD P E EQS42554_RET EQUITYTRS / DE (000000000) | 0.01 | 0.0027 | 0.0027 | ||||||

| COFFEE 'C' FUTURE DEC24 / DCO (000000000) | 0.01 | 0.0024 | 0.0024 | ||||||

| Long: EQS42755 TRS USD R E BUS_CI_20241009_L1YTRS / Short: EQS42755 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.01 | 0.0023 | 0.0023 | ||||||

| Long: EQS42544 TRS USD R V 00MEOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS42544 TRS USD P E EQS42544_RET EQUITYTRS / DE (000000000) | 0.01 | 0.0023 | 0.0023 | ||||||

| NIKKEI 225 (OSE) DEC24 / DE (000000000) | 0.00 | 0.0021 | 0.0021 | ||||||

| Long: EQS42768 TRS USD R F .00000 BULLET -0.06 FIXED / Short: EQS42768 TRS USD P E BCOMAG_BA_20241011_S1 / DCO (000000000) | 0.00 | 0.0021 | 0.0021 | ||||||

| Long: EQS42464 TRS USD R E RCMUS_CI_20240807_L1RS / Short: EQS42464 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.00 | 0.0020 | 0.0020 | ||||||

| CORN FUTURE DEC24 / DCO (000000000) | 0.00 | 0.0020 | 0.0020 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.00 | 0.0017 | 0.0017 | ||||||

| Long: EQS41549 TRS USD R V 00MSOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS41549 TRS USD P E VWO_CI_20240228_S1 / DE (000000000) | 0.00 | 0.0016 | 0.0016 | ||||||

| Long: EQS42391 TRS USD R E EVRIUS_CI_20240731_L1_CSLAF9 / Short: EQS42391 TRS USD P V 12MSOFR PAY SOFRRATE + 35BPS / DE (000000000) | 0.00 | 0.0015 | 0.0015 | ||||||

| BRENT CRUDE FUTR MAR25 / DCO (000000000) | 0.00 | 0.0015 | 0.0015 | ||||||

| Long: EQS41335 TRS USD R E JNPRUS_CI_20240117_L1S / Short: EQS41335 TRS USD P V 00MSOFR 10 ROLL SOFRRATE + 35BPS / DE (000000000) | 0.00 | 0.0015 | 0.0015 | ||||||

| LIVE CATTLE FUTR DEC24 / DCO (000000000) | 0.00 | 0.0013 | 0.0013 | ||||||

| Long: EQS41428 TRS USD R E HAYNUS_CI_20240207_L1 / Short: EQS41428 TRS USD P V 00MSOFR 10 ROLL SOFRRATE + 35BPS / DE (000000000) | 0.00 | 0.0013 | 0.0013 | ||||||

| COPPER FUTURE DEC24 / DCO (000000000) | 0.00 | 0.0011 | 0.0011 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.00 | 0.0010 | 0.0010 | ||||||

| Long: EQS42899 TRS USD R E ZUOUS_CI_20241023_L1RS / Short: EQS42899 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.00 | 0.0010 | 0.0010 | ||||||

| Long: EQS42598 TRS USD R E KUS_CI_20240821_L1YTRS / Short: EQS42598 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.00 | 0.0009 | 0.0009 | ||||||

| Long: EQS42517 TRS USD R E CBSUS_CI_20240819_L1RS / Short: EQS42517 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.00 | 0.0008 | 0.0008 | ||||||

| BNP / BNP Paribas SA | 0.00 | 0.0006 | 0.0006 | ||||||

| Long: EQS42520 TRS USD R V 00MEOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS42520 TRS USD P E EQS42520_RET EQUITYTRS / DE (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| LEAN HOGS FUTURE FEB25 / DCO (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| COTTON NO.2 FUTR DEC24 / DCO (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| Long: EQS42775 TRS USD R F .00000 BULLET -0.06 FIXED / Short: EQS42775 TRS USD P E BCOMAG_BA_20241015_S1 / DCO (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| BNP / BNP Paribas SA | 0.00 | 0.0004 | 0.0004 | ||||||

| Long: EQS42545 TRS USD R V 00MEOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS42545 TRS USD P E EQS42545_RET EQUITYTRS / DE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| Long: EQS42524 TRS USD R E EDRUS1_CI_20240819_L1S / Short: EQS42524 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| Long: EQS42548 TRS USD R E SRCLUS_CI_20240819_L1S / Short: EQS42548 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| Long: EQS42534 TRS USD R E NVEIUS_CI_20240819_L1S / Short: EQS42534 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| Long: EQS41519 TRS USD R V 00MSOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS41519 TRS USD P E VWO_CI_20240223_S2 / DE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| Long: EQS42540 TRS USD R E RCMUS_CI_20240819_L1RS / Short: EQS42540 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| Long: EQS42525 TRS USD R E EVRIUS_CI_20240819_L1S / Short: EQS42525 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| Long: EQS42529 TRS USD R E JNPRUS_CI_20240819_L1S / Short: EQS42529 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| Long: EQS42526 TRS USD R E HAYNUS_CI_20240819_L1S / Short: EQS42526 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| RDW / Redrow plc | 0.00 | -100.00 | 0.00 | -100.00 | -0.7292 | ||||

| DO / Diamond Offshore Drilling, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4328 | ||||

| MORF / Morphic Holding, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4175 | ||||

| Long: EQS42757 TRS USD R E NAPAUS_CI_20241009_L1S / Short: EQS42757 TRS USD P V 00MSOFR 10 ROLL FLOAT / 35BPRS / DE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| Long: EQS42515 TRS USD R E BALYUS_CI_20240819_L1S / Short: EQS42515 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| WHEAT FUTURE(CBT) MAR25 / DCO (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| BNP / BNP Paribas SA | -0.00 | -0.0000 | -0.0000 | ||||||

| Long: EQS42527 TRS USD R E HCPUS1_CI_20240819_L1S / Short: EQS42527 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| Long: EQS42549 TRS USD R E SRDXUS_CI_20240819_L1S / Short: EQS42549 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | -0.00 | -0.0002 | -0.0002 | ||||||

| WHEAT FUTURE(CBT) DEC24 / DCO (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| Long: EQS42555 TRS USD R E VZIOUS_CI_20240819_L1S / Short: EQS42555 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| Long: EQS42867 TRS USD R F .00000 BULLET -0.06 FIXED / Short: EQS42867 TRS USD P E BCOMAG_BA_20241018_S1 / DCO (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| Long: EQS42513 TRS USD R E ALEUS_CI_20240819_L1RS / Short: EQS42513 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| Long: EQS42589 TRS USD R E PXH_CI_20240820_L1YTRS / Short: EQS42589 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| EURO FX CURR FUT DEC24 / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | -0.00 | -0.0003 | -0.0003 | ||||||

| Long: EQS42390 TRS USD R E BALYUS_CI_20240731_L1_CSLAF9 / Short: EQS42390 TRS USD P V 12MSOFR PAY SOFRRATE + 35BPS / DE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0003 | -0.0003 | ||||||

| Long: EQS42550 TRS USD R V 00MEOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS42550 TRS USD P E EQS42550_RET EQUITYTRS / DE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| Long: EQS42532 TRS CAD R V 01MEIBOR 05 ROLL CDOR01 - 40BPS / Short: EQS42532 TRS CAD P E EQS42532_RET EQUITYTRS / DE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| Long: EQS42546 TRS GBP R E SPTLN_GS_20240819_L1RS / Short: EQS42546 TRS GBP P V 00MSONIA 05 ROLL FLOAT SONIA 48BP / DE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| Long: EQS42556 TRS USD R V 00MEOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS42556 TRS USD P E EQS42556_RET EQUITYTRS / DE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| Long: EQS42541 TRS USD R V 00MEOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS42541 TRS USD P E EQS42541_RET EQUITYTRS / DE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| COTTON NO.2 FUTR MAR25 / DCO (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| Long: EQS41791 TRS GBP R E SPTLN_GS_20240410_L1 / Short: EQS41791 TRS GBP P V 12MSONIA 05 ROLL SONIA + 48BPS / DE (000000000) | -0.00 | -0.0006 | -0.0006 | ||||||

| Long: EQS42521 TRS USD R E CTLTUS_CI_20240819_L1S / Short: EQS42521 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | -0.00 | -0.0007 | -0.0007 | ||||||

| BNP / BNP Paribas SA | -0.00 | -0.0008 | -0.0008 | ||||||

| Long: EQS42552 TRS USD R V 00MEOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS42552 TRS USD P E EQS42552_RET EQUITYTRS / DE (000000000) | -0.00 | -0.0009 | -0.0009 | ||||||

| AUDUSD CRNCY FUT DEC24 / DFE (000000000) | -0.00 | -0.0009 | -0.0009 | ||||||

| Long: EQS42931 TRS USD R F .00000 BULLET -0.06 FIXED / Short: EQS42931 TRS USD P E BCOMEN_BA_20241028_S1 / DCO (000000000) | -0.00 | -0.0009 | -0.0009 | ||||||

| Long: EQS42912 TRS USD R E BCOMIN_GS_20241024_L1TYTRS / Short: EQS42912 TRS USD P F .10000 BULLET 0.1 FIXEDMMODITYTRS / DCO (000000000) | -0.00 | -0.0010 | -0.0010 | ||||||

| COPPER FUTURE MAR25 / DCO (000000000) | -0.00 | -0.0011 | -0.0011 | ||||||

| Long: EQS41926 TRS USD R E HCPUS1_CI_20240501_L1S / Short: EQS41926 TRS USD P V 00MSOFR 10 ROLL SOFRRATE + 35BPS / DE (000000000) | -0.00 | -0.0014 | -0.0014 | ||||||

| Long: EQS42359 TRS USD R V 12MSOFR ECEIVE SOFRRATE - 10BPS / Short: EQS42359 TRS USD P E CLFUS_CI_20240724_S1_CSLAF9 / DE (000000000) | -0.00 | -0.0014 | -0.0014 | ||||||

| Long: EQS42519 TRS USD R V 00MEOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS42519 TRS USD P E EQS42519_RET EQUITYTRS / DE (000000000) | -0.00 | -0.0014 | -0.0014 | ||||||

| LIVE CATTLE FUTR FEB25 / DCO (000000000) | -0.00 | -0.0015 | -0.0015 | ||||||

| BRENT CRUDE FUTR JAN25 / DCO (000000000) | -0.00 | -0.0015 | -0.0015 | ||||||

| CORN FUTURE MAR25 / DCO (000000000) | -0.00 | -0.0015 | -0.0015 | ||||||

| US LONG BOND(CBT) DEC24 / DIR (000000000) | -0.00 | -0.0015 | -0.0015 | ||||||

| LEAN HOGS FUTURE DEC24 / DCO (000000000) | -0.00 | -0.0019 | -0.0019 | ||||||

| COFFEE 'C' FUTURE MAR25 / DCO (000000000) | -0.01 | -0.0022 | -0.0022 | ||||||

| Long: EQS42929 TRS USD R E CIEQCNX1_CI_20241028_L1TRS / Short: EQS42929 TRS USD P F .00000 BULLET 0 FIXEDCOMMODITYTRS / DE (000000000) | -0.01 | -0.0022 | -0.0022 | ||||||

| BNP / BNP Paribas SA | -0.01 | -0.0026 | -0.0026 | ||||||

| Long: EQS41808 TRS GBP R E SPTLN_GS_20240415_L1 / Short: EQS41808 TRS GBP P V 12MSONIA 05 ROLL SONIA + 48BPS / DE (000000000) | -0.01 | -0.0026 | -0.0026 | ||||||

| Long: EQS41548 TRS USD R E PXH_CI_20240228_L1 / Short: EQS41548 TRS USD P V 00MSOFR 10 ROLL SOFRRATE + 35BPS / DE (000000000) | -0.01 | -0.0026 | -0.0026 | ||||||

| Long: EQS41797 TRS GBP R E SPTLN_GS_20240411_L1 / Short: EQS41797 TRS GBP P V 12MSONIA 05 ROLL SONIA + 48BPS / DE (000000000) | -0.01 | -0.0027 | -0.0027 | ||||||

| Long: EQS42539 TRS USD R E PXH_CI_20240819_L1YTRS / Short: EQS42539 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | -0.01 | -0.0027 | -0.0027 | ||||||

| Long: EQS42756 TRS USD R V 00MEOFR 10 ROLL FLOAT SOFRRATE -10BP / Short: EQS42756 TRS USD P E CDEUS_CI_20241009_S1RS / DE (000000000) | -0.01 | -0.0030 | -0.0030 | ||||||

| XAY CONS DISCRET DEC24 / DE (000000000) | -0.01 | -0.0031 | -0.0031 | ||||||

| US55608PBS20 / Macquarie Bank Ltd. | -0.01 | -0.0035 | -0.0035 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.01 | -0.0037 | -0.0037 | ||||||

| Long: EQS41805 TRS GBP R E SPTLN_GS_20240412_L1 / Short: EQS41805 TRS GBP P V 12MSONIA 05 ROLL SONIA + 48BPS / DE (000000000) | -0.01 | -0.0037 | -0.0037 | ||||||

| Long: EQS42056 TRS USD R E SRDXUS_CI_20240605_L1S / Short: EQS42056 TRS USD P V 00MSOFR 10 ROLL SOFRRATE + 35BPS / DE (000000000) | -0.01 | -0.0038 | -0.0038 | ||||||

| Long: EQS41552 TRS USD R E VZIOUS_CI_20240228_L1 / Short: EQS41552 TRS USD P V 00MSOFR 10 ROLL SOFRRATE + 35BPS / DE (000000000) | -0.01 | -0.0044 | -0.0044 | ||||||

| XAU UTILITIES DEC24 / DE (000000000) | -0.01 | -0.0048 | -0.0048 | ||||||

| Long: EQS41948 TRS USD R E ALEUS_CI_20240508_L1RS / Short: EQS41948 TRS USD P V 00MSOFR 10 ROLL SOFRRATE + 35BPS / DE (000000000) | -0.01 | -0.0049 | -0.0049 | ||||||

| US 2YR NOTE (CBT) DEC24 / DIR (000000000) | -0.01 | -0.0053 | -0.0053 | ||||||

| Long: EQS42936 TRS USD R E BCOMIN_GS_20241028_L1TYTRS / Short: EQS42936 TRS USD P F .10000 BULLET 0.1 FIXEDMMODITYTRS / DCO (000000000) | -0.01 | -0.0053 | -0.0053 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.01 | -0.0064 | -0.0064 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.01 | -0.0064 | -0.0064 | ||||||

| GOLD 100 OZ FUTR FEB25 / DCO (000000000) | -0.02 | -0.0066 | -0.0066 | ||||||

| Long: EQS42913 TRS USD R E GSISEVWB_GS_20241024_L1TRS / Short: EQS42913 TRS USD P F .40000 BULLET 0.4 FIXEDMMODITYTRS / DE (000000000) | -0.02 | -0.0070 | -0.0070 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | -0.02 | -0.0070 | -0.0070 | ||||||

| G3651J115 / ORDINARY SHARES | -0.02 | -0.0070 | -0.0070 | ||||||

| PURCHASED NZD / SOLD USD / DFE (000000000) | -0.02 | -0.0070 | -0.0070 | ||||||

| SILVER FUTURE MAR25 / DCO (000000000) | -0.02 | -0.0075 | -0.0075 | ||||||

| Long: EQS42938 TRS USD R E BCOMPR_GS_20241028_L1TYTRS / Short: EQS42938 TRS USD P F .07000 BULLET 0.07 FIXEDMODITYTRS / DCO (000000000) | -0.02 | -0.0077 | -0.0077 | ||||||

| Long: EQS42780 TRS USD R E ALTMUS_CI_20241016_L1S / Short: EQS42780 TRS USD P V 00MSOFR 10 ROLL FLOAT SOFRRATE 35BP / DE (000000000) | -0.02 | -0.0078 | -0.0078 | ||||||

| SX5E DIVIDEND FUT DEC25 / DE (000000000) | -0.02 | -0.0083 | -0.0083 | ||||||

| BNP / BNP Paribas SA | -0.02 | -0.0084 | -0.0084 | ||||||

| Long: EQS42916 TRS USD R E BCCFHI2P_BC_20241025_L1TRS / Short: EQS42916 TRS USD P F .15000 BULLET 0.15 FIXEDMODITYTRS / DCO (000000000) | -0.02 | -0.0086 | -0.0086 | ||||||

| Long: EQS42006 TRS USD R V 00MEOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS42006 TRS USD P E SSBUS_CI_20240522_S1 / DE (000000000) | -0.02 | -0.0092 | -0.0092 | ||||||

| Long: EQS42158 TRS CAD R V 01MCDOR 05 ROLL CDOR01 - 40BPS / Short: EQS42158 TRS CAD P E NACN_GS_20240620_S1 / DE (000000000) | -0.02 | -0.0094 | -0.0094 | ||||||

| Long: EQS42392 TRS USD R V 12MSOFR WSBCUS_CI_20240731_S1_CSLAF9 / Short: EQS42392 TRS USD P E RECEIVE SOFRRATE - 10BPS / DE (000000000) | -0.02 | -0.0095 | -0.0095 | ||||||

| LME ZINC FUTURE JAN25 / DCO (000000000) | -0.02 | -0.0097 | -0.0097 | ||||||

| Long: EQS42465 TRS USD R V 00MEOFR EQS42465_INT EQUITYTRS / Short: EQS42465 TRS USD P E EQS42465_RET EQUITYTRS / DE (000000000) | -0.03 | -0.0109 | -0.0109 | ||||||

| FTSE 100 IDX FUT DEC24 / DE (000000000) | -0.03 | -0.0114 | -0.0114 | ||||||

| MSCI EMGMKT DEC24 / DE (000000000) | -0.03 | -0.0127 | -0.0127 | ||||||

| BP CURRENCY FUT DEC24 / DFE (000000000) | -0.03 | -0.0128 | -0.0128 | ||||||

| LME PRI ALUM FUTR JAN25 / DCO (000000000) | -0.03 | -0.0130 | -0.0130 | ||||||

| LME LEAD FUTURE JAN25 / DCO (000000000) | -0.03 | -0.0131 | -0.0131 | ||||||

| E-MINI RUSS 2000 DEC24 / DE (000000000) | -0.04 | -0.0160 | -0.0160 | ||||||

| Long: EQS41426 TRS USD R E CTLTUS_CI_20240207_L1 / Short: EQS41426 TRS USD P V 12MSOFR 10 ROLL SOFRRATE + 35BPS / DE (000000000) | -0.04 | -0.0179 | -0.0179 | ||||||

| BNP / BNP Paribas SA | -0.05 | -0.0217 | -0.0217 | ||||||

| Long: EQS42933 TRS USD R E GSVIUS31_GS_20241028_L1TRS / Short: EQS42933 TRS USD P F .00000 BULLET 0 FIXEDCOMMODITYTRS / DCO (000000000) | -0.05 | -0.0224 | -0.0224 | ||||||

| Long: EQS41928 TRS USD R V 00MEOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS41928 TRS USD P E UMBFUS_CI_20240501_S1 / DE (000000000) | -0.05 | -0.0233 | -0.0233 | ||||||

| Long: EQS42734 TRS USD R E EQS42734_RET EQUITYTRS / Short: EQS42734 TRS USD P V 12MSOFR EQS42734_INT EQUITYTRS / DE (000000000) | -0.06 | -0.0240 | -0.0240 | ||||||

| Long: EQS42934 TRS USD R E GSVIVV75_GS_20241028_L1TRS / Short: EQS42934 TRS USD P F .00000 BULLET 0 FIXEDCOMMODITYTRS / DCO (000000000) | -0.06 | -0.0253 | -0.0253 | ||||||

| BNP / BNP Paribas SA | -0.07 | -0.0284 | -0.0284 | ||||||

| CAN 10YR BOND FUT DEC24 / DIR (000000000) | -0.07 | -0.0321 | -0.0321 | ||||||

| Long: EQS41550 TRS USD R V 00MSOFR 10 ROLL SOFRRATE - 10BPS / Short: EQS41550 TRS USD P E COFUS_CI_20240228_S1 / DE (000000000) | -0.09 | -0.0380 | -0.0380 | ||||||

| LME LEAD FUTURE NOV24 / DCO (000000000) | -0.09 | -0.0396 | -0.0396 | ||||||

| US 5YR NOTE (CBT) DEC24 / DIR (000000000) | -0.10 | -0.0432 | -0.0432 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | -0.10 | -0.0440 | -0.0440 | ||||||

| Long: EQS42918 TRS USD R E BFXSMEUU_BC_20241025_L1TRS / Short: EQS42918 TRS USD P F .20000 BULLET 0.2 FIXEDMMODITYTRS / DE (000000000) | -0.11 | -0.0487 | -0.0487 | ||||||

| Long: EQS42924 TRS USD R E BXIITSTP_BC_20241025_L1TRS / Short: EQS42924 TRS USD P F .60000 BULLET 0.6 FIXEDMMODITYTRS / DE (000000000) | -0.14 | -0.0593 | -0.0593 | ||||||

| LME NICKEL FUTURE JAN25 / DCO (000000000) | -0.16 | -0.0707 | -0.0707 | ||||||

| Long: EQS42926 TRS USD R E MLCSEQBK_BA_20241028_L1 / Short: EQS42926 TRS USD P V 01MLIBOR 25 ROLL FLOAT USDL1M 45BP / DE (000000000) | -0.18 | -0.0762 | -0.0762 | ||||||

| S+P 500 INDEX / DE (000000000) | -0.19 | -0.0807 | -0.0807 | ||||||

| BNP / BNP Paribas SA | -0.23 | -0.1006 | -0.1006 | ||||||

| AUST 10Y BOND FUT DEC24 / DIR (000000000) | -0.25 | -0.1060 | -0.1060 | ||||||

| Long: EQS41517 TRS USD R E PXH_CI_20240223_L1 / Short: EQS41517 TRS USD P V 00MSOFR 10 ROLL SOFRRATE + 35BPS / DE (000000000) | -0.29 | -0.1258 | -0.1258 | ||||||

| EURO-BUND FUTURE DEC24 / DIR (000000000) | -0.41 | -0.1782 | -0.1782 | ||||||

| LME NICKEL FUTURE NOV24 / DCO (000000000) | -0.43 | -0.1865 | -0.1865 | ||||||

| Long: EQS42942 TRS USD R E MLCSREIL_BA_20241028_L1 / Short: EQS42942 TRS USD P V 01MLIBOR 25 ROLL FLOAT USDL1M 30BP / DE (000000000) | -0.58 | -0.2475 | -0.2475 | ||||||

| LME ZINC FUTURE NOV24 / DCO (000000000) | -0.68 | -0.2903 | -0.2903 | ||||||

| Long: EQS42941 TRS USD R E MLCSTHMO_BA_20241028_L1 / Short: EQS42941 TRS USD P V 01MLIBOR 25 ROLL FLOAT USDL1M 45BP / DE (000000000) | -0.99 | -0.4269 | -0.4269 | ||||||

| LME PRI ALUM FUTR NOV24 / DCO (000000000) | -1.12 | -0.4831 | -0.4831 |